Mga Batayang Estadistika

| Nilai Portofolio | $ 75,353,350 |

| Posisi Saat Ini | 73 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

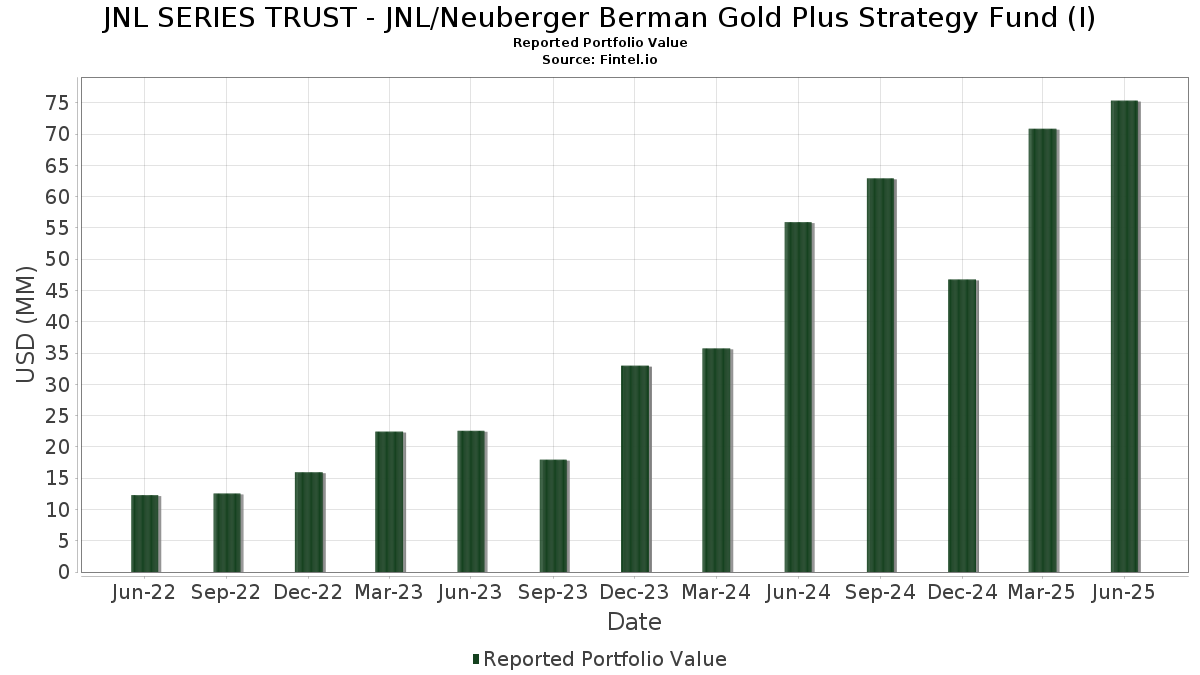

JNL SERIES TRUST - JNL/Neuberger Berman Gold Plus Strategy Fund (I) telah mengungkapkan total kepemilikan 73 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 75,353,350 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama JNL SERIES TRUST - JNL/Neuberger Berman Gold Plus Strategy Fund (I) adalah JNL Government Money Market Fund (US:46628D437) , iShares Bitcoin Trust ETF (US:IBIT) , AT&T Inc (US:US00206RML32) , Simon Property Gr Bond (US:US828807CV75) , and Capital One Financial Corp (US:US14040HCU77) . Posisi baru JNL SERIES TRUST - JNL/Neuberger Berman Gold Plus Strategy Fund (I) meliputi: AT&T Inc (US:US00206RML32) , Simon Property Gr Bond (US:US828807CV75) , Capital One Financial Corp (US:US14040HCU77) , Oracle Corp (US:US68389XCC74) , and JPMorgan Chase & Co (US:US46647PCQ72) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 14.97 | 18.9878 | 18.9878 | ||

| 3.95 | 5.0146 | 5.0146 | ||

| 1.06 | 1.3388 | 1.3388 | ||

| 1.67 | 2.1182 | 1.2115 | ||

| 0.87 | 1.1053 | 1.1053 | ||

| 0.85 | 1.0813 | 1.0813 | ||

| 0.80 | 1.0092 | 1.0092 | ||

| 0.66 | 0.8385 | 0.8385 | ||

| 0.62 | 0.7862 | 0.7862 | ||

| 0.98 | 1.2485 | 0.7436 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 7.88 | 7.88 | 9.9914 | -7.2214 | |

| 0.65 | 0.8262 | -1.1592 | ||

| 1.71 | 2.1624 | -0.2361 | ||

| 1.72 | 2.1824 | -0.2360 | ||

| 1.49 | 1.8886 | -0.1859 | ||

| 1.26 | 1.6016 | -0.1673 | ||

| 1.14 | 1.4457 | -0.1550 | ||

| 1.13 | 1.4267 | -0.1531 | ||

| 0.95 | 1.2073 | -0.1307 | ||

| 0.89 | 1.1259 | -0.1262 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-27 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| Treasury, United States Department of / STIV (US912797PE18) | 14.97 | 18.9878 | 18.9878 | ||||||

| 46628D437 / JNL Government Money Market Fund | 7.88 | -35.75 | 7.88 | -35.75 | 9.9914 | -7.2214 | |||

| Treasury, United States Department of / STIV (US912797RB50) | 3.95 | 5.0146 | 5.0146 | ||||||

| IBIT / iShares Bitcoin Trust ETF | 0.04 | -9.42 | 2.41 | 18.47 | 3.0590 | 0.2001 | |||

| Morgan Stanley Bank, N.A. / DBT (US61690U8F08) | 1.72 | -0.12 | 2.1824 | -0.2360 | |||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 1.71 | -0.18 | 2.1624 | -0.2361 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 1.67 | 158.91 | 2.1182 | 1.2115 | |||||

| US00206RML32 / AT&T Inc | 1.49 | 0.81 | 1.8886 | -0.1859 | |||||

| US828807CV75 / Simon Property Gr Bond | 1.26 | 0.16 | 1.6016 | -0.1673 | |||||

| US14040HCU77 / Capital One Financial Corp | 1.14 | -0.09 | 1.4457 | -0.1550 | |||||

| U.S. Bank National Association / DBT (US90331HPQ01) | 1.13 | 0.00 | 1.4267 | -0.1531 | |||||

| PM / Philip Morris International Inc. - Depositary Receipt (Common Stock) | 1.06 | 1.3388 | 1.3388 | ||||||

| US68389XCC74 / Oracle Corp | 0.98 | 174.09 | 1.2485 | 0.7436 | |||||

| CA14913LAA85 / CATERP FIN S LTD | 0.95 | -0.21 | 1.2073 | -0.1307 | |||||

| US46647PCQ72 / JPMorgan Chase & Co | 0.93 | 18.45 | 1.1819 | 0.0772 | |||||

| GlaxoSmithKline Capital PLC / DBT (US377373AN53) | 0.92 | 21.83 | 1.1686 | 0.1067 | |||||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | 0.90 | 0.00 | 1.1390 | -0.1218 | |||||

| US458140CD04 / Intel Corp | 0.90 | 0.00 | 1.1373 | -0.1208 | |||||

| UNH / UnitedHealth Group Incorporated - Depositary Receipt (Common Stock) | 0.89 | -0.45 | 1.1259 | -0.1262 | |||||

| US89788MAA09 / Truist Financial Corp | 0.87 | 0.93 | 1.1060 | -0.1081 | |||||

| US87264ABU88 / T-Mobile USA Inc | 0.87 | 1.1053 | 1.1053 | ||||||

| WMT / Walmart Inc. - Depositary Receipt (Common Stock) | 0.85 | 1.0813 | 1.0813 | ||||||

| PNC Bank, National Association / DBT (US69353RFW34) | 0.83 | -0.12 | 1.0531 | -0.1135 | |||||

| US06051GLX50 / BANK OF AMERICA CORP SR UNSECURED 09/27 VAR | 0.81 | -0.37 | 1.0233 | -0.1127 | |||||

| BK / The Bank of New York Mellon Corporation - Depositary Receipt (Common Stock) | 0.80 | 1.0092 | 1.0092 | ||||||

| Chevron U.S.A. Inc. / DBT (US166756BA36) | 0.78 | 0.13 | 0.9909 | -0.1043 | |||||

| US06051GJK67 / Bank of America Corp | 0.77 | 0.78 | 0.9789 | -0.0953 | |||||

| S1TT34 / State Street Corporation - Depositary Receipt (Common Stock) | 0.77 | -0.26 | 0.9755 | -0.1076 | |||||

| US29379VBH50 / Enterprise Products Operating LLC | 0.73 | 0.00 | 0.9215 | -0.0982 | |||||

| Consolidated Edison Company of New York, Inc. / DBT (US209111GL10) | 0.72 | 96.99 | 0.9124 | 0.3991 | |||||

| BMY / Bristol-Myers Squibb Company - Depositary Receipt (Common Stock) | 0.70 | 0.00 | 0.8829 | -0.0951 | |||||

| HD / The Home Depot, Inc. - Depositary Receipt (Common Stock) | 0.70 | 0.00 | 0.8826 | -0.0944 | |||||

| US36962GW752 / General Electric Co. Floating Rate Bond Due 5/5/2026 | 0.69 | 7.28 | 0.8799 | -0.0282 | |||||

| John Deere Capital Corporation / DBT (US24422EXL81) | 0.69 | -0.14 | 0.8763 | -0.0940 | |||||

| New York Life Global Funding / DBT (US64953BBQ05) | 0.68 | 0.00 | 0.8649 | -0.0925 | |||||

| Siemens Funding B.V. / DBT (US82622RAB24) | 0.66 | 0.8385 | 0.8385 | ||||||

| Goldman Sachs Bank USA / DBT (US38151LAH33) | 0.65 | -53.96 | 0.8262 | -1.1592 | |||||

| PYPL / PayPal Holdings, Inc. - Depositary Receipt (Common Stock) | 0.65 | 27.72 | 0.8186 | 0.1094 | |||||

| US11135FBB67 / Broadcom Inc | 0.62 | 0.48 | 0.7898 | -0.0801 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0.62 | 0.00 | 0.7864 | -0.0853 | |||||

| US38141GZS64 / GOLDMAN SACHS GROUP INC SR UNSECURED 03/28 VAR | 0.62 | 0.7862 | 0.7862 | ||||||

| US89233FHN15 / Toyota Motor Credit Corporation | 0.60 | 0.00 | 0.7633 | -0.0818 | |||||

| US913017DD80 / United Technologies Corp | 0.60 | 0.17 | 0.7625 | -0.0805 | |||||

| GPJA / Georgia Power Company - Preferred Security | 0.59 | -0.17 | 0.7527 | -0.0818 | |||||

| Athene Global Funding / DBT (US04685A4F53) | 0.59 | -0.34 | 0.7493 | -0.0826 | |||||

| US031162DN74 / Amgen Inc | 0.59 | 0.7427 | 0.7427 | ||||||

| US00138CAW82 / Corebridge Global Funding | 0.58 | 0.00 | 0.7408 | -0.0802 | |||||

| US872287AF41 / TCI Communications Inc | 0.55 | -0.72 | 0.6997 | -0.0798 | |||||

| Fifth Third Bank, National Association / DBT (US31677QBV05) | 0.55 | -0.54 | 0.6967 | -0.0783 | |||||

| PepsiCo Singapore Financing I Pte. Ltd. / DBT (US713466AE09) | 0.53 | -0.75 | 0.6708 | -0.0761 | |||||

| New York Life Global Funding / DBT (US64953BBU17) | 0.49 | 0.21 | 0.6152 | -0.0646 | |||||

| US29250RAW60 / Enbridge Energy Partners LP | 0.47 | 0.00 | 0.5988 | -0.0639 | |||||

| MMC / Marsh & McLennan Companies, Inc. - Depositary Receipt (Common Stock) | 0.47 | -0.21 | 0.5970 | -0.0647 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | 0.45 | 0.5767 | 0.5767 | ||||||

| US126650CL25 / CVS Health Corp | 0.45 | 0.22 | 0.5755 | -0.0600 | |||||

| US694308JL21 / PACIFIC GAS and ELECTRIC CO 3.45% 07/01/2025 | 0.42 | 0.47 | 0.5390 | -0.0554 | |||||

| AXP / American Express Company - Depositary Receipt (Common Stock) | 0.42 | -0.71 | 0.5349 | -0.0611 | |||||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 0.41 | 0.00 | 0.5148 | -0.0550 | |||||

| US92343VGG32 / Verizon Communications Inc | 0.39 | 94.47 | 0.4914 | 0.2116 | |||||

| US38141GYH19 / Goldman Sachs Group Inc/The | 0.38 | 0.4821 | 0.4821 | ||||||

| US225401AT54 / Credit Suisse Group AG | 0.33 | 0.60 | 0.4231 | -0.0416 | |||||

| US126650DS68 / CVS Health Corp | 0.30 | 0.33 | 0.3819 | -0.0407 | |||||

| US89233FHN15 / Toyota Motor Credit Corporation | 0.29 | 0.00 | 0.3618 | -0.0383 | |||||

| X5S8VL105 / Nordea Bank Abp | 0.27 | 0.00 | 0.3437 | -0.0368 | |||||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 0.26 | 0.00 | 0.3242 | -0.0348 | |||||

| US713448FP87 / PepsiCo, Inc. | 0.25 | 0.00 | 0.3173 | -0.0342 | |||||

| John Deere Capital Corporation / DBT (US24422EXS35) | 0.23 | 0.00 | 0.2927 | -0.0314 | |||||

| MA / Mastercard Incorporated - Depositary Receipt (Common Stock) | 0.23 | 0.44 | 0.2921 | -0.0301 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | 0.20 | 0.2591 | 0.2591 | ||||||

| US857477CE17 / State Street Corp | 0.20 | -0.51 | 0.2484 | -0.0268 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | 0.15 | 0.1945 | 0.1945 | ||||||

| US87264ABR59 / T-MOBILE USA INC 2.25% 02/15/2026 | 0.10 | 0.00 | 0.1250 | -0.0125 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | 0.06 | 0.0795 | 0.0795 |