Mga Batayang Estadistika

| Nilai Portofolio | $ 1,710,909,018 |

| Posisi Saat Ini | 2,372 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

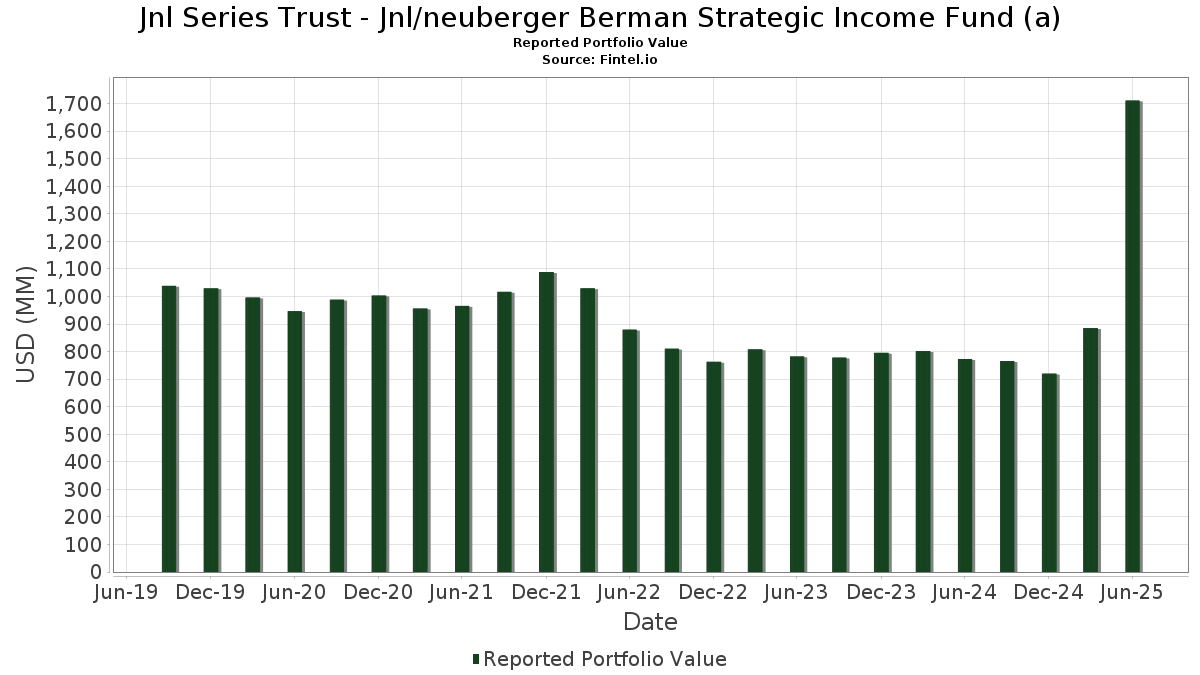

Jnl Series Trust - Jnl/neuberger Berman Strategic Income Fund (a) telah mengungkapkan total kepemilikan 2,372 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 1,710,909,018 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Jnl Series Trust - Jnl/neuberger Berman Strategic Income Fund (a) adalah Uniform Mortgage-Backed Security, TBA (US:US01F0606750) , Edwards Lifesciences Corporation (US:EW) , Edwards Lifesciences Corporation (US:EW) , Uniform Mortgage-Backed Security, TBA (US:US01F0526727) , and Uniform Mortgage-Backed Security, TBA (US:US01F0226757) . Posisi baru Jnl Series Trust - Jnl/neuberger Berman Strategic Income Fund (a) meliputi: Uniform Mortgage-Backed Security, TBA (US:US01F0606750) , Edwards Lifesciences Corporation (US:EW) , Edwards Lifesciences Corporation (US:EW) , Uniform Mortgage-Backed Security, TBA (US:US01F0526727) , and Uniform Mortgage-Backed Security, TBA (US:US01F0226757) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 48.80 | 4.6291 | 4.6291 | ||

| 48.80 | 4.6291 | 4.6291 | ||

| 16.95 | 1.6075 | 1.6075 | ||

| 16.95 | 1.6075 | 1.6075 | ||

| 26.46 | 2.5103 | 1.5157 | ||

| 26.46 | 2.5103 | 1.5157 | ||

| 34.02 | 3.2264 | 1.5154 | ||

| 0.42 | 10.71 | 1.0164 | 1.0164 | |

| 7.93 | 0.7523 | 0.7523 | ||

| 7.37 | 0.6987 | 0.6987 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 3.46 | 0.3285 | -1.8676 | ||

| 17.86 | 1.6944 | -1.5634 | ||

| 10.49 | 0.9946 | -1.5157 | ||

| 14.01 | 1.3287 | -1.1816 | ||

| 0.54 | 0.0514 | -1.0532 | ||

| 17.08 | 1.6199 | -0.8717 | ||

| 0.98 | 0.0934 | -0.6232 | ||

| 0.95 | 0.0905 | -0.3690 | ||

| 0.85 | 0.0806 | -0.3178 | ||

| 3.28 | 0.3108 | -0.3145 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-27 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| Treasury, United States Department of / DBT (US91282CKP58) | 48.80 | 4.6291 | 4.6291 | ||||||

| Treasury, United States Department of / DBT (US91282CKP58) | 48.80 | 4.6291 | 4.6291 | ||||||

| US01F0606750 / Uniform Mortgage-Backed Security, TBA | 34.02 | 189.93 | 3.2264 | 1.5154 | |||||

| EW / Edwards Lifesciences Corporation | 26.46 | 152.40 | 2.5103 | 1.5157 | |||||

| EW / Edwards Lifesciences Corporation | 26.46 | 152.40 | 2.5103 | 1.5157 | |||||

| US01F0526727 / Uniform Mortgage-Backed Security, TBA | 17.86 | -20.04 | 1.6944 | -1.5634 | |||||

| US01F0226757 / Uniform Mortgage-Backed Security, TBA | 17.08 | -0.05 | 1.6199 | -0.8717 | |||||

| Treasury, United States Department of / DBT (US91282CML27) | 16.95 | 1.6075 | 1.6075 | ||||||

| Treasury, United States Department of / DBT (US91282CML27) | 16.95 | 1.6075 | 1.6075 | ||||||

| EW / Edwards Lifesciences Corporation | 14.01 | -47.07 | 1.3287 | -1.1816 | |||||

| 46628D437 / JNL Government Money Market Fund | 13.40 | 128.75 | 13.40 | 128.77 | 1.2708 | 0.4457 | |||

| US21H0526788 / Ginnie Mae | 12.86 | 173.44 | 1.2196 | 0.5338 | |||||

| 46628D395 / JNL Government Money Market Fund - Class SL | 12.75 | 81.48 | 12.75 | 81.48 | 1.2096 | 0.2197 | |||

| US21H0506723 / Ginnie Mae | 11.44 | 72.14 | 1.0851 | 0.1160 | |||||

| EMLC / VanEck ETF Trust - VanEck J.P. Morgan EM Local Currency Bond ETF | 0.42 | 10.71 | 1.0164 | 1.0164 | |||||

| EW / Edwards Lifesciences Corporation | 10.49 | -60.38 | 0.9946 | -1.5157 | |||||

| EW / Edwards Lifesciences Corporation | 10.49 | 81.12 | 0.9946 | 0.1504 | |||||

| US91282CEP23 / WI TREASURY N/B REGD 2.87500000 | 7.93 | 0.7523 | 0.7523 | ||||||

| Treasury, United States Department of / DBT (US91282CJW29) | 7.37 | 0.6987 | 0.6987 | ||||||

| Treasury, United States Department of / DBT (US91282CJW29) | 7.37 | 0.6987 | 0.6987 | ||||||

| MX0MGO0000U2 / Mexican Bonos | 6.83 | 219.86 | 0.6478 | 0.3469 | |||||

| US91282CGT27 / United States Treasury Note/Bond | 5.34 | 0.5066 | 0.5066 | ||||||

| US55954WAS89 / Magnetite XXIV Ltd | 5.21 | 0.10 | 0.4938 | -0.2389 | |||||

| US912810TU25 / United States Treasury Note/Bond | 5.13 | 0.4866 | 0.4866 | ||||||

| Treasury, United States Department of / DBT (US91282CNC19) | 5.06 | 0.4802 | 0.4802 | ||||||

| Treasury, United States Department of / DBT (US91282CNC19) | 5.06 | 0.4802 | 0.4802 | ||||||

| MX0MGO0001D6 / Mexican Bonos Desarr Fixed Rate, Series M | 4.65 | 0.4415 | 0.4415 | ||||||

| US35564KRN18 / Freddie Mac Structured Agency Credit Risk Debt Notes | 3.95 | 0.54 | 0.3742 | -0.1787 | |||||

| US912810TM09 / United States Treasury Note/Bond | 3.60 | 0.3417 | 0.3417 | ||||||

| Treasury, United States Department of / DBT (US912810TZ12) | 3.56 | 0.3373 | 0.3373 | ||||||

| Treasury, United States Department of / DBT (US912810TZ12) | 3.56 | 0.3373 | 0.3373 | ||||||

| US85573QAA85 / STARWOOD MORTGAGE RESIDENTIAL TRUST 2021-5 | 3.49 | -2.76 | 0.3309 | -0.1746 | |||||

| US21H0606713 / Ginnie Mae | 3.46 | -77.01 | 0.3285 | -1.8676 | |||||

| US35564KH446 / FHLMC STACR REMIC Trust, Series 2022-DNA6, Class M1B | 3.44 | 0.20 | 0.3262 | -0.1572 | |||||

| US902973BC96 / US Bancorp | 3.31 | 1.19 | 0.3143 | -0.1470 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 3.31 | 0.3141 | 0.3141 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 3.31 | 0.3141 | 0.3141 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 3.28 | 0.3112 | 0.3112 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 3.28 | 0.3112 | 0.3112 | ||||||

| US55903VBD47 / Warnermedia Holdings Inc | 3.28 | -26.18 | 0.3108 | -0.3145 | |||||

| CAON34 / Capital One Financial Corporation - Depositary Receipt (Common Stock) | 3.14 | 27.85 | 0.2979 | -0.0482 | |||||

| CAON34 / Capital One Financial Corporation - Depositary Receipt (Common Stock) | 3.14 | 27.85 | 0.2979 | -0.0482 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 3.13 | 183.86 | 0.2971 | 0.1362 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 3.13 | 183.86 | 0.2971 | 0.1362 | |||||

| US31418ESQ43 / FNMA 30YR 3.5% 04/01/2053#MA5026 | 3.11 | 0.2949 | 0.2949 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 3.05 | 0.2895 | 0.2895 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 3.05 | 0.2895 | 0.2895 | ||||||

| Balboa Bay Loan Funding 2024-1 Ltd / ABS-CBDO (US05766NAN21) | 3.01 | -0.07 | 0.2860 | -0.1390 | |||||

| Balboa Bay Loan Funding 2024-1 Ltd / ABS-CBDO (US05766NAN21) | 3.01 | -0.07 | 0.2860 | -0.1390 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 3.01 | 0.2854 | 0.2854 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 3.01 | 0.2854 | 0.2854 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 2.97 | 0.2814 | 0.2814 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 2.97 | 0.2814 | 0.2814 | ||||||

| US92538MAA71 / Verus Securitization Trust | 2.95 | -4.16 | 0.2796 | -0.1537 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 2.90 | 0.2753 | 0.2753 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 2.90 | 0.2753 | 0.2753 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 2.84 | 0.2698 | 0.2698 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 2.84 | 0.2698 | 0.2698 | ||||||

| US33829WAJ80 / 522 Funding CLO 2019-5 Ltd | 2.82 | -0.11 | 0.2676 | -0.1302 | |||||

| US20753YCK64 / Connecticut Avenue Securities Trust, Series 2022-R04, Class 1M2 | 2.82 | -0.11 | 0.2670 | -0.1300 | |||||

| Treasury, United States Department of / DBT (US91282CNE74) | 2.74 | 0.2600 | 0.2600 | ||||||

| Treasury, United States Department of / DBT (US91282CNE74) | 2.74 | 0.2600 | 0.2600 | ||||||

| USF1R15XK367 / BNP Paribas SA | 2.74 | 0.2599 | 0.2599 | ||||||

| JBS USA Holding Lux S.a r.l. / DBT (US472140AC65) | 2.71 | -0.37 | 0.2570 | -0.1262 | |||||

| JBS USA Holding Lux S.a r.l. / DBT (US472140AC65) | 2.71 | -0.37 | 0.2570 | -0.1262 | |||||

| Treasury, United States Department of / DBT (US912810UH94) | 2.66 | 0.2526 | 0.2526 | ||||||

| Treasury, United States Department of / DBT (US912810UH94) | 2.66 | 0.2526 | 0.2526 | ||||||

| US35564KTJ87 / Freddie Mac STACR REMIC Trust 2022-HQA1 | 2.61 | 0.12 | 0.2477 | -0.1199 | |||||

| Connecticut Avenue Securities Trust 2025-R04 / ABS-MBS (US20755TAC53) | 2.60 | 0.2468 | 0.2468 | ||||||

| Connecticut Avenue Securities Trust 2025-R04 / ABS-MBS (US20755TAC53) | 2.60 | 0.2468 | 0.2468 | ||||||

| US064058AL44 / Bank of New York Mellon Corp/The | 2.59 | 2.09 | 0.2461 | -0.1120 | |||||

| US31418EU817 / Fannie Mae Pool | 2.59 | 784.64 | 0.2459 | 0.2031 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 2.56 | 0.2431 | 0.2431 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 2.56 | 0.2431 | 0.2431 | ||||||

| SB12AGO32 / Peru - Sovereign or Government Agency Debt | 2.56 | 54.71 | 0.2431 | 0.0097 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 2.50 | 0.2367 | 0.2367 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 2.50 | 0.2367 | 0.2367 | ||||||

| US31418EQ864 / Fannie Mae Pool | 2.49 | 63.22 | 0.2366 | 0.0198 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 2.47 | 0.2341 | 0.2341 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 2.47 | 0.2341 | 0.2341 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 2.46 | 0.2336 | 0.2336 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 2.46 | 0.2336 | 0.2336 | ||||||

| US81527CAP23 / Sedgwick Claims Management Services Inc | 2.44 | 0.2319 | 0.2319 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 2.41 | 0.2286 | 0.2286 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 2.41 | 0.2286 | 0.2286 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 2.38 | -5.25 | 0.2258 | -0.1281 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 2.38 | -5.25 | 0.2258 | -0.1281 | |||||

| US20753XAB01 / Fannie Mae Connecticut Avenue Securities | 2.34 | 0.21 | 0.2219 | -0.1070 | |||||

| Treasury, United States Department of / DBT (US91282CNG23) | 2.33 | 0.2208 | 0.2208 | ||||||

| Treasury, United States Department of / DBT (US91282CNG23) | 2.33 | 0.2208 | 0.2208 | ||||||

| US20755DAF33 / Connecticut Avenue Securities Trust 2022-R08 | 2.31 | -0.39 | 0.2196 | -0.1078 | |||||

| US3140XGRB71 / Federal National Mortgage Association, Inc. | 2.26 | 27.01 | 0.2146 | -0.0364 | |||||

| US06051GJA85 / Bank of America Corp | 2.26 | 0.2139 | 0.2139 | ||||||

| US600814AN71 / Millicom International Cellular SA | 2.24 | 0.2124 | 0.2124 | ||||||

| US212015AQ46 / Continental Resources Inc/OK | 2.23 | 0.2114 | 0.2114 | ||||||

| US00206RKJ04 / AT&T Inc | 2.21 | -0.54 | 0.2099 | -0.1035 | |||||

| US3140XJZX49 / Federal National Mortgage Association, Inc. | 2.20 | -1.21 | 0.2085 | -0.1050 | |||||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 2.20 | 40.98 | 0.2083 | -0.0112 | |||||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 2.20 | 40.98 | 0.2083 | -0.0112 | |||||

| US097023CW33 / BOEING CO 5.805 5/50 | 2.19 | 1.20 | 0.2078 | -0.0972 | |||||

| US969457BV14 / Williams Cos Inc/The | 2.16 | 0.2051 | 0.2051 | ||||||

| US20754BAF85 / CAS_22-R02 | 2.13 | 0.09 | 0.2018 | -0.0976 | |||||

| BX Trust 2025-LIFE / ABS-MBS (US05616HAA59) | 2.12 | 0.2011 | 0.2011 | ||||||

| BX Trust 2025-LIFE / ABS-MBS (US05616HAA59) | 2.12 | 0.2011 | 0.2011 | ||||||

| US808513BJ38 / Charles Schwab Corp/The | 2.09 | 46.03 | 0.1987 | -0.0033 | |||||

| US3132DWF570 / FNCL UMBS 5.0 SD8288 01-01-53 | 2.09 | -2.52 | 0.1984 | -0.1039 | |||||

| US1248EPCN14 / CORPORATE BONDS | 2.06 | 1,603.31 | 0.1955 | 0.1784 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 2.06 | -2.88 | 0.1950 | -0.1031 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 2.06 | -2.88 | 0.1950 | -0.1031 | |||||

| US58733RAF91 / MERCADOLIBRE INC 3.125% 01/14/2031 | 2.05 | 0.1943 | 0.1943 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 2.03 | -3.11 | 0.1924 | -0.1025 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 2.03 | -3.11 | 0.1924 | -0.1025 | |||||

| Signal Peak CLO 4, Ltd. / ABS-CBDO (US82666XAG51) | 2.01 | 0.25 | 0.1905 | -0.0918 | |||||

| Signal Peak CLO 4, Ltd. / ABS-CBDO (US82666XAG51) | 2.01 | 0.25 | 0.1905 | -0.0918 | |||||

| US91282CFV81 / United States Treasury Note/Bond | 1.98 | 0.1881 | 0.1881 | ||||||

| MU / Micron Technology, Inc. - Depositary Receipt (Common Stock) | 1.98 | 0.1880 | 0.1880 | ||||||

| MU / Micron Technology, Inc. - Depositary Receipt (Common Stock) | 1.98 | 0.1880 | 0.1880 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.97 | -5.19 | 0.1871 | -0.1060 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.97 | -5.19 | 0.1871 | -0.1060 | |||||

| Santander Drive Auto Receivables Trust 2025-1 / ABS-CBDO (US80288DAF33) | 1.97 | 0.46 | 0.1870 | -0.0895 | |||||

| Santander Drive Auto Receivables Trust 2025-1 / ABS-CBDO (US80288DAF33) | 1.97 | 0.46 | 0.1870 | -0.0895 | |||||

| US35564KVE62 / Freddie Mac STACR REMIC Trust 2022-DNA3 | 1.97 | 0.20 | 0.1866 | -0.0900 | |||||

| US3142GQBU57 / FHLG 30YR 5.5% 10/01/2053#RJ0050 | 1.95 | 0.1848 | 0.1848 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.95 | 631.95 | 0.1847 | 0.1478 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.95 | 631.95 | 0.1847 | 0.1478 | |||||

| USX10001AB51 / Allianz SE | 1.93 | 0.1829 | 0.1829 | ||||||

| US693475BC86 / PNC Financial Services Group Inc/The | 1.92 | 1.53 | 0.1823 | -0.0844 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.91 | 0.1807 | 0.1807 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.91 | 0.1807 | 0.1807 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.90 | -4.23 | 0.1805 | -0.0994 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.90 | -4.23 | 0.1805 | -0.0994 | |||||

| US3132DWJM64 / Freddie Mac Pool | 1.89 | -3.56 | 0.1797 | -0.0970 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.89 | -4.89 | 0.1791 | -0.1005 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.89 | -4.89 | 0.1791 | -0.1005 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.88 | -4.96 | 0.1782 | -0.1003 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.88 | -4.96 | 0.1782 | -0.1003 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.86 | -4.87 | 0.1760 | -0.0989 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.86 | -4.87 | 0.1760 | -0.0989 | |||||

| US3140NK4F57 / FNCL UMBS 5.5 BY3521 06-01-53 | 1.84 | -2.34 | 0.1744 | -0.0907 | |||||

| US639057AD02 / Natwest Group PLC | 1.82 | 3.24 | 0.1725 | -0.0756 | |||||

| US31418EMS62 / FNCL UMBS 5.0 MA4868 01-01-53 | 1.81 | -2.58 | 0.1718 | -0.0901 | |||||

| US95000U3H45 / Wells Fargo & Co | 1.80 | 1.29 | 0.1711 | -0.0797 | |||||

| US00253XAB73 / American Airlines Inc/AAdvantage Loyalty IP Ltd | 1.80 | 360.10 | 0.1707 | 0.1155 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.79 | -4.99 | 0.1697 | -0.0955 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.79 | -4.99 | 0.1697 | -0.0955 | |||||

| US74365PAE88 / Prosus NV | 1.78 | 0.1687 | 0.1687 | ||||||

| US3140XHD387 / Federal National Mortgage Association, Inc. | 1.78 | -2.04 | 0.1684 | -0.0870 | |||||

| Treasury, United States Department of / DBT (US91282CNA52) | 1.77 | 0.1676 | 0.1676 | ||||||

| Treasury, United States Department of / DBT (US91282CNA52) | 1.77 | 0.1676 | 0.1676 | ||||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 1.77 | 1.85 | 0.1675 | -0.0768 | |||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 1.77 | 1.85 | 0.1675 | -0.0768 | |||||

| ROCK Trust 2024-CNTR / ABS-MBS (US74970WAG50) | 1.76 | 0.74 | 0.1668 | -0.0791 | |||||

| ROCK Trust 2024-CNTR / ABS-MBS (US74970WAG50) | 1.76 | 0.74 | 0.1668 | -0.0791 | |||||

| US60162PAL67 / Milos CLO Ltd | 1.75 | 0.11 | 0.1662 | -0.0804 | |||||

| D1OM34 / Dominion Energy, Inc. - Depositary Receipt (Common Stock) | 1.74 | 68.08 | 0.1654 | 0.0192 | |||||

| D1OM34 / Dominion Energy, Inc. - Depositary Receipt (Common Stock) | 1.74 | 68.08 | 0.1654 | 0.0192 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.74 | -6.91 | 0.1649 | -0.0983 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.74 | -6.91 | 0.1649 | -0.0983 | |||||

| US3132DWJ531 / UMBS | 1.74 | -4.67 | 0.1646 | -0.0919 | |||||

| US836205BB97 / Republic of South Africa Government International Bond | 1.74 | 746.34 | 0.1646 | 0.1357 | |||||

| US912810TP30 / US TREASURY I/L 1.5% 02-15-53 | 1.72 | 0.1628 | 0.1628 | ||||||

| US3140QRVZ32 / Federal National Mortgage Association, Inc. | 1.72 | -1.04 | 0.1627 | -0.0815 | |||||

| US3132DWGG24 / FHLG 30YR 5% 02/01/2053# | 1.71 | -2.56 | 0.1625 | -0.0852 | |||||

| US3133KPUA47 / Freddie Mac Pool | 1.71 | -1.78 | 0.1618 | -0.0829 | |||||

| US31418EE308 / Fannie Mae Pool | 1.70 | 54.82 | 0.1616 | 0.0066 | |||||

| LHOME Mortgage Trust 2024-RTL4 / ABS-MBS (US50205PAA03) | 1.70 | 0.06 | 0.1610 | -0.0779 | |||||

| LHOME Mortgage Trust 2024-RTL4 / ABS-MBS (US50205PAA03) | 1.70 | 0.06 | 0.1610 | -0.0779 | |||||

| US345370DA55 / Ford Motor Co | 1.69 | 1,002.61 | 0.1600 | 0.1380 | |||||

| US35564KUE71 / Freddie Mac STACR REMIC Trust 2022-HQA1 | 1.68 | -0.24 | 0.1598 | -0.0781 | |||||

| US3132DWES89 / FR SD8245 | 1.68 | -2.15 | 0.1598 | -0.0828 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.68 | 0.1591 | 0.1591 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.68 | 0.1591 | 0.1591 | ||||||

| US26439XAH61 / DCP Midstream Operating LP | 1.66 | 0.1570 | 0.1570 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.65 | 0.1566 | 0.1566 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.65 | 0.1566 | 0.1566 | ||||||

| US902613BE74 / UBS Group AG | 1.64 | 1.43 | 0.1552 | -0.0721 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.63 | 0.68 | 0.1545 | -0.0735 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.63 | 0.68 | 0.1545 | -0.0735 | |||||

| US207932AB01 / Connecticut Avenue Securities Trust 2023-R01 | 1.61 | 0.06 | 0.1527 | -0.0739 | |||||

| BX Trust 2025-ROIC / ABS-MBS (US05593VAL71) | 1.60 | -1.36 | 0.1514 | -0.0765 | |||||

| BX Trust 2025-ROIC / ABS-MBS (US05593VAL71) | 1.60 | -1.36 | 0.1514 | -0.0765 | |||||

| US92857WBS89 / Vodafone Group PLC | 1.59 | 0.70 | 0.1508 | -0.0715 | |||||

| Pk Alift Loan Funding 6 LP / ABS-CBDO (US69291YAA64) | 1.59 | 0.1506 | 0.1506 | ||||||

| Pk Alift Loan Funding 6 LP / ABS-CBDO (US69291YAA64) | 1.59 | 0.1506 | 0.1506 | ||||||

| US3140QN2S02 / Federal National Mortgage Association, Inc. | 1.59 | -1.55 | 0.1504 | -0.0764 | |||||

| INTOWN 2025-STAY Mortgage Trust / ABS-MBS (US46117WAE21) | 1.57 | -26.73 | 0.1490 | -0.1531 | |||||

| INTOWN 2025-STAY Mortgage Trust / ABS-MBS (US46117WAE21) | 1.57 | -26.73 | 0.1490 | -0.1531 | |||||

| A1PP34 / AppLovin Corporation - Depositary Receipt (Common Stock) | 1.56 | 83.51 | 0.1478 | 0.0282 | |||||

| A1PP34 / AppLovin Corporation - Depositary Receipt (Common Stock) | 1.56 | 83.51 | 0.1478 | 0.0282 | |||||

| PRM Trust 2025-PRM6 / ABS-MBS (US74277DAJ19) | 1.55 | 0.1472 | 0.1472 | ||||||

| PRM Trust 2025-PRM6 / ABS-MBS (US74277DAJ19) | 1.55 | 0.1472 | 0.1472 | ||||||

| GA Global Funding Trust / DBT (US36143L2Q77) | 1.54 | 1.05 | 0.1465 | -0.0689 | |||||

| GA Global Funding Trust / DBT (US36143L2Q77) | 1.54 | 1.05 | 0.1465 | -0.0689 | |||||

| US35564KE476 / STACR_22-HQA3 | 1.52 | -0.26 | 0.1445 | -0.0707 | |||||

| US35564KLU15 / Freddie Mac STACR REMIC Trust 2021-DNA6 | 1.52 | 0.33 | 0.1444 | -0.0695 | |||||

| US38144GAG64 / Goldman Sachs Group Inc/The | 1.50 | 695.24 | 0.1426 | 0.1159 | |||||

| US89642DAJ72 / Trinitas CLO Ltd | 1.50 | 0.00 | 0.1424 | -0.0692 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.50 | 0.1421 | 0.1421 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.50 | 0.1421 | 0.1421 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.49 | -6.45 | 0.1417 | -0.0834 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.49 | -6.45 | 0.1417 | -0.0834 | |||||

| PTPP / PT PP (Persero) Tbk | 1.48 | 1,155.93 | 0.1406 | 0.1239 | |||||

| PTPP / PT PP (Persero) Tbk | 1.48 | 1,155.93 | 0.1406 | 0.1239 | |||||

| XS1040508167 / Imperial Brands Finance plc | 1.48 | 1.17 | 0.1400 | -0.0655 | |||||

| XS1040508167 / Imperial Brands Finance plc | 1.48 | 1.17 | 0.1400 | -0.0655 | |||||

| US3132DWF653 / Freddie Mac Pool | 1.47 | -2.84 | 0.1394 | -0.0737 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.47 | -2.39 | 0.1393 | -0.0727 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.47 | -2.39 | 0.1393 | -0.0727 | |||||

| C1MS34 / CMS Energy Corporation - Depositary Receipt (Common Stock) | 1.46 | 0.1389 | 0.1389 | ||||||

| C1MS34 / CMS Energy Corporation - Depositary Receipt (Common Stock) | 1.46 | 0.1389 | 0.1389 | ||||||

| 30064K105 / Exacttarget, Inc. | 1.46 | 0.1387 | 0.1387 | ||||||

| 30064K105 / Exacttarget, Inc. | 1.46 | 0.1387 | 0.1387 | ||||||

| US3140XLMY15 / Fannie Mae Pool | 1.45 | -3.59 | 0.1377 | -0.0745 | |||||

| US67115DAA00 / Onslow Bay Mortgage Loan Trust | 1.45 | -1.29 | 0.1376 | -0.0695 | |||||

| US3132DQM784 / Freddie Mac Pool | 1.45 | -1.16 | 0.1372 | -0.0690 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.44 | -6.78 | 0.1369 | -0.0812 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.44 | -6.78 | 0.1369 | -0.0812 | |||||

| US31418EMT46 / Fannie Mae Pool | 1.44 | -3.03 | 0.1368 | -0.0728 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.44 | 0.1366 | 0.1366 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.44 | 0.1366 | 0.1366 | ||||||

| US3133KRCK86 / Freddie Mac Pool | 1.44 | -3.16 | 0.1365 | -0.0728 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.44 | 0.1364 | 0.1364 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.44 | 0.1364 | 0.1364 | ||||||

| US87264ABF12 / CORP. NOTE | 1.44 | 0.1363 | 0.1363 | ||||||

| US20754LAB53 / Fannie Mae Connecticut Avenue Securities | 1.43 | 0.21 | 0.1356 | -0.0654 | |||||

| Navient Private Education Refi Loan Trust 2023-A / ABS-CBDO (US63943CAA99) | 1.43 | -7.27 | 0.1355 | -0.0815 | |||||

| Navient Private Education Refi Loan Trust 2023-A / ABS-CBDO (US63943CAA99) | 1.43 | -7.27 | 0.1355 | -0.0815 | |||||

| XS2240463674 / Lorca Telecom Bondco SA | 1.42 | -0.63 | 0.1350 | -0.0681 | |||||

| USC98874AJ64 / Glencore Finance (Canada) Limited | 1.41 | 0.1342 | 0.1342 | ||||||

| US3133KPYS19 / Federal Home Loan Mortgage Corporation | 1.41 | -4.54 | 0.1338 | -0.0743 | |||||

| C1NP34 / CenterPoint Energy, Inc. - Depositary Receipt (Common Stock) | 1.39 | 2.05 | 0.1320 | -0.0602 | |||||

| C1NP34 / CenterPoint Energy, Inc. - Depositary Receipt (Common Stock) | 1.39 | 2.05 | 0.1320 | -0.0602 | |||||

| US3132DWE748 / Freddie Mac Pool | 1.39 | -2.45 | 0.1320 | -0.0689 | |||||

| US87264ACT07 / T-Mobile USA Inc | 1.39 | -0.64 | 0.1316 | -0.0652 | |||||

| US55336V3087 / MPLX LP | 1.39 | -1.42 | 0.1315 | -0.0666 | |||||

| HU0000404892 / Hungary Government Bond | 1.39 | 201.74 | 0.1314 | 0.0663 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.38 | 0.1312 | 0.1312 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.38 | 0.1312 | 0.1312 | ||||||

| USP87324BE10 / Peruvian Government International Bond | 1.38 | 0.1311 | 0.1311 | ||||||

| US59170JAA60 / MetroNet Infrastructure Issuer LLC | 1.37 | -0.36 | 0.1303 | -0.0639 | |||||

| FR0014003S56 / Electricite de France SA | 1.37 | 65.98 | 0.1301 | 0.0137 | |||||

| AU3FN0029609 / AAI Ltd | 1.37 | 0.07 | 0.1299 | -0.0629 | |||||

| AU3FN0029609 / AAI Ltd | 1.37 | 0.07 | 0.1299 | -0.0629 | |||||

| US3132DN4H32 / Freddie Mac Pool | 1.37 | -2.49 | 0.1298 | -0.0679 | |||||

| US78432WAA18 / SFO Commercial Mortgage Trust 2021-555 | 1.37 | 26.22 | 0.1298 | -0.0229 | |||||

| Gracie Point International Funding 2024-1, LLC / ABS-CBDO (US38410KAA79) | 1.37 | 0.44 | 0.1295 | -0.0619 | |||||

| Gracie Point International Funding 2024-1, LLC / ABS-CBDO (US38410KAA79) | 1.37 | 0.44 | 0.1295 | -0.0619 | |||||

| US3133KQW281 / Federal Home Loan Mortgage Corporation | 1.36 | -2.51 | 0.1290 | -0.0675 | |||||

| UBERD / Uber Technologies, Inc. - Depositary Receipt (Common Stock) | 1.36 | -0.22 | 0.1287 | -0.0628 | |||||

| UBERD / Uber Technologies, Inc. - Depositary Receipt (Common Stock) | 1.36 | -0.22 | 0.1287 | -0.0628 | |||||

| US35564KYP82 / Freddie Mac Structured Agency Credit Risk Debt Notes | 1.34 | -0.59 | 0.1275 | -0.0631 | |||||

| S1RE34 / Sempra - Depositary Receipt (Common Stock) | 1.34 | 162.82 | 0.1274 | 0.0554 | |||||

| S1RE34 / Sempra - Depositary Receipt (Common Stock) | 1.34 | 162.82 | 0.1274 | 0.0554 | |||||

| US3140XGSN01 / FN30 | 1.34 | -2.27 | 0.1267 | -0.0658 | |||||

| US3132DQGW06 / Freddie Mac Pool | 1.33 | -3.83 | 0.1264 | -0.0688 | |||||

| US11135FBP53 / SR UNSECURED 144A 11/35 3.137 | 1.33 | -36.85 | 0.1262 | -0.1725 | |||||

| US03846JAA88 / Egypt Government International Bond | 1.33 | 0.1258 | 0.1258 | ||||||

| US060505GB47 / Bank of America Corp | 1.32 | 0.61 | 0.1252 | -0.0597 | |||||

| US842587DF14 / Southern Co/The | 1.31 | 0.69 | 0.1246 | -0.0592 | |||||

| US74113XAF33 / Prestige Auto Receivables Trust 2021-1 | 1.31 | 0.69 | 0.1246 | -0.0592 | |||||

| US64016NAE76 / Neighborly Issuer 2023-1 | 1.31 | 0.1245 | 0.1245 | ||||||

| US3140QQCK90 / FANNIE MAE POOL FN CB4573 | 1.31 | -2.24 | 0.1241 | -0.0644 | |||||

| Foundry JV Holdco LLC / DBT (US350930AD58) | 1.30 | 1.72 | 0.1237 | -0.0570 | |||||

| Foundry JV Holdco LLC / DBT (US350930AD58) | 1.30 | 1.72 | 0.1237 | -0.0570 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.30 | -3.64 | 0.1231 | -0.0666 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.30 | -3.64 | 0.1231 | -0.0666 | |||||

| OBX 2025-HE1 Trust / ABS-CBDO (US67121CAA45) | 1.29 | -5.35 | 0.1225 | -0.0697 | |||||

| XS2264968665 / Ivory Coast Government International Bond | 1.29 | 453.22 | 0.1223 | 0.0894 | |||||

| XS2264968665 / Ivory Coast Government International Bond | 1.29 | 453.22 | 0.1223 | 0.0894 | |||||

| US3140XKVT46 / Fannie Mae Pool | 1.29 | -10.83 | 0.1219 | -0.0812 | |||||

| US91282CHZ77 / United States Treasury Note/Bond | 1.28 | 0.1211 | 0.1211 | ||||||

| US31418EV807 / FN MA5138 | 1.27 | -22.55 | 0.1206 | -0.1121 | |||||

| US64035GAE98 / Nelnet Student Loan Trust 2021-C | 1.26 | 0.1192 | 0.1192 | ||||||

| US35910EAA29 / Frontier Issuer LLC | 1.26 | -0.32 | 0.1192 | -0.0583 | |||||

| US29379VBU61 / Enterprise Produc Bond | 1.26 | 0.1191 | 0.1191 | ||||||

| MX0MGO000102 / Mexican Bonos | 1.25 | 0.1187 | 0.1187 | ||||||

| COL17CT03615 / Colombian TES | 1.25 | 296.51 | 0.1185 | 0.0741 | |||||

| US3133C9Z488 / Federal Home Loan Mortgage Corporation | 1.25 | -7.43 | 0.1183 | -0.0714 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.25 | -5.53 | 0.1183 | -0.0676 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.25 | -5.53 | 0.1183 | -0.0676 | |||||

| RO52CQA3C829 / ROMANIA GOVERNMENT BOND 8.250000% 09/29/2032 | 1.24 | 6.24 | 0.1180 | -0.0469 | |||||

| US3140XKZX12 / Fannie Mae Pool | 1.24 | -5.49 | 0.1176 | -0.0673 | |||||

| US3133BT5R79 / Freddie Mac Pool | 1.22 | -3.09 | 0.1161 | -0.0617 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.22 | 0.1160 | 0.1160 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.22 | 0.1160 | 0.1160 | ||||||

| US3140NABJ12 / Federal National Mortgage Association, Inc. | 1.22 | -7.18 | 0.1154 | -0.0692 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.22 | 3.58 | 0.1153 | -0.0475 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.22 | 3.58 | 0.1153 | -0.0475 | |||||

| US3140XGY609 / Federal National Mortgage Association, Inc. | 1.21 | -1.39 | 0.1147 | -0.0580 | |||||

| Consolidated Communications LLC/Fidium Fiber Finan / ABS-CBDO (US209031AC71) | 1.20 | 0.1142 | 0.1142 | ||||||

| Consolidated Communications LLC/Fidium Fiber Finan / ABS-CBDO (US209031AC71) | 1.20 | 0.1142 | 0.1142 | ||||||

| Towd Point Mortgage Trust 2024-CES2 / ABS-MBS (US89182JAA97) | 1.20 | -9.57 | 0.1139 | -0.0731 | |||||

| Towd Point Mortgage Trust 2024-CES2 / ABS-MBS (US89182JAA97) | 1.20 | -9.57 | 0.1139 | -0.0731 | |||||

| US63942EAA64 / Navient Private Education Refi Loan Trust, Series 2021-EA, Class A | 1.20 | -5.44 | 0.1138 | -0.0649 | |||||

| HU0000403001 / Hungary Government Bond | 1.20 | 12.37 | 0.1138 | -0.0366 | |||||

| Howard Midstream Energy Partners, LLC / DBT (US442722AC80) | 1.20 | 533.86 | 0.1137 | 0.0870 | |||||

| Howard Midstream Energy Partners, LLC / DBT (US442722AC80) | 1.20 | 533.86 | 0.1137 | 0.0870 | |||||

| BX Trust 2025-GW / ABS-MBS (US12433GAG10) | 1.20 | 0.1137 | 0.1137 | ||||||

| BX Trust 2025-GW / ABS-MBS (US12433GAG10) | 1.20 | 0.1137 | 0.1137 | ||||||

| PL0000115291 / Republic of Poland Government Bond | 1.19 | 9.26 | 0.1131 | -0.0406 | |||||

| DAL / Delta Air Lines, Inc. - Depositary Receipt (Common Stock) | 1.19 | 0.1127 | 0.1127 | ||||||

| DAL / Delta Air Lines, Inc. - Depositary Receipt (Common Stock) | 1.19 | 0.1127 | 0.1127 | ||||||

| US038779AB06 / ARBYS FUNDING LLC ARBYS 2020-1A A2 | 1.18 | 0.1122 | 0.1122 | ||||||

| Chase Home Lending Mortgage Trust Series 2024-4 / ABS-MBS (US16159NAK00) | 1.18 | -9.23 | 0.1120 | -0.0712 | |||||

| Chase Home Lending Mortgage Trust Series 2024-4 / ABS-MBS (US16159NAK00) | 1.18 | -9.23 | 0.1120 | -0.0712 | |||||

| XS2636324274 / British Telecommunications PLC | 1.18 | 7.10 | 0.1117 | -0.0432 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.17 | -4.32 | 0.1114 | -0.0615 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.17 | -4.32 | 0.1114 | -0.0615 | |||||

| Towd Point Mortgage Trust 2024-CES1 / ABS-CBDO (US89183CAA36) | 1.17 | -8.74 | 0.1111 | -0.0696 | |||||

| Towd Point Mortgage Trust 2024-CES1 / ABS-CBDO (US89183CAA36) | 1.17 | -8.74 | 0.1111 | -0.0696 | |||||

| US958667AA50 / WESTERN MIDSTREAM OPERAT SR UNSECURED 02/50 5.25 | 1.16 | -10.91 | 0.1101 | -0.0501 | |||||

| AON North America, Inc. / DBT (US03740MAF77) | 1.16 | 0.17 | 0.1099 | -0.0531 | |||||

| AON North America, Inc. / DBT (US03740MAF77) | 1.16 | 0.17 | 0.1099 | -0.0531 | |||||

| US3140XJR391 / Federal National Mortgage Association, Inc. | 1.16 | -2.69 | 0.1097 | -0.0577 | |||||

| Benchmark 2024-V8 Mortgage Trust / ABS-MBS (US08190AAE01) | 1.16 | 3.31 | 0.1096 | -0.0480 | |||||

| Benchmark 2024-V8 Mortgage Trust / ABS-MBS (US08190AAE01) | 1.16 | 3.31 | 0.1096 | -0.0480 | |||||

| US55361AAU88 / MSWF Commercial Mortgage Trust 2023-2 | 1.16 | 0.1096 | 0.1096 | ||||||

| LYG / Lloyds Banking Group plc - Depositary Receipt (Common Stock) | 1.16 | 0.1096 | 0.1096 | ||||||

| LYG / Lloyds Banking Group plc - Depositary Receipt (Common Stock) | 1.16 | 0.1096 | 0.1096 | ||||||

| US3137FRV571 / Federal Home Loan Mortgage Corporation | 1.15 | -6.81 | 0.1090 | -0.0648 | |||||

| US3140N6SX12 / Fannie Mae Pool | 1.15 | -12.50 | 0.1089 | -0.0760 | |||||

| US3140XGG457 / Fannie Mae Pool | 1.15 | -3.21 | 0.1087 | -0.0580 | |||||

| US912810TQ13 / United States Treasury Note/Bond | 1.15 | 0.1086 | 0.1086 | ||||||

| US89180YAA82 / Towd Point Mortgage Trust 2022-4 | 1.15 | -2.39 | 0.1086 | -0.0567 | |||||

| Government National Mortgage Association Guaranteed Remic Pass-Through Securities, The / ABS-MBS (US38385CCE66) | 1.14 | -7.69 | 0.1083 | -0.0659 | |||||

| Government National Mortgage Association Guaranteed Remic Pass-Through Securities, The / ABS-MBS (US38385CCE66) | 1.14 | -7.69 | 0.1083 | -0.0659 | |||||

| Dell International L.L.C. / DBT (US24703TAP12) | 1.14 | 28.35 | 0.1082 | -0.0171 | |||||

| Dell International L.L.C. / DBT (US24703TAP12) | 1.14 | 28.35 | 0.1082 | -0.0171 | |||||

| Frontier Issuer LLC / ABS-CBDO (US35910EAM66) | 1.14 | -0.96 | 0.1078 | -0.0538 | |||||

| Frontier Issuer LLC / ABS-CBDO (US35910EAM66) | 1.14 | -0.96 | 0.1078 | -0.0538 | |||||

| Ziply Fiber Issuer LLC / ABS-CBDO (US98979QAE35) | 1.13 | 0.18 | 0.1076 | -0.0520 | |||||

| Ziply Fiber Issuer LLC / ABS-CBDO (US98979QAE35) | 1.13 | 0.18 | 0.1076 | -0.0520 | |||||

| BRAVO Residential Funding Trust 2025-NQM5 / ABS-MBS (US10569RAF91) | 1.13 | 0.1069 | 0.1069 | ||||||

| BRAVO Residential Funding Trust 2025-NQM5 / ABS-MBS (US10569RAF91) | 1.13 | 0.1069 | 0.1069 | ||||||

| US38382GDD16 / Ginnie Mae REMIC Trust 2020-095 | 1.13 | -3.35 | 0.1068 | -0.0572 | |||||

| US12563LAP22 / CLIF 20-1A B 144A 3.62% 09-18-45 | 1.11 | 0.1057 | 0.1057 | ||||||

| US3132E0B685 / Freddie Mac Pool | 1.11 | -0.45 | 0.1055 | -0.0520 | |||||

| US3140XHJC20 / UMBS, 30 Year | 1.11 | -2.88 | 0.1054 | -0.0558 | |||||

| US85236KAK88 / Stack Infrastructure Issuer LLC | 1.11 | -0.63 | 0.1053 | -0.0521 | |||||

| XS2397781944 / Iliad Holding SASU | 1.11 | -3.73 | 0.1053 | -0.0572 | |||||

| US31418EGK01 / Federal National Mortgage Association | 1.11 | -2.29 | 0.1050 | -0.0547 | |||||

| SDAL Trust 2025-DAL / ABS-MBS (US78437RAE99) | 1.10 | 0.1042 | 0.1042 | ||||||

| SDAL Trust 2025-DAL / ABS-MBS (US78437RAE99) | 1.10 | 0.1042 | 0.1042 | ||||||

| XS2199597456 / TK Elevator Midco GmbH | 1.09 | -33.92 | 0.1030 | -0.1300 | |||||

| US31418ELX66 / FNMA 30YR 5% 12/01/2052#MA4841 | 1.08 | -2.43 | 0.1028 | -0.0536 | |||||

| US63935CAC55 / Navient Private Education Refi Loan Trust 2019-F | 1.08 | 1.31 | 0.1028 | -0.0479 | |||||

| Chase Home Lending Mortgage Trust 2024-11 / ABS-MBS (US161919AD70) | 1.08 | -7.69 | 0.1026 | -0.0625 | |||||

| Chase Home Lending Mortgage Trust 2024-11 / ABS-MBS (US161919AD70) | 1.08 | -7.69 | 0.1026 | -0.0625 | |||||

| BX Trust / ABS-MBS (US05612AAJ51) | 1.08 | 0.28 | 0.1026 | -0.0493 | |||||

| BX Trust / ABS-MBS (US05612AAJ51) | 1.08 | 0.28 | 0.1026 | -0.0493 | |||||

| A1EP34 / American Electric Power Company, Inc. - Depositary Receipt (Common Stock) | 1.08 | 1.79 | 0.1025 | -0.0470 | |||||

| A1EP34 / American Electric Power Company, Inc. - Depositary Receipt (Common Stock) | 1.08 | 1.79 | 0.1025 | -0.0470 | |||||

| US35671DBC83 / Freeport-McMoRan Inc. Bond | 1.08 | -55.08 | 0.1024 | -0.1799 | |||||

| IRV Trust 2025-200P / ABS-MBS (US45006HAE18) | 1.08 | 0.94 | 0.1023 | -0.0482 | |||||

| IRV Trust 2025-200P / ABS-MBS (US45006HAE18) | 1.08 | 0.94 | 0.1023 | -0.0482 | |||||

| TRTX 2025-FL6 Issuer, Ltd. / ABS-CBDO (US897764AA45) | 1.08 | 0.28 | 0.1023 | -0.0493 | |||||

| TRTX 2025-FL6 Issuer, Ltd. / ABS-CBDO (US897764AA45) | 1.08 | 0.28 | 0.1023 | -0.0493 | |||||

| US63942KAA25 / Navient Student Loan Trust | 1.08 | -3.58 | 0.1021 | -0.0552 | |||||

| ONNI Commercial Mortgage Trust 2024-APT / ABS-MBS (US682939AE39) | 1.08 | 0.28 | 0.1020 | -0.0491 | |||||

| ONNI Commercial Mortgage Trust 2024-APT / ABS-MBS (US682939AE39) | 1.08 | 0.28 | 0.1020 | -0.0491 | |||||

| US38382UP707 / Government National Mortgage Association | 1.07 | -3.34 | 0.1016 | -0.0545 | |||||

| BLP Commercial Mortgage Trust 2025-IND / ABS-MBS (US05625BAA70) | 1.07 | 0.47 | 0.1012 | -0.0484 | |||||

| BLP Commercial Mortgage Trust 2025-IND / ABS-MBS (US05625BAA70) | 1.07 | 0.47 | 0.1012 | -0.0484 | |||||

| US172967MV07 / Citigroup Inc | 1.07 | 0.76 | 0.1012 | -0.0479 | |||||

| CH0286864027 / UBS Group AG | 1.07 | -0.19 | 0.1011 | -0.0494 | |||||

| XS2406607171 / Teva Pharmaceutical Finance Netherlands II BV | 1.07 | 11.40 | 0.1011 | -0.0337 | |||||

| BRAVO Residential Funding Trust 2025-NQM5 / ABS-MBS (US10569RAE27) | 1.07 | 0.1011 | 0.1011 | ||||||

| BRAVO Residential Funding Trust 2025-NQM5 / ABS-MBS (US10569RAE27) | 1.07 | 0.1011 | 0.1011 | ||||||

| Chase Home Lending Mortgage Trust Series 2024-2 / ABS-MBS (US16159HAK32) | 1.06 | -10.66 | 0.1010 | -0.0668 | |||||

| Chase Home Lending Mortgage Trust Series 2024-2 / ABS-MBS (US16159HAK32) | 1.06 | -10.66 | 0.1010 | -0.0668 | |||||

| BX Trust 2024-VLT4 / ABS-MBS (US05612TAJ43) | 1.06 | 0.38 | 0.1009 | -0.0483 | |||||

| BX Trust 2024-VLT4 / ABS-MBS (US05612TAJ43) | 1.06 | 0.38 | 0.1009 | -0.0483 | |||||

| US279158AS81 / Ecopetrol SA | 1.06 | 0.1008 | 0.1008 | ||||||

| COMM 2024-277P Mortgage Trust / ABS-MBS (US12654FAE07) | 1.06 | 0.28 | 0.1005 | -0.0483 | |||||

| COMM 2024-277P Mortgage Trust / ABS-MBS (US12654FAE07) | 1.06 | 0.28 | 0.1005 | -0.0483 | |||||

| US3132DWGH07 / Freddie Mac Pool | 1.06 | -3.20 | 0.1005 | -0.0536 | |||||

| US43300LAL45 / HILTON USA TRUST 2016-HHV HILT 2016-HHV D | 1.06 | 0.1004 | 0.1004 | ||||||

| US55261FAN42 / M&T Bank Corp | 1.06 | 1.83 | 0.1004 | -0.0459 | |||||

| US38382TV848 / Government National Mortgage Association | 1.06 | -3.82 | 0.1003 | -0.0546 | |||||

| US92538MAC38 / Verus Securitization Trust | 1.05 | -4.53 | 0.1000 | -0.0555 | |||||

| Avis Budget Rental Car Funding (AESOP) LLC / ABS-CBDO (US05377RGN89) | 1.05 | -0.10 | 0.0996 | -0.0485 | |||||

| Avis Budget Rental Car Funding (AESOP) LLC / ABS-CBDO (US05377RGN89) | 1.05 | -0.10 | 0.0996 | -0.0485 | |||||

| XS2187646901 / Virgin Media Vendor Financing Notes III DAC | 1.05 | 9.49 | 0.0996 | -0.0356 | |||||

| US87264AAZ84 / T-MOBILE USA INC 4.5% 04/15/2050 | 1.05 | -0.76 | 0.0994 | -0.0494 | |||||

| US126650DZ02 / CVS HEALTH CORP | 1.03 | 1.18 | 0.0979 | -0.0458 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.03 | -4.54 | 0.0979 | -0.0544 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.03 | -4.54 | 0.0979 | -0.0544 | |||||

| LV Trust 2024-SHOW / ABS-MBS (US50245XAE76) | 1.02 | 159.24 | 0.0972 | 0.0415 | |||||

| LV Trust 2024-SHOW / ABS-MBS (US50245XAE76) | 1.02 | 159.24 | 0.0972 | 0.0415 | |||||

| NRZ FHT Excess LLC / ABS-MBS (US64832EAA73) | 1.02 | -4.40 | 0.0969 | -0.0537 | |||||

| NRZ FHT Excess LLC / ABS-MBS (US64832EAA73) | 1.02 | -4.40 | 0.0969 | -0.0537 | |||||

| US80281LAS43 / SANTANDER UK GROUP HOLDINGS PLC | 1.02 | -0.39 | 0.0966 | -0.0475 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.02 | -2.68 | 0.0966 | -0.0509 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.02 | -2.68 | 0.0966 | -0.0509 | |||||

| US46644UBE73 / JPMBB COMMERCIAL MORTGAGE SECURITIES TRUST FRN 07/15/2048 2015-C30 AS | 1.01 | 0.0962 | 0.0962 | ||||||

| 026375AE5 / American Greetings Corp 6.100% Notes 08/01/28 | 1.01 | 146.23 | 0.0960 | 0.0380 | |||||

| 026375AE5 / American Greetings Corp 6.100% Notes 08/01/28 | 1.01 | 146.23 | 0.0960 | 0.0380 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.01 | -2.51 | 0.0959 | -0.0502 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.01 | -2.51 | 0.0959 | -0.0502 | |||||

| Trafigura Securitisation Finance Public Limited Company / ABS-CBDO (US892725AZ52) | 1.01 | 0.10 | 0.0957 | -0.0463 | |||||

| Trafigura Securitisation Finance Public Limited Company / ABS-CBDO (US892725AZ52) | 1.01 | 0.10 | 0.0957 | -0.0463 | |||||

| US20755AAC62 / Fannie Mae Connecticut Avenue Securities | 1.01 | -0.10 | 0.0954 | -0.0463 | |||||

| MX0MGO0000D8 / Mexican Bonos | 1.01 | 0.0954 | 0.0954 | ||||||

| US3140N9TX42 / Federal National Mortgage Association, Inc. | 1.00 | -1.86 | 0.0952 | -0.0489 | |||||

| Sequoia Mortgage Trust 2024-4 / ABS-MBS (US81743BAK35) | 1.00 | -12.25 | 0.0952 | -0.0659 | |||||

| Sequoia Mortgage Trust 2024-4 / ABS-MBS (US81743BAK35) | 1.00 | -12.25 | 0.0952 | -0.0659 | |||||

| CVS / CVS Health Corporation - Depositary Receipt (Common Stock) | 1.00 | 2.56 | 0.0951 | -0.0426 | |||||

| CVS / CVS Health Corporation - Depositary Receipt (Common Stock) | 1.00 | 2.56 | 0.0951 | -0.0426 | |||||

| TRESTLES CLO III LTD / ABS-CBDO (US89532TAY29) | 1.00 | 0.60 | 0.0950 | -0.0452 | |||||

| TRESTLES CLO III LTD / ABS-CBDO (US89532TAY29) | 1.00 | 0.60 | 0.0950 | -0.0452 | |||||

| US87248TAS42 / TICP CLO VII Ltd | 1.00 | 0.10 | 0.0950 | -0.0460 | |||||

| Wireless Propco Funding LLC / ABS-CBDO (US97655EAG89) | 1.00 | 0.0949 | 0.0949 | ||||||

| Wireless Propco Funding LLC / ABS-CBDO (US97655EAG89) | 1.00 | 0.0949 | 0.0949 | ||||||

| US556227AA48 / Eleven Madison Trust 2015-11MD Mortgage Trust | 1.00 | 0.60 | 0.0947 | -0.0451 | |||||

| US76243NAJ54 / RIAL 2022-FL8 ISSUER LTD SER 2022-FL8 CL D V/R REGD 144A P/P 5.05000000 | 1.00 | 0.0945 | 0.0945 | ||||||

| Cloud Capital Holdco LP / ABS-CBDO (US102104AA49) | 1.00 | 0.51 | 0.0944 | -0.0451 | |||||

| Cloud Capital Holdco LP / ABS-CBDO (US102104AA49) | 1.00 | 0.51 | 0.0944 | -0.0451 | |||||

| US3133BRKQ65 / Federal Home Loan Mortgage Corporation | 0.99 | -3.97 | 0.0941 | -0.0515 | |||||

| E1XC34 / Exelon Corporation - Depositary Receipt (Common Stock) | 0.99 | 0.0935 | 0.0935 | ||||||

| E1XC34 / Exelon Corporation - Depositary Receipt (Common Stock) | 0.99 | 0.0935 | 0.0935 | ||||||

| US48667QAQ82 / KazMunayGas National Co JSC | 0.98 | 78.58 | 0.0934 | 0.0236 | |||||

| US912828P469 / United States Treasury Note/Bond | 0.98 | -79.55 | 0.0934 | -0.6232 | |||||

| US3140XGJS98 / Fannie Mae Pool | 0.98 | -1.70 | 0.0933 | -0.0477 | |||||

| US20754RAF38 / Connecticut Avenue Securities Trust 2021-R01 | 0.98 | 0.0933 | 0.0933 | ||||||

| Westlake Automobile Receivables Trust 2025-1 / ABS-CBDO (US96043VAH15) | 0.98 | 0.10 | 0.0931 | -0.0451 | |||||

| Westlake Automobile Receivables Trust 2025-1 / ABS-CBDO (US96043VAH15) | 0.98 | 0.10 | 0.0931 | -0.0451 | |||||

| BX Commercial Mortgage Trust 2024-GPA2 / ABS-MBS (US12433DAE31) | 0.98 | 0.10 | 0.0930 | -0.0450 | |||||

| BX Commercial Mortgage Trust 2024-GPA2 / ABS-MBS (US12433DAE31) | 0.98 | 0.10 | 0.0930 | -0.0450 | |||||

| US3140QKSW94 / Fannie Mae Pool | 0.98 | -3.07 | 0.0928 | -0.0495 | |||||

| US3140QPK488 / Fannie Mae Pool | 0.98 | -2.98 | 0.0927 | -0.0492 | |||||

| US07134WAL72 / Battalion CLO XXI Ltd. | 0.98 | -0.61 | 0.0927 | -0.0457 | |||||

| BBV / Banco Bilbao Vizcaya Argentaria, S.A. - Depositary Receipt (Common Stock) | 0.97 | 3.73 | 0.0923 | -0.0399 | |||||

| BBV / Banco Bilbao Vizcaya Argentaria, S.A. - Depositary Receipt (Common Stock) | 0.97 | 3.73 | 0.0923 | -0.0399 | |||||

| US035198AC46 / Angolan Government International Bond | 0.97 | 15.75 | 0.0921 | -0.0261 | |||||

| BX Commercial Mortgage Trust 2024-XL5 / ABS-MBS (US05612GAG82) | 0.97 | -9.51 | 0.0921 | -0.0591 | |||||

| BX Commercial Mortgage Trust 2024-XL5 / ABS-MBS (US05612GAG82) | 0.97 | -9.51 | 0.0921 | -0.0591 | |||||

| US456837AY94 / ING GROEP NV | 0.97 | 1.25 | 0.0919 | -0.0430 | |||||

| US205768AS39 / Comstock Resources Inc | 0.97 | 209.27 | 0.0919 | 0.0477 | |||||

| US35137LAN55 / Fox Corp | 0.97 | 1.04 | 0.0918 | -0.0431 | |||||

| Uniti Fiber Abs Issuer Llc / ABS-CBDO (US91326EAB11) | 0.97 | 0.73 | 0.0917 | -0.0435 | |||||

| Uniti Fiber Abs Issuer Llc / ABS-CBDO (US91326EAB11) | 0.97 | 0.73 | 0.0917 | -0.0435 | |||||

| US3140XHCY13 / FANNIE MAE POOL UMBS P#FS1886 3.00000000 | 0.96 | -2.24 | 0.0913 | -0.0474 | |||||

| US3132DWFG33 / Freddie Mac Pool | 0.96 | -1.84 | 0.0909 | -0.0467 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.96 | -0.42 | 0.0908 | -0.0446 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.96 | -0.42 | 0.0908 | -0.0446 | |||||

| US912810TR95 / United States Treasury Note/Bond | 0.95 | -68.53 | 0.0905 | -0.3690 | |||||

| US3140N3AD19 / Federal National Mortgage Association, Inc. | 0.95 | -3.83 | 0.0905 | -0.0492 | |||||

| XS2690056374 / Banijay Entertainment | 0.95 | 358.17 | 0.0904 | 0.0610 | |||||

| US3140XLPT92 / Fannie Mae Pool | 0.95 | -6.31 | 0.0903 | -0.0528 | |||||

| SUZ.30 / Suzano Austria GmbH | 0.95 | 199.37 | 0.0901 | 0.0528 | |||||

| XS2451803063 / BAYER AG 5.375%/VAR 03/25/2082 REGS | 0.95 | 11.44 | 0.0897 | -0.0299 | |||||

| ZAG000077488 / Republic of South Africa Government Bond | 0.95 | 0.0896 | 0.0896 | ||||||

| XS2696094270 / Pinnacle Bidco PLC | 0.94 | 175.73 | 0.0895 | 0.0413 | |||||

| SHA0 / Schaeffler AG | 0.94 | 123.28 | 0.0893 | 0.0298 | |||||

| SHA0 / Schaeffler AG | 0.94 | 123.28 | 0.0893 | 0.0298 | |||||

| IDG000015207 / Indonesia Treasury Bond | 0.94 | 4.10 | 0.0892 | -0.0381 | |||||

| US31418EPD66 / Fannie Mae Pool | 0.94 | -2.80 | 0.0891 | -0.0471 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.94 | -4.29 | 0.0891 | -0.0490 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.94 | -4.29 | 0.0891 | -0.0490 | |||||

| US3133BBZQ58 / Freddie Mac Pool | 0.94 | -2.80 | 0.0890 | -0.0470 | |||||

| US3140XKB823 / Fannie Mae Pool | 0.94 | -1.26 | 0.0890 | -0.0449 | |||||

| Hudson Yards 2025-SPRL Mortgage Trust / ABS-MBS (US44855PAE88) | 0.94 | 162.01 | 0.0890 | 0.0385 | |||||

| Hudson Yards 2025-SPRL Mortgage Trust / ABS-MBS (US44855PAE88) | 0.94 | 162.01 | 0.0890 | 0.0385 | |||||

| US05565AB286 / BNP Paribas SA | 0.94 | 1.63 | 0.0889 | -0.0411 | |||||

| AerCap Ireland Capital Designated Activity Company / DBT (US00774MBK09) | 0.94 | 0.0888 | 0.0888 | ||||||

| AerCap Ireland Capital Designated Activity Company / DBT (US00774MBK09) | 0.94 | 0.0888 | 0.0888 | ||||||

| US3133BAFE65 / UMBS | 0.93 | -3.02 | 0.0885 | -0.0469 | |||||

| New Residential Mortgage LLC / ABS-MBS (US62956YAA73) | 0.93 | -5.78 | 0.0883 | -0.0508 | |||||

| New Residential Mortgage LLC / ABS-MBS (US62956YAA73) | 0.93 | -5.78 | 0.0883 | -0.0508 | |||||

| US31574PAE51 / Ellington Financial Mortgage Trust 2020-1 | 0.93 | 0.0883 | 0.0883 | ||||||

| US674599CS21 / Occidental Petroleum Corp | 0.93 | -61.76 | 0.0882 | -0.1976 | |||||

| BX Commercial Mortgage Trust 2024-KING / ABS-MBS (US05612RAG48) | 0.93 | 0.43 | 0.0882 | -0.0422 | |||||

| BX Commercial Mortgage Trust 2024-KING / ABS-MBS (US05612RAG48) | 0.93 | 0.43 | 0.0882 | -0.0422 | |||||

| US39843PAG81 / Grifols Worldwide Operations USA, Inc. USD 2019 Term Loan B | 0.93 | 373.98 | 0.0881 | 0.0625 | |||||

| UNH / UnitedHealth Group Incorporated - Depositary Receipt (Common Stock) | 0.93 | 0.0881 | 0.0881 | ||||||

| UNH / UnitedHealth Group Incorporated - Depositary Receipt (Common Stock) | 0.93 | 0.0881 | 0.0881 | ||||||

| New Residential Mortgage Loan Trust 2024-RTL2 / ABS-MBS (US64831WAA80) | 0.93 | 0.54 | 0.0881 | -0.0420 | |||||

| New Residential Mortgage Loan Trust 2024-RTL2 / ABS-MBS (US64831WAA80) | 0.93 | 0.54 | 0.0881 | -0.0420 | |||||

| Subway Funding LLC / ABS-CBDO (US864300AA61) | 0.93 | 0.54 | 0.0879 | -0.0419 | |||||

| Subway Funding LLC / ABS-CBDO (US864300AA61) | 0.93 | 0.54 | 0.0879 | -0.0419 | |||||

| US06738EBX22 / Barclays PLC | 0.92 | 1.65 | 0.0875 | -0.0403 | |||||

| TeamSystem S.p.A. / DBT (XS2864287540) | 0.92 | 0.0871 | 0.0871 | ||||||

| TeamSystem S.p.A. / DBT (XS2864287540) | 0.92 | 0.0871 | 0.0871 | ||||||

| EQH.PRC / Equitable Holdings, Inc. - Preferred Stock | 0.91 | 2.70 | 0.0868 | -0.0386 | |||||

| EQH.PRC / Equitable Holdings, Inc. - Preferred Stock | 0.91 | 2.70 | 0.0868 | -0.0386 | |||||

| US35564KQC61 / Freddie Mac STACR REMIC Trust 2022-DNA1 | 0.91 | 0.77 | 0.0867 | -0.0410 | |||||

| US65559CAD39 / Nordea Bank Abp | 0.91 | 1.67 | 0.0866 | -0.0399 | |||||

| XS2287912450 / Verisure Midholding AB | 0.91 | 9.09 | 0.0866 | -0.0313 | |||||

| US808513BK01 / Charles Schwab Corp/The | 0.91 | 1.00 | 0.0865 | -0.0407 | |||||

| US172967NB34 / Citigroup Inc | 0.91 | 0.33 | 0.0865 | -0.0415 | |||||

| US458140BJ82 / Intel Corp | 0.91 | 1.34 | 0.0864 | -0.0403 | |||||

| NGL Energy Operating LLC / DBT (US62922LAC28) | 0.91 | 1,680.39 | 0.0862 | 0.0789 | |||||

| NGL Energy Operating LLC / DBT (US62922LAC28) | 0.91 | 1,680.39 | 0.0862 | 0.0789 | |||||

| US3140XMRJ75 / Fannie Mae Pool | 0.91 | -2.05 | 0.0860 | -0.0444 | |||||

| ELM Trust 2024-ELM / ABS-MBS (US26860XBE04) | 0.91 | 0.33 | 0.0860 | -0.0414 | |||||

| ELM Trust 2024-ELM / ABS-MBS (US26860XBE04) | 0.91 | 0.33 | 0.0860 | -0.0414 | |||||

| MVW 2024-2 LLC / ABS-CBDO (US55389QAB32) | 0.90 | -6.81 | 0.0857 | -0.0508 | |||||

| MVW 2024-2 LLC / ABS-CBDO (US55389QAB32) | 0.90 | -6.81 | 0.0857 | -0.0508 | |||||

| HPEFS Equipment Trust 2024-2 / ABS-CBDO (US40444MAL54) | 0.90 | 0.22 | 0.0857 | -0.0413 | |||||

| HPEFS Equipment Trust 2024-2 / ABS-CBDO (US40444MAL54) | 0.90 | 0.22 | 0.0857 | -0.0413 | |||||

| Connecticut Avenue Securities Trust 2025-R02 / ABS-MBS (US20754TAD46) | 0.90 | 0.33 | 0.0855 | -0.0410 | |||||

| Connecticut Avenue Securities Trust 2025-R02 / ABS-MBS (US20754TAD46) | 0.90 | 0.33 | 0.0855 | -0.0410 | |||||

| US05609VAQ86 / BX Commercial Mortgage Trust, Series 2021-VOLT, Class F | 0.90 | -2.38 | 0.0855 | -0.0446 | |||||

| Foundry JV Holdco LLC / DBT (US350930AK91) | 0.90 | 1.47 | 0.0851 | -0.0395 | |||||

| Foundry JV Holdco LLC / DBT (US350930AK91) | 0.90 | 1.47 | 0.0851 | -0.0395 | |||||

| US63942GAA13 / Navient Private Education Refi Loan Trust 2021-F | 0.90 | -5.78 | 0.0851 | -0.0490 | |||||

| US92682RAA05 / Viking Ocean Cruises Ship VII Ltd | 0.89 | 860.22 | 0.0848 | 0.0716 | |||||

| Aris Water Holdings, LLC / DBT (US04041NAA00) | 0.89 | 510.27 | 0.0846 | 0.0639 | |||||

| Aris Water Holdings, LLC / DBT (US04041NAA00) | 0.89 | 510.27 | 0.0846 | 0.0639 | |||||

| ATHS / Athene Holding Ltd. - Corporate Bond/Note | 0.89 | 0.0844 | 0.0844 | ||||||

| ATHS / Athene Holding Ltd. - Corporate Bond/Note | 0.89 | 0.0844 | 0.0844 | ||||||

| US19425AAE47 / College Avenue Student Loans LLC | 0.89 | 0.0842 | 0.0842 | ||||||

| USA Compression Finance Corp. / DBT (US91740PAG37) | 0.89 | 397.75 | 0.0841 | 0.0590 | |||||

| USA Compression Finance Corp. / DBT (US91740PAG37) | 0.89 | 397.75 | 0.0841 | 0.0590 | |||||

| US3132DWH303 / Freddie Mac Pool | 0.89 | -3.07 | 0.0840 | -0.0447 | |||||

| COL17CT03490 / Colombian TES | 0.88 | 2.08 | 0.0837 | -0.0380 | |||||

| S1NP34 / Synopsys, Inc. - Depositary Receipt (Common Stock) | 0.88 | 0.0835 | 0.0835 | ||||||

| S1NP34 / Synopsys, Inc. - Depositary Receipt (Common Stock) | 0.88 | 0.0835 | 0.0835 | ||||||

| Verus Securitization Trust 2024-7 / ABS-MBS (US924925AA84) | 0.88 | -6.52 | 0.0830 | -0.0488 | |||||

| Verus Securitization Trust 2024-7 / ABS-MBS (US924925AA84) | 0.88 | -6.52 | 0.0830 | -0.0488 | |||||

| OWN Equipment Fund I LLC / ABS-CBDO (US69121NAA63) | 0.87 | -4.90 | 0.0829 | -0.0465 | |||||

| OWN Equipment Fund I LLC / ABS-CBDO (US69121NAA63) | 0.87 | -4.90 | 0.0829 | -0.0465 | |||||

| US25179MAV54 / Devon Energy Corp Bond | 0.87 | 0.0828 | 0.0828 | ||||||

| US3140QDU368 / Federal National Mortgage Association, Inc. | 0.87 | -4.07 | 0.0828 | -0.0455 | |||||

| US74166MAE66 / PRIME SECSRVC BRW / FINANC | 0.87 | 112.96 | 0.0827 | 0.0251 | |||||

| US12637UBC27 / CSAIL 2016-C7 Commercial Mortgage Trust | 0.87 | 0.0826 | 0.0826 | ||||||

| US90117PAJ49 / 1211 AVENUE OF THE AMERICAS TRUST 2015-1211 SER 2015-1211 CL B V/R REGD 144A P/P 4.22957000 | 0.87 | 0.12 | 0.0824 | -0.0399 | |||||

| TPRY34 / Tapestry, Inc. - Depositary Receipt (Common Stock) | 0.87 | 1.64 | 0.0823 | -0.0380 | |||||

| TPRY34 / Tapestry, Inc. - Depositary Receipt (Common Stock) | 0.87 | 1.64 | 0.0823 | -0.0380 | |||||

| US90385KAJ07 / BANK LOAN NOTE | 0.87 | 127.89 | 0.0822 | 0.0286 | |||||

| US90385KAJ07 / BANK LOAN NOTE | 0.87 | 127.89 | 0.0822 | 0.0286 | |||||

| US031162DU18 / Amgen Inc | 0.87 | -0.35 | 0.0821 | -0.0402 | |||||

| US77289KAA34 / Rockcliff Energy II LLC | 0.86 | 395.40 | 0.0818 | 0.0573 | |||||

| Huntington National Bank, The / ABS-CBDO (US44644NAA72) | 0.86 | -12.84 | 0.0818 | -0.0576 | |||||

| Huntington National Bank, The / ABS-CBDO (US44644NAA72) | 0.86 | -12.84 | 0.0818 | -0.0576 | |||||

| GRF / Greiffenberger AG | 0.86 | 81.01 | 0.0814 | 0.0146 | |||||

| GRF / Greiffenberger AG | 0.86 | 81.01 | 0.0814 | 0.0146 | |||||

| US3140XHCC92 / Fannie Mae Pool | 0.86 | -1.72 | 0.0812 | -0.0415 | |||||

| US3140XLPD41 / FN FS4919 | 0.86 | 0.0811 | 0.0811 | ||||||

| US3140XJAH63 / Federal National Mortgage Association, Inc. | 0.85 | -5.75 | 0.0810 | -0.0466 | |||||

| US281020AT41 / Edison International | 0.85 | -4.28 | 0.0806 | -0.0445 | |||||

| Blue Stream Issuer, LLC / ABS-CBDO (US09606BAG95) | 0.85 | 0.47 | 0.0806 | -0.0385 | |||||

| Blue Stream Issuer, LLC / ABS-CBDO (US09606BAG95) | 0.85 | 0.47 | 0.0806 | -0.0385 | |||||

| US31418ES431 / UMBS, 30 Year | 0.85 | -69.98 | 0.0806 | -0.3178 | |||||

| US05606FAN33 / BX TRUST BX 2019 OC11 E 144A | 0.84 | 0.0799 | 0.0799 | ||||||

| US456837AR44 / ING Groep NV | 0.84 | 0.36 | 0.0798 | -0.0383 | |||||

| US456837AZ69 / ING Groep NV | 0.84 | -0.24 | 0.0795 | -0.0387 | |||||

| US126307AZ02 / CSC Holdings, LLC | 0.84 | 0.0794 | 0.0794 | ||||||

| US31418EVA53 / Fannie Mae Pool | 0.84 | -3.69 | 0.0792 | -0.0430 | |||||

| PL0000113783 / Republic of Poland Government Bond | 0.83 | 0.0791 | 0.0791 | ||||||

| Great Wolf Trust 2024-WOLF / ABS-MBS (US39152MAG06) | 0.83 | 0.36 | 0.0788 | -0.0379 | |||||

| Great Wolf Trust 2024-WOLF / ABS-MBS (US39152MAG06) | 0.83 | 0.36 | 0.0788 | -0.0379 | |||||

| Sierra Timeshare 2025-1 Receivables Funding LLC / ABS-CBDO (US82653CAD39) | 0.83 | -15.24 | 0.0787 | -0.0592 | |||||

| Sierra Timeshare 2025-1 Receivables Funding LLC / ABS-CBDO (US82653CAD39) | 0.83 | -15.24 | 0.0787 | -0.0592 | |||||

| Goldstory / DBT (XS2761227037) | 0.83 | 0.0787 | 0.0787 | ||||||

| Goldstory / DBT (XS2761227037) | 0.83 | 0.0787 | 0.0787 | ||||||

| XS2193661324 / BP Capital Markets PLC | 0.82 | 9.57 | 0.0782 | -0.0278 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 0.82 | -11.68 | 0.0782 | -0.0533 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 0.82 | -11.68 | 0.0782 | -0.0533 | |||||

| ROCK Trust 2024-CNTR / ABS-MBS (US74970WAC47) | 0.82 | 0.0781 | 0.0781 | ||||||

| ROCK Trust 2024-CNTR / ABS-MBS (US74970WAC47) | 0.82 | 0.0781 | 0.0781 | ||||||

| US03464TAC36 / Angel Oak Mortgage Trust 2022-3 | 0.82 | 0.0780 | 0.0780 | ||||||

| RO3B41D8EX14 / ROMANIA GOVT | 0.82 | 6.76 | 0.0779 | -0.0304 | |||||

| US81761TAG04 / ServiceMaster Funding LLC | 0.82 | 0.0776 | 0.0776 | ||||||

| US63859WAF68 / Nationwide Building Society | 0.82 | 0.62 | 0.0774 | -0.0368 | |||||

| BX Commercial Mortgage Trust 2024-KING / ABS-MBS (US05612RAE99) | 0.81 | 0.37 | 0.0773 | -0.0370 | |||||

| BX Commercial Mortgage Trust 2024-KING / ABS-MBS (US05612RAE99) | 0.81 | 0.37 | 0.0773 | -0.0370 | |||||

| US3140XKBL30 / Fannie Mae Pool | 0.81 | -3.67 | 0.0773 | -0.0419 | |||||

| US49461MAA80 / Kinetik Holdings LP | 0.81 | 2,288.24 | 0.0770 | 0.0722 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 0.81 | -0.12 | 0.0769 | -0.0374 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 0.81 | -0.12 | 0.0769 | -0.0374 | |||||

| Alpha Generation LLC / DBT (US02073LAA98) | 0.81 | 148.92 | 0.0768 | 0.0310 | |||||

| Alpha Generation LLC / DBT (US02073LAA98) | 0.81 | 148.92 | 0.0768 | 0.0310 | |||||

| US31418EHP88 / Federal National Mortgage Association | 0.81 | -3.12 | 0.0766 | -0.0409 | |||||

| XS1634252628 / UPCB Finance VII Ltd | 0.81 | 10.41 | 0.0765 | -0.0265 | |||||

| Boels Topholding B.V. / DBT (XS2806449356) | 0.81 | 0.0764 | 0.0764 | ||||||

| Boels Topholding B.V. / DBT (XS2806449356) | 0.81 | 0.0764 | 0.0764 | ||||||

| MX0MGO0000P2 / Mexican Bonos | 0.80 | 10.33 | 0.0760 | -0.0264 | |||||

| US3140NCT252 / Fannie Mae Pool | 0.80 | -1.84 | 0.0760 | -0.0389 | |||||

| US95000U3D31 / Wells Fargo & Co | 0.80 | 0.0758 | 0.0758 | ||||||

| Ray Financing LLC / DBT (XS2854278194) | 0.80 | 0.0755 | 0.0755 | ||||||

| Ray Financing LLC / DBT (XS2854278194) | 0.80 | 0.0755 | 0.0755 | ||||||

| RCI.A / Rogers Communications Inc. | 0.79 | 2.06 | 0.0752 | -0.0342 | |||||

| RCI.A / Rogers Communications Inc. | 0.79 | 2.06 | 0.0752 | -0.0342 | |||||

| INTC / Intel Corporation - Depositary Receipt (Common Stock) | 0.79 | 1.41 | 0.0750 | -0.0350 | |||||

| INTC / Intel Corporation - Depositary Receipt (Common Stock) | 0.79 | 1.41 | 0.0750 | -0.0350 | |||||

| Flora Food Management B.V. / DBT (XS2848926239) | 0.79 | 9.58 | 0.0749 | -0.0267 | |||||

| Flora Food Management B.V. / DBT (XS2848926239) | 0.79 | 9.58 | 0.0749 | -0.0267 | |||||

| US3137FQXS79 / Freddie Mac Multiclass Certificates Series 2020-RR03 | 0.79 | -7.40 | 0.0748 | -0.0452 | |||||

| US03959KAA88 / Archrock Partners LP / Archrock Partners Finance Corp 6.875% 04/01/2027 144A | 0.78 | 302.05 | 0.0744 | 0.0469 | |||||

| US03959KAA88 / Archrock Partners LP / Archrock Partners Finance Corp 6.875% 04/01/2027 144A | 0.78 | 302.05 | 0.0744 | 0.0469 | |||||

| Volofin Finance (Ireland) Designated Activity Company / ABS-CBDO (US92873RAA95) | 0.78 | -15.06 | 0.0744 | -0.0557 | |||||

| Volofin Finance (Ireland) Designated Activity Company / ABS-CBDO (US92873RAA95) | 0.78 | -15.06 | 0.0744 | -0.0557 | |||||

| XS2643284461 / Peu (Fin) PLC | 0.78 | 233.33 | 0.0741 | 0.0411 | |||||

| Sierra Timeshare 2024-3 Receivables Funding LLC / ABS-CBDO (US82653BAC72) | 0.78 | -15.53 | 0.0739 | -0.0560 | |||||

| Sierra Timeshare 2024-3 Receivables Funding LLC / ABS-CBDO (US82653BAC72) | 0.78 | -15.53 | 0.0739 | -0.0560 | |||||

| FR001400EFQ6 / Electricite de France SA | 0.78 | 9.59 | 0.0737 | -0.0262 | |||||

| BX Trust / ABS-MBS (US05612EAG35) | 0.77 | 0.26 | 0.0730 | -0.0351 | |||||

| BX Trust / ABS-MBS (US05612EAG35) | 0.77 | 0.26 | 0.0730 | -0.0351 | |||||

| XS2232102876 / Altice France SA/France | 0.77 | 132.02 | 0.0729 | 0.0263 | |||||

| COLT 2025-6 Mortgage Loan Trust / ABS-MBS (US19689BAD55) | 0.77 | 0.0727 | 0.0727 | ||||||

| COLT 2025-6 Mortgage Loan Trust / ABS-MBS (US19689BAD55) | 0.77 | 0.0727 | 0.0727 | ||||||

| US78449YAA82 / SMB PRIVATE EDUCATION LOAN TRUST 2021-B 1.31% 07/17/2051 144A | 0.77 | 0.0727 | 0.0727 | ||||||

| US20754AAF03 / Fannie Mae Connecticut Avenue Securities | 0.77 | 0.0726 | 0.0726 | ||||||

| US46655AAJ79 / J.P. Morgan Chase Commercial Mortgage Securities Trust 2021-OPO | 0.76 | -3.42 | 0.0723 | -0.0389 | |||||

| US65505PAA57 / Noble Finance II LLC | 0.76 | 408.72 | 0.0720 | 0.0509 | |||||

| Foundation Finance Trust 2025-1 / ABS-CBDO (US35040WAA53) | 0.76 | -8.89 | 0.0719 | -0.0453 | |||||

| Foundation Finance Trust 2025-1 / ABS-CBDO (US35040WAA53) | 0.76 | -8.89 | 0.0719 | -0.0453 | |||||

| US3140MMZZ45 / Fannie Mae Pool | 0.76 | -2.70 | 0.0719 | -0.0378 | |||||

| Kimmeridge Texas Gas, LLC / DBT (US49446BAA26) | 0.76 | 788.24 | 0.0717 | 0.0597 | |||||

| Kimmeridge Texas Gas, LLC / DBT (US49446BAA26) | 0.76 | 788.24 | 0.0717 | 0.0597 | |||||

| MED Commercial Mortgage Trust 2024-MOB / ABS-MBS (US55287BAE39) | 0.75 | 1.35 | 0.0713 | -0.0333 | |||||

| US21987BBB36 / Corp Nacional del Cobre de Chile | 0.75 | 1.36 | 0.0707 | -0.0329 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.74 | 1.09 | 0.0703 | -0.0330 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.74 | 1.09 | 0.0703 | -0.0330 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0.74 | 0.0701 | 0.0701 | ||||||

| US92538NAA54 / Verus Securitization Trust 2022-4 | 0.74 | 0.0700 | 0.0700 | ||||||

| XS2358483258 / Vmed O2 UK Financing I PLC | 0.74 | 0.0698 | 0.0698 | ||||||

| NYMT Loan Trust 2024-INV1 / ABS-MBS (US62956XAC56) | 0.73 | -2.65 | 0.0697 | -0.0367 | |||||

| NYMT Loan Trust 2024-INV1 / ABS-MBS (US62956XAC56) | 0.73 | -2.65 | 0.0697 | -0.0367 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.73 | -0.41 | 0.0697 | -0.0341 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.73 | -0.41 | 0.0697 | -0.0341 | |||||

| Business Jet Securities 2024-1, LLC / ABS-CBDO (US12327CAA27) | 0.73 | -4.70 | 0.0693 | -0.0387 | |||||

| Business Jet Securities 2024-1, LLC / ABS-CBDO (US12327CAA27) | 0.73 | -4.70 | 0.0693 | -0.0387 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.73 | -4.45 | 0.0693 | -0.0384 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.73 | -4.45 | 0.0693 | -0.0384 | |||||

| US038461AM14 / Egypt Government International Bond | 0.72 | 7.27 | 0.0687 | -0.0264 | |||||

| US05606FAL76 / BX TRUST BX 2019 OC11 D 144A | 0.72 | 3.29 | 0.0686 | -0.0300 | |||||

| US3132DWDS98 / Freddie Mac Pool | 0.72 | -2.18 | 0.0682 | -0.0354 | |||||

| US06738ECN31 / BARCLAYS PLC 9.625%/VAR PERP | 0.72 | 1.84 | 0.0682 | -0.0313 | |||||

| US682413AJ88 / ONE 2021-PARK MORTGAGE TRUST 1ML+ 03/15/2036 144A | 0.72 | -3.49 | 0.0681 | -0.0368 | |||||

| PFS Financing Corp. / ABS-CBDO (US69335PFU49) | 0.72 | 0.42 | 0.0680 | -0.0326 | |||||

| PFS Financing Corp. / ABS-CBDO (US69335PFU49) | 0.72 | 0.42 | 0.0680 | -0.0326 | |||||

| Global Atlantic Financial Company / DBT (US37959GAG29) | 0.71 | 0.56 | 0.0678 | -0.0323 | |||||

| Global Atlantic Financial Company / DBT (US37959GAG29) | 0.71 | 0.56 | 0.0678 | -0.0323 | |||||

| Bank of America Corporation / DBT (US06051GMM86) | 0.71 | 1.13 | 0.0678 | -0.0318 | |||||

| Bank of America Corporation / DBT (US06051GMM86) | 0.71 | 1.13 | 0.0678 | -0.0318 | |||||

| OBX 2025-NQM7 Trust / ABS-MBS (US67121DAC83) | 0.71 | 0.0677 | 0.0677 | ||||||

| XS2010039894 / ZF Europe Finance BV | 0.71 | 6.91 | 0.0676 | -0.0263 | |||||

| Progroup AG / DBT (DE000A383CE8) | 0.71 | 45.01 | 0.0675 | -0.0017 | |||||

| Progroup AG / DBT (DE000A383CE8) | 0.71 | 45.01 | 0.0675 | -0.0017 | |||||

| ABN / ABN AMRO Bank N.V. - Depositary Receipt (Common Stock) | 0.71 | 1.28 | 0.0675 | -0.0315 | |||||

| ABN / ABN AMRO Bank N.V. - Depositary Receipt (Common Stock) | 0.71 | 1.28 | 0.0675 | -0.0315 | |||||

| US458140CB48 / Intel Corp | 0.71 | 0.99 | 0.0675 | -0.0318 | |||||

| FUTURE - PHYSICALLY DELIVERED / DIR (N/A) | 0.71 | 0.0674 | 0.0674 | ||||||

| FUTURE - PHYSICALLY DELIVERED / DIR (N/A) | 0.71 | 0.0674 | 0.0674 | ||||||

| BRSTNCNTF204 / Brazil Notas do Tesouro Nacional Serie F | 0.71 | 101.99 | 0.0673 | 0.0178 | |||||

| UBERD / Uber Technologies, Inc. - Depositary Receipt (Common Stock) | 0.71 | 0.0673 | 0.0673 | ||||||

| UBERD / Uber Technologies, Inc. - Depositary Receipt (Common Stock) | 0.71 | 0.0673 | 0.0673 | ||||||

| OBX 2024-NQM14 Trust / ABS-MBS (US67119XAF15) | 0.71 | 0.57 | 0.0671 | -0.0321 | |||||

| SAGB / Republic of South Africa Government Bond | 0.70 | 7.82 | 0.0668 | -0.0257 | |||||

| Government National Mortgage Association / ABS-MBS (US38384MEP86) | 0.70 | -10.14 | 0.0665 | -0.0434 | |||||

| Government National Mortgage Association / ABS-MBS (US38384MEP86) | 0.70 | -10.14 | 0.0665 | -0.0434 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.70 | 0.0664 | 0.0664 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.70 | 0.0664 | 0.0664 | ||||||

| US36257UAS69 / GS Mortgage Securities Trust 2019-GC42 | 0.70 | 1.01 | 0.0663 | -0.0312 | |||||

| US3132DM5Y73 / FHLMC 30YR UMBS SUPER | 0.70 | -1.27 | 0.0663 | -0.0335 | |||||

| XS0943370543 / ORSTED A/S | 0.70 | 547.22 | 0.0663 | 0.0510 | |||||

| XS0943370543 / ORSTED A/S | 0.70 | 547.22 | 0.0663 | 0.0510 | |||||

| US207942AB90 / Fannie Mae Connecticut Avenue Securities | 0.70 | 0.0663 | 0.0663 | ||||||

| US3140QRHN67 / Fannie Mae Pool | 0.70 | -0.14 | 0.0662 | -0.0322 | |||||

| US71654QDD16 / Petroleos Mexicanos | 0.70 | -64.40 | 0.0661 | -0.2094 | |||||

| N1RG34 / NRG Energy, Inc. - Depositary Receipt (Common Stock) | 0.70 | 214.48 | 0.0660 | 0.0348 | |||||

| N1RG34 / NRG Energy, Inc. - Depositary Receipt (Common Stock) | 0.70 | 214.48 | 0.0660 | 0.0348 | |||||

| ORL 2024-GLKS Mortgage Trust / ABS-MBS (US67120DAG07) | 0.70 | -0.14 | 0.0660 | -0.0321 | |||||

| Bank of America Corporation / DBT (US06055HAH66) | 0.69 | 0.0653 | 0.0653 | ||||||

| Bank of America Corporation / DBT (US06055HAH66) | 0.69 | 0.0653 | 0.0653 | ||||||

| US31418EDD94 / Federal National Mortgage Association | 0.68 | -2.29 | 0.0650 | -0.0337 | |||||

| CVS / CVS Health Corporation | 0.68 | 1.48 | 0.0649 | -0.0301 | |||||

| US880451AZ24 / TENNESSEE GAS PIPELINE REGD 144A P/P 2.90000000 | 0.68 | 0.0648 | 0.0648 | ||||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 0.68 | 1.49 | 0.0648 | -0.0300 | |||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 0.68 | 1.49 | 0.0648 | -0.0300 | |||||

| OBX 2024-NQM1 Trust / ABS-MBS (US67448LAA08) | 0.68 | 0.0647 | 0.0647 | ||||||

| Amsted Industries Incorporated / DBT (US032177AK30) | 0.68 | 226.92 | 0.0646 | 0.0352 | |||||

| Amsted Industries Incorporated / DBT (US032177AK30) | 0.68 | 226.92 | 0.0646 | 0.0352 | |||||

| IDG000023607 / INDONESIA GOVERNMENT IDR 6.625% 02-15-34 | 0.68 | 4.95 | 0.0644 | -0.0268 | |||||

| IP 2025-IP Mortgage Trust / ABS-MBS (US449843AG69) | 0.68 | 0.0643 | 0.0643 | ||||||

| IP 2025-IP Mortgage Trust / ABS-MBS (US449843AG69) | 0.68 | 0.0643 | 0.0643 | ||||||

| US316773DF47 / Fifth Third Bancorp | 0.68 | 1.50 | 0.0643 | -0.0298 | |||||

| US53944YAV56 / Lloyds Banking Group PLC | 0.68 | 1.80 | 0.0643 | -0.0295 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.68 | -3.42 | 0.0642 | -0.0345 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.68 | -3.42 | 0.0642 | -0.0345 | |||||

| New Residential Mortgage Loan Trust 2025-NQM3 / ABS-MBS (US64832CAF05) | 0.68 | 0.0642 | 0.0642 | ||||||

| New Residential Mortgage Loan Trust 2025-NQM3 / ABS-MBS (US64832CAF05) | 0.68 | 0.0642 | 0.0642 | ||||||

| US3132DP5B08 / UMBS Freddie Mac Pool | 0.67 | -2.88 | 0.0640 | -0.0338 | |||||

| US53079EBM57 / Liberty Mutual Group Inc | 0.67 | 2.44 | 0.0639 | -0.0288 | |||||

| US06051GLH01 / Bank of America Corp. | 0.67 | 0.0638 | 0.0638 | ||||||

| US09261HAC16 / Blackstone Private Credit Fund | 0.67 | 1.51 | 0.0638 | -0.0297 | |||||

| US09261HAC16 / Blackstone Private Credit Fund | 0.67 | 1.51 | 0.0638 | -0.0297 | |||||

| US698299BT07 / PANAMA (REPUBLIC OF) | 0.67 | 57.75 | 0.0638 | 0.0037 | |||||

| Chase Home Lending Mortgage Trust Series 2024-2 / ABS-MBS (US161929AJ31) | 0.67 | -11.84 | 0.0636 | -0.0435 | |||||

| Chase Home Lending Mortgage Trust Series 2024-2 / ABS-MBS (US161929AJ31) | 0.67 | -11.84 | 0.0636 | -0.0435 | |||||

| US983793AK61 / XPO Inc | 0.67 | 264.13 | 0.0636 | 0.0376 | |||||

| US05609VAN55 / BX Commercial Mortgage Trust, Series 2021-VOLT, Class E | 0.67 | 0.0635 | 0.0635 | ||||||

| Avis Budget Rental Car Funding (AESOP) LLC / ABS-CBDO (US05377RJA32) | 0.67 | 0.30 | 0.0631 | -0.0303 | |||||

| Avis Budget Rental Car Funding (AESOP) LLC / ABS-CBDO (US05377RJA32) | 0.67 | 0.30 | 0.0631 | -0.0303 | |||||

| Harvest Midstream I, L.P. / DBT (US417558AB90) | 0.67 | 381.88 | 0.0631 | 0.0436 | |||||

| Harvest Midstream I, L.P. / DBT (US417558AB90) | 0.67 | 381.88 | 0.0631 | 0.0436 | |||||

| US35563PJQ37 / Seasoned Credit Risk Transfer Trust Series 2019-1 | 0.67 | 0.0631 | 0.0631 | ||||||

| US3140QRR471 / Fannie Mae Pool | 0.67 | -3.48 | 0.0631 | -0.0340 | |||||

| BAMLL Trust 2024-BHP / ABS-MBS (US05493WAC64) | 0.66 | -33.93 | 0.0628 | -0.0784 | |||||

| BAMLL Trust 2024-BHP / ABS-MBS (US05493WAC64) | 0.66 | -33.93 | 0.0628 | -0.0784 | |||||

| US61691QAH11 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0.66 | 3.28 | 0.0628 | -0.0275 | |||||

| Crockett Partners Equipment Company IIA LLC / ABS-CBDO (US22689LAA35) | 0.66 | -5.57 | 0.0627 | -0.0359 | |||||

| Crockett Partners Equipment Company IIA LLC / ABS-CBDO (US22689LAA35) | 0.66 | -5.57 | 0.0627 | -0.0359 | |||||

| US06738EBT10 / Barclays PLC | 0.66 | 3.44 | 0.0627 | -0.0274 | |||||

| XS2338167104 / BK LC Lux Finco1 Sarl | 0.66 | 9.44 | 0.0627 | -0.0224 | |||||

| Bell Canada inc. / DBT (US0778FPAP47) | 0.66 | 2.18 | 0.0623 | -0.0282 | |||||

| Bell Canada inc. / DBT (US0778FPAP47) | 0.66 | 2.18 | 0.0623 | -0.0282 | |||||

| Verus Securitization Trust 2025-4 / ABS-MBS (US92540UAE73) | 0.66 | 0.0622 | 0.0622 | ||||||

| Verus Securitization Trust 2025-4 / ABS-MBS (US92540UAE73) | 0.66 | 0.0622 | 0.0622 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.65 | -3.27 | 0.0617 | -0.0330 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.65 | -3.27 | 0.0617 | -0.0330 | |||||

| XS2411541738 / B&M European Value Retail SA | 0.65 | 0.0616 | 0.0616 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.64 | 0.0612 | 0.0612 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.64 | 0.0612 | 0.0612 | ||||||

| US3140QPAA53 / Federal National Mortgage Association, Inc. | 0.64 | -1.68 | 0.0609 | -0.0311 | |||||

| US05548WAA53 / BARCLAYS COMMERCIAL MORTGAGE S BBCMS 2018 TALL A 144A | 0.64 | 144.11 | 0.0609 | 0.0238 | |||||

| US17291NAE13 / CGCMT_23-SMRT | 0.64 | 1.26 | 0.0609 | -0.0285 | |||||

| XS2630490717 / VODAFONE GROUP PLC /EUR/ REGD V/R REG S EMTN 6.50000000 | 0.64 | 9.95 | 0.0609 | -0.0213 | |||||

| ELFI Graduate Loan Program 2024-A LLC / ABS-CBDO (US28627LAA52) | 0.64 | -6.84 | 0.0607 | -0.0362 | |||||

| ELFI Graduate Loan Program 2024-A LLC / ABS-CBDO (US28627LAA52) | 0.64 | -6.84 | 0.0607 | -0.0362 | |||||

| Cloud Capital Holdco LP / ABS-CBDO (US102104AC05) | 0.64 | -1.24 | 0.0606 | -0.0305 | |||||

| Cloud Capital Holdco LP / ABS-CBDO (US102104AC05) | 0.64 | -1.24 | 0.0606 | -0.0305 | |||||

| US49456BAH42 / Kinder Morgan Inc/DE | 0.64 | 0.79 | 0.0604 | -0.0287 | |||||

| US3132DWHV81 / Freddie Mac Pool | 0.64 | -6.19 | 0.0604 | -0.0352 | |||||

| Morgan Stanley Residential Mortgage Loan Trust 202 / ABS-MBS (US61776QAC06) | 0.64 | -18.57 | 0.0603 | -0.0498 | |||||

| US404119CQ00 / HCA Inc | 0.64 | 1.93 | 0.0603 | -0.0275 | |||||

| US049362AA49 / Allied Universal Holdco LLC/Allied Universal Finance Corp/Atlas Luxco 4 Sarl | 0.63 | 212.32 | 0.0602 | 0.0316 | |||||

| E1VR34 / Evergy, Inc. - Depositary Receipt (Common Stock) | 0.63 | 2.93 | 0.0601 | -0.0265 | |||||

| E1VR34 / Evergy, Inc. - Depositary Receipt (Common Stock) | 0.63 | 2.93 | 0.0601 | -0.0265 | |||||

| ELM Trust 2024-ELM / ABS-MBS (US26860XAL55) | 0.63 | -0.47 | 0.0598 | -0.0293 | |||||

| ELM Trust 2024-ELM / ABS-MBS (US26860XAL55) | 0.63 | -0.47 | 0.0598 | -0.0293 | |||||

| VIE / Veolia Environnement SA | 0.63 | 9.77 | 0.0597 | -0.0210 | |||||

| VIE / Veolia Environnement SA | 0.63 | 9.77 | 0.0597 | -0.0210 | |||||

| CPI Property Group / DBT (XS2904791774) | 0.63 | 0.0594 | 0.0594 | ||||||

| CPI Property Group / DBT (XS2904791774) | 0.63 | 0.0594 | 0.0594 | ||||||

| XS2308313860 / AUSNET SERVICES HOLDINGS PTY LTD 1.625%/VAR 03/11/2081 REGS | 0.63 | 10.60 | 0.0594 | -0.0204 | |||||

| USP7807HAT25 / Petroleos de Venezuela SA | 0.63 | 17.48 | 0.0594 | -0.0162 | |||||

| Nidda Healthcare Holding GmbH / DBT (XS2920589699) | 0.62 | 160.00 | 0.0593 | 0.0253 | |||||

| Nidda Healthcare Holding GmbH / DBT (XS2920589699) | 0.62 | 160.00 | 0.0593 | 0.0253 | |||||

| Connecticut Avenue Securities Trust 2025-R02 / ABS-MBS (US20754TAH59) | 0.62 | 0.00 | 0.0592 | -0.0286 | |||||

| Connecticut Avenue Securities Trust 2025-R02 / ABS-MBS (US20754TAH59) | 0.62 | 0.00 | 0.0592 | -0.0286 | |||||

| NYC Commercial Mortgage Trust 2025-3BP / ABS-MBS (US67120UAG22) | 0.62 | -1.27 | 0.0592 | -0.0299 | |||||

| US37959GAC15 / Global Atlantic Fin Co | 0.62 | 1.80 | 0.0591 | -0.0272 | |||||

| US92538NAC11 / Verus Securitization Trust 2022-4 | 0.62 | -2.51 | 0.0589 | -0.0309 | |||||

| UBSG34 / UBS Group AG - Depositary Receipt (Common Stock) | 0.62 | 0.65 | 0.0589 | -0.0280 | |||||

| UBSG34 / UBS Group AG - Depositary Receipt (Common Stock) | 0.62 | 0.65 | 0.0589 | -0.0280 | |||||

| US949746TD35 / Wells Fargo & Co | 0.62 | 0.82 | 0.0586 | -0.0277 | |||||

| XS2734938249 / EPHIOS SUBCO SARL /EUR/ REGD REG S 7.87500000 | 0.62 | 78.26 | 0.0584 | 0.0098 | |||||

| Ceconomy AG / DBT (XS2854329104) | 0.61 | 71.99 | 0.0583 | 0.0080 | |||||

| Ceconomy AG / DBT (XS2854329104) | 0.61 | 71.99 | 0.0583 | 0.0080 | |||||

| Verus Securitization Trust 2024-7 / ABS-MBS (US924925AE07) | 0.61 | -6.62 | 0.0577 | -0.0340 | |||||

| Verus Securitization Trust 2024-7 / ABS-MBS (US924925AE07) | 0.61 | -6.62 | 0.0577 | -0.0340 | |||||

| ConocoPhillips Company / DBT (US20826FBM77) | 0.61 | -1.94 | 0.0576 | -0.0295 | |||||

| ConocoPhillips Company / DBT (US20826FBM77) | 0.61 | -1.94 | 0.0576 | -0.0295 | |||||

| US22822RBH21 / Crown Castle Towers LLC | 0.60 | 1.34 | 0.0573 | -0.0268 | |||||

| XS2387675395 / SOUTHERN COMPANY EUSA5 1.875/VAR 09/15/2081 | 0.60 | 9.84 | 0.0573 | -0.0201 | |||||

| US3140XKEV84 / Fannie Mae Pool | 0.60 | -3.05 | 0.0572 | -0.0305 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.60 | 0.0572 | 0.0572 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.60 | 0.0572 | 0.0572 | ||||||

| US38382KMV25 / Government National Mortgage Association | 0.60 | 3.08 | 0.0572 | -0.0253 | |||||

| Aeropuertos Dominicanos Siglo XXI S.A. / DBT (US007866AE69) | 0.60 | 0.0572 | 0.0572 | ||||||

| Aeropuertos Dominicanos Siglo XXI S.A. / DBT (US007866AE69) | 0.60 | 0.0572 | 0.0572 | ||||||

| US25278XAW92 / DIAMONDBACK ENERGY INC | 0.60 | -1.31 | 0.0572 | -0.0288 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.60 | 1.01 | 0.0571 | -0.0268 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.60 | 1.01 | 0.0571 | -0.0268 | |||||

| XS2579480307 / Eurofins Scientific SE | 0.60 | 125.09 | 0.0571 | 0.0194 | |||||

| XS1138360166 / Walgreens Boots Alliance Inc | 0.60 | 56.51 | 0.0570 | 0.0029 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.60 | -3.70 | 0.0568 | -0.0309 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.60 | -3.70 | 0.0568 | -0.0309 | |||||