Mga Batayang Estadistika

| Nilai Portofolio | $ 963,212,052 |

| Posisi Saat Ini | 80 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

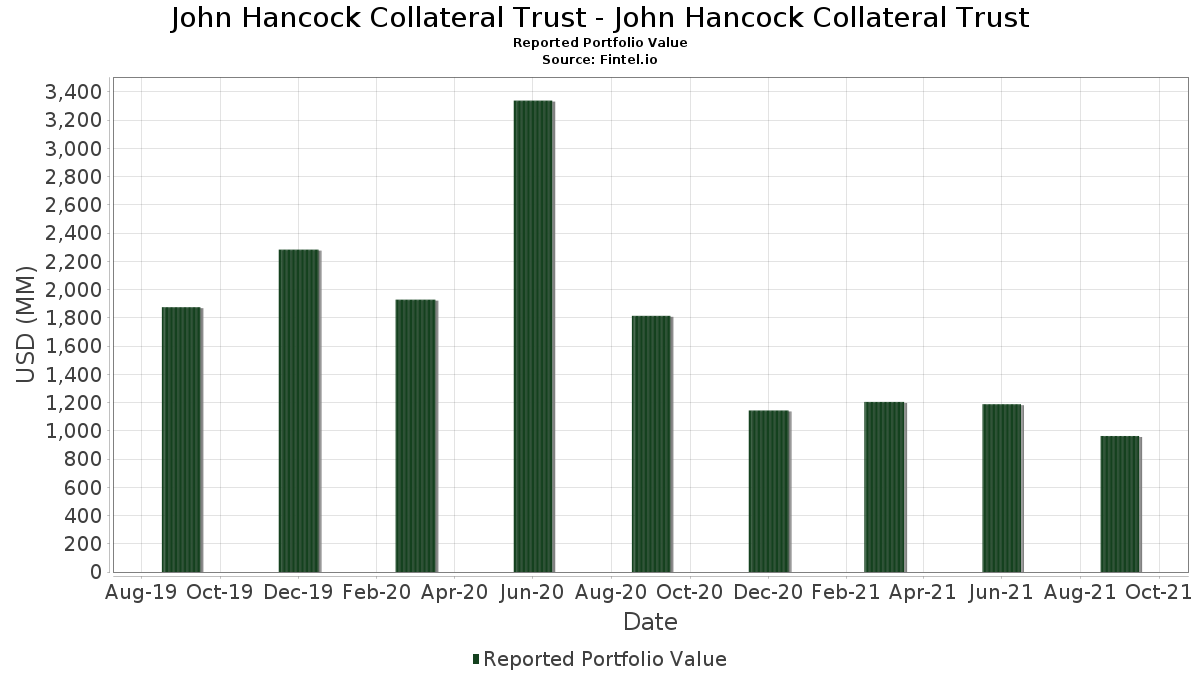

John Hancock Collateral Trust - John Hancock Collateral Trust telah mengungkapkan total kepemilikan 80 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 963,212,052 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama John Hancock Collateral Trust - John Hancock Collateral Trust adalah SUMITOMO MITSUI BANKING CORP TIME DEPOSIT (US:971VUT001) , Bank of Nova Scotia (The) (CA:US06417MNB71) , Dreyfus Institutional Preferred Government Plus Money Market Fund (US:US85748R0096) , Federal National Mortgage Association (US:US3135G03J02) , and U.S. Treasury Notes (US:US912828Z450) . Posisi baru John Hancock Collateral Trust - John Hancock Collateral Trust meliputi: SUMITOMO MITSUI BANKING CORP TIME DEPOSIT (US:971VUT001) , Bank of Nova Scotia (The) (CA:US06417MNB71) , Dreyfus Institutional Preferred Government Plus Money Market Fund (US:US85748R0096) , Federal National Mortgage Association (US:US3135G03J02) , and U.S. Treasury Notes (US:US912828Z450) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 50.00 | 4.9620 | 2.2688 | ||

| 50.00 | 4.9620 | 2.2688 | ||

| 40.00 | 3.9695 | 1.2763 | ||

| 50.00 | 4.9621 | 1.1027 | ||

| 8.00 | 0.7938 | 0.7938 | ||

| 35.10 | 3.4832 | 0.7900 | ||

| 7.03 | 0.6974 | 0.6974 | ||

| 10.01 | 0.9936 | 0.6924 | ||

| 10.01 | 0.9934 | 0.6916 | ||

| 25.01 | 2.4820 | 0.5518 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 43.00 | 4.2674 | -5.2730 | ||

| 1.00 | 0.0992 | -2.5940 | ||

| 1.30 | 0.1289 | -2.5643 | ||

| 1.50 | 0.1488 | -2.5444 | ||

| 1.75 | 0.1736 | -2.5196 | ||

| 2.50 | 0.2480 | -2.4453 | ||

| 2.72 | 0.2703 | -2.4229 | ||

| 3.00 | 0.2975 | -2.3958 | ||

| 3.80 | 0.3771 | -2.3162 | ||

| 4.50 | 0.4462 | -2.2470 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2021-11-26 untuk periode pelaporan 2021-09-30. Investor ini belum mengungkapkan sekuritas yang diperhitungkan dalam bentuk saham, sehingga kolom terkait saham dalam tabel di bawah ini dihilangkan. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|

| 971VUT001 / SUMITOMO MITSUI BANKING CORP TIME DEPOSIT | 50.00 | 0.00 | 4.9621 | 1.1027 | ||

| CARGILL GBL FUNDING / DBT (N/A) | 50.00 | 0.00 | 4.9620 | 2.2688 | ||

| 5108 / Bridgestone Corporation | 50.00 | 0.00 | 4.9620 | 2.2688 | ||

| ARP0F94T1 / BARCLAYS CAPITAL GROUP | 43.00 | -65.21 | 4.2674 | -5.2730 | ||

| MUFG BK LTD N Y BRH DISC COML COMMERCIAL PAPER DISCOUNT / DBT (N/A) | 40.00 | -20.00 | 3.9695 | 1.2763 | ||

| SALT RIVER PROJECT AGRICULTURA COMMERCIAL PAPER DISCOUNT / DBT (N/A) | 35.10 | -29.80 | 3.4832 | 0.7900 | ||

| YALE UNIVERSITY COMMERCIAL PAPER DISCOUNT / DBT (N/A) | 28.39 | -43.21 | 2.8178 | 0.1246 | ||

| US06417MNB71 / Bank of Nova Scotia (The) | 25.01 | 0.01 | 2.4820 | 0.5518 | ||

| US85748R0096 / Dreyfus Institutional Preferred Government Plus Money Market Fund | 25.00 | 0.00 | 2.4810 | 0.3108 | ||

| SWED A / Swedbank AB (publ) | 25.00 | -50.00 | 2.4809 | -0.2123 | ||

| OLD LINE FUNDING LLC 20211025 00000.0000000000 / DBT (N/A) | 25.00 | -50.00 | 2.4809 | -0.2124 | ||

| TOYOTA CR CDA INC COMMERCIAL PAPER DISCOUNT / DBT (N/A) | 24.99 | -50.02 | 2.4802 | -0.2130 | ||

| CREDIT SUISSE NY DISCOUNT / DBT (N/A) | 24.99 | -50.02 | 2.4802 | -0.2131 | ||

| WESTPAC BANKING CORP. COMMERCIAL PAPER DISCOUNT / DBT (N/A) | 24.98 | -50.03 | 2.4795 | -0.2137 | ||

| SWED A / Swedbank AB (publ) | 21.72 | -56.55 | 2.1560 | -0.5372 | ||

| US3135G03J02 / Federal National Mortgage Association | 20.04 | -0.10 | 1.9888 | 0.4404 | ||

| US912828Z450 / U.S. Treasury Notes | 20.01 | -0.04 | 1.9858 | 0.4407 | ||

| 05199D002 / BNP PARIBAS NY BRANCH 00000000 00000.0000000000 | 20.00 | -20.00 | 1.9848 | 0.0551 | ||

| LONG ISLAND PWE AUTH 20211006 00000.0000000000 / DBT (N/A) | 16.60 | -66.80 | 1.6474 | -1.0458 | ||

| YALE UNIVERSITY COMMERCIAL PAPER DISCOUNT / DBT (N/A) | 15.80 | -68.40 | 1.5679 | -1.1253 | ||

| US3133ELD350 / Federal Farm Credit Banks Funding Corp | 15.02 | -0.07 | 1.4905 | 0.3305 | ||

| MANHATTAN ASSET FDG. COMMERCIAL PAPER DISCOUNT / DBT (N/A) | 14.98 | -70.04 | 1.4866 | -1.2066 | ||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | 14.00 | -72.00 | 1.3892 | -1.3041 | ||

| CHARIOT FNDG LLC COMMERCIAL PAPER DISCOUNT / DBT (N/A) | 12.00 | -76.00 | 1.1909 | -1.5024 | ||

| US22546QAR83 / Credit Suisse AG/New York NY | 10.88 | -0.70 | 1.0795 | 0.2339 | ||

| US3133EMMS89 / FEDERAL FARM CREDIT BANK VARIABLE RATE 01/13/2023 | 10.53 | 0.07 | 1.0451 | 0.2328 | ||

| US437076BG61 / Home Depot Inc/The | 10.14 | -0.66 | 1.0061 | 0.2184 | ||

| US22550UAA97 / VAR.RT. CORP. BONDS | 10.01 | -0.04 | 0.9936 | 0.2205 | ||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 10.01 | 0.15 | 0.9936 | 0.6924 | ||

| FEDERAL FARM CREDIT BANKS FUND BONDS 02/22 VAR / DBT (US3133EKVV51) | 10.01 | -0.02 | 0.9934 | 0.6916 | ||

| NRUC / National Rural Utilities Cooperative Finance Corporation - Corporate Bond/Note | 10.00 | -80.00 | 0.9924 | -1.7008 | ||

| NRUC / National Rural Utilities Cooperative Finance Corporation - Corporate Bond/Note | 10.00 | -80.00 | 0.9924 | -1.7009 | ||

| CAFCO LLC COMMERCIAL PAPER DISCOUNT / DBT (N/A) | 10.00 | -80.00 | 0.9924 | -1.7009 | ||

| CHARIOT FNDG LLC COMMERCIAL PAPER DISCOUNT / DBT (N/A) | 10.00 | -80.00 | 0.9923 | -1.7010 | ||

| LIME FUNDING COMMERCIAL PAPER DISCOUNT / DBT (N/A) | 10.00 | -80.01 | 0.9922 | -1.7010 | ||

| ANZ / ANZ Group Holdings Limited | 10.00 | -80.01 | 0.9921 | -1.7011 | ||

| OLD LINE FUNDING LLC COMMERCIAL PAPER DISCOUNT / DBT (N/A) | 10.00 | -80.01 | 0.9920 | -1.7012 | ||

| GOTHAM FDG CORP COMMERCIAL PAPER DISCOUNT / DBT (N/A) | 10.00 | -80.01 | 0.9919 | -1.7013 | ||

| RGTS OF UNIV OF CA COMMERCIAL PAPER DISCOUNT / DBT (N/A) | 9.00 | -82.00 | 0.8932 | -1.8001 | ||

| US313385TN61 / FED HM LN BK BD 2/25/2022 | 8.00 | 0.7938 | 0.7938 | |||

| MANHATTAN ASSET FDG. COMMERCIAL PAPER DISCOUNT / DBT (N/A) | 8.00 | -84.01 | 0.7936 | -1.8996 | ||

| LIME FUNDING DISCOUNT / DBT (N/A) | 7.80 | -84.40 | 0.7742 | -1.9190 | ||

| UNIVERSITY OF CHICAG DISCOUNT / DBT (N/A) | 7.60 | -84.80 | 0.7541 | -1.9391 | ||

| US912828YZ72 / United States Treasury Note/Bond | 7.03 | 0.6974 | 0.6974 | |||

| FEDERAL FARM CREDIT BANKS FUND BONDS 03/22 VAR / DBT (US3133EL6Q21) | 7.00 | 0.01 | 0.6949 | 0.3121 | ||

| US594918BW38 / Microsoft Corp | 6.76 | -0.62 | 0.6712 | 0.1459 | ||

| OLD LINE FUNDING LLC COMMERCIAL PAPER DISCOUNT / DBT (N/A) | 6.75 | -86.50 | 0.6698 | -2.0234 | ||

| GOTHAM FDG CORP COMMERCIAL PAPER DISCOUNT / DBT (N/A) | 6.00 | -88.01 | 0.5952 | -2.0981 | ||

| US902674YA28 / UBS AG/London | 5.04 | 0.4997 | 0.4997 | |||

| FEDERAL FARM CREDIT BANKS FUND BONDS 04/22 VAR / DBT (US3133ELXT60) | 5.01 | 0.04 | 0.4972 | 0.3463 | ||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 5.01 | 0.10 | 0.4967 | 0.3460 | ||

| FEDERAL FARM CREDIT BANKS FUND BONDS 03/22 VAR / DBT (US3133EL7H13) | 5.00 | 0.06 | 0.4964 | 0.2230 | ||

| NRUC / National Rural Utilities Cooperative Finance Corporation - Corporate Bond/Note | 5.00 | -90.00 | 0.4962 | -2.1971 | ||

| PSP CAPITAL INC. COMMERCIAL PAPER DISCOUNT / DBT (N/A) | 5.00 | -90.00 | 0.4961 | -2.1971 | ||

| CAFCO LLC COMMERCIAL PAPER DISCOUNT / DBT (N/A) | 5.00 | -90.00 | 0.4961 | -2.1971 | ||

| GOTHAM FDG CORP COMMERCIAL PAPER DISCOUNT / DBT (N/A) | 5.00 | -90.00 | 0.4961 | -2.1972 | ||

| PSP CAPITAL INC. COMMERCIAL PAPER DISCOUNT / DBT (N/A) | 5.00 | -90.01 | 0.4959 | -2.1973 | ||

| BNSB34 / The Bank of Nova Scotia - Depositary Receipt (Common Stock) | 5.00 | -90.01 | 0.4958 | -2.1974 | ||

| WESTPAC BANKING CORP. DISCOUNT / DBT (N/A) | 4.99 | -90.02 | 0.4953 | -2.1979 | ||

| BNSB34 / The Bank of Nova Scotia - Depositary Receipt (Common Stock) | 4.99 | -90.02 | 0.4953 | -2.1980 | ||

| CMMNWLTH BNK OF AUS COMMERCIAL PAPER DISCOUNT / DBT (N/A) | 4.50 | -91.01 | 0.4462 | -2.2470 | ||

| US961214DG53 / Westpac Banking Corp | 4.49 | -0.64 | 0.4451 | 0.0967 | ||

| MUFG BK LTD N Y BRH DISC COML DISCOUNT / DBT (N/A) | 3.80 | -92.40 | 0.3771 | -2.3162 | ||

| US313378WG23 / FEDERAL HOME LOAN BANK | 3.03 | 0.3010 | 0.3010 | |||

| US13063DAD03 / CA ST GO HI SPEED TRAIN TAXABLE 17A 2.367% 04-01-22 | 3.03 | -0.56 | 0.3009 | 0.0655 | ||

| US88602UCJ79 / THUNDER BAY FNDNG LLC COMMERCIAL PAPER DISCOUNT | 3.00 | 0.2975 | 0.2975 | |||

| WESTPAC SECS NZ LTD DISCOUNT / DBT (N/A) | 3.00 | -94.01 | 0.2975 | -2.3958 | ||

| US66989HAM07 / Novartis Capital Corp | 2.81 | -0.53 | 0.2792 | 0.0609 | ||

| SWED A / Swedbank AB (publ) | 2.72 | -94.55 | 0.2703 | -2.4229 | ||

| US91159HHC79 / U.S. Bancorp | 2.53 | -0.71 | 0.2507 | 0.0544 | ||

| OLD LINE FUNDING LLC COMMERCIAL PAPER DISCOUNT / DBT (N/A) | 2.50 | -95.00 | 0.2480 | -2.4453 | ||

| WESTPAC SECS NZ LTD DISCOUNT / DBT (N/A) | 1.75 | -96.50 | 0.1736 | -2.5196 | ||

| US717081ER06 / Pfizer Inc | 1.52 | -0.65 | 0.1506 | 0.0327 | ||

| PSP CAPITAL INC. COMMERCIAL PAPER DISCOUNT / DBT (N/A) | 1.50 | -97.00 | 0.1488 | -2.5444 | ||

| WESTPAC SECS NZ LTD COMMERCIAL PAPER DISCOUNT / DBT (N/A) | 1.30 | -97.40 | 0.1289 | -2.5643 | ||

| CORPOERATIVE CENTRALE COMMERCIAL PAPER DISCOUNT / DBT (21687BB83) | 1.25 | 0.1240 | 0.1240 | |||

| US718172BZ15 / Philip Morris International Inc | 1.23 | -0.57 | 0.1220 | 0.0266 | ||

| US58933YAQ89 / Merck & Co Inc | 1.01 | -0.59 | 0.1005 | 0.0219 | ||

| PSP CAPITAL INC. DISCOUNT / DBT (N/A) | 1.00 | -98.00 | 0.0992 | -2.5940 | ||

| US3135G0Z630 / Fannie Mae | 0.09 | 0.0089 | 0.0089 |