Mga Batayang Estadistika

| Nilai Portofolio | $ 4,940,424,319 |

| Posisi Saat Ini | 86 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

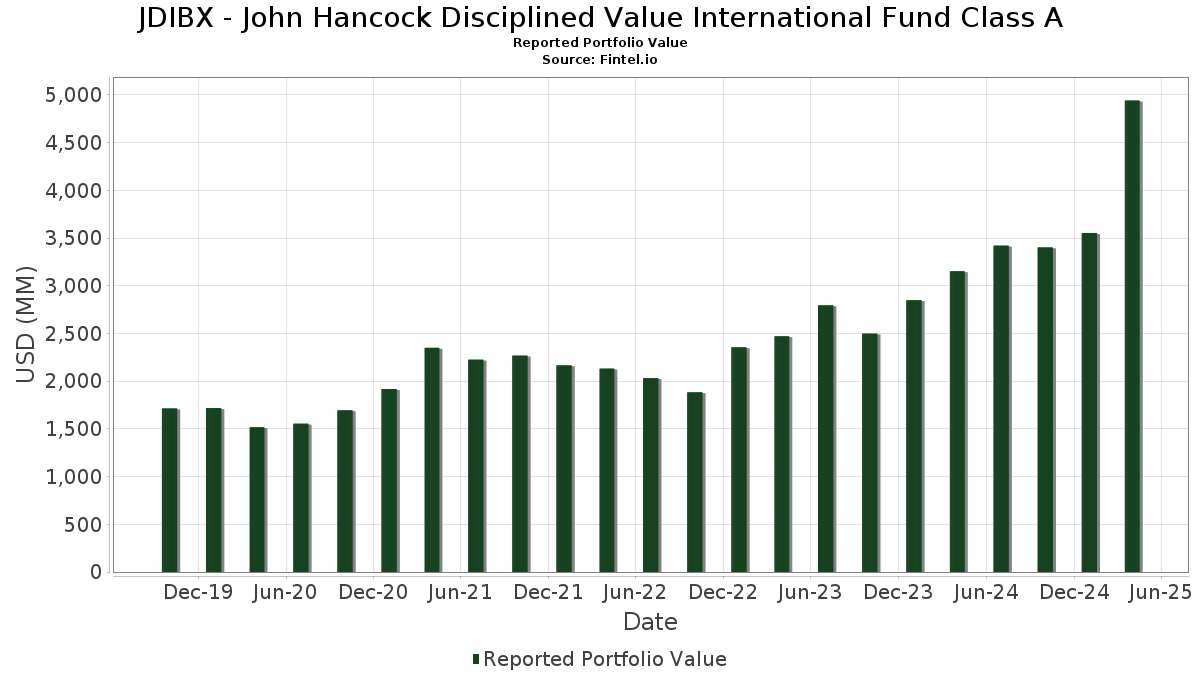

JDIBX - John Hancock Disciplined Value International Fund Class A telah mengungkapkan total kepemilikan 86 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 4,940,424,319 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama JDIBX - John Hancock Disciplined Value International Fund Class A adalah Fidelity Investments Money Market Government Portfolio (US:US31607A7037) , BAE Systems PLC (GB:BA/) , The Weir Group PLC (US:WEIGF) , Hiscox Ltd (US:HCXLF) , and Astrazeneca plc (CH:AZN) . Posisi baru JDIBX - John Hancock Disciplined Value International Fund Class A meliputi: Prudential plc (US:PUKPF) , Banco Santander, S.A. (AT:SAN) , Babcock International Group PLC (US:BCKIF) , Danske Bank A/S (CH:DSN) , and Millicom International Cellular S.A. (US:TIGO) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 234.52 | 234.52 | 4.8396 | 3.7599 | |

| 13.01 | 130.13 | 2.6853 | 2.6853 | |

| 8.86 | 94.18 | 1.9435 | 1.9435 | |

| 10.08 | 70.99 | 1.4648 | 1.4648 | |

| 6.07 | 65.43 | 1.3503 | 1.3503 | |

| 1.25 | 111.50 | 2.3010 | 1.3002 | |

| 1.54 | 54.17 | 1.1179 | 1.1179 | |

| 8.01 | 185.62 | 3.8305 | 1.1166 | |

| 1.35 | 46.65 | 0.9627 | 0.9627 | |

| 0.53 | 87.87 | 1.8134 | 0.7541 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.84 | 96.33 | 1.9879 | -1.5584 | |

| 0.82 | 10.28 | 0.2122 | -1.3690 | |

| 0.00 | 0.00 | -1.2882 | ||

| 2.56 | 67.50 | 1.3930 | -1.2645 | |

| 2.02 | 87.63 | 1.8082 | -0.9523 | |

| 2.10 | 49.98 | 1.0315 | -0.9154 | |

| 3.50 | 39.02 | 0.8053 | -0.8359 | |

| 1.13 | 16.74 | 0.3455 | -0.7763 | |

| 3.53 | 49.51 | 1.0217 | -0.7444 | |

| 3.27 | 21.01 | 0.4335 | -0.6848 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-06-26 untuk periode pelaporan 2025-04-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US31607A7037 / Fidelity Investments Money Market Government Portfolio | 234.52 | 501.46 | 234.52 | 501.47 | 4.8396 | 3.7599 | |||

| BA/ / BAE Systems PLC | 8.01 | 23.49 | 185.62 | 89.39 | 3.8305 | 1.1166 | |||

| JH COLLATERAL / STIV (N/A) | 13.01 | 130.13 | 2.6853 | 2.6853 | |||||

| WEIGF / The Weir Group PLC | 4.08 | 33.63 | 122.86 | 35.03 | 2.5354 | 0.0159 | |||

| HCXLF / Hiscox Ltd | 7.83 | 23.49 | 115.30 | 34.74 | 2.3793 | 0.0099 | |||

| AZN / Astrazeneca plc | 0.80 | 23.49 | 114.99 | 26.03 | 2.3729 | -0.1534 | |||

| HINKF / Heineken N.V. | 1.25 | 139.45 | 111.50 | 208.51 | 2.3010 | 1.3002 | |||

| SHELL / Shell plc | 3.42 | 53.89 | 110.25 | 51.25 | 2.2751 | 0.2568 | |||

| 2RR / Alibaba Group Holding Limited | 7.34 | -7.48 | 109.52 | 12.61 | 2.2600 | -0.4328 | |||

| NHNCF / NAVER Corporation | 0.75 | 81.63 | 105.20 | 72.57 | 2.1709 | 0.4830 | |||

| VK / Vallourec S.A. | 5.30 | 40.77 | 97.94 | 36.98 | 2.0212 | 0.0413 | |||

| NVSEF / Novartis AG | 0.84 | -30.97 | 96.33 | -24.79 | 1.9879 | -1.5584 | |||

| PUKPF / Prudential plc | 8.86 | 94.18 | 1.9435 | 1.9435 | |||||

| ENLAY / Enel SpA - Depositary Receipt (Common Stock) | 10.57 | 23.49 | 91.61 | 50.62 | 1.8904 | 0.2063 | |||

| ENX / Euronext N.V. | 0.53 | 59.62 | 87.87 | 129.72 | 1.8134 | 0.7541 | |||

| SDZ / Sandoz Group AG | 2.02 | -2.98 | 87.63 | -12.11 | 1.8082 | -0.9523 | |||

| MIELF / Mitsubishi Electric Corporation | 4.34 | 87.97 | 84.05 | 121.85 | 1.7344 | 0.6854 | |||

| SPIE / SPIE SA | 1.70 | 48.45 | 83.56 | 118.31 | 1.7243 | 0.6645 | |||

| BVA / Banco Bilbao Vizcaya Argentaria, S.A. | 6.02 | 23.49 | 82.57 | 48.87 | 1.7039 | 0.1681 | |||

| CAP / Capgemini SE | 0.51 | 23.49 | 81.46 | 8.50 | 1.6810 | -0.3979 | |||

| NDB / Nordea Bank Abp | 5.93 | 23.49 | 81.40 | 42.32 | 1.6798 | 0.0961 | |||

| BZLYF / Beazley plc | 6.04 | -8.78 | 71.55 | 4.68 | 1.4765 | -0.4161 | |||

| SAN / Banco Santander, S.A. | 10.08 | 70.99 | 1.4648 | 1.4648 | |||||

| TECK / Teck Resources Limited | 2.07 | 73.12 | 70.27 | 44.02 | 1.4501 | 0.0991 | |||

| SNEJF / Sony Group Corporation | 2.56 | -41.17 | 67.50 | -29.67 | 1.3930 | -1.2645 | |||

| BVVBY / Bureau Veritas SA - Depositary Receipt (Common Stock) | 2.11 | 143.17 | 66.93 | 147.00 | 1.3813 | 0.6309 | |||

| CRH / CRH plc | 0.69 | 92.69 | 65.55 | 84.72 | 1.3527 | 0.3701 | |||

| BCKIF / Babcock International Group PLC | 6.07 | 65.43 | 1.3503 | 1.3503 | |||||

| KRYAY / Kerry Group plc - Depositary Receipt (Common Stock) | 0.61 | 23.49 | 64.80 | 27.30 | 1.3373 | -0.0722 | |||

| SAN / Santander UK plc - Preferred Stock | 0.57 | 89.99 | 61.90 | 91.23 | 1.2774 | 0.3811 | |||

| FELTF / Fuji Electric Co., Ltd. | 1.38 | 44.77 | 61.47 | 35.12 | 1.2684 | 0.0088 | |||

| EG / Everest Group, Ltd. | 0.17 | 24.94 | 59.29 | 29.01 | 1.2236 | -0.0491 | |||

| CVE / Cenovus Energy Inc. | 5.02 | 24.94 | 59.06 | 1.70 | 1.2188 | -0.3893 | |||

| SZKMF / Suzuki Motor Corporation | 4.79 | 51.28 | 57.41 | 51.50 | 1.1846 | 0.1354 | |||

| SPM / Splendid Medien AG | 24.03 | 23.49 | 55.51 | 16.90 | 1.1455 | -0.1693 | |||

| DSN / Danske Bank A/S | 1.54 | 54.17 | 1.1179 | 1.1179 | |||||

| ASBRF / Asahi Group Holdings, Ltd. | 3.62 | 23.49 | 50.06 | 57.60 | 1.0330 | 0.1535 | |||

| SMFG / Sumitomo Mitsui Financial Group, Inc. - Depositary Receipt (Common Stock) | 2.10 | -26.57 | 49.98 | -28.91 | 1.0315 | -0.9154 | |||

| MEGEF / MEG Energy Corp. | 3.53 | -9.27 | 49.51 | -22.38 | 1.0217 | -0.7444 | |||

| A017670 / SK Telecom Co., Ltd. | 1.29 | 105.38 | 49.38 | 106.07 | 1.0190 | 0.3555 | |||

| SSNLF / Samsung Electronics Co., Ltd. | 1.25 | 23.49 | 48.84 | 34.92 | 1.0078 | 0.0055 | |||

| PRX / Prosus N.V. | 1.01 | -25.76 | 47.40 | -8.87 | 0.9781 | -0.4621 | |||

| SGIPF / Sugi Holdings Co.,Ltd. | 2.22 | 43.53 | 46.72 | 73.37 | 0.9641 | 0.2180 | |||

| TIGO / Millicom International Cellular S.A. | 1.35 | 46.65 | 0.9627 | 0.9627 | |||||

| SMAWF / Siemens Aktiengesellschaft | 0.20 | 23.49 | 46.64 | 32.64 | 0.9625 | -0.0112 | |||

| BDEV / Barratt Developments plc | 7.19 | -24.56 | 44.79 | -16.04 | 0.9243 | -0.5530 | |||

| IMI / IMI plc - Depositary Receipt (Common Stock) | 1.89 | 23.49 | 44.74 | 18.45 | 0.9233 | -0.1226 | |||

| IVG / Iveco Group N.V. | 2.73 | -15.26 | 43.56 | 11.23 | 0.8989 | -0.1855 | |||

| 000810 / Samsung Fire & Marine Insurance Co., Ltd. | 0.16 | 23.49 | 42.37 | 24.83 | 0.8744 | -0.0655 | |||

| A030200 / KT Corporation | 1.15 | 0.25 | 42.07 | 11.60 | 0.8682 | -0.1757 | |||

| NOMD / Nomad Foods Limited | 2.04 | 24.94 | 40.72 | 39.84 | 0.8403 | 0.0340 | |||

| SZUKF / Suzuken Co., Ltd. | 1.11 | 62.79 | 40.25 | 88.43 | 0.8305 | 0.2391 | |||

| AMADY / Amadeus IT Group, S.A. - Depositary Receipt (Common Stock) | 0.50 | -9.61 | 39.54 | -2.77 | 0.8160 | -0.3101 | |||

| HBCYF / HSBC Holdings plc | 3.50 | -38.31 | 39.02 | -34.16 | 0.8053 | -0.8359 | |||

| HTHIF / Hitachi, Ltd. | 1.55 | 335.05 | 38.29 | 86.94 | 0.7901 | -0.1234 | |||

| FGR / FirstGroup plc | 0.28 | -37.36 | 37.78 | -4.59 | 0.7796 | -0.3169 | |||

| TOELF / Tokyo Electron Limited | 0.25 | 371.92 | 37.03 | 161.80 | 0.7642 | -0.0772 | |||

| IFPJF / Informa plc | 3.69 | 23.49 | 36.06 | 13.06 | 0.7442 | -0.1390 | |||

| NHYKF / Norsk Hydro ASA | 6.76 | 23.49 | 35.85 | 11.06 | 0.7397 | -0.1540 | |||

| MTLHF / Mitsubishi Chemical Group Corporation | 7.34 | 110.07 | 35.69 | 99.95 | 0.7364 | 0.2422 | |||

| AIBGL / AIB Group plc | 5.27 | 104.23 | 35.44 | 133.44 | 0.7313 | 0.3109 | |||

| KT / KT Corporation - Depositary Receipt (Common Stock) | 1.74 | 354.64 | 33.93 | 410.53 | 0.7001 | 0.5161 | |||

| SAND / Sandstorm Gold Ltd. | 3.86 | -24.18 | 33.56 | 13.01 | 0.6925 | -0.1297 | |||

| A105560 / KB Financial Group Inc. | 0.52 | 200.20 | 33.02 | 202.82 | 0.6814 | 0.3794 | |||

| RNECF / Renesas Electronics Corporation | 2.74 | 164.85 | 32.13 | 132.04 | 0.6631 | 0.2796 | |||

| RF / Eurazeo SE | 0.43 | 23.49 | 31.22 | 9.38 | 0.6442 | -0.1461 | |||

| AAUC / Allied Gold Corporation | 7.54 | 24.94 | 30.37 | 60.66 | 0.6267 | 0.1033 | |||

| RNR / RenaissanceRe Holdings Ltd. | 0.12 | 24.93 | 29.70 | 29.96 | 0.6129 | -0.0199 | |||

| ADRZY / Andritz AG - Depositary Receipt (Common Stock) | 0.41 | 23.49 | 29.70 | 56.73 | 0.6128 | 0.0882 | |||

| 6E2 / Endeavour Mining plc | 1.08 | 24.94 | 29.29 | 64.59 | 0.6044 | 0.1117 | |||

| IWJ / IHI Corporation | 0.36 | 28.33 | 0.5847 | 0.5847 | |||||

| KYO / Kyocera Corp. | 2.38 | 28.22 | 0.5823 | 0.5823 | |||||

| ATE / Alten S.A. | 0.31 | 76.40 | 26.70 | 62.56 | 0.5509 | 0.0962 | |||

| IPSEF / Ipsen S.A. | 0.23 | 26.67 | 0.5504 | 0.5504 | |||||

| TSUKF / Toyo Suisan Kaisha, Ltd. | 0.40 | 23.53 | 26.13 | 23.59 | 0.5392 | -0.0462 | |||

| BNP / BNP Paribas SA | 0.30 | -42.05 | 25.47 | -28.12 | 0.5257 | -0.4556 | |||

| TOTTF / Toyo Tire Corporation | 1.26 | 23.49 | 23.58 | 40.46 | 0.4867 | 0.0218 | |||

| EVK / Evonik Industries AG | 1.04 | -37.47 | 23.43 | -25.17 | 0.4835 | -0.3835 | |||

| 1 / CK Hutchison Holdings Limited | 3.74 | 100.36 | 21.10 | 27.87 | 0.4355 | -0.5242 | |||

| RYSD / NatWest Group plc | 3.27 | -56.89 | 21.01 | -47.99 | 0.4335 | -0.6848 | |||

| IFNNF / Infineon Technologies AG | 0.63 | -38.24 | 21.00 | -37.78 | 0.4334 | -0.5014 | |||

| RXEEY / Rexel S.A. - Depositary Receipt (Common Stock) | 0.64 | 23.49 | 17.88 | 29.61 | 0.3689 | -0.0130 | |||

| KGC / Kinross Gold Corporation | 1.13 | -68.47 | 16.74 | -58.67 | 0.3455 | -0.7763 | |||

| HMDPF / Hammond Power Solutions Inc. | 0.16 | 24.94 | 10.77 | 15.75 | 0.2223 | -0.0354 | |||

| MBFJF / Mitsubishi UFJ Financial Group, Inc. | 0.82 | -81.92 | 10.28 | -81.99 | 0.2122 | -1.3690 | |||

| P1UK34 / Prudential plc - Depositary Receipt (Common Stock) | 8.86 | 1.47 | 0.0303 | 0.0303 | |||||

| 27M / Melrose Industries PLC | 0.00 | -100.00 | 0.00 | -100.00 | -1.2882 |