Mga Batayang Estadistika

| Nilai Portofolio | $ 12,336,733 |

| Posisi Saat Ini | 57 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

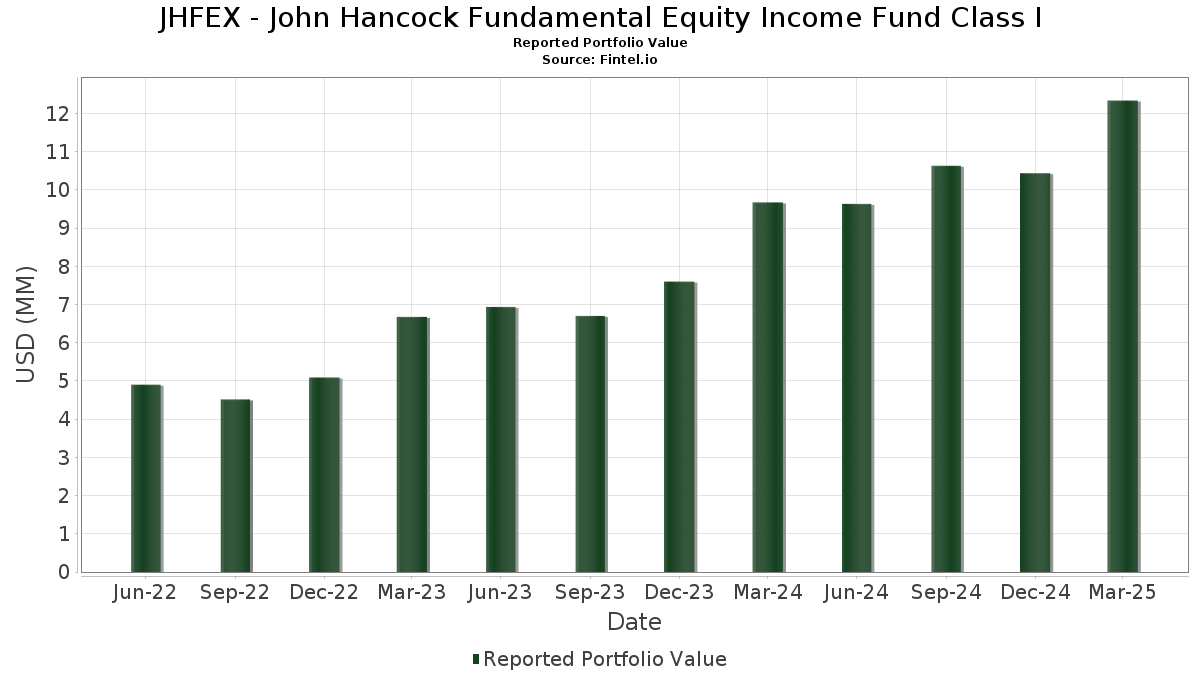

JHFEX - John Hancock Fundamental Equity Income Fund Class I telah mengungkapkan total kepemilikan 57 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 12,336,733 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama JHFEX - John Hancock Fundamental Equity Income Fund Class I adalah Elevance Health, Inc. (US:ELV) , Comcast Corporation (US:CMCSA) , Cheniere Energy, Inc. (US:LNG) , Becton, Dickinson and Company (US:BDX) , and GSK plc - Depositary Receipt (Common Stock) (US:GSK) . Posisi baru JHFEX - John Hancock Fundamental Equity Income Fund Class I meliputi: Millrose Properties, Inc. (US:MRP) , McKesson Corporation (US:MCK) , Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) (US:TSM) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.10 | 0.98 | 7.8775 | 7.8775 | |

| 0.01 | 0.55 | 4.4020 | 1.5796 | |

| 0.01 | 0.17 | 1.3637 | 1.3637 | |

| 0.00 | 0.16 | 1.2697 | 1.2697 | |

| 0.00 | 0.13 | 1.0480 | 1.0480 | |

| 0.00 | 0.60 | 4.8361 | 0.8622 | |

| 0.00 | 0.20 | 1.6068 | 0.5305 | |

| 0.00 | 0.31 | 2.5030 | 0.4374 | |

| 0.00 | 0.14 | 1.1584 | 0.2804 | |

| 0.01 | 0.19 | 1.5285 | 0.2539 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.31 | 2.4858 | -1.5365 | |

| 0.00 | 0.13 | 1.0498 | -1.0210 | |

| 0.00 | 0.28 | 2.2714 | -0.7102 | |

| 0.00 | 0.31 | 2.4600 | -0.6074 | |

| 0.01 | 0.36 | 2.9111 | -0.4838 | |

| 0.00 | 0.12 | 0.9933 | -0.4088 | |

| 0.00 | 0.19 | 1.5615 | -0.3992 | |

| 0.00 | 0.15 | 1.2003 | -0.3913 | |

| 0.00 | 0.15 | 1.1864 | -0.3905 | |

| 0.01 | 0.10 | 0.7899 | -0.3029 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-05-29 untuk periode pelaporan 2025-03-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| JH COLLATERAL / STIV (N/A) | 0.10 | 0.98 | 7.8775 | 7.8775 | |||||

| ELV / Elevance Health, Inc. | 0.00 | 23.02 | 0.60 | 45.04 | 4.8361 | 0.8622 | |||

| CMCSA / Comcast Corporation | 0.01 | 89.06 | 0.55 | 86.01 | 4.4020 | 1.5796 | |||

| LNG / Cheniere Energy, Inc. | 0.00 | 19.16 | 0.42 | 28.35 | 3.3993 | 0.2423 | |||

| BDX / Becton, Dickinson and Company | 0.00 | 19.16 | 0.40 | 20.24 | 3.2153 | 0.0302 | |||

| GSK / GSK plc - Depositary Receipt (Common Stock) | 0.01 | -10.78 | 0.36 | 2.27 | 2.9111 | -0.4838 | |||

| LYB / LyondellBasell Industries N.V. | 0.00 | 30.24 | 0.33 | 23.77 | 2.6451 | 0.0915 | |||

| SU / Suncor Energy Inc. | 0.01 | 19.21 | 0.32 | 29.32 | 2.5999 | 0.2047 | |||

| BMY / Bristol-Myers Squibb Company | 0.01 | 11.94 | 0.31 | 20.85 | 2.5271 | 0.0318 | |||

| MSFT / Microsoft Corporation | 0.00 | 62.16 | 0.31 | 44.86 | 2.5030 | 0.4374 | |||

| CCI / Crown Castle Inc. | 0.00 | -35.86 | 0.31 | -26.32 | 2.4858 | -1.5365 | |||

| NDAQ / Nasdaq, Inc. | 0.00 | -2.59 | 0.31 | -4.39 | 2.4600 | -0.6074 | |||

| UPS / United Parcel Service, Inc. | 0.00 | 29.90 | 0.29 | 13.33 | 2.3350 | -0.1212 | |||

| ORCL / Oracle Corporation | 0.00 | 8.22 | 0.28 | -9.35 | 2.2714 | -0.7102 | |||

| MTN / Vail Resorts, Inc. | 0.00 | 25.54 | 0.27 | 7.51 | 2.1946 | -0.2461 | |||

| STT / State Street Corporation | 0.00 | 19.18 | 0.26 | 8.64 | 2.1352 | -0.2057 | |||

| LVMUY / LVMH Moët Hennessy - Louis Vuitton, Société Européenne - Depositary Receipt (Common Stock) | 0.00 | 19.18 | 0.26 | 13.16 | 2.0853 | -0.1149 | |||

| AMT / American Tower Corporation | 0.00 | 9.25 | 0.25 | 29.69 | 2.0106 | 0.1618 | |||

| DANOY / Danone S.A. - Depositary Receipt (Common Stock) | 0.02 | -1.96 | 0.24 | 12.04 | 1.9564 | -0.1237 | |||

| DEO / Diageo plc - Depositary Receipt (Common Stock) | 0.00 | 55.84 | 0.23 | 28.57 | 1.8157 | 0.1310 | |||

| KKR / KKR & Co. Inc. | 0.00 | 53.08 | 0.22 | 20.11 | 1.7822 | 0.0070 | |||

| URI / United Rentals, Inc. | 0.00 | 100.00 | 0.20 | 77.68 | 1.6068 | 0.5305 | |||

| MS / Morgan Stanley | 0.00 | 2.28 | 0.19 | -5.39 | 1.5615 | -0.3992 | |||

| RBGLY / Reckitt Benckiser Group plc - Depositary Receipt (Common Stock) | 0.01 | 26.51 | 0.19 | 43.18 | 1.5285 | 0.2539 | |||

| HLN / Haleon plc - Depositary Receipt (Common Stock) | 0.02 | 2.98 | 0.18 | 10.91 | 1.4786 | -0.1080 | |||

| LEN / Lennar Corporation | 0.00 | 52.10 | 0.18 | 28.17 | 1.4751 | 0.1018 | |||

| GOOGL / Alphabet Inc. | 0.00 | 41.30 | 0.18 | 15.92 | 1.4675 | -0.0478 | |||

| WMT / Walmart Inc. | 0.00 | 4.87 | 0.18 | 1.74 | 1.4164 | -0.2402 | |||

| KMI / Kinder Morgan, Inc. | 0.01 | 19.20 | 0.17 | 24.64 | 1.3907 | 0.0553 | |||

| MRP / Millrose Properties, Inc. | 0.01 | 0.17 | 1.3637 | 1.3637 | |||||

| AXP / American Express Company | 0.00 | 19.09 | 0.16 | 8.05 | 1.2994 | -0.1351 | |||

| MRK / Merck & Co., Inc. | 0.00 | 30.77 | 0.16 | 18.52 | 1.2918 | -0.0130 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | 50.23 | 0.16 | 44.55 | 1.2838 | 0.2190 | |||

| MCK / McKesson Corporation | 0.00 | 0.16 | 1.2697 | 1.2697 | |||||

| GS / The Goldman Sachs Group, Inc. | 0.00 | 19.21 | 0.15 | 13.74 | 1.2024 | -0.0576 | |||

| C / Citigroup Inc. | 0.00 | -10.88 | 0.15 | -10.30 | 1.2003 | -0.3913 | |||

| LVS / Las Vegas Sands Corp. | 0.00 | 19.22 | 0.15 | -10.37 | 1.1864 | -0.3905 | |||

| US7587501039 / Regal-Beloit Corp. | 0.00 | 114.26 | 0.14 | 57.14 | 1.1584 | 0.2804 | |||

| RTX / RTX Corporation | 0.00 | 19.14 | 0.14 | 37.37 | 1.0968 | 0.1383 | |||

| GILD / Gilead Sciences, Inc. | 0.00 | -50.19 | 0.13 | -39.53 | 1.0498 | -1.0210 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.00 | 0.13 | 1.0480 | 1.0480 | |||||

| SPGI / S&P Global Inc. | 0.00 | 18.96 | 0.13 | 20.95 | 1.0283 | 0.0185 | |||

| EBAY / eBay Inc. | 0.00 | 19.21 | 0.13 | 29.90 | 1.0234 | 0.0876 | |||

| TXN / Texas Instruments Incorporated | 0.00 | -2.00 | 0.12 | -6.11 | 0.9939 | -0.2674 | |||

| SBUX / Starbucks Corporation | 0.00 | -21.45 | 0.12 | -15.17 | 0.9933 | -0.4088 | |||

| WFC / Wells Fargo & Company | 0.00 | 19.21 | 0.12 | 21.21 | 0.9736 | 0.0212 | |||

| ADI / Analog Devices, Inc. | 0.00 | -4.39 | 0.12 | -9.23 | 0.9561 | -0.2995 | |||

| KVUE / Kenvue Inc. | 0.00 | -6.06 | 0.10 | 5.26 | 0.8117 | -0.1052 | |||

| MBLY / Mobileye Global Inc. | 0.01 | 19.22 | 0.10 | -14.16 | 0.7899 | -0.3029 | |||

| AMZN / Amazon.com, Inc. | 0.00 | 100.00 | 0.10 | 74.55 | 0.7793 | 0.2438 | |||

| UNP / Union Pacific Corporation | 0.00 | 18.96 | 0.09 | 22.97 | 0.7409 | 0.0244 | |||

| LOW / Lowe's Companies, Inc. | 0.00 | 19.15 | 0.09 | 12.35 | 0.7371 | -0.0431 | |||

| BAC / Bank of America Corporation | 0.00 | 19.18 | 0.09 | 13.75 | 0.7338 | -0.0391 | |||

| FHB / First Hawaiian, Inc. | 0.00 | 19.20 | 0.09 | 13.16 | 0.6948 | -0.0428 | |||

| REYN / Reynolds Consumer Products Inc. | 0.00 | 19.19 | 0.07 | 4.41 | 0.5796 | -0.0760 | |||

| META / Meta Platforms, Inc. | 0.00 | -5.21 | 0.05 | -7.14 | 0.4229 | -0.1173 | |||

| VLO / Valero Energy Corporation | 0.00 | 19.14 | 0.05 | 27.03 | 0.3844 | 0.0275 |