Mga Batayang Estadistika

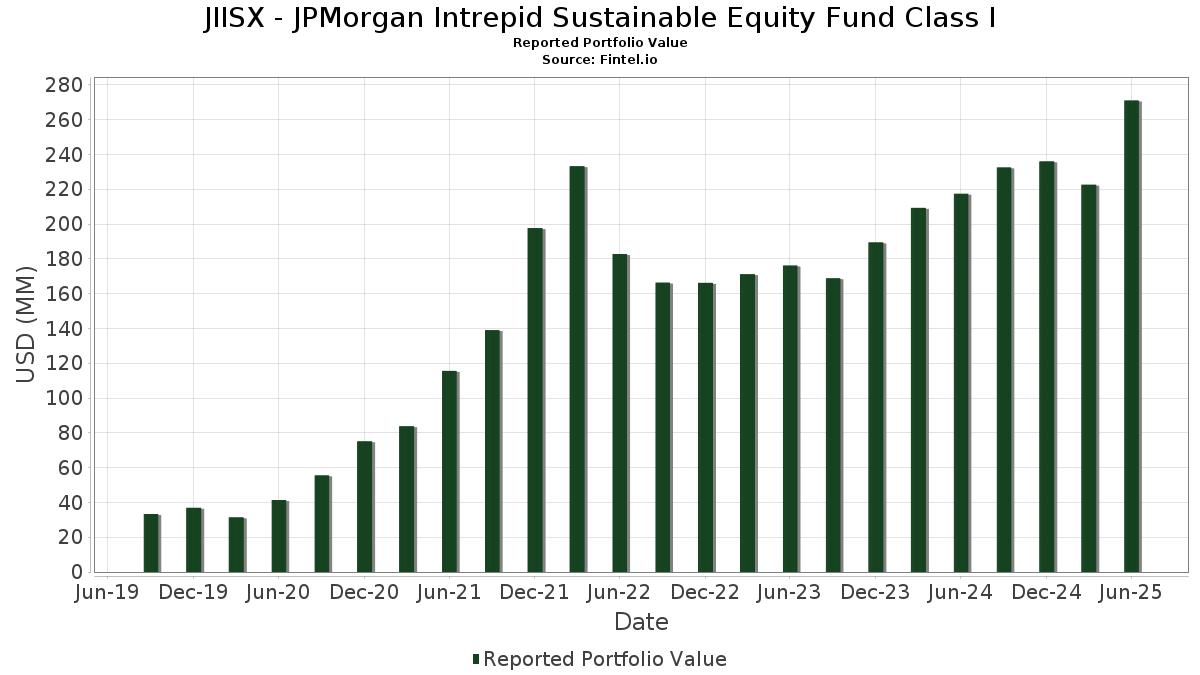

| Nilai Portofolio | $ 270,947,715 |

| Posisi Saat Ini | 67 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

JIISX - JPMorgan Intrepid Sustainable Equity Fund Class I telah mengungkapkan total kepemilikan 67 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 270,947,715 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama JIISX - JPMorgan Intrepid Sustainable Equity Fund Class I adalah Microsoft Corporation (US:MSFT) , NVIDIA Corporation (US:NVDA) , Apple Inc. (US:AAPL) , Amazon.com, Inc. (US:AMZN) , and Mastercard Incorporated (US:MA) . Posisi baru JIISX - JPMorgan Intrepid Sustainable Equity Fund Class I meliputi: Emerson Electric Co. (US:EMR) , Danaher Corporation (US:DHR) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.15 | 23.30 | 8.5931 | 2.1119 | |

| 0.06 | 27.44 | 10.1166 | 1.6921 | |

| 0.02 | 2.58 | 0.9511 | 0.9511 | |

| 0.02 | 4.97 | 1.8311 | 0.7277 | |

| 0.01 | 1.78 | 0.6551 | 0.6551 | |

| 0.00 | 1.71 | 0.6289 | 0.6289 | |

| 0.01 | 1.58 | 0.5827 | 0.5827 | |

| 0.02 | 4.43 | 1.6319 | 0.5412 | |

| 0.01 | 2.86 | 1.0541 | 0.4116 | |

| 0.03 | 5.19 | 1.9125 | 0.3174 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.01 | 3.65 | 1.3474 | -1.1955 | |

| 0.00 | 1.82 | 0.6717 | -1.0383 | |

| 3.10 | 3.10 | 1.1415 | -0.8054 | |

| 0.00 | 0.00 | -0.4691 | ||

| 0.00 | 0.00 | -0.4691 | ||

| 0.00 | 0.00 | -0.4691 | ||

| 0.00 | 0.00 | -0.4691 | ||

| 0.03 | 5.94 | 2.1917 | -0.4510 | |

| 0.08 | 16.40 | 6.0485 | -0.4025 | |

| 0.01 | 3.35 | 1.2337 | -0.3809 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-26 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.06 | 10.34 | 27.44 | 46.20 | 10.1166 | 1.6921 | |||

| NVDA / NVIDIA Corporation | 0.15 | 10.73 | 23.30 | 61.41 | 8.5931 | 2.1119 | |||

| AAPL / Apple Inc. | 0.08 | 23.59 | 16.40 | 14.16 | 6.0485 | -0.4025 | |||

| AMZN / Amazon.com, Inc. | 0.06 | 12.83 | 13.28 | 30.11 | 4.8969 | 0.3145 | |||

| MA / Mastercard Incorporated | 0.02 | 15.96 | 12.15 | 18.88 | 4.4815 | -0.1081 | |||

| GOOGL / Alphabet Inc. | 0.05 | -2.28 | 8.50 | 11.37 | 3.1354 | -0.2922 | |||

| ABBV / AbbVie Inc. | 0.03 | 13.97 | 5.94 | 0.97 | 2.1917 | -0.4510 | |||

| HWM / Howmet Aerospace Inc. | 0.03 | 1.74 | 5.19 | 45.96 | 1.9125 | 0.3174 | |||

| ORCL / Oracle Corporation | 0.02 | 29.20 | 4.97 | 102.08 | 1.8311 | 0.7277 | |||

| PG / The Procter & Gamble Company | 0.03 | 14.01 | 4.71 | 6.59 | 1.7369 | -0.2470 | |||

| TT / Trane Technologies plc | 0.01 | -10.20 | 4.60 | 16.59 | 1.6977 | -0.0751 | |||

| AVGO / Broadcom Inc. | 0.02 | 10.64 | 4.43 | 82.17 | 1.6319 | 0.5412 | |||

| AJG / Arthur J. Gallagher & Co. | 0.01 | 11.19 | 4.18 | 3.11 | 1.5395 | -0.2784 | |||

| AON / Aon plc | 0.01 | 21.94 | 4.13 | 9.00 | 1.5224 | -0.1780 | |||

| BAC / Bank of America Corporation | 0.09 | 13.97 | 4.04 | 29.26 | 1.4892 | 0.0863 | |||

| LOW / Lowe's Companies, Inc. | 0.02 | 14.02 | 3.97 | 8.48 | 1.4630 | -0.1791 | |||

| WFC / Wells Fargo & Company | 0.05 | 13.97 | 3.79 | 27.20 | 1.3971 | 0.0599 | |||

| T / AT&T Inc. | 0.13 | 9.92 | 3.74 | 12.50 | 1.3773 | -0.1133 | |||

| DIS / The Walt Disney Company | 0.03 | 0.05 | 3.67 | 25.71 | 1.3541 | 0.0426 | |||

| UNH / UnitedHealth Group Incorporated | 0.01 | 8.30 | 3.65 | -35.49 | 1.3474 | -1.1955 | |||

| SYK / Stryker Corporation | 0.01 | 14.10 | 3.62 | 21.29 | 1.3364 | -0.0053 | |||

| FIS / Fidelity National Information Services, Inc. | 0.04 | 18.12 | 3.60 | 28.77 | 1.3273 | 0.0723 | |||

| SCHW / The Charles Schwab Corporation | 0.04 | 13.98 | 3.53 | 32.84 | 1.3022 | 0.1088 | |||

| CMG / Chipotle Mexican Grill, Inc. | 0.06 | 2.38 | 3.51 | 14.50 | 1.2956 | -0.0821 | |||

| NEE / NextEra Energy, Inc. | 0.05 | 33.02 | 3.51 | 30.28 | 1.2947 | 0.0846 | |||

| LIN / Linde plc | 0.01 | -7.68 | 3.35 | -6.98 | 1.2337 | -0.3809 | |||

| IR / Ingersoll Rand Inc. | 0.04 | 13.96 | 3.19 | 18.44 | 1.1751 | -0.0327 | |||

| OTIS / Otis Worldwide Corporation | 0.03 | 13.94 | 3.18 | 9.31 | 1.1731 | -0.1333 | |||

| TSLA / Tesla, Inc. | 0.01 | 18.19 | 3.16 | 44.90 | 1.1638 | 0.1857 | |||

| JIMXX / JPMorgan Trust I. - JPMorgan Prime Money Market Fund IM | 3.10 | -28.61 | 3.10 | -28.62 | 1.1415 | -0.8054 | |||

| ADI / Analog Devices, Inc. | 0.01 | -4.60 | 2.97 | 12.61 | 1.0965 | -0.0891 | |||

| CRM / Salesforce, Inc. | 0.01 | 20.94 | 2.96 | 22.86 | 1.0922 | 0.0102 | |||

| TXN / Texas Instruments Incorporated | 0.01 | 70.07 | 2.86 | 88.27 | 1.0541 | 0.4116 | |||

| ETN / Eaton Corporation plc | 0.01 | 14.47 | 2.81 | 50.35 | 1.0351 | 0.1968 | |||

| BURL / Burlington Stores, Inc. | 0.01 | 13.99 | 2.64 | 11.27 | 0.9727 | -0.0916 | |||

| HLT / Hilton Worldwide Holdings Inc. | 0.01 | 13.94 | 2.63 | 33.38 | 0.9710 | 0.0846 | |||

| CPAY / Corpay, Inc. | 0.01 | 9.15 | 2.63 | 3.88 | 0.9688 | -0.1668 | |||

| ECL / Ecolab Inc. | 0.01 | 26.28 | 2.60 | 45.27 | 0.9573 | 0.2006 | |||

| EMR / Emerson Electric Co. | 0.02 | 2.58 | 0.9511 | 0.9511 | |||||

| BMY / Bristol-Myers Squibb Company | 0.05 | 13.97 | 2.52 | -13.51 | 0.9305 | -0.3792 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.01 | -13.82 | 2.49 | 17.60 | 0.9189 | -0.0325 | |||

| NXPI / NXP Semiconductors N.V. | 0.01 | -6.74 | 2.42 | 7.18 | 0.8923 | -0.1210 | |||

| CSX / CSX Corporation | 0.07 | -22.79 | 2.31 | -14.40 | 0.8532 | -0.3602 | |||

| URI / United Rentals, Inc. | 0.00 | 14.19 | 2.27 | 37.25 | 0.8359 | 0.0946 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.01 | -5.00 | 2.26 | -12.74 | 0.8335 | -0.3297 | |||

| CHTR / Charter Communications, Inc. | 0.01 | 7.35 | 2.18 | 19.06 | 0.8041 | -0.0180 | |||

| EW / Edwards Lifesciences Corporation | 0.03 | 13.97 | 2.17 | 23.00 | 0.7988 | 0.0080 | |||

| CTSH / Cognizant Technology Solutions Corporation | 0.03 | 13.97 | 2.11 | 16.29 | 0.7792 | -0.0369 | |||

| WDC / Western Digital Corporation | 0.03 | 33.24 | 2.02 | 110.88 | 0.7436 | 0.3143 | |||

| AMT / American Tower Corporation | 0.01 | 30.02 | 2.01 | 32.06 | 0.7399 | 0.0578 | |||

| VTR / Ventas, Inc. | 0.03 | 13.96 | 1.94 | 4.69 | 0.7163 | -0.1169 | |||

| AMP / Ameriprise Financial, Inc. | 0.00 | 0.53 | 1.92 | 0.79 | 0.7089 | -0.0985 | |||

| MDT / Medtronic plc | 0.02 | 13.96 | 1.86 | 10.57 | 0.6867 | -0.0696 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | -41.31 | 1.82 | -52.19 | 0.6717 | -1.0383 | |||

| EQIX / Equinix, Inc. | 0.00 | 13.54 | 1.81 | 10.78 | 0.6667 | -0.0661 | |||

| ROST / Ross Stores, Inc. | 0.01 | 13.99 | 1.78 | 13.85 | 0.6579 | -0.0459 | |||

| AXP / American Express Company | 0.01 | 1.78 | 0.6551 | 0.6551 | |||||

| REGN / Regeneron Pharmaceuticals, Inc. | 0.00 | 13.96 | 1.77 | -5.65 | 0.6528 | -0.1897 | |||

| FITB / Fifth Third Bancorp | 0.04 | 7.84 | 1.73 | 13.15 | 0.6381 | -0.0485 | |||

| LLY / Eli Lilly and Company | 0.00 | 1.71 | 0.6289 | 0.6289 | |||||

| MU / Micron Technology, Inc. | 0.01 | -35.58 | 1.66 | -8.65 | 0.6114 | -0.2032 | |||

| DHR / Danaher Corporation | 0.01 | 1.58 | 0.5827 | 0.5827 | |||||

| PCG / PG&E Corporation | 0.09 | 12.26 | 1.28 | -8.92 | 0.4707 | -0.1584 | |||

| TOST / Toast, Inc. | 0.02 | 14.52 | 1.11 | 52.84 | 0.4077 | 0.0831 | |||

| WMG / Warner Music Group Corp. | 0.04 | 0.00 | 0.96 | -13.09 | 0.3552 | -0.1425 | |||

| ARE / Alexandria Real Estate Equities, Inc. | 0.01 | -0.11 | 0.93 | -21.56 | 0.3424 | -0.1891 | |||

| S&P 500 E-Mini Index / DE (N/A) | 0.05 | 0.0198 | 0.0198 | ||||||

| MCHP / Microchip Technology Incorporated | 0.00 | -100.00 | 0.00 | -100.00 | -0.4691 | ||||

| MCHP / Microchip Technology Incorporated | 0.00 | -100.00 | 0.00 | -100.00 | -0.4691 | ||||

| MCP / Microchip Technology Incorporated | 0.00 | -100.00 | 0.00 | -100.00 | -0.4691 | ||||

| MCHP / Microchip Technology Incorporated | 0.00 | -100.00 | 0.00 | -100.00 | -0.4691 |