Mga Batayang Estadistika

| Nilai Portofolio | $ 330,787,974 |

| Posisi Saat Ini | 45 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

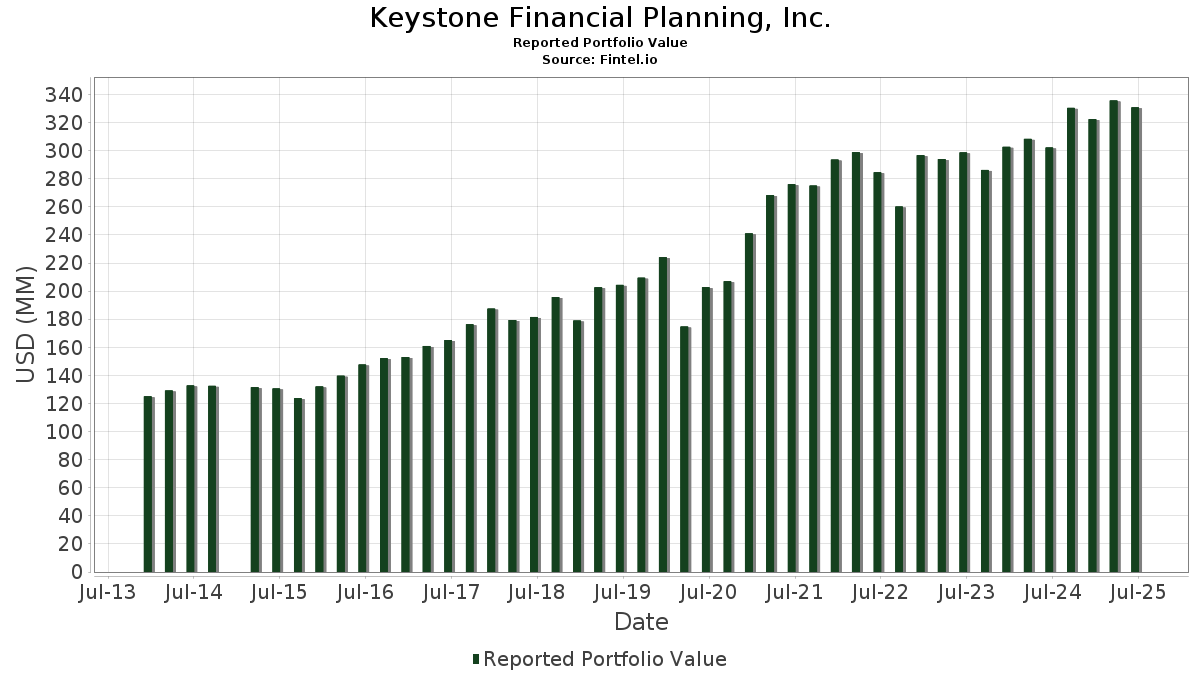

Keystone Financial Planning, Inc. telah mengungkapkan total kepemilikan 45 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 330,787,974 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Keystone Financial Planning, Inc. adalah Schwab Strategic Trust - Schwab U.S. Dividend Equity ETF (US:SCHD) , Microsoft Corporation (US:MSFT) , Verizon Communications Inc. (US:VZ) , U.S. Bancorp (US:USB) , and GSK plc - Depositary Receipt (Common Stock) (US:GSK) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 6.34 | 168.08 | 50.8118 | 5.0931 | |

| 0.03 | 13.37 | 4.0424 | 0.9424 | |

| 0.12 | 8.73 | 2.6379 | 0.5196 | |

| 0.14 | 7.73 | 2.3383 | 0.3754 | |

| 0.17 | 8.12 | 2.4556 | 0.3264 | |

| 0.23 | 10.35 | 3.1303 | 0.2497 | |

| 0.11 | 2.52 | 0.7622 | 0.1428 | |

| 0.03 | 4.65 | 1.4060 | 0.1418 | |

| 0.07 | 6.84 | 2.0663 | 0.1276 | |

| 0.05 | 3.47 | 1.0498 | 0.1124 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.01 | 1.19 | 0.3612 | -1.9481 | |

| 0.07 | 2.16 | 0.6541 | -1.6676 | |

| 0.16 | 7.51 | 2.2705 | -0.6306 | |

| 0.02 | 3.55 | 1.0726 | -0.1913 | |

| 0.00 | 0.29 | 0.0880 | -0.1819 | |

| 0.05 | 5.28 | 1.5969 | -0.1704 | |

| 0.25 | 10.64 | 3.2155 | -0.1220 | |

| 0.05 | 4.77 | 1.4419 | -0.1065 | |

| 0.25 | 6.18 | 1.8676 | -0.0665 | |

| 0.20 | 8.36 | 2.5267 | -0.0651 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-31 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SCHD / Schwab Strategic Trust - Schwab U.S. Dividend Equity ETF | 6.34 | 15.57 | 168.08 | 9.53 | 50.8118 | 5.0931 | |||

| MSFT / Microsoft Corporation | 0.03 | -3.02 | 13.37 | 28.52 | 4.0424 | 0.9424 | |||

| VZ / Verizon Communications Inc. | 0.25 | -0.46 | 10.64 | -5.05 | 3.2155 | -0.1220 | |||

| USB / U.S. Bancorp | 0.23 | -0.08 | 10.35 | 7.10 | 3.1303 | 0.2497 | |||

| GSK / GSK plc - Depositary Receipt (Common Stock) | 0.23 | 0.10 | 8.80 | -0.78 | 2.6597 | 0.0179 | |||

| TD / The Toronto-Dominion Bank | 0.12 | 0.15 | 8.73 | 22.73 | 2.6379 | 0.5196 | |||

| SPYD / SPDR Series Trust - SPDR Portfolio S&P 500 High Dividend ETF | 0.20 | 0.20 | 8.36 | -3.93 | 2.5267 | -0.0651 | |||

| BTI / British American Tobacco p.l.c. - Depositary Receipt (Common Stock) | 0.17 | -0.65 | 8.12 | 13.66 | 2.4556 | 0.3264 | |||

| BNS / The Bank of Nova Scotia | 0.14 | 0.75 | 7.73 | 17.40 | 2.3383 | 0.3754 | |||

| BMY / Bristol-Myers Squibb Company | 0.16 | 1.62 | 7.51 | -22.87 | 2.2705 | -0.6306 | |||

| TROW / T. Rowe Price Group, Inc. | 0.07 | 0.00 | 6.84 | 5.04 | 2.0663 | 0.1276 | |||

| MO / Altria Group, Inc. | 0.11 | 0.00 | 6.43 | -2.31 | 1.9442 | -0.0173 | |||

| PFE / Pfizer Inc. | 0.25 | -0.52 | 6.18 | -4.84 | 1.8676 | -0.0665 | |||

| XOM / Exxon Mobil Corporation | 0.05 | -1.75 | 5.28 | -10.94 | 1.5969 | -0.1704 | |||

| UPS / United Parcel Service, Inc. | 0.05 | 0.00 | 4.77 | -8.24 | 1.4419 | -0.1065 | |||

| PM / Philip Morris International Inc. | 0.03 | -4.47 | 4.65 | 9.59 | 1.4060 | 0.1418 | |||

| QCOM / QUALCOMM Incorporated | 0.03 | -1.41 | 4.20 | 2.22 | 1.2693 | 0.0455 | |||

| CVX / Chevron Corporation | 0.02 | -2.29 | 3.55 | -16.38 | 1.0726 | -0.1913 | |||

| HDV / iShares Trust - iShares Core High Dividend ETF | 0.03 | -3.20 | 3.53 | -6.36 | 1.0677 | -0.0560 | |||

| CSCO / Cisco Systems, Inc. | 0.05 | -1.83 | 3.47 | 10.36 | 1.0498 | 0.1124 | |||

| KO / The Coca-Cola Company | 0.04 | -2.38 | 2.56 | -3.58 | 0.7742 | -0.0170 | |||

| GPC / Genuine Parts Company | 0.02 | -5.20 | 2.55 | -3.48 | 0.7720 | -0.0162 | |||

| IBM / International Business Machines Corporation | 0.01 | -4.44 | 2.53 | 13.31 | 0.7642 | 0.0994 | |||

| BEN / Franklin Resources, Inc. | 0.11 | -2.11 | 2.52 | 21.32 | 0.7622 | 0.1428 | |||

| MCD / McDonald's Corporation | 0.01 | 0.00 | 2.50 | -6.47 | 0.7561 | -0.0406 | |||

| HLN / Haleon plc - Depositary Receipt (Common Stock) | 0.22 | -0.56 | 2.32 | 0.22 | 0.7011 | 0.0116 | |||

| T / AT&T Inc. | 0.07 | -72.87 | 2.16 | -72.24 | 0.6541 | -1.6676 | |||

| JNJ / Johnson & Johnson | 0.01 | -3.64 | 1.47 | -11.28 | 0.4450 | -0.0491 | |||

| PG / The Procter & Gamble Company | 0.01 | 0.00 | 1.44 | -6.51 | 0.4345 | -0.0235 | |||

| SOLV / Solventum Corporation | 0.02 | -0.03 | 1.28 | -0.31 | 0.3866 | 0.0045 | |||

| PNW / Pinnacle West Capital Corporation | 0.01 | -83.59 | 1.19 | -84.60 | 0.3612 | -1.9481 | |||

| SNY / Sanofi - Depositary Receipt (Common Stock) | 0.02 | -4.16 | 1.06 | -16.53 | 0.3190 | -0.0576 | |||

| LMT / Lockheed Martin Corporation | 0.00 | 0.00 | 0.90 | 3.70 | 0.2711 | 0.0134 | |||

| CL / Colgate-Palmolive Company | 0.01 | 0.00 | 0.81 | -3.01 | 0.2439 | -0.0039 | |||

| WBD / Warner Bros. Discovery, Inc. | 0.06 | 0.48 | 0.74 | 7.27 | 0.2233 | 0.0182 | |||

| K / Kellanova | 0.01 | 0.00 | 0.70 | -3.60 | 0.2105 | -0.0047 | |||

| EMR / Emerson Electric Co. | 0.00 | -8.05 | 0.61 | 11.72 | 0.1847 | 0.0219 | |||

| TJX / The TJX Companies, Inc. | 0.00 | 0.33 | 0.52 | 1.76 | 0.1569 | 0.0049 | |||

| PEG / Public Service Enterprise Group Incorporated | 0.01 | -0.86 | 0.47 | 1.31 | 0.1408 | 0.0040 | |||

| VNQ / Vanguard Specialized Funds - Vanguard Real Estate ETF | 0.00 | 0.00 | 0.44 | -1.57 | 0.1331 | -0.0003 | |||

| ACN / Accenture plc | 0.00 | 0.00 | 0.32 | -4.14 | 0.0980 | -0.0028 | |||

| CVS / CVS Health Corporation | 0.00 | 0.00 | 0.31 | 1.63 | 0.0943 | 0.0030 | |||

| VYM / Vanguard Whitehall Funds - Vanguard High Dividend Yield ETF | 0.00 | -68.91 | 0.29 | -67.85 | 0.0880 | -0.1819 | |||

| BAC / Bank of America Corporation | 0.01 | 0.00 | 0.28 | 13.47 | 0.0841 | 0.0110 | |||

| VTRS / Viatris Inc. | 0.03 | -0.69 | 0.23 | 1.76 | 0.0701 | 0.0022 | |||

| CME / CME Group Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |