Mga Batayang Estadistika

| Nilai Portofolio | $ 101,684,777 |

| Posisi Saat Ini | 39 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

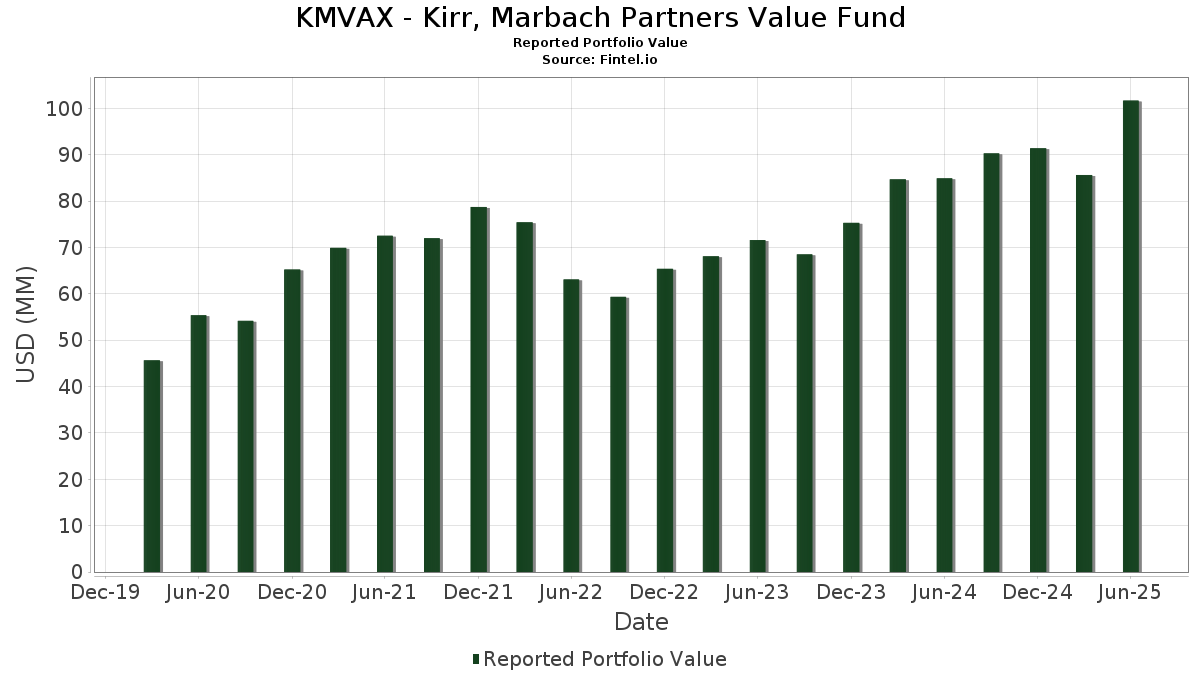

KMVAX - Kirr, Marbach Partners Value Fund telah mengungkapkan total kepemilikan 39 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 101,684,777 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama KMVAX - Kirr, Marbach Partners Value Fund adalah Broadcom Inc. (US:AVGO) , EMCOR Group, Inc. (US:EME) , Vistra Corp. (US:VST) , AutoZone, Inc. (US:AZO) , and MasTec, Inc. (US:MTZ) . Posisi baru KMVAX - Kirr, Marbach Partners Value Fund meliputi: Generac Holdings Inc. (US:GNRC) , Amrize AG (US:AMRZ) , Peloton Interactive, Inc. (US:PTON) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.02 | 2.15 | 2.1177 | 2.1177 | |

| 0.04 | 7.10 | 6.9882 | 1.9621 | |

| 0.01 | 7.18 | 7.0665 | 1.2705 | |

| 0.03 | 5.92 | 5.8257 | 1.0905 | |

| 0.02 | 0.95 | 0.9324 | 0.9324 | |

| 0.13 | 0.87 | 0.8600 | 0.8600 | |

| 0.03 | 8.85 | 8.7169 | 0.5881 | |

| 0.01 | 1.37 | 1.3448 | 0.5809 | |

| 0.04 | 1.86 | 1.8351 | 0.3093 | |

| 0.02 | 2.25 | 2.2161 | 0.2224 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 6.35 | 6.2542 | -1.3702 | |

| 3.01 | 3.01 | 2.9681 | -1.0396 | |

| 0.01 | 0.93 | 0.9206 | -0.8840 | |

| 0.02 | 4.74 | 4.6710 | -0.7731 | |

| 0.04 | 3.40 | 3.3517 | -0.6616 | |

| 0.02 | 1.64 | 1.6166 | -0.5003 | |

| 0.03 | 3.94 | 3.8844 | -0.3998 | |

| 0.00 | 3.58 | 3.5263 | -0.3915 | |

| 0.02 | 0.55 | 0.5393 | -0.3741 | |

| 0.02 | 1.89 | 1.8636 | -0.2708 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-15 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AVGO / Broadcom Inc. | 0.03 | -22.69 | 8.85 | 27.28 | 8.7169 | 0.5881 | |||

| EME / EMCOR Group, Inc. | 0.01 | 0.00 | 7.18 | 44.71 | 7.0665 | 1.2705 | |||

| VST / Vistra Corp. | 0.04 | 0.00 | 7.10 | 65.05 | 6.9882 | 1.9621 | |||

| AZO / AutoZone, Inc. | 0.00 | 0.00 | 6.35 | -2.64 | 6.2542 | -1.3702 | |||

| MTZ / MasTec, Inc. | 0.03 | 0.00 | 5.92 | 46.04 | 5.8257 | 1.0905 | |||

| CNSWF / Constellation Software Inc. | 0.00 | 0.00 | 5.37 | 15.78 | 5.2894 | -0.1330 | |||

| RSG / Republic Services, Inc. | 0.02 | 0.00 | 4.74 | 1.82 | 4.6710 | -0.7731 | |||

| CIGI / Colliers International Group Inc. | 0.03 | 0.00 | 3.94 | 7.61 | 3.8844 | -0.3998 | |||

| MKL / Markel Group Inc. | 0.00 | 0.00 | 3.58 | 6.83 | 3.5263 | -0.3915 | |||

| GOOGL / Alphabet Inc. | 0.02 | 0.00 | 3.40 | 13.96 | 3.3525 | -0.1392 | |||

| SSNC / SS&C Technologies Holdings, Inc. | 0.04 | 0.00 | 3.40 | -0.87 | 3.3517 | -0.6616 | |||

| FGXXX / First American Funds Inc - First American Government Obligations Fund Class X | 3.01 | -12.10 | 3.01 | -12.10 | 2.9681 | -1.0396 | |||

| LRN / Stride, Inc. | 0.02 | 0.00 | 2.95 | 14.78 | 2.9060 | -0.0992 | |||

| CP / Canadian Pacific Kansas City Limited | 0.04 | 0.00 | 2.84 | 12.89 | 2.7949 | -0.1433 | |||

| BN / Brookfield Corporation | 0.04 | 0.00 | 2.51 | 18.01 | 2.4723 | -0.0143 | |||

| DLTR / Dollar Tree, Inc. | 0.02 | 0.00 | 2.25 | 31.96 | 2.2161 | 0.2224 | |||

| GNRC / Generac Holdings Inc. | 0.02 | 2.15 | 2.1177 | 2.1177 | |||||

| BCO / The Brink's Company | 0.02 | 0.00 | 1.89 | 3.61 | 1.8636 | -0.2708 | |||

| APG / APi Group Corporation | 0.04 | 0.00 | 1.86 | 42.76 | 1.8351 | 0.3093 | |||

| GXO / GXO Logistics, Inc. | 0.04 | 0.00 | 1.79 | 24.65 | 1.7582 | 0.0836 | |||

| VLTO / Veralto Corporation | 0.02 | 0.00 | 1.78 | 3.55 | 1.7506 | -0.2552 | |||

| MPC / Marathon Petroleum Corporation | 0.01 | 0.00 | 1.77 | 14.06 | 1.7419 | -0.0715 | |||

| XOM / Exxon Mobil Corporation | 0.02 | 0.00 | 1.64 | -9.39 | 1.6166 | -0.5003 | |||

| LYV / Live Nation Entertainment, Inc. | 0.01 | 0.00 | 1.63 | 15.82 | 1.6007 | -0.0392 | |||

| VC / Visteon Corporation | 0.01 | 0.00 | 1.39 | 20.23 | 1.3643 | 0.0171 | |||

| MOGA / Moog, Inc. - Class A | 0.01 | 0.00 | 1.37 | 4.41 | 1.3534 | -0.1853 | |||

| CROX / Crocs, Inc. | 0.01 | 119.09 | 1.37 | 109.04 | 1.3448 | 0.5809 | |||

| CXT / Crane NXT, Co. | 0.02 | 0.00 | 1.16 | 4.88 | 1.1423 | -0.1506 | |||

| ICUI / ICU Medical, Inc. | 0.01 | 0.00 | 1.05 | -4.81 | 1.0324 | -0.2552 | |||

| ALIT / Alight, Inc. | 0.18 | 0.00 | 1.00 | -4.59 | 0.9823 | -0.2392 | |||

| AMRZ / Amrize AG | 0.02 | 0.95 | 0.9324 | 0.9324 | |||||

| IOSP / Innospec Inc. | 0.01 | -31.77 | 0.93 | -39.51 | 0.9206 | -0.8840 | |||

| SHYF / The Shyft Group, Inc. | 0.07 | 0.00 | 0.92 | 55.22 | 0.9080 | 0.2127 | |||

| DIS / The Walt Disney Company | 0.01 | 0.00 | 0.88 | 25.64 | 0.8643 | 0.0478 | |||

| PTON / Peloton Interactive, Inc. | 0.13 | 0.87 | 0.8600 | 0.8600 | |||||

| RXO / RXO, Inc. | 0.04 | 0.00 | 0.62 | -17.71 | 0.6089 | -0.2692 | |||

| ATEX / Anterix Inc. | 0.02 | 0.00 | 0.55 | -29.96 | 0.5393 | -0.3741 | |||

| BAM / Brookfield Asset Management Ltd. | 0.01 | 0.00 | 0.37 | 14.11 | 0.3665 | -0.0148 | |||

| TOITF / Topicus.com Inc. | 0.00 | 0.00 | 0.34 | 27.72 | 0.3362 | 0.0237 | |||

| CA21037X1345 / CONSTELLATION SOFTWARE INC | 0.00 | 0.00 | 0.00 | 0.0000 | 0.0000 |