Mga Batayang Estadistika

| Nilai Portofolio | $ 442,354,248 |

| Posisi Saat Ini | 81 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

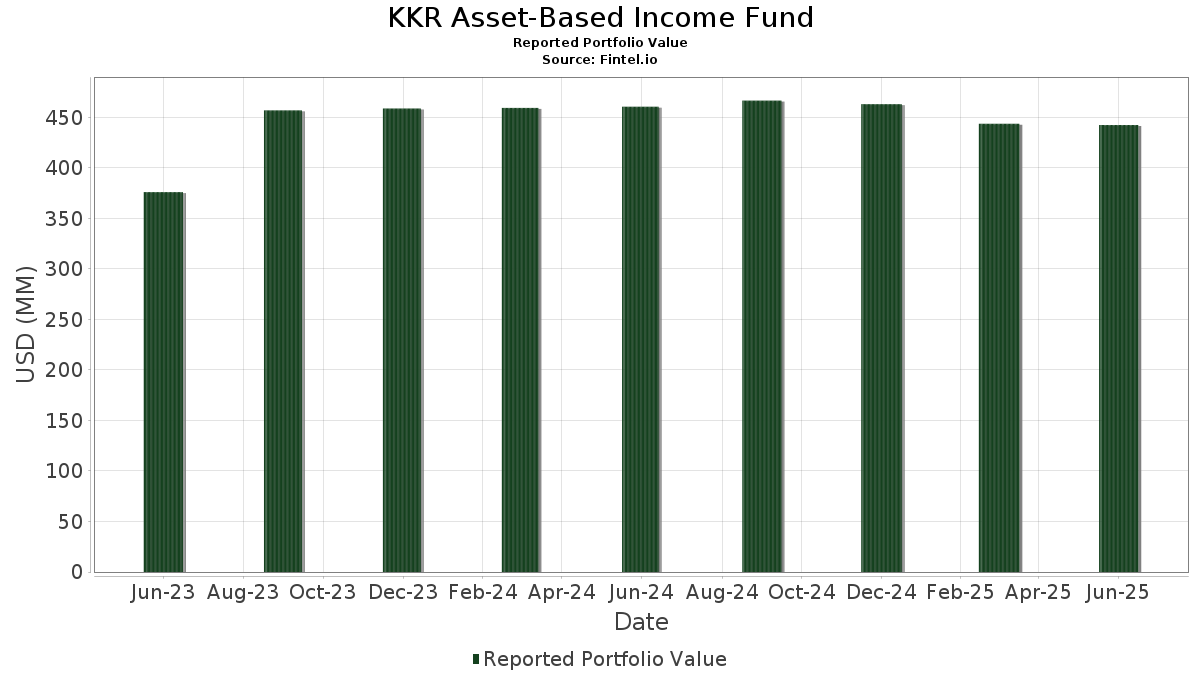

KKR Asset-Based Income Fund telah mengungkapkan total kepemilikan 81 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 442,354,248 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama KKR Asset-Based Income Fund adalah Fidelity Treasury Portfolio (US:US3161755042) , Adams Outdoor Advertising LP (US:US006346AW02) , FirstKey Homes 2022-SFR3 Trust (US:US33768EAL65) , ALLO Issuer LLC (US:US01983KAA25) , and Imperial Fund Mortgage Trust 2022-NQM7 (US:US452763AD70) . Posisi baru KKR Asset-Based Income Fund meliputi: Adams Outdoor Advertising LP (US:US006346AW02) , FirstKey Homes 2022-SFR3 Trust (US:US33768EAL65) , ALLO Issuer LLC (US:US01983KAA25) , Imperial Fund Mortgage Trust 2022-NQM7 (US:US452763AD70) , and CSMC 2022-ATH3 (US:US12664AAG40) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 19.02 | 4.0751 | 4.0751 | ||

| 10.23 | 2.1912 | 2.1912 | ||

| 10.04 | 2.1517 | 2.1517 | ||

| 10.02 | 2.1464 | 2.1464 | ||

| 9.88 | 2.1169 | 2.1169 | ||

| 8.48 | 1.8171 | 1.8171 | ||

| 8.33 | 1.7840 | 1.7840 | ||

| 6.76 | 1.4483 | 1.4483 | ||

| 21.01 | 21.01 | 4.5010 | 1.2696 | |

| 4.56 | 0.9780 | 0.9780 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 2.49 | 0.5330 | -0.3902 | ||

| 4.28 | 0.9181 | -0.3717 | ||

| 20.53 | 4.3996 | -0.3405 | ||

| 16.82 | 3.6036 | -0.2778 | ||

| 19.42 | 4.1610 | -0.2768 | ||

| 17.33 | 3.7127 | -0.2724 | ||

| 11.93 | 2.5571 | -0.2259 | ||

| 15.26 | 3.2699 | -0.2257 | ||

| 12.57 | 2.6943 | -0.2170 | ||

| 13.40 | 2.8711 | -0.2128 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-29 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US3161755042 / Fidelity Treasury Portfolio | 21.01 | 49.61 | 21.01 | 49.60 | 4.5010 | 1.2696 | |||

| US006346AW02 / Adams Outdoor Advertising LP | 20.53 | -0.31 | 4.3996 | -0.3405 | |||||

| US33768EAL65 / FirstKey Homes 2022-SFR3 Trust | 19.42 | 0.71 | 4.1610 | -0.2768 | |||||

| Sunnova Energy Corp - SNVA 2024-3 A / ABS-O (000000000) | 19.02 | 4.0751 | 4.0751 | ||||||

| US01983KAA25 / ALLO Issuer LLC | 17.33 | 0.07 | 3.7127 | -0.2724 | |||||

| US452763AD70 / Imperial Fund Mortgage Trust 2022-NQM7 | 16.82 | -0.28 | 3.6036 | -0.2778 | |||||

| US12664AAG40 / CSMC 2022-ATH3 | 15.26 | 0.47 | 3.2699 | -0.2257 | |||||

| New Mountain Guardian IV Rated Feeder III Ltd / ABS-CBDO (US647907AA26) | 13.40 | 0.00 | 2.8711 | -0.2128 | |||||

| US529922AA43 / Libertas Asset Securitization LLC | 12.57 | -0.60 | 2.6943 | -0.2170 | |||||

| US12665HAA14 / CPC ASSET SECURITIZATION II LLC | 11.93 | -1.31 | 2.5571 | -0.2259 | |||||

| US79582GAC87 / Saluda Grade Alternative Mortgage Trust 2020-PAC1 | 10.28 | 0.20 | 2.2029 | -0.1586 | |||||

| Unison Trust 2025-1 - UNSN 2025-1 A / DBT (000000000) | 10.23 | 2.1912 | 2.1912 | ||||||

| Vista Point Securitization Trust 2024-CES1 / ABS-MBS (US92839HAD89) | 10.20 | 0.48 | 2.1858 | -0.1508 | |||||

| Lyra Music Assets Delaware LP - LYRA 2024-3A A2 / ABS-O (US551916AB51) | 10.04 | 2.1517 | 2.1517 | ||||||

| BHG FUNDING 06 LLC - TL 1L 05/23 Tranche 2 Class A / LON (000000000) | 10.02 | 2.1464 | 2.1464 | ||||||

| KKR Asset-Based Income Fund - HG ABF / ABS-MBS (000000000) | 9.88 | 2.1169 | 2.1169 | ||||||

| Mulligan Asset Securitization II LLC / ABS-O (US62534LAA61) | 9.50 | 0.16 | 2.0356 | -0.1475 | |||||

| AMSR 2024-SFR2 Trust / ABS-O (US00179UAF57) | 9.26 | 1.42 | 1.9835 | -0.1172 | |||||

| Progress Residential 2024-SFR5 Trust / ABS-O (US74332HAL06) | 9.14 | 1.27 | 1.9578 | -0.1187 | |||||

| GSAM Vintage Platform IX NAV TL 1L 02/25 (Vintage IX B AB) / DBT (000000000) | 8.48 | 1.8171 | 1.8171 | ||||||

| Sunnova Sol IX Issuer LLC - Sunnova 2025-1 Class A / ABS-MBS (000000000) | 8.33 | 1.7840 | 1.7840 | ||||||

| US36170HAD26 / GCAT 2022-NQM4 Trust | 7.28 | -2.50 | 1.5598 | -0.1586 | |||||

| Colt 2024-7 Mortgage Loan Trust / ABS-MBS (US19688YAD67) | 7.09 | 0.55 | 1.5185 | -0.1037 | |||||

| Angel Oak Mortgage Trust 2024-13 / ABS-MBS (US03466PAD78) | 7.08 | 0.63 | 1.5174 | -0.1023 | |||||

| US618933AB16 / Mosaic Solar Loan Trust 2023-3 | 6.77 | -3.41 | 1.4512 | -0.1624 | |||||

| Genesis Aircraft Services Ltd - TL 1L DD 08/23 / LON (000000000) | 6.76 | 1.4483 | 1.4483 | ||||||

| US79582GAB05 / Saluda Grade Alternative Mortgage Trust 2020-PAC1 | 5.90 | 0.24 | 1.2650 | -0.0907 | |||||

| US66981XAF87 / AMSR Trust, Series 2023-SFR1, Class E2 | 5.61 | 0.84 | 1.2026 | -0.0783 | |||||

| Upstart Securitization Trust / ABS-O (US91684NAB73) | 5.15 | 0.49 | 1.1045 | -0.0759 | |||||

| Homes 2024-Nqm2 Trust / ABS-MBS (US43761CAG78) | 5.06 | 0.04 | 1.0834 | -0.0800 | |||||

| Lesha - Project Skyline - TL 1L DD 10/24 / DBT (000000000) | 4.56 | 0.9780 | 0.9780 | ||||||

| Unlock HEA Trust 2024-1 / ABS-MBS (US91530QAA85) | 4.37 | -1.58 | 0.9364 | -0.0855 | |||||

| US86746AAB17 / Sunnova Helios XI Issuer LLC | 4.28 | -23.55 | 0.9181 | -0.3717 | |||||

| Lesha - Project Skyline - TL 1L DD 10/24 / DBT (000000000) | 4.28 | 0.9163 | 0.9163 | ||||||

| US193938AF45 / College Ave Student Loans 2023-A LLC | 4.11 | 0.10 | 0.8813 | -0.0645 | |||||

| KKR Asset-Based Income Fund - HG ABF / ABS-CBDO (000000000) | 4.00 | 0.8577 | 0.8577 | ||||||

| US45276QAD60 / IMPRL 2022-NQM5 M1 | 3.99 | 0.05 | 0.8555 | -0.0630 | |||||

| New Residential Mortgage Loan Trust 2024-NQM3 / ABS-MBS (US647910AF59) | 3.90 | 0.59 | 0.8355 | -0.0566 | |||||

| US79582GAD60 / Saluda Grade Alternative Mortgage Trust 2020-PAC1 | 3.85 | -0.03 | 0.8240 | -0.0613 | |||||

| Morgan Stanley Residential Mortgage Loan Trust 2024-NQM5 / ABS-MBS (US61777QAF28) | 3.65 | 0.94 | 0.7826 | -0.0501 | |||||

| US57109RAD26 / Marlette Funding Trust 2023-3 | 3.63 | 1.68 | 0.7784 | -0.0440 | |||||

| Lesha - Project Skyline - TL 1L DD 10/24 / DBT (000000000) | 3.61 | 0.7744 | 0.7744 | ||||||

| GSAM Vintage Platform IX NAV TL 1L DD 02/25 (Vintage IX B AB) / DBT (000000000) | 3.57 | 0.7648 | 0.7648 | ||||||

| Lesha - Project Skyline - TL 1L DD 10/24 / DBT (000000000) | 3.23 | 0.6916 | 0.6916 | ||||||

| SunPower Financial TL 01/25 (Q1 2025) / DBT (000000000) | 3.10 | 0.6639 | 0.6639 | ||||||

| SSI ABS-2025-1 Issuer LLC / ABS-O (US78475CAA36) | 3.07 | 0.6580 | 0.6580 | ||||||

| Angel Oak Mortgage Trust 2024-12 / ABS-MBS (US034932AE30) | 3.03 | -0.53 | 0.6487 | -0.0517 | |||||

| Lesha - Project Skyline - TL 1L DD 10/24 / DBT (000000000) | 3.02 | 0.6478 | 0.6478 | ||||||

| Unison Trust 2023-2 / ABS-MBS (US90920AAA34) | 2.95 | -0.34 | 0.6312 | -0.0491 | |||||

| SSI ABS-2025-1 Issuer LLC / ABS-O (US78475CAB19) | 2.89 | 0.6186 | 0.6186 | ||||||

| US74334FAL22 / PROGRESS RESIDENTIAL 2023-SFR1 TR 6.6% 03/17/2040 144A | 2.51 | -0.08 | 0.5382 | -0.0403 | |||||

| Towd Point Mortgage Trust 2024-CES3 / ABS-MBS (US89183EAC57) | 2.49 | -38.00 | 0.5330 | -0.3902 | |||||

| US86772HAA59 / Sunrun Demeter Issuer 2021-2 | 2.44 | 0.29 | 0.5232 | -0.0371 | |||||

| US69377TAD81 / PRKCM 2022-AFC2 Trust | 2.42 | -0.08 | 0.5180 | -0.0388 | |||||

| Navient Refinance Loan Trust 2025-A / ABS-O (US63943FAC86) | 2.30 | 0.39 | 0.4919 | -0.0343 | |||||

| US193938AE79 / College Ave Student Loans 2023-A LLC | 2.04 | 0.15 | 0.4377 | -0.0318 | |||||

| Morgan Stanley Residential Mortgage Loan Trust 2024-NQM5 / ABS-MBS (US61777QAH83) | 2.02 | 0.50 | 0.4326 | -0.0300 | |||||

| Angel Oak Mortgage Trust 2024-13 / ABS-MBS (US03466PAE51) | 2.01 | 0.00 | 0.4308 | -0.0319 | |||||

| Cross 2024-H8 Mortgage Trust / ABS-MBS (US22757GAG82) | 1.99 | 0.40 | 0.4255 | -0.0299 | |||||

| Metro Communications Issuer LLC / ABS-MBS (000000000) | 1.80 | 0.3859 | 0.3859 | ||||||

| JP Morgan Mortgage Trust Series 2024-NQM1 / ABS-MBS (US465983AE42) | 1.69 | -0.18 | 0.3619 | -0.0276 | |||||

| BHG FUNDING 06 LLC - TL 2L 05/23 Tranche 2 Class B / LON (000000000) | 1.68 | 0.3590 | 0.3590 | ||||||

| BHG FUNDING 06 LLC - TL 3L 05/23 Tranche 2 Class C / LON (000000000) | 1.53 | 0.3269 | 0.3269 | ||||||

| RFS Asset Securitization V LLC / ABS-O (US74970DAG79) | 1.26 | 0.2702 | 0.2702 | ||||||

| Vista Point Securitization Trust 2024-CES3 / ABS-MBS (US92841WAD11) | 1.26 | -0.16 | 0.2701 | -0.0204 | |||||

| US66981YAF60 / AMSR Trust, Series 2022-SFR3, Class E2 | 1.20 | 0.67 | 0.2576 | -0.0173 | |||||

| RFS Asset Securitization V LLC / ABS-O (US74970DAH52) | 1.01 | 0.2162 | 0.2162 | ||||||

| GSAM Vintage Platform IX NAV TL 1L 02/25 (Vintage IX A AB) / DBT (000000000) | 0.92 | 0.1973 | 0.1973 | ||||||

| JP Morgan Mortgage Trust Series 2025-INV1 / ABS-MBS (US466910BD71) | 0.91 | 0.1953 | 0.1953 | ||||||

| Fora Financial Asset Securitization 2024 LLC / ABS-O (US34512PAB04) | 0.86 | -0.23 | 0.1853 | -0.0142 | |||||

| Sunnova Energy Corp - SNVA 2024-3 B / ABS-O (000000000) | 0.82 | 0.1767 | 0.1767 | ||||||

| Navient Education Loan Trust 2025-A / ABS-O (US63943EAD94) | 0.76 | 0.1619 | 0.1619 | ||||||

| JP Morgan Mortgage Trust Series 2025-4 / ABS-MBS (US46593UBE82) | 0.73 | 0.1567 | 0.1567 | ||||||

| SunPower Financial - Private Equity (SPV) / EC (000000000) | 0.64 | 0.69 | 0.1471 | 0.1471 | |||||

| GS Mortgage-Backed Securities Trust 2025-PJ5 / ABS-MBS (US36272DCK00) | 0.68 | 0.1449 | 0.1449 | ||||||

| Sunnova Sol IX Issuer LLC - Sunnova 2025-1 Class B / ABS-MBS (000000000) | 0.64 | 0.1374 | 0.1374 | ||||||

| GSAM Vintage Platform IX NAV TL 1L 02/25 (Vintage IX B2 AB) / DBT (000000000) | 0.56 | 0.1205 | 0.1205 | ||||||

| GSAM Vintage Platform IX NAV TL 1L DD 02/25 (Vintage IX B2 AB) / DBT (000000000) | 0.40 | 0.0861 | 0.0861 | ||||||

| GSAM Vintage Platform IX NAV TL 1L DD 02/25 (Vintage IX A AB) / DBT (000000000) | 0.28 | 0.0608 | 0.0608 | ||||||

| METROCOMMUNICATIONSI0.0125FEB55 / DBT (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| METROCOMMUNICATIONSI0.0125FEB55 / DBT (000000000) | 0.00 | 0.0000 | 0.0000 |