Mga Batayang Estadistika

| Nilai Portofolio | $ 125,915,537 |

| Posisi Saat Ini | 53 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

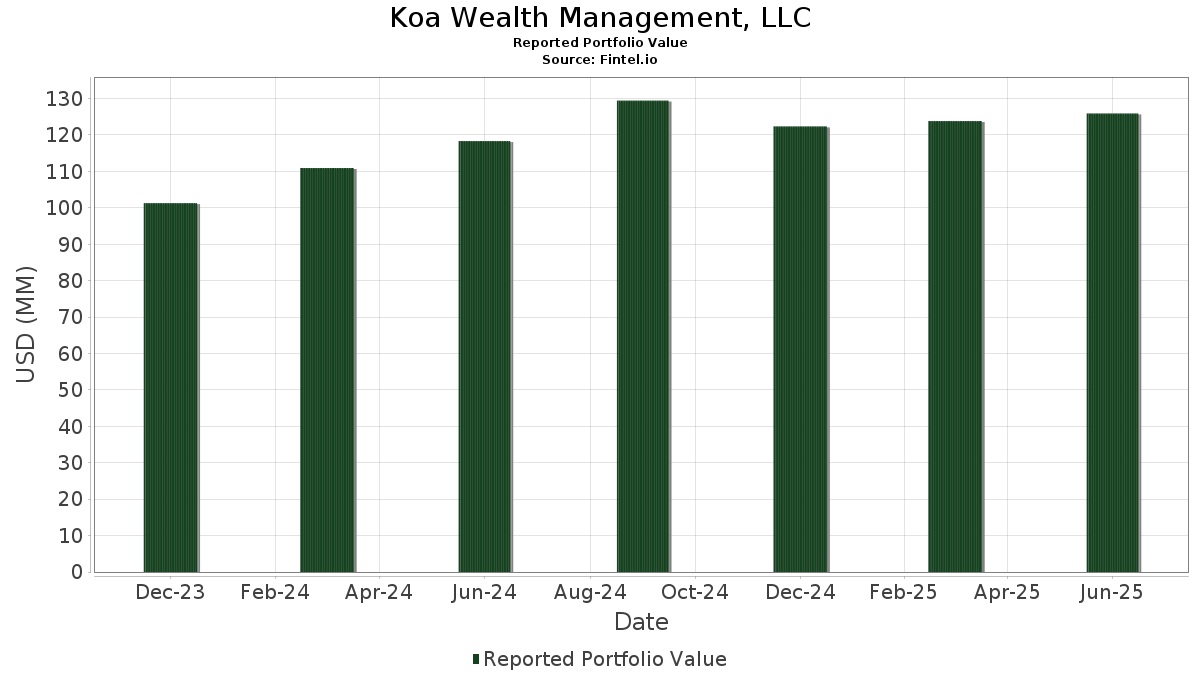

Koa Wealth Management, LLC telah mengungkapkan total kepemilikan 53 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 125,915,537 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Koa Wealth Management, LLC adalah Berkshire Hathaway Inc. (US:BRK.B) , Apple Inc. (US:AAPL) , Alphabet Inc. (US:GOOGL) , iShares Trust - iShares 0-3 Month Treasury Bond ETF (US:SGOV) , and iShares Trust - iShares 1-3 Year Treasury Bond ETF (US:SHY) . Posisi baru Koa Wealth Management, LLC meliputi: Barrick Mining Corporation (US:B) , PepsiCo, Inc. (US:PEP) , Colgate-Palmolive Company (US:CL) , The Procter & Gamble Company (US:PG) , and Connect Biopharma Holdings Limited - Depositary Receipt (Common Stock) (US:CNTB) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.07 | 1.43 | 1.1383 | 1.1383 | |

| 0.00 | 3.25 | 2.5797 | 1.0532 | |

| 0.01 | 0.99 | 0.7865 | 0.7865 | |

| 0.01 | 0.84 | 0.6680 | 0.6680 | |

| 0.00 | 0.77 | 0.6104 | 0.6104 | |

| 0.01 | 2.33 | 1.8505 | 0.5590 | |

| 0.04 | 6.52 | 5.1778 | 0.5576 | |

| 0.07 | 3.77 | 2.9918 | 0.3633 | |

| 0.02 | 3.79 | 3.0107 | 0.3606 | |

| 0.00 | 1.60 | 1.2702 | 0.2909 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.04 | 18.96 | 15.0543 | -1.6344 | |

| 0.06 | 12.68 | 10.0692 | -1.0203 | |

| 0.09 | 4.71 | 3.7397 | -0.6651 | |

| 0.01 | 3.30 | 2.6231 | -0.5307 | |

| 0.02 | 2.81 | 2.2281 | -0.4211 | |

| 0.01 | 1.98 | 1.5697 | -0.4048 | |

| 0.00 | 1.68 | 1.3345 | -0.2746 | |

| 0.03 | 2.52 | 1.9995 | -0.2059 | |

| 0.03 | 1.84 | 1.4574 | -0.1604 | |

| 0.01 | 1.80 | 1.4320 | -0.1183 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-29 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| BRK.B / Berkshire Hathaway Inc. | 0.04 | 0.57 | 18.96 | -8.27 | 15.0543 | -1.6344 | |||

| AAPL / Apple Inc. | 0.06 | -0.04 | 12.68 | -7.67 | 10.0692 | -1.0203 | |||

| GOOGL / Alphabet Inc. | 0.04 | -0.00 | 6.52 | 13.95 | 5.1778 | 0.5576 | |||

| SGOV / iShares Trust - iShares 0-3 Month Treasury Bond ETF | 0.06 | -0.47 | 6.07 | -0.44 | 4.8209 | -0.1036 | |||

| SHY / iShares Trust - iShares 1-3 Year Treasury Bond ETF | 0.06 | 6.08 | 5.11 | 6.26 | 4.0583 | 0.1742 | |||

| HALO / Halozyme Therapeutics, Inc. | 0.09 | 5.90 | 4.71 | -13.68 | 3.7397 | -0.6651 | |||

| DHR / Danaher Corporation | 0.02 | 6.95 | 3.92 | 3.05 | 3.1122 | 0.0415 | |||

| AMZN / Amazon.com, Inc. | 0.02 | 0.19 | 3.79 | 15.51 | 3.0107 | 0.3606 | |||

| IIPR / Innovative Industrial Properties, Inc. | 0.07 | 13.37 | 3.77 | 15.77 | 2.9918 | 0.3633 | |||

| V / Visa Inc. | 0.01 | -0.37 | 3.34 | 0.94 | 2.6508 | -0.0198 | |||

| AMT / American Tower Corporation | 0.01 | -16.73 | 3.30 | -15.44 | 2.6231 | -0.5307 | |||

| FICO / Fair Isaac Corporation | 0.00 | 73.37 | 3.25 | 71.85 | 2.5797 | 1.0532 | |||

| PM / Philip Morris International Inc. | 0.02 | -10.70 | 2.82 | 2.47 | 2.2401 | 0.0170 | |||

| STZ / Constellation Brands, Inc. | 0.02 | -3.52 | 2.81 | -14.48 | 2.2281 | -0.4211 | |||

| BX / Blackstone Inc. | 0.02 | 0.53 | 2.57 | 7.59 | 2.0388 | 0.1116 | |||

| XLU / The Select Sector SPDR Trust - The Utilities Select Sector SPDR Fund | 0.03 | -10.98 | 2.52 | -7.80 | 1.9995 | -0.2059 | |||

| NEM / Newmont Corporation | 0.04 | -16.67 | 2.47 | 0.57 | 1.9627 | -0.0220 | |||

| NVDA / NVIDIA Corporation | 0.01 | -0.05 | 2.33 | 45.72 | 1.8505 | 0.5590 | |||

| RH / RH | 0.01 | 0.26 | 1.98 | -19.15 | 1.5697 | -0.4048 | |||

| AZN / AstraZeneca PLC - Depositary Receipt (Common Stock) | 0.03 | -3.65 | 1.84 | -8.39 | 1.4574 | -0.1604 | |||

| CME / CME Group Inc. | 0.01 | -9.59 | 1.80 | -6.04 | 1.4320 | -0.1183 | |||

| URA / Global X Funds - Global X Uranium ETF | 0.05 | -35.49 | 1.80 | 9.22 | 1.4300 | 0.0989 | |||

| HD / The Home Depot, Inc. | 0.00 | 0.41 | 1.72 | 0.47 | 1.3680 | -0.0168 | |||

| MA / Mastercard Incorporated | 0.00 | -0.68 | 1.72 | 1.84 | 1.3661 | 0.0018 | |||

| GDX / VanEck ETF Trust - VanEck Gold Miners ETF | 0.03 | -17.19 | 1.72 | -6.22 | 1.3647 | -0.1151 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | 3.50 | 1.68 | -15.66 | 1.3345 | -0.2746 | |||

| LOW / Lowe's Companies, Inc. | 0.01 | 0.51 | 1.61 | -4.39 | 1.2803 | -0.0813 | |||

| MSFT / Microsoft Corporation | 0.00 | -0.46 | 1.60 | 31.93 | 1.2702 | 0.2909 | |||

| PAVE / Global X Funds - Global X U.S. Infrastructure Development ETF | 0.04 | -0.63 | 1.56 | 14.84 | 1.2350 | 0.1408 | |||

| BKFOF / Brookfield Corporation - Preferred Stock | 0.02 | -0.87 | 1.54 | 16.96 | 1.2221 | 0.1598 | |||

| B / Barrick Mining Corporation | 0.07 | 1.43 | 1.1383 | 1.1383 | |||||

| IHAK / iShares Trust - iShares Cybersecurity and Tech ETF | 0.03 | -1.17 | 1.43 | 11.93 | 1.1327 | 0.1037 | |||

| PYPL / PayPal Holdings, Inc. | 0.02 | 0.27 | 1.12 | 14.26 | 0.8914 | 0.0977 | |||

| PEP / PepsiCo, Inc. | 0.01 | 0.99 | 0.7865 | 0.7865 | |||||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.00 | 5.21 | 0.97 | -3.39 | 0.7708 | -0.0405 | |||

| WM / Waste Management, Inc. | 0.00 | -0.26 | 0.87 | -1.37 | 0.6871 | -0.0217 | |||

| WMT / Walmart Inc. | 0.01 | -0.02 | 0.86 | 11.43 | 0.6817 | 0.0592 | |||

| CL / Colgate-Palmolive Company | 0.01 | 0.84 | 0.6680 | 0.6680 | |||||

| PG / The Procter & Gamble Company | 0.00 | 0.77 | 0.6104 | 0.6104 | |||||

| VIG / Vanguard Specialized Funds - Vanguard Dividend Appreciation ETF | 0.00 | -0.33 | 0.75 | 5.18 | 0.5967 | 0.0198 | |||

| REXR / Rexford Industrial Realty, Inc. | 0.02 | 29.38 | 0.66 | 17.56 | 0.5214 | 0.0704 | |||

| QQQ / Invesco QQQ Trust, Series 1 | 0.00 | -1.33 | 0.61 | 16.07 | 0.4881 | 0.0605 | |||

| ED / Consolidated Edison, Inc. | 0.01 | 0.00 | 0.50 | -9.24 | 0.3985 | -0.0481 | |||

| IAU / iShares Gold Trust | 0.01 | -11.62 | 0.43 | -6.58 | 0.3391 | -0.0298 | |||

| QCOM / QUALCOMM Incorporated | 0.00 | -4.17 | 0.37 | -0.54 | 0.2909 | -0.0068 | |||

| MBX / MBX Biosciences, Inc. | 0.03 | 63.70 | 0.36 | 153.15 | 0.2877 | 0.1721 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | 23.13 | 0.33 | 35.98 | 0.2586 | 0.0652 | |||

| COST / Costco Wholesale Corporation | 0.00 | 0.00 | 0.31 | 4.67 | 0.2499 | 0.0072 | |||

| DXCM / DexCom, Inc. | 0.00 | 0.00 | 0.29 | 27.75 | 0.2305 | 0.0471 | |||

| JEPI / J.P. Morgan Exchange-Traded Fund Trust - JPMorgan Equity Premium Income ETF | 0.00 | 5.79 | 0.26 | 5.31 | 0.2055 | 0.0070 | |||

| PACB / Pacific Biosciences of California, Inc. | 0.12 | 0.00 | 0.15 | 4.96 | 0.1182 | 0.0038 | |||

| CATX / Perspective Therapeutics, Inc. | 0.03 | 0.00 | 0.09 | 61.82 | 0.0710 | 0.0263 | |||

| CNTB / Connect Biopharma Holdings Limited - Depositary Receipt (Common Stock) | 0.05 | 0.05 | 0.0386 | 0.0386 | |||||

| IHI / iShares Trust - iShares U.S. Medical Devices ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MCD / McDonald's Corporation | 0.00 | -100.00 | 0.00 | 0.0000 |