Mga Batayang Estadistika

| Nilai Portofolio | $ 800,723,722 |

| Posisi Saat Ini | 146 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

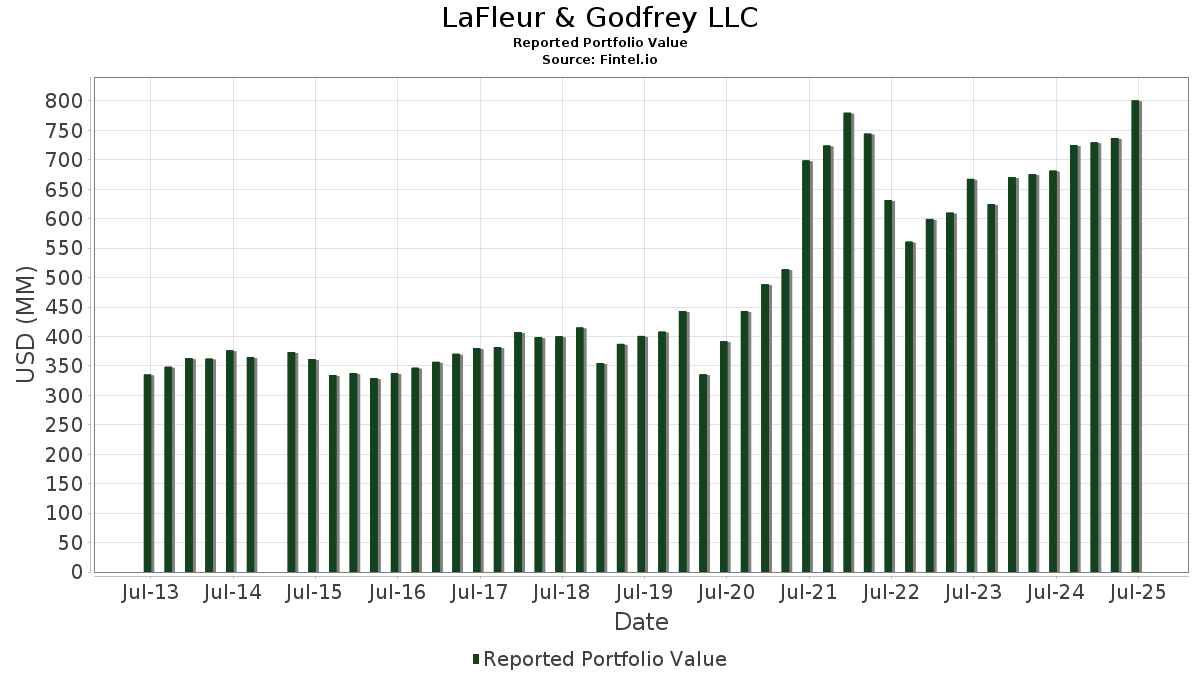

LaFleur & Godfrey LLC telah mengungkapkan total kepemilikan 146 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 800,723,722 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama LaFleur & Godfrey LLC adalah Apple Inc. (US:AAPL) , Microsoft Corporation (US:MSFT) , JPMorgan Chase & Co. (US:JPM) , Stryker Corporation (US:SYK) , and Broadcom Inc. (US:AVGO) . Posisi baru LaFleur & Godfrey LLC meliputi: The Trade Desk, Inc. (US:TTD) , Spotify Technology S.A. (US:SPOT) , iShares Trust - iShares Russell Mid-Cap Growth ETF (US:IWP) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.02 | 10.92 | 1.3633 | 1.3338 | |

| 0.09 | 24.25 | 3.0291 | 1.0125 | |

| 0.09 | 43.64 | 5.4504 | 0.9192 | |

| 0.06 | 18.14 | 2.2653 | 0.8141 | |

| 0.10 | 6.79 | 0.8477 | 0.7494 | |

| 0.04 | 11.52 | 1.4389 | 0.7217 | |

| 0.07 | 5.03 | 0.6281 | 0.6281 | |

| 0.06 | 18.67 | 2.3316 | 0.6215 | |

| 0.02 | 10.90 | 1.3619 | 0.5971 | |

| 0.09 | 9.27 | 1.1580 | 0.5676 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.22 | 45.55 | 5.6884 | -0.9380 | |

| 0.03 | 12.58 | 1.5706 | -0.5181 | |

| 0.07 | 9.84 | 1.2292 | -0.4737 | |

| 0.04 | 17.39 | 2.1718 | -0.4665 | |

| 0.08 | 14.58 | 1.8206 | -0.4348 | |

| 0.02 | 0.93 | 0.1166 | -0.4267 | |

| 0.14 | 21.94 | 2.7400 | -0.3842 | |

| 0.21 | 10.44 | 1.3033 | -0.3532 | |

| 0.11 | 16.15 | 2.0172 | -0.3460 | |

| 0.16 | 23.13 | 2.8881 | -0.3214 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-14 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AAPL / Apple Inc. | 0.22 | 0.97 | 45.55 | -6.74 | 5.6884 | -0.9380 | |||

| MSFT / Microsoft Corporation | 0.09 | -1.38 | 43.64 | 30.68 | 5.4504 | 0.9192 | |||

| JPM / JPMorgan Chase & Co. | 0.14 | -0.32 | 40.25 | 17.81 | 5.0268 | 0.3914 | |||

| SYK / Stryker Corporation | 0.08 | -0.92 | 29.80 | 5.31 | 3.7216 | -0.1177 | |||

| AVGO / Broadcom Inc. | 0.09 | -0.88 | 24.25 | 63.18 | 3.0291 | 1.0125 | |||

| RTX / RTX Corporation | 0.16 | -11.32 | 23.13 | -2.24 | 2.8881 | -0.3214 | |||

| JNJ / Johnson & Johnson | 0.14 | 3.44 | 21.94 | -4.72 | 2.7400 | -0.3842 | |||

| PLTR / Palantir Technologies Inc. | 0.16 | -17.64 | 21.71 | 33.03 | 2.7114 | 0.4970 | |||

| CAT / Caterpillar Inc. | 0.05 | 5.12 | 20.96 | 23.74 | 2.6173 | 0.3195 | |||

| ECL / Ecolab Inc. | 0.08 | -1.50 | 20.76 | 4.69 | 2.5922 | -0.0979 | |||

| ZS / Zscaler, Inc. | 0.06 | -6.38 | 18.67 | 48.12 | 2.3316 | 0.6215 | |||

| CEG / Constellation Energy Corporation | 0.06 | 5.94 | 18.14 | 69.59 | 2.2653 | 0.8141 | |||

| FLOT / iShares Trust - iShares Floating Rate Bond ETF | 0.35 | 5.12 | 17.70 | 5.06 | 2.2102 | -0.0753 | |||

| WSO / Watsco, Inc. | 0.04 | 2.93 | 17.39 | -10.57 | 2.1718 | -0.4665 | |||

| WWD / Woodward, Inc. | 0.07 | -3.58 | 17.19 | 29.49 | 2.1468 | 0.3457 | |||

| ALC / Alcon Inc. | 0.19 | 1.78 | 16.54 | -5.35 | 2.0653 | -0.3052 | |||

| PAYX / Paychex, Inc. | 0.11 | -1.64 | 16.15 | -7.27 | 2.0172 | -0.3460 | |||

| VMC / Vulcan Materials Company | 0.06 | 3.78 | 15.97 | 16.02 | 1.9949 | 0.1270 | |||

| ABBV / AbbVie Inc. | 0.08 | -1.01 | 14.58 | -12.30 | 1.8206 | -0.4348 | |||

| AMZN / Amazon.com, Inc. | 0.06 | 13.53 | 13.30 | 30.91 | 1.6616 | 0.2827 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.03 | 0.25 | 12.58 | -18.31 | 1.5706 | -0.5181 | |||

| HON / Honeywell International Inc. | 0.05 | 2.10 | 12.44 | 12.29 | 1.5542 | 0.0506 | |||

| ABT / Abbott Laboratories | 0.09 | -1.24 | 12.27 | 1.26 | 1.5324 | -0.1116 | |||

| AXP / American Express Company | 0.04 | 83.83 | 11.52 | 117.95 | 1.4389 | 0.7217 | |||

| XOM / Exxon Mobil Corporation | 0.10 | 2.65 | 11.00 | -6.95 | 1.3739 | -0.2302 | |||

| CW / Curtiss-Wright Corporation | 0.02 | 3,161.90 | 10.92 | 4,930.41 | 1.3633 | 1.3338 | |||

| GEV / GE Vernova Inc. | 0.02 | 11.62 | 10.90 | 93.47 | 1.3619 | 0.5971 | |||

| CPRT / Copart, Inc. | 0.21 | -1.43 | 10.44 | -14.52 | 1.3033 | -0.3532 | |||

| STE / STERIS plc | 0.04 | -10.54 | 10.02 | -5.18 | 1.2518 | -0.1824 | |||

| CVX / Chevron Corporation | 0.07 | -8.38 | 9.84 | -21.58 | 1.2292 | -0.4737 | |||

| APH / Amphenol Corporation | 0.09 | 41.53 | 9.27 | 113.10 | 1.1580 | 0.5676 | |||

| IBM / International Business Machines Corporation | 0.03 | -4.44 | 8.32 | 13.27 | 1.0392 | 0.0425 | |||

| PG / The Procter & Gamble Company | 0.05 | -0.80 | 7.88 | -7.26 | 0.9842 | -0.1687 | |||

| CHD / Church & Dwight Co., Inc. | 0.08 | 0.67 | 7.83 | -12.11 | 0.9774 | -0.2308 | |||

| MRK / Merck & Co., Inc. | 0.10 | -4.91 | 7.68 | -16.14 | 0.9587 | -0.2833 | |||

| HOLX / Hologic, Inc. | 0.12 | -1.59 | 7.54 | 3.81 | 0.9418 | -0.0438 | |||

| HSY / The Hershey Company | 0.04 | -7.77 | 6.80 | -10.51 | 0.8490 | -0.1816 | |||

| NEE / NextEra Energy, Inc. | 0.10 | 856.76 | 6.79 | 837.43 | 0.8477 | 0.7494 | |||

| PEP / PepsiCo, Inc. | 0.05 | -1.34 | 6.75 | -13.13 | 0.8430 | -0.2111 | |||

| WMT / Walmart Inc. | 0.07 | -0.35 | 6.73 | 10.99 | 0.8401 | 0.0178 | |||

| SCHW / The Charles Schwab Corporation | 0.07 | -4.25 | 6.64 | 11.60 | 0.8293 | 0.0220 | |||

| BXSL / Blackstone Secured Lending Fund | 0.19 | 15.17 | 5.81 | 9.45 | 0.7261 | 0.0053 | |||

| CSCO / Cisco Systems, Inc. | 0.08 | 0.62 | 5.62 | 13.12 | 0.7022 | 0.0279 | |||

| GOOG / Alphabet Inc. | 0.03 | -0.41 | 5.53 | 13.09 | 0.6904 | 0.0271 | |||

| IDXX / IDEXX Laboratories, Inc. | 0.01 | -4.64 | 5.26 | 21.80 | 0.6575 | 0.0710 | |||

| DHR / Danaher Corporation | 0.03 | -8.91 | 5.17 | -12.23 | 0.6454 | -0.1534 | |||

| TFC / Truist Financial Corporation | 0.12 | -8.36 | 5.10 | -4.26 | 0.6365 | -0.0858 | |||

| TTD / The Trade Desk, Inc. | 0.07 | 5.03 | 0.6281 | 0.6281 | |||||

| LHX / L3Harris Technologies, Inc. | 0.02 | -17.10 | 4.50 | -0.66 | 0.5619 | -0.0526 | |||

| ADP / Automatic Data Processing, Inc. | 0.01 | -0.76 | 4.22 | 0.17 | 0.5269 | -0.0445 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.01 | -2.54 | 4.11 | -11.11 | 0.5135 | -0.1141 | |||

| APD / Air Products and Chemicals, Inc. | 0.01 | 0.02 | 3.75 | -4.34 | 0.4685 | -0.0636 | |||

| FI / Fiserv, Inc. | 0.02 | 3.90 | 3.63 | -18.89 | 0.4528 | -0.1536 | |||

| HD / The Home Depot, Inc. | 0.01 | -2.14 | 3.52 | -2.11 | 0.4395 | -0.0482 | |||

| MDT / Medtronic plc | 0.04 | -1.47 | 3.48 | -4.42 | 0.4348 | -0.0594 | |||

| KVUE / Kenvue Inc. | 0.17 | 23.73 | 3.46 | 7.99 | 0.4325 | -0.0026 | |||

| GOOGL / Alphabet Inc. | 0.02 | -0.12 | 3.30 | 13.84 | 0.4121 | 0.0188 | |||

| AMAT / Applied Materials, Inc. | 0.02 | -10.74 | 3.26 | 12.62 | 0.4068 | 0.0143 | |||

| MCD / McDonald's Corporation | 0.01 | -1.45 | 3.22 | -7.82 | 0.4019 | -0.0718 | |||

| AMGN / Amgen Inc. | 0.01 | -5.41 | 3.04 | -15.23 | 0.3796 | -0.1069 | |||

| GNTX / Gentex Corporation | 0.14 | -3.47 | 2.98 | -8.91 | 0.3728 | -0.0717 | |||

| OKE / ONEOK, Inc. | 0.04 | -13.36 | 2.93 | -28.72 | 0.3657 | -0.1916 | |||

| ZTS / Zoetis Inc. | 0.02 | -34.67 | 2.72 | -38.13 | 0.3392 | -0.2563 | |||

| KO / The Coca-Cola Company | 0.03 | -7.12 | 2.12 | -8.23 | 0.2646 | -0.0487 | |||

| VZ / Verizon Communications Inc. | 0.05 | 1.76 | 2.00 | -2.91 | 0.2499 | -0.0298 | |||

| BMY / Bristol-Myers Squibb Company | 0.04 | -4.88 | 1.92 | -27.81 | 0.2396 | -0.1210 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | -1.38 | 1.76 | 8.91 | 0.2199 | 0.0006 | |||

| ITW / Illinois Tool Works Inc. | 0.01 | -0.56 | 1.75 | -0.85 | 0.2181 | -0.0209 | |||

| VUG / Vanguard Index Funds - Vanguard Growth ETF | 0.00 | 0.00 | 1.65 | 18.22 | 0.2059 | 0.0167 | |||

| EVRG / Evergy, Inc. | 0.02 | 2.32 | 1.65 | 2.30 | 0.2058 | -0.0128 | |||

| MBWM / Mercantile Bank Corporation | 0.04 | 0.02 | 1.64 | 6.92 | 0.2046 | -0.0034 | |||

| BLK / BlackRock, Inc. | 0.00 | -1.56 | 1.53 | 9.16 | 0.1907 | 0.0009 | |||

| SBUX / Starbucks Corporation | 0.02 | 11.94 | 1.48 | 4.60 | 0.1845 | -0.0072 | |||

| ADBE / Adobe Inc. | 0.00 | 39.50 | 1.46 | 40.85 | 0.1817 | 0.0414 | |||

| IGSB / iShares Trust - iShares 1-5 Year Investment Grade Corporate Bond ETF | 0.03 | 12.45 | 1.41 | 13.31 | 0.1756 | 0.0072 | |||

| ACN / Accenture plc | 0.00 | -2.67 | 1.36 | -6.78 | 0.1702 | -0.0281 | |||

| FSLR / First Solar, Inc. | 0.01 | -1.79 | 1.35 | 28.61 | 0.1690 | 0.0262 | |||

| WAT / Waters Corporation | 0.00 | -3.30 | 1.33 | -8.40 | 0.1663 | -0.0310 | |||

| KDP / Keurig Dr Pepper Inc. | 0.04 | 4.56 | 1.25 | 1.05 | 0.1567 | -0.0118 | |||

| COST / Costco Wholesale Corporation | 0.00 | -2.55 | 1.21 | 2.02 | 0.1512 | -0.0098 | |||

| ULTA / Ulta Beauty, Inc. | 0.00 | 4.02 | 1.21 | 32.86 | 0.1510 | 0.0274 | |||

| NKE / NIKE, Inc. | 0.02 | -3.82 | 1.16 | 7.69 | 0.1453 | -0.0014 | |||

| EOG / EOG Resources, Inc. | 0.01 | -6.32 | 1.07 | -12.62 | 0.1341 | -0.0326 | |||

| ISRG / Intuitive Surgical, Inc. | 0.00 | -0.83 | 1.04 | 8.75 | 0.1305 | 0.0002 | |||

| KAI / Kadant Inc. | 0.00 | 0.00 | 1.02 | -5.76 | 0.1268 | -0.0194 | |||

| WDAY / Workday, Inc. | 0.00 | 0.00 | 0.99 | 2.81 | 0.1233 | -0.0070 | |||

| CMA / Comerica Incorporated | 0.02 | -76.91 | 0.93 | -76.70 | 0.1166 | -0.4267 | |||

| SO / The Southern Company | 0.01 | -13.89 | 0.88 | -13.96 | 0.1093 | -0.0288 | |||

| XLK / The Select Sector SPDR Trust - The Technology Select Sector SPDR Fund | 0.00 | 0.00 | 0.87 | 22.63 | 0.1083 | 0.0124 | |||

| UPS / United Parcel Service, Inc. | 0.01 | -17.43 | 0.85 | -24.25 | 0.1066 | -0.0462 | |||

| VTV / Vanguard Index Funds - Vanguard Value ETF | 0.00 | -3.25 | 0.85 | -0.93 | 0.1064 | -0.0104 | |||

| SLB / Schlumberger Limited | 0.02 | -15.76 | 0.79 | -31.90 | 0.0987 | -0.0587 | |||

| IMCG / iShares Trust - iShares Morningstar Mid-Cap Growth ETF | 0.01 | 0.31 | 0.77 | 12.66 | 0.0968 | 0.0035 | |||

| ROP / Roper Technologies, Inc. | 0.00 | 21.26 | 0.71 | 16.47 | 0.0884 | 0.0060 | |||

| VYM / Vanguard Whitehall Funds - Vanguard High Dividend Yield ETF | 0.01 | 0.11 | 0.70 | 3.53 | 0.0879 | -0.0044 | |||

| MA / Mastercard Incorporated | 0.00 | 0.00 | 0.70 | 2.48 | 0.0877 | -0.0052 | |||

| MRVL / Marvell Technology, Inc. | 0.01 | -49.80 | 0.70 | -36.88 | 0.0868 | -0.0626 | |||

| MRCC / Monroe Capital Corporation | 0.11 | -1.78 | 0.68 | -19.91 | 0.0850 | -0.0303 | |||

| SYY / Sysco Corporation | 0.01 | 0.00 | 0.65 | 0.94 | 0.0809 | -0.0062 | |||

| IMCV / iShares Trust - iShares Morningstar Mid-Cap Value ETF | 0.01 | 0.67 | 0.64 | 3.05 | 0.0802 | -0.0043 | |||

| KMB / Kimberly-Clark Corporation | 0.00 | -26.97 | 0.63 | -33.82 | 0.0792 | -0.0508 | |||

| VCSH / Vanguard Scottsdale Funds - Vanguard Short-Term Corporate Bond ETF | 0.01 | 1.09 | 0.61 | 1.85 | 0.0756 | -0.0051 | |||

| JPIE / J.P. Morgan Exchange-Traded Fund Trust - JPMorgan Income ETF | 0.01 | -1.26 | 0.59 | -0.67 | 0.0737 | -0.0069 | |||

| FITB / Fifth Third Bancorp | 0.01 | 0.52 | 0.55 | 5.54 | 0.0690 | -0.0021 | |||

| IVW / iShares Trust - iShares S&P 500 Growth ETF | 0.00 | -3.10 | 0.52 | 14.92 | 0.0645 | 0.0035 | |||

| ORCL / Oracle Corporation | 0.00 | 0.00 | 0.51 | 56.31 | 0.0635 | 0.0194 | |||

| STIP / iShares Trust - iShares 0-5 Year TIPS Bond ETF | 0.00 | -1.67 | 0.49 | -2.19 | 0.0614 | -0.0068 | |||

| NVDD / Direxion Shares ETF Trust - Direxion Daily NVDA Bear 1X Shares | 0.00 | -5.51 | 0.47 | 37.50 | 0.0592 | 0.0125 | |||

| SUB / iShares Trust - iShares Short-Term National Muni Bond ETF | 0.00 | 0.00 | 0.46 | 0.66 | 0.0572 | -0.0045 | |||

| XCEM / Columbia ETF Trust II - Columbia EM Core ex-China ETF | 0.01 | -0.73 | 0.44 | 14.92 | 0.0549 | 0.0030 | |||

| CL / Colgate-Palmolive Company | 0.00 | 0.00 | 0.44 | -2.90 | 0.0545 | -0.0065 | |||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 0.42 | 8.74 | 0.0528 | -0.0000 | |||

| GD / General Dynamics Corporation | 0.00 | 0.00 | 0.41 | 7.14 | 0.0506 | -0.0008 | |||

| DIS / The Walt Disney Company | 0.00 | -11.20 | 0.39 | 11.65 | 0.0491 | 0.0013 | |||

| QCOM / QUALCOMM Incorporated | 0.00 | -22.39 | 0.39 | -19.58 | 0.0483 | -0.0169 | |||

| SCHG / Schwab Strategic Trust - Schwab U.S. Large-Cap Growth ETF | 0.01 | -7.64 | 0.37 | 7.62 | 0.0459 | -0.0004 | |||

| DT / Dynatrace, Inc. | 0.01 | 0.00 | 0.36 | 17.05 | 0.0447 | 0.0032 | |||

| IWD / iShares Trust - iShares Russell 1000 Value ETF | 0.00 | 0.00 | 0.35 | 3.29 | 0.0432 | -0.0023 | |||

| NTRS / Northern Trust Corporation | 0.00 | -25.54 | 0.34 | -4.46 | 0.0429 | -0.0058 | |||

| GLD / SPDR Gold Trust | 0.00 | 0.00 | 0.32 | 5.96 | 0.0400 | -0.0011 | |||

| SPHY / SPDR Series Trust - SPDR Portfolio High Yield Bond ETF | 0.01 | -0.99 | 0.32 | 0.63 | 0.0399 | -0.0032 | |||

| IJT / iShares Trust - iShares S&P Small-Cap 600 Growth ETF | 0.00 | 0.00 | 0.31 | 6.64 | 0.0382 | -0.0006 | |||

| IWF / iShares Trust - iShares Russell 1000 Growth ETF | 0.00 | 0.00 | 0.31 | 17.76 | 0.0382 | 0.0029 | |||

| BIV / Vanguard Bond Index Funds - Vanguard Intermediate-Term Bond ETF | 0.00 | -9.27 | 0.29 | -8.15 | 0.0366 | -0.0068 | |||

| IVE / iShares Trust - iShares S&P 500 Value ETF | 0.00 | 0.00 | 0.29 | 2.49 | 0.0360 | -0.0021 | |||

| WM / Waste Management, Inc. | 0.00 | 0.00 | 0.26 | -1.13 | 0.0329 | -0.0033 | |||

| SPOT / Spotify Technology S.A. | 0.00 | 0.26 | 0.0326 | 0.0326 | |||||

| VBK / Vanguard Index Funds - Vanguard Small-Cap Growth ETF | 0.00 | 2.64 | 0.26 | 13.16 | 0.0323 | 0.0012 | |||

| IHI / iShares Trust - iShares U.S. Medical Devices ETF | 0.00 | 0.25 | 0.25 | 4.12 | 0.0317 | -0.0013 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.00 | 0.25 | 0.0316 | 0.0316 | |||||

| CB / Chubb Limited | 0.00 | -10.33 | 0.25 | -14.04 | 0.0314 | -0.0083 | |||

| TROW / T. Rowe Price Group, Inc. | 0.00 | 0.00 | 0.25 | 4.64 | 0.0311 | -0.0011 | |||

| MUSA / Murphy USA Inc. | 0.00 | 0.00 | 0.24 | -13.17 | 0.0305 | -0.0078 | |||

| AMT / American Tower Corporation | 0.00 | -5.22 | 0.24 | -4.00 | 0.0301 | -0.0039 | |||

| VGSH / Vanguard Scottsdale Funds - Vanguard Short-Term Treasury ETF | 0.00 | -16.20 | 0.23 | -16.13 | 0.0292 | -0.0086 | |||

| UNP / Union Pacific Corporation | 0.00 | 0.00 | 0.23 | -2.54 | 0.0287 | -0.0033 | |||

| GDX / VanEck ETF Trust - VanEck Gold Miners ETF | 0.00 | -14.57 | 0.23 | -3.39 | 0.0286 | -0.0035 | |||

| ETR / Entergy Corporation | 0.00 | 0.00 | 0.23 | -2.99 | 0.0284 | -0.0033 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.00 | -0.27 | 0.23 | 10.29 | 0.0281 | 0.0004 | |||

| HBAN / Huntington Bancshares Incorporated | 0.01 | 0.00 | 0.23 | 11.94 | 0.0281 | 0.0008 | |||

| IWP / iShares Trust - iShares Russell Mid-Cap Growth ETF | 0.00 | 0.21 | 0.0267 | 0.0267 | |||||

| LNT / Alliant Energy Corporation | 0.00 | 0.00 | 0.21 | -6.28 | 0.0262 | -0.0041 | |||

| IJK / iShares Trust - iShares S&P Mid-Cap 400 Growth ETF | 0.00 | -6.73 | 0.21 | 1.96 | 0.0260 | -0.0017 | |||

| IWS / iShares Trust - iShares Russell Mid-Cap Value ETF | 0.00 | 0.21 | 0.0257 | 0.0257 | |||||

| RVT / Royce Small-Cap Trust, Inc. | 0.01 | 0.00 | 0.15 | 6.21 | 0.0193 | -0.0005 | |||

| RIG / Transocean Ltd. | 0.01 | 0.00 | 0.03 | -18.42 | 0.0040 | -0.0013 | |||

| ZBH / Zimmer Biomet Holdings, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GNRC / Generac Holdings Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VMI / Valmont Industries, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| LMT / Lockheed Martin Corporation | 0.00 | -100.00 | 0.00 | 0.0000 |