Mga Batayang Estadistika

| Nilai Portofolio | $ 256,536,407 |

| Posisi Saat Ini | 105 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

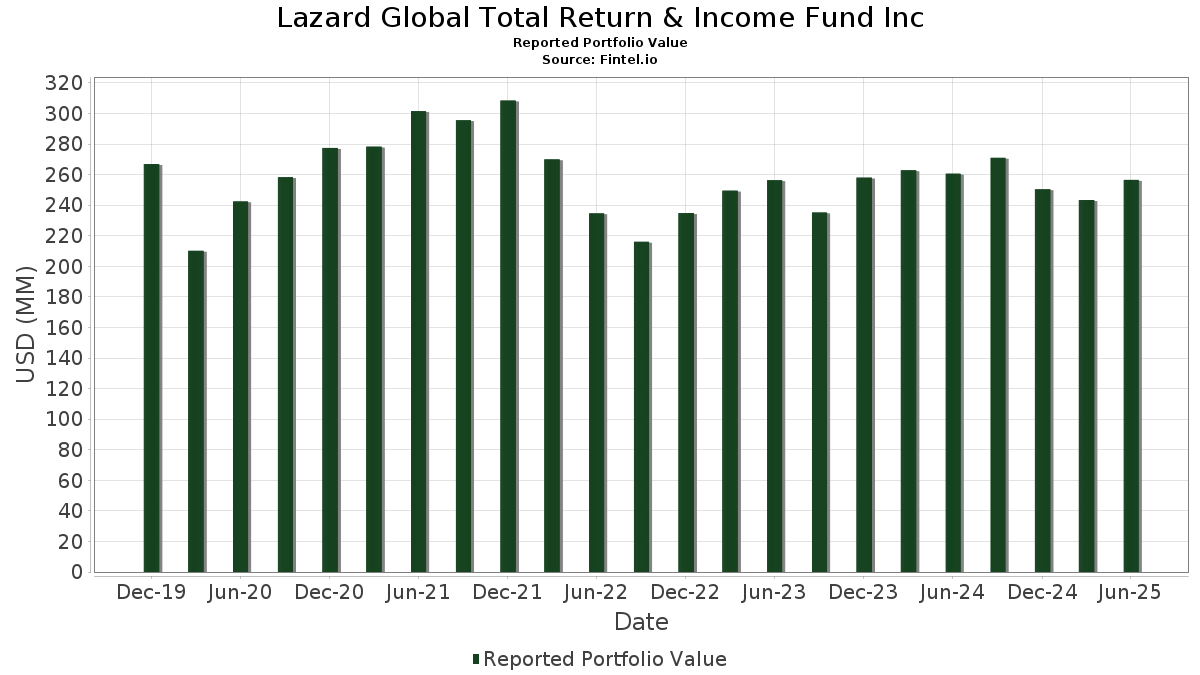

Lazard Global Total Return & Income Fund Inc telah mengungkapkan total kepemilikan 105 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 256,536,407 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Lazard Global Total Return & Income Fund Inc adalah Microsoft Corporation (US:MSFT) , Apple Inc. (US:AAPL) , Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) (US:TSM) , Amazon.com, Inc. (US:AMZN) , and Visa Inc. (US:V) . Posisi baru Lazard Global Total Return & Income Fund Inc meliputi: Brazil Notas do Tesouro Nacional Serie F (BR:BRSTNCNTF1Q6) , ASML Holding N.V. (NL:ASML) , Malaysia Government Bond (MY:MYBMS1300057) , Mexican Bonos (MX:MX0MGO0000P2) , and Malaysia Government Bond (MY:MYBMX0700034) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.01 | 5.16 | 2.2222 | 2.2222 | |

| 2.57 | 1.1054 | 1.1054 | ||

| 0.26 | 2.40 | 1.0336 | 1.0336 | |

| 0.02 | 9.80 | 4.2156 | 0.8090 | |

| 1.71 | 0.7345 | 0.7345 | ||

| 0.03 | 7.72 | 3.3224 | 0.7150 | |

| 0.06 | 5.57 | 2.3962 | 0.6920 | |

| 0.04 | 5.33 | 2.2938 | 0.4297 | |

| 0.99 | 0.4264 | 0.4264 | ||

| 0.00 | 2.77 | 1.1916 | 0.2784 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 3.92 | 3.92 | 1.6875 | -1.7023 | |

| 0.06 | 2.79 | 1.2010 | -1.1465 | |

| 0.04 | 8.92 | 3.8374 | -0.6113 | |

| 0.01 | 3.31 | 1.4255 | -0.4477 | |

| 0.01 | 4.61 | 1.9847 | -0.3926 | |

| 0.02 | 5.42 | 2.3307 | -0.2747 | |

| 0.02 | 2.87 | 1.2357 | -0.2446 | |

| 0.00 | 1.85 | 0.7980 | -0.2192 | |

| 0.02 | 3.31 | 1.4261 | -0.2073 | |

| 0.00 | 2.62 | 1.1273 | -0.1791 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-21 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.02 | -1.43 | 9.80 | 30.61 | 4.2156 | 0.8090 | |||

| AAPL / Apple Inc. | 0.04 | -1.43 | 8.92 | -8.95 | 3.8374 | -0.6113 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.03 | -1.43 | 7.72 | 34.49 | 3.3224 | 0.7150 | |||

| AMZN / Amazon.com, Inc. | 0.03 | -1.43 | 7.43 | 13.67 | 3.1993 | 0.2284 | |||

| V / Visa Inc. | 0.02 | -1.43 | 6.02 | -0.13 | 2.5892 | -0.1474 | |||

| SCHW / The Charles Schwab Corporation | 0.06 | -1.43 | 5.85 | 14.90 | 2.5153 | 0.2045 | |||

| BRSTNCNTF1Q6 / Brazil Notas do Tesouro Nacional Serie F | 5.63 | 7.52 | 2.4245 | 0.0442 | |||||

| APH / Amphenol Corporation | 0.06 | -1.43 | 5.57 | 48.40 | 2.3962 | 0.6920 | |||

| RELX / RELX PLC - Depositary Receipt (Common Stock) | 0.10 | -1.43 | 5.42 | 6.45 | 2.3314 | 0.0197 | |||

| ACN / Accenture plc | 0.02 | -1.43 | 5.42 | -5.58 | 2.3307 | -0.2747 | |||

| DLMAY / Dollarama Inc. - Depositary Receipt (Common Stock) | 0.04 | -1.43 | 5.33 | 29.87 | 2.2938 | 0.4297 | |||

| ICE / Intercontinental Exchange, Inc. | 0.03 | -1.43 | 5.19 | 4.85 | 2.2336 | -0.0151 | |||

| ASML / ASML Holding N.V. | 0.01 | 5.16 | 2.2222 | 2.2222 | |||||

| ABBN / ABB Ltd | 0.08 | -1.43 | 4.95 | 13.88 | 2.1294 | 0.1555 | |||

| CRM / Salesforce, Inc. | 0.02 | -1.42 | 4.79 | 0.17 | 2.0629 | -0.1109 | |||

| WKL / Wolters Kluwer N.V. | 0.03 | -1.43 | 4.64 | 6.11 | 1.9957 | 0.0108 | |||

| AON / Aon plc | 0.01 | -1.43 | 4.61 | -11.88 | 1.9847 | -0.3926 | |||

| SPGI / S&P Global Inc. | 0.01 | -1.43 | 4.44 | 2.30 | 1.9123 | -0.0608 | |||

| UNA / Unilever PLC | 0.07 | -1.43 | 4.21 | 0.79 | 1.8113 | -0.0857 | |||

| KO / The Coca-Cola Company | 0.06 | -1.43 | 3.95 | -2.64 | 1.6996 | -0.1427 | |||

| TPVXX / State Street Institutional Investment Trust - State Street Institutional Treasury Plus Fund Investment Class | 3.92 | -47.46 | 3.92 | -47.46 | 1.6875 | -1.7023 | |||

| 8411 / Mizuho Financial Group, Inc. | 0.14 | -1.42 | 3.82 | -0.36 | 1.6454 | -0.0975 | |||

| TXN / Texas Instruments Incorporated | 0.02 | -1.43 | 3.73 | 13.89 | 1.6055 | 0.1175 | |||

| CCEP / COCA COLA EUROPACIFIC COMPANY GUAR REGS 11/27 1.5 | 0.04 | -1.43 | 3.72 | 5.03 | 1.6005 | -0.0081 | |||

| MSI / Motorola Solutions, Inc. | 0.01 | -1.43 | 3.34 | -5.33 | 1.4360 | -0.1651 | |||

| AZN / Astrazeneca plc | 0.02 | -1.43 | 3.31 | -5.93 | 1.4261 | -0.1742 | |||

| PG / The Procter & Gamble Company | 0.02 | -1.43 | 3.31 | -7.84 | 1.4261 | -0.2073 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.01 | -1.42 | 3.31 | -19.69 | 1.4255 | -0.4477 | |||

| DHR / Danaher Corporation | 0.02 | -1.43 | 3.21 | -5.01 | 1.3799 | -0.1535 | |||

| BAC / Bank of America Corporation | 0.07 | -1.43 | 3.20 | 11.79 | 1.3750 | 0.0766 | |||

| HDB / HDFC Bank Limited - Depositary Receipt (Common Stock) | 0.04 | -1.43 | 3.12 | 13.75 | 1.3426 | 0.0968 | |||

| PTC / PTC Inc. | 0.02 | -1.42 | 3.06 | 9.62 | 1.3188 | 0.0492 | |||

| BAH / Booz Allen Hamilton Holding Corporation | 0.03 | -1.43 | 3.01 | -1.86 | 1.2952 | -0.0976 | |||

| NNND / Tencent Holdings Limited | 0.05 | -1.50 | 2.95 | -0.71 | 1.2686 | -0.0804 | |||

| TMTNF / Toromont Industries Ltd. | 0.03 | -1.43 | 2.88 | 13.17 | 1.2392 | 0.0837 | |||

| IQV / IQVIA Holdings Inc. | 0.02 | -1.43 | 2.87 | -11.91 | 1.2357 | -0.2446 | |||

| ROK / Rockwell Automation, Inc. | 0.01 | -1.43 | 2.85 | 26.75 | 1.2258 | 0.2048 | |||

| MCD / McDonald's Corporation | 0.01 | -1.43 | 2.85 | -7.81 | 1.2249 | -0.1774 | |||

| ITX / Industria de Diseño Textil, S.A. | 0.05 | -1.43 | 2.84 | 2.98 | 1.2205 | -0.0306 | |||

| 8136 / Sanrio Company, Ltd. | 0.06 | -48.30 | 2.79 | -45.99 | 1.2010 | -1.1465 | |||

| CPU / Computershare Limited | 0.11 | -1.43 | 2.78 | 5.22 | 1.1964 | -0.0039 | |||

| ASM / ASM International NV | 0.00 | -1.44 | 2.77 | 37.76 | 1.1916 | 0.2784 | |||

| EFX / Equifax Inc. | 0.01 | -1.43 | 2.73 | 4.95 | 1.1768 | -0.0065 | |||

| ADBE / Adobe Inc. | 0.01 | -1.43 | 2.64 | -0.57 | 1.1344 | -0.0698 | |||

| PGHN / Partners Group Holding AG | 0.00 | -1.43 | 2.62 | -8.94 | 1.1273 | -0.1791 | |||

| GOOGL / Alphabet Inc. | 0.01 | -1.43 | 2.60 | 12.31 | 1.1195 | 0.0676 | |||

| US836205AY00 / Republic of South Africa Government International Bond | 2.57 | 1.1054 | 1.1054 | ||||||

| MYBMS1300057 / Malaysia Government Bond | 2.53 | 6.30 | 1.0888 | 0.0075 | |||||

| DGE / Diageo plc | 0.10 | -1.43 | 2.51 | -4.96 | 1.0796 | -0.1193 | |||

| MX0MGO0000P2 / Mexican Bonos | 2.49 | 10.58 | 1.0704 | 0.0485 | |||||

| MYBMX0700034 / Malaysia Government Bond | 2.46 | 6.00 | 1.0569 | 0.0045 | |||||

| META / Meta Platforms, Inc. | 0.00 | -1.42 | 2.41 | 26.26 | 1.0370 | 0.1700 | |||

| ZTS / Zoetis Inc. | 0.02 | -1.43 | 2.41 | -6.63 | 1.0365 | -0.1353 | |||

| 8308 / Resona Holdings, Inc. | 0.26 | 2.40 | 1.0336 | 1.0336 | |||||

| KNEBV / KONE Oyj | 0.04 | -1.43 | 2.38 | 17.35 | 1.0248 | 0.1029 | |||

| LR / Legrand SA | 0.02 | -1.42 | 2.29 | 24.35 | 0.9868 | 0.1492 | |||

| HQY / HealthEquity, Inc. | 0.02 | -1.43 | 2.22 | 16.82 | 0.9535 | 0.0923 | |||

| HXG / Hexagon AB (publ) | 0.22 | -1.43 | 2.17 | -7.55 | 0.9321 | -0.1322 | |||

| EL / EssilorLuxottica Société anonyme | 0.01 | -1.43 | 2.07 | -5.86 | 0.8913 | -0.1081 | |||

| FUC / Fanuc Corporation | 0.07 | -1.41 | 1.90 | -1.76 | 0.8170 | -0.0606 | |||

| 1299 / AIA Group Limited | 0.21 | -1.41 | 1.89 | 17.32 | 0.8134 | 0.0814 | |||

| 669 / Techtronic Industries Company Limited | 0.17 | -1.44 | 1.88 | -9.86 | 0.8106 | -0.1385 | |||

| ZAG000016320 / Republic of South Africa Government Bond | 1.88 | 3.88 | 0.8069 | -0.0132 | |||||

| MC / LVMH Moët Hennessy - Louis Vuitton, Société Européenne | 0.00 | -1.42 | 1.85 | -17.20 | 0.7980 | -0.2192 | |||

| ROXL7LT7QZ66 / Romania Government Bond | 1.71 | 0.7345 | 0.7345 | ||||||

| CBGB / Carlsberg A/S | 0.01 | -1.43 | 1.70 | 9.81 | 0.7321 | 0.0282 | |||

| ARGX / argenx SE - Depositary Receipt (Common Stock) | 0.00 | -1.42 | 1.69 | -8.17 | 0.7261 | -0.1086 | |||

| MRVL / Marvell Technology, Inc. | 0.02 | -1.43 | 1.64 | 23.92 | 0.7069 | 0.1048 | |||

| CPAY / Corpay, Inc. | 0.00 | -1.43 | 1.63 | -6.23 | 0.6997 | -0.0877 | |||

| ALZC / ASSA ABLOY AB (publ) | 0.05 | -1.43 | 1.59 | 2.58 | 0.6840 | -0.0198 | |||

| 7974 / Nintendo Co., Ltd. | 0.02 | -1.21 | 1.56 | 38.93 | 0.6728 | 0.1616 | |||

| AVY / Avery Dennison Corporation | 0.01 | -1.42 | 1.53 | -2.79 | 0.6595 | -0.0567 | |||

| INDOGB / Indonesia Treasury Bond | 1.40 | 2.41 | 0.6038 | -0.0188 | |||||

| NKE / NIKE, Inc. | 0.02 | -1.43 | 1.40 | 10.24 | 0.6024 | 0.0260 | |||

| RI / Pernod Ricard SA | 0.01 | -1.43 | 1.03 | -0.86 | 0.4444 | -0.0288 | |||

| RSMFRSD86176 / Serbia Treasury Bonds | 0.99 | 0.4264 | 0.4264 | ||||||

| 22Z / Zealand Pharma A/S | 0.02 | -1.43 | 0.94 | -26.70 | 0.4042 | -0.1777 | |||

| PURCHASED HUF / SOLD USD / DFE (000000000) | 0.34 | 0.1469 | 0.1469 | ||||||

| PURCHASED PLN / SOLD USD / DFE (000000000) | 0.23 | 0.0975 | 0.0975 | ||||||

| PURCHASED EGP / SOLD USD / DFE (000000000) | 0.19 | 0.0800 | 0.0800 | ||||||

| PURCHASED NGN / SOLD USD / DFE (000000000) | 0.18 | 0.0790 | 0.0790 | ||||||

| PURCHASED COP / SOLD USD / DFE (000000000) | 0.16 | 0.0708 | 0.0708 | ||||||

| PURCHASED MXN / SOLD USD / DFE (000000000) | 0.15 | 0.0632 | 0.0632 | ||||||

| PURCHASED UYU / SOLD USD / DFE (000000000) | 0.15 | 0.0626 | 0.0626 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.13 | 0.0562 | 0.0562 | ||||||

| PURCHASED CLP / SOLD USD / DFE (000000000) | 0.11 | 0.0483 | 0.0483 | ||||||

| PURCHASED PEN / SOLD USD / DFE (000000000) | 0.10 | 0.0445 | 0.0445 | ||||||

| PURCHASED EGP / SOLD USD / DFE (000000000) | 0.10 | 0.0445 | 0.0445 | ||||||

| PURCHASED SGD / SOLD USD / DFE (000000000) | 0.10 | 0.0430 | 0.0430 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0.09 | 0.0376 | 0.0376 | ||||||

| PURCHASED CLP / SOLD USD / DFE (000000000) | 0.08 | 0.0349 | 0.0349 | ||||||

| PURCHASED NGN / SOLD USD / DFE (000000000) | 0.08 | 0.0347 | 0.0347 | ||||||

| PURCHASED EGP / SOLD USD / DFE (000000000) | 0.07 | 0.0322 | 0.0322 | ||||||

| PURCHASED TRY / SOLD USD / DFE (000000000) | 0.07 | 0.0296 | 0.0296 | ||||||

| PURCHASED KRW / SOLD USD / DFE (000000000) | 0.06 | 0.0251 | 0.0251 | ||||||

| PURCHASED IDR / SOLD USD / DFE (000000000) | 0.05 | 0.0236 | 0.0236 | ||||||

| PURCHASED ILS / SOLD USD / DFE (000000000) | 0.03 | 0.0127 | 0.0127 | ||||||

| PURCHASED ILS / SOLD USD / DFE (000000000) | 0.03 | 0.0127 | 0.0127 | ||||||

| PURCHASED BRL / SOLD USD / DFE (000000000) | 0.01 | 0.0058 | 0.0058 | ||||||

| PURCHASED TRY / SOLD USD / DFE (000000000) | -0.00 | -0.0012 | -0.0012 | ||||||

| PURCHASED INR / SOLD USD / DFE (000000000) | -0.00 | -0.0019 | -0.0019 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0.03 | -0.0110 | -0.0110 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0.03 | -0.0140 | -0.0140 | ||||||

| PURCHASED KZT / SOLD USD / DFE (000000000) | -0.05 | -0.0221 | -0.0221 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0.27 | -0.1162 | -0.1162 |