Mga Batayang Estadistika

| Nilai Portofolio | $ 1,878,883,031 |

| Posisi Saat Ini | 141 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

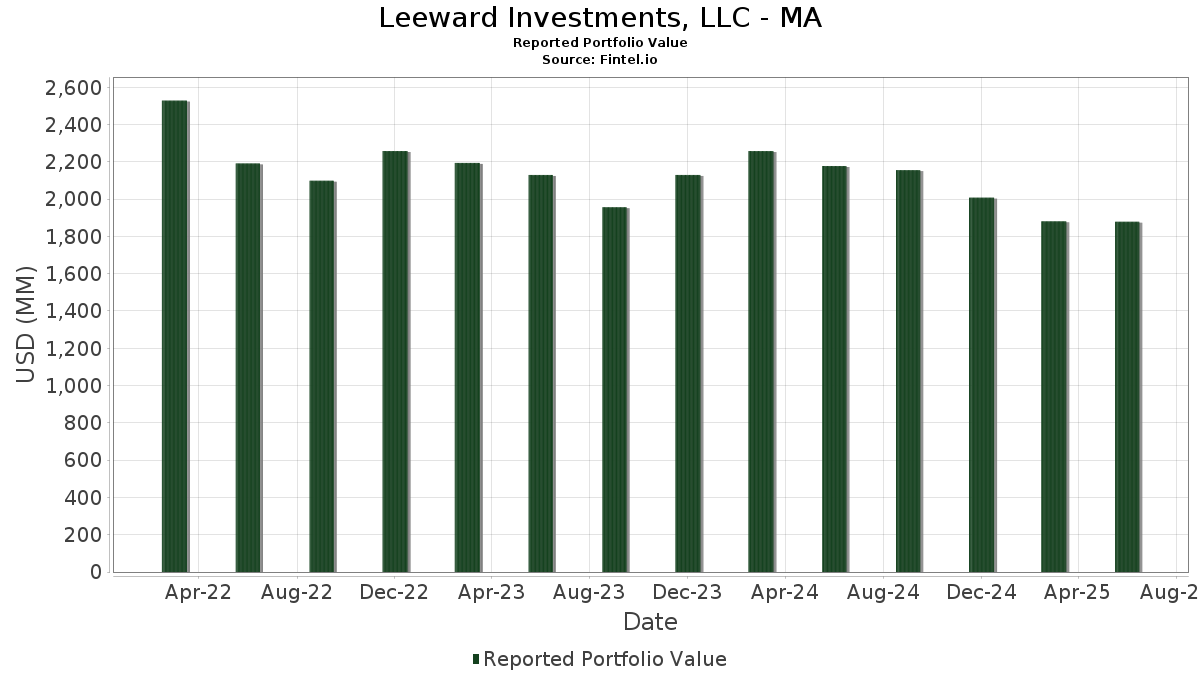

Leeward Investments, LLC - MA telah mengungkapkan total kepemilikan 141 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 1,878,883,031 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Leeward Investments, LLC - MA adalah Lumentum Holdings Inc. (US:LITE) , Encompass Health Corporation (US:EHC) , First Horizon Corporation (US:FHN) , Clean Harbors, Inc. (US:CLH) , and Pinnacle Financial Partners, Inc. (US:PNFP) . Posisi baru Leeward Investments, LLC - MA meliputi: Evercore Inc. (US:EVR) , Addus HomeCare Corporation (US:ADUS) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.52 | 49.09 | 2.6128 | 1.1219 | |

| 0.04 | 11.07 | 0.5890 | 0.5890 | |

| 0.08 | 9.15 | 0.4871 | 0.4871 | |

| 0.12 | 17.36 | 0.9242 | 0.3427 | |

| 0.77 | 18.67 | 0.9937 | 0.3374 | |

| 0.17 | 19.87 | 1.0577 | 0.3076 | |

| 0.19 | 26.94 | 1.4341 | 0.2764 | |

| 0.21 | 11.70 | 0.6226 | 0.2420 | |

| 1.15 | 26.44 | 1.4074 | 0.2402 | |

| 0.15 | 35.49 | 1.8890 | 0.2340 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.25 | 9.99 | 0.5318 | -0.7799 | |

| 0.34 | 6.57 | 0.3499 | -0.4689 | |

| 0.10 | 16.52 | 0.8792 | -0.3812 | |

| 0.33 | 9.86 | 0.5249 | -0.3160 | |

| 0.32 | 25.65 | 1.3652 | -0.2795 | |

| 0.05 | 7.81 | 0.4158 | -0.2754 | |

| 0.18 | 24.11 | 1.2831 | -0.2209 | |

| 0.37 | 4.60 | 0.2448 | -0.2097 | |

| 0.43 | 31.13 | 1.6568 | -0.2062 | |

| 0.42 | 13.29 | 0.7072 | -0.2020 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-31 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| LITE / Lumentum Holdings Inc. | 0.52 | 14.79 | 49.09 | 75.04 | 2.6128 | 1.1219 | |||

| EHC / Encompass Health Corporation | 0.35 | -18.79 | 43.06 | -1.67 | 2.2917 | -0.0361 | |||

| FHN / First Horizon Corporation | 1.78 | -3.05 | 37.65 | 5.84 | 2.0038 | 0.1128 | |||

| CLH / Clean Harbors, Inc. | 0.15 | -2.80 | 35.49 | 14.00 | 1.8890 | 0.2340 | |||

| PNFP / Pinnacle Financial Partners, Inc. | 0.29 | -3.15 | 31.50 | 0.84 | 1.6767 | 0.0159 | |||

| ADC / Agree Realty Corporation | 0.43 | -6.16 | 31.13 | -11.18 | 1.6568 | -0.2062 | |||

| WTFC / Wintrust Financial Corporation | 0.24 | -3.49 | 29.35 | 6.40 | 1.5618 | 0.0956 | |||

| RRX / Regal Rexnord Corporation | 0.19 | -2.82 | 26.94 | 23.73 | 1.4341 | 0.2764 | |||

| PR / Permian Resources Corporation | 1.97 | -1.12 | 26.81 | -2.76 | 1.4271 | -0.0387 | |||

| GTES / Gates Industrial Corporation plc | 1.15 | -3.72 | 26.44 | 20.44 | 1.4074 | 0.2402 | |||

| STWD / Starwood Property Trust, Inc. | 1.28 | -3.37 | 25.68 | -1.90 | 1.3667 | -0.0248 | |||

| PBH / Prestige Consumer Healthcare Inc. | 0.32 | -10.74 | 25.65 | -17.09 | 1.3652 | -0.2795 | |||

| HURN / Huron Consulting Group Inc. | 0.18 | -11.13 | 24.11 | -14.79 | 1.2831 | -0.2209 | |||

| NMRK / Newmark Group, Inc. | 1.85 | 9.37 | 22.45 | 9.19 | 1.1950 | 0.1018 | |||

| NPO / Enpro Inc. | 0.11 | -3.50 | 21.83 | 14.25 | 1.1619 | 0.1461 | |||

| COLB / Columbia Banking System, Inc. | 0.93 | -3.74 | 21.73 | -9.76 | 1.1567 | -0.1236 | |||

| IWN / iShares Trust - iShares Russell 2000 Value ETF | 0.13 | -3.36 | 20.76 | 0.98 | 1.1047 | 0.0120 | |||

| VVV / Valvoline Inc. | 0.55 | -0.78 | 20.66 | 7.94 | 1.0997 | 0.0821 | |||

| INGR / Ingredion Incorporated | 0.15 | -3.03 | 20.45 | -2.74 | 1.0883 | -0.0293 | |||

| ONB / Old National Bancorp | 0.96 | -3.69 | 20.39 | -3.01 | 1.0853 | -0.0323 | |||

| CACI / CACI International Inc | 0.04 | -3.61 | 20.16 | 25.23 | 1.0731 | 0.2172 | |||

| IDA / IDACORP, Inc. | 0.17 | 41.77 | 19.87 | 40.84 | 1.0577 | 0.3076 | |||

| VMI / Valmont Industries, Inc. | 0.06 | 10.86 | 19.79 | 26.86 | 1.0533 | 0.2240 | |||

| FIBK / First Interstate BancSystem, Inc. | 0.67 | 13.49 | 19.22 | 14.16 | 1.0229 | 0.1280 | |||

| ASB / Associated Banc-Corp | 0.77 | 39.70 | 18.67 | 51.24 | 0.9937 | 0.3374 | |||

| VOYA / Voya Financial, Inc. | 0.26 | 17.09 | 18.11 | 22.69 | 0.9640 | 0.1792 | |||

| KEYS / Keysight Technologies, Inc. | 0.11 | 16.29 | 17.71 | 27.23 | 0.9427 | 0.2027 | |||

| SXI / Standex International Corporation | 0.11 | -3.50 | 17.69 | -6.43 | 0.9417 | -0.0636 | |||

| INDB / Independent Bank Corp. | 0.28 | -4.36 | 17.67 | -4.00 | 0.9402 | -0.0381 | |||

| ITT / ITT Inc. | 0.11 | -3.50 | 17.66 | 17.18 | 0.9397 | 0.1387 | |||

| SLAB / Silicon Laboratories Inc. | 0.12 | 21.26 | 17.36 | 58.73 | 0.9242 | 0.3427 | |||

| NBHC / National Bank Holdings Corporation | 0.45 | 15.70 | 16.99 | 13.70 | 0.9042 | 0.1099 | |||

| STAG / STAG Industrial, Inc. | 0.46 | -4.23 | 16.80 | -3.81 | 0.8942 | -0.0343 | |||

| MTG / MGIC Investment Corporation | 0.60 | -3.52 | 16.63 | 8.39 | 0.8849 | 0.0695 | |||

| THG / The Hanover Insurance Group, Inc. | 0.10 | -28.65 | 16.52 | -30.33 | 0.8792 | -0.3812 | |||

| CHX / ChampionX Corporation | 0.66 | -2.67 | 16.30 | -18.87 | 0.8676 | -0.2005 | |||

| PFGC / Performance Food Group Company | 0.19 | -15.55 | 16.29 | -6.06 | 0.8672 | -0.0548 | |||

| HLIT / Harmonic Inc. | 1.69 | -3.56 | 15.99 | -4.77 | 0.8510 | -0.0416 | |||

| IBP / Installed Building Products, Inc. | 0.09 | -4.46 | 15.86 | 0.48 | 0.8443 | 0.0050 | |||

| ALL / The Allstate Corporation | 0.08 | -1.93 | 15.84 | -4.65 | 0.8432 | -0.0401 | |||

| HXL / Hexcel Corporation | 0.28 | -3.17 | 15.72 | -0.11 | 0.8366 | 0.0001 | |||

| KFY / Korn Ferry | 0.21 | -3.49 | 15.67 | 4.33 | 0.8341 | 0.0356 | |||

| RGA / Reinsurance Group of America, Incorporated | 0.08 | -2.03 | 15.38 | -1.30 | 0.8184 | -0.0098 | |||

| CBT / Cabot Corporation | 0.20 | 12.11 | 15.27 | 1.14 | 0.8128 | 0.0101 | |||

| VIAV / Viavi Solutions Inc. | 1.46 | -3.48 | 14.74 | -13.14 | 0.7845 | -0.1176 | |||

| DORM / Dorman Products, Inc. | 0.12 | -3.51 | 14.69 | -1.80 | 0.7819 | -0.0134 | |||

| AER / AerCap Holdings N.V. | 0.13 | -2.43 | 14.64 | 11.73 | 0.7792 | 0.0826 | |||

| WCC / WESCO International, Inc. | 0.08 | -2.40 | 14.52 | 16.40 | 0.7726 | 0.1096 | |||

| VLY / Valley National Bancorp | 1.62 | -4.23 | 14.51 | -3.80 | 0.7723 | -0.0296 | |||

| GNTX / Gentex Corporation | 0.63 | -3.59 | 13.96 | -9.02 | 0.7428 | -0.0726 | |||

| CDP / COPT Defense Properties | 0.50 | -4.25 | 13.76 | -3.15 | 0.7322 | -0.0230 | |||

| EXLS / ExlService Holdings, Inc. | 0.31 | -3.48 | 13.67 | -10.47 | 0.7274 | -0.0841 | |||

| PTC / PTC Inc. | 0.08 | 7.47 | 13.53 | 19.53 | 0.7199 | 0.1184 | |||

| NSA / National Storage Affiliates Trust | 0.42 | -4.31 | 13.29 | -22.31 | 0.7072 | -0.2020 | |||

| MUSA / Murphy USA Inc. | 0.03 | -3.80 | 13.23 | -16.71 | 0.7042 | -0.1402 | |||

| LH / Labcorp Holdings Inc. | 0.05 | -9.24 | 13.04 | 2.38 | 0.6940 | 0.0169 | |||

| AIG / American International Group, Inc. | 0.15 | -1.58 | 13.00 | -3.11 | 0.6918 | -0.0213 | |||

| WHD / Cactus, Inc. | 0.28 | 13.71 | 12.18 | 8.48 | 0.6484 | 0.0514 | |||

| FAF / First American Financial Corporation | 0.20 | -3.69 | 12.17 | -9.92 | 0.6475 | -0.0704 | |||

| WTW / Willis Towers Watson Public Limited Company | 0.04 | -2.19 | 12.07 | -11.30 | 0.6424 | -0.0809 | |||

| OPCH / Option Care Health, Inc. | 0.37 | -3.71 | 12.06 | -10.52 | 0.6420 | -0.0746 | |||

| COR / Cencora, Inc. | 0.04 | -24.35 | 11.85 | -18.43 | 0.6309 | -0.1416 | |||

| SLGN / Silgan Holdings Inc. | 0.22 | -3.55 | 11.73 | 2.21 | 0.6244 | 0.0143 | |||

| WBS / Webster Financial Corporation | 0.21 | 54.26 | 11.70 | 63.39 | 0.6226 | 0.2420 | |||

| DTE / DTE Energy Company | 0.09 | -8.02 | 11.55 | -11.88 | 0.6146 | -0.0820 | |||

| WAB / Westinghouse Air Brake Technologies Corporation | 0.05 | -2.59 | 11.23 | 12.45 | 0.5976 | 0.0668 | |||

| NMIH / NMI Holdings, Inc. | 0.26 | -3.52 | 11.08 | 12.93 | 0.5895 | 0.0681 | |||

| EVR / Evercore Inc. | 0.04 | 11.07 | 0.5890 | 0.5890 | |||||

| TSN / Tyson Foods, Inc. | 0.20 | -10.10 | 11.04 | -21.19 | 0.5874 | -0.1570 | |||

| WEC / WEC Energy Group, Inc. | 0.11 | -15.23 | 10.99 | -18.95 | 0.5847 | -0.1359 | |||

| HOLX / Hologic, Inc. | 0.16 | -1.90 | 10.65 | 3.48 | 0.5668 | 0.0197 | |||

| G / Genpact Limited | 0.24 | -13.63 | 10.52 | -24.55 | 0.5600 | -0.1813 | |||

| NI / NiSource Inc. | 0.26 | -2.16 | 10.50 | -1.55 | 0.5588 | -0.0081 | |||

| EPAC / Enerpac Tool Group Corp. | 0.26 | -3.54 | 10.43 | -12.79 | 0.5550 | -0.0806 | |||

| UVSP / Univest Financial Corporation | 0.35 | -3.65 | 10.42 | 2.06 | 0.5546 | 0.0119 | |||

| HAS / Hasbro, Inc. | 0.14 | -2.35 | 10.37 | 17.23 | 0.5520 | 0.0817 | |||

| ARMK / Aramark | 0.24 | 19.85 | 10.15 | 45.38 | 0.5402 | 0.1690 | |||

| LKQ / LKQ Corporation | 0.27 | -1.95 | 10.12 | -14.69 | 0.5386 | -0.0920 | |||

| PH / Parker-Hannifin Corporation | 0.01 | -1.75 | 10.06 | 12.89 | 0.5355 | 0.0617 | |||

| MAA / Mid-America Apartment Communities, Inc. | 0.07 | -1.79 | 10.02 | -13.27 | 0.5335 | -0.0808 | |||

| NVST / Envista Holdings Corporation | 0.51 | -3.23 | 10.01 | 9.56 | 0.5325 | 0.0470 | |||

| POR / Portland General Electric Company | 0.25 | -55.55 | 9.99 | -59.50 | 0.5318 | -0.7799 | |||

| ALLY / Ally Financial Inc. | 0.26 | 1.65 | 9.98 | 8.57 | 0.5314 | 0.0425 | |||

| EVRG / Evergy, Inc. | 0.14 | -2.28 | 9.92 | -2.31 | 0.5282 | -0.0118 | |||

| AXTA / Axalta Coating Systems Ltd. | 0.33 | -30.35 | 9.86 | -37.66 | 0.5249 | -0.3160 | |||

| XEL / Xcel Energy Inc. | 0.14 | -1.75 | 9.81 | -5.49 | 0.5222 | -0.0296 | |||

| GPI / Group 1 Automotive, Inc. | 0.02 | -4.17 | 9.61 | 9.58 | 0.5114 | 0.0452 | |||

| ETR / Entergy Corporation | 0.12 | -1.57 | 9.57 | -4.30 | 0.5091 | -0.0223 | |||

| EPAM / EPAM Systems, Inc. | 0.05 | 16.87 | 9.50 | 22.39 | 0.5056 | 0.0930 | |||

| CNP / CenterPoint Energy, Inc. | 0.26 | -1.68 | 9.41 | -0.30 | 0.5006 | -0.0009 | |||

| CHCO / City Holding Company | 0.08 | -3.69 | 9.32 | 0.37 | 0.4958 | 0.0024 | |||

| GMED / Globus Medical, Inc. | 0.16 | -3.77 | 9.25 | -22.42 | 0.4922 | -0.1415 | |||

| AKAM / Akamai Technologies, Inc. | 0.12 | -2.36 | 9.23 | -3.26 | 0.4913 | -0.0160 | |||

| ADUS / Addus HomeCare Corporation | 0.08 | 9.15 | 0.4871 | 0.4871 | |||||

| QRVO / Qorvo, Inc. | 0.11 | -2.36 | 9.09 | 14.50 | 0.4838 | 0.0617 | |||

| AMP / Ameriprise Financial, Inc. | 0.02 | -1.96 | 8.99 | 8.10 | 0.4783 | 0.0363 | |||

| EXP / Eagle Materials Inc. | 0.04 | 23.30 | 8.94 | 12.28 | 0.4758 | 0.0526 | |||

| DOV / Dover Corporation | 0.05 | -1.64 | 8.88 | 2.58 | 0.4727 | 0.0125 | |||

| BDC / Belden Inc. | 0.08 | -3.61 | 8.82 | 11.34 | 0.4695 | 0.0483 | |||

| ZBH / Zimmer Biomet Holdings, Inc. | 0.10 | 1.97 | 8.77 | -17.83 | 0.4667 | -0.1006 | |||

| COHU / Cohu, Inc. | 0.45 | 6.20 | 8.72 | 38.91 | 0.4639 | 0.1303 | |||

| LHX / L3Harris Technologies, Inc. | 0.03 | -1.81 | 8.70 | 17.67 | 0.4629 | 0.0700 | |||

| FANG / Diamondback Energy, Inc. | 0.06 | 15.35 | 8.68 | -0.87 | 0.4622 | -0.0035 | |||

| DAR / Darling Ingredients Inc. | 0.23 | 1.97 | 8.62 | 23.85 | 0.4588 | 0.0888 | |||

| ESS / Essex Property Trust, Inc. | 0.03 | 3.72 | 8.62 | -4.12 | 0.4587 | -0.0191 | |||

| CIVI / Civitas Resources, Inc. | 0.31 | -4.48 | 8.61 | -24.66 | 0.4581 | -0.1492 | |||

| BALL / Ball Corporation | 0.15 | -2.03 | 8.60 | 5.54 | 0.4575 | 0.0245 | |||

| CTRA / Coterra Energy Inc. | 0.34 | -2.36 | 8.53 | -14.25 | 0.4540 | -0.0748 | |||

| ROG / Rogers Corporation | 0.12 | 19.94 | 8.45 | 21.63 | 0.4499 | 0.0805 | |||

| OI / O-I Glass, Inc. | 0.56 | -3.70 | 8.29 | 23.76 | 0.4414 | 0.0851 | |||

| URBN / Urban Outfitters, Inc. | 0.11 | -3.59 | 8.22 | 33.47 | 0.4376 | 0.1101 | |||

| BKH / Black Hills Corporation | 0.15 | -4.26 | 8.17 | -11.44 | 0.4346 | -0.0555 | |||

| LDOS / Leidos Holdings, Inc. | 0.05 | -48.61 | 7.81 | -39.92 | 0.4158 | -0.2754 | |||

| SR / Spire Inc. | 0.11 | -3.72 | 7.73 | -10.18 | 0.4112 | -0.0461 | |||

| CASY / Casey's General Stores, Inc. | 0.02 | -18.44 | 7.72 | -4.11 | 0.4106 | -0.0171 | |||

| LW / Lamb Weston Holdings, Inc. | 0.15 | -2.03 | 7.68 | -4.69 | 0.4088 | -0.0196 | |||

| MZTI / The Marzetti Company | 0.04 | -3.55 | 7.68 | -4.77 | 0.4087 | -0.0200 | |||

| NGVT / Ingevity Corporation | 0.17 | -3.71 | 7.53 | 4.80 | 0.4008 | 0.0188 | |||

| FFIV / F5, Inc. | 0.03 | -1.36 | 7.46 | 9.02 | 0.3970 | 0.0333 | |||

| WABC / Westamerica Bancorporation | 0.15 | -4.31 | 7.07 | -8.46 | 0.3761 | -0.0342 | |||

| CAKE / The Cheesecake Factory Incorporated | 0.11 | -37.47 | 7.03 | -19.48 | 0.3742 | -0.0900 | |||

| CIM / Chimera Investment Corporation | 0.50 | -4.23 | 6.97 | 3.52 | 0.3709 | 0.0131 | |||

| XPRO / Expro Group Holdings N.V. | 0.81 | -4.53 | 6.96 | -17.50 | 0.3705 | -0.0780 | |||

| NVRI / Enviri Corporation | 0.78 | -4.30 | 6.77 | 24.93 | 0.3601 | 0.0722 | |||

| IFF / International Flavors & Fragrances Inc. | 0.09 | -2.43 | 6.75 | -7.53 | 0.3593 | -0.0288 | |||

| THS / TreeHouse Foods, Inc. | 0.34 | -40.46 | 6.57 | -57.32 | 0.3499 | -0.4689 | |||

| SNA / Snap-on Incorporated | 0.02 | -1.18 | 6.55 | -8.76 | 0.3489 | -0.0330 | |||

| CTO / CTO Realty Growth, Inc. | 0.38 | -4.47 | 6.51 | -14.61 | 0.3464 | -0.0588 | |||

| SHOO / Steven Madden, Ltd. | 0.27 | -4.32 | 6.41 | -13.87 | 0.3412 | -0.0545 | |||

| IOSP / Innospec Inc. | 0.07 | -3.54 | 6.20 | -14.39 | 0.3300 | -0.0550 | |||

| COLM / Columbia Sportswear Company | 0.10 | -2.38 | 6.00 | -21.23 | 0.3195 | -0.0856 | |||

| QDEL / QuidelOrtho Corporation | 0.20 | -4.32 | 5.68 | -21.15 | 0.3023 | -0.0806 | |||

| DLTR / Dollar Tree, Inc. | 0.06 | -2.29 | 5.67 | 28.92 | 0.3018 | 0.0680 | |||

| STZ / Constellation Brands, Inc. | 0.03 | -2.45 | 5.48 | -13.53 | 0.2918 | -0.0452 | |||

| ARE / Alexandria Real Estate Equities, Inc. | 0.07 | -2.44 | 5.44 | -23.42 | 0.2897 | -0.0881 | |||

| HST / Host Hotels & Resorts, Inc. | 0.35 | 49.50 | 5.39 | 61.61 | 0.2866 | 0.1095 | |||

| BWA / BorgWarner Inc. | 0.14 | -2.43 | 4.61 | 14.02 | 0.2454 | 0.0304 | |||

| IART / Integra LifeSciences Holdings Corporation | 0.37 | -3.59 | 4.60 | -46.21 | 0.2448 | -0.2097 | |||

| HUM / Humana Inc. | 0.02 | -1.83 | 3.92 | -9.29 | 0.2085 | -0.0211 | |||

| YETI / YETI Holdings, Inc. | 0.11 | -4.31 | 3.36 | -8.86 | 0.1789 | -0.0172 | |||

| MGPI / MGP Ingredients, Inc. | 0.07 | -4.32 | 2.16 | -2.39 | 0.1152 | -0.0027 | |||

| GPN / Global Payments Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| HAIN / The Hain Celestial Group, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| AZEK / The AZEK Company Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| IWS / iShares Trust - iShares Russell Mid-Cap Value ETF | 0.00 | -100.00 | 0.00 | 0.0000 |