Mga Batayang Estadistika

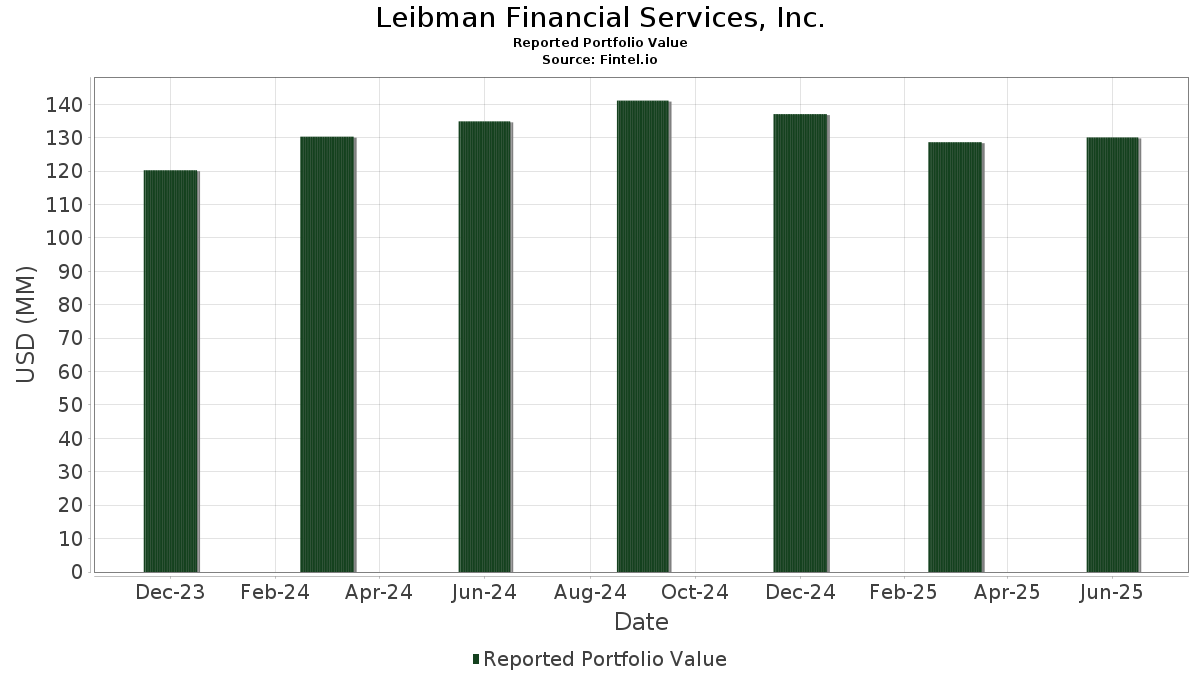

| Nilai Portofolio | $ 130,074,411 |

| Posisi Saat Ini | 49 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

Leibman Financial Services, Inc. telah mengungkapkan total kepemilikan 49 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 130,074,411 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Leibman Financial Services, Inc. adalah WisdomTree Trust - WisdomTree Floating Rate Treasury Fund (US:USFR) , WisdomTree Trust - WisdomTree India Earnings Fund (US:EPI) , Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) (US:TSM) , First Solar, Inc. (US:FSLR) , and Berkshire Hathaway Inc. (US:BRK.A) . Posisi baru Leibman Financial Services, Inc. meliputi: American Century ETF Trust - Avantis International Small Cap Value ETF (US:AVDV) , Sterling Infrastructure, Inc. (US:STRL) , Chipotle Mexican Grill, Inc. (US:CMG) , Casey's General Stores, Inc. (IT:1CASY) , and CAVA Group, Inc. (US:CAVA) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.05 | 3.97 | 3.0545 | 3.0545 | |

| 0.01 | 3.34 | 2.5678 | 2.5678 | |

| 0.04 | 2.41 | 1.8546 | 1.8546 | |

| 0.03 | 4.55 | 3.4968 | 1.5512 | |

| 0.02 | 4.20 | 3.2309 | 1.4788 | |

| 0.00 | 1.32 | 1.0117 | 1.0117 | |

| 0.05 | 3.44 | 2.6431 | 0.9276 | |

| 0.01 | 1.03 | 0.7919 | 0.7919 | |

| 0.02 | 2.47 | 1.8975 | 0.6070 | |

| 0.03 | 3.22 | 2.4774 | 0.6038 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.20 | 9.86 | 7.5784 | -3.8124 | |

| 0.00 | 0.57 | 0.4410 | -2.0580 | |

| 0.01 | 4.38 | 3.3676 | -1.0625 | |

| 0.01 | 3.06 | 2.3557 | -0.6641 | |

| 0.04 | 3.23 | 2.4849 | -0.5519 | |

| 0.03 | 1.21 | 0.9284 | -0.4932 | |

| 0.31 | 3.28 | 2.5210 | -0.4356 | |

| 0.01 | 2.68 | 2.0602 | -0.4214 | |

| 0.01 | 2.28 | 1.7533 | -0.4115 | |

| 0.00 | 0.25 | 0.1924 | -0.3520 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-09 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| USFR / WisdomTree Trust - WisdomTree Floating Rate Treasury Fund | 0.20 | -32.70 | 9.86 | -32.74 | 7.5784 | -3.8124 | |||

| EPI / WisdomTree Trust - WisdomTree India Earnings Fund | 0.13 | 0.99 | 6.01 | 9.67 | 4.6200 | 0.3610 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.02 | -13.93 | 4.85 | 17.44 | 3.7282 | 0.5185 | |||

| FSLR / First Solar, Inc. | 0.03 | 38.79 | 4.55 | 81.77 | 3.4968 | 1.5512 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.01 | -15.74 | 4.38 | -23.14 | 3.3676 | -1.0625 | |||

| AMZN / Amazon.com, Inc. | 0.02 | 61.69 | 4.20 | 86.51 | 3.2309 | 1.4788 | |||

| FCX / Freeport-McMoRan Inc. | 0.10 | -8.14 | 4.19 | 5.20 | 3.2176 | 0.1246 | |||

| URI / United Rentals, Inc. | 0.01 | -18.07 | 4.08 | -1.52 | 3.1333 | -0.0834 | |||

| AVDV / American Century ETF Trust - Avantis International Small Cap Value ETF | 0.05 | 3.97 | 3.0545 | 3.0545 | |||||

| GOOGL / Alphabet Inc. | 0.02 | -10.99 | 3.91 | 1.06 | 3.0078 | -0.0012 | |||

| TECK / Teck Resources Limited | 0.10 | -3.02 | 3.88 | 7.51 | 2.9831 | 0.1771 | |||

| SMIN / iShares Trust - iShares MSCI India Small-Cap ETF | 0.05 | 6.45 | 3.82 | 20.67 | 2.9404 | 0.4765 | |||

| TTD / The Trade Desk, Inc. | 0.05 | 18.41 | 3.44 | 55.80 | 2.6431 | 0.9276 | |||

| TMUS / T-Mobile US, Inc. | 0.01 | 0.15 | 3.43 | -10.51 | 2.6382 | -0.3426 | |||

| STRL / Sterling Infrastructure, Inc. | 0.01 | 3.34 | 2.5678 | 2.5678 | |||||

| AES / The AES Corporation | 0.31 | 1.78 | 3.28 | -13.78 | 2.5210 | -0.4356 | |||

| ARE / Alexandria Real Estate Equities, Inc. | 0.04 | 5.38 | 3.23 | -17.26 | 2.4849 | -0.5519 | |||

| DG / Dollar General Corporation | 0.03 | 2.78 | 3.22 | 33.69 | 2.4774 | 0.6038 | |||

| DIS / The Walt Disney Company | 0.03 | -19.51 | 3.13 | 1.13 | 2.4032 | 0.0005 | |||

| MSFT / Microsoft Corporation | 0.01 | -15.42 | 3.09 | 12.08 | 2.3762 | 0.2324 | |||

| AMGN / Amgen Inc. | 0.01 | -11.99 | 3.06 | -21.11 | 2.3557 | -0.6641 | |||

| ALB / Albemarle Corporation | 0.05 | 14.63 | 3.06 | -0.26 | 2.3546 | -0.0321 | |||

| GPC / Genuine Parts Company | 0.03 | -2.50 | 3.03 | -0.72 | 2.3323 | -0.0429 | |||

| LULU / lululemon athletica inc. | 0.01 | 3.72 | 2.78 | -12.95 | 2.1399 | -0.3455 | |||

| AAPL / Apple Inc. | 0.01 | -9.12 | 2.68 | -16.07 | 2.0602 | -0.4214 | |||

| AMAT / Applied Materials, Inc. | 0.01 | -4.87 | 2.67 | 20.01 | 2.0521 | 0.3231 | |||

| DDOG / Datadog, Inc. | 0.02 | 9.79 | 2.47 | 48.67 | 1.8975 | 0.6070 | |||

| CMG / Chipotle Mexican Grill, Inc. | 0.04 | 2.41 | 1.8546 | 1.8546 | |||||

| LOW / Lowe's Companies, Inc. | 0.01 | -13.92 | 2.28 | -18.13 | 1.7533 | -0.4115 | |||

| PSTG / Pure Storage, Inc. | 0.04 | -0.09 | 2.21 | 29.94 | 1.6988 | 0.3771 | |||

| KNSL / Kinsale Capital Group, Inc. | 0.00 | -3.59 | 2.17 | -4.15 | 1.6680 | -0.0917 | |||

| PLD / Prologis, Inc. | 0.02 | 3.61 | 2.05 | -2.57 | 1.5727 | -0.0593 | |||

| PINS / Pinterest, Inc. | 0.05 | 4.72 | 1.97 | 21.17 | 1.5139 | 0.2503 | |||

| TGT / Target Corporation | 0.02 | 5.11 | 1.75 | -0.62 | 1.3471 | -0.0237 | |||

| CRWD / CrowdStrike Holdings, Inc. | 0.00 | 2.58 | 1.64 | 48.14 | 1.2586 | 0.3997 | |||

| 1CASY / Casey's General Stores, Inc. | 0.00 | 1.32 | 1.0117 | 1.0117 | |||||

| PUBM / PubMatic, Inc. | 0.10 | 65.68 | 1.30 | 125.65 | 1.0012 | 0.5523 | |||

| ENPH / Enphase Energy, Inc. | 0.03 | 3.34 | 1.21 | -33.97 | 0.9284 | -0.4932 | |||

| GRAB / Grab Holdings Limited | 0.22 | 9.85 | 1.12 | 21.99 | 0.8575 | 0.1467 | |||

| CAVA / CAVA Group, Inc. | 0.01 | 1.03 | 0.7919 | 0.7919 | |||||

| PGNY / Progyny, Inc. | 0.05 | 1.13 | 1.01 | -0.39 | 0.7771 | -0.0119 | |||

| SHV / iShares Trust - iShares Short Treasury Bond ETF | 0.01 | -24.27 | 0.81 | -24.30 | 0.6207 | -0.2083 | |||

| DE / Deere & Company | 0.00 | -83.53 | 0.57 | -82.17 | 0.4410 | -2.0580 | |||

| TSLA / Tesla, Inc. | 0.00 | -17.08 | 0.43 | 1.64 | 0.3343 | 0.0018 | |||

| INDA / iShares Trust - iShares MSCI India ETF | 0.00 | -7.30 | 0.27 | 0.37 | 0.2092 | -0.0018 | |||

| WMT / Walmart Inc. | 0.00 | -67.92 | 0.25 | -64.29 | 0.1924 | -0.3520 | |||

| RS / Reliance, Inc. | 0.00 | 0.00 | 0.23 | 8.70 | 0.1735 | 0.0121 | |||

| UNP / Union Pacific Corporation | 0.00 | -64.60 | 0.22 | -65.62 | 0.1698 | -0.3282 | |||

| SHEL / Shell plc - Depositary Receipt (Common Stock) | 0.00 | -62.14 | 0.21 | -63.60 | 0.1615 | -0.2874 | |||

| RTX / RTX Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| LUV / Southwest Airlines Co. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| NUE / Nucor Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CARR / Carrier Global Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MGA / Magna International Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MTH / Meritage Homes Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CAT / Caterpillar Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ROK / Rockwell Automation, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CVX / Chevron Corporation | 0.00 | -100.00 | 0.00 | 0.0000 |