Mga Batayang Estadistika

| Nilai Portofolio | $ 460,605,863 |

| Posisi Saat Ini | 226 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

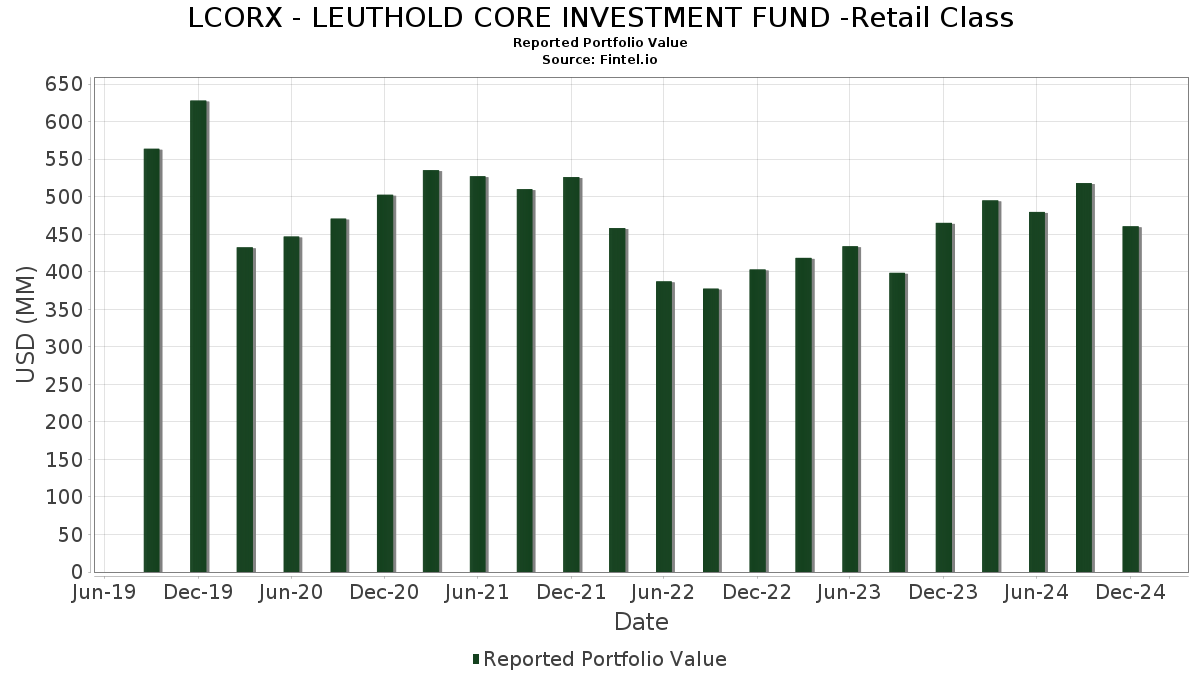

LCORX - LEUTHOLD CORE INVESTMENT FUND -Retail Class telah mengungkapkan total kepemilikan 226 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 460,605,863 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama LCORX - LEUTHOLD CORE INVESTMENT FUND -Retail Class adalah Fidelity Colchester Street Trust - Fidelity Institutional Money Market Funds Government Portfolio Class I (US:FIGXX) , Microsoft Corporation (US:MSFT) , Meta Platforms, Inc. (US:META) , SPDR Series Trust - SPDR Portfolio Intermediate Term Corporate Bond ETF (US:SPIB) , and US TNOTE 3.875% DUE 08/15/2033 (US:US91282CHT18) . Posisi baru LCORX - LEUTHOLD CORE INVESTMENT FUND -Retail Class meliputi: US TNOTE 3.875% DUE 08/15/2033 (US:US91282CHT18) , Janus Detroit Street Trust - Janus Henderson AAA CLO ETF (US:JAAA) , FRANCE (GOVT OF) /EUR/ REGD REG S 3.00000000 (FR:FR001400H7V7) , JPMorgan Chase & Co (US:XS1174469137) , and Arista Networks Inc (US:ANET) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.00 | 5.3972 | ||

| 16.97 | 3.2008 | 3.2008 | ||

| 5.43 | 1.0248 | 1.0248 | ||

| 0.10 | 5.07 | 0.9567 | 0.9567 | |

| 0.07 | 4.35 | 0.8204 | 0.8204 | |

| 0.03 | 3.36 | 0.6333 | 0.6333 | |

| 0.16 | 2.71 | 0.5120 | 0.5120 | |

| 0.03 | 2.69 | 0.5073 | 0.5073 | |

| 0.20 | 2.68 | 0.5056 | 0.5056 | |

| 0.02 | 2.62 | 0.4945 | 0.4945 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| -0.04 | -21.32 | -4.0214 | -3.8220 | |

| 0.00 | 0.00 | -2.0426 | ||

| 0.00 | 0.00 | -1.2132 | ||

| 0.00 | 0.00 | -0.9524 | ||

| 4.93 | 0.9290 | -0.7512 | ||

| 0.00 | 0.00 | -0.7501 | ||

| 64.03 | 64.03 | 12.0785 | -0.6837 | |

| 0.00 | 0.00 | -0.6632 | ||

| 0.10 | 4.77 | 0.9005 | -0.5652 | |

| 0.16 | 8.11 | 1.5306 | -0.5532 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-02-18 untuk periode pelaporan 2024-12-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| FIGXX / Fidelity Colchester Street Trust - Fidelity Institutional Money Market Funds Government Portfolio Class I | 64.03 | -12.27 | 64.03 | -12.27 | 12.0785 | -0.6837 | |||

| United States Treasury Bill / DBT (US912797LY18) | 16.97 | 3.2008 | 3.2008 | ||||||

| MSFT / Microsoft Corporation | 0.03 | -5.38 | 14.71 | -7.32 | 2.7744 | -0.0003 | |||

| META / Meta Platforms, Inc. | 0.02 | -5.73 | 12.03 | -3.58 | 2.2686 | 0.0876 | |||

| SPIB / SPDR Series Trust - SPDR Portfolio Intermediate Term Corporate Bond ETF | 0.32 | 0.00 | 10.48 | -2.82 | 1.9762 | 0.0912 | |||

| US91282CHT18 / US TNOTE 3.875% DUE 08/15/2033 | 9.80 | -5.49 | 1.8493 | 0.0356 | |||||

| NFLX / Netflix, Inc. | 0.01 | -5.11 | 8.95 | 19.26 | 1.6875 | 0.3758 | |||

| GOOGL / Alphabet Inc. | 0.05 | -5.49 | 8.88 | 7.87 | 1.6753 | 0.2357 | |||

| IGIB / iShares Trust - iShares 5-10 Year Investment Grade Corporate Bond ETF | 0.16 | -28.99 | 8.11 | -31.91 | 1.5306 | -0.5532 | |||

| ORCL / Oracle Corporation | 0.05 | -5.46 | 7.80 | -7.55 | 1.4711 | -0.0038 | |||

| PHM / PulteGroup, Inc. | 0.07 | -5.47 | 7.19 | -28.28 | 1.3569 | -0.3968 | |||

| IGOV / iShares Trust - iShares International Treasury Bond ETF | 0.18 | 0.00 | 6.77 | -8.13 | 1.2771 | -0.0115 | |||

| URI / United Rentals, Inc. | 0.01 | -5.59 | 6.66 | -17.86 | 1.2561 | -0.1616 | |||

| GS / The Goldman Sachs Group, Inc. | 0.01 | 9.66 | 6.42 | 26.83 | 1.2102 | 0.3257 | |||

| MCK / McKesson Corporation | 0.01 | -5.43 | 6.12 | 9.01 | 1.1543 | 0.1728 | |||

| DHI / D.R. Horton, Inc. | 0.04 | -5.35 | 6.10 | -30.62 | 1.1512 | -0.3871 | |||

| JBL / Jabil Inc. | 0.04 | -5.42 | 5.98 | 13.56 | 1.1278 | 0.2073 | |||

| MBB / iShares Trust - iShares MBS ETF | 0.06 | 0.00 | 5.78 | -4.31 | 1.0902 | 0.0341 | |||

| RGA / Reinsurance Group of America, Incorporated | 0.03 | -5.19 | 5.68 | -7.03 | 1.0723 | 0.0031 | |||

| TMUS / T-Mobile US, Inc. | 0.03 | -5.30 | 5.62 | 1.28 | 1.0593 | 0.0899 | |||

| MS / Morgan Stanley | 0.04 | -5.27 | 5.58 | 14.24 | 1.0517 | 0.1984 | |||

| MA / Mastercard Incorporated | 0.01 | -5.12 | 5.53 | 1.19 | 1.0433 | 0.0874 | |||

| BWX / SPDR Series Trust - SPDR Bloomberg International Treasury Bond ETF | 0.26 | 0.00 | 5.50 | -8.43 | 1.0366 | -0.0128 | |||

| GB00BMV7TC88 / United Kingdom Gilt | 5.43 | 1.0248 | 1.0248 | ||||||

| FLEX / Flex Ltd. | 0.14 | -5.44 | 5.27 | 8.59 | 0.9947 | 0.1456 | |||

| JPM / JPMorgan Chase & Co. | 0.02 | -5.39 | 5.15 | 7.57 | 0.9710 | 0.1342 | |||

| JAAA / Janus Detroit Street Trust - Janus Henderson AAA CLO ETF | 0.10 | 5.07 | 0.9567 | 0.9567 | |||||

| TOL / Toll Brothers, Inc. | 0.04 | -5.43 | 5.06 | -22.90 | 0.9538 | -0.1929 | |||

| CAH / Cardinal Health, Inc. | 0.04 | -5.39 | 5.01 | 1.25 | 0.9451 | 0.0798 | |||

| FR001400H7V7 / FRANCE (GOVT OF) /EUR/ REGD REG S 3.00000000 | 4.93 | -48.75 | 0.9290 | -0.7512 | |||||

| MTBA / Simplify Exchange Traded Funds - Simplify MBS ETF | 0.10 | -41.00 | 4.77 | -43.06 | 0.9005 | -0.5652 | |||

| BAC / Bank of America Corporation | 0.11 | -5.40 | 4.76 | 4.78 | 0.8979 | 0.1035 | |||

| XS1174469137 / JPMorgan Chase & Co | 4.76 | -6.48 | 0.8977 | 0.0078 | |||||

| RNR / RenaissanceRe Holdings Ltd. | 0.02 | -5.42 | 4.65 | -13.61 | 0.8764 | -0.0640 | |||

| COR / Cencora, Inc. | 0.02 | -5.80 | 4.64 | -5.98 | 0.8755 | 0.0124 | |||

| V / Visa Inc. | 0.01 | -5.77 | 4.39 | 8.32 | 0.8279 | 0.1194 | |||

| DAL / Delta Air Lines, Inc. | 0.07 | 4.35 | 0.8204 | 0.8204 | |||||

| TJX / The TJX Companies, Inc. | 0.04 | -5.61 | 4.23 | -2.98 | 0.7979 | 0.0356 | |||

| FTNT / Fortinet, Inc. | 0.04 | -5.53 | 4.05 | 15.07 | 0.7633 | 0.1485 | |||

| DIS / The Walt Disney Company | 0.04 | -5.30 | 3.99 | 9.62 | 0.7526 | 0.1162 | |||

| C / Citigroup Inc. | 0.06 | 27.70 | 3.94 | 48.88 | 0.7423 | 0.3098 | |||

| TE Connectivity PLC / EC (IE000IVNQZ81) | 0.03 | -5.37 | 3.85 | -10.39 | 0.7270 | -0.0251 | |||

| AER / AerCap Holdings N.V. | 0.04 | -5.46 | 3.85 | -4.49 | 0.7268 | 0.0215 | |||

| CHKP / Check Point Software Technologies Ltd. | 0.02 | -5.73 | 3.83 | -8.74 | 0.7234 | -0.0112 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.01 | -6.16 | 3.81 | -7.60 | 0.7185 | -0.0022 | |||

| KGC / Kinross Gold Corporation | 0.41 | 147.92 | 3.79 | 145.57 | 0.7157 | 0.4455 | |||

| T / AT&T Inc. | 0.16 | -5.43 | 3.74 | -2.12 | 0.7063 | 0.0374 | |||

| EMLC / VanEck ETF Trust - VanEck J.P. Morgan EM Local Currency Bond ETF | 0.16 | 0.00 | 3.71 | -9.02 | 0.7006 | -0.0132 | |||

| EG / Everest Group, Ltd. | 0.01 | -4.94 | 3.60 | -12.08 | 0.6782 | -0.0368 | |||

| LEN / Lennar Corporation | 0.03 | -5.18 | 3.56 | -31.05 | 0.6725 | -0.2314 | |||

| CM / Canadian Imperial Bank of Commerce | 0.05 | -5.34 | 3.46 | -2.43 | 0.6528 | 0.0327 | |||

| CB / Chubb Limited | 0.01 | -5.04 | 3.39 | -9.03 | 0.6387 | -0.0120 | |||

| CSCO / Cisco Systems, Inc. | 0.06 | -17.22 | 3.38 | 3.15 | 0.6372 | 0.0442 | |||

| CARG / CarGurus, Inc. | 0.09 | -5.39 | 3.37 | 15.11 | 0.6355 | 0.1238 | |||

| ANET / Arista Networks Inc | 0.03 | 3.36 | 0.6333 | 0.6333 | |||||

| HCA / HCA Healthcare, Inc. | 0.01 | -5.57 | 3.26 | -30.27 | 0.6145 | -0.2023 | |||

| ROST / Ross Stores, Inc. | 0.02 | -5.43 | 3.25 | -4.95 | 0.6127 | 0.0152 | |||

| WCC / WESCO International, Inc. | 0.02 | -5.16 | 3.23 | 2.18 | 0.6095 | 0.0565 | |||

| 2561 / Blackrock Japan Co Ltd - Ishares Core Japan Government Bond Etf | 0.21 | 0.00 | 3.19 | -10.28 | 0.6013 | -0.0198 | |||

| MTB / M&T Bank Corporation | 0.02 | -5.33 | 3.14 | -0.10 | 0.5919 | 0.0428 | |||

| FXY / Invesco CurrencyShares Japanese Yen Trust | 0.05 | 0.00 | 3.06 | -8.84 | 0.5775 | -0.0097 | |||

| TMHC / Taylor Morrison Home Corporation | 0.05 | -5.39 | 3.05 | -17.57 | 0.5754 | -0.0717 | |||

| CAT / Caterpillar Inc. | 0.01 | -5.03 | 2.96 | -11.92 | 0.5591 | -0.0293 | |||

| 0XGN / IAMGOLD Corporation | 0.56 | 52.73 | 2.90 | 50.75 | 0.5463 | 0.2102 | |||

| HBAN / Huntington Bancshares Incorporated | 0.18 | -5.43 | 2.88 | 4.65 | 0.5434 | 0.0621 | |||

| MTH / Meritage Homes Corporation | 0.02 | -5.09 | 2.87 | -28.81 | 0.5418 | -0.1637 | |||

| SMFG / Sumitomo Mitsui Financial Group, Inc. - Depositary Receipt (Common Stock) | 0.19 | -5.40 | 2.76 | 8.53 | 0.5209 | 0.0760 | |||

| ALSN / Allison Transmission Holdings, Inc. | 0.03 | -5.49 | 2.74 | 6.29 | 0.5162 | 0.0661 | |||

| CFG / Citizens Financial Group, Inc. | 0.06 | -5.40 | 2.73 | 0.81 | 0.5154 | 0.0414 | |||

| DBK / Deutsche Bank Aktiengesellschaft | 0.16 | 2.71 | 0.5120 | 0.5120 | |||||

| PYPL / PayPal Holdings, Inc. | 0.03 | 2.69 | 0.5073 | 0.5073 | |||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 0.20 | 2.68 | 0.5056 | 0.5056 | |||||

| PCAR / PACCAR Inc | 0.03 | -5.18 | 2.67 | -0.07 | 0.5038 | 0.0366 | |||

| ANF / Abercrombie & Fitch Co. | 0.02 | 2.62 | 0.4945 | 0.4945 | |||||

| TRV / The Travelers Companies, Inc. | 0.01 | -5.49 | 2.61 | -2.75 | 0.4932 | 0.0230 | |||

| RJF / Raymond James Financial, Inc. | 0.02 | -39.72 | 2.56 | -5.23 | 0.4822 | -0.0507 | |||

| THC / Tenet Healthcare Corporation | 0.02 | -5.11 | 2.53 | -27.94 | 0.4780 | -0.1368 | |||

| MTCH / Match Group, Inc. | 0.08 | -5.36 | 2.52 | -18.19 | 0.4760 | -0.0634 | |||

| ALL / The Allstate Corporation | 0.01 | -5.39 | 2.52 | -3.85 | 0.4753 | 0.0172 | |||

| AEM / Agnico Eagle Mines Limited | 0.03 | 2.52 | 0.4752 | 0.4752 | |||||

| HRB / H&R Block, Inc. | 0.05 | 2.50 | 0.4711 | 0.4711 | |||||

| AIZ / Assurant, Inc. | 0.01 | -5.42 | 2.49 | 1.43 | 0.4694 | 0.0403 | |||

| HIG / The Hartford Insurance Group, Inc. | 0.02 | -5.28 | 2.43 | -11.91 | 0.4576 | -0.0238 | |||

| LDOS / Leidos Holdings, Inc. | 0.02 | 2.37 | 0.4472 | 0.4472 | |||||

| QLYS / Qualys, Inc. | 0.02 | -5.72 | 2.27 | 2.90 | 0.4291 | 0.0426 | |||

| UHS / Universal Health Services, Inc. | 0.01 | -5.80 | 2.24 | -26.19 | 0.4226 | -0.1082 | |||

| NOK / Nokia Oyj - Depositary Receipt (Common Stock) | 0.49 | 2.19 | 0.4132 | 0.4132 | |||||

| ERIC / Telefonaktiebolaget LM Ericsson (publ) - Depositary Receipt (Common Stock) | 0.27 | 2.19 | 0.4131 | 0.4131 | |||||

| URBN / Urban Outfitters, Inc. | 0.04 | -5.58 | 2.18 | 35.22 | 0.4108 | 0.1292 | |||

| FFIV / F5, Inc. | 0.01 | 2.17 | 0.4086 | 0.4086 | |||||

| KBH / KB Home | 0.03 | -5.33 | 2.13 | -27.38 | 0.4022 | -0.1113 | |||

| ONB / Old National Bancorp | 0.10 | -5.41 | 2.12 | 10.04 | 0.3990 | 0.0629 | |||

| ACGL / Arch Capital Group Ltd. | 0.02 | -5.47 | 2.08 | -21.95 | 0.3924 | -0.0737 | |||

| COLB / Columbia Banking System, Inc. | 0.08 | -5.40 | 2.03 | -2.17 | 0.3823 | 0.0202 | |||

| MKL / Markel Group Inc. | 0.00 | -6.57 | 2.01 | 2.81 | 0.3800 | 0.0374 | |||

| ATGE / Adtalem Global Education Inc. | 0.02 | 1.98 | 0.3740 | 0.3740 | |||||

| GAP / The Gap, Inc. | 0.08 | -5.39 | 1.98 | 1.43 | 0.3735 | 0.0320 | |||

| RUSHA / Rush Enterprises, Inc. | 0.04 | -5.25 | 1.94 | -1.77 | 0.3667 | 0.0208 | |||

| LKQ / LKQ Corporation | 0.05 | -5.36 | 1.93 | -12.87 | 0.3641 | -0.0233 | |||

| LRN / Stride, Inc. | 0.02 | 1.93 | 0.3638 | 0.3638 | |||||

| EHC / Encompass Health Corporation | 0.02 | -5.58 | 1.92 | -9.78 | 0.3619 | -0.0099 | |||

| GPN / Global Payments Inc. | 0.02 | 1.86 | 0.3503 | 0.3503 | |||||

| VIRT / Virtu Financial, Inc. | 0.05 | -495.32 | 1.84 | -984.62 | 0.3472 | 0.3813 | |||

| CADE / Cadence Bank | 0.05 | -5.48 | 1.83 | 2.24 | 0.3443 | 0.0321 | |||

| XYZ / Block, Inc. | 0.02 | 1.81 | 0.3405 | 0.3405 | |||||

| VZ / Verizon Communications Inc. | 0.05 | -5.49 | 1.80 | -15.84 | 0.3398 | -0.0345 | |||

| FIS / Fidelity National Information Services, Inc. | 0.02 | 1.79 | 0.3378 | 0.3378 | |||||

| EGO / Eldorado Gold Corporation | 0.12 | 1.75 | 0.3306 | 0.3306 | |||||

| EQX / Equinox Gold Corp. | 0.35 | 1.75 | 0.3296 | 0.3296 | |||||

| SAIC / Science Applications International Corporation | 0.02 | 1.74 | 0.3273 | 0.3273 | |||||

| PAAS / Pan American Silver Corp. | 0.09 | 1.72 | 0.3245 | 0.3245 | |||||

| CACI / CACI International Inc | 0.00 | 1.70 | 0.3202 | 0.3202 | |||||

| GMS / GMS Inc. | 0.02 | -5.59 | 1.64 | -11.57 | 0.3100 | -0.0150 | |||

| BCC / Boise Cascade Company | 0.01 | -5.54 | 1.62 | -20.36 | 0.3062 | -0.0502 | |||

| IAC / IAC Inc. | 0.04 | -5.26 | 1.61 | -24.05 | 0.3039 | -0.0670 | |||

| WTM / White Mountains Insurance Group, Ltd. | 0.00 | -3.55 | 1.59 | 10.61 | 0.2990 | 0.0484 | |||

| CPA / Copa Holdings, S.A. | 0.02 | 1.58 | 0.2979 | 0.2979 | |||||

| CMI / Cummins Inc. | 0.00 | -6.14 | 1.55 | 1.11 | 0.2916 | 0.0241 | |||

| KBR / KBR, Inc. | 0.03 | 1.52 | 0.2869 | 0.2869 | |||||

| HLIT / Harmonic Inc. | 0.11 | -395.40 | 1.48 | -400.00 | 0.2785 | 0.3708 | |||

| TEX / Terex Corporation | 0.03 | -5.49 | 1.19 | -17.39 | 0.2249 | -0.0276 | |||

| SEM / Select Medical Holdings Corporation | 0.05 | -5.40 | 0.98 | -48.86 | 0.1855 | -0.1507 | |||

| CON / Concentra Group Holdings Parent, Inc. | 0.04 | 0.83 | 0.1568 | 0.1568 | |||||

| GOLD / Barrick Mining Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.3921 | ||||

| WK / Workiva Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0490 | ||||

| NSC / Norfolk Southern Corporation | 0.00 | -100.00 | 0.00 | -100.00 | 0.0931 | ||||

| AA / Alcoa Corporation | 0.00 | -100.00 | 0.00 | -100.00 | 0.0413 | ||||

| BX / Blackstone Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.1137 | ||||

| EL / The Estée Lauder Companies Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0405 | ||||

| CHRW / C.H. Robinson Worldwide, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0575 | ||||

| WEX / WEX Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0438 | ||||

| AAPL / Apple Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -2.0426 | ||||

| TSLA / Tesla, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.1184 | ||||

| BDX / Becton, Dickinson and Company | 0.00 | -100.00 | 0.00 | -100.00 | 0.1010 | ||||

| 67 / CHINA LUMENA NEW MATERIALS COR COMMON STOCK USD.00001 | 0.02 | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| ALK / Alaska Air Group, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0538 | ||||

| ILMN / Illumina, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0897 | ||||

| PTEN / Patterson-UTI Energy, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0310 | ||||

| BROS / Dutch Bros Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0476 | ||||

| AMAT / Applied Materials, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.2132 | ||||

| TRU / TransUnion | 0.00 | -100.00 | 0.00 | -100.00 | 0.0717 | ||||

| HUM / Humana Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2656 | ||||

| ARMK / Aramark | 0.00 | -100.00 | 0.00 | -100.00 | 0.0636 | ||||

| PCTY / Paylocity Holding Corporation | 0.00 | -100.00 | 0.00 | -100.00 | 0.0327 | ||||

| ACVA / ACV Auctions Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0506 | ||||

| EXPO / Exponent, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0621 | ||||

| EXP / Eagle Materials Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.6632 | ||||

| TECH / Bio-Techne Corporation | 0.00 | -100.00 | 0.00 | -100.00 | 0.0473 | ||||

| AEO / American Eagle Outfitters, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.3674 | ||||

| VSAT / Viasat, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0212 | ||||

| SITE / SiteOne Landscape Supply, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0435 | ||||

| OXY / Occidental Petroleum Corporation | 0.00 | -100.00 | 0.00 | -100.00 | 0.0760 | ||||

| ELV / Elevance Health, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.7501 | ||||

| QQQM / Invesco Exchange-Traded Fund Trust II - Invesco NASDAQ 100 ETF | 0.00 | -100.00 | 0.00 | -100.00 | 5.3972 | ||||

| XOM / Exxon Mobil Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.9524 | ||||

| TTC / The Toro Company | 0.00 | -100.00 | 0.00 | -100.00 | 0.0392 | ||||

| HI / Hillenbrand, Inc. | Short | -0.01 | -0.00 | -0.17 | 10.74 | -0.0312 | -0.0051 | ||

| TALO / Talos Energy Inc. | Short | -0.02 | -0.00 | -0.17 | -6.04 | -0.0323 | -0.0004 | ||

| VAL / Valaris Limited | Short | -0.00 | -0.00 | -0.18 | -20.81 | -0.0331 | 0.0056 | ||

| CC / The Chemours Company | Short | -0.01 | -0.18 | -0.0339 | -0.0339 | ||||

| SCL / Stepan Company | Short | -0.00 | -0.00 | -0.19 | -16.37 | -0.0357 | 0.0038 | ||

| ELF / e.l.f. Beauty, Inc. | Short | -0.00 | -0.21 | -0.0389 | -0.0389 | ||||

| ORA / Ormat Technologies, Inc. | Short | -0.00 | -0.00 | -0.21 | -11.97 | -0.0389 | 0.0021 | ||

| REXR / Rexford Industrial Realty, Inc. | Short | -0.01 | -0.00 | -0.21 | -23.13 | -0.0389 | 0.0080 | ||

| FND / Floor & Decor Holdings, Inc. | Short | -0.00 | -0.21 | -0.0404 | -0.0404 | ||||

| NOVT / Novanta Inc. | Short | -0.00 | -0.00 | -0.22 | -14.29 | -0.0407 | 0.0035 | ||

| MTN / Vail Resorts, Inc. | Short | -0.00 | -0.00 | -0.22 | 7.92 | -0.0411 | -0.0057 | ||

| ADNT / Adient plc | Short | -0.01 | -0.00 | -0.22 | -23.88 | -0.0417 | 0.0089 | ||

| RRR / Red Rock Resorts, Inc. | Short | -0.00 | -84.23 | -0.22 | -33.23 | -0.0418 | 0.0208 | ||

| CWST / Casella Waste Systems, Inc. | Short | -0.00 | -0.22 | -0.0420 | -0.0420 | ||||

| INSP / Inspire Medical Systems, Inc. | Short | -0.00 | -0.23 | -0.0431 | -0.0431 | ||||

| POWI / Power Integrations, Inc. | Short | -0.00 | -0.00 | -0.23 | -3.77 | -0.0434 | -0.0016 | ||

| SLAB / Silicon Laboratories Inc. | Short | -0.00 | -0.00 | -0.23 | 7.44 | -0.0436 | -0.0060 | ||

| MRTN / Marten Transport, Ltd. | Short | -0.01 | -0.00 | -0.23 | -11.79 | -0.0438 | 0.0022 | ||

| BIRK / Birkenstock Holding plc | Short | -0.00 | -0.24 | -0.0448 | -0.0448 | ||||

| TREX / Trex Company, Inc. | Short | -0.00 | -45.92 | -0.24 | -43.06 | -0.0449 | 0.0366 | ||

| DAN / Dana Incorporated | Short | -0.02 | -0.00 | -0.24 | 9.55 | -0.0455 | -0.0070 | ||

| FLYW / Flywire Corporation | Short | -0.01 | -0.24 | -0.0456 | -0.0456 | ||||

| GH / Guardant Health, Inc. | Short | -0.01 | -18.38 | -0.25 | -7.87 | -0.0465 | 0.0036 | ||

| SAIA / Saia, Inc. | Short | -0.00 | -0.00 | -0.25 | 4.22 | -0.0467 | -0.0052 | ||

| KMX / CarMax, Inc. | Short | -0.00 | -0.00 | -0.25 | 5.53 | -0.0469 | -0.0058 | ||

| WMG / Warner Music Group Corp. | Short | -0.01 | -0.25 | -0.0470 | -0.0470 | ||||

| QDEL / QuidelOrtho Corporation | Short | -0.01 | -0.00 | -0.25 | -2.34 | -0.0472 | -0.0024 | ||

| HHH / Howard Hughes Holdings Inc. | Short | -0.00 | -0.00 | -0.25 | -0.78 | -0.0478 | -0.0032 | ||

| KNX / Knight-Swift Transportation Holdings Inc. | Short | -0.00 | -0.00 | -0.25 | -1.55 | -0.0479 | -0.0027 | ||

| IRTC / iRhythm Technologies, Inc. | Short | -0.00 | -0.26 | -0.0487 | -0.0487 | ||||

| RGEN / Repligen Corporation | Short | -0.00 | -0.00 | -0.26 | -3.35 | -0.0491 | -0.0020 | ||

| IPAR / Interparfums, Inc. | Short | -0.00 | -0.00 | -0.26 | 1.56 | -0.0493 | -0.0043 | ||

| CFLT / Confluent, Inc. | Short | -0.01 | -0.00 | -0.27 | 36.92 | -0.0505 | -0.0164 | ||

| SPR / Spirit AeroSystems Holdings, Inc. | Short | -0.01 | -0.00 | -0.27 | 5.00 | -0.0515 | -0.0060 | ||

| CGNX / Cognex Corporation | Short | -0.01 | -0.00 | -0.27 | -11.36 | -0.0516 | 0.0024 | ||

| KTOS / Kratos Defense & Security Solutions, Inc. | Short | -0.01 | -0.28 | -0.0525 | -0.0525 | ||||

| SNDR / Schneider National, Inc. | Short | -0.01 | -0.00 | -0.28 | 2.58 | -0.0526 | -0.0051 | ||

| CRC / California Resources Corporation | Short | -0.01 | -0.00 | -0.28 | -1.06 | -0.0531 | -0.0033 | ||

| RRC / Range Resources Corporation | Short | -0.01 | -0.28 | -0.0538 | -0.0538 | ||||

| FDS / FactSet Research Systems Inc. | Short | -0.00 | -0.00 | -0.29 | 4.29 | -0.0553 | -0.0062 | ||

| DAY / Dayforce Inc. | Short | -0.00 | -0.00 | -0.29 | 18.55 | -0.0555 | -0.0121 | ||

| RYAN / Ryan Specialty Holdings, Inc. | Short | -0.00 | -0.00 | -0.31 | -3.46 | -0.0581 | -0.0024 | ||

| AMBA / Ambarella, Inc. | Short | -0.00 | -0.32 | -0.0611 | -0.0611 | ||||

| MKTX / MarketAxess Holdings Inc. | Short | -0.00 | -0.00 | -0.33 | -11.68 | -0.0613 | 0.0031 | ||

| RELY / Remitly Global, Inc. | Short | -0.01 | -0.00 | -0.33 | 68.72 | -0.0622 | -0.0280 | ||

| MDB / MongoDB, Inc. | Short | -0.00 | -0.00 | -0.35 | -13.86 | -0.0658 | 0.0050 | ||

| ALB / Albemarle Corporation | Short | -0.00 | -0.00 | -0.40 | -9.20 | -0.0746 | 0.0015 | ||

| BFB / Brown-Forman Corp. - Class B | Short | -0.01 | -0.00 | -0.40 | -22.93 | -0.0756 | 0.0152 | ||

| VRTX / Vertex Pharmaceuticals Incorporated | Short | -0.00 | -0.40 | -0.0760 | -0.0760 | ||||

| APD / Air Products and Chemicals, Inc. | Short | -0.00 | -34.25 | -0.41 | -36.01 | -0.0782 | 0.0350 | ||

| CRWD / CrowdStrike Holdings, Inc. | Short | -0.00 | -77.95 | -0.42 | -48.65 | -0.0789 | 0.0798 | ||

| FAST / Fastenal Company | Short | -0.01 | -0.42 | -0.0797 | -0.0797 | ||||

| EFX / Equifax Inc. | Short | -0.00 | -0.43 | -0.0813 | -0.0813 | ||||

| ZS / Zscaler, Inc. | Short | -0.00 | -0.43 | -0.0815 | -0.0815 | ||||

| JBHT / J.B. Hunt Transport Services, Inc. | Short | -0.00 | -0.00 | -0.43 | -1.15 | -0.0815 | -0.0052 | ||

| NDAQ / Nasdaq, Inc. | Short | -0.01 | -33.56 | -0.43 | -29.71 | -0.0818 | 0.0260 | ||

| ASML / ASML Holding N.V. - Depositary Receipt (Common Stock) | Short | -0.00 | -0.44 | -0.0829 | -0.0829 | ||||

| ARM / Arm Holdings plc - Depositary Receipt (Common Stock) | Short | -0.00 | -0.44 | -0.0836 | -0.0836 | ||||

| DLR / Digital Realty Trust, Inc. | Short | -0.00 | -0.45 | -0.0841 | -0.0841 | ||||

| XYL / Xylem Inc. | Short | -0.00 | -0.45 | -0.0842 | -0.0842 | ||||

| ODFL / Old Dominion Freight Line, Inc. | Short | -0.00 | -0.00 | -0.45 | -11.29 | -0.0847 | 0.0037 | ||

| CSGP / CoStar Group, Inc. | Short | -0.01 | -0.45 | -0.0851 | -0.0851 | ||||

| TXN / Texas Instruments Incorporated | Short | -0.00 | -0.00 | -0.45 | -9.20 | -0.0857 | 0.0018 | ||

| STZ / Constellation Brands, Inc. | Short | -0.00 | -27.54 | -0.46 | -35.00 | -0.0860 | 0.0506 | ||

| DHR / Danaher Corporation | Short | -0.00 | -0.46 | -0.0862 | -0.0862 | ||||

| PEP / PepsiCo, Inc. | Short | -0.00 | -0.46 | -0.0873 | -0.0873 | ||||

| Smurfit WestRock PLC / EC (IE00028FXN24) | Short | -0.01 | -0.47 | -0.0880 | -0.0880 | ||||

| EMR / Emerson Electric Co. | Short | -0.00 | -0.47 | -0.0884 | -0.0884 | ||||

| ISRG / Intuitive Surgical, Inc. | Short | -0.00 | -33.43 | -0.47 | -29.32 | -0.0888 | 0.0276 | ||

| UPS / United Parcel Service, Inc. | Short | -0.00 | -0.00 | -0.47 | -7.44 | -0.0893 | 0.0002 | ||

| IEX / IDEX Corporation | Short | -0.00 | -0.48 | -0.0902 | -0.0902 | ||||

| CVX / Chevron Corporation | Short | -0.00 | -0.00 | -0.48 | -1.63 | -0.0911 | -0.0052 | ||

| QSR / Restaurant Brands International Inc. | Short | -0.01 | -0.00 | -0.48 | -9.72 | -0.0913 | 0.0023 | ||

| TDG / TransDigm Group Incorporated | Short | -0.00 | -0.49 | -0.0916 | -0.0916 | ||||

| INVH / Invitation Homes Inc. | Short | -0.02 | -0.49 | -0.0916 | -0.0916 | ||||

| EXE / Expand Energy Corporation | Short | -0.01 | -0.50 | -0.0949 | -0.0949 | ||||

| RBLX / Roblox Corporation | Short | -0.01 | -33.06 | -0.51 | -12.52 | -0.0963 | 0.0057 | ||

| SBUX / Starbucks Corporation | Short | -0.01 | -0.00 | -0.52 | -6.35 | -0.0974 | -0.0009 | ||

| DKNG / DraftKings Inc. | Short | -0.01 | -0.00 | -0.53 | -5.05 | -0.0993 | -0.0023 | ||

| WST / West Pharmaceutical Services, Inc. | Short | -0.00 | -0.00 | -0.53 | 9.09 | -0.0997 | -0.0150 | ||

| ROK / Rockwell Automation, Inc. | Short | -0.00 | -0.54 | -0.1024 | -0.1024 | ||||

| LUV / Southwest Airlines Co. | Short | -0.02 | -0.00 | -0.54 | 13.36 | -0.1025 | -0.0188 | ||

| MNST / Monster Beverage Corporation | Short | -0.01 | -0.00 | -0.55 | 0.74 | -0.1030 | -0.0082 | ||

| HES / Hess Corporation | Short | -0.00 | -0.00 | -0.55 | -1.97 | -0.1032 | -0.0055 | ||

| FNV / Franco-Nevada Corporation | Short | -0.00 | -0.00 | -0.55 | -5.35 | -0.1034 | -0.0021 | ||

| BA / The Boeing Company | Short | -0.00 | -0.00 | -0.56 | 16.36 | -0.1062 | -0.0216 | ||

| KVUE / Kenvue Inc. | Short | -0.03 | -0.00 | -0.56 | -7.70 | -0.1063 | 0.0005 | ||

| AON / Aon plc | Short | -0.00 | -0.00 | -0.56 | 3.87 | -0.1064 | -0.0114 | ||

| EQT / EQT Corporation | Short | -0.01 | -0.00 | -0.58 | 25.82 | -0.1085 | -0.0286 | ||

| TTWO / Take-Two Interactive Software, Inc. | Short | -0.00 | -0.00 | -0.58 | 19.71 | -0.1101 | -0.0249 | ||

| AJG / Arthur J. Gallagher & Co. | Short | -0.00 | -0.00 | -0.60 | 0.84 | -0.1129 | -0.0092 | ||

| CDNS / Cadence Design Systems, Inc. | Short | -0.00 | -0.00 | -0.61 | 10.95 | -0.1147 | -0.0188 | ||

| XLRE / The Select Sector SPDR Trust - The Real Estate Select Sector SPDR Fund | Short | -0.02 | -0.00 | -0.63 | -8.96 | -0.1189 | 0.0022 | ||

| MSCI / MSCI Inc. | Short | -0.00 | -0.00 | -0.63 | 2.93 | -0.1193 | -0.0119 | ||

| CLX / The Clorox Company | Short | -0.00 | -0.00 | -0.64 | -0.31 | -0.1200 | -0.0084 | ||

| ARES / Ares Management Corporation | Short | -0.00 | -0.00 | -0.66 | 13.50 | -0.1254 | -0.0231 | ||

| IGV / iShares Trust - iShares Expanded Tech-Software Sector ETF | Short | -0.01 | -0.00 | -0.86 | 12.03 | -0.1618 | -0.0279 | ||

| SOXX / iShares Trust - iShares Semiconductor ETF | Short | -0.00 | -0.00 | -1.02 | -6.54 | -0.1915 | -0.0015 | ||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | Short | -0.00 | -64.41 | -1.07 | -63.69 | -0.2016 | 0.3127 | ||

| IYT / iShares Trust - iShares U.S. Transportation ETF | Short | -0.02 | -0.00 | -1.09 | -1.98 | -0.2054 | -0.0112 | ||

| IDU / iShares Trust - iShares U.S. Utilities ETF | Short | -0.02 | -0.00 | -1.63 | -5.72 | -0.3078 | -0.0053 | ||

| IVW / iShares Trust - iShares S&P 500 Growth ETF | Short | -0.03 | -25.51 | -2.84 | -21.03 | -0.5365 | 0.0931 | ||

| QQQ / Invesco QQQ Trust, Series 1 | Short | -0.04 | 1,685.15 | -21.32 | 1,770.00 | -4.0214 | -3.8220 |