Mga Batayang Estadistika

| Nilai Portofolio | $ 764,257,678 |

| Posisi Saat Ini | 359 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

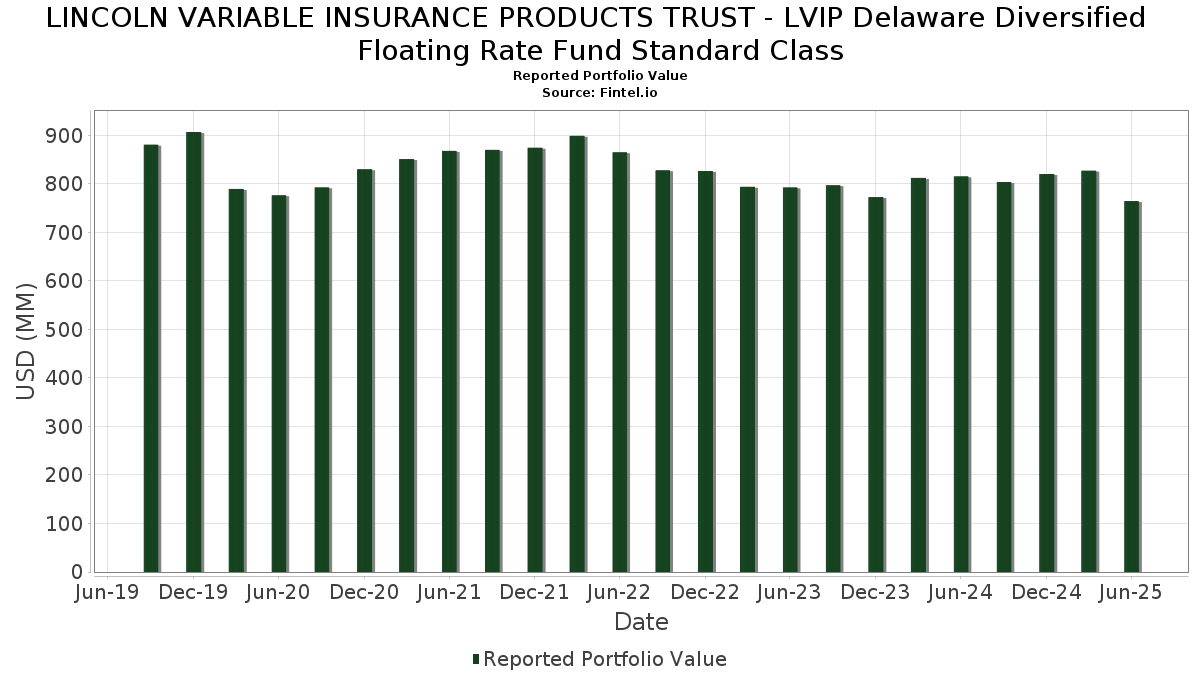

LINCOLN VARIABLE INSURANCE PRODUCTS TRUST - LVIP Delaware Diversified Floating Rate Fund Standard Class telah mengungkapkan total kepemilikan 359 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 764,257,678 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama LINCOLN VARIABLE INSURANCE PRODUCTS TRUST - LVIP Delaware Diversified Floating Rate Fund Standard Class adalah State Street Institutional Investment Trust - State Street Institutional US Govt Money Market Fnd Premier Cls (US:GVMXX) , International Bank for Reconstruction & Development (XX:US459058KG74) , Inter-American Development Bank (XX:US4581X0EC87) , International Bank for Reconstruction & Development (XX:US459058JU87) , and ONTARIO TEACHERS FINANCE 144A LIFE SR UNSEC 3.0% 04-13-27 (CA:US68329AAL26) . Posisi baru LINCOLN VARIABLE INSURANCE PRODUCTS TRUST - LVIP Delaware Diversified Floating Rate Fund Standard Class meliputi: International Bank for Reconstruction & Development (XX:US459058KG74) , Inter-American Development Bank (XX:US4581X0EC87) , International Bank for Reconstruction & Development (XX:US459058JU87) , ONTARIO TEACHERS FINANCE 144A LIFE SR UNSEC 3.0% 04-13-27 (CA:US68329AAL26) , and Province of British Columbia Canada (CA:US11070TAM09) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 155.86 | 20.3473 | 20.3473 | ||

| 5.96 | 0.7786 | 0.7786 | ||

| 4.79 | 4.79 | 0.6253 | 0.6253 | |

| 2.51 | 0.3279 | 0.3279 | ||

| 2.06 | 0.2692 | 0.2692 | ||

| 2.00 | 0.2611 | 0.2611 | ||

| 1.59 | 0.2075 | 0.2075 | ||

| 1.58 | 0.2062 | 0.2062 | ||

| 1.51 | 0.1968 | 0.1968 | ||

| 1.51 | 0.1965 | 0.1965 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 14.63 | 14.63 | 1.9103 | -7.0839 | |

| 1.50 | 0.1956 | -1.6533 | ||

| 1.37 | 0.1795 | -0.4134 | ||

| -2.50 | -2.50 | -0.3258 | -0.3258 | |

| 3.13 | 0.4081 | -0.2831 | ||

| 1.91 | 0.2497 | -0.2688 | ||

| 4.32 | 0.5639 | -0.2135 | ||

| -1.33 | -0.1737 | -0.1737 | ||

| 0.39 | 0.0509 | -0.1659 | ||

| 6.12 | 0.7988 | -0.1261 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-06 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| U.S. Treasury Floating Rate Notes / DBT (US91282CMX64) | 155.86 | 20.3473 | 20.3473 | ||||||

| U.S. Treasury Floating Rate Notes / DBT (US91282CKM28) | 28.75 | 0.00 | 3.7529 | 0.1689 | |||||

| GVMXX / State Street Institutional Investment Trust - State Street Institutional US Govt Money Market Fnd Premier Cls | 14.63 | -79.72 | 14.63 | -79.72 | 1.9103 | -7.0839 | |||

| US459058KG74 / International Bank for Reconstruction & Development | 11.99 | 0.01 | 1.5659 | 0.0706 | |||||

| Huntington Auto Trust 2024-1 / ABS-O (US446144AE71) | 10.09 | -0.10 | 1.3170 | 0.0580 | |||||

| US4581X0EC87 / Inter-American Development Bank | 9.98 | -0.06 | 1.3027 | 0.0579 | |||||

| US459058JU87 / International Bank for Reconstruction & Development | 9.95 | 0.02 | 1.2992 | 0.0587 | |||||

| US68329AAL26 / ONTARIO TEACHERS FINANCE 144A LIFE SR UNSEC 3.0% 04-13-27 | 9.84 | 0.67 | 1.2846 | 0.0660 | |||||

| US11070TAM09 / Province of British Columbia Canada | 8.34 | 0.71 | 1.0888 | 0.0563 | |||||

| US34528QGA67 / Ford Credit Floorplan Master Owner Trust A | 8.14 | 0.04 | 1.0628 | 0.0482 | |||||

| US3134GWH823 / Federal Home Loan Mortgage Corp | 8.11 | 0.87 | 1.0583 | 0.0564 | |||||

| US3132DWHE66 / UMBS | 8.10 | -2.13 | 1.0580 | 0.0256 | |||||

| International Bank for Reconstruction & Development / DBT (US459058LG65) | 8.00 | 0.00 | 1.0445 | 0.0470 | |||||

| US563469VC69 / Province of Manitoba Canada | 7.89 | 0.70 | 1.0295 | 0.0532 | |||||

| US46645JAD46 / JPMBB COMMERCIAL MORTGAGE SECURITIES TRUST 2015-C3 JPMBB 2015-C33 A4 | 7.67 | -3.17 | 1.0019 | 0.0137 | |||||

| US17328CAD48 / Citigroup Commercial Mortgage Trust 2019-C7 | 7.52 | 2.12 | 0.9819 | 0.0636 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 7.31 | -5.39 | 0.9540 | -0.0090 | |||||

| US36258RBA05 / GS MORTGAGE SECURITIES TRUST 2020-GC47 GSMS 2020-GC47 A5 | 7.20 | 1.64 | 0.9402 | 0.0568 | |||||

| US08162MAX65 / Benchmark 2020-B17 Mortgage Trust | 7.07 | 1.78 | 0.9232 | 0.0570 | |||||

| US459058KD44 / International Bank for Reconstruction & Development | 6.99 | -0.03 | 0.9121 | 0.0408 | |||||

| US4581X0DW50 / Inter-American Development Bank | 6.95 | -0.01 | 0.9080 | 0.0408 | |||||

| US3132DWJG96 / Federal Home Loan Mortgage Corp. | 6.50 | -3.45 | 0.8482 | 0.0093 | |||||

| US3133WKN510 / Freddie Mac Pool | 6.41 | -2.06 | 0.8372 | 0.0208 | |||||

| ARI Fleet Lease Trust 2024-B / ABS-O (US04033HAB15) | 6.12 | -17.52 | 0.7988 | -0.1261 | |||||

| US4581X0DT22 / Inter-American Development Bank | 6.00 | 0.07 | 0.7839 | 0.0358 | |||||

| US298785JS67 / EUROPEAN INVESTMENT BANK | 5.99 | 0.39 | 0.7816 | 0.0380 | |||||

| U.S. Treasury Notes / DBT (US91282CNC19) | 5.96 | 0.7786 | 0.7786 | ||||||

| US31418EM236 / Fannie Mae Pool | 5.71 | -4.21 | 0.7459 | 0.0022 | |||||

| Hyundai Auto Lease Securitization Trust 2024-A / ABS-O (US448988AD77) | 5.11 | -0.10 | 0.6676 | 0.0295 | |||||

| Q / Quetzal Copper Corp. | 5.10 | 0.87 | 0.6659 | 0.0355 | |||||

| US08162WBC91 / BENCHMARK MORTGAGE TRUST BMARK 2020 B19 A5 | 5.06 | 1.83 | 0.6606 | 0.0411 | |||||

| PFS Financing Corp / ABS-O (US69335PFE07) | 5.05 | 0.26 | 0.6591 | 0.0313 | |||||

| US682142AF15 / OMERS Finance Trust | 4.89 | 0.80 | 0.6382 | 0.0336 | |||||

| SWAP CCPC JP MORGAN COC / STIV (000000000) | 4.79 | 4.79 | 0.6253 | 0.6253 | |||||

| US08160KAE47 / BENCHMARK MORTGAGE TRUST SERIES 2019-B15 CLASS A5 | 4.78 | 1.64 | 0.6246 | 0.0377 | |||||

| US61747YEX94 / Morgan Stanley | 4.78 | -0.35 | 0.6234 | 0.0260 | |||||

| US31418EJ687 / Federal National Mortgage Association (FNMA) | 4.69 | -2.39 | 0.6122 | 0.0131 | |||||

| US161571HN70 / Chase Issuance Trust | 4.51 | 0.16 | 0.5891 | 0.0274 | |||||

| US08163NBJ37 / BMARK 22-B32 A5 3.0019% 01-15-55/01-21-32 | 4.41 | 2.34 | 0.5756 | 0.0384 | |||||

| Mercedes-Benz Auto Lease Trust 2024-A / ABS-O (US58770JAC80) | 4.32 | -30.73 | 0.5639 | -0.2135 | |||||

| US3134GXS471 / FREDDIE MAC 4.200000% 08/28/2025 | 4.22 | 0.12 | 0.5507 | 0.0254 | |||||

| US31418EP387 / UMBS | 4.04 | -2.84 | 0.5268 | 0.0090 | |||||

| Wheels Fleet Lease Funding 1 LLC / ABS-O (US96328GBZ90) | 4.02 | 0.12 | 0.5247 | 0.0242 | |||||

| US30220L2B92 / Export Finance & Insurance Corp | 3.97 | 0.28 | 0.5180 | 0.0247 | |||||

| US00206RML32 / AT&T Inc | 3.71 | 0.76 | 0.4849 | 0.0253 | |||||

| US06539WBB19 / BANK 2020-BNK25 BANK 2020-BN25 A5 | 3.63 | 1.85 | 0.4739 | 0.0295 | |||||

| Toyota Auto Receivables 2024-B Owner Trust / ABS-O (US89237NAD93) | 3.55 | -0.08 | 0.4630 | 0.0205 | |||||

| US3132DWE664 / UMBS | 3.35 | -2.16 | 0.4377 | 0.0105 | |||||

| CNH Equipment Trust 2024-B / ABS-O (US18978JAC27) | 3.13 | -43.61 | 0.4081 | -0.2831 | |||||

| US36179XFJ00 / Ginnie Mae II Pool | 3.09 | -3.44 | 0.4034 | 0.0044 | |||||

| US08163BBA89 / Benchmark 2020-B22 Mortgage Trust | 3.00 | 2.11 | 0.3920 | 0.0254 | |||||

| DVAI34 / DaVita Inc. - Depositary Receipt (Common Stock) | 2.99 | 0.44 | 0.3906 | 0.0192 | |||||

| US25159MAZ05 / Development Bank of Japan Inc | 2.98 | 0.98 | 0.3892 | 0.0211 | |||||

| US22822VAV36 / Crown Castle International Corp | 2.91 | 1.04 | 0.3803 | 0.0208 | |||||

| US70015QAA67 / Park Avenue Institutional Advisers CLO Ltd 2021-1 | 2.75 | 0.11 | 0.3596 | 0.0165 | |||||

| US35564K3F46 / Freddie Mac Stacr Remic Trust 2023-Hqa3 | 2.75 | -1.82 | 0.3593 | 0.0097 | |||||

| US38141GXX77 / Goldman Sachs Group Inc/The | 2.71 | -0.15 | 0.3536 | 0.0154 | |||||

| US3133KYZJ18 / Freddie Mac Pool | 2.63 | -4.84 | 0.3440 | -0.0011 | |||||

| Bank of America Corp / DBT (US06051GMD87) | 2.55 | 1.96 | 0.3326 | 0.0210 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 2.51 | 0.3279 | 0.3279 | ||||||

| ORCL / Oracle Corporation - Depositary Receipt (Common Stock) | 2.50 | 1.25 | 0.3268 | 0.0186 | |||||

| Peer Holding III BV 2023 USD Term Loan B4 / LON (XAN6872NAG15) | 2.49 | 0.48 | 0.3248 | 0.0160 | |||||

| US471068AS59 / JAPAN FIN ORG MUNICIPAL SR UNSECURED 144A 09/25 0.625 | 2.48 | 0.93 | 0.3242 | 0.0175 | |||||

| US20753BAA08 / Fannie Mae Connecticut Avenue Securities | 2.46 | -13.25 | 0.3214 | -0.0324 | |||||

| US95003QAS84 / WFCM_21-C61 | 2.44 | 1.08 | 0.3183 | 0.0175 | |||||

| Santander Drive Auto Receivables Trust 2025-1 / ABS-O (US80288DAF33) | 2.39 | 0.38 | 0.3117 | 0.0152 | |||||

| Zais Clo 16 Ltd / ABS-CBDO (US98875JBJ25) | 2.29 | 0.18 | 0.2989 | 0.0140 | |||||

| US61747YEV39 / Morgan Stanley | 2.19 | 0.14 | 0.2863 | 0.0133 | |||||

| US08163CBC29 / Benchmark 2021-B24 Mortgage Trust | 2.19 | 1.81 | 0.2859 | 0.0177 | |||||

| Charter Communications Operating LLC 2024 Term Loan B5 / LON (US16117LCE74) | 2.19 | 0.32 | 0.2858 | 0.0136 | |||||

| US3132DWFH16 / Freddie Mac Pool | 2.17 | -2.96 | 0.2830 | 0.0045 | |||||

| US47233WBM01 / Jefferies Financial Group, Inc. | 2.12 | 1.00 | 0.2773 | 0.0151 | |||||

| AmWINS Group Inc 2025 Term Loan B / LON (US03234TBA51) | 2.09 | 0.63 | 0.2728 | 0.0140 | |||||

| Rocket Cos Inc / DBT (US77311WAB72) | 2.06 | 0.2692 | 0.2692 | ||||||

| US131347CK09 / Calpine Corp. Bond | 2.04 | 0.34 | 0.2664 | 0.0128 | |||||

| COKE / Coca-Cola Consolidated, Inc. | 2.03 | 0.84 | 0.2650 | 0.0140 | |||||

| PNCS34 / The PNC Financial Services Group, Inc. - Depositary Receipt (Common Stock) | 2.03 | 0.85 | 0.2646 | 0.0141 | |||||

| Magnetite XL Ltd / ABS-CBDO (US55955RAA77) | 2.01 | 0.05 | 0.2619 | 0.0119 | |||||

| US44928XAY04 / ICG US CLO 2014-1 Ltd | 2.00 | 0.00 | 0.2612 | 0.0117 | |||||

| Marathon CLO 2021-16 Ltd / ABS-CBDO (US56580KAS42) | 2.00 | 0.2611 | 0.2611 | ||||||

| US56580KAA34 / Marathon CLO 2021-16 Ltd | 2.00 | 0.55 | 0.2611 | 0.0130 | |||||

| Boost Newco Borrower LLC 2025 USD Term Loan B / LON (US92943EAG17) | 1.99 | 0.76 | 0.2603 | 0.0135 | |||||

| USI Inc 2024 Term Loan D / LON (US90351NAR61) | 1.99 | 0.56 | 0.2593 | 0.0131 | |||||

| Trans Union LLC 2024 Term Loan B8 / LON (US89334GBF00) | 1.98 | 0.15 | 0.2587 | 0.0121 | |||||

| Flutter Financing BV 2024 Term Loan B / LON (XAN3313EAG51) | 1.96 | 0.05 | 0.2562 | 0.0116 | |||||

| US08163AAE38 / Benchmark Mortgage Trust, Series 2020-B18, Class A5 | 1.96 | 2.19 | 0.2555 | 0.0166 | |||||

| US46284NAV10 / Iron Mountain, Inc. 2023 Term Loan B | 1.92 | 0.26 | 0.2503 | 0.0119 | |||||

| A1JG34 / Arthur J. Gallagher & Co. - Depositary Receipt (Common Stock) | 1.91 | -54.02 | 0.2497 | -0.2688 | |||||

| US90385KAJ07 / BANK LOAN NOTE | 1.91 | -30.55 | 0.2497 | -0.0936 | |||||

| Fannie Mae Connecticut Avenue Securities / ABS-MBS (US20753GAA94) | 1.87 | -1.42 | 0.2440 | 0.0076 | |||||

| US24702HAE36 / Dell Equipment Finance Trust 2023-1 | 1.86 | -36.92 | 0.2432 | -0.1250 | |||||

| US13134NAH44 / CALPINE CONSTRUCTION FINANCE TERM B 1LN 07/20/2030 | 1.86 | 0.32 | 0.2428 | 0.0116 | |||||

| US05492VAF22 / BBCMS Mortgage Trust 2020-C7 | 1.78 | 2.42 | 0.2320 | 0.0157 | |||||

| Octagon Investment Partners 51 Ltd / ABS-CBDO (US675943AA23) | 1.70 | 0.89 | 0.2225 | 0.0119 | |||||

| UBSG34 / UBS Group AG - Depositary Receipt (Common Stock) | 1.70 | 1.01 | 0.2216 | 0.0121 | |||||

| Connecticut Avenue Securities Series 2025-R01 / ABS-MBS (US20755JAC71) | 1.67 | 0.48 | 0.2182 | 0.0107 | |||||

| US87612BBG68 / Targa Resources Partners LP / Targa Resources Partners Finance Corp | 1.65 | 0.06 | 0.2149 | 0.0098 | |||||

| US85172FAQ28 / Springleaf Finance Corp 6.625% 01/15/2028 | 1.59 | 0.2075 | 0.2075 | ||||||

| US70932MAD92 / PennyMac Financial Services Inc | 1.58 | 0.2062 | 0.2062 | ||||||

| Leidos Inc / DBT (US52532XAL91) | 1.58 | 61.68 | 0.2061 | 0.0843 | |||||

| Fannie Mae Connecticut Avenue Securities / ABS-MBS (US20754TAD46) | 1.57 | 0.38 | 0.2056 | 0.0100 | |||||

| AGL CLO 17 Ltd / ABS-CBDO (US00120DAJ54) | 1.55 | 0.58 | 0.2027 | 0.0103 | |||||

| US92867YAC84 / Volkswagen Auto Loan Enhanced Trust 2023-2 | 1.55 | -40.50 | 0.2020 | -0.1222 | |||||

| Celsius Holdings Inc Term Loan / LON (US15118XAB01) | 1.51 | 0.1968 | 0.1968 | ||||||

| US00774MAB19 / AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 1.51 | 0.80 | 0.1967 | 0.0104 | |||||

| Opal Bidco SAS USD Term Loan B / LON (XAF7000QAB77) | 1.51 | 0.1965 | 0.1965 | ||||||

| Stonepeak Nile Parent LLC Term Loan B / LON (US86184XAB01) | 1.50 | 0.80 | 0.1964 | 0.0102 | |||||

| Alliance Laundry Systems LLC 2024 Term Loan B / LON (US01862LBA52) | 1.50 | 0.60 | 0.1961 | 0.0099 | |||||

| US923260AC79 / Venture 42 CLO Ltd | 1.50 | 0.07 | 0.1960 | 0.0089 | |||||

| Dragon Buyer Inc Term Loan B / LON (US26143FAB58) | 1.50 | -89.90 | 0.1956 | -1.6533 | |||||

| Lightning Power LLC Term Loan B / LON (US53229LAB36) | 1.50 | 1.29 | 0.1956 | 0.0112 | |||||

| US89364MCA09 / TRANSDIGM INC | 1.49 | 0.54 | 0.1952 | 0.0098 | |||||

| Roper Industrial Products Investment Company LLC 2024 USD 1st Lien Term Loan B / LON (US77669LAK98) | 1.49 | 0.07 | 0.1943 | 0.0088 | |||||

| Cotiviti Corporation 2024 Term Loan / LON (US22164MAB37) | 1.48 | 1.50 | 0.1937 | 0.0114 | |||||

| US29374GAB77 / Enterprise Fleet Financing 2022-4 LLC | 1.46 | -23.62 | 0.1909 | -0.0478 | |||||

| Fannie Mae Connecticut Avenue Securities / ABS-MBS (US20755TAC53) | 1.45 | 0.1888 | 0.1888 | ||||||

| US3137H9C983 / Federal Home Loan Mortgage Corporation Multifamily Structured Pass Through Certificates | 1.43 | 0.1870 | 0.1870 | ||||||

| Bunge Ltd Finance Corp / DBT (US120568BE94) | 1.43 | 0.56 | 0.1866 | 0.0095 | |||||

| Amentum Government Services Holdings LLC 2024 Term Loan B / LON (US02351XAB47) | 1.42 | -1.87 | 0.1849 | 0.0049 | |||||

| US29273VAN01 / Energy Transfer LP | 1.41 | 0.57 | 0.1842 | 0.0093 | |||||

| US362548AD16 / GM Financial Automobile Leasing Trust 2023-2 | 1.37 | -71.10 | 0.1795 | -0.4134 | |||||

| US06051GLC14 / BANK OF AMERICA CORP | 1.37 | 0.15 | 0.1787 | 0.0083 | |||||

| US20755CAA62 / Connecticut Avenue Securities Trust 2023-R08 | 1.34 | -12.69 | 0.1744 | -0.0162 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 1.32 | 0.1718 | 0.1718 | ||||||

| Janney Montgomery Scott LLC Term Loan / LON (US48171UAB17) | 1.29 | 0.62 | 0.1690 | 0.0086 | |||||

| Henneman Trust / DBT (US425911AA21) | 1.28 | 0.1673 | 0.1673 | ||||||

| US31418ES688 / FNCL UMBS 6.0 MA5040 06-01-53 | 1.28 | -3.98 | 0.1669 | 0.0009 | |||||

| US04538FAD15 / Asplundh Tree Expert LLC | 1.26 | 0.08 | 0.1640 | 0.0075 | |||||

| Ballyrock CLO 27 Ltd / ABS-CBDO (US05874UAA34) | 1.25 | 0.00 | 0.1634 | 0.0074 | |||||

| Azorra Soar TLB Finance Ltd Term Loan B / LON (XAG0754AAB44) | 1.25 | -0.08 | 0.1626 | 0.0072 | |||||

| UNPD / Union Pacific Corporation - Depositary Receipt (Common Stock) | 1.23 | -0.96 | 0.1610 | 0.0057 | |||||

| US64953BBF40 / New York Life Global Funding | 1.23 | -0.24 | 0.1609 | 0.0069 | |||||

| Caesars Entertainment Inc 2024 Term Loan B1 / LON (US12768EAH99) | 1.23 | 0.41 | 0.1608 | 0.0078 | |||||

| Setanta Aircraft Leasing Designated Activity Company 2024 Term Loan B / LON (XAG8057JAC09) | 1.23 | 0.16 | 0.1607 | 0.0075 | |||||

| US925650AC72 / VICI Properties LP | 1.21 | 1.51 | 0.1582 | 0.0093 | |||||

| US693475BU84 / PNC Financial Services Group Inc/The | 1.20 | 1.10 | 0.1562 | 0.0087 | |||||

| Mars Inc / DBT (US571676AY11) | 1.19 | 0.76 | 0.1554 | 0.0081 | |||||

| Generate CLO 10 Ltd / ABS-CBDO (US37148DAY22) | 1.19 | -1.00 | 0.1549 | 0.0054 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 1.18 | 0.34 | 0.1547 | 0.0075 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 1.18 | 0.1546 | 0.1546 | ||||||

| Bank of America Corp / DBT (US06051GML04) | 1.17 | 1.13 | 0.1525 | 0.0084 | |||||

| RIO TINTO FIN USA PLC / DBT (US76720AAR77) | 1.16 | -41.64 | 0.1513 | -0.0964 | |||||

| US38141GA468 / Goldman Sachs Group Inc/The | 1.15 | 0.35 | 0.1503 | 0.0074 | |||||

| Canyon CLO 2020-2 Ltd / ABS-CBDO (US13876NAW39) | 1.14 | -0.35 | 0.1492 | 0.0061 | |||||

| US92840VAQ59 / Vistra Operations Co. LLC | 1.14 | 2.24 | 0.1491 | 0.0098 | |||||

| E1OG34 / EOG Resources, Inc. - Depositary Receipt (Common Stock) | 1.13 | 0.1481 | 0.1481 | ||||||

| US3137H7M911 / Freddie Mac Multifamily Structured Pass Through Certificates | 1.10 | 0.1442 | 0.1442 | ||||||

| C1FG34 / Citizens Financial Group, Inc. - Depositary Receipt (Common Stock) | 1.10 | 0.82 | 0.1442 | 0.0076 | |||||

| U.S. Treasury Notes / DBT (US91282CNK35) | 1.09 | 0.1428 | 0.1428 | ||||||

| Clydesdale Acquisition Holdings Inc 2025 Term Loan B / LON (US18972FAE25) | 1.08 | 0.19 | 0.1405 | 0.0065 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 1.07 | 0.75 | 0.1401 | 0.0073 | |||||

| US61747YFH36 / Morgan Stanley | 1.06 | 0.38 | 0.1390 | 0.0067 | |||||

| US61747YFJ91 / Morgan Stanley | 1.06 | 1.05 | 0.1381 | 0.0076 | |||||

| Mars Inc / DBT (US571676BA26) | 1.05 | 0.67 | 0.1367 | 0.0070 | |||||

| Accenture Capital Inc / DBT (US00440KAB98) | 1.03 | 0.78 | 0.1349 | 0.0071 | |||||

| US06051GLS65 / Bank of America Corp | 1.03 | 0.59 | 0.1338 | 0.0067 | |||||

| Toyota Auto Receivables 2024-A Owner Trust / ABS-O (US89238DAD03) | 1.01 | 0.00 | 0.1313 | 0.0059 | |||||

| US3137HB2L74 / FREDDIE MAC MULTIFAMILY STRUCTURED PASS THROUGH CERTIFICATES | 1.01 | 0.1312 | 0.1312 | ||||||

| VVV / Valvoline Inc. | 1.00 | 0.40 | 0.1309 | 0.0064 | |||||

| Freddie Mac STACR REMIC Trust 2024-DNA3 / ABS-MBS (US35564NEZ24) | 1.00 | -23.21 | 0.1304 | -0.0319 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 1.00 | 0.1304 | 0.1304 | ||||||

| Instructure Holdings Inc 2024 Term Loan / LON (000000000) | 1.00 | 0.1303 | 0.1303 | ||||||

| US513076BB49 / LAMAR MEDIA TERM B 1LN 01/30/2027 | 1.00 | 0.10 | 0.1303 | 0.0060 | |||||

| US88233FAK66 / Vistra Operations Co. LLC, Term Loan | 1.00 | 0.30 | 0.1302 | 0.0063 | |||||

| United Rentals Inc 2024 Term Loan B / LON (US91136EAL92) | 0.99 | 0.00 | 0.1299 | 0.0059 | |||||

| Quikrete Holdings Inc 2025 Term Loan B1 / LON (US74839XAM11) | 0.99 | 0.71 | 0.1296 | 0.0067 | |||||

| Ardonagh Midco 3 PLC 2024 USD Term Loan B / LON (XAQ0500HAB59) | 0.99 | 0.20 | 0.1291 | 0.0061 | |||||

| Zekelman Industries Inc 2024 Term Loan B / LON (US98931YAD58) | 0.99 | -0.30 | 0.1289 | 0.0053 | |||||

| Foundry JV Holdco LLC / DBT (US350930AH62) | 0.97 | 1.04 | 0.1263 | 0.0069 | |||||

| CAT / Caterpillar Inc. - Depositary Receipt (Common Stock) | 0.96 | 0.1258 | 0.1258 | ||||||

| LLY / Eli Lilly and Company - Depositary Receipt (Common Stock) | 0.92 | 0.55 | 0.1204 | 0.0060 | |||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 0.92 | 1.88 | 0.1203 | 0.0075 | |||||

| US12513GBH11 / CDW LLC / CDW Finance Corp | 0.92 | 1.32 | 0.1202 | 0.0069 | |||||

| BK / The Bank of New York Mellon Corporation - Depositary Receipt (Common Stock) | 0.92 | 1.32 | 0.1200 | 0.0068 | |||||

| Morgan Stanley Bank NA / DBT (US61690U8B93) | 0.91 | 0.22 | 0.1193 | 0.0057 | |||||

| USB / U.S. Bancorp - Depositary Receipt (Common Stock) | 0.91 | 1.00 | 0.1189 | 0.0064 | |||||

| Aramark Services Inc 2024 Term Loan B7 / LON (US03852JAU51) | 0.90 | 0.22 | 0.1180 | 0.0055 | |||||

| US097023DG73 / Boeing Co/The | 0.90 | 0.56 | 0.1169 | 0.0059 | |||||

| Midcontinent Communications / DBT (US59565XAD21) | 0.88 | 4.65 | 0.1147 | 0.0100 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0.87 | 0.12 | 0.1132 | 0.0051 | |||||

| US82967NBG25 / SIRIUS XM RADIO INC COMPANY GUAR 144A 07/30 4.125 | 0.86 | 3.75 | 0.1119 | 0.0090 | |||||

| UNPD / Union Pacific Corporation - Depositary Receipt (Common Stock) | 0.85 | 0.83 | 0.1115 | 0.0059 | |||||

| D1TE34 / DTE Energy Company - Depositary Receipt (Common Stock) | 0.85 | 0.59 | 0.1112 | 0.0057 | |||||

| ACA / Crédit Agricole S.A. | 0.85 | 0.1110 | 0.1110 | ||||||

| Canyon Capital CLO 2019-2 Ltd / ABS-CBDO (US13887WAS98) | 0.85 | 0.59 | 0.1110 | 0.0056 | |||||

| CNH Equipment Trust 2024-A / ABS-O (US18978FAB22) | 0.85 | -41.48 | 0.1108 | -0.0698 | |||||

| US Bank NA/Cincinnati OH / DBT (US90331HPS66) | 0.84 | 0.1096 | 0.1096 | ||||||

| Jazz Financing Lux Sarl 2024 1st Lien Term Loan B / LON (XAG5080AAJ16) | 0.84 | 0.00 | 0.1095 | 0.0050 | |||||

| D1OM34 / Dominion Energy, Inc. - Depositary Receipt (Common Stock) | 0.84 | 1.58 | 0.1092 | 0.0066 | |||||

| Amentum Holdings Inc / DBT (US02352BAA35) | 0.83 | 4.65 | 0.1088 | 0.0095 | |||||

| Caesars Entertainment Inc / DBT (US12769GAC42) | 0.83 | 2.97 | 0.1085 | 0.0078 | |||||

| JBS USA Holding Lux Sarl / JBS USA Foods Group Holdings Inc / JBS USA Food Co / DBT (US472140AE22) | 0.83 | 0.1079 | 0.1079 | ||||||

| BNP / BNP Paribas SA | 0.82 | 0.1070 | 0.1070 | ||||||

| Woodside Finance Ltd / DBT (US980236AU78) | 0.82 | 0.1070 | 0.1070 | ||||||

| Enterprise Products Operating LLC / DBT (US29379VCK70) | 0.81 | 0.1059 | 0.1059 | ||||||

| US92328MAC73 / Venture Global Calcasieu Pass LLC | 0.81 | 1.51 | 0.1056 | 0.0063 | |||||

| Freddie Mac Stacr Remic Trust 2025-Hqa1 / ABS-MBS (US35564NHA46) | 0.80 | 1.01 | 0.1047 | 0.0057 | |||||

| Bain Capital Credit CLO 2021-7 Ltd / ABS-CBDO (US05682NAL73) | 0.80 | 0.88 | 0.1047 | 0.0056 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0.79 | 0.1037 | 0.1037 | ||||||

| AVGO / Broadcom Inc. - Depositary Receipt (Common Stock) | 0.78 | 1.04 | 0.1016 | 0.0055 | |||||

| BK / The Bank of New York Mellon Corporation - Depositary Receipt (Common Stock) | 0.78 | 0.26 | 0.1013 | 0.0048 | |||||

| US00108WAF77 / AEP Texas Inc. | 0.77 | 0.92 | 0.1004 | 0.0053 | |||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 0.77 | 1.73 | 0.0999 | 0.0061 | |||||

| CLF / Cleveland-Cliffs Inc. | 0.76 | -1.80 | 0.0997 | 0.0028 | |||||

| ENB.PRN / Enbridge Inc. - Preferred Security | 0.76 | 0.0995 | 0.0995 | ||||||

| US89788MAE21 / Truist Financial Corp | 0.75 | 1.48 | 0.0984 | 0.0059 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0.75 | 0.67 | 0.0977 | 0.0051 | |||||

| COLOSSUS ACQUIRECO LLC TERM LOAN B / LON (000000000) | 0.74 | 0.0972 | 0.0972 | ||||||

| DGZ / DB Gold Short ETN | 0.74 | 0.0968 | 0.0968 | ||||||

| US69120VAU52 / BLUE OWL CREDIT 7.75 1/29 | 0.74 | 0.0967 | 0.0967 | ||||||

| US174610BA28 / Citizens Financial Group Inc | 0.74 | 0.54 | 0.0965 | 0.0049 | |||||

| US29365BAA17 / ENTG 4 3/4 04/15/29 | 0.73 | 2.52 | 0.0955 | 0.0066 | |||||

| US91159HJK77 / US Bancorp | 0.72 | 0.56 | 0.0942 | 0.0048 | |||||

| ATHS / Athene Holding Ltd. - Corporate Bond/Note | 0.71 | 0.0922 | 0.0922 | ||||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 0.70 | 0.86 | 0.0917 | 0.0049 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0.69 | 1.03 | 0.0897 | 0.0049 | |||||

| US11135FBK66 / BROADCOM INC 3.419% 04/15/2033 144A | 0.67 | 1.83 | 0.0873 | 0.0054 | |||||

| US25160PAN78 / Deutsche Bank AG | 0.66 | -0.15 | 0.0857 | 0.0036 | |||||

| Long: BIE29FU96 IRS USD R V 12MSOFR BIE29FU96 CCP OIS / Short: BIE29FU96 IRS USD P F .27649 BIE29FU96 CCP OIS / DIR (000000000) | 0.65 | 0.0854 | 0.0854 | ||||||

| Ballyrock CLO 18 Ltd / ABS-CBDO (US05875YAQ98) | 0.65 | 0.00 | 0.0850 | 0.0038 | |||||

| HCA Inc / DBT (US404121AK12) | 0.65 | 1.72 | 0.0849 | 0.0052 | |||||

| PNCS34 / The PNC Financial Services Group, Inc. - Depositary Receipt (Common Stock) | 0.65 | 1.56 | 0.0848 | 0.0050 | |||||

| US07330MAC10 / Truist Bank | 0.65 | 1.10 | 0.0842 | 0.0046 | |||||

| US05401AAB70 / Avolon Holdings Funding Ltd | 0.64 | 0.95 | 0.0833 | 0.0045 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0.63 | 0.0818 | 0.0818 | ||||||

| PNCS34 / The PNC Financial Services Group, Inc. - Depositary Receipt (Common Stock) | 0.62 | 1.31 | 0.0807 | 0.0046 | |||||

| Accenture Capital Inc / DBT (US00440KAC71) | 0.61 | 0.99 | 0.0802 | 0.0043 | |||||

| US00774MAV72 / AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 0.61 | 0.82 | 0.0801 | 0.0042 | |||||

| M1TB34 / M&T Bank Corporation - Depositary Receipt (Common Stock) | 0.61 | 0.0796 | 0.0796 | ||||||

| 081437AG0 / Bemis Inc Notes 5.65% 08/01/14 | 0.61 | 1.00 | 0.0795 | 0.0044 | |||||

| Freddie Mac STACR REMIC Trust 2025-DNA2 / ABS-MBS (US35564NJA28) | 0.61 | 0.0792 | 0.0792 | ||||||

| Siemens Funding BV / DBT (US82622RAD89) | 0.60 | 0.0788 | 0.0788 | ||||||

| FR00140066D6 / ENGIE - Loyalty Line 2024 | 0.60 | 0.33 | 0.0788 | 0.0038 | |||||

| Citibank NA / DBT (US17325FBF45) | 0.60 | -0.33 | 0.0783 | 0.0033 | |||||

| Bank of America Corp / DBT (US06055HAH66) | 0.60 | 0.0777 | 0.0777 | ||||||

| US733174AL01 / Popular Inc | 0.59 | 2.61 | 0.0770 | 0.0054 | |||||

| US85350EAB20 / Standard Industries, Inc., Term Loan B | 0.59 | -1.02 | 0.0765 | 0.0027 | |||||

| SYY / Sysco Corporation - Depositary Receipt (Common Stock) | 0.57 | 0.89 | 0.0742 | 0.0040 | |||||

| US09261HAC16 / Blackstone Private Credit Fund | 0.56 | 0.0736 | 0.0736 | ||||||

| CBAMR 2021-15 LLC / ABS-CBDO (US149918AL84) | 0.55 | 1.47 | 0.0725 | 0.0043 | |||||

| UBSG34 / UBS Group AG - Depositary Receipt (Common Stock) | 0.55 | 0.0721 | 0.0721 | ||||||

| OHA Credit Partners VII Ltd / ABS-CBDO (US67102QBT40) | 0.55 | 1.85 | 0.0721 | 0.0045 | |||||

| Madison Park Funding XXVII Ltd / ABS-CBDO (US55820YAW75) | 0.55 | 0.92 | 0.0721 | 0.0039 | |||||

| Elmwood CLO 22 Ltd / ABS-CBDO (US29001YAQ61) | 0.55 | 0.18 | 0.0720 | 0.0035 | |||||

| Aimco CLO 15 Ltd / ABS-CBDO (US00889BAH42) | 0.55 | 0.18 | 0.0720 | 0.0034 | |||||

| CIFC Funding 2025-I Ltd / ABS-CBDO (US12572VAG95) | 0.55 | 2.04 | 0.0718 | 0.0047 | |||||

| Dryden 109 CLO Ltd / ABS-CBDO (US26248KAS15) | 0.55 | 0.37 | 0.0714 | 0.0035 | |||||

| Magnetite Xlv Ltd / ABS-CBDO (US55956CAJ09) | 0.54 | -1.45 | 0.0708 | 0.0022 | |||||

| UBSG34 / UBS Group AG - Depositary Receipt (Common Stock) | 0.54 | 1.13 | 0.0701 | 0.0038 | |||||

| S1TT34 / State Street Corporation - Depositary Receipt (Common Stock) | 0.53 | 0.0698 | 0.0698 | ||||||

| US00912XBK90 / Air Lease Corp | 0.53 | 2.11 | 0.0696 | 0.0045 | |||||

| Siemens Funding BV / DBT (US82622RAC07) | 0.52 | 0.0679 | 0.0679 | ||||||

| US251526CS67 / Deutsche Bank AG/New York NY | 0.52 | 0.39 | 0.0675 | 0.0033 | |||||

| US17325FBC14 / CITIBANK NA | 0.51 | -0.19 | 0.0670 | 0.0029 | |||||

| US06051GLU12 / Bank of America Corp | 0.51 | 0.99 | 0.0668 | 0.0037 | |||||

| SVB Financial Trust / EP (US78500B2051) | 0.00 | 0.00 | 0.51 | 8.33 | 0.0663 | 0.0078 | |||

| US62675KAB52 / MURPHY USA TERM B 1LN 01/21/2028 | 0.50 | 0.0657 | 0.0657 | ||||||

| Signal Peak CLO 5 Ltd / ABS-CBDO (US82666VAA26) | 0.50 | 0.00 | 0.0655 | 0.0030 | |||||

| TCW CLO 2019-2 Ltd / ABS-CBDO (US87242BBQ23) | 0.50 | 1.01 | 0.0654 | 0.0036 | |||||

| OFSI BSL XII Ltd / ABS-CBDO (US67629HAL69) | 0.50 | 1.43 | 0.0650 | 0.0039 | |||||

| US031162DP23 / Amgen Inc | 0.50 | 0.41 | 0.0647 | 0.0031 | |||||

| Oaktree CLO 2020-1 Ltd / ABS-CBDO (US67402FBA66) | 0.50 | 0.81 | 0.0646 | 0.0034 | |||||

| US00206RJX17 / AT&T Inc | 0.49 | 0.82 | 0.0642 | 0.0034 | |||||

| USB / U.S. Bancorp - Depositary Receipt (Common Stock) | 0.49 | 1.45 | 0.0639 | 0.0036 | |||||

| PNCS34 / The PNC Financial Services Group, Inc. - Depositary Receipt (Common Stock) | 0.49 | 0.0635 | 0.0635 | ||||||

| ENB.PRN / Enbridge Inc. - Preferred Security | 0.48 | 0.0633 | 0.0633 | ||||||

| Long: BIE2LMDY1 IRS USD R V 12MSOFR BIE2LMDY1_FLO CCPOIS / Short: BIE2LMDY1 IRS USD P F .72295 BIE2LMDY1_FIX CCPOIS / DIR (000000000) | 0.47 | 0.0617 | 0.0617 | ||||||

| Leidos Inc / DBT (US52532XAK19) | 0.47 | 0.0613 | 0.0613 | ||||||

| NUE / Nucor Corporation - Depositary Receipt (Common Stock) | 0.47 | 1.75 | 0.0609 | 0.0037 | |||||

| KMIC34 / Kinder Morgan, Inc. - Depositary Receipt (Common Stock) | 0.46 | 1.10 | 0.0599 | 0.0033 | |||||

| US87264ADC62 / T-Mobile USA, Inc. | 0.46 | 0.44 | 0.0595 | 0.0030 | |||||

| E1OG34 / EOG Resources, Inc. - Depositary Receipt (Common Stock) | 0.45 | 0.0585 | 0.0585 | ||||||

| US91159HJP64 / US Bancorp | 0.45 | -0.45 | 0.0585 | 0.0024 | |||||

| US00774MAR60 / AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 0.44 | 0.68 | 0.0577 | 0.0030 | |||||

| US68389XCH61 / Oracle Corp | 0.43 | 0.93 | 0.0564 | 0.0030 | |||||

| E1XC34 / Exelon Corporation - Depositary Receipt (Common Stock) | 0.43 | 0.95 | 0.0556 | 0.0030 | |||||

| BBD.A / Bombardier Inc. | 0.43 | 4.68 | 0.0555 | 0.0048 | |||||

| US30251GBE61 / FMG RESOURCES AUGUST 2006 | 0.42 | 3.18 | 0.0551 | 0.0041 | |||||

| BBD.A / Bombardier Inc. | 0.42 | 4.47 | 0.0551 | 0.0048 | |||||

| US30251GBD88 / FMG Resources August 2006 Pty. Ltd. | 0.42 | 2.69 | 0.0549 | 0.0038 | |||||

| TransDigm Inc / DBT (US893647BV82) | 0.42 | 2.20 | 0.0547 | 0.0036 | |||||

| Siemens Funding BV / DBT (US82622RAE62) | 0.41 | 0.0538 | 0.0538 | ||||||

| US431318AV64 / HILCORP ENERGY I LP/FIN CO 6% 02/01/2031 144A | 0.41 | 3.54 | 0.0535 | 0.0041 | |||||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 0.41 | 0.25 | 0.0534 | 0.0025 | |||||

| US00914AAH59 / Air Lease Corp | 0.40 | 0.50 | 0.0522 | 0.0025 | |||||

| GEHC34 / GE HealthCare Technologies Inc. - Depositary Receipt (Common Stock) | 0.40 | 0.0520 | 0.0520 | ||||||

| GEHC34 / GE HealthCare Technologies Inc. - Depositary Receipt (Common Stock) | 0.39 | 0.0515 | 0.0515 | ||||||

| VICI / VICI Properties Inc. | 0.39 | 1.03 | 0.0513 | 0.0029 | |||||

| US073685AD12 / Beacon Roofing Supply Inc 4.875% 11/01/2025 144a Bond | 0.39 | 0.0510 | 0.0510 | ||||||

| Apollo Debt Solutions BDC / DBT (US03770DAD57) | 0.39 | -77.62 | 0.0509 | -0.1659 | |||||

| US431318AZ78 / Hilcorp Energy I LP | 0.39 | 2.12 | 0.0505 | 0.0033 | |||||

| US446150BC73 / Huntington Bancshares Inc/OH | 0.38 | -63.90 | 0.0500 | -0.0824 | |||||

| W1BD34 / Warner Bros. Discovery, Inc. - Depositary Receipt (Common Stock) | 0.38 | 0.0498 | 0.0498 | ||||||

| Vistra Operations Co LLC / DBT (US92840VAS16) | 0.38 | 2.99 | 0.0495 | 0.0035 | |||||

| E1OG34 / EOG Resources, Inc. - Depositary Receipt (Common Stock) | 0.38 | 0.0490 | 0.0490 | ||||||

| US00774MAN56 / AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 0.37 | -0.27 | 0.0477 | 0.0020 | |||||

| US37046US851 / General Motors Financial Co Inc | 0.36 | 0.0476 | 0.0476 | ||||||

| UBSG34 / UBS Group AG - Depositary Receipt (Common Stock) | 0.36 | 1.40 | 0.0475 | 0.0027 | |||||

| 69511JD28 / PACIFICORP | 0.35 | 0.57 | 0.0463 | 0.0023 | |||||

| US29278GAN88 / Enel Finance International NV | 0.35 | 1.43 | 0.0463 | 0.0028 | |||||

| US47233JGT97 / Jefferies Group LLC / Jefferies Group Capital Finance Inc | 0.35 | 2.92 | 0.0460 | 0.0033 | |||||

| T-Mobile USA Inc / DBT (US87264ADS15) | 0.34 | 1.19 | 0.0446 | 0.0026 | |||||

| US816851BK46 / Sempra Energy | 0.34 | 0.60 | 0.0442 | 0.0022 | |||||

| PEP / PepsiCo, Inc. - Depositary Receipt (Common Stock) | 0.34 | 0.90 | 0.0437 | 0.0022 | |||||

| US00108WAR16 / AEP Texas Inc | 0.33 | 0.60 | 0.0437 | 0.0023 | |||||

| HD / The Home Depot, Inc. - Depositary Receipt (Common Stock) | 0.33 | 0.30 | 0.0431 | 0.0020 | |||||

| US682680BJ18 / ONEOK Inc | 0.32 | 0.63 | 0.0419 | 0.0021 | |||||

| US14314LAC90 / Carlyle Global Market Strategies CLO 2014-2R Ltd | 0.32 | -36.07 | 0.0417 | -0.0206 | |||||

| Resideo Funding Inc / DBT (US76119LAD38) | 0.31 | 2.62 | 0.0409 | 0.0029 | |||||

| US24736CBS26 / Delta Air Lines, Inc. 2020 1st Lien Term Loan B | 0.31 | -9.41 | 0.0402 | -0.0022 | |||||

| US30231GBD34 / Exxon Mobil Corp. | 0.30 | 0.33 | 0.0397 | 0.0020 | |||||

| US37046US851 / General Motors Financial Co Inc | 0.30 | 1.72 | 0.0387 | 0.0025 | |||||

| USB / U.S. Bancorp - Depositary Receipt (Common Stock) | 0.29 | 1.03 | 0.0383 | 0.0021 | |||||

| US251526CU14 / DEUTSCHE BANK AG SR NON PREF 6.819% 11-20-29/28 | 0.27 | -66.37 | 0.0351 | -0.0643 | |||||

| Neuberger Berman CLO XX Ltd / ABS-CBDO (US64130TBS33) | 0.25 | 0.81 | 0.0328 | 0.0018 | |||||

| Janney Montgomery Scott LLC Delayed Draw Term Loan / LON (US48171UAD72) | 0.22 | 0.47 | 0.0281 | 0.0014 | |||||

| US880451AZ24 / TENNESSEE GAS PIPELINE REGD 144A P/P 2.90000000 | 0.21 | 1.44 | 0.0277 | 0.0016 | |||||

| 69511JD28 / PACIFICORP | 0.21 | 0.00 | 0.0273 | 0.0012 | |||||

| US00206RAG74 / At&t Inc. 6.3% Notes 1/15/38 | 0.21 | -0.49 | 0.0268 | 0.0011 | |||||

| US30303M8H84 / Meta Platforms, Inc. | 0.20 | 0.0257 | 0.0257 | ||||||

| US29379VCD38 / Enterprise Products Operating LLC | 0.19 | 1.06 | 0.0250 | 0.0014 | |||||

| US68389XCF06 / Oracle Corp | 0.19 | -0.52 | 0.0249 | 0.0010 | |||||

| US85816VAA44 / Steele Creek Clo 2017-1 Ltd | 0.19 | -36.95 | 0.0244 | -0.0125 | |||||

| US29278GAP37 / Enel Finance International NV | 0.18 | 2.22 | 0.0240 | 0.0016 | |||||

| US98138HAH49 / Workday Inc | 0.18 | 1.12 | 0.0236 | 0.0014 | |||||

| Long: BIE3AS5R2 IRS USD R V 12MSOFR BIE3AS5R2_FLO CCPOIS / Short: BIE3AS5R2 IRS USD P F 1.64690 BIE3AS5R2_FIX CCPOIS / DIR (000000000) | 0.18 | 0.0231 | 0.0231 | ||||||

| US91159HJH49 / US Bancorp | 0.18 | -0.57 | 0.0229 | 0.0010 | |||||

| Long: BIE5KTW29 IRS USD R V 00MSOFR BIE5KTW29_FLO CCPOIS / Short: BIE5KTW29 IRS USD P F 3.26497 BIE5KTW29_FIX CCPOIS / DIR (000000000) | 0.17 | 0.0216 | 0.0216 | ||||||

| Fannie Mae Connecticut Avenue Securities / ABS-MBS (US20754VAB36) | 0.16 | 0.0213 | 0.0213 | ||||||

| US06406RBL06 / Bank of New York Mellon Corp/The | 0.16 | 0.65 | 0.0203 | 0.0010 | |||||

| Radnor Re 2024-1 Ltd / ABS-MBS (US75049AAB89) | 0.15 | 0.00 | 0.0198 | 0.0009 | |||||

| A3KMYN / Air Lease Corporation - Preferred Stock | 0.14 | 1.48 | 0.0180 | 0.0011 | |||||

| Long: BIE24E7F6 IRS USD R V 12MSOFR BIE24E7F6 CCP OIS / Short: BIE24E7F6 IRS USD P F .09480 BIE24E7F6 CCP OIS / DIR (000000000) | 0.13 | 0.0167 | 0.0167 | ||||||

| US98138HAG65 / Workday Inc | 0.12 | 0.85 | 0.0155 | 0.0008 | |||||

| Ford Credit Auto Lease Trust 2024-A / ABS-O (US345290AD29) | 0.10 | 0.00 | 0.0131 | 0.0006 | |||||

| AVTR / Avantor, Inc. | 0.08 | -2.47 | 0.0104 | 0.0003 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0.06 | 0.00 | 0.0077 | 0.0004 | |||||

| Long: BIE3QDAK7 IRS USD R V 00MSOFR BIE3QDAK7_FLO CCPOIS / Short: BIE3QDAK7 IRS USD P F 2.81174 BIE3QDAK7_FIX CCPOIS / DIR (000000000) | 0.03 | 0.0040 | 0.0040 | ||||||

| US00912XBF06 / Air Lease Corp. | 0.02 | 4.35 | 0.0032 | 0.0002 | |||||

| Clydesdale Acquisition Holdings Inc 2025 Delayed Draw Term Loan / LON (US18972FAF99) | 0.02 | 0.00 | 0.0025 | 0.0001 | |||||

| A3KMYN / Air Lease Corporation - Preferred Stock | 0.02 | 0.00 | 0.0024 | 0.0001 | |||||

| Long: BIE4V2QE0 IRS USD R V 12MSOFR BIE4V2QE0_FLO CCPOIS / Short: BIE4V2QE0 IRS USD P F 4.13740 BIE4V2QE0_FIX CCPOIS / DIR (000000000) | 0.01 | 0.0013 | 0.0013 | ||||||

| MNSH / MNSN Holdings Inc. | 0.00 | 0.00 | 0.00 | -25.00 | 0.0005 | -0.0001 | |||

| Long: BIE5MLL67 IRS USD R V 00MSOFR BIE5MLL67_FLO CCPOIS / Short: BIE5MLL67 IRS USD P F 3.50850 BIE5MLL67_FIX CCPOIS / DIR (000000000) | -0.01 | -0.0013 | -0.0013 | ||||||

| Long: BIE4QTJW5 IRS USD R V 00MSOFR BIE4QTJW5_FLO CCPOIS / Short: BIE4QTJW5 IRS USD P F 4.95590 BIE4QTJW5_FIX CCPOIS / DIR (000000000) | -0.01 | -0.0015 | -0.0015 | ||||||

| Long: BIE4RDLC0 IRS USD R V 00MSOFR BIE4RDLC0_FLO CCPOIS / Short: BIE4RDLC0 IRS USD P F 4.79450 BIE4RDLC0_FIX CCPOIS / DIR (000000000) | -0.03 | -0.0034 | -0.0034 | ||||||

| Long: BIE4DD5N9 IRS USD R V 00MSOFR BIE4DD5N9_FLO CCPOIS / Short: BIE4DD5N9 IRS USD P F 3.68000 BIE4DD5N9_FIX CCPOIS / DIR (000000000) | -0.03 | -0.0036 | -0.0036 | ||||||

| Long: BIE4Y4R77 IRS USD R V 12MSOFR BIE4Y4R77_FLO CCPOIS / Short: BIE4Y4R77 IRS USD P F 3.75750 BIE4Y4R77_FIX CCPOIS / DIR (000000000) | -0.05 | -0.0061 | -0.0061 | ||||||

| Long: BIE67Q9R9 IRS USD R V 12MSOFR BIE67Q9R9_FLO CCPOIS / Short: BIE67Q9R9 IRS USD P F 3.75476 BIE67Q9R9_FIX CCPOIS / DIR (000000000) | -0.05 | -0.0062 | -0.0062 | ||||||

| Long: BIE5MLKP6 IRS USD R V 00MSOFR BIE5MLKP6_FLO CCPOIS / Short: BIE5MLKP6 IRS USD P F 3.60083 BIE5MLKP6_FIX CCPOIS / DIR (000000000) | -0.06 | -0.0074 | -0.0074 | ||||||

| Long: BIE4C5SP7 IRS USD R V 00MSOFR BIE4C5SP7_FLO CCPOIS / Short: BIE4C5SP7 IRS USD P F 3.52700 BIE4C5SP7_FIX CCPOIS / DIR (000000000) | -0.06 | -0.0078 | -0.0078 | ||||||

| Long: BIE4V2QA8 IRS USD R V 12MSOFR BIE4V2QA8_FLO CCPOIS / Short: BIE4V2QA8 IRS USD P F 3.52060 BIE4V2QA8_FIX CCPOIS / DIR (000000000) | -0.07 | -0.0087 | -0.0087 | ||||||

| Long: BIE5A22P1 IRS USD R V 12MSOFR BIE5A22P1_FLO CCPOIS / Short: BIE5A22P1 IRS USD P F 4.74200 BIE5A22P1_FIX CCPOIS / DIR (000000000) | -0.24 | -0.0308 | -0.0308 | ||||||

| Long: BIE4RDLJ5 IRS USD R V 00MSOFR BIE4RDLJ5_FLO CCPOIS / Short: BIE4RDLJ5 IRS USD P F 4.26835 BIE4RDLJ5_FIX CCPOIS / DIR (000000000) | -0.24 | -0.0309 | -0.0309 | ||||||

| US 10YR ULTRA FUT SEP25 / DIR (000000000) | -0.31 | -0.0405 | -0.0405 | ||||||

| Long: BIE4PTGV1 IRS USD R V 00MSOFR BIE4PTGV1_FLO CCPOIS / Short: BIE4PTGV1 IRS USD P F 4.55603 BIE4PTGV1_FIX CCPOIS / DIR (000000000) | -0.37 | -0.0478 | -0.0478 | ||||||

| Long: BIE5A22L0 IRS USD R V 12MSOFR BIE5A22L0_FLO CCPOIS / Short: BIE5A22L0 IRS USD P F 4.48595 BIE5A22L0_FIX CCPOIS / DIR (000000000) | -0.54 | -0.0709 | -0.0709 | ||||||

| Long: BIE5A22H9 IRS USD R V 12MSOFR BIE5A22H9_FLO CCPOIS / Short: BIE5A22H9 IRS USD P F 4.12877 BIE5A22H9_FIX CCPOIS / DIR (000000000) | -1.33 | -0.1737 | -0.1737 | ||||||

| SWAP CCPC JP MORGAN COC / STIV (000000000) | Short | -2.50 | -2.50 | -0.3258 | -0.3258 |