Mga Batayang Estadistika

| Nilai Portofolio | $ 957,738,341 |

| Posisi Saat Ini | 97 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

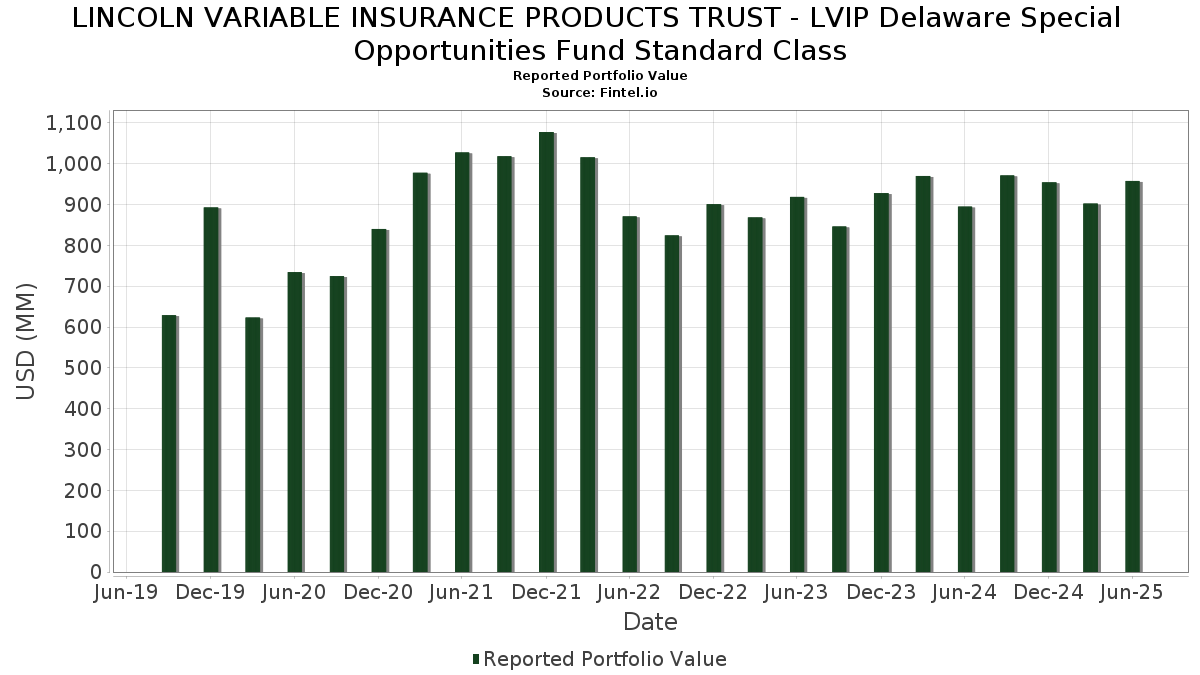

LINCOLN VARIABLE INSURANCE PRODUCTS TRUST - LVIP Delaware Special Opportunities Fund Standard Class telah mengungkapkan total kepemilikan 97 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 957,738,341 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama LINCOLN VARIABLE INSURANCE PRODUCTS TRUST - LVIP Delaware Special Opportunities Fund Standard Class adalah Raymond James Financial, Inc. (US:RJF) , ITT Inc. (US:ITT) , CACI International Inc (US:CACI) , Webster Financial Corporation (US:WBS) , and Cheniere Energy, Inc. (US:LNG) . Posisi baru LINCOLN VARIABLE INSURANCE PRODUCTS TRUST - LVIP Delaware Special Opportunities Fund Standard Class meliputi: Amcor plc (US:AMCR) , Ventas, Inc. (US:VTR) , AXIS Capital Holdings Limited (US:AXS) , The Kroger Co. (US:KR) , and .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 26.70 | 2.7862 | 2.7862 | ||

| 0.92 | 8.44 | 0.8806 | 0.8806 | |

| 0.13 | 8.17 | 0.8530 | 0.8530 | |

| 0.07 | 7.20 | 0.7513 | 0.7513 | |

| 0.07 | 4.81 | 0.5022 | 0.5022 | |

| 0.32 | 7.33 | 0.7648 | 0.4856 | |

| 0.20 | 13.17 | 1.3741 | 0.3596 | |

| 0.21 | 10.66 | 1.1129 | 0.3513 | |

| 0.03 | 14.92 | 1.5570 | 0.3197 | |

| 0.06 | 9.77 | 1.0191 | 0.2985 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.00 | -0.9527 | ||

| 0.09 | 11.92 | 1.2438 | -0.8491 | |

| 0.16 | 7.68 | 0.8016 | -0.5507 | |

| 0.17 | 8.18 | 0.8538 | -0.3347 | |

| 0.04 | 12.46 | 1.3001 | -0.2960 | |

| 0.16 | 9.38 | 0.9790 | -0.2537 | |

| 0.08 | 7.57 | 0.7900 | -0.2221 | |

| 0.06 | 14.19 | 1.4802 | -0.2136 | |

| 0.00 | 10.95 | 1.1428 | -0.2083 | |

| 0.43 | 10.87 | 1.1346 | -0.1995 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-06 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | 26.70 | 2.7862 | 2.7862 | ||||||

| RJF / Raymond James Financial, Inc. | 0.11 | 2.78 | 16.42 | 13.49 | 1.7137 | 0.1112 | |||

| ITT / ITT Inc. | 0.10 | 2.77 | 16.29 | 24.79 | 1.6995 | 0.2542 | |||

| CACI / CACI International Inc | 0.03 | 2.79 | 14.92 | 33.55 | 1.5570 | 0.3197 | |||

| WBS / Webster Financial Corporation | 0.27 | 2.78 | 14.74 | 8.86 | 1.5381 | 0.0387 | |||

| LNG / Cheniere Energy, Inc. | 0.06 | -11.88 | 14.19 | -7.26 | 1.4802 | -0.2136 | |||

| MAR / Marriott International, Inc. | 0.05 | 2.78 | 14.16 | 17.89 | 1.4779 | 0.1474 | |||

| CMS / CMS Energy Corporation | 0.20 | 2.79 | 13.80 | -5.19 | 1.4405 | -0.1719 | |||

| TRGP / Targa Resources Corp. | 0.08 | 10.65 | 13.74 | -3.92 | 1.4342 | -0.1498 | |||

| XEL / Xcel Energy Inc. | 0.20 | 2.76 | 13.68 | -1.14 | 1.4273 | -0.1049 | |||

| VMC / Vulcan Materials Company | 0.05 | 2.79 | 13.47 | 14.91 | 1.4057 | 0.1075 | |||

| US7587501039 / Regal-Beloit Corp. | 0.09 | 2.77 | 13.42 | 30.87 | 1.4007 | 0.2648 | |||

| EA / Electronic Arts Inc. | 0.08 | 2.76 | 13.36 | 13.56 | 1.3940 | 0.0913 | |||

| SYF / Synchrony Financial | 0.20 | 14.01 | 13.17 | 43.73 | 1.3741 | 0.3596 | |||

| OSK / Oshkosh Corporation | 0.11 | 2.75 | 12.93 | 24.00 | 1.3489 | 0.1946 | |||

| TWLO / Twilio Inc. | 0.10 | 2.79 | 12.82 | 30.57 | 1.3373 | 0.2503 | |||

| EWBC / East West Bancorp, Inc. | 0.13 | -4.60 | 12.78 | 7.33 | 1.3340 | 0.0150 | |||

| RGA / Reinsurance Group of America, Incorporated | 0.06 | -4.14 | 12.64 | -3.43 | 1.3185 | -0.1304 | |||

| STT / State Street Corporation | 0.12 | 2.79 | 12.53 | 22.10 | 1.3077 | 0.1711 | |||

| WTY / Willis Towers Watson Public Limited Company | 0.04 | -4.69 | 12.46 | -13.56 | 1.3001 | -0.2960 | |||

| NRG / NRG Energy, Inc. | 0.08 | -40.29 | 12.44 | 0.44 | 1.2986 | -0.0735 | |||

| WEC / WEC Energy Group, Inc. | 0.12 | 2.78 | 12.34 | -1.73 | 1.2874 | -0.1029 | |||

| ALL / The Allstate Corporation | 0.06 | 2.77 | 12.33 | -0.09 | 1.2867 | -0.0800 | |||

| LHX / L3Harris Technologies, Inc. | 0.05 | 2.75 | 12.19 | 23.13 | 1.2721 | 0.1758 | |||

| AME / AMETEK, Inc. | 0.07 | -5.70 | 12.12 | -0.87 | 1.2652 | -0.0892 | |||

| ACM / AECOM | 0.11 | -10.77 | 12.11 | 8.60 | 1.2637 | 0.0289 | |||

| CW / Curtiss-Wright Corporation | 0.02 | -28.57 | 12.09 | 9.99 | 1.2618 | 0.0444 | |||

| USFD / US Foods Holding Corp. | 0.15 | 2.79 | 11.93 | 20.92 | 1.2452 | 0.1524 | |||

| HIG / The Hartford Insurance Group, Inc. | 0.09 | -38.49 | 11.92 | -36.93 | 1.2438 | -0.8491 | |||

| JCI / Johnson Controls International plc | 0.11 | 2.76 | 11.79 | 35.49 | 1.2299 | 0.2666 | |||

| SNV / Synovus Financial Corp. | 0.23 | 2.77 | 11.71 | 13.79 | 1.2218 | 0.0823 | |||

| DGX / Quest Diagnostics Incorporated | 0.06 | 2.77 | 11.66 | 9.11 | 1.2165 | 0.0333 | |||

| PEG / Public Service Enterprise Group Incorporated | 0.14 | 2.79 | 11.64 | 5.13 | 1.2144 | -0.0114 | |||

| SNX / TD SYNNEX Corporation | 0.09 | 2.76 | 11.64 | 34.13 | 1.2143 | 0.2536 | |||

| CCK / Crown Holdings, Inc. | 0.11 | 2.80 | 11.55 | 18.60 | 1.2052 | 0.1268 | |||

| AMH / American Homes 4 Rent | 0.30 | -4.81 | 10.97 | -9.18 | 1.1443 | -0.1929 | |||

| AZO / AutoZone, Inc. | 0.00 | -7.81 | 10.95 | -10.24 | 1.1428 | -0.2083 | |||

| CTRA / Coterra Energy Inc. | 0.43 | 2.77 | 10.87 | -9.75 | 1.1346 | -0.1995 | |||

| VICI / VICI Properties Inc. | 0.33 | -7.76 | 10.81 | -7.82 | 1.1276 | -0.1705 | |||

| FLEX / Flex Ltd. | 0.21 | 2.77 | 10.66 | 55.07 | 1.1129 | 0.3513 | |||

| ROST / Ross Stores, Inc. | 0.08 | 2.77 | 10.65 | 2.60 | 1.1110 | -0.0381 | |||

| STE / STERIS plc | 0.04 | 2.79 | 10.62 | 8.95 | 1.1080 | 0.0287 | |||

| RS / Reliance, Inc. | 0.03 | 2.74 | 10.59 | 11.69 | 1.1055 | 0.0551 | |||

| COR / Cencora, Inc. | 0.04 | -13.44 | 10.52 | -6.67 | 1.0983 | -0.1505 | |||

| AIZ / Assurant, Inc. | 0.05 | 2.75 | 10.35 | -3.26 | 1.0799 | -0.1047 | |||

| KEY / KeyCorp | 0.59 | 2.77 | 10.26 | 11.96 | 1.0705 | 0.0559 | |||

| DHI / D.R. Horton, Inc. | 0.08 | 2.79 | 10.22 | 4.24 | 1.0666 | -0.0193 | |||

| WCC / WESCO International, Inc. | 0.06 | 2.80 | 10.21 | 22.59 | 1.0654 | 0.1431 | |||

| LPX / Louisiana-Pacific Corporation | 0.12 | 2.78 | 10.16 | -3.92 | 1.0602 | -0.1107 | |||

| AMG / Affiliated Managers Group, Inc. | 0.05 | 2.80 | 10.10 | 20.39 | 1.0544 | 0.1249 | |||

| PH / Parker-Hannifin Corporation | 0.01 | -20.00 | 9.92 | -8.07 | 1.0350 | -0.1598 | |||

| ALLY / Ally Financial Inc. | 0.25 | -6.16 | 9.79 | 0.23 | 1.0212 | -0.0601 | |||

| MTZ / MasTec, Inc. | 0.06 | 2.78 | 9.77 | 50.09 | 1.0191 | 0.2985 | |||

| DAL / Delta Air Lines, Inc. | 0.20 | 2.76 | 9.70 | 15.91 | 1.0118 | 0.0855 | |||

| URI / United Rentals, Inc. | 0.01 | 2.80 | 9.68 | 23.59 | 1.0102 | 0.1427 | |||

| PWR / Quanta Services, Inc. | 0.03 | -7.55 | 9.49 | 37.52 | 0.9899 | 0.2260 | |||

| O / Realty Income Corporation | 0.16 | -15.14 | 9.38 | -15.72 | 0.9790 | -0.2537 | |||

| VLO / Valero Energy Corporation | 0.07 | 46.74 | 9.24 | 49.36 | 0.9643 | 0.2792 | |||

| DRI / Darden Restaurants, Inc. | 0.04 | -8.23 | 8.88 | -3.72 | 0.9262 | -0.0946 | |||

| KEYS / Keysight Technologies, Inc. | 0.05 | -15.87 | 8.75 | -7.96 | 0.9127 | -0.1396 | |||

| EIX / Edison International | 0.17 | 2.79 | 8.56 | -9.98 | 0.8930 | -0.1597 | |||

| AMCR / Amcor plc | 0.92 | 8.44 | 0.8806 | 0.8806 | |||||

| RCL / Royal Caribbean Cruises Ltd. | 0.03 | -25.62 | 8.41 | 13.36 | 0.8774 | 0.0561 | |||

| KIM / Kimco Realty Corporation | 0.40 | 2.78 | 8.33 | 1.71 | 0.8690 | -0.0377 | |||

| HST / Host Hotels & Resorts, Inc. | 0.54 | -15.52 | 8.27 | -8.68 | 0.8627 | -0.1399 | |||

| OGE / OGE Energy Corp. | 0.19 | 2.76 | 8.25 | -0.77 | 0.8611 | -0.0598 | |||

| KBR / KBR, Inc. | 0.17 | -20.79 | 8.18 | -23.77 | 0.8538 | -0.3347 | |||

| VTR / Ventas, Inc. | 0.13 | 8.17 | 0.8530 | 0.8530 | |||||

| GPN / Global Payments Inc. | 0.10 | 23.02 | 8.15 | 0.57 | 0.8503 | -0.0470 | |||

| TER / Teradyne, Inc. | 0.09 | 2.77 | 7.85 | 11.88 | 0.8187 | 0.0421 | |||

| AKAM / Akamai Technologies, Inc. | 0.10 | 2.78 | 7.82 | 1.84 | 0.8165 | -0.0344 | |||

| FR / First Industrial Realty Trust, Inc. | 0.16 | -29.47 | 7.68 | -37.10 | 0.8016 | -0.5507 | |||

| ZBH / Zimmer Biomet Holdings, Inc. | 0.08 | 2.79 | 7.57 | -17.17 | 0.7900 | -0.2221 | |||

| GTES / Gates Industrial Corporation plc | 0.32 | 44.17 | 7.33 | 191.06 | 0.7648 | 0.4856 | |||

| ON / ON Semiconductor Corporation | 0.14 | 2.76 | 7.31 | 32.37 | 0.7627 | 0.1512 | |||

| NXT / Nextracker Inc. | 0.13 | -5.73 | 7.30 | 21.64 | 0.7613 | 0.0971 | |||

| AXS / AXIS Capital Holdings Limited | 0.07 | 7.20 | 0.7513 | 0.7513 | |||||

| PHM / PulteGroup, Inc. | 0.07 | 2.77 | 7.04 | 5.42 | 0.7351 | -0.0048 | |||

| EXR / Extra Space Storage Inc. | 0.05 | 2.82 | 6.98 | 2.09 | 0.7280 | -0.0287 | |||

| A / Agilent Technologies, Inc. | 0.06 | 2.79 | 6.97 | 3.69 | 0.7272 | -0.0170 | |||

| HSY / The Hershey Company | 0.04 | 2.77 | 6.78 | -0.28 | 0.7074 | -0.0454 | |||

| DVN / Devon Energy Corporation | 0.20 | 27.39 | 6.39 | 8.34 | 0.6670 | 0.0137 | |||

| DKS / DICK'S Sporting Goods, Inc. | 0.03 | 2.75 | 6.28 | 0.83 | 0.6554 | -0.0343 | |||

| JBHT / J.B. Hunt Transport Services, Inc. | 0.04 | 2.76 | 6.15 | -0.26 | 0.6413 | -0.0410 | |||

| Aptiv PLC / EC (JE00BTDN8H13) | 0.09 | 56.40 | 5.90 | 79.33 | 0.6157 | 0.2513 | |||

| IPG / The Interpublic Group of Companies, Inc. | 0.23 | 2.77 | 5.68 | -7.39 | 0.5929 | -0.0864 | |||

| KNF / Knife River Corporation | 0.07 | 2.76 | 5.63 | -7.00 | 0.5875 | -0.0829 | |||

| CIEN / Ciena Corporation | 0.07 | 2.76 | 5.60 | 38.31 | 0.5847 | 0.1361 | |||

| GPK / Graphic Packaging Holding Company | 0.26 | 2.77 | 5.39 | -16.59 | 0.5629 | -0.1532 | |||

| AVTR / Avantor, Inc. | 0.40 | 2.78 | 5.33 | -14.65 | 0.5558 | -0.1353 | |||

| TSN / Tyson Foods, Inc. | 0.09 | 2.80 | 5.13 | -9.88 | 0.5353 | -0.0950 | |||

| KR / The Kroger Co. | 0.07 | 4.81 | 0.5022 | 0.5022 | |||||

| CE / Celanese Corporation | 0.07 | 2.79 | 3.88 | 0.18 | 0.4047 | -0.0240 | |||

| BDX / Becton, Dickinson and Company | 0.02 | 2.72 | 3.57 | -22.76 | 0.3730 | -0.1394 | |||

| HUN / Huntsman Corporation | 0.27 | 2.77 | 2.82 | -32.19 | 0.2942 | -0.1662 | |||

| OLN / Olin Corporation | 0.11 | 2.78 | 2.31 | -14.82 | 0.2406 | -0.0591 | |||

| GVMXX / State Street Institutional Investment Trust - State Street Institutional US Govt Money Market Fnd Premier Cls | 0.08 | -44.01 | 0.08 | -44.00 | 0.0088 | -0.0079 | |||

| BERY / Berry Global Group, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.9527 |