Mga Batayang Estadistika

| Nilai Portofolio | $ 344,695,481 |

| Posisi Saat Ini | 142 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

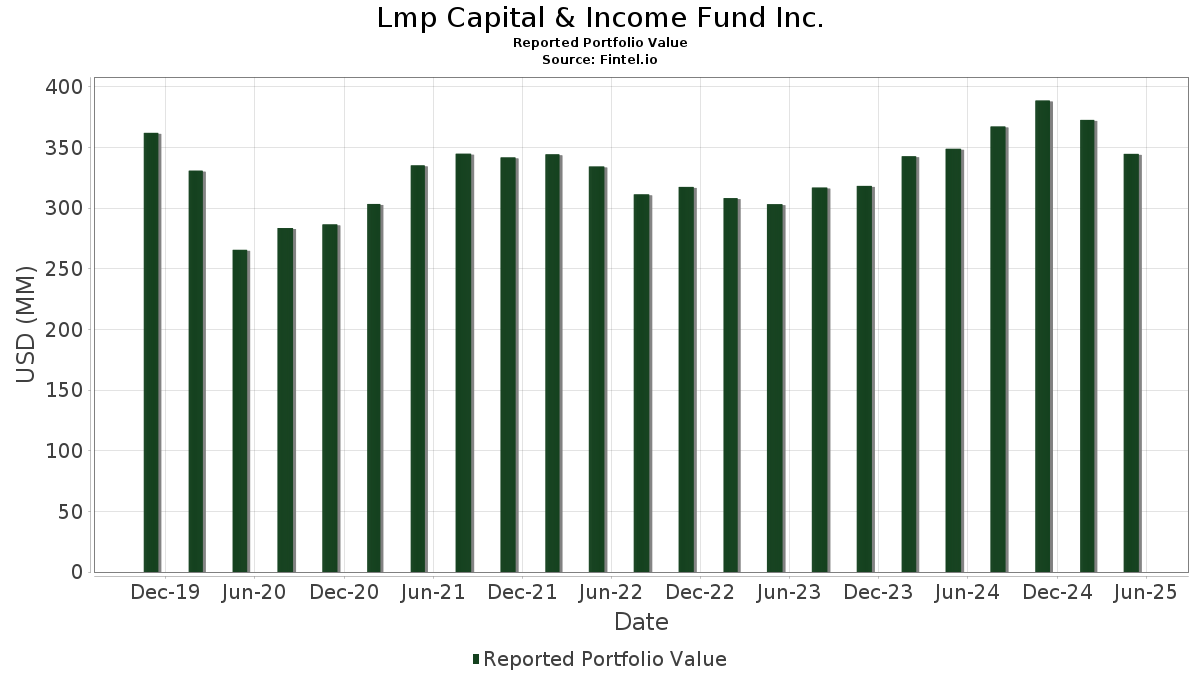

Lmp Capital & Income Fund Inc. telah mengungkapkan total kepemilikan 142 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 344,695,481 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Lmp Capital & Income Fund Inc. adalah NEXTERA ENERGY INC 6.926% PC 09/01/2025 (US:US65339F7134) , PPL Corporation (US:PPL) , Enterprise Products Partners L.P. - Limited Partnership (US:EPD) , Energy Transfer LP - Limited Partnership (US:ET) , and The Procter & Gamble Company (US:PG) . Posisi baru Lmp Capital & Income Fund Inc. meliputi: VICI Properties Inc. (US:VICI) , Shift4 Payments, Inc. - Preferred Stock (US:FOUR.PRA) , Walmart Inc. (US:WMT) , KKR & Co. Inc. - Preferred Stock (US:KKR.PRD) , and TC Energy Corporation (BG:TRS) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.05 | 6.28 | 2.2740 | 2.2740 | |

| 0.18 | 5.56 | 2.0129 | 2.0129 | |

| 0.04 | 4.77 | 1.7280 | 1.7280 | |

| 0.05 | 4.48 | 1.6221 | 1.6221 | |

| 0.07 | 3.67 | 1.3268 | 1.3268 | |

| 0.21 | 8.34 | 3.0192 | 1.2651 | |

| 0.07 | 3.44 | 1.2444 | 1.2444 | |

| 0.07 | 3.40 | 1.2314 | 1.2314 | |

| 0.04 | 6.69 | 2.4199 | 1.2153 | |

| 0.01 | 3.33 | 1.2052 | 1.2052 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.39 | 6.76 | 2.4451 | -3.6754 | |

| 0.24 | 7.49 | 2.7102 | -2.4876 | |

| 0.02 | 4.57 | 1.6551 | -2.3410 | |

| 0.06 | 3.22 | 1.1647 | -2.1794 | |

| 0.02 | 2.99 | 1.0813 | -1.6357 | |

| 0.23 | 4.11 | 1.4892 | -1.5139 | |

| 0.16 | 2.99 | 1.0811 | -1.5050 | |

| 0.08 | 6.53 | 2.3634 | -1.4515 | |

| 0.00 | 0.92 | 0.3345 | -1.2826 | |

| 0.07 | 4.90 | 1.7716 | -1.1276 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-23 untuk periode pelaporan 2025-05-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US65339F7134 / NEXTERA ENERGY INC 6.926% PC 09/01/2025 | 0.21 | 57.99 | 8.34 | 56.51 | 3.0192 | 1.2651 | |||

| PPL / PPL Corporation | 0.23 | 35.07 | 7.86 | 33.31 | 2.8433 | 0.9039 | |||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 0.24 | -48.61 | 7.49 | -52.59 | 2.7102 | -2.4876 | |||

| ET / Energy Transfer LP - Limited Partnership | 0.39 | -59.91 | 6.76 | -63.68 | 2.4451 | -3.6754 | |||

| PG / The Procter & Gamble Company | 0.04 | 86.90 | 6.69 | 82.68 | 2.4199 | 1.2153 | |||

| JPM / JPMorgan Chase & Co. | 0.02 | -23.57 | 6.59 | -23.76 | 2.3850 | -0.4595 | |||

| ELS / Equity LifeStyle Properties, Inc. | 0.10 | 61.36 | 6.54 | 49.57 | 2.3657 | 0.9276 | |||

| OKE / ONEOK, Inc. | 0.08 | -30.05 | 6.53 | -43.67 | 2.3634 | -1.4515 | |||

| UNP / Union Pacific Corporation | 0.03 | 18.86 | 6.43 | 6.80 | 2.3256 | 0.3457 | |||

| ARCC / Ares Capital Corporation | 0.29 | 0.00 | 6.33 | -5.70 | 2.2894 | 0.0822 | |||

| PEP / PepsiCo, Inc. | 0.05 | 6.28 | 2.2740 | 2.2740 | |||||

| BA.PRA / The Boeing Company - Preferred Security | 0.09 | 0.00 | 5.91 | 12.42 | 2.1390 | 0.4091 | |||

| TMUS / T-Mobile US, Inc. | 0.02 | 0.00 | 5.69 | -10.19 | 2.0576 | -0.0256 | |||

| VICI / VICI Properties Inc. | 0.18 | 5.56 | 2.0129 | 2.0129 | |||||

| KO / The Coca-Cola Company | 0.08 | 96.85 | 5.51 | 99.35 | 1.9942 | 1.0844 | |||

| AAPL / Apple Inc. | 0.03 | -26.23 | 5.48 | -38.73 | 1.9835 | -0.9600 | |||

| AMH / American Homes 4 Rent | 0.14 | 0.00 | 5.47 | 2.26 | 1.9795 | 0.2196 | |||

| ORCL / Oracle Corporation | 0.03 | -19.81 | 5.43 | -20.08 | 1.9640 | -0.2701 | |||

| RHHBY / Roche Holding AG - Depositary Receipt (Common Stock) | 0.13 | -0.82 | 5.38 | -4.23 | 1.9486 | 0.0984 | |||

| CL / Colgate-Palmolive Company | 0.06 | 57.94 | 5.32 | 61.02 | 1.9254 | 0.8381 | |||

| JNJ / Johnson & Johnson | 0.03 | -3.12 | 5.31 | -8.86 | 1.9203 | 0.0042 | |||

| WLKP / Westlake Chemical Partners LP - Limited Partnership | 0.24 | 0.00 | 5.30 | -7.83 | 1.9176 | 0.0258 | |||

| QCOM / QUALCOMM Incorporated | 0.04 | 0.00 | 5.19 | -7.61 | 1.8795 | 0.0297 | |||

| MCK / McKesson Corporation | 0.01 | 4.41 | 5.11 | 17.34 | 1.8488 | 0.4161 | |||

| ABBV / AbbVie Inc. | 0.03 | 14.05 | 4.99 | 1.55 | 1.8047 | 0.1887 | |||

| VZ / Verizon Communications Inc. | 0.11 | 42.64 | 4.93 | 75.96 | 1.7835 | 0.6277 | |||

| EMR / Emerson Electric Co. | 0.04 | 0.00 | 4.92 | -1.82 | 1.7803 | 0.1313 | |||

| MSFT / Microsoft Corporation | 0.01 | -51.51 | 4.90 | -43.78 | 1.7721 | -1.0936 | |||

| APO.PRA / Apollo Global Management, Inc. - Preferred Stock | 0.07 | -37.46 | 4.90 | -44.44 | 1.7716 | -1.1276 | |||

| AMT / American Tower Corporation | 0.02 | 0.00 | 4.82 | 4.39 | 1.7458 | 0.2252 | |||

| FOUR.PRA / Shift4 Payments, Inc. - Preferred Stock | 0.04 | 4.77 | 1.7280 | 1.7280 | |||||

| LHX / L3Harris Technologies, Inc. | 0.02 | 29.25 | 4.64 | 53.25 | 1.6802 | 0.6831 | |||

| AVGO / Broadcom Inc. | 0.02 | -68.97 | 4.57 | -62.34 | 1.6551 | -2.3410 | |||

| GOOGL / Alphabet Inc. | 0.03 | 62.98 | 4.49 | 64.40 | 1.6246 | 0.7259 | |||

| WMT / Walmart Inc. | 0.05 | 4.48 | 1.6221 | 1.6221 | |||||

| BAC / Bank of America Corporation | 0.10 | 0.00 | 4.46 | -4.27 | 1.6147 | 0.0810 | |||

| SUN / Sunoco LP - Limited Partnership | 0.08 | 0.00 | 4.40 | -8.29 | 1.5941 | 0.0138 | |||

| META / Meta Platforms, Inc. | 0.01 | 3.08 | 4.34 | -0.12 | 1.5698 | 0.1408 | |||

| MET / MetLife, Inc. | 0.05 | 0.00 | 4.29 | -8.82 | 1.5528 | 0.0044 | |||

| OTIS / Otis Worldwide Corporation | 0.04 | 30.77 | 4.26 | 24.96 | 1.5400 | 0.4195 | |||

| CRM / Salesforce, Inc. | 0.02 | -4.27 | 4.16 | -14.72 | 1.5062 | -0.0995 | |||

| PAGP / Plains GP Holdings, L.P. - Limited Partnership | 0.23 | -44.66 | 4.11 | -54.92 | 1.4892 | -1.5139 | |||

| HPE.PRC / Hewlett Packard Enterprise Company - Preferred Security | 0.08 | -14.33 | 4.00 | -22.69 | 1.4491 | -0.2549 | |||

| NOC / Northrop Grumman Corporation | 0.01 | 78.86 | 3.96 | 87.85 | 1.4325 | 0.7389 | |||

| MKC / McCormick & Company, Incorporated | 0.05 | 10.98 | 3.82 | -2.30 | 1.3835 | 0.0960 | |||

| MRK / Merck & Co., Inc. | 0.05 | 15.24 | 3.72 | -4.03 | 1.3461 | 0.0710 | |||

| KKR.PRD / KKR & Co. Inc. - Preferred Stock | 0.07 | 3.67 | 1.3268 | 1.3268 | |||||

| C / Citigroup Inc. | 0.05 | 0.00 | 3.65 | -5.79 | 1.3194 | 0.0460 | |||

| ARES.PRB / Ares Management Corporation - Preferred Security | 0.07 | -20.54 | 3.54 | -21.40 | 1.2807 | -0.2006 | |||

| ICE / Intercontinental Exchange, Inc. | 0.02 | 167.36 | 3.48 | 177.56 | 1.2578 | 0.8457 | |||

| TRS / TC Energy Corporation | 0.07 | 3.44 | 1.2444 | 1.2444 | |||||

| LEN / Lennar Corporation | 0.03 | 25.78 | 3.42 | 11.53 | 1.2361 | 0.2284 | |||

| QXO.PRB / QXO, Inc. - Preferred Security | 0.07 | 3.40 | 1.2314 | 1.2314 | |||||

| ETN / Eaton Corporation plc | 0.01 | 3.33 | 1.2052 | 1.2052 | |||||

| MPLX / MPLX LP - Limited Partnership | 0.06 | -66.53 | 3.22 | -68.33 | 1.1647 | -2.1794 | |||

| EQR / Equity Residential | 0.04 | 0.00 | 3.00 | -5.42 | 1.0858 | 0.0418 | |||

| BX / Blackstone Inc. | 0.02 | -57.97 | 2.99 | -63.82 | 1.0813 | -1.6357 | |||

| OWL / Blue Owl Capital Inc. | 0.16 | -56.19 | 2.99 | -61.99 | 1.0811 | -1.5050 | |||

| MRVL / Marvell Technology, Inc. | 0.05 | 2.98 | 1.0783 | 1.0783 | |||||

| FCX / Freeport-McMoRan Inc. | 0.08 | 2.95 | 1.0682 | 1.0682 | |||||

| LMT / Lockheed Martin Corporation | 0.01 | -31.20 | 2.87 | -26.33 | 1.0393 | -0.2431 | |||

| UNH / UnitedHealth Group Incorporated | 0.01 | 174.38 | 2.61 | 74.37 | 0.9456 | 0.4526 | |||

| HON / Honeywell International Inc. | 0.01 | -43.22 | 2.56 | -39.54 | 0.9270 | -0.4671 | |||

| SCHW / The Charles Schwab Corporation | 0.03 | -14.10 | 2.53 | -4.56 | 0.9157 | 0.0431 | |||

| LLY / Eli Lilly and Company | 0.00 | 0.00 | 2.50 | -19.87 | 0.9034 | -0.1218 | |||

| PEG / Public Service Enterprise Group Incorporated | 0.03 | 44.68 | 2.49 | 44.46 | 0.9022 | 0.3343 | |||

| LINE / Lineage, Inc. | 0.05 | -3.08 | 2.28 | -31.36 | 0.8252 | -0.2674 | |||

| ASML / ASML Holding N.V. - Depositary Receipt (Common Stock) | 0.00 | -11.71 | 2.22 | -8.26 | 0.8039 | 0.0071 | |||

| CAPL / CrossAmerica Partners LP - Limited Partnership | 0.10 | 0.00 | 2.20 | -7.03 | 0.7949 | 0.0176 | |||

| WMB / The Williams Companies, Inc. | 0.03 | -63.58 | 1.97 | -62.13 | 0.7126 | -0.9978 | |||

| GS / The Goldman Sachs Group, Inc. | 0.00 | 1.74 | 0.6302 | 0.6302 | |||||

| JTSXX / JPMorgan Trust I. - JPMorgan 100% U.S. Treasury Securities Money Market Fund Inst | 1.69 | -36.99 | 1.69 | -36.97 | 0.6102 | -0.2704 | |||

| PLD / Prologis, Inc. | 0.01 | 0.00 | 1.62 | -12.35 | 0.5856 | -0.0220 | |||

| ADC / Agree Realty Corporation | 0.02 | 1.54 | 0.5559 | 0.5559 | |||||

| ENB / Enbridge Inc. | 0.03 | -9.67 | 1.35 | -1.68 | 0.4872 | 0.0364 | |||

| AMGN / Amgen Inc. | 0.00 | 0.00 | 1.24 | -6.43 | 0.4474 | 0.0125 | |||

| EQIX / Equinix, Inc. | 0.00 | -72.08 | 1.14 | -72.59 | 0.4111 | -0.9517 | |||

| DLR / Digital Realty Trust, Inc. | 0.01 | -64.73 | 1.00 | -61.30 | 0.3620 | -0.4884 | |||

| LNG / Cheniere Energy, Inc. | 0.00 | -81.86 | 0.92 | -81.20 | 0.3345 | -1.2826 | |||

| ARE / Alexandria Real Estate Equities, Inc. | 0.01 | 0.00 | 0.89 | -31.38 | 0.3231 | -0.1049 | |||

| US46647PDK93 / JPMORGAN CHASE & CO REGD V/R 5.71700000 | 0.72 | -0.55 | 0.2606 | 0.0221 | |||||

| US17327CAR43 / Citigroup Inc | 0.72 | -0.69 | 0.2597 | 0.0221 | |||||

| US06051GKY43 / Bank of America Corp. | 0.60 | 0.00 | 0.2165 | 0.0194 | |||||

| US126650DJ69 / CVS Health Corp | 0.57 | 0.18 | 0.2056 | 0.0193 | |||||

| US031162DR88 / Amgen Inc | 0.56 | -0.54 | 0.2009 | 0.0171 | |||||

| US254687FL52 / Walt Disney Co/The | 0.55 | 1.30 | 0.1981 | 0.0202 | |||||

| US20030NCU37 / Comcast Corp | 0.54 | 0.37 | 0.1961 | 0.0188 | |||||

| US716973AE24 / Pfizer Investment Enterprises Pte Ltd | 0.54 | -0.55 | 0.1958 | 0.0165 | |||||

| US15135BAW19 / Centene Corp | 0.53 | 0.57 | 0.1912 | 0.0183 | |||||

| US025816DF35 / American Express Co | 0.50 | -0.99 | 0.1803 | 0.0147 | |||||

| US95000U3B74 / Wells Fargo & Co | 0.49 | -0.41 | 0.1779 | 0.0156 | |||||

| US023135BZ81 / AMAZON.COM INC 2.1% 05/12/2031 | 0.48 | 0.83 | 0.1755 | 0.0174 | |||||

| US87264ABF12 / CORP. NOTE | 0.48 | 0.84 | 0.1746 | 0.0169 | |||||

| US35671DBC83 / Freeport-McMoRan Inc. Bond | 0.46 | -2.94 | 0.1672 | 0.0103 | |||||

| GMRE / Global Medical REIT Inc. | 0.07 | 0.00 | 0.46 | -27.74 | 0.1669 | -0.0431 | |||

| US345370DA55 / Ford Motor Co | 0.45 | -1.09 | 0.1643 | 0.0132 | |||||

| US911365BP80 / United Rentals North America Inc | 0.45 | 0.45 | 0.1626 | 0.0153 | |||||

| DGCXX / Dreyfus Government Cash Management Funds - Dreyfus Government Cash Management Fund Institutional Shares | 0.45 | -1.64 | 0.45 | -1.55 | 0.1612 | 0.0122 | |||

| US666807BH45 / Northrop Grumman Corp. | 0.44 | -3.49 | 0.1605 | 0.0093 | |||||

| US64110LAU08 / Netflix Inc | 0.41 | 0.24 | 0.1501 | 0.0142 | |||||

| US404121AJ49 / HCA Inc | 0.41 | 0.25 | 0.1481 | 0.0136 | |||||

| US49177JAK88 / Kenvue Inc | 0.40 | 0.00 | 0.1453 | 0.0131 | |||||

| US98379KAA07 / XPO INC | 0.35 | 0.00 | 0.1282 | 0.0115 | |||||

| US513272AE49 / Lamb Weston Holdings Inc | 0.34 | -32.48 | 0.1236 | -0.0427 | |||||

| United States Treasury Note/Bond / DBT (US91282CLF67) | 0.34 | -1.17 | 0.1221 | 0.0097 | |||||

| US058498AX40 / Ball Corp | 0.32 | -34.10 | 0.1144 | -0.0430 | |||||

| US125523CL22 / Cigna Corp | 0.31 | 0.64 | 0.1136 | 0.0111 | |||||

| B1BT34 / Truist Financial Corporation - Depositary Receipt (Common Stock) | 0.30 | -1.30 | 0.1104 | 0.0088 | |||||

| US437076CB65 / Home Depot Inc/The | 0.28 | 1.09 | 0.1005 | 0.0102 | |||||

| PCG.PRD / Pacific Gas and Electric Company - Preferred Stock | 0.27 | -2.55 | 0.0966 | 0.0061 | |||||

| US00774MAX39 / AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 0.27 | 0.00 | 0.0965 | 0.0087 | |||||

| US36268NAA81 / GTCR W-2 Merger Sub LLC | 0.26 | 1.15 | 0.0958 | 0.0097 | |||||

| US05581KAG67 / BNP Paribas SA | 0.26 | -0.38 | 0.0945 | 0.0080 | |||||

| US37045XBT28 / General Motors Financial Co Inc | 0.25 | 0.00 | 0.0897 | 0.0081 | |||||

| US57667JAA07 / Match Group Holdings II LLC | 0.22 | 0.93 | 0.0792 | 0.0080 | |||||

| Teva Pharmaceutical Finance Netherlands III BV / DBT (US88167AAT88) | 0.20 | 0.0731 | 0.0731 | ||||||

| R1CL34 / Royal Caribbean Cruises Ltd. - Depositary Receipt (Common Stock) | 0.19 | -1.06 | 0.0680 | 0.0058 | |||||

| Glencore Funding LLC / DBT (US378272CA49) | 0.16 | 0.0581 | 0.0581 | ||||||

| XS2066744231 / Carnival PLC | 0.16 | 0.0580 | 0.0580 | ||||||

| Shift4 Payments LLC / Shift4 Payments Finance Sub Inc / DBT (US82453AAB35) | 0.15 | 0.66 | 0.0554 | 0.0051 | |||||

| ZF North America Capital Inc / DBT (US98877DAF24) | 0.14 | 0.0516 | 0.0516 | ||||||

| Jane Street Group / JSG Finance Inc / DBT (US47077WAE84) | 0.12 | 0.0446 | 0.0446 | ||||||

| Lightning Power LLC / DBT (US53229KAA79) | 0.10 | 0.97 | 0.0380 | 0.0037 | |||||

| CXW / CoreCivic, Inc. | 0.08 | 0.00 | 0.0306 | 0.0027 | |||||

| US073685AD12 / Beacon Roofing Supply Inc 4.875% 11/01/2025 144a Bond | 0.06 | 0.0223 | 0.0223 | ||||||

| FOR / Forestar Group Inc. | 0.06 | 0.0216 | 0.0216 | ||||||

| Celanese US Holdings LLC / DBT (US15089QBA13) | 0.06 | 0.0212 | 0.0212 | ||||||

| XS2066744231 / Carnival PLC | 0.05 | 0.0182 | 0.0182 | ||||||

| Methanex US Operations Inc / DBT (US59151LAA44) | 0.05 | -4.00 | 0.0175 | 0.0010 | |||||

| LVS / Las Vegas Sands Corp. - Depositary Receipt (Common Stock) | 0.04 | 0.0146 | 0.0146 | ||||||

| AMCX / AMC Networks Inc. | 0.03 | 0.00 | 0.0115 | 0.0010 | |||||

| EZPW / EZCORP, Inc. | 0.03 | 0.0113 | 0.0113 | ||||||

| Herc Holdings Escrow Inc / DBT (US42703NAA90) | 0.03 | 0.0112 | 0.0112 | ||||||

| Herc Holdings Escrow Inc / DBT (US42703NAB73) | 0.03 | 0.0112 | 0.0112 | ||||||

| DLX / Deluxe Corporation | 0.03 | 0.00 | 0.0110 | 0.0010 | |||||

| US35137LAN55 / Fox Corp | 0.02 | 0.00 | 0.0078 | 0.0007 | |||||

| Jane Street Group / JSG Finance Inc / DBT (US47077WAC29) | 0.02 | 0.0076 | 0.0076 | ||||||

| Quikrete Holdings Inc / DBT (US74843PAA84) | 0.02 | 0.00 | 0.0074 | 0.0007 | |||||

| S1YM34 / Gen Digital Inc. - Depositary Receipt (Common Stock) | 0.02 | 0.00 | 0.0073 | 0.0007 | |||||

| A2XO34 / Axon Enterprise, Inc. - Depositary Receipt (Common Stock) | 0.01 | 0.0037 | 0.0037 | ||||||

| A2XO34 / Axon Enterprise, Inc. - Depositary Receipt (Common Stock) | 0.01 | 0.0037 | 0.0037 | ||||||

| LVS / Las Vegas Sands Corp. - Depositary Receipt (Common Stock) | 0.01 | 0.0036 | 0.0036 |