Mga Batayang Estadistika

| Nilai Portofolio | $ 937,069,865 |

| Posisi Saat Ini | 71 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

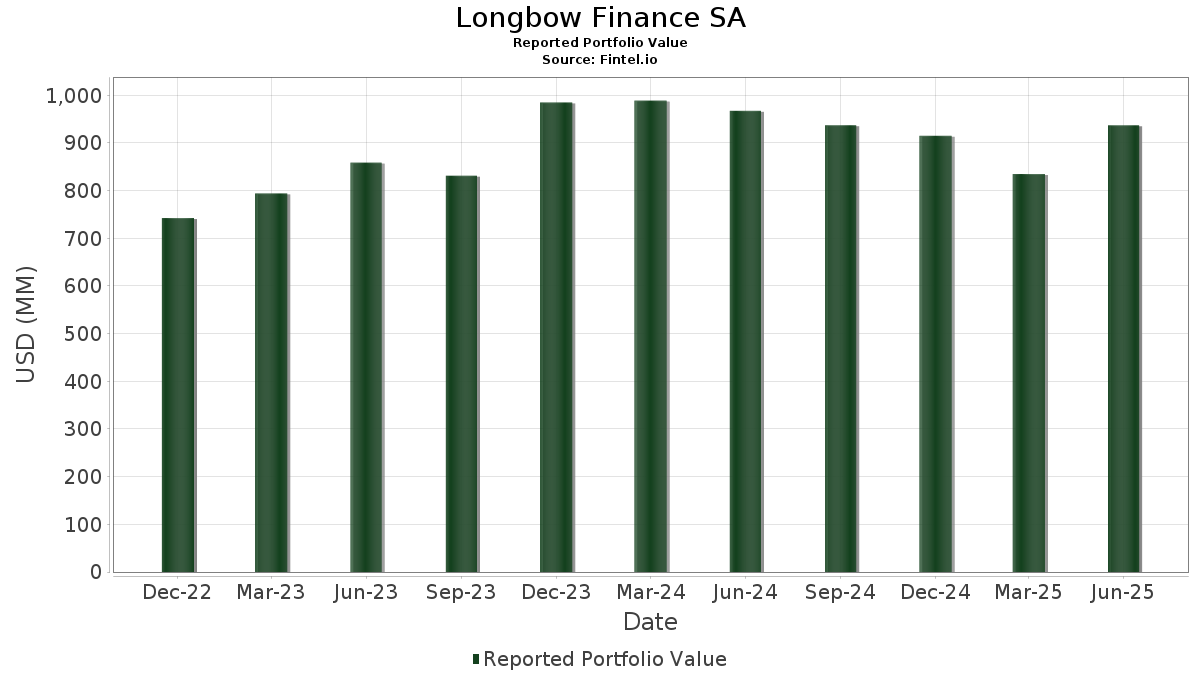

Longbow Finance SA telah mengungkapkan total kepemilikan 71 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 937,069,865 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Longbow Finance SA adalah NVIDIA Corporation (US:NVDA) , Microsoft Corporation (US:MSFT) , Apple Inc. (US:AAPL) , Amazon.com, Inc. (US:AMZN) , and Meta Platforms, Inc. (US:META) . Posisi baru Longbow Finance SA meliputi: Republic Services, Inc. (US:RSG) , McDonald's Corporation (US:MCD) , Motorola Solutions, Inc. (IT:1MSI) , The Southern Company (US:SO) , and T-Mobile US, Inc. (US:TMUS) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.49 | 77.86 | 8.3093 | 1.9823 | |

| 0.13 | 66.40 | 7.0855 | 1.5996 | |

| 0.06 | 19.00 | 2.0278 | 1.5366 | |

| 0.04 | 13.97 | 1.4913 | 1.4913 | |

| 0.07 | 13.62 | 1.4537 | 1.4537 | |

| 0.03 | 12.69 | 1.3542 | 1.3542 | |

| 0.04 | 11.46 | 1.2232 | 1.2232 | |

| 0.26 | 28.18 | 3.0073 | 1.1553 | |

| 0.09 | 10.75 | 1.1469 | 1.1469 | |

| 0.06 | 9.05 | 0.9662 | 0.9662 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.21 | 36.76 | 3.9225 | -1.5783 | |

| 0.02 | 14.77 | 1.5767 | -1.4581 | |

| 0.07 | 6.90 | 0.7366 | -1.2764 | |

| 0.04 | 18.49 | 1.9727 | -1.1911 | |

| 0.23 | 15.96 | 1.7028 | -1.0569 | |

| 0.01 | 7.70 | 0.8214 | -1.0007 | |

| 0.08 | 21.46 | 2.2902 | -0.8349 | |

| 0.00 | 4.89 | 0.5220 | -0.7963 | |

| 0.20 | 44.21 | 4.7182 | -0.5656 | |

| 0.10 | 7.57 | 0.8079 | -0.4967 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-05 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NVDA / NVIDIA Corporation | 0.49 | 1.13 | 77.86 | 47.42 | 8.3093 | 1.9823 | |||

| MSFT / Microsoft Corporation | 0.13 | 9.42 | 66.40 | 44.98 | 7.0855 | 1.5996 | |||

| AAPL / Apple Inc. | 0.26 | 19.24 | 52.81 | 10.14 | 5.6361 | -0.1080 | |||

| AMZN / Amazon.com, Inc. | 0.20 | -13.07 | 44.21 | 0.23 | 4.7182 | -0.5656 | |||

| META / Meta Platforms, Inc. | 0.05 | -9.60 | 39.23 | 15.77 | 4.1869 | 0.1272 | |||

| GOOGL / Alphabet Inc. | 0.21 | -29.50 | 36.76 | -19.96 | 3.9225 | -1.5783 | |||

| XOM / Exxon Mobil Corporation | 0.26 | 101.09 | 28.18 | 82.28 | 3.0073 | 1.1553 | |||

| JPM / JPMorgan Chase & Co. | 0.09 | 0.00 | 25.05 | 18.19 | 2.6733 | 0.1343 | |||

| AVGO / Broadcom Inc. | 0.08 | -50.03 | 21.46 | -17.74 | 2.2902 | -0.8349 | |||

| AJG / Arthur J. Gallagher & Co. | 0.06 | 399.71 | 19.00 | 363.35 | 2.0278 | 1.5366 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.04 | -23.27 | 18.49 | -30.01 | 1.9727 | -1.1911 | |||

| ABBV / AbbVie Inc. | 0.10 | 61.46 | 18.35 | 43.05 | 1.9579 | 0.4215 | |||

| KO / The Coca-Cola Company | 0.23 | -29.89 | 15.96 | -30.74 | 1.7028 | -1.0569 | |||

| LLY / Eli Lilly and Company | 0.02 | -38.21 | 14.77 | -41.68 | 1.5767 | -1.4581 | |||

| KMI / Kinder Morgan, Inc. | 0.49 | 63.56 | 14.55 | 68.55 | 1.5529 | 0.5187 | |||

| V / Visa Inc. | 0.04 | 13.97 | 1.4913 | 1.4913 | |||||

| WMT / Walmart Inc. | 0.14 | -17.66 | 13.85 | -8.29 | 1.4780 | -0.3310 | |||

| AMAT / Applied Materials, Inc. | 0.07 | 13.62 | 1.4537 | 1.4537 | |||||

| CAT / Caterpillar Inc. | 0.03 | 12.69 | 1.3542 | 1.3542 | |||||

| GSCE / GS Connect S&P GSCI Enhanced Commodity Total Return ETN | 0.02 | 36.00 | 12.01 | 76.21 | 1.2812 | 0.4650 | |||

| C / Citigroup Inc. | 0.14 | -26.81 | 11.71 | -12.24 | 1.2491 | -0.3487 | |||

| MCK / McKesson Corporation | 0.02 | 94.47 | 11.59 | 111.73 | 1.2365 | 0.5810 | |||

| ADP / Automatic Data Processing, Inc. | 0.04 | 11.46 | 1.2232 | 1.2232 | |||||

| TJX / The TJX Companies, Inc. | 0.09 | 10.75 | 1.1469 | 1.1469 | |||||

| APH / Amphenol Corporation | 0.11 | -13.81 | 10.60 | 29.77 | 1.1314 | 0.1527 | |||

| FCX / Freeport-McMoRan Inc. | 0.23 | 339.04 | 9.94 | 402.83 | 1.0604 | 0.8236 | |||

| STT / State Street Corporation | 0.09 | 24.12 | 9.92 | 47.43 | 1.0588 | 0.2526 | |||

| WFC / Wells Fargo & Company | 0.12 | -5.75 | 9.80 | 5.19 | 1.0463 | -0.0702 | |||

| PANW / Palo Alto Networks, Inc. | 0.05 | 91.70 | 9.78 | 129.88 | 1.0435 | 0.5340 | |||

| ISRG / Intuitive Surgical, Inc. | 0.02 | -8.77 | 9.77 | 0.09 | 1.0421 | -0.1266 | |||

| GE / General Electric Company | 0.04 | -18.57 | 9.58 | 4.71 | 1.0221 | -0.0735 | |||

| PGR / The Progressive Corporation | 0.04 | 10.33 | 9.42 | 4.03 | 1.0049 | -0.0794 | |||

| WELL / Welltower Inc. | 0.06 | 9.05 | 0.9662 | 0.9662 | |||||

| AXP / American Express Company | 0.03 | 9.02 | 0.9624 | 0.9624 | |||||

| HD / The Home Depot, Inc. | 0.02 | 161.07 | 8.88 | 161.19 | 0.9475 | 0.5403 | |||

| AZO / AutoZone, Inc. | 0.00 | 8.82 | 0.9413 | 0.9413 | |||||

| AMD / Advanced Micro Devices, Inc. | 0.06 | 8.80 | 0.9386 | 0.9386 | |||||

| RSG / Republic Services, Inc. | 0.04 | 8.64 | 0.9216 | 0.9216 | |||||

| MA / Mastercard Incorporated | 0.02 | 8.60 | 0.9180 | 0.9180 | |||||

| MCD / McDonald's Corporation | 0.03 | 8.14 | 0.8684 | 0.8684 | |||||

| NFLX / Netflix, Inc. | 0.01 | -64.76 | 7.70 | -49.40 | 0.8214 | -1.0007 | |||

| GILD / Gilead Sciences, Inc. | 0.07 | 15.81 | 7.62 | 14.59 | 0.8136 | 0.0166 | |||

| CAH / Cardinal Health, Inc. | 0.05 | -34.55 | 7.59 | -20.18 | 0.8104 | -0.3294 | |||

| USFD / US Foods Holding Corp. | 0.10 | -40.91 | 7.57 | -30.49 | 0.8079 | -0.4967 | |||

| COST / Costco Wholesale Corporation | 0.01 | 0.00 | 7.48 | 4.68 | 0.7977 | -0.0578 | |||

| VST / Vistra Corp. | 0.04 | -55.57 | 7.46 | -26.68 | 0.7963 | -0.4228 | |||

| FLEX / Flex Ltd. | 0.14 | 17.69 | 7.23 | 77.65 | 0.7718 | 0.2840 | |||

| CSCO / Cisco Systems, Inc. | 0.10 | -20.84 | 7.18 | -11.01 | 0.7664 | -0.2002 | |||

| GEV / GE Vernova Inc. | 0.01 | 20.75 | 7.17 | 109.29 | 0.7648 | 0.3546 | |||

| AMGN / Amgen Inc. | 0.03 | 7.07 | 0.7548 | 0.7548 | |||||

| HWM / Howmet Aerospace Inc. | 0.04 | -29.14 | 7.02 | 1.68 | 0.7489 | -0.0780 | |||

| RL / Ralph Lauren Corporation | 0.03 | 19.75 | 6.97 | 48.81 | 0.7434 | 0.1826 | |||

| CRH / CRH plc | 0.08 | 133.99 | 6.91 | 144.20 | 0.7375 | 0.3985 | |||

| UBER / Uber Technologies, Inc. | 0.07 | -67.92 | 6.90 | -58.93 | 0.7366 | -1.2764 | |||

| LIN / Linde plc | 0.01 | -24.55 | 6.89 | -23.98 | 0.7349 | -0.3502 | |||

| 1MSI / Motorola Solutions, Inc. | 0.02 | 6.88 | 0.7346 | 0.7346 | |||||

| SO / The Southern Company | 0.07 | 6.75 | 0.7205 | 0.7205 | |||||

| BSX / Boston Scientific Corporation | 0.06 | 0.00 | 6.66 | 6.47 | 0.7110 | -0.0386 | |||

| ORCL / Oracle Corporation | 0.03 | 4.17 | 6.33 | 62.91 | 0.6755 | 0.2100 | |||

| IBM / International Business Machines Corporation | 0.02 | 0.00 | 6.26 | 18.55 | 0.6678 | 0.0355 | |||

| TMUS / T-Mobile US, Inc. | 0.03 | 6.23 | 0.6647 | 0.6647 | |||||

| RCL / Royal Caribbean Cruises Ltd. | 0.02 | 0.00 | 5.47 | 52.44 | 0.5839 | 0.1539 | |||

| PLTR / Palantir Technologies Inc. | 0.04 | 5.06 | 0.5398 | 0.5398 | |||||

| BKNG / Booking Holdings Inc. | 0.00 | -64.63 | 4.89 | -55.56 | 0.5220 | -0.7963 | |||

| CYBR / CyberArk Software Ltd. | 0.01 | 4.82 | 0.5147 | 0.5147 | |||||

| RBRK / Rubrik, Inc. | 0.05 | 4.68 | 0.4998 | 0.4998 | |||||

| WAB / Westinghouse Air Brake Technologies Corporation | 0.02 | 0.00 | 3.92 | 15.43 | 0.4183 | 0.0116 | |||

| SNPS / Synopsys, Inc. | 0.01 | 3.64 | 0.3887 | 0.3887 | |||||

| LIT / Global X Funds - Global X Lithium & Battery Tech ETF | 0.08 | 0.00 | 3.07 | -1.16 | 0.3278 | -0.0445 | |||

| INKT / MiNK Therapeutics, Inc. | 0.02 | 0.12 | 0.0131 | 0.0131 | |||||

| PLUG / Plug Power Inc. | 0.02 | 0.00 | 0.03 | 10.71 | 0.0033 | -0.0001 | |||

| MTB / M&T Bank Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BK / The Bank of New York Mellon Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SYK / Stryker Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| YUMC / Yum China Holdings, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SPGI / S&P Global Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| AR / Antero Resources Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| FITB / Fifth Third Bancorp | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| FI / Fiserv, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| EXEL / Exelixis, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| INKT / MiNK Therapeutics, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| HON / Honeywell International Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| UNH / UnitedHealth Group Incorporated | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| EXPE / Expedia Group, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CMI / Cummins Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| EMR / Emerson Electric Co. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PCAR / PACCAR Inc | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| UTHR / United Therapeutics Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TKO / TKO Group Holdings, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GMED / Globus Medical, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| NFG / National Fuel Gas Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MMC / Marsh & McLennan Companies, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MS / Morgan Stanley | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| LYV / Live Nation Entertainment, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GM / General Motors Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PODD / Insulet Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SNOW / Snowflake Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| LNG / Cheniere Energy, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| LDOS / Leidos Holdings, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| DLR / Digital Realty Trust, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |