Mga Batayang Estadistika

| Nilai Portofolio | $ 5,790,155,345 |

| Posisi Saat Ini | 72 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

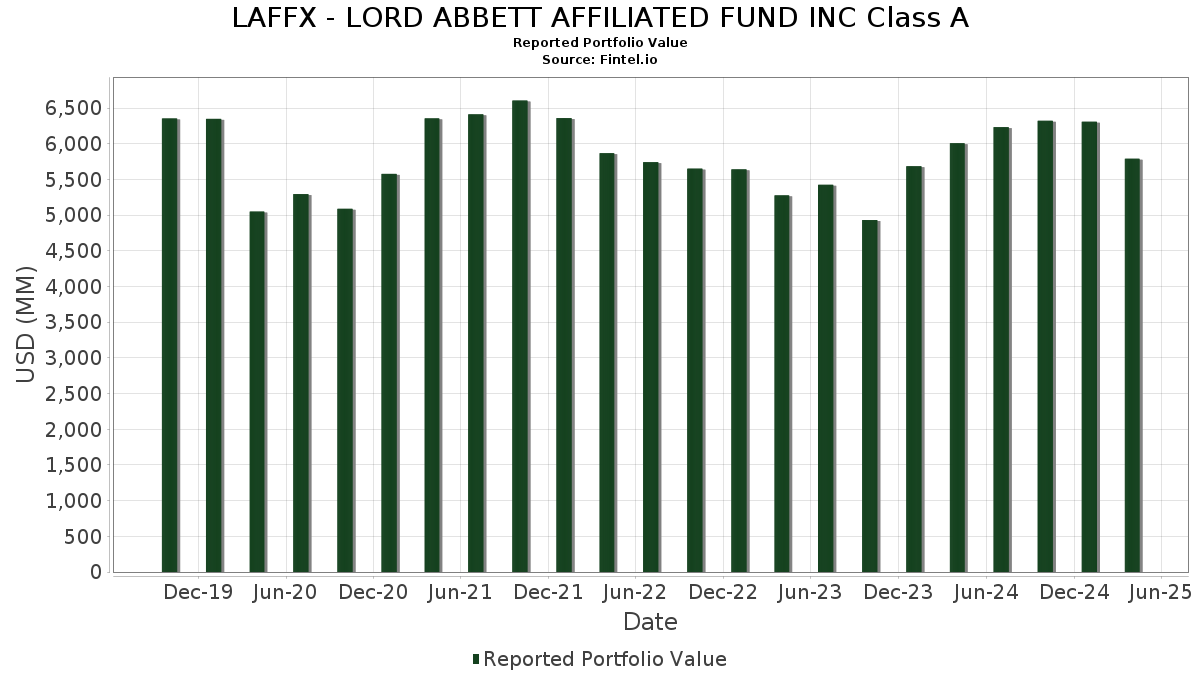

LAFFX - LORD ABBETT AFFILIATED FUND INC Class A telah mengungkapkan total kepemilikan 72 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 5,790,155,345 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama LAFFX - LORD ABBETT AFFILIATED FUND INC Class A adalah Philip Morris International Inc. (US:PM) , Exxon Mobil Corporation (US:XOM) , JPMorgan Chase & Co. (US:JPM) , Walmart Inc. (US:WMT) , and Abbott Laboratories (US:ABT) . Posisi baru LAFFX - LORD ABBETT AFFILIATED FUND INC Class A meliputi: Stryker Corporation (US:SYK) , Cintas Corporation (US:CTAS) , Compagnie de Saint-Gobain S.A. (CH:GOB) , NVIDIA Corporation (US:NVDA) , and Amphenol Corporation (US:APH) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.26 | 99.01 | 1.7098 | 1.7098 | |

| 94.34 | 1.6291 | 1.6291 | ||

| 0.98 | 104.25 | 1.8003 | 1.2913 | |

| 0.35 | 74.69 | 1.2897 | 1.2897 | |

| 0.68 | 74.19 | 1.2812 | 1.2812 | |

| 0.51 | 55.38 | 0.9563 | 0.9563 | |

| 0.96 | 73.07 | 1.2618 | 0.7612 | |

| 0.57 | 43.76 | 0.7556 | 0.7556 | |

| 0.01 | 72.70 | 1.2553 | 0.6830 | |

| 0.18 | 57.60 | 0.9946 | 0.6440 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.03 | 29.11 | 0.5028 | -1.1247 | |

| 0.02 | 8.42 | 0.1453 | -0.9619 | |

| 1.85 | 73.74 | 1.2734 | -0.8405 | |

| 0.22 | 43.68 | 0.7543 | -0.7736 | |

| 0.68 | 71.61 | 1.2366 | -0.7108 | |

| 0.08 | 47.81 | 0.8257 | -0.6623 | |

| 0.48 | 66.68 | 1.1514 | -0.6595 | |

| 0.36 | 49.99 | 0.8632 | -0.5928 | |

| 1.90 | 58.10 | 1.0033 | -0.5926 | |

| 0.46 | 76.39 | 1.3192 | -0.5769 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-06-26 untuk periode pelaporan 2025-04-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| PM / Philip Morris International Inc. | 1.16 | -18.17 | 198.34 | 7.70 | 3.4251 | 0.5040 | |||

| XOM / Exxon Mobil Corporation | 1.81 | 0.00 | 191.13 | -1.12 | 3.3006 | 0.2345 | |||

| JPM / JPMorgan Chase & Co. | 0.75 | -9.07 | 182.68 | -16.78 | 3.1545 | -0.3273 | |||

| WMT / Walmart Inc. | 1.81 | -21.12 | 176.29 | -21.85 | 3.0443 | -0.5336 | |||

| ABT / Abbott Laboratories | 1.31 | 6.75 | 171.02 | 9.11 | 2.9532 | 0.4670 | |||

| SCHW / The Charles Schwab Corporation | 1.92 | 0.00 | 156.61 | -1.60 | 2.7044 | 0.1801 | |||

| WFC / Wells Fargo & Company | 2.05 | 0.00 | 145.24 | -9.89 | 2.5080 | -0.0484 | |||

| UNH / UnitedHealth Group Incorporated | 0.33 | 23.48 | 137.27 | -6.35 | 2.3704 | 0.0455 | |||

| MMC / Marsh & McLennan Companies, Inc. | 0.60 | -10.02 | 135.33 | -6.45 | 2.3370 | 0.0423 | |||

| CRH / CRH plc | 1.37 | -7.20 | 130.81 | -10.58 | 2.2590 | -0.0614 | |||

| AVGO / Broadcom Inc. | 0.65 | 31.41 | 124.42 | 14.30 | 2.1486 | 0.4220 | |||

| GE / General Electric Company | 0.61 | -10.37 | 123.54 | -11.26 | 2.1333 | -0.0748 | |||

| LIN / Linde plc | 0.27 | 19.35 | 122.69 | 21.25 | 2.1186 | 0.5137 | |||

| ETR / Entergy Corporation | 1.42 | -29.49 | 118.10 | -27.67 | 2.0394 | -0.5504 | |||

| SPGI / S&P Global Inc. | 0.23 | 0.00 | 113.92 | -4.10 | 1.9671 | 0.0831 | |||

| KMI / Kinder Morgan, Inc. | 4.29 | -15.07 | 112.81 | -18.71 | 1.9481 | -0.2532 | |||

| PH / Parker-Hannifin Corporation | 0.18 | -7.36 | 110.39 | -20.72 | 1.9063 | -0.3023 | |||

| GILD / Gilead Sciences, Inc. | 0.98 | 196.37 | 104.25 | 224.85 | 1.8003 | 1.2913 | |||

| WM / Waste Management, Inc. | 0.44 | 0.00 | 103.17 | 5.95 | 1.7816 | 0.2370 | |||

| GOOGL / Alphabet Inc. | 0.65 | 0.00 | 102.60 | -22.16 | 1.7718 | -0.3191 | |||

| META / Meta Platforms, Inc. | 0.19 | 0.00 | 102.23 | -20.34 | 1.7654 | -0.2702 | |||

| SYK / Stryker Corporation | 0.26 | 99.01 | 1.7098 | 1.7098 | |||||

| FIXED INC CLEARING CORP.REPO / RA (000000000) | 94.34 | 1.6291 | 1.6291 | ||||||

| MS / Morgan Stanley | 0.81 | 9.08 | 93.47 | -9.05 | 1.6141 | -0.0160 | |||

| ABBV / AbbVie Inc. | 0.47 | 0.00 | 92.36 | 6.09 | 1.5948 | 0.2140 | |||

| NEE.PRS / NextEra Energy, Inc. - Debt/Equity Composite Units | 1.98 | 0.00 | 92.02 | -5.15 | 1.5891 | 0.0503 | |||

| NOC / Northrop Grumman Corporation | 0.18 | -4.53 | 89.53 | -4.68 | 1.5460 | 0.0562 | |||

| LNG / Cheniere Energy, Inc. | 0.38 | 5.52 | 88.30 | 48.71 | 1.5248 | 0.4789 | |||

| KO / The Coca-Cola Company | 1.20 | 29.51 | 87.22 | 48.01 | 1.5061 | 0.5715 | |||

| CRM / Salesforce, Inc. | 0.31 | 14.96 | 84.06 | -9.59 | 1.4516 | -0.0232 | |||

| AER / AerCap Holdings N.V. | 0.78 | -23.69 | 82.94 | -15.39 | 1.4323 | -0.1226 | |||

| LH / Labcorp Holdings Inc. | 0.33 | 31.89 | 80.17 | 27.25 | 1.3844 | 0.3851 | |||

| CB / Chubb Limited | 0.28 | -21.95 | 80.01 | -17.87 | 1.3817 | -0.1636 | |||

| LOW / Lowe's Companies, Inc. | 0.36 | 0.00 | 79.60 | -14.03 | 1.3746 | -0.0940 | |||

| WSO / Watsco, Inc. | 0.17 | 23.12 | 79.14 | 18.30 | 1.3666 | 0.3055 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.46 | -19.75 | 76.39 | -36.10 | 1.3192 | -0.5769 | |||

| CTAS / Cintas Corporation | 0.35 | 74.69 | 1.2897 | 1.2897 | |||||

| GOB / Compagnie de Saint-Gobain S.A. | 0.68 | 74.19 | 1.2812 | 1.2812 | |||||

| BAC / Bank of America Corporation | 1.85 | -35.76 | 73.74 | -44.67 | 1.2734 | -0.8405 | |||

| NDAQ / Nasdaq, Inc. | 0.96 | 150.13 | 73.07 | 131.51 | 1.2618 | 0.7612 | |||

| BKNG / Booking Holdings Inc. | 0.01 | 87.18 | 72.70 | 101.48 | 1.2553 | 0.6830 | |||

| EMR / Emerson Electric Co. | 0.68 | -27.89 | 71.61 | -41.67 | 1.2366 | -0.7108 | |||

| CBOE / Cboe Global Markets, Inc. | 0.31 | 62.14 | 69.08 | 76.00 | 1.1929 | 0.5704 | |||

| ROST / Ross Stores, Inc. | 0.48 | -36.74 | 66.68 | -41.60 | 1.1514 | -0.6595 | |||

| MFC / Manulife Financial Corporation | 1.90 | -43.59 | 58.10 | -42.25 | 1.0033 | -0.5926 | |||

| MCD / McDonald's Corporation | 0.18 | 135.32 | 57.60 | 160.56 | 0.9946 | 0.6440 | |||

| LRCX / Lam Research Corporation | 0.79 | 58.18 | 56.72 | 39.88 | 0.9795 | 0.3363 | |||

| NVDA / NVIDIA Corporation | 0.51 | 55.38 | 0.9563 | 0.9563 | |||||

| ROP / Roper Technologies, Inc. | 0.10 | 0.00 | 53.40 | -2.70 | 0.9221 | 0.0516 | |||

| EXE / Expand Energy Corporation | 0.48 | 26.99 | 50.19 | 29.87 | 0.8668 | 0.2537 | |||

| ALLE / Allegion plc | 0.36 | -48.08 | 49.99 | -45.55 | 0.8632 | -0.5928 | |||

| AMP / Ameriprise Financial, Inc. | 0.10 | -24.03 | 48.59 | -34.15 | 0.8390 | -0.3313 | |||

| LLY / Eli Lilly and Company | 0.05 | 89.31 | 48.51 | 109.82 | 0.8377 | 0.4710 | |||

| BX / Blackstone Inc. | 0.37 | 0.00 | 48.21 | -25.63 | 0.8325 | -0.1957 | |||

| URI / United Rentals, Inc. | 0.08 | -38.81 | 47.81 | -49.03 | 0.8257 | -0.6623 | |||

| SHEL / Shell plc | 0.73 | -34.51 | 47.22 | -35.87 | 0.8154 | -0.3525 | |||

| APH / Amphenol Corporation | 0.57 | 43.76 | 0.7556 | 0.7556 | |||||

| ADI / Analog Devices, Inc. | 0.22 | -50.70 | 43.68 | -54.65 | 0.7543 | -0.7736 | |||

| STLD / Steel Dynamics, Inc. | 0.31 | -19.11 | 40.38 | -18.15 | 0.6973 | -0.0852 | |||

| COST / Costco Wholesale Corporation | 0.04 | 0.00 | 36.07 | 1.49 | 0.6228 | 0.0592 | |||

| PG / The Procter & Gamble Company | 0.21 | 0.00 | 34.37 | -2.06 | 0.5935 | 0.0369 | |||

| FERG / Ferguson Enterprises Inc. | 0.18 | -51.93 | 30.56 | -54.97 | 0.5277 | -0.5488 | |||

| ACN / Accenture plc | 0.10 | -34.47 | 29.29 | -49.07 | 0.5058 | -0.4064 | |||

| BLK / BlackRock, Inc. | 0.03 | -66.62 | 29.11 | -71.62 | 0.5028 | -1.1247 | |||

| UNP / Union Pacific Corporation | 0.13 | 0.00 | 28.99 | -12.97 | 0.5006 | -0.0277 | |||

| POOL / Pool Corporation | 0.08 | -36.91 | 23.91 | -46.28 | 0.4129 | -0.2931 | |||

| CMS / CMS Energy Corporation | 0.32 | 23.33 | 0.4029 | 0.4029 | |||||

| PGR / The Progressive Corporation | 0.06 | 18.04 | 0.3115 | 0.3115 | |||||

| BAH / Booz Allen Hamilton Holding Corporation | 0.14 | -41.41 | 17.16 | -45.49 | 0.2964 | -0.2030 | |||

| MPC / Marathon Petroleum Corporation | 0.09 | 0.00 | 12.51 | -5.69 | 0.2159 | 0.0056 | |||

| CMI / Cummins Inc. | 0.04 | -52.18 | 11.70 | -60.55 | 0.2021 | -0.2685 | |||

| MC / LVMH Moët Hennessy - Louis Vuitton, Société Européenne | 0.02 | -84.08 | 8.42 | -87.95 | 0.1453 | -0.9619 |