Mga Batayang Estadistika

| Nilai Portofolio | $ 2,951,000,455 |

| Posisi Saat Ini | 191 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

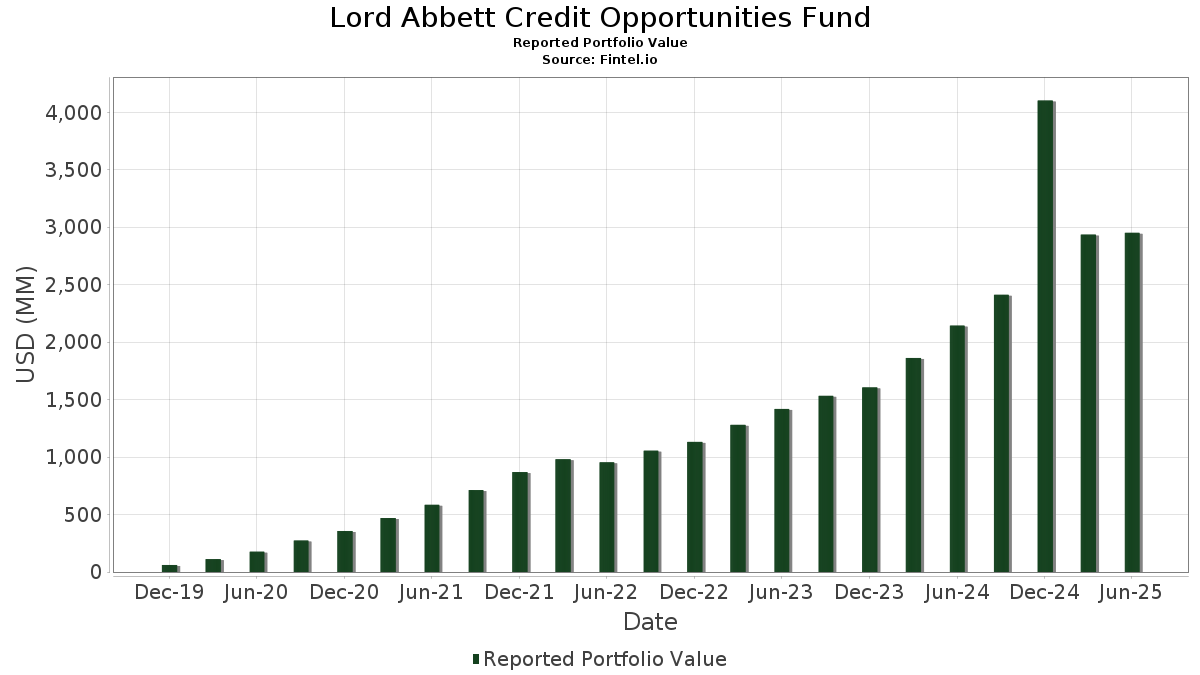

Lord Abbett Credit Opportunities Fund telah mengungkapkan total kepemilikan 191 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 2,951,000,455 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Lord Abbett Credit Opportunities Fund adalah LBM Acquisition LLC (US:US05552BAA44) , Shelf Drilling Holdings Ltd (KY:US822538AH74) , Transocean Inc 7.50% 4/15/2031 (US:US893830AF64) , Cornerstone Building Brands, Inc. (US:US21925DAA72) , and Park River Holdings Inc (US:US70082LAA52) . Posisi baru Lord Abbett Credit Opportunities Fund meliputi: LBM Acquisition LLC (US:US05552BAA44) , Shelf Drilling Holdings Ltd (KY:US822538AH74) , Transocean Inc 7.50% 4/15/2031 (US:US893830AF64) , Cornerstone Building Brands, Inc. (US:US21925DAA72) , and Park River Holdings Inc (US:US70082LAA52) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 125.62 | 4.3044 | 4.3044 | ||

| 3.99 | 99.72 | 3.4169 | 3.4169 | |

| 75.49 | 2.5866 | 2.5866 | ||

| 1.63 | 40.93 | 1.4026 | 1.4026 | |

| 39.74 | 1.3617 | 1.3617 | ||

| 38.50 | 1.3192 | 1.3192 | ||

| 31.46 | 1.0780 | 1.0780 | ||

| 24.31 | 0.8329 | 0.8329 | ||

| 23.00 | 0.7881 | 0.7881 | ||

| 22.96 | 0.7867 | 0.7867 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 5.15 | 0.1765 | -0.4609 | ||

| 8.20 | 0.2810 | -0.4081 | ||

| 29.35 | 1.0058 | -0.3775 | ||

| 1.25 | 0.0428 | -0.3604 | ||

| 4.99 | 0.1710 | -0.3521 | ||

| 39.48 | 1.3526 | -0.3422 | ||

| 20.66 | 0.7079 | -0.2612 | ||

| 15.71 | 0.5383 | -0.2367 | ||

| 24.57 | 0.8420 | -0.1867 | ||

| 49.69 | 1.7025 | -0.1674 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-28 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| FIXED INC CLEARING CORP.REPO / RA (000000000) | 125.62 | 4.3044 | 4.3044 | ||||||

| LORD ABBETT PCF2 / EC (000000000) | 3.99 | 99.72 | 3.4169 | 3.4169 | |||||

| Q1UA34 / Quanta Services, Inc. - Depositary Receipt (Common Stock) | 75.49 | 2.5866 | 2.5866 | ||||||

| VTLE / Vital Energy, Inc. | 69.97 | 8.55 | 2.3977 | 0.1313 | |||||

| US05552BAA44 / LBM Acquisition LLC | 67.87 | 13.00 | 2.3255 | 0.2139 | |||||

| SOIL / Saturn Oil & Gas Inc. | 63.19 | 20.62 | 2.1652 | 0.3232 | |||||

| Moss Creek Resources Holdings Inc / DBT (US61965RAC97) | 61.34 | 11.91 | 2.1019 | 0.1747 | |||||

| BTE / Baytex Energy Corp. | 60.10 | 51.80 | 2.0593 | 0.6673 | |||||

| Kraken Oil & Gas Partners LLC / DBT (US50076PAA66) | 55.83 | 19.83 | 1.9129 | 0.2749 | |||||

| US822538AH74 / Shelf Drilling Holdings Ltd | 52.79 | -4.57 | 1.8087 | -0.1362 | |||||

| US893830AF64 / Transocean Inc 7.50% 4/15/2031 | 49.69 | -6.58 | 1.7025 | -0.1674 | |||||

| Twitter Inc 2025 Fixed Term Loan / LON (US90184NAK46) | 47.04 | 28.39 | 1.6119 | 0.3236 | |||||

| US21925DAA72 / Cornerstone Building Brands, Inc. | 43.06 | 17.42 | 1.4754 | 0.1861 | |||||

| US70082LAA52 / Park River Holdings Inc | 42.65 | 3.72 | 1.4613 | 0.0156 | |||||

| SCF Equipment Leasing 2022-2 LLC / ABS-O (US78397WAH97) | 42.33 | 0.55 | 1.4505 | -0.0298 | |||||

| XS2340137343 / Herens Midco Sarl | 41.64 | 3.04 | 1.4269 | 0.0059 | |||||

| LORD ABBETT PVT CR FUND 1 LP / EC (000000000) | 1.63 | 40.93 | 1.4026 | 1.4026 | |||||

| VET / Vermilion Energy Inc. | 40.44 | 135.48 | 1.3858 | 0.7819 | |||||

| US29450YAA73 / EquipmentShare.com, Inc. | 40.31 | -5.28 | 1.3812 | -0.1150 | |||||

| XAG0300CAC73 / Alloy Finco Limited USD Holdco PIK Term Loan | 40.30 | 19.44 | 1.3809 | 0.1946 | |||||

| Aviation Capital Group LLC / STIV (US05369BU158) | 39.74 | 1.3617 | 1.3617 | ||||||

| US350392AA45 / Foundation Building Materials Inc | 39.48 | -18.11 | 1.3526 | -0.3422 | |||||

| US389286AA34 / Gray Escrow II Inc | 38.70 | 8.70 | 1.3261 | 0.0743 | |||||

| HCA Inc / STIV (US40412BU195) | 38.50 | 1.3192 | 1.3192 | ||||||

| US81105DAB10 / SCRIPPS ESCROW II INC SR UNSECURED 144A 01/31 5.375 | 37.17 | 52.83 | 1.2735 | 0.4185 | |||||

| VStrong Auto Receivables Trust 2024-A / ABS-O (US92891PAN33) | 36.42 | -0.16 | 1.2479 | -0.0346 | |||||

| US444454AF95 / HUGHES SATELLITE SYSTEMS CORPORATION 6.625% 08/01/2026 | 33.67 | 5.48 | 1.1537 | 0.0313 | |||||

| US80290CBK99 / Santander Bank Auto Credit-Linked Notes Series 2022-C | 33.32 | -2.67 | 1.1417 | -0.0619 | |||||

| US126307BD80 / CSC HOLDINGS LLC SR UNSECURED 144A 12/30 4.625 | 33.24 | 12.90 | 1.1389 | 0.1038 | |||||

| US92641PAA49 / VICTORS MERGER CORP 6.375% 05/15/2029 144A | 32.76 | -7.28 | 1.1227 | -0.1197 | |||||

| 888 Acquisitions Limited USD Term Loan B / LON (000000000) | 31.46 | 1.0780 | 1.0780 | ||||||

| ASP UNIFRAX HLDGS INC / DBT (US00218LAG68) | 30.98 | -1.77 | 1.0616 | -0.0473 | |||||

| US629571AB69 / Nabors Industries Ltd | 30.34 | -3.10 | 1.0396 | -0.0613 | |||||

| US30168CAG33 / Exeter Automobile Receivables Trust, Series 2023-2A, Class E | 29.55 | -0.06 | 1.0125 | -0.0270 | |||||

| US36262BAA08 / GPS Hospitality Holding Co LLC / GPS Finco Inc | 29.40 | 3.66 | 1.0072 | 0.0102 | |||||

| US92840JAB52 / VistaJet Malta Finance PLC / XO Management Holding Inc | 29.35 | -25.39 | 1.0058 | -0.3775 | |||||

| Crescent Energy Finance LLC / DBT (US45344LAE39) | 28.63 | 16.10 | 0.9809 | 0.1139 | |||||

| US78397NAA46 / SCF Preferred Equity LLC | 28.20 | -0.77 | 0.9663 | -0.0329 | |||||

| US20600RAB87 / Conair Holdings, LLC Term Loan B | 28.03 | 12.79 | 0.9603 | 0.0866 | |||||

| Central Parent Inc 2024 Term Loan B / LON (US15477BAE74) | 24.57 | -16.02 | 0.8420 | -0.1867 | |||||

| HCA Inc / STIV (US40412BU278) | 24.31 | 0.8329 | 0.8329 | ||||||

| JBS USA Holding Lux Sarl/ JBS USA Food Co/ JBS Lux Co Sarl / STIV (US47214KU140) | 23.00 | 0.7881 | 0.7881 | ||||||

| CMP / Compass Minerals International, Inc. | 22.96 | 0.7867 | 0.7867 | ||||||

| Hilcorp Energy I LP / Hilcorp Finance Co / DBT (US431318BG88) | 21.44 | 20.42 | 0.7347 | 0.1086 | |||||

| US70082LAB36 / Park River Holdings Inc | 20.73 | 4.25 | 0.7102 | 0.0112 | |||||

| Brand Industrial Services Inc 2024 Term Loan B / LON (US10524MAS61) | 20.66 | -25.04 | 0.7079 | -0.2612 | |||||

| Santander Bank Auto Credit-Linked Notes Series 2022-B / ABS-O (US80290CBC73) | 20.49 | -0.36 | 0.7020 | -0.0209 | |||||

| Crescent Energy Finance LLC / DBT (US45344LAD55) | 20.38 | 87.87 | 0.6983 | 0.3169 | |||||

| A1ES34 / The AES Corporation - Depositary Receipt (Common Stock) | 20.25 | 0.6939 | 0.6939 | ||||||

| Exeter Automobile Receivables Trust 2024-2 / ABS-O (US30166DAG34) | 20.09 | 31.41 | 0.6885 | 0.1509 | |||||

| US67351PAC23 / OCP CLO 2023-26 Ltd | 20.09 | 0.84 | 0.6884 | -0.0121 | |||||

| US80290CAV63 / Santander Bank Auto Credit-Linked Notes Series 2022-A | 19.05 | -1.55 | 0.6528 | -0.0276 | |||||

| US893830AT68 / Transocean Inc. 6.8% Senior Notes 3/15/38 | 18.45 | 17.98 | 0.6323 | 0.0824 | |||||

| JBS USA Holding Lux Sarl/ JBS USA Food Co/ JBS Lux Co Sarl / STIV (US47214KU223) | 17.60 | 0.6030 | 0.6030 | ||||||

| US350392AA45 / Foundation Building Materials Inc | 17.53 | 0.6006 | 0.6006 | ||||||

| A3KMYN / Air Lease Corporation - Preferred Stock | 17.50 | 0.5995 | 0.5995 | ||||||

| Sinclair Television Group Inc 2025 Term Loan B6 / LON (US829229AU76) | 16.66 | 36.50 | 0.5710 | 0.1418 | |||||

| US30168BAG59 / Exeter Automobile Receivables Trust, Series 2023-1A, Class E | 16.16 | -0.75 | 0.5537 | -0.0187 | |||||

| US83549RU107 / SONOCO PRODUCTS CO | 16.10 | 0.5517 | 0.5517 | ||||||

| US12804BAB45 / CAL Receivables 2022-1 LLC | 15.71 | -28.73 | 0.5383 | -0.2367 | |||||

| NBR / Nabors Industries Ltd. | 15.16 | 28.41 | 0.5194 | 0.1043 | |||||

| KKR CLO 56 Ltd / ABS-CBDO (US48256HAA05) | 14.98 | 0.38 | 0.5132 | -0.0114 | |||||

| AGL CLO 30 Ltd / ABS-CBDO (US00120YAA82) | 13.82 | -0.55 | 0.4734 | -0.0151 | |||||

| CTM CLO 2025-1 Ltd / ABS-CBDO (US12719PAJ03) | 13.66 | 0.4681 | 0.4681 | ||||||

| Cedar Funding XVIII CLO Ltd / ABS-CBDO (US15033BAJ35) | 13.65 | 0.70 | 0.4678 | -0.0089 | |||||

| Madison Park Funding XLVII Ltd / ABS-CBDO (US55820FAS74) | 12.62 | -0.93 | 0.4326 | -0.0154 | |||||

| US500688AD86 / Kosmos Energy Ltd | 12.30 | -12.75 | 0.4216 | -0.0742 | |||||

| US65441VAE11 / Nine Energy Service Inc | 12.19 | -22.99 | 0.4178 | -0.1389 | |||||

| GLS Auto Receivables Issuer Trust 2023-4 / ABS-O (US362929AG61) | 12.05 | 1.28 | 0.4128 | -0.0054 | |||||

| JBS USA Holding Lux Sarl/ JBS USA Food Co/ JBS Lux Co Sarl / STIV (US47214KU306) | 12.00 | 0.4111 | 0.4111 | ||||||

| New Mountain CLO 5 Ltd / ABS-CBDO (US64754XAC56) | 11.51 | -13.10 | 0.3944 | -0.0713 | |||||

| Rad CLO 22 Ltd / ABS-CBDO (US74936CAC10) | 11.41 | -13.21 | 0.3910 | -0.0713 | |||||

| XS2333301674 / PCF GmbH | 11.38 | 5.74 | 0.3900 | 0.0116 | |||||

| Elmwood CLO 20 Ltd / ABS-CBDO (US29002BAE20) | 11.35 | -28.16 | 0.3890 | -0.1666 | |||||

| US750105AA69 / Rad CLO 20 Ltd | 11.25 | -1.32 | 0.3855 | -0.0154 | |||||

| US36267PAL04 / GLS Auto Receivables Issuer Trust, Series 2023-3A, Class E | 10.74 | 1.25 | 0.3681 | -0.0049 | |||||

| US00791GAA58 / AG Merger Sub II, Inc. | 10.64 | -1.62 | 0.3647 | -0.0157 | |||||

| KKR CLO 47 Ltd / ABS-CBDO (US48190EAA64) | 10.58 | 0.88 | 0.3626 | -0.0063 | |||||

| ICG US CLO 2024-R1 Ltd / ABS-CBDO (US44934XAG16) | 10.54 | -1.91 | 0.3611 | -0.0166 | |||||

| Dryden 94 CLO Ltd / ABS-CBDO (US26248EAE68) | 10.39 | 2.52 | 0.3560 | -0.0003 | |||||

| US33843EAN13 / Flagship Credit Auto Trust 2023-2 | 10.38 | -26.41 | 0.3556 | -0.1402 | |||||

| Ally Auto Receivables Trust 2024-1 / ABS-O (US02008F1049) | 10.19 | -9.68 | 0.3492 | -0.0475 | |||||

| US817942AA30 / 720 East CLO 2023-II Ltd | 10.17 | -0.47 | 0.3483 | -0.0108 | |||||

| NGC CLO 2 LTD / ABS-CBDO (US652942AN36) | 10.08 | 0.79 | 0.3454 | -0.0062 | |||||

| Bryant Park Funding 2025-26 Ltd / ABS-CBDO (US11765YAA55) | 10.06 | 0.55 | 0.3445 | -0.0071 | |||||

| Generate CLO 20 Ltd / ABS-CBDO (US370913AA35) | 10.02 | -1.08 | 0.3432 | -0.0128 | |||||

| US156700BD72 / LUMEN TECHNOLOGIES 4.5% 01/15/2029 144A | 9.96 | -22.69 | 0.3413 | -0.1117 | |||||

| Sycamore Tree CLO 2023-3 Ltd / ABS-CBDO (US87122FAW68) | 9.83 | -0.29 | 0.3368 | -0.0098 | |||||

| Dryden 115 CLO Ltd / ABS-CBDO (US26248HAA77) | 9.76 | 0.10 | 0.3345 | -0.0084 | |||||

| Empower CLO 2024-2 Ltd / ABS-CBDO (US29248KAA43) | 9.62 | 0.02 | 0.3296 | -0.0085 | |||||

| Trinitas CLO XXVI Ltd / ABS-CBDO (US89642PAE16) | 9.28 | 0.3181 | 0.3181 | ||||||

| US05875VAC63 / Ballyrock CLO 24 Ltd | 9.25 | -10.19 | 0.3169 | -0.0452 | |||||

| Bain Capital Credit CLO 2024-4 Ltd / ABS-CBDO (US05685WAA80) | 9.13 | 0.57 | 0.3128 | -0.0064 | |||||

| Harmony-Peace Park CLO Ltd / ABS-CBDO (US413279AL46) | 9.03 | -0.98 | 0.3094 | -0.0112 | |||||

| AMMC CLO 31 Ltd / ABS-CBDO (US031929AA01) | 8.90 | -0.16 | 0.3050 | -0.0085 | |||||

| GLS Auto Receivables Issuer Trust 2024-2 / ABS-O (US37964VAG23) | 8.62 | 1.84 | 0.2954 | -0.0022 | |||||

| 37 Capital Clo 4 Ltd / ABS-CBDO (US883933AE39) | 8.59 | -0.49 | 0.2943 | -0.0092 | |||||

| Ares LXXIV CLO Ltd / ABS-CBDO (US03990GAA85) | 8.54 | -0.29 | 0.2925 | -0.0085 | |||||

| AMMC CLO 30 Ltd / ABS-CBDO (US03165YAA82) | 8.39 | -0.42 | 0.2873 | -0.0087 | |||||

| US00164VAF04 / AMC Networks Inc | 8.20 | -58.16 | 0.2810 | -0.4081 | |||||

| Silver Point CLO 9 Ltd / ABS-CBDO (US82810LAA98) | 8.14 | 0.2787 | 0.2787 | ||||||

| CA30575PAU09 / Fairstone Financial Issuance Trust I | 8.10 | 5.87 | 0.2774 | 0.0086 | |||||

| NBR / Nabors Industries Ltd. | 8.09 | -14.25 | 0.2770 | -0.0545 | |||||

| ASP Unifrax Holdings Inc / DBT (US00218LAH42) | 8.08 | 29.36 | 0.2770 | 0.0573 | |||||

| Exeter Automobile Receivables Trust 2024-5 / ABS-O (US30165BAH69) | 7.86 | 0.2693 | 0.2693 | ||||||

| Ares LV CLO Ltd / ABS-CBDO (US04018DAG88) | 7.85 | 0.52 | 0.2690 | -0.0056 | |||||

| 720 East CLO 2022-I Ltd / ABS-CBDO (US81785CAE49) | 7.84 | -0.31 | 0.2688 | -0.0079 | |||||

| Exeter Automobile Receivables Trust 2024-3 / ABS-O (US30165AAG04) | 7.82 | 2.85 | 0.2681 | 0.0007 | |||||

| Perimeter Master Note Business Trust / ABS-O (US71384PBF71) | 7.77 | 0.2662 | 0.2662 | ||||||

| Trinitas CLO XXVI Ltd / ABS-CBDO (US89642MAS70) | 7.51 | 0.2573 | 0.2573 | ||||||

| US30166RAJ68 / EXETER AUTOMOBILE RECEIVABLES TRUST 2021-2 | 7.50 | -10.76 | 0.2570 | -0.0385 | |||||

| Generate Clo 16 Ltd / ABS-CBDO (US37149WAA18) | 7.41 | -1.04 | 0.2540 | -0.0094 | |||||

| US100018AB62 / Borr IHC Ltd. | 7.39 | 0.2531 | 0.2531 | ||||||

| Rockford Tower CLO 2025-1 Ltd / ABS-CBDO (US77341BAA98) | 7.33 | -1.09 | 0.2511 | -0.0094 | |||||

| AMMC CLO 23 Ltd / ABS-CBDO (US00176RAL24) | 7.29 | 0.2497 | 0.2497 | ||||||

| ASP Unifrax Holdings Inc 2024 Delayed Draw Term Loan / LON (US00216UAH68) | 7.26 | -0.64 | 0.2486 | -0.0081 | |||||

| Barrow Hanley CLO I Ltd / ABS-CBDO (US06875PAG81) | 7.24 | -1.08 | 0.2482 | -0.0093 | |||||

| Generate Clo 13 Ltd / ABS-CBDO (US370919AA05) | 7.09 | -0.67 | 0.2431 | -0.0080 | |||||

| Generate Clo 13 Ltd / ABS-CBDO (US370918AG91) | 7.09 | -0.34 | 0.2430 | -0.0072 | |||||

| Rad CLO 20 Ltd / ABS-CBDO (US749979AW01) | 7.08 | 0.2425 | 0.2425 | ||||||

| CIFC Funding 2024-I Ltd / ABS-CBDO (US12570XAG79) | 6.82 | 0.01 | 0.2336 | -0.0061 | |||||

| USB Auto Owner Trust 2025-1 / ABS-O (US90367VAH24) | 6.71 | 0.2298 | 0.2298 | ||||||

| US749979AG50 / Rad CLO 20 Ltd | 6.50 | -1.28 | 0.2227 | -0.0088 | |||||

| OII / Oceaneering International, Inc. | 6.50 | -29.03 | 0.2226 | -0.0992 | |||||

| SBNA Auto Receivables Trust 2024-A / ABS-O (US78437PAH64) | 6.17 | 1.98 | 0.2116 | -0.0013 | |||||

| Q1UA34 / Quanta Services, Inc. - Depositary Receipt (Common Stock) | 6.00 | 0.2056 | 0.2056 | ||||||

| AMCX / AMC Networks Inc. | 5.74 | 0.1968 | 0.1968 | ||||||

| INVESCO US CLO 2025-1 LTD / ABS-CBDO (US46151PAA21) | 5.54 | 0.1897 | 0.1897 | ||||||

| CIFC Funding 2023-II Ltd / ABS-CBDO (US125492AA65) | 5.51 | 0.15 | 0.1890 | -0.0046 | |||||

| Ballyrock CLO 26 Ltd / ABS-CBDO (US05876PAC86) | 5.47 | -15.31 | 0.1874 | -0.0397 | |||||

| Ballyrock CLO 20 Ltd / ABS-CBDO (US05876DAG60) | 5.33 | -2.24 | 0.1827 | -0.0091 | |||||

| US30165XAJ46 / EXETER AUTOMOBILE RECEIVABLES EART 2021 2A R | 5.33 | -13.07 | 0.1825 | -0.0329 | |||||

| HCA Inc / STIV (US40412BU922) | 5.31 | 0.1821 | 0.1821 | ||||||

| US91889FAC59 / Valaris Ltd | 5.15 | -71.59 | 0.1765 | -0.4609 | |||||

| Affirm Holdings Inc / DBT (US00827BAC00) | 5.14 | -14.65 | 0.1761 | -0.0356 | |||||

| Affirm Asset Securitization Trust 2025-X1 / ABS-O (US00834M1036) | 5.09 | 0.1743 | 0.1743 | ||||||

| EquipmentShare.com Inc / DBT (US29450YAB56) | 4.99 | -66.46 | 0.1710 | -0.3521 | |||||

| RAD CLO 23 Ltd / ABS-CBDO (US75009DAA28) | 4.91 | -0.39 | 0.1684 | -0.0051 | |||||

| US51507KAD81 / Lending Funding Trust 2020-2 | 4.81 | 0.80 | 0.1647 | -0.0030 | |||||

| APIDOS CLO XLVIII Ltd / ABS-CBDO (US03770XAA72) | 4.60 | -0.04 | 0.1576 | -0.0042 | |||||

| Bain Capital Credit Clo 2024-5 Ltd / ABS-CBDO (US056913AA48) | 4.59 | 0.37 | 0.1574 | -0.0035 | |||||

| Kleopatra Finco Sarl / DBT (XS3056028171) | 4.41 | 0.1512 | 0.1512 | ||||||

| US45332JAA07 / Rackspace Hosting Inc | 4.26 | 0.1459 | 0.1459 | ||||||

| AGL CLO 26 Ltd / ABS-CBDO (US00852JAA51) | 4.18 | -1.39 | 0.1432 | -0.0058 | |||||

| Affirm Asset Securitization Trust 2024-X2 / ABS-O (US00833Q1058) | 4.13 | -32.07 | 0.1416 | -0.0723 | |||||

| US05353LAE56 / Avant Loans Funding Trust 2021-REV1 | 3.91 | 1.11 | 0.1341 | -0.0020 | |||||

| Bridge Street CLO Ltd / ABS-CBDO (US107922AA48) | 3.48 | -0.63 | 0.1192 | -0.0039 | |||||

| Affirm Asset Securitization Trust 2024-X1 / ABS-O (US00834XAE94) | 3.19 | -29.63 | 0.1092 | -0.0500 | |||||

| Orion CLO 2025-5 Ltd / ABS-CBDO (US68627DAA90) | 3.02 | 0.1034 | 0.1034 | ||||||

| Silver Point CLO 1 Ltd / ABS-CBDO (US82808DAL73) | 2.70 | -1.57 | 0.0924 | -0.0039 | |||||

| US70687AAA88 / PenFed Auto Receivables Owner Trust 2022-A | 2.63 | -1.09 | 0.0901 | -0.0034 | |||||

| XS2708724179 / Sunac China Holdings Ltd. | 2.26 | -65.28 | 0.0773 | -0.1512 | |||||

| HINNT 2024-A LLC / ABS-O (US40472QAD97) | 2.17 | -12.42 | 0.0744 | -0.0128 | |||||

| 720 East CLO 2023-I Ltd / ABS-CBDO (US81785GAE52) | 2.07 | 0.0709 | 0.0709 | ||||||

| US30165JAN63 / Exeter Automobile Receivables Trust 2021-4 | 1.57 | -41.76 | 0.0538 | -0.0409 | |||||

| XS2385392936 / Shimao Group Holdings Ltd | 1.41 | -2.22 | 0.0483 | -0.0024 | |||||

| 52466JU12 / Leggett & Platt Inc | 1.25 | -44.44 | 0.0428 | -0.3604 | |||||

| US98625UBA97 / York CLO-3 Ltd | 1.17 | -0.09 | 0.0402 | -0.0011 | |||||

| US00085Q6052 / ACBL HLDG CORP PREFERRED STOCK | 0.02 | 0.00 | 0.99 | -2.38 | 0.0338 | -0.0017 | |||

| US14687D1028 / Carvana Auto Receivables Trust 2021-N1 | 0.95 | -3.16 | 0.0325 | -0.0020 | |||||

| Sierra Timeshare 2024-2 Receivables Funding LLC / ABS-O (US82650DAD49) | 0.94 | -15.50 | 0.0323 | -0.0069 | |||||

| US33845X1072 / Flagship Credit Auto Trust 2020-4 | 0.89 | -2.74 | 0.0304 | -0.0017 | |||||

| US51889RAD17 / Laurel Road Prime Student Loan Trust 2019-A | 0.76 | 9.86 | 0.0260 | 0.0017 | |||||

| XS2099272846 / CIFI Holdings Group Co Ltd | 0.72 | -13.20 | 0.0246 | -0.0045 | |||||

| LOGPH / Logan Group Co Ltd | 0.56 | -6.67 | 0.0192 | -0.0019 | |||||

| XS2276735326 / Shimao Group Holdings Ltd | 0.39 | -3.19 | 0.0135 | -0.0008 | |||||

| XS2708722470 / Sunac China Holdings Ltd. | 0.29 | 3.62 | 0.0098 | 0.0001 | |||||

| XS2708722041 / Sunac China Holdings Ltd. | 0.29 | 8.78 | 0.0098 | 0.0005 | |||||

| XS2281303896 / Logan Group Co Ltd | 0.28 | -8.09 | 0.0097 | -0.0011 | |||||

| SCNR / Sunac China Holdings Limited | 1.12 | 0.00 | 0.20 | -8.52 | 0.0070 | -0.0009 | |||

| XS2708721662 / Sunac China Holdings Ltd. | 0.19 | 3.83 | 0.0065 | 0.0001 | |||||

| XS2251822727 / CIFI Holdings Group Co Ltd | 0.19 | -10.90 | 0.0064 | -0.0010 | |||||

| XS2280431763 / CIFI Holdings Group Co Ltd | 0.19 | -19.40 | 0.0064 | -0.0017 | |||||

| US80290CBJ27 / Santander Bank Auto Credit-Linked Notes Series 2022-C | 0.15 | -68.81 | 0.0052 | -0.0118 | |||||

| US00085Q2093 / ACBL HLDG CORP COMMON STOCK | 0.00 | 0.00 | 0.14 | 0.74 | 0.0047 | -0.0001 | |||

| XS2708722710 / Sunac China Holdings Ltd. | 0.13 | 1.54 | 0.0045 | -0.0001 | |||||

| XS2708721316 / Sunac China Holdings Ltd. | 0.09 | 8.05 | 0.0032 | 0.0002 | |||||

| XS2708721159 / Sunac China Holdings Ltd. | 0.09 | 8.14 | 0.0032 | 0.0001 | |||||

| PURCHASED USD / SOLD CAD / DFE (000000000) | 0.01 | 0.0005 | 0.0005 | ||||||

| US69546B1017 / Pagaya AI Debt Selection Trust 2020-1 | 0.01 | -65.71 | 0.0004 | -0.0008 | |||||

| CHINOS INTERMEDIATE WARRANTS / DE (000000000) | 0.01 | 0.01 | 0.0004 | 0.0004 | |||||

| US46642MAL28 / JP Morgan Chase Commercial Mortgage Securities Trust 2014-DSTY | 0.01 | -16.67 | 0.0002 | -0.0000 | |||||

| US69640GAL95 / Palisades Center Trust 2016-PLSD | 0.00 | 0.00 | 0.0001 | -0.0000 | |||||

| US69547JAD54 / Pagaya AI Debt Selection Trust 2021-1 | 0.00 | 0.00 | 0.0001 | -0.0000 | |||||

| Vista Management Holding Inc 2025 Term Loan B / LON (US92842EAB48) | 0.00 | 0.0000 | 0.0000 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0.03 | -0.0010 | -0.0010 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.11 | -0.0037 | -0.0037 | ||||||

| I1CE34 / Intercontinental Exchange, Inc. - Depositary Receipt (Common Stock) | -0.11 | -0.0038 | -0.0038 | ||||||

| I1CE34 / Intercontinental Exchange, Inc. - Depositary Receipt (Common Stock) | -0.75 | -0.0257 | -0.0257 | ||||||

| I1CE34 / Intercontinental Exchange, Inc. - Depositary Receipt (Common Stock) | -1.49 | -0.0511 | -0.0511 | ||||||

| I1CE34 / Intercontinental Exchange, Inc. - Depositary Receipt (Common Stock) | -1.87 | -0.0639 | -0.0639 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -2.08 | -0.0712 | -0.0712 |