Mga Batayang Estadistika

| Nilai Portofolio | $ 180,764,640 |

| Posisi Saat Ini | 99 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

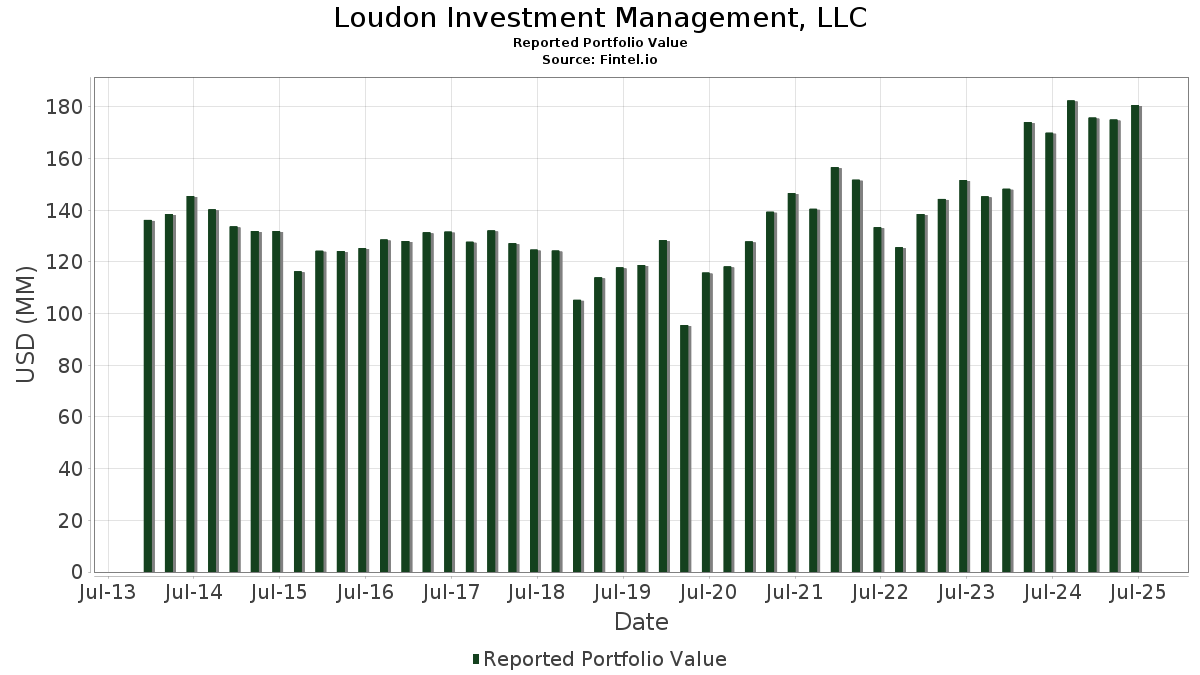

Loudon Investment Management, LLC telah mengungkapkan total kepemilikan 99 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 180,764,640 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Loudon Investment Management, LLC adalah Microsoft Corporation (US:MSFT) , The Select Sector SPDR Trust - The Technology Select Sector SPDR Fund (US:XLK) , Enterprise Products Partners L.P. - Limited Partnership (US:EPD) , Fastenal Company (US:FAST) , and Genpact Limited (US:G) . Posisi baru Loudon Investment Management, LLC meliputi: Novo Nordisk A/S - Depositary Receipt (Common Stock) (US:NVO) , T-Mobile US, Inc. (US:TMUS) , Domino's Pizza, Inc. (US:DPZ) , RTX Corporation (US:RTX) , and GS Connect S&P GSCI Enhanced Commodity Total Return ETN (US:GSCE) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.03 | 13.52 | 7.4808 | 1.6201 | |

| 0.04 | 2.60 | 1.4384 | 1.4384 | |

| 0.03 | 2.25 | 1.2454 | 1.1138 | |

| 0.01 | 1.80 | 0.9971 | 0.9971 | |

| 0.00 | 1.78 | 0.9844 | 0.9844 | |

| 0.03 | 8.21 | 4.5432 | 0.7734 | |

| 0.01 | 3.25 | 1.7989 | 0.4449 | |

| 0.00 | 0.54 | 0.2965 | 0.2965 | |

| 0.01 | 0.99 | 0.5504 | 0.2577 | |

| 0.00 | 0.69 | 0.3805 | 0.2577 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.01 | 2.13 | 1.1784 | -1.2614 | |

| 0.03 | 1.90 | 1.0520 | -0.9216 | |

| 0.02 | 0.78 | 0.4289 | -0.8312 | |

| 0.15 | 6.46 | 3.5729 | -0.6632 | |

| 0.03 | 5.24 | 2.9000 | -0.6442 | |

| 0.22 | 6.74 | 3.7290 | -0.5405 | |

| 0.01 | 3.59 | 1.9840 | -0.5055 | |

| 0.03 | 1.47 | 0.8148 | -0.4974 | |

| 0.00 | 0.27 | 0.1499 | -0.4540 | |

| 0.01 | 3.61 | 1.9972 | -0.4372 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-18 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.03 | -0.55 | 13.52 | 31.78 | 7.4808 | 1.6201 | |||

| XLK / The Select Sector SPDR Trust - The Technology Select Sector SPDR Fund | 0.03 | 1.45 | 8.21 | 24.42 | 4.5432 | 0.7734 | |||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 0.22 | -0.73 | 6.74 | -9.83 | 3.7290 | -0.5405 | |||

| FAST / Fastenal Company | 0.16 | 96.91 | 6.68 | 6.64 | 3.6962 | 0.1180 | |||

| G / Genpact Limited | 0.15 | -0.32 | 6.46 | -12.93 | 3.5729 | -0.6632 | |||

| SPY / SPDR S&P 500 ETF | 0.01 | 1.30 | 5.88 | 11.87 | 3.2539 | 0.2515 | |||

| TFC / Truist Financial Corporation | 0.12 | -0.42 | 5.37 | 4.05 | 2.9685 | 0.0227 | |||

| QCOM / QUALCOMM Incorporated | 0.03 | -18.52 | 5.24 | -15.52 | 2.9000 | -0.6442 | |||

| CSCO / Cisco Systems, Inc. | 0.07 | -4.49 | 5.04 | 7.39 | 2.7901 | 0.1077 | |||

| LOW / Lowe's Companies, Inc. | 0.02 | -1.01 | 4.87 | -5.84 | 2.6956 | -0.2597 | |||

| LNC / Lincoln National Corporation | 0.14 | 3.68 | 4.83 | -0.10 | 2.6714 | -0.0894 | |||

| JPM / JPMorgan Chase & Co. | 0.01 | -17.23 | 4.01 | -2.17 | 2.2185 | -0.1229 | |||

| ABBV / AbbVie Inc. | 0.02 | -2.33 | 3.89 | -13.47 | 2.1499 | -0.4152 | |||

| ESS / Essex Property Trust, Inc. | 0.01 | -8.38 | 3.61 | -15.30 | 1.9972 | -0.4372 | |||

| ITW / Illinois Tool Works Inc. | 0.01 | -17.47 | 3.59 | -17.73 | 1.9840 | -0.5055 | |||

| AAPL / Apple Inc. | 0.02 | -1.68 | 3.48 | -9.20 | 1.9268 | -0.2636 | |||

| ABT / Abbott Laboratories | 0.02 | 15.03 | 3.30 | 17.92 | 1.8244 | 0.2275 | |||

| AMT / American Tower Corporation | 0.01 | 5.44 | 3.26 | 7.11 | 1.8008 | 0.0649 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.01 | 0.53 | 3.25 | 37.17 | 1.7989 | 0.4449 | |||

| CAT / Caterpillar Inc. | 0.01 | -0.15 | 3.06 | 17.53 | 1.6914 | 0.2057 | |||

| DLR / Digital Realty Trust, Inc. | 0.02 | -1.52 | 2.83 | 19.81 | 1.5657 | 0.2166 | |||

| EMR / Emerson Electric Co. | 0.02 | 0.00 | 2.69 | 21.61 | 1.4885 | 0.2248 | |||

| USB / U.S. Bancorp | 0.06 | -0.48 | 2.62 | 6.67 | 1.4520 | 0.0466 | |||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.04 | 2.60 | 1.4384 | 1.4384 | |||||

| AMP / Ameriprise Financial, Inc. | 0.00 | -21.58 | 2.51 | -13.56 | 1.3863 | -0.2691 | |||

| CMI / Cummins Inc. | 0.01 | 0.00 | 2.46 | 4.50 | 1.3635 | 0.0163 | |||

| NEE / NextEra Energy, Inc. | 0.03 | 897.85 | 2.25 | 878.70 | 1.2454 | 1.1138 | |||

| AMGN / Amgen Inc. | 0.01 | -44.36 | 2.13 | -50.13 | 1.1784 | -1.2614 | |||

| PNR / Pentair plc | 0.02 | 0.00 | 2.09 | 17.33 | 1.1575 | 0.1392 | |||

| DE / Deere & Company | 0.00 | -2.42 | 2.05 | 5.73 | 1.1339 | 0.0266 | |||

| APD / Air Products and Chemicals, Inc. | 0.01 | 3.29 | 2.01 | -1.18 | 1.1115 | -0.0501 | |||

| UGI / UGI Corporation | 0.05 | 0.00 | 1.93 | 10.14 | 1.0699 | 0.0670 | |||

| SWK / Stanley Black & Decker, Inc. | 0.03 | -37.55 | 1.90 | -44.98 | 1.0520 | -0.9216 | |||

| TMUS / T-Mobile US, Inc. | 0.01 | 1.80 | 0.9971 | 0.9971 | |||||

| DPZ / Domino's Pizza, Inc. | 0.00 | 1.78 | 0.9844 | 0.9844 | |||||

| ADP / Automatic Data Processing, Inc. | 0.00 | 2.01 | 1.52 | 2.98 | 0.8416 | -0.0023 | |||

| O / Realty Income Corporation | 0.03 | 0.04 | 1.51 | -0.66 | 0.8340 | -0.0327 | |||

| VZ / Verizon Communications Inc. | 0.03 | -32.80 | 1.47 | -35.92 | 0.8148 | -0.4974 | |||

| FLOT / iShares Trust - iShares Floating Rate Bond ETF | 0.03 | 0.12 | 1.44 | 0.07 | 0.7966 | -0.0253 | |||

| GBCI / Glacier Bancorp, Inc. | 0.03 | 0.00 | 1.35 | -2.59 | 0.7493 | -0.0447 | |||

| ENB / Enbridge Inc. | 0.03 | 40.56 | 1.35 | 43.77 | 0.7471 | 0.2106 | |||

| AFL / Aflac Incorporated | 0.01 | -14.43 | 1.24 | -18.85 | 0.6885 | -0.1873 | |||

| XLC / The Select Sector SPDR Trust - The Communication Services Select Sector SPDR Fund | 0.01 | 29.11 | 1.21 | 45.30 | 0.6674 | 0.1931 | |||

| IBM / International Business Machines Corporation | 0.00 | -8.02 | 1.16 | 9.02 | 0.6419 | 0.0342 | |||

| PAYX / Paychex, Inc. | 0.01 | 4.35 | 1.05 | -1.60 | 0.5790 | -0.0286 | |||

| LMT / Lockheed Martin Corporation | 0.00 | 0.32 | 1.00 | 4.05 | 0.5544 | 0.0041 | |||

| PLD / Prologis, Inc. | 0.01 | 106.43 | 0.99 | 94.14 | 0.5504 | 0.2577 | |||

| PEP / PepsiCo, Inc. | 0.01 | -22.06 | 0.98 | -31.38 | 0.5446 | -0.2745 | |||

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.00 | -9.54 | 0.98 | 0.00 | 0.5421 | -0.0174 | |||

| VCSH / Vanguard Scottsdale Funds - Vanguard Short-Term Corporate Bond ETF | 0.01 | -0.68 | 0.96 | 0.00 | 0.5318 | -0.0171 | |||

| JNJ / Johnson & Johnson | 0.01 | -1.50 | 0.91 | -9.27 | 0.5036 | -0.0695 | |||

| BK / The Bank of New York Mellon Corporation | 0.01 | -8.36 | 0.86 | -0.46 | 0.4751 | -0.0176 | |||

| BSV / Vanguard Bond Index Funds - Vanguard Short-Term Bond ETF | 0.01 | -1.62 | 0.84 | -1.06 | 0.4639 | -0.0203 | |||

| SCHD / Schwab Strategic Trust - Schwab U.S. Dividend Equity ETF | 0.03 | -1.01 | 0.82 | -6.19 | 0.4530 | -0.0455 | |||

| GD / General Dynamics Corporation | 0.00 | 0.00 | 0.81 | 6.97 | 0.4502 | 0.0158 | |||

| WEC / WEC Energy Group, Inc. | 0.01 | 7.16 | 0.80 | 2.42 | 0.4444 | -0.0034 | |||

| MRK / Merck & Co., Inc. | 0.01 | -3.04 | 0.80 | -14.55 | 0.4424 | -0.0917 | |||

| SLB / Schlumberger Limited | 0.02 | -56.54 | 0.78 | -64.87 | 0.4289 | -0.8312 | |||

| TU / TELUS Corporation | 0.04 | 0.00 | 0.72 | 11.94 | 0.3997 | 0.0312 | |||

| PM / Philip Morris International Inc. | 0.00 | 6.51 | 0.71 | 22.26 | 0.3955 | 0.0614 | |||

| PSA / Public Storage | 0.00 | 0.00 | 0.70 | -1.95 | 0.3896 | -0.0207 | |||

| NVDA / NVIDIA Corporation | 0.00 | 119.35 | 0.69 | 219.53 | 0.3805 | 0.2577 | |||

| MO / Altria Group, Inc. | 0.01 | -8.19 | 0.68 | -10.34 | 0.3742 | -0.0566 | |||

| CMCSA / Comcast Corporation | 0.02 | -26.63 | 0.65 | -29.07 | 0.3620 | -0.1646 | |||

| VNQ / Vanguard Specialized Funds - Vanguard Real Estate ETF | 0.01 | 0.00 | 0.65 | -1.67 | 0.3594 | -0.0178 | |||

| FRT / Federal Realty Investment Trust | 0.01 | -28.24 | 0.59 | -30.31 | 0.3271 | -0.1575 | |||

| WTRG / Essential Utilities, Inc. | 0.02 | 0.00 | 0.57 | -6.06 | 0.3177 | -0.0314 | |||

| VLO / Valero Energy Corporation | 0.00 | 0.00 | 0.57 | 1.80 | 0.3137 | -0.0045 | |||

| SYY / Sysco Corporation | 0.01 | 0.00 | 0.56 | 0.90 | 0.3119 | -0.0071 | |||

| MDT / Medtronic plc | 0.01 | -11.00 | 0.55 | -13.66 | 0.3044 | -0.0596 | |||

| IJR / iShares Trust - iShares Core S&P Small-Cap ETF | 0.01 | 2.04 | 0.55 | 6.63 | 0.3029 | 0.0097 | |||

| RTX / RTX Corporation | 0.00 | 0.54 | 0.2965 | 0.2965 | |||||

| TAP / Molson Coors Beverage Company | 0.01 | -21.78 | 0.53 | -38.24 | 0.2953 | -0.1980 | |||

| RSP / Invesco Exchange-Traded Fund Trust - Invesco S&P 500 Equal Weight ETF | 0.00 | 23.99 | 0.50 | 30.03 | 0.2759 | 0.0569 | |||

| BLK / BlackRock, Inc. | 0.00 | 0.00 | 0.49 | 11.01 | 0.2734 | 0.0188 | |||

| ECL / Ecolab Inc. | 0.00 | 0.00 | 0.48 | 6.42 | 0.2662 | 0.0076 | |||

| ACWX / iShares Trust - iShares MSCI ACWI ex U.S. ETF | 0.01 | 0.54 | 0.47 | 10.64 | 0.2591 | 0.0170 | |||

| XOM / Exxon Mobil Corporation | 0.00 | 10.22 | 0.46 | -0.22 | 0.2572 | -0.0086 | |||

| UPS / United Parcel Service, Inc. | 0.00 | -50.47 | 0.45 | -54.55 | 0.2485 | -0.3159 | |||

| ADM / Archer-Daniels-Midland Company | 0.01 | -1.60 | 0.41 | 8.29 | 0.2242 | 0.0102 | |||

| XLF / The Select Sector SPDR Trust - The Financial Select Sector SPDR Fund | 0.01 | 0.00 | 0.41 | 5.19 | 0.2242 | 0.0041 | |||

| QQQ / Invesco QQQ Trust, Series 1 | 0.00 | 1.27 | 0.40 | 19.34 | 0.2188 | 0.0292 | |||

| BIV / Vanguard Bond Index Funds - Vanguard Intermediate-Term Bond ETF | 0.00 | 1.17 | 0.35 | 2.32 | 0.1954 | -0.0020 | |||

| CRWD / CrowdStrike Holdings, Inc. | 0.00 | 0.00 | 0.34 | 44.73 | 0.1902 | 0.0543 | |||

| GSCE / GS Connect S&P GSCI Enhanced Commodity Total Return ETN | 0.00 | 0.34 | 0.1895 | 0.1895 | |||||

| TTD / The Trade Desk, Inc. | 0.00 | 0.00 | 0.34 | 31.52 | 0.1872 | 0.0403 | |||

| EXR / Extra Space Storage Inc. | 0.00 | -6.34 | 0.33 | -7.12 | 0.1807 | -0.0199 | |||

| BIL / SPDR Series Trust - SPDR Bloomberg 1-3 Month T-Bill ETF | 0.00 | -18.06 | 0.30 | -18.11 | 0.1681 | -0.0437 | |||

| NOBL / ProShares Trust - ProShares S&P 500 Dividend Aristocrats ETF | 0.00 | -9.45 | 0.30 | -10.75 | 0.1655 | -0.0260 | |||

| TGT / Target Corporation | 0.00 | -72.89 | 0.27 | -74.46 | 0.1499 | -0.4540 | |||

| XLI / The Select Sector SPDR Trust - The Industrial Select Sector SPDR Fund | 0.00 | 0.27 | 0.1485 | 0.1485 | |||||

| AMZN / Amazon.com, Inc. | 0.00 | 3.98 | 0.25 | 20.00 | 0.1363 | 0.0189 | |||

| FDX / FedEx Corporation | 0.00 | 5.00 | 0.24 | -2.06 | 0.1320 | -0.0072 | |||

| PPG / PPG Industries, Inc. | 0.00 | 0.00 | 0.23 | 4.13 | 0.1259 | 0.0010 | |||

| SDY / SPDR Series Trust - SPDR S&P Dividend ETF | 0.00 | -24.51 | 0.22 | -24.32 | 0.1240 | -0.0455 | |||

| CLX / The Clorox Company | 0.00 | 0.00 | 0.22 | -18.49 | 0.1196 | -0.0318 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.00 | 0.00 | 0.22 | -8.51 | 0.1194 | -0.0148 | |||

| TSLA / Tesla, Inc. | 0.00 | 0.21 | 0.1142 | 0.1142 | |||||

| VEA / Vanguard Tax-Managed Funds - Vanguard FTSE Developed Markets ETF | 0.00 | 0.20 | 0.1124 | 0.1124 | |||||

| COP / ConocoPhillips | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CTSH / Cognizant Technology Solutions Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PFE / Pfizer Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.3237 | ||||

| CL / Colgate-Palmolive Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PG / The Procter & Gamble Company | 0.00 | -100.00 | 0.00 | 0.0000 |