Mga Batayang Estadistika

| Nilai Portofolio | $ 123,590,000 |

| Posisi Saat Ini | 67 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

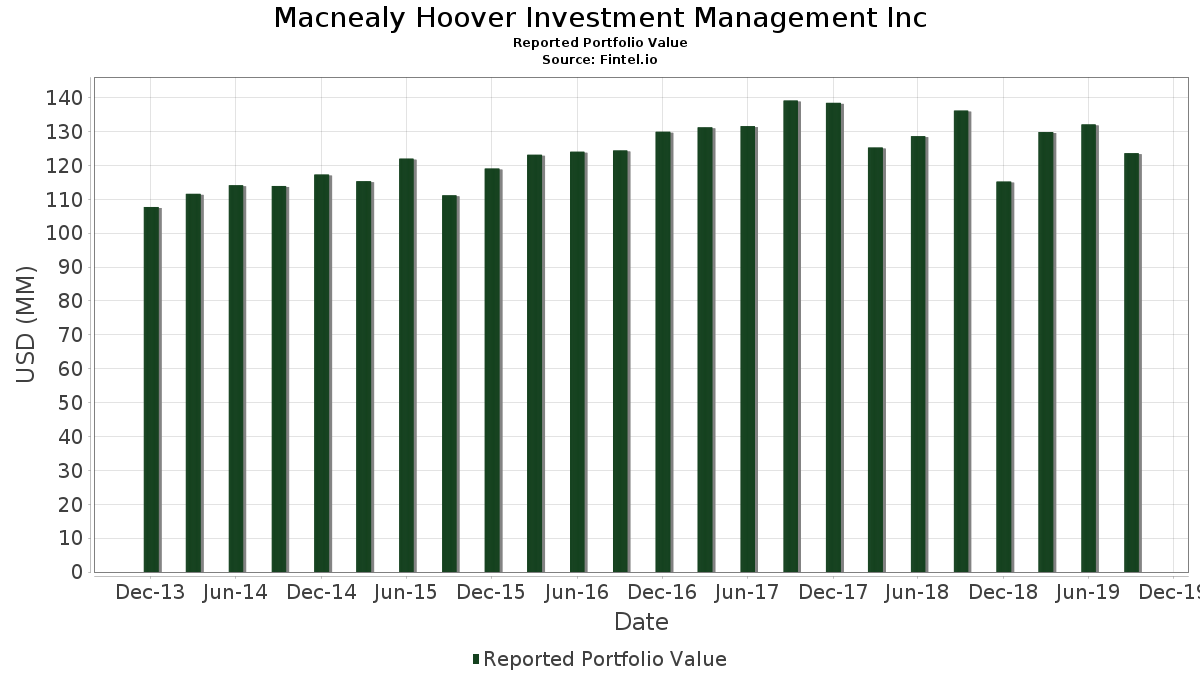

Macnealy Hoover Investment Management Inc telah mengungkapkan total kepemilikan 67 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 123,590,000 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Macnealy Hoover Investment Management Inc adalah Farmers National Banc Corp. (US:FMNB) , Apple Inc. (US:AAPL) , Civista Bancshares, Inc. (US:CIVB) , The Procter & Gamble Company (US:PG) , and Johnson & Johnson (US:JNJ) . Posisi baru Macnealy Hoover Investment Management Inc meliputi: TimkenSteel Corporation Bond (US:US887399AA15) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.03 | 6.60 | 5.3427 | 0.8898 | |

| 0.05 | 5.84 | 4.7293 | 0.7588 | |

| 0.03 | 3.98 | 3.2179 | 0.5398 | |

| 0.21 | 3.87 | 3.1305 | 0.3722 | |

| 0.02 | 2.00 | 1.6174 | 0.3394 | |

| 0.00 | 2.43 | 1.9670 | 0.3262 | |

| 0.01 | 1.94 | 1.5665 | 0.3013 | |

| 0.04 | 2.07 | 1.6757 | 0.1750 | |

| 0.03 | 1.55 | 1.2541 | 0.1358 | |

| 0.02 | 4.25 | 3.4356 | 0.1336 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 2.81 | 2.2704 | -1.8273 | |

| 0.03 | 4.30 | 3.4809 | -0.4791 | |

| 0.01 | 0.67 | 0.5381 | -0.4629 | |

| 0.01 | 1.84 | 1.4864 | -0.3535 | |

| 0.05 | 3.48 | 2.8198 | -0.3466 | |

| 0.00 | 0.00 | -0.1719 | ||

| 0.03 | 0.22 | 0.1812 | -0.1428 | |

| 0.03 | 1.18 | 0.9540 | -0.1401 | |

| 0.02 | 1.64 | 1.3294 | -0.1228 | |

| 0.04 | 1.33 | 1.0786 | -0.1071 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2019-10-01 untuk periode pelaporan 2019-09-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| FMNB / Farmers National Banc Corp. | 0.60 | -3.02 | 8.64 | -5.30 | 6.9909 | 0.0826 | |||

| AAPL / Apple Inc. | 0.03 | -0.77 | 6.60 | 12.28 | 5.3427 | 0.8898 | |||

| CIVB / Civista Bancshares, Inc. | 0.28 | -5.06 | 6.17 | -8.11 | 4.9964 | -0.0917 | |||

| PG / The Procter & Gamble Company | 0.05 | -1.75 | 5.84 | 11.46 | 4.7293 | 0.7588 | |||

| JNJ / Johnson & Johnson | 0.03 | -11.44 | 4.30 | -17.74 | 3.4809 | -0.4791 | |||

| MSFT / Microsoft Corporation | 0.03 | -6.57 | 4.28 | -3.06 | 3.4647 | 0.1203 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.02 | -0.22 | 4.25 | -2.64 | 3.4356 | 0.1336 | |||

| HSY / The Hershey Company | 0.03 | -2.75 | 3.98 | 12.44 | 3.2179 | 0.5398 | |||

| CBKM / Consumers Bancorp, Inc. | 0.21 | 4.89 | 3.87 | 6.20 | 3.1305 | 0.3722 | |||

| CVX / Chevron Corporation | 0.03 | -2.68 | 3.71 | -7.23 | 3.0019 | -0.0260 | |||

| XOM / Exxon Mobil Corporation | 0.05 | -9.57 | 3.48 | -16.67 | 2.8198 | -0.3466 | |||

| US887399AA15 / TimkenSteel Corporation Bond | 2.83 | -8.84 | 2.2866 | -0.0606 | |||||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | -47.06 | 2.81 | -48.15 | 2.2704 | -1.8273 | |||

| ABBV / AbbVie Inc. | 0.03 | -10.02 | 2.55 | -6.32 | 2.0633 | 0.0023 | |||

| SJM / The J. M. Smucker Company | 0.02 | -2.35 | 2.52 | -6.75 | 2.0350 | -0.0071 | |||

| CAT / Caterpillar Inc. | 0.02 | 0.01 | 2.51 | -7.34 | 2.0325 | -0.0201 | |||

| GOOG / Alphabet Inc. | 0.00 | -0.50 | 2.43 | 12.18 | 1.9670 | 0.3262 | |||

| MMM / 3M Company | 0.01 | 0.59 | 2.38 | -4.61 | 1.9233 | 0.0365 | |||

| APD / Air Products and Chemicals, Inc. | 0.01 | -0.83 | 2.24 | -2.87 | 1.8100 | 0.0663 | |||

| HBAN / Huntington Bancshares Incorporated | 0.15 | -7.92 | 2.18 | -4.93 | 1.7623 | 0.0276 | |||

| CFBK / CF Bankshares Inc. | 0.17 | -4.73 | 2.15 | -1.97 | 1.7356 | 0.0789 | |||

| KO / The Coca-Cola Company | 0.04 | -2.28 | 2.07 | 4.49 | 1.6757 | 0.1750 | |||

| EMR / Emerson Electric Co. | 0.03 | -6.15 | 2.04 | -5.96 | 1.6466 | 0.0081 | |||

| UPS / United Parcel Service, Inc. | 0.02 | 2.09 | 2.00 | 18.42 | 1.6174 | 0.3394 | |||

| JPM / JPMorgan Chase & Co. | 0.02 | -12.63 | 1.98 | -8.02 | 1.6053 | -0.0279 | |||

| DIS / The Walt Disney Company | 0.02 | -0.09 | 1.98 | -6.80 | 1.5980 | -0.0064 | |||

| NOC / Northrop Grumman Corporation | 0.01 | -0.12 | 1.94 | 15.86 | 1.5665 | 0.3013 | |||

| ADP / Automatic Data Processing, Inc. | 0.01 | -22.55 | 1.84 | -24.40 | 1.4864 | -0.3535 | |||

| IR / Ingersoll Rand Inc. | 0.01 | -2.01 | 1.77 | -4.63 | 1.4330 | 0.0269 | |||

| PEP / PepsiCo, Inc. | 0.01 | -2.97 | 1.71 | 1.49 | 1.3796 | 0.1075 | |||

| ABT / Abbott Laboratories | 0.02 | -13.92 | 1.64 | -14.34 | 1.3294 | -0.1228 | |||

| DE / Deere & Company | 0.01 | 0.00 | 1.64 | 1.80 | 1.3237 | 0.1070 | |||

| INTC / Intel Corporation | 0.03 | -2.51 | 1.55 | 4.94 | 1.2541 | 0.1358 | |||

| QCOM / QUALCOMM Incorporated | 0.02 | -1.31 | 1.43 | -1.04 | 1.1595 | 0.0631 | |||

| FITB / Fifth Third Bancorp | 0.05 | -5.13 | 1.42 | -6.83 | 1.1473 | -0.0051 | |||

| MRK / Merck & Co., Inc. | 0.02 | -6.67 | 1.39 | -6.34 | 1.1239 | 0.0010 | |||

| SLB / Schlumberger Limited | 0.04 | -1.02 | 1.33 | -14.88 | 1.0786 | -0.1071 | |||

| GD / General Dynamics Corporation | 0.01 | -1.15 | 1.18 | -0.67 | 0.9572 | 0.0554 | |||

| PFE / Pfizer Inc. | 0.03 | -1.63 | 1.18 | -18.41 | 0.9540 | -0.1401 | |||

| HD / The Home Depot, Inc. | 0.00 | -3.10 | 1.04 | 8.08 | 0.8439 | 0.1133 | |||

| COP / ConocoPhillips | 0.02 | 0.00 | 0.86 | -6.61 | 0.6975 | -0.0014 | |||

| VZ / Verizon Communications Inc. | 0.01 | -0.31 | 0.77 | 5.34 | 0.6230 | 0.0695 | |||

| BMY / Bristol-Myers Squibb Company | 0.01 | 0.03 | 0.75 | 11.96 | 0.6060 | 0.0995 | |||

| T / AT&T Inc. | 0.02 | -2.02 | 0.72 | 10.75 | 0.5834 | 0.0905 | |||

| DOW / Dow Inc. | 0.01 | -17.27 | 0.68 | -21.35 | 0.5486 | -0.1041 | |||

| LOW / Lowe's Companies, Inc. | 0.01 | -53.82 | 0.67 | -49.70 | 0.5381 | -0.4629 | |||

| IBM / International Business Machines Corporation | 0.00 | -11.62 | 0.67 | -6.73 | 0.5381 | -0.0018 | |||

| TMST / TimkenSteel Corporation | 0.10 | 1.67 | 0.65 | -21.35 | 0.5276 | -0.1001 | |||

| MIME / Mimecast Ltd | 0.02 | 1.83 | 0.65 | -22.20 | 0.5219 | -0.1058 | |||

| AMZN / Amazon.com, Inc. | 0.00 | -1.40 | 0.61 | -9.64 | 0.4928 | -0.0176 | |||

| CSCO / Cisco Systems, Inc. | 0.01 | -1.22 | 0.60 | -10.75 | 0.4839 | -0.0234 | |||

| D / Dominion Energy, Inc. | 0.01 | -0.73 | 0.55 | 3.96 | 0.4458 | 0.0445 | |||

| EFA / iShares Trust - iShares MSCI EAFE ETF | 0.01 | -3.25 | 0.46 | -4.14 | 0.3746 | 0.0089 | |||

| DBD / Diebold Nixdorf, Incorporated | 0.04 | -11.74 | 0.43 | 7.71 | 0.3504 | 0.0460 | |||

| GIS / General Mills, Inc. | 0.01 | -15.38 | 0.35 | -11.20 | 0.2824 | -0.0152 | |||

| CSX / CSX Corporation | 0.00 | 0.00 | 0.33 | -10.44 | 0.2638 | -0.0118 | |||

| SO / The Southern Company | 0.01 | -7.08 | 0.33 | 4.17 | 0.2630 | 0.0267 | |||

| SNY / Sanofi - Depositary Receipt (Common Stock) | 0.01 | 0.00 | 0.32 | 7.33 | 0.2605 | 0.0334 | |||

| BA / The Boeing Company | 0.00 | 0.00 | 0.32 | 4.58 | 0.2589 | 0.0272 | |||

| / Total S.A. | 0.01 | 0.00 | 0.32 | -6.80 | 0.2549 | -0.0010 | |||

| MDLZ / Mondelez International, Inc. | 0.01 | 0.00 | 0.30 | 2.42 | 0.2395 | 0.0207 | |||

| MCD / McDonald's Corporation | 0.00 | -0.78 | 0.27 | 2.63 | 0.2209 | 0.0195 | |||

| RPM / RPM International Inc. | 0.00 | -3.11 | 0.27 | 8.94 | 0.2168 | 0.0306 | |||

| AEP / American Electric Power Company, Inc. | 0.00 | 0.00 | 0.25 | 6.41 | 0.2015 | 0.0243 | |||

| SDY / SPDR Series Trust - SPDR S&P Dividend ETF | 0.00 | 0.00 | 0.23 | 1.80 | 0.1829 | 0.0148 | |||

| GE / General Electric Company | 0.03 | -38.67 | 0.22 | -47.66 | 0.1812 | -0.1428 | |||

| ORCL / Oracle Corporation | 0.00 | -7.85 | 0.20 | -10.87 | 0.1659 | -0.0083 | |||

| CTVA / Corteva, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1719 | ||||

| AMNB / American National Bankshares Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 |