Mga Batayang Estadistika

| Nilai Portofolio | $ 990,784,609 |

| Posisi Saat Ini | 552 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

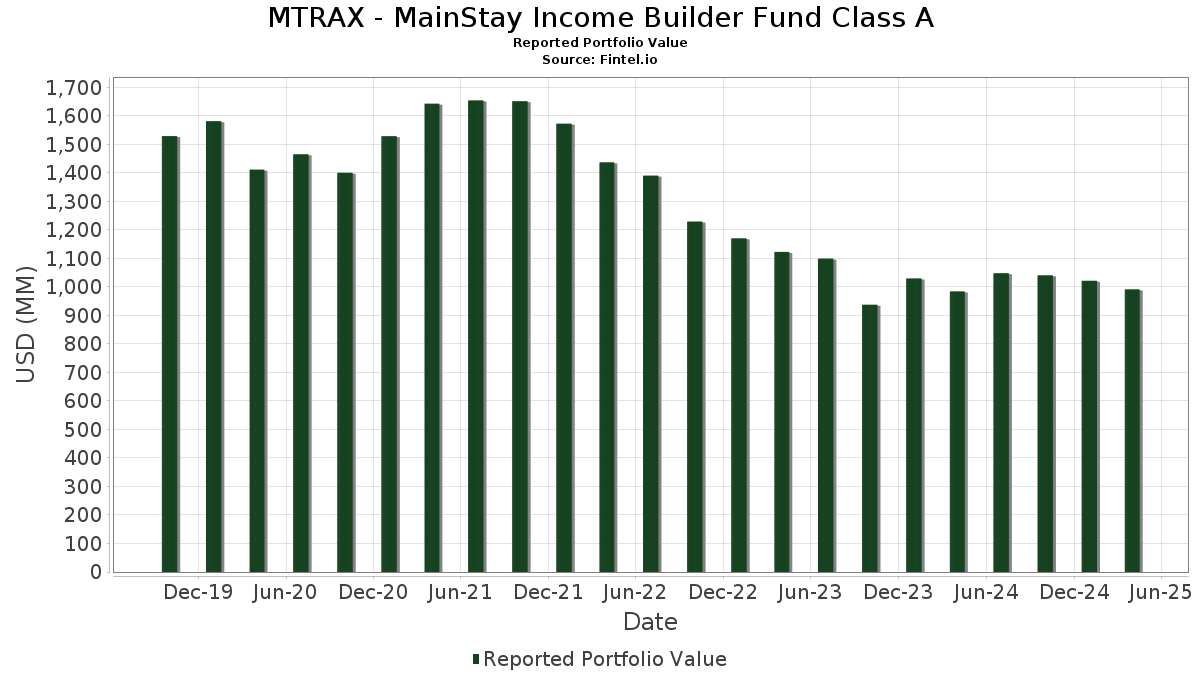

MTRAX - MainStay Income Builder Fund Class A telah mengungkapkan total kepemilikan 552 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 990,784,609 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama MTRAX - MainStay Income Builder Fund Class A adalah Broadcom Inc. (US:AVGO) , Microsoft Corporation (US:MSFT) , MainStay U.S. Government Liquidity Fund (US:MUSXX) , AbbVie Inc. (US:ABBV) , and International Business Machines Corporation (US:IBM) . Posisi baru MTRAX - MainStay Income Builder Fund Class A meliputi: Microchip Technology Incorporated (US:MCHP) , Fannie Mae Pool (US:US3140XLG937) , Equinor ASA (US:STOHF) , NISSAN MOTOR ACCEPTANCE SR UNSECURED 144A 09/26 1.85 (US:US65480CAC91) , and GNMA (US:US36179WR347) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 13.54 | 13.54 | 1.3538 | 0.9819 | |

| 0.09 | 4.10 | 0.4097 | 0.4097 | |

| 0.16 | 3.68 | 0.3677 | 0.3677 | |

| 3.42 | 0.3425 | 0.3425 | ||

| 0.11 | 7.11 | 0.7114 | 0.3220 | |

| 0.10 | 6.33 | 0.6336 | 0.3007 | |

| 2.94 | 0.2944 | 0.2944 | ||

| 0.07 | 11.56 | 1.1563 | 0.2691 | |

| 2.61 | 0.2608 | 0.2608 | ||

| 2.56 | 0.2558 | 0.2558 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.05 | 12.66 | 1.2665 | -0.3951 | |

| 0.06 | 3.12 | 0.3122 | -0.3901 | |

| 0.00 | 0.00 | -0.3533 | ||

| 0.42 | 6.80 | 0.6805 | -0.3200 | |

| 0.04 | 7.59 | 0.7595 | -0.2942 | |

| 0.02 | 3.33 | 0.3334 | -0.2589 | |

| 0.06 | 9.78 | 0.9785 | -0.2421 | |

| 0.22 | 7.93 | 0.7932 | -0.1996 | |

| 0.92 | 0.0917 | -0.1831 | ||

| 0.06 | 5.18 | 0.5180 | -0.1820 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-06-24 untuk periode pelaporan 2025-04-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AVGO / Broadcom Inc. | 0.08 | 15.54 | 14.50 | 0.51 | 1.4497 | 0.0555 | |||

| MSFT / Microsoft Corporation | 0.04 | 4.39 | 14.38 | -0.59 | 1.4377 | 0.0397 | |||

| MUSXX / MainStay U.S. Government Liquidity Fund | 13.54 | 251.84 | 13.54 | 251.86 | 1.3538 | 0.9819 | |||

| ABBV / AbbVie Inc. | 0.07 | 9.91 | 12.96 | 16.60 | 1.2959 | 0.2216 | |||

| IBM / International Business Machines Corporation | 0.05 | -22.10 | 12.66 | -26.33 | 1.2665 | -0.3951 | |||

| CSCO / Cisco Systems, Inc. | 0.20 | -2.70 | 11.71 | -7.31 | 1.1708 | -0.0501 | |||

| PM / Philip Morris International Inc. | 0.07 | -4.29 | 11.56 | 25.98 | 1.1563 | 0.2691 | |||

| CCEP / COCA COLA EUROPACIFIC COMPANY GUAR REGS 11/27 1.5 | 0.11 | -17.61 | 9.89 | -4.82 | 0.9888 | -0.0154 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.06 | -2.70 | 9.78 | -22.52 | 0.9785 | -0.2421 | |||

| WMT / Walmart Inc. | 0.09 | -11.88 | 9.14 | -12.70 | 0.9139 | -0.0979 | |||

| CRM / Salesforce, Inc. | 0.03 | 27.04 | 8.77 | -0.09 | 0.8767 | 0.0285 | |||

| JPM / JPMorgan Chase & Co. | 0.03 | 10.51 | 8.54 | 1.14 | 0.8538 | 0.0378 | |||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0.07 | -2.70 | 8.36 | 5.11 | 0.8357 | 0.0671 | |||

| MET / MetLife, Inc. | 0.11 | -2.65 | 8.02 | -15.18 | 0.8023 | -0.1120 | |||

| DTEGY / Deutsche Telekom AG - Depositary Receipt (Common Stock) | 0.22 | -27.82 | 7.93 | -22.78 | 0.7932 | -0.1996 | |||

| MFC / Manulife Financial Corporation | 0.25 | -2.71 | 7.81 | -0.29 | 0.7811 | 0.0239 | |||

| SAN / Santander UK plc - Preferred Stock | 0.07 | -2.70 | 7.78 | -1.62 | 0.7778 | 0.0136 | |||

| IMB / Imperial Brands PLC | 0.19 | -2.70 | 7.70 | 18.16 | 0.7705 | 0.1401 | |||

| ADI / Analog Devices, Inc. | 0.04 | -24.26 | 7.59 | -30.33 | 0.7595 | -0.2942 | |||

| ETR / Entergy Corporation | 0.09 | -2.87 | 7.45 | -0.36 | 0.7451 | 0.0223 | |||

| META / Meta Platforms, Inc. | 0.01 | 24.03 | 7.19 | -1.21 | 0.7188 | 0.0156 | |||

| CVS / CVS Health Corporation | 0.11 | 49.51 | 7.11 | 76.59 | 0.7114 | 0.3220 | |||

| CMI / Cummins Inc. | 0.02 | -2.70 | 7.05 | -19.75 | 0.7051 | -0.1441 | |||

| QSR / Restaurant Brands International Inc. | 0.11 | 2.70 | 6.93 | 7.47 | 0.6934 | 0.0697 | |||

| TXN / Texas Instruments Incorporated | 0.04 | -2.86 | 6.86 | -15.78 | 0.6865 | -0.1014 | |||

| HPE / Hewlett Packard Enterprise Company | 0.42 | -14.12 | 6.80 | -34.26 | 0.6805 | -0.3200 | |||

| MCD / McDonald's Corporation | 0.02 | 13.80 | 6.71 | 26.00 | 0.6708 | 0.1562 | |||

| IRM / Iron Mountain Incorporated | 0.07 | -2.70 | 6.70 | -14.11 | 0.6706 | -0.0840 | |||

| BAC / Bank of America Corporation | 0.17 | -2.70 | 6.70 | -16.19 | 0.6696 | -0.1027 | |||

| KLAC / KLA Corporation | 0.01 | -2.70 | 6.68 | -7.39 | 0.6681 | -0.0292 | |||

| NEE / NextEra Energy, Inc. | 0.10 | -2.70 | 6.67 | -9.07 | 0.6670 | -0.0420 | |||

| MDLZ / Mondelez International, Inc. | 0.10 | -2.65 | 6.63 | 14.38 | 0.6629 | 0.1027 | |||

| MSM / MSC Industrial Direct Co., Inc. | 0.09 | 26.84 | 6.60 | 20.64 | 0.6602 | 0.1312 | |||

| DELL / Dell Technologies Inc. | 0.07 | 14.32 | 6.55 | 1.25 | 0.6548 | 0.0297 | |||

| LIN / Linde plc | 0.01 | -2.65 | 6.44 | -1.09 | 0.6443 | 0.0146 | |||

| AZN / AstraZeneca PLC - Depositary Receipt (Common Stock) | 0.09 | -2.70 | 6.44 | -1.27 | 0.6443 | 0.0134 | |||

| UL / Unilever PLC - Depositary Receipt (Common Stock) | 0.10 | 66.17 | 6.33 | 83.97 | 0.6336 | 0.3007 | |||

| BA. / BAE Systems plc | 0.27 | -21.41 | 6.25 | 19.37 | 0.6256 | 0.1190 | |||

| MDT / Medtronic plc | 0.07 | 6.85 | 6.08 | -0.28 | 0.6085 | 0.0187 | |||

| KO / The Coca-Cola Company | 0.08 | 8.28 | 5.93 | 23.76 | 0.5934 | 0.1299 | |||

| VICI / VICI Properties Inc. | 0.18 | -2.70 | 5.90 | 4.65 | 0.5898 | 0.0451 | |||

| AEP / American Electric Power Company, Inc. | 0.05 | -2.70 | 5.85 | 7.19 | 0.5848 | 0.0574 | |||

| T / AT&T Inc. | 0.21 | 0.00 | 5.84 | 16.72 | 0.5839 | 0.1004 | |||

| EMR / Emerson Electric Co. | 0.05 | 16.72 | 5.77 | -5.59 | 0.5774 | -0.0137 | |||

| RTX / RTX Corporation | 0.05 | -2.70 | 5.74 | -4.83 | 0.5741 | -0.0090 | |||

| AAPL / Apple Inc. | 0.03 | -12.07 | 5.74 | -20.82 | 0.5737 | -0.1267 | |||

| CS / AXA SA | 0.12 | -2.65 | 5.70 | 21.68 | 0.5704 | 0.1173 | |||

| NTR / Nutrien Ltd. | 0.10 | 9.19 | 5.70 | 20.66 | 0.5703 | 0.1134 | |||

| HAS / Hasbro, Inc. | 0.09 | -2.87 | 5.69 | 3.95 | 0.5690 | 0.0399 | |||

| PAYX / Paychex, Inc. | 0.04 | -2.70 | 5.36 | -3.05 | 0.5364 | 0.0016 | |||

| NI / NiSource Inc. | 0.14 | -29.01 | 5.34 | -25.57 | 0.5342 | -0.1595 | |||

| SIE / Siemens Aktiengesellschaft | 0.02 | -5.63 | 5.32 | 0.61 | 0.5322 | 0.0209 | |||

| WMB / The Williams Companies, Inc. | 0.09 | -14.45 | 5.31 | -9.61 | 0.5314 | -0.0368 | |||

| MUV2 / Münchener Rückversicherungs-Gesellschaft Aktiengesellschaft in München | 0.01 | -2.80 | 5.28 | 22.25 | 0.5281 | 0.1105 | |||

| WEC / WEC Energy Group, Inc. | 0.05 | 10.95 | 5.23 | 22.41 | 0.5229 | 0.1100 | |||

| NTAP / NetApp, Inc. | 0.06 | -2.70 | 5.18 | -28.48 | 0.5180 | -0.1820 | |||

| ALV / Allianz SE | 0.01 | -2.70 | 5.13 | 23.28 | 0.5133 | 0.1109 | |||

| GS71 / GSK plc | 0.26 | 31.84 | 5.09 | 49.01 | 0.5094 | 0.1789 | |||

| BC94 / Samsung Electronics Co., Ltd. - Depositary Receipt (Common Stock) | 0.01 | -4.25 | 5.07 | 2.78 | 0.5067 | 0.0302 | |||

| LMT / Lockheed Martin Corporation | 0.01 | 2.99 | 4.99 | 6.28 | 0.4996 | 0.0453 | |||

| SRG / Snam S.p.A. | 0.86 | 11.37 | 4.92 | 38.14 | 0.4923 | 0.1478 | |||

| HD / The Home Depot, Inc. | 0.01 | -2.70 | 4.89 | -14.87 | 0.4886 | -0.0661 | |||

| ORANY / Orange S.A. - Depositary Receipt (Common Stock) | 0.33 | -2.70 | 4.81 | 31.49 | 0.4816 | 0.1276 | |||

| JNJ / Johnson & Johnson | 0.03 | 18.77 | 4.66 | 22.02 | 0.4661 | 0.0969 | |||

| OMC / Omnicom Group Inc. | 0.06 | -2.86 | 4.56 | -14.77 | 0.4561 | -0.0611 | |||

| BMY / Bristol-Myers Squibb Company | 0.09 | 14.36 | 4.53 | -2.62 | 0.4531 | 0.0034 | |||

| BG / BAWAG Group AG | 0.04 | -2.65 | 4.52 | 17.63 | 0.4518 | 0.0805 | |||

| LAZ / Lazard, Inc. | 0.12 | -2.64 | 4.47 | -30.35 | 0.4475 | -0.1734 | |||

| VCISY / Vinci SA - Depositary Receipt (Common Stock) | 0.03 | -2.70 | 4.39 | 26.98 | 0.4388 | 0.1047 | |||

| WTRG / Essential Utilities, Inc. | 0.11 | 5.23 | 4.35 | 22.01 | 0.4353 | 0.0904 | |||

| NSRGY / Nestlé S.A. - Depositary Receipt (Common Stock) | 0.04 | -2.70 | 4.35 | 21.79 | 0.4349 | 0.0897 | |||

| LLY / Eli Lilly and Company | 0.00 | -26.02 | 4.23 | -18.00 | 0.4233 | -0.0757 | |||

| DUK / Duke Energy Corporation | 0.03 | -2.70 | 4.22 | 6.01 | 0.4216 | 0.0372 | |||

| PEP / PepsiCo, Inc. | 0.03 | 41.03 | 4.20 | 26.91 | 0.4203 | 0.1001 | |||

| AAGIY / AIA Group Limited - Depositary Receipt (Common Stock) | 0.55 | 16.52 | 4.17 | 25.17 | 0.4168 | 0.0949 | |||

| MCHP / Microchip Technology Incorporated | 0.09 | 4.10 | 0.4097 | 0.4097 | |||||

| USB / U.S. Bancorp | 0.10 | 12.64 | 4.09 | -4.91 | 0.4088 | -0.0067 | |||

| RHHBY / Roche Holding AG - Depositary Receipt (Common Stock) | 0.01 | -2.70 | 4.08 | 1.06 | 0.4083 | 0.0179 | |||

| ETN / Eaton Corporation plc | 0.01 | -4.76 | 4.05 | -14.12 | 0.4046 | -0.0508 | |||

| MRK / Merck & Co., Inc. | 0.05 | -2.70 | 4.03 | -16.11 | 0.4030 | -0.0613 | |||

| US3140XLG937 / Fannie Mae Pool | 3.94 | 0.59 | 0.3939 | 0.0154 | |||||

| PNW / Pinnacle West Capital Corporation | 0.04 | -2.70 | 3.91 | 6.51 | 0.3914 | 0.0362 | |||

| O / Realty Income Corporation | 0.07 | -2.70 | 3.89 | 3.02 | 0.3891 | 0.0241 | |||

| LLOY / Lloyds Banking Group plc | 3.90 | -23.00 | 3.81 | -1.91 | 0.3811 | 0.0056 | |||

| STOHF / Equinor ASA | 0.16 | 3.68 | 0.3677 | 0.3677 | |||||

| PYXB / Schroders plc | 0.83 | -6.02 | 3.67 | -4.95 | 0.3670 | -0.0062 | |||

| TOYOF / Toyota Motor Corporation | 0.19 | -2.70 | 3.66 | -2.27 | 0.3658 | 0.0040 | |||

| DPW / Deutsche Post AG | 0.09 | -28.78 | 3.64 | -16.08 | 0.3643 | -0.0553 | |||

| COLB / Columbia Banking System, Inc. | 0.16 | 25.03 | 3.62 | 0.47 | 0.3617 | 0.0137 | |||

| HON / Honeywell International Inc. | 0.02 | -2.70 | 3.59 | -8.45 | 0.3587 | -0.0200 | |||

| SGRO / SEGRO Plc | 0.39 | -2.70 | 3.54 | -0.42 | 0.3541 | 0.0104 | |||

| RY / Royal Bank of Canada | 0.03 | -2.70 | 3.52 | -4.22 | 0.3523 | -0.0032 | |||

| NHK / NHK Spring Co., Ltd. | 0.31 | -2.01 | 3.48 | -14.57 | 0.3479 | -0.0456 | |||

| GD / General Dynamics Corporation | 0.01 | -2.70 | 3.47 | 3.03 | 0.3473 | 0.0215 | |||

| U.S. Treasury Notes / DBT (US91282CNA52) | 3.42 | 0.3425 | 0.3425 | ||||||

| BLK / BlackRock, Inc. | 0.00 | -2.71 | 3.41 | -17.28 | 0.3413 | -0.0576 | |||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 3.41 | 0.41 | 0.3411 | 0.0128 | |||||

| BBY / Best Buy Co., Inc. | 0.05 | 18.10 | 3.40 | -8.26 | 0.3399 | -0.0182 | |||

| PFE / Pfizer Inc. | 0.14 | 3.71 | 3.39 | -4.53 | 0.3393 | -0.0043 | |||

| MPLX / MPLX LP - Limited Partnership | 0.07 | -32.82 | 3.38 | -34.23 | 0.3381 | -0.1587 | |||

| ALPMY / Astellas Pharma Inc. - Depositary Receipt (Common Stock) | 0.33 | 3.99 | 3.34 | 6.82 | 0.3337 | 0.0317 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.02 | -31.97 | 3.33 | -45.59 | 0.3334 | -0.2589 | |||

| RCI / Rogers Communications Inc. | 0.13 | 24.82 | 3.31 | 18.49 | 0.3314 | 0.0610 | |||

| TFC / Truist Financial Corporation | 0.09 | -2.70 | 3.30 | -21.66 | 0.3303 | -0.0772 | |||

| MGDDY / Compagnie Générale des Établissements Michelin Société en commandite par actions - Depositary Receipt (Common Stock) | 0.09 | -2.70 | 3.28 | 2.21 | 0.3284 | 0.0179 | |||

| VZ / Verizon Communications Inc. | 0.07 | -7.86 | 3.28 | 3.05 | 0.3283 | 0.0204 | |||

| UPS / United Parcel Service, Inc. | 0.03 | -6.18 | 3.26 | -21.74 | 0.3258 | -0.0765 | |||

| RF / Regions Financial Corporation | 0.16 | -2.70 | 3.21 | -19.40 | 0.3208 | -0.0639 | |||

| 017670 / SK Telecom Co., Ltd. | 0.08 | -11.03 | 3.14 | -10.28 | 0.3143 | -0.0243 | |||

| FP / TotalEnergies SE | 0.06 | -55.99 | 3.12 | -57.03 | 0.3122 | -0.3901 | |||

| CVX / Chevron Corporation | 0.02 | -1.14 | 3.06 | -9.85 | 0.3059 | -0.0220 | |||

| US65480CAC91 / NISSAN MOTOR ACCEPTANCE SR UNSECURED 144A 09/26 1.85 | 3.03 | 0.40 | 0.3026 | 0.0112 | |||||

| LYB / LyondellBasell Industries N.V. | 0.05 | 7.95 | 2.95 | -17.00 | 0.2954 | -0.0486 | |||

| U.S. Treasury Notes / DBT (US91282CMY48) | 2.94 | 0.2944 | 0.2944 | ||||||

| MTN / Vail Resorts, Inc. | 0.02 | -2.70 | 2.80 | -20.38 | 0.2803 | -0.0600 | |||

| UNH / UnitedHealth Group Incorporated | 0.01 | -2.71 | 2.77 | -26.21 | 0.2768 | -0.0858 | |||

| U.S. Treasury Bonds / DBT (US912810UG12) | 2.61 | 0.2608 | 0.2608 | ||||||

| US36179WR347 / GNMA | 2.56 | 0.2558 | 0.2558 | ||||||

| US31418EKU37 / UMBS | 2.55 | -0.47 | 0.2554 | 0.0074 | |||||

| MSCI EAFE Index / DE (N/A) | 2.28 | 0.2277 | 0.2277 | ||||||

| US36179WQB71 / GNMA | 2.21 | -0.85 | 0.2215 | 0.0055 | |||||

| U.S. Treasury Bills / STIV (US912797NN35) | 2.19 | 0.2193 | 0.2193 | ||||||

| US266233AG08 / Duquesne Light Holdings, Inc. | 2.19 | 0.09 | 0.2190 | 0.0074 | |||||

| US3137G0VB27 / STACR Trust 2018-HRP1 | 2.19 | 50.59 | 0.2186 | 0.0782 | |||||

| US830867AB33 / Delta Air Lines Inc / SkyMiles IP Ltd | 2.11 | 0.05 | 0.2112 | 0.0071 | |||||

| US320517AD78 / First Horizon National Corp | 2.10 | 0.29 | 0.2098 | 0.0076 | |||||

| US35565JBE01 / Freddie Mac STACR REMIC Trust 2020-HQA | 2.06 | -2.83 | 0.2061 | 0.0010 | |||||

| AGTXX / Allspring Funds Trust - Allspring Government Money Market Fd USD - Tribal Inclusion Cls | 2.00 | -46.56 | 2.00 | -46.55 | 0.2000 | -0.0316 | |||

| FMCC / Federal Home Loan Mortgage Corporation | 1.96 | 0.15 | 0.1960 | 0.0068 | |||||

| ROCK Trust, Series 2024-CNTR, Class E / ABS-MBS (US74970WAJ99) | 1.95 | -0.97 | 0.1950 | 0.0047 | |||||

| Seasoned Credit Risk Transfer Trust, Series 2025-1, Class MTU / ABS-MBS (US35563PYZ60) | 1.95 | 0.1948 | 0.1948 | ||||||

| US62548NAB47 / MULTIFAMILY CONN AVE SECS TR 2023-01 M10 SOFR30A+650 11/25/2053 144A | 1.94 | -0.26 | 0.1941 | 0.0060 | |||||

| US251526CN70 / Deutsche Bank AG/New York NY | 1.93 | -0.77 | 0.1935 | 0.0050 | |||||

| US35564KKL25 / FHLMC STACR REMIC Trust, Series 2021-HQA3, Class B2 | 1.92 | -2.34 | 0.1925 | 0.0020 | |||||

| US20754LAJ89 / Connecticut Avenue Securities Trust, Series 2022-R01, Class 1B2 | 1.92 | -1.54 | 0.1925 | 0.0036 | |||||

| US46652VBT17 / JP Morgan Mortgage Trust 2021-4 | 1.92 | 0.1923 | 0.1923 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.89 | -2.22 | 0.1893 | 0.0021 | |||||

| U.S. Treasury Notes / DBT (US91282CMZ13) | 1.88 | 0.1879 | 0.1879 | ||||||

| US36186CBY84 / Ally Financial Inc | 1.87 | -1.32 | 0.1866 | 0.0039 | |||||

| US35564KQZ56 / FHLMC STACR REMIC Trust, Series 2022-DNA1, Class B2 | 1.81 | 21.38 | 0.1812 | 0.0369 | |||||

| RCKT Mortgage Trust, Series 2021-5, Class A1 / ABS-MBS (US749384AA14) | 1.81 | 12.04 | 0.1806 | 0.0248 | |||||

| U.S. Treasury Bills / STIV (US912797ND52) | 1.80 | 0.1800 | 0.1800 | ||||||

| US33939HAA77 / FLEX INTERMEDIATE HOLDCO LLC | 1.79 | 2.93 | 0.1794 | 0.0109 | |||||

| US06738EBT10 / Barclays PLC | 1.79 | -1.92 | 0.1793 | 0.0026 | |||||

| US20753BAB80 / Connecticut Avenue Securities Trust 2023-R07 | 1.79 | 0.1791 | 0.1791 | ||||||

| US902613AD01 / UBS Group AG | 1.79 | -1.97 | 0.1790 | 0.0025 | |||||

| US3137FBKV76 / FHR 4725 WZ | 1.79 | 3.84 | 0.1786 | 0.0124 | |||||

| US61747YEF88 / Morgan Stanley | 1.76 | 1.50 | 0.1765 | 0.0084 | |||||

| US44701QBE17 / Huntsman International LLC | 1.76 | -1.40 | 0.1755 | 0.0034 | |||||

| LYG / Lloyds Banking Group plc - Depositary Receipt (Common Stock) | 1.68 | 0.06 | 0.1685 | 0.0058 | |||||

| US20754PAD24 / CONNECTICUT AVENUE SECURITIES TRUST 2019-HRP1 SER 2019-HRP1 CL B1 V/R REGD 144A P/P 0.00000000 | 1.67 | -29.97 | 0.1669 | -0.0634 | |||||

| US040555DD31 / ARIZONA PUBLIC SERVICE COMPANY | 1.63 | 2.26 | 0.1633 | 0.0090 | |||||

| US30166QAG47 / EXETER AUTOMOBILE RECEIVABLES TRUST 2022-2 EART 2022-2A E | 1.63 | -7.29 | 0.1628 | -0.0070 | |||||

| US35564KPP83 / Freddie Mac STACR REMIC Trust 2021-HQA4 | 1.59 | 40.69 | 0.1587 | 0.0497 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.58 | 0.1585 | 0.1585 | ||||||

| US337158AJ88 / FIRST HORIZON BANK | 1.56 | 0.39 | 0.1562 | 0.0058 | |||||

| US36262LAB62 / GS Mortgage-Backed Securities Trust | 1.55 | -54.41 | 0.1553 | -0.1739 | |||||

| US35564XBE04 / Freddie Mac STACR 2019-HQA3 | 1.54 | -0.06 | 0.1544 | 0.0051 | |||||

| US31418EP205 / FNMA 30YR 5% 03/01/2053#MA4940 | 1.51 | -0.92 | 0.1510 | 0.0037 | |||||

| US11042CAA80 / British Airways 2021-1 Class A Pass Through Trust | 1.50 | -1.44 | 0.1505 | 0.0029 | |||||

| US24703DBF78 / Dell International LLC/EMC Corp. | 1.50 | -1.90 | 0.1500 | 0.0022 | |||||

| US05401AAM36 / Avolon Holdings Funding Ltd | 1.48 | 0.48 | 0.1477 | 0.0056 | |||||

| US35564KUE71 / Freddie Mac STACR REMIC Trust 2022-HQA1 | 1.47 | -1.68 | 0.1467 | 0.0025 | |||||

| Connecticut Avenue Securities, Series 2025-R01, Class 1B1 / ABS-MBS (US20755JAG85) | 1.46 | 0.1465 | 0.1465 | ||||||

| US62548QAF81 / MCAS 2020-01 CE | 1.46 | -0.14 | 0.1459 | 0.0046 | |||||

| US361841AP42 / GLP Capital LP / GLP Financing II Inc | 1.45 | 0.69 | 0.1452 | 0.0058 | |||||

| US476556DD44 / Jersey Central Power & Light Co | 1.43 | 1.28 | 0.1428 | 0.0065 | |||||

| Forward Foreign Currency Contract / DFE (N/A) | 1.43 | 0.1427 | 0.1427 | ||||||

| US38382QWD86 / GNMA, Series 2021-83, Class FM | 1.42 | -0.28 | 0.1416 | 0.0043 | |||||

| US35565EAE23 / CORP CMO | 1.41 | -3.29 | 0.1412 | 0.0001 | |||||

| US38383XXB53 / Government National Mortgage Association | 1.41 | 1.44 | 0.1406 | 0.0066 | |||||

| US174610AW56 / CITIZENS FINANCIAL GROUP SUBORDINATED 09/32 2.638 | 1.39 | -0.85 | 0.1395 | 0.0035 | |||||

| US35564KE476 / STACR_22-HQA3 | 1.39 | 0.1393 | 0.1393 | ||||||

| BRASKM / Braskem Netherlands Finance BV | 1.38 | -3.50 | 0.1381 | -0.0003 | |||||

| US195325DZ51 / Colombia Government International Bond | 1.37 | -0.07 | 0.1372 | 0.0045 | |||||

| US05565AB286 / BNP Paribas SA | 1.37 | -0.51 | 0.1370 | 0.0038 | |||||

| US33844XAL29 / FLAGSHIP CREDIT AUTO TRUST 2022-2 SER 2022-2 CL D REGD 144A P/P 5.80000000 | 1.36 | 0.74 | 0.1361 | 0.0056 | |||||

| US61747YEH45 / Morgan Stanley | 1.32 | 2.09 | 0.1321 | 0.0071 | |||||

| XAG9368PBE34 / VIRGIN MEDIA BRISTOL LLC 2020 USD TERM LOAN Q | 1.32 | 83.70 | 0.1320 | 0.0625 | |||||

| Citigroup Mortgage Loan Trust, Series 2014-C, Class B3 / ABS-MBS (US17323GAE89) | 1.32 | 0.1317 | 0.1317 | ||||||

| TEVA / Teva Pharmaceutical Industries Limited - Depositary Receipt (Common Stock) | 1.31 | -0.30 | 0.1310 | 0.0040 | |||||

| 5727 / Sands China Ltd. - Corporate Bond/Note | 1.31 | -0.15 | 0.1308 | 0.0042 | |||||

| Connecticut Avenue Securities Trust, Series 2024-R05, Class 2B1 / ABS-MBS (US20754XAG88) | 1.31 | 0.1307 | 0.1307 | ||||||

| US603374AH26 / Minerva Luxembourg SA | 1.31 | 1.24 | 0.1307 | 0.0059 | |||||

| US20753VBT44 / CORP CMO | 1.30 | 221.48 | 0.1302 | 0.0910 | |||||

| US17327FAJ57 / Citigroup Commercial Mortgage Trust 2018-B2 | 1.29 | 0.78 | 0.1291 | 0.0053 | |||||

| U.S. Treasury Bills / STIV (US912797QH30) | 1.29 | 0.1286 | 0.1286 | ||||||

| HPEFS Equipment Trust, Series 2024-1A, Class D / ABS-O (US403963AF87) | 1.27 | -0.31 | 0.1275 | 0.0039 | |||||

| US06054MAW38 / Bank of America Commercial Mortgage Trust | 1.27 | -1.17 | 0.1272 | 0.0028 | |||||

| US38382CGQ87 / GNMA, Series 2020-5, Class FA | 1.26 | 0.08 | 0.1258 | 0.0043 | |||||

| US35564PAC23 / Freddie Mac Stacr Trust 2019-FTR1 | 1.26 | -3.38 | 0.1257 | -0.0001 | |||||

| US46590XAY22 / JBS USA LUX SA / JBS USA Food Co. / JBS USA Finance, Inc. | 1.25 | 1.46 | 0.1254 | 0.0059 | |||||

| US05609MCJ27 / BMO 2022 C1 MORTGAGE TRUST BMO 2022 C1 111A 144A | 1.25 | 21.10 | 0.1252 | 0.0252 | |||||

| US16412XAL91 / Cheniere Corpus Christi Holdings LLC | 1.25 | -0.72 | 0.1248 | 0.0033 | |||||

| US699149AB65 / Paraguay Government International Bond | 1.24 | -0.88 | 0.1244 | 0.0031 | |||||

| US12631DBG79 / COMMERCIAL MORTGAGE BACKED SECURITIES | 1.24 | -0.08 | 0.1238 | 0.0040 | |||||

| US636180BR19 / National Fuel Gas Co | 1.22 | 2.35 | 0.1218 | 0.0067 | |||||

| US33846QAJ04 / Flagship Credit Auto Trust, Series 2021-3, Class E | 1.21 | 1.42 | 0.1213 | 0.0058 | |||||

| US3137G1DF16 / Freddie Mac Structured Agency Credit Risk Debt Notes | 1.21 | -1.23 | 0.1208 | 0.0026 | |||||

| US05583JAK88 / BPCE SA | 1.21 | 1.34 | 0.1208 | 0.0056 | |||||

| US33843WAG69 / Flagship Credit Auto Trust, Series 2021-1, Class D | 1.20 | 0.50 | 0.1196 | 0.0046 | |||||

| US38384AWS85 / GNMA, Series 2023-66, Class MP | 1.19 | 3.11 | 0.1194 | 0.0074 | |||||

| US80386WAF23 / Sasol Financing USA LLC | 1.19 | -6.65 | 0.1194 | -0.0043 | |||||

| Zayo Issuer LLC, Series 2025-1A, Class B / ABS-O (US98919WAC73) | 1.19 | 0.1188 | 0.1188 | ||||||

| ANZ / ANZ Group Holdings Limited | 1.18 | 1.03 | 0.1178 | 0.0052 | |||||

| US501797AW48 / L Brands Inc | 1.18 | 75.11 | 0.1176 | 0.0526 | |||||

| US832248AZ15 / Smithfield Foods Inc | 1.16 | 0.69 | 0.1165 | 0.0047 | |||||

| US83370RAA68 / Societe Generale SA | 1.13 | -0.79 | 0.1135 | 0.0030 | |||||

| US431318AU81 / HILCORP ENERGY I LP/FIN CO 5.75% 02/01/2029 144A | 1.13 | 0.1133 | 0.1133 | ||||||

| US38381YHP25 / GNMA, Series 2019-97, Class FG | 1.13 | -0.62 | 0.1132 | 0.0032 | |||||

| US20754BAJ08 / CAS_22-R02 | 1.13 | 38.62 | 0.1128 | 0.0319 | |||||

| US8252528851 / Invesco Government & Agency Portfolio, Institutional Class | 1.11 | 115.59 | 1.11 | 115.56 | 0.1109 | 0.0612 | |||

| U.S. Treasury Notes / DBT (US91282CMM00) | 1.10 | 0.1105 | 0.1105 | ||||||

| US00108WAP59 / AEP Texas Inc | 1.10 | 1.29 | 0.1102 | 0.0050 | |||||

| BX Commercial Mortgage Trust, Series 2024-BRBK, Class D / ABS-MBS (US05613NAL10) | 1.10 | 15.23 | 0.1098 | 0.0177 | |||||

| Arcos Dorados BV / DBT (US03965TAC71) | 1.09 | 1.59 | 0.1089 | 0.0053 | |||||

| C1MA34 / Comerica Incorporated - Depositary Receipt (Common Stock) | 1.09 | 0.28 | 0.1088 | 0.0039 | |||||

| H1BA34 / Huntington Bancshares Incorporated - Depositary Receipt (Common Stock) | 1.09 | 0.09 | 0.1087 | 0.0037 | |||||

| US86964WAJ18 / Suzano Austria GmbH | 1.08 | 1.50 | 0.1085 | 0.0052 | |||||

| US961214EX77 / Westpac Banking Corp | 1.08 | 1.50 | 0.1083 | 0.0052 | |||||

| US61765BAA08 / Morgan Stanley Capital I Trust 2015-420 | 1.08 | 2.96 | 0.1080 | 0.0066 | |||||

| US09659W2K94 / BNP Paribas SA | 1.08 | 2.09 | 0.1076 | 0.0058 | |||||

| US95001FAC95 / Wells Fargo Commercial Mortgage Trust, Series 2017-RC1, Class D | 1.08 | 0.1076 | 0.1076 | ||||||

| US25714PEF18 / Dominican Republic International Bond | 1.07 | -0.46 | 0.1072 | 0.0031 | |||||

| Hilton Domestic Operating Co., Inc. / DBT (US432833AP66) | 1.07 | 0.28 | 0.1071 | 0.0039 | |||||

| FHLMC, Multifamily Structured Pass-Through Certificates, REMIC, Series 2024-MN9, Class M2 / ABS-MBS (US355917AB15) | 1.07 | 6.16 | 0.1070 | 0.0097 | |||||

| US38384AQK24 / GNMA, Series 2023-66, Class OQ | 1.07 | 3.39 | 0.1068 | 0.0070 | |||||

| US12530MAE57 / CF Hippolyta LLC | 1.07 | 0.09 | 0.1068 | 0.0036 | |||||

| US62954PAQ37 / BF Mortgage Trust | 1.06 | 6.21 | 0.1061 | 0.0095 | |||||

| US643821AA93 / New Economy Assets Phase 1 Sponsor LLC, Series 2021-1, Class A1 | 1.04 | 1.56 | 0.1042 | 0.0050 | |||||

| US08162YAJ10 / Benchmark 2019-B14 Mortgage Trust, Series 2019-B14, Class C | 1.04 | -1.05 | 0.1041 | 0.0023 | |||||

| US62547NAC39 / Freddie Mac Multifamily Connecticut Avenue Securities Trust, Series 2019-01, Class B10 | 1.04 | -1.80 | 0.1038 | 0.0017 | |||||

| US539439AM10 / Lloyds Banking Group PLC | 1.04 | 0.00 | 0.1035 | 0.0035 | |||||

| US05971AAG67 / Banco BTG Pactual SA/Cayman Islands | 1.03 | 0.19 | 0.1031 | 0.0036 | |||||

| LVS / Las Vegas Sands Corp. - Depositary Receipt (Common Stock) | 1.03 | 0.1028 | 0.1028 | ||||||

| US3140XMMG81 / UMBS, 30 Year | 1.03 | -4.83 | 0.1026 | -0.0016 | |||||

| US040114HT09 / Argentine Republic Government International Bond | 1.02 | -1.82 | 0.1024 | 0.0016 | |||||

| SAN / Banco Santander, S.A. - Depositary Receipt (Common Stock) | 1.02 | 0.00 | 0.1022 | 0.0034 | |||||

| GNMA, Series 2025-2, Class WZ / ABS-MBS (US38385B3C29) | 1.02 | 0.1019 | 0.1019 | ||||||

| GLS Auto Receivables Issuer Trust, Series 2024-3A, Class D / ABS-O (US37989AAL89) | 1.02 | -0.10 | 0.1018 | 0.0033 | |||||

| US12656KAJ60 / COMM_20-CX | 1.02 | 29.55 | 0.1018 | 0.0259 | |||||

| US35564WBE21 / FREDDIE MAC STACR TRUST 2019-FTR2 SER 2019-FTR2 CL B2 V/R REGD 144A P/P 7.49163000 | 1.02 | -3.88 | 0.1017 | -0.0005 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.02 | -0.98 | 0.1015 | 0.0024 | |||||

| US38383X4E17 / Government National Mortgage Association | 1.01 | 0.90 | 0.1013 | 0.0042 | |||||

| WP Glimcher Mall Trust, Series 2015-WPG, Class C / ABS-MBS (US92939VAG95) | 1.01 | -0.49 | 0.1012 | 0.0029 | |||||

| US38383XSW55 / GNMA, Series 2023-60, Class ES | 1.01 | -0.69 | 0.1012 | 0.0027 | |||||

| US345397A860 / Ford Motor Credit Co LLC | 1.01 | -1.18 | 0.1007 | 0.0023 | |||||

| US3137FAD211 / FHR 4710 WZ | 1.00 | 3.74 | 0.0999 | 0.0069 | |||||

| US3137HAFC59 / Freddie Mac REMICS | 0.99 | -1.97 | 0.0994 | 0.0014 | |||||

| US06540WBG78 / Bank 2019-BNK19 | 0.99 | -7.37 | 0.0994 | -0.0043 | |||||

| US38141GXR00 / Goldman Sachs Group Inc/The | 0.99 | 2.16 | 0.0993 | 0.0054 | |||||

| US3132DWHT36 / FEDERAL HOME LOAN MORTGAGE CORP | 0.99 | -0.90 | 0.0993 | 0.0025 | |||||

| Flagship Credit Auto Trust, Series 2024-1, Class D / ABS-O (US33843VAL71) | 0.99 | -0.40 | 0.0986 | 0.0029 | |||||

| US883199AR25 / Textron Financial Corp | 0.98 | 0.41 | 0.0984 | 0.0037 | |||||

| US65336YAN31 / Nexstar Broadcasting Inc | 0.98 | 77.68 | 0.0979 | 0.0446 | |||||

| U.S. Treasury 5 Year Notes / DIR (N/A) | 0.98 | 0.0978 | 0.0978 | ||||||

| Golub Capital Partners CLO 78M, Series 2025-78A, Class A1 / ABS-CBDO (US381934AC27) | 0.98 | 0.0977 | 0.0977 | ||||||

| US06541KAJ79 / BANK, Series 2018-BN12, Class D | 0.97 | -0.21 | 0.0973 | 0.0031 | |||||

| US12636MAV00 / CSAIL 2016-C6 Commercial Mortgage Trust | 0.97 | 4.30 | 0.0971 | 0.0071 | |||||

| US38383X4D34 / Government National Mortgage Association | 0.97 | 0.41 | 0.0970 | 0.0036 | |||||

| Belron UK Finance plc / DBT (US080782AA38) | 0.97 | 0.0969 | 0.0969 | ||||||

| US38382QAM24 / GNMA CMO IO | 0.96 | 17.89 | 0.0962 | 0.0173 | |||||

| US023764AA14 / American Airlin Bond | 0.94 | 1.07 | 0.0944 | 0.0041 | |||||

| Apidos CLO, Series 2018-18A, Class BR2 / ABS-CBDO (US03767NBA37) | 0.94 | -1.36 | 0.0944 | 0.0018 | |||||

| US91327TAA97 / Uniti Group LP / Uniti Group Finance Inc / CSL Capital LLC | 0.94 | -4.78 | 0.0937 | -0.0014 | |||||

| US914906AU68 / Univision Communications Inc | 0.93 | 0.0934 | 0.0934 | ||||||

| US225401AU28 / Credit Suisse Group AG | 0.93 | 1.75 | 0.0931 | 0.0046 | |||||

| US35564KB654 / FHLMC Structured Agency Credit Risk Debt Notes, Series 2022-HQA2, Class M2 | 0.93 | -1.90 | 0.0931 | 0.0014 | |||||

| DIRECTV Financing LLC, First Lien 2024 Refinancing Term Loan B / LON (US25460HAD44) | 0.93 | -5.32 | 0.0925 | -0.0019 | |||||

| US37045XDL73 / GENERAL MOTORS FINL CO SR UNSECURED 06/31 2.7 | 0.92 | 0.76 | 0.0924 | 0.0037 | |||||

| US85571BAY11 / Starwood Property Trust Inc | 0.92 | 1.10 | 0.0922 | 0.0040 | |||||

| US23345MAC10 / DT Midstream, Inc. | 0.92 | -0.22 | 0.0919 | 0.0030 | |||||

| US20754KAJ07 / CAS_21-R02 | 0.92 | 20.79 | 0.0918 | 0.0183 | |||||

| 4755 / Rakuten Group, Inc. | 0.92 | 0.0918 | 0.0918 | ||||||

| US3132DWDZ32 / FREDDIE MAC POOL UMBS P#SD8220 3.00000000 | 0.92 | -67.77 | 0.0917 | -0.1831 | |||||

| US045054AJ25 / Ashtead Capital Inc | 0.92 | 1.22 | 0.0915 | 0.0041 | |||||

| US08162PBB67 / BENCHMARK 2018-B1 Mortgage Trust | 0.91 | -20.07 | 0.0913 | -0.0191 | |||||

| US114259AX24 / Brooklyn Union Gas Co/The | 0.91 | 0.66 | 0.0910 | 0.0037 | |||||

| Subway Funding LLC, Series 2024-3A, Class A23 / ABS-O (US864300AL27) | 0.91 | -0.11 | 0.0908 | 0.0029 | |||||

| US345397B777 / Ford Motor Credit Co LLC | 0.90 | -0.22 | 0.0904 | 0.0028 | |||||

| US83370RAB42 / Societe Generale SA | 0.90 | -0.22 | 0.0901 | 0.0028 | |||||

| US00206RKJ04 / AT&T Inc | 0.90 | -0.88 | 0.0900 | 0.0022 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.90 | -57.05 | 0.0896 | -0.1121 | |||||

| US06541FBF53 / BANK 2017-BNK4 | 0.89 | 2.18 | 0.0891 | 0.0048 | |||||

| US95003WAL00 / Wells Fargo Commercial Mortgage Trust, Series 2022-ONL, Class E | 0.88 | 2.31 | 0.0884 | 0.0049 | |||||

| US38384CBE84 / Government National Mortgage Association | 0.88 | -40.19 | 0.0882 | -0.0543 | |||||

| US08160KAK07 / Benchmark Mortgage Trust | 0.88 | 0.57 | 0.0880 | 0.0034 | |||||

| U.S. Treasury Notes / DBT (US91282CMW81) | 0.88 | 0.0879 | 0.0879 | ||||||

| S1YF34 / Synchrony Financial - Depositary Receipt (Common Stock) | 0.88 | 0.0878 | 0.0878 | ||||||

| Vedanta Resources Finance II plc / DBT (US92243XAL55) | 0.87 | -10.12 | 0.0871 | -0.0066 | |||||

| US85172FAQ28 / Springleaf Finance Corp 6.625% 01/15/2028 | 0.87 | 0.0868 | 0.0868 | ||||||

| US3132DWJN48 / Freddie Mac Pool, 30 Year | 0.87 | -3.45 | 0.0868 | -0.0001 | |||||

| US15089QAY08 / Celanese US Holdings LLC | 0.87 | -4.31 | 0.0867 | -0.0008 | |||||

| US86765BAQ23 / Sunoco Logistics Partners Operations LP | 0.87 | -3.78 | 0.0867 | -0.0004 | |||||

| US61690FAB94 / Morgan Stanley Bank of America Merrill Lynch Trust, Series 2015-C22, Class D | 0.87 | 2.12 | 0.0867 | 0.0047 | |||||

| US03846JX543 / Egypt Government International Bond | 0.86 | -5.50 | 0.0860 | -0.0020 | |||||

| US53944YAU73 / Lloyds Banking Group PLC | 0.85 | 1.55 | 0.0854 | 0.0041 | |||||

| US893574AM57 / Transcontinental Gas Pipe Line Co. LLC | 0.85 | -1.16 | 0.0852 | 0.0018 | |||||

| US225313AP06 / Credit Agricole SA | 0.85 | -1.39 | 0.0851 | 0.0017 | |||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.85 | 0.0848 | 0.0848 | ||||||

| US86389QAG73 / Studio City Finance Ltd | 0.85 | -3.64 | 0.0847 | -0.0003 | |||||

| Great Lakes CLO Ltd., Series 2019-1A, Class ARR / ABS-CBDO (US390578AT95) | 0.84 | 0.0843 | 0.0843 | ||||||

| BBCMS Mortgage Trust, Series 2022-C16, Class D / ABS-MBS (US05552YAX40) | 0.84 | -0.71 | 0.0843 | 0.0022 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.84 | -1.98 | 0.0842 | 0.0011 | |||||

| US599191AA16 / Mileage Plus Holdings LLC / Mileage Plus Intellectual Property Assets Ltd | 0.84 | -10.55 | 0.0840 | -0.0067 | |||||

| US95000U2U64 / Wells Fargo & Co | 0.84 | 1.70 | 0.0840 | 0.0042 | |||||

| US30166AAG94 / Exeter Automobile Receivables Trust 2021-3 | 0.83 | 0.97 | 0.0833 | 0.0036 | |||||

| US172967BL44 / Citigroup Inc 6.625% Subordinated Notes 06/15/32 | 0.83 | 0.73 | 0.0831 | 0.0033 | |||||

| US46648KAC09 / JPMDB Commercial Mortgage Securities Trust 2017-C7 | 0.83 | -0.24 | 0.0828 | 0.0026 | |||||

| US12531WAL63 / CFCRE Commercial Mortgage Trust | 0.83 | 2.61 | 0.0826 | 0.0047 | |||||

| AAL / American Airlines Group Inc. | 0.82 | -2.72 | 0.0825 | 0.0005 | |||||

| US38382XFY67 / GNMA, Series 2021-139, Class IA | 0.82 | 2.11 | 0.0822 | 0.0044 | |||||

| US05604FAL94 / BWAY Mortgage Trust, Series 2013-1515, Class C | 0.82 | 0.00 | 0.0820 | 0.0027 | |||||

| US3136BP5A53 / FNMA, REMIC, Series 2023-24, Class OQ | 0.81 | 5.17 | 0.0814 | 0.0066 | |||||

| US49327V2C76 / KeyBank NA/Cleveland OH | 0.81 | -1.82 | 0.0812 | 0.0012 | |||||

| US85172FAQ28 / Springleaf Finance Corp 6.625% 01/15/2028 | 0.81 | -2.52 | 0.0811 | 0.0007 | |||||

| US3136BGMS79 / FNMA, REMIC, Series 2021-53, Class GI | 0.81 | 24.50 | 0.0809 | 0.0181 | |||||

| AGL CLO 32 Ltd., Series 2024-32A, Class A1 / ABS-CBDO (US00121BAA70) | 0.80 | -0.99 | 0.0800 | 0.0019 | |||||

| US90931GAA76 / United Airlines 2020-1 Class A Pass Through Trust | 0.80 | -6.46 | 0.0797 | -0.0027 | |||||

| AIMCO CLO, Series 2018-AA, Class B1R / ABS-CBDO (US00900GAQ82) | 0.80 | -1.36 | 0.0796 | 0.0017 | |||||

| Regatta 30 Funding Ltd., Series 2024-4A, Class B / ABS-CBDO (US75903UAE38) | 0.80 | -1.24 | 0.0796 | 0.0017 | |||||

| US38383VFN38 / Government National Mortgage Association | 0.79 | 0.25 | 0.0794 | 0.0029 | |||||

| US466317AS33 / J.P. Morgan Chase Commercial Mortgage Securities Trust 2022-NLP | 0.78 | 0.0782 | 0.0782 | ||||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 0.78 | 0.00 | 0.0778 | 0.0027 | |||||

| US65342QAM42 / NEXTERA ENERGY OPERATING REGD 144A P/P 7.25000000 | 0.78 | 0.0777 | 0.0777 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.78 | 0.00 | 0.0776 | 0.0025 | |||||

| TEX / Terex Corporation | 0.78 | -3.25 | 0.0775 | 0.0001 | |||||

| US03952HAD61 / Arches Buyer Inc 2021 Term Loan B | 0.78 | -0.26 | 0.0775 | 0.0023 | |||||

| Trust Fibra Uno / DBT (US89834JAC71) | 0.77 | 2.66 | 0.0772 | 0.0046 | |||||

| Huntington Bank Auto Credit-Linked Notes, Series 2024-2, Class E / ABS-O (US44644NAL38) | 0.77 | -9.45 | 0.0768 | -0.0051 | |||||

| US68267EAD67 / ODART 2019 1A D 144A | 0.77 | 0.39 | 0.0767 | 0.0028 | |||||

| US80282KBF21 / Santander Holdings USA, Inc. | 0.76 | 0.40 | 0.0762 | 0.0028 | |||||

| US3132DWE664 / UMBS | 0.76 | -0.26 | 0.0762 | 0.0024 | |||||

| US3133Q3C336 / FHLMC, STRIPS, Series 402 | 0.76 | -2.06 | 0.0761 | 0.0010 | |||||

| US20753AAA25 / Connecticut Avenue Securities Trust 2023-R03 | 0.75 | 0.0754 | 0.0754 | ||||||

| Fortress Credit Opportunities XXI CLO LLC, Series 2023-21A, Class A1TR / ABS-CBDO (US34964UAN63) | 0.75 | -0.93 | 0.0747 | 0.0019 | |||||

| US90291JBB26 / UBS Commercial Mortgage Trust 2018-C9 | 0.74 | 2.48 | 0.0744 | 0.0042 | |||||

| US3128HXY255 / Freddie Mac Strips | 0.74 | 0.00 | 0.0744 | 0.0026 | |||||

| US345397C924 / Ford Motor Credit Co LLC | 0.74 | -2.12 | 0.0741 | 0.0010 | |||||

| J.P. Morgan Chase Commercial Mortgage Securities Trust, Series 2021-1MEM, Class C / ABS-MBS (US46654BAG23) | 0.74 | 3.94 | 0.0738 | 0.0051 | |||||

| US31418ED805 / Fannie Mae Pool | 0.74 | -0.14 | 0.0736 | 0.0024 | |||||

| US20753VBE74 / Connecticut Avenue Securities Trust 2020-SBT1 | 0.71 | -1.39 | 0.0711 | 0.0015 | |||||

| E1SE34 / Eversource Energy - Depositary Receipt (Common Stock) | 0.71 | 1.00 | 0.0710 | 0.0030 | |||||

| N1WG34 / NatWest Group plc - Depositary Receipt (Common Stock) | 0.71 | 0.86 | 0.0707 | 0.0029 | |||||

| US29280LAA17 / EnfraGen Energia Sur SA / EnfraGen Spain SA / Prime Energia SpA | 0.70 | -0.85 | 0.0705 | 0.0018 | |||||

| US89787RAH57 / TruGreen Limited Partnership 2020 Term Loan | 0.69 | -3.09 | 0.0690 | 0.0001 | |||||

| Perenti Finance Pty. Ltd. / DBT (US71367VAB53) | 0.69 | -0.58 | 0.0690 | 0.0020 | |||||

| US37045XDE31 / General Motors Financial Co Inc | 0.69 | 0.73 | 0.0688 | 0.0028 | |||||

| US958667AA50 / WESTERN MIDSTREAM OPERAT SR UNSECURED 02/50 5.25 | 0.69 | -7.04 | 0.0688 | -0.0027 | |||||

| US35564KE708 / STACR_22-HQA3 | 0.68 | -2.15 | 0.0685 | 0.0009 | |||||

| US3137HAYG52 / Freddie Mac REMICS | 0.67 | 0.60 | 0.0671 | 0.0026 | |||||

| US842434CS98 / Southern California Gas Co. | 0.67 | -1.19 | 0.0667 | 0.0015 | |||||

| US345397C437 / Ford Motor Credit Co LLC | 0.67 | -0.75 | 0.0667 | 0.0017 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.67 | -0.75 | 0.0666 | 0.0017 | |||||

| US737446AQ74 / Post Holdings Inc | 0.66 | 211.74 | 0.0665 | 0.0458 | |||||

| US37045XDV55 / General Motors Financial Co Inc | 0.66 | 0.00 | 0.0657 | 0.0022 | |||||

| Mill City Mortgage Loan Trust, Series 2018-4, Class B4 / ABS-MBS (US59980YAN58) | 0.65 | -0.15 | 0.0651 | 0.0021 | |||||

| Regatta XI Funding Ltd., Series 2018-1A, Class AR / ABS-CBDO (US75887XAN75) | 0.65 | -0.61 | 0.0650 | 0.0018 | |||||

| Golub Capital Partners CLO 76 B Ltd., Series 2024-76A, Class A1 / ABS-CBDO (US38180BAA52) | 0.65 | -1.07 | 0.0648 | 0.0014 | |||||

| OCP CLO Ltd., Series 2017-14A, Class A1R / ABS-CBDO (US67097QAN51) | 0.65 | -0.92 | 0.0648 | 0.0015 | |||||

| US3136BQFY03 / FNMA | 0.64 | -0.77 | 0.0642 | 0.0017 | |||||

| US927804GF58 / Virginia Electric and Power Co | 0.64 | -0.63 | 0.0635 | 0.0017 | |||||

| 69511JD28 / PACIFICORP | 0.63 | 0.0635 | 0.0635 | ||||||

| FHN.PRF / First Horizon Corporation - Preferred Stock | 0.63 | 0.0629 | 0.0629 | ||||||

| US3137FYEX00 / FREDDIE MAC FHR 5092 XA | 0.63 | -0.32 | 0.0626 | 0.0019 | |||||

| US08162CAL46 / BENCHMARK 2018-B6 Mortgage Trust | 0.63 | 1.13 | 0.0625 | 0.0027 | |||||

| US38383WJT45 / GNMA, Series 2023-38, Class WT | 0.62 | 0.16 | 0.0615 | 0.0021 | |||||

| US131347CN48 / Calpine Corp | 0.61 | 1.00 | 0.0609 | 0.0025 | |||||

| US38382UVG39 / GNMA, Series 2021-96, Class NS | 0.61 | 12.80 | 0.0609 | 0.0087 | |||||

| US677415CU30 / Ohio Power Co., Series R | 0.60 | 0.17 | 0.0602 | 0.0021 | |||||

| Vistra Operations Co. LLC / DBT (US92840VAR33) | 0.60 | 0.67 | 0.0601 | 0.0024 | |||||

| US3140XHL547 / UMBS, 30 Year | 0.60 | -0.50 | 0.0596 | 0.0016 | |||||

| Prime Healthcare Services, Inc. / DBT (US74165HAC25) | 0.60 | 0.17 | 0.0596 | 0.0021 | |||||

| US46115HBU05 / INTESA SANPAOLO SPA | 0.59 | -0.51 | 0.0592 | 0.0017 | |||||

| US20753XAJ37 / Connecticut Avenue Securities Trust 2022-R03 | 0.59 | -2.48 | 0.0591 | 0.0005 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.59 | -1.17 | 0.0589 | 0.0013 | |||||

| US35563GAA76 / FHLMC, Multi-Family Structured Credit Risk, Series 2021-MN3, Class M1 | 0.58 | 0.0584 | 0.0584 | ||||||

| US3136BKHZ89 / FNMA, REMIC, Series 2021-85, Class BI | 0.58 | 7.56 | 0.0584 | 0.0060 | |||||

| US05329WAQ50 / AUTONATION INC DEL 4.75% 06/01/2030 | 0.58 | 0.69 | 0.0583 | 0.0023 | |||||

| US90276FAC86 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0.58 | 1.22 | 0.0581 | 0.0026 | |||||

| US38383CTL45 / GNMA, Series 2021-188 | 0.58 | -1.02 | 0.0581 | 0.0013 | |||||

| US65342QAB86 / NextEra Energy Operating Partners LP | 0.58 | -67.72 | 0.0581 | -0.1157 | |||||

| NEXT34 / NextEra Energy, Inc. - Depositary Receipt (Common Stock) | 0.58 | 0.0577 | 0.0577 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.58 | -2.04 | 0.0576 | 0.0007 | |||||

| US29336TAC45 / EnLink Midstream LLC | 0.58 | 0.70 | 0.0576 | 0.0024 | |||||

| Stifel SBA IO Trust, Series 2024-1A, Class A2 / ABS-O (US86063NAB82) | 0.57 | -4.65 | 0.0575 | -0.0007 | |||||

| US02005NBT63 / Ally Financial Inc | 0.57 | -1.04 | 0.0571 | 0.0014 | |||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.57 | 0.0570 | 0.0570 | ||||||

| US281020AZ01 / Edison International | 0.57 | 0.35 | 0.0567 | 0.0021 | |||||

| US3137HAA486 / FHLMC, REMIC, Series 5315, Class OQ | 0.57 | -3.42 | 0.0566 | -0.0001 | |||||

| US38382LX221 / GNMA, Series 2020-188, Class DI | 0.56 | -2.08 | 0.0565 | 0.0007 | |||||

| Santander Bank Auto Credit-Linked Notes, Series 2023-B, Class F / ABS-O (US80290CCF95) | 0.56 | -12.44 | 0.0564 | -0.0058 | |||||

| US88167AAE10 / Teva Pharmaceutical Fin Neth 10/01/2026 3.150 Bond | 0.56 | -0.36 | 0.0556 | 0.0017 | |||||

| US38382QAD25 / GNMA, Series 2021-57, Class SA | 0.55 | 14.68 | 0.0547 | 0.0085 | |||||

| K1EY34 / KeyCorp - Depositary Receipt (Common Stock) | 0.54 | 0.00 | 0.0545 | 0.0019 | |||||

| Towd Point Mortgage Trust, Series 2017-4, Class B5 / ABS-MBS (US89173UAJ60) | 0.54 | -0.73 | 0.0544 | 0.0015 | |||||

| US251526CK32 / DEUTSCHE BANK AG NEW YORK BNCH 3.035/VAR 05/28/2032 | 0.53 | 2.32 | 0.0530 | 0.0029 | |||||

| Signal Peak CLO 12 Ltd., Series 2022-12A, Class A1R / ABS-CBDO (US82671XAQ60) | 0.53 | -0.94 | 0.0530 | 0.0013 | |||||

| US38383CFZ86 / GNMA, Series 2021-177, Class IM | 0.53 | 9.75 | 0.0530 | 0.0063 | |||||

| US641423CF35 / Nevada Power Co | 0.52 | -0.76 | 0.0523 | 0.0014 | |||||

| Towd Point Mortgage Trust, Series 2018-2, Class B5 / ABS-MBS (US89175VAJ26) | 0.51 | -2.67 | 0.0512 | 0.0004 | |||||

| Ally Bank Auto Credit-Linked Notes, Series 2024-A, Class G / ABS-O (US02007G2A07) | 0.51 | -11.13 | 0.0512 | -0.0045 | |||||

| US842400HV80 / Southern California Edison Co | 0.51 | -2.30 | 0.0510 | 0.0006 | |||||

| US38382PMU39 / GNMA, Series 2021-44, Class IQ | 0.51 | -1.55 | 0.0509 | 0.0009 | |||||

| CONE Trust, Series 2024-DFW1, Class E / ABS-MBS (US20682AAN00) | 0.51 | -1.36 | 0.0507 | 0.0010 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.50 | -3.63 | 0.0504 | -0.0002 | |||||

| US38382MCH07 / GNMA, Series 2020-189, Class NS | 0.50 | 13.35 | 0.0502 | 0.0074 | |||||

| Texas Debt Capital CLO Ltd., Series 2024-2A, Class B / ABS-CBDO (US88238EAE86) | 0.50 | -1.19 | 0.0499 | 0.0011 | |||||

| US12564ECM21 / CIM Trust, Series 2021-J2, Class AIOS | 0.50 | 1.02 | 0.0498 | 0.0022 | |||||

| U.S. Treasury Bills / STIV (US912797PT86) | 0.50 | 0.0497 | 0.0497 | ||||||

| US20754AAJ25 / Connecticut Avenue Securities Trust 2021-R03 | 0.49 | -44.14 | 0.0491 | -0.0339 | |||||

| CBAPJ / Commonwealth Bank of Australia - Preferred Security | 0.49 | 0.0488 | 0.0488 | ||||||

| Owl Rock CLO XX LLC, Series 2024-20A, Class C / ABS-CBDO (US69122LAC54) | 0.49 | -2.40 | 0.0488 | 0.0005 | |||||

| US29245JAM45 / Empresa Nacional del Petroleo | 0.49 | 1.89 | 0.0485 | 0.0024 | |||||

| GNMA, Series 2024-51, Class SX / ABS-MBS (US38384KVY45) | 0.48 | 23.65 | 0.0481 | 0.0104 | |||||

| US38141GFD16 / Goldman Sachs 6.75% Notes 10/1/37 | 0.48 | 0.00 | 0.0477 | 0.0016 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.48 | -5.37 | 0.0477 | -0.0010 | |||||

| J1EF34 / Jefferies Financial Group Inc. - Depositary Receipt (Common Stock) | 0.48 | -1.65 | 0.0476 | 0.0008 | |||||

| US842400GG23 / Southern California Edison Co. Bond 4% Due 4/1/2047 | 0.47 | -2.07 | 0.0473 | 0.0006 | |||||

| US38380RA758 / Government National Mortgage Association | 0.47 | 1.96 | 0.0468 | 0.0024 | |||||

| US43732VAA44 / Home Partners of America 2021-2 Trust | 0.47 | 1.75 | 0.0465 | 0.0023 | |||||

| AAL / American Airlines Group Inc. | 0.46 | -20.45 | 0.0464 | -0.0100 | |||||

| US20754AAF03 / Fannie Mae Connecticut Avenue Securities | 0.46 | -60.09 | 0.0456 | -0.0645 | |||||

| Silver Point SCF CLO IV Ltd., Series 2021-1A, Class A2R / ABS-CBDO (US82809JAE91) | 0.45 | -0.66 | 0.0453 | 0.0012 | |||||

| Rad CLO 25 Ltd., Series 2024-25A, Class A1 / ABS-CBDO (US75009GAA58) | 0.45 | -0.88 | 0.0449 | 0.0011 | |||||

| US38382AGG40 / GNMA, Series 2019-128, Class YF | 0.45 | 0.45 | 0.0448 | 0.0016 | |||||

| Ivy Hill Middle Market Credit Fund VII Ltd., Series 7A, Class AR3 / ABS-CBDO (US46602ABE10) | 0.45 | -0.89 | 0.0448 | 0.0011 | |||||

| Ares Direct Lending CLO 3 LLC, Series 2024-3A, Class A2 / ABS-CBDO (US039945AB60) | 0.45 | -1.11 | 0.0446 | 0.0010 | |||||

| US17322YAG52 / CITIGROUP COMMERCIAL MORTGAGE TRUST 2014-GC25 SER 2014-GC25 CL B V/R REGD 4.34500000 | 0.44 | -23.70 | 0.0441 | -0.0117 | |||||

| US3136BFES88 / Fannie Mae REMICS | 0.44 | -10.04 | 0.0440 | -0.0032 | |||||

| US38382AEQ40 / GNMA, Series 2019-128, Class KF | 0.43 | -0.69 | 0.0434 | 0.0013 | |||||

| US95000CBJ18 / Wells Fargo Commercial Mortgage Trust 2016-NXS5 | 0.43 | 4.85 | 0.0432 | 0.0034 | |||||

| GNMA, Series 2023-159, Class CI / ABS-MBS (US38381JZC43) | 0.43 | 0.23 | 0.0429 | 0.0015 | |||||

| US00775CAC01 / Aegea Finance Sarl | 0.43 | 0.23 | 0.0428 | 0.0015 | |||||

| US30167FAG72 / Exeter Automobile Receivables Trust 2022-5, Series 2022-5A, Class E | 0.43 | -1.62 | 0.0426 | 0.0007 | |||||

| US3136BHWC90 / FNMA, REMIC, Series 2021-34, Class MI | 0.43 | -3.41 | 0.0426 | -0.0001 | |||||

| US3140XKAD23 / UMBS, 30 Year | 0.42 | 0.48 | 0.0419 | 0.0016 | |||||

| Apidos CLO LI Ltd., Series 2024-51A, Class B / ABS-CBDO (US03771JAE91) | 0.42 | -1.19 | 0.0415 | 0.0009 | |||||

| US3137FU6G48 / FHLMC, REMIC, Series 4993, Class KS | 0.41 | 12.26 | 0.0412 | 0.0057 | |||||

| US38381WS337 / GNMA, Series 2019-92, Class GF | 0.41 | -0.48 | 0.0411 | 0.0011 | |||||

| Mill City Mortgage Loan Trust, Series 2018-3, Class B4 / ABS-MBS (US59980XAN75) | 0.41 | -1.21 | 0.0410 | 0.0009 | |||||

| CAON34 / Capital One Financial Corporation - Depositary Receipt (Common Stock) | 0.41 | 0.00 | 0.0409 | 0.0014 | |||||

| US023765AA88 / American Airlines 2016-2 Class AA Pass Through Trust | 0.41 | 0.25 | 0.0407 | 0.0015 | |||||

| US38383CYH77 / GNMA, Series 2021-179, Class SA | 0.40 | 14.41 | 0.0398 | 0.0062 | |||||

| US38383PV406 / Government National Mortgage Association | 0.40 | -3.87 | 0.0397 | -0.0002 | |||||

| US643821AB76 / New Economy Assets Phase 1 Sponsor LLC | 0.40 | 0.77 | 0.0395 | 0.0016 | |||||

| US390607AF62 / GREAT LAKES DRDG and DOCK CORP NEW 5.25% 06/01/2029 144A | 0.38 | -1.82 | 0.0379 | 0.0006 | |||||

| US31418EPD66 / Fannie Mae Pool | 0.38 | -1.82 | 0.0379 | 0.0006 | |||||

| US19828TAC09 / CORPORATE BONDS | 0.38 | -51.48 | 0.0377 | -0.0373 | |||||

| GNMA, Series 2023-172 / ABS-MBS (US38381JA720) | 0.38 | 0.27 | 0.0376 | 0.0013 | |||||

| US38379XY204 / Government National Mortgage Association | 0.38 | 0.0376 | 0.0376 | ||||||

| US38383XYN82 / Government National Mortgage Association | 0.38 | -5.06 | 0.0376 | -0.0007 | |||||

| US38382WH262 / GNMA, Series 2021-146, Class IN | 0.38 | -3.10 | 0.0375 | 0.0001 | |||||

| US3140HJJS12 / Fannie Mae Pool | 0.37 | 0.00 | 0.0367 | 0.0012 | |||||

| Connecticut Avenue Securities Trust, Series 2025-R02, Class 1B1 / ABS-MBS (US20754TAH59) | 0.36 | 0.0364 | 0.0364 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.36 | 0.0360 | 0.0360 | ||||||

| US31422MZU34 / FNMA, STRIPS, Series 426, Class C32 | 0.36 | -1.10 | 0.0360 | 0.0009 | |||||

| US38383HFY09 / GNMA, Series 2022-207 | 0.36 | -3.24 | 0.0358 | 0.0000 | |||||

| M1TB34 / M&T Bank Corporation - Depositary Receipt (Common Stock) | 0.36 | 0.00 | 0.0355 | 0.0011 | |||||

| GNMA, Series 2024-48, Class JI / ABS-MBS (US38384KHH77) | 0.35 | 0.0355 | 0.0355 | ||||||

| Bain Capital Credit CLO Ltd., Series 2021-6A, Class DR / ABS-CBDO (US05684PAU03) | 0.35 | -1.13 | 0.0350 | 0.0007 | |||||

| US38382L2B68 / GNMA, Series 2020-188 | 0.35 | -2.53 | 0.0348 | 0.0003 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.34 | -3.38 | 0.0343 | -0.0000 | |||||

| US33844TAG22 / Flagship Credit Auto Trust 2020-3 | 0.34 | -37.25 | 0.0343 | -0.0185 | |||||

| Sally Holdings LLC / DBT (US79546VAQ95) | 0.34 | 0.0343 | 0.0343 | ||||||

| US38383UVS67 / GNMA, Series 2022-137, Class S | 0.34 | 13.33 | 0.0341 | 0.0050 | |||||

| US55903VBC63 / Warnermedia Holdings Inc | 0.33 | -2.99 | 0.0325 | 0.0001 | |||||

| US38382MV975 / GNMA_21-1 | 0.33 | -1.22 | 0.0325 | 0.0006 | |||||

| US31325URK42 / FHLMC, STRIPS, Series 311, Class S1 | 0.32 | 21.89 | 0.0324 | 0.0067 | |||||

| US61690QAS84 / Morgan Stanley Bank of America Merrill Lynch Trust 2015-C23 | 0.32 | -64.99 | 0.0322 | -0.0565 | |||||

| US38382UVH12 / GNMA, Series 2021-96, Class SN | 0.32 | 13.67 | 0.0317 | 0.0048 | |||||

| US63942LAA08 / Navient Private Education Refi Loan Trust 2021-B | 0.32 | -4.55 | 0.0316 | -0.0004 | |||||

| US38382WBD83 / GNMA, Series 2021-122, Class HS | 0.31 | 12.59 | 0.0314 | 0.0044 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.31 | 0.0313 | 0.0313 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.31 | 0.0310 | 0.0310 | ||||||

| US38382KWJ86 / GNMA, Series 2020-146, Class SA | 0.30 | 15.06 | 0.0298 | 0.0047 | |||||

| US3140XBG466 / FNMA UMBS, 30 Year | 0.29 | -1.01 | 0.0294 | 0.0007 | |||||

| US38382UYG02 / Government National Mortgage Association | 0.29 | 14.17 | 0.0290 | 0.0044 | |||||

| US81748WBB19 / Sequoia Mortgage Trust, Series 2021-4, Class AIO1 | 0.28 | 1.07 | 0.0283 | 0.0012 | |||||

| US38382DM304 / GNMA, Series 2020-34, Class SC | 0.28 | 15.29 | 0.0279 | 0.0045 | |||||

| GNMA, Series 2023-194, Class CI / ABS-MBS (US38381JN947) | 0.28 | -2.13 | 0.0276 | 0.0004 | |||||

| FTSE 100 Index / DE (GB00M251VK77) | 0.26 | 0.0264 | 0.0264 | ||||||

| US38382WR253 / Government National Mortgage Association | 0.26 | 153.40 | 0.0261 | 0.0161 | |||||

| US3137FVSU75 / FHLMC, REMIC, Series 5011, Class MI | 0.26 | -1.53 | 0.0257 | 0.0004 | |||||

| US38384A3B74 / GNMA, Series 2023-86, Class SE | 0.26 | 9.36 | 0.0257 | 0.0029 | |||||

| US3137F9Y542 / FREDDIE MAC FHR 5070 PI | 0.25 | -1.96 | 0.0250 | 0.0003 | |||||

| AGL CLO 35 Ltd., Series 2024-35A, Class A2 / ABS-CBDO (US00852KAB08) | 0.25 | -1.20 | 0.0249 | 0.0006 | |||||

| US38382RR758 / GNMA CMO IO | 0.24 | 1.27 | 0.0240 | 0.0011 | |||||

| US38382TM276 / GNMA, Series 2021-98, Class IN | 0.24 | -0.83 | 0.0240 | 0.0007 | |||||

| US3137FUFU30 / FHLMC, REMIC, Series 4994, Class TS | 0.24 | 20.81 | 0.0239 | 0.0047 | |||||

| US38383GFG10 / GNMA, Series 2022-10, Class IC | 0.24 | -1.26 | 0.0236 | 0.0005 | |||||

| US38382P5E89 / Government National Mortgage Association | 0.23 | 12.62 | 0.0232 | 0.0033 | |||||

| US3136BHQA09 / FNMA, REMIC, Series 2021-40, Class SI | 0.23 | 22.22 | 0.0231 | 0.0048 | |||||

| US38380REA41 / GNR 2020-168 IA | 0.21 | 3.38 | 0.0214 | 0.0014 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.21 | -2.79 | 0.0209 | 0.0001 | |||||

| US95001LAC63 / Wells Fargo Commercial Mortgage Trust, Series 2018-C43, Class D | 0.21 | 0.49 | 0.0206 | 0.0008 | |||||

| US3136BL3H16 / FNMA, Series 2022-10, Class SA | 0.21 | -5.96 | 0.0205 | -0.0006 | |||||

| US3137FYQ585 / FHLMC, REMIC, Series 5094, Class IP | 0.20 | -1.45 | 0.0205 | 0.0004 | |||||

| US3140JNRL60 / Fannie Mae Pool | 0.20 | -3.33 | 0.0203 | 0.0000 | |||||

| GNMA, Series 2022-107, Class SA / ABS-MBS (US38383TLA96) | 0.20 | 54.20 | 0.0202 | 0.0075 | |||||

| US38382LBS97 / Government National Mortgage Association | 0.20 | 13.87 | 0.0198 | 0.0031 | |||||

| US3136BFKM45 / Fannie Mae REMICS | 0.20 | 4.84 | 0.0196 | 0.0016 | |||||

| US38384BPQ85 / GNMA, Series 2023-80, Class SA | 0.19 | 28.00 | 0.0193 | 0.0048 | |||||

| US3137FWV720 / FHLMC, REMIC, Series 5023, Class LI | 0.19 | -2.63 | 0.0186 | 0.0002 | |||||

| US3137F6PH41 / FHLMC, REMIC, Series 5040 | 0.19 | -1.07 | 0.0185 | 0.0005 | |||||

| US3136ATEN05 / FNMA, REMIC, Series 2016-57, Class SN | 0.18 | 22.82 | 0.0184 | 0.0039 | |||||

| US30166TAF03 / Exeter Automobile Receivables Trust, Series 2023-4A, Class D | 0.18 | -0.56 | 0.0180 | 0.0006 | |||||

| GNMA, Series 2022-185, Class DI / ABS-MBS (US38381HVY43) | 0.18 | 0.00 | 0.0179 | 0.0006 | |||||

| US830867AA59 / Delta Air Lines Inc / SkyMiles IP Ltd | 0.18 | -33.58 | 0.0178 | -0.0081 | |||||

| US38382VAW90 / GNMA, Series 2021-97, Class SM | 0.16 | 15.00 | 0.0161 | 0.0025 | |||||

| U.S. Treasury 10 Year Ultra Bonds / DIR (N/A) | 0.15 | 0.0151 | 0.0151 | ||||||

| US3137H3WL29 / FHLMC, REMIC, Series 5160 | 0.15 | -3.27 | 0.0148 | -0.0000 | |||||

| US38382XY588 / GNMA, Series 2021-158, Class SB | 0.13 | 61.45 | 0.0134 | 0.0053 | |||||

| US38382ML562 / GOVERNMENT NATIONAL MORTGAGE ASSOCIATION GNR 2021-1 PI | 0.13 | 23.36 | 0.0132 | 0.0029 | |||||

| U.S. Treasury Long Bonds / DIR (N/A) | 0.12 | 0.0118 | 0.0118 | ||||||

| US38383C3X68 / Government National Mortgage Association | 0.12 | 64.79 | 0.0117 | 0.0049 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.11 | -0.93 | 0.0107 | 0.0002 | |||||

| US38382P5H11 / Government National Mortgage Association | 0.11 | 12.90 | 0.0106 | 0.0015 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.10 | -0.99 | 0.0101 | 0.0002 | |||||

| US38382MGE30 / Government National Mortgage Association | 0.10 | 13.95 | 0.0098 | 0.0015 | |||||

| US3137FWMZ00 / Freddie Mac REMICS | 0.09 | 78.00 | 0.0089 | 0.0040 | |||||

| US38382LQD63 / GNMA, Series 2020-166, Class IC | 0.09 | 27.54 | 0.0089 | 0.0022 | |||||

| US33851GAU94 / Flagstar Mortgage Trust | 0.07 | 0.00 | 0.0071 | 0.0002 | |||||

| US3136BGKA89 / FNMA, REMIC, Series 2021-54, Class HI | 0.06 | -3.08 | 0.0064 | 0.0000 | |||||

| GNMA, Series 2022-87, Class SA / ABS-MBS (US38383RYT84) | 0.06 | 136.00 | 0.0059 | 0.0034 | |||||

| US38382RLF37 / GNMA, Series 2021-74, Class HI | 0.05 | -1.89 | 0.0052 | 0.0000 | |||||

| US38382VET26 / Government National Mortgage Association | 0.05 | 10.87 | 0.0052 | 0.0007 | |||||

| GNMA, Series 2022-78, Class S / ABS-MBS (US38383P8S39) | 0.05 | 76.92 | 0.0046 | 0.0020 | |||||

| U.S. Treasury 10 Year Notes / DIR (N/A) | 0.05 | 0.0045 | 0.0045 | ||||||

| GNMA, Series 2021-29, Class AS / ABS-MBS (US38382NP769) | 0.04 | 2.38 | 0.0043 | 0.0003 | |||||

| GNMA, Series 2021-16, Class AS / ABS-MBS (US38382NAB38) | 0.03 | 112.50 | 0.0035 | 0.0019 | |||||

| GNMA, Series 2022-101, Class SB / ABS-MBS (US38383F6G36) | 0.03 | 141.67 | 0.0030 | 0.0017 | |||||

| US38382CDW82 / GNMA, Series 2020-1, Class YS | 0.03 | 68.75 | 0.0027 | 0.0011 | |||||

| US126650AQ30 / CVS Pass-Through Trust | 0.02 | -25.00 | 0.0019 | -0.0005 | |||||

| US3137H6KD61 / Freddie Mac REMICS | 0.01 | 66.67 | 0.0010 | 0.0004 | |||||

| GNMA, Series 2021-226, Class SA / ABS-MBS (US38383FAC77) | 0.00 | 33.33 | 0.0004 | 0.0001 | |||||

| US31418EV989 / Fannie Mae Pool | 0.00 | 0.00 | 0.0004 | 0.0000 | |||||

| QUAD / Quad/Graphics, Inc. | 0.00 | 0.00 | 0.00 | 0.0000 | -0.0000 | ||||

| US36209FLA56 / Ginnie Mae I Pool | 0.00 | 0.0000 | -0.0000 | ||||||

| US36207KUR93 / Ginnie Mae I Pool | 0.00 | 0.0000 | -0.0000 | ||||||

| TU / TELUS Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.3533 | ||||

| U.S. Treasury Ultra Bonds / DIR (N/A) | -0.08 | -0.0082 | -0.0082 | ||||||

| Canada 5 Year Bonds / DIR (N/A) | -0.09 | -0.0091 | -0.0091 | ||||||

| S&P Midcap 400 E-Mini Index / DE (N/A) | -0.17 | -0.0174 | -0.0174 | ||||||

| U.S. Treasury 2 Year Notes / DIR (N/A) | -0.21 | -0.0215 | -0.0215 | ||||||

| Russell 2000 E-Mini Index / DE (N/A) | -0.37 | -0.0367 | -0.0367 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.37 | -0.0369 | -0.0369 | ||||||

| Yen Denominated Nikkei 225 Index / DE (N/A) | -0.50 | -0.0500 | -0.0500 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.62 | -0.0623 | -0.0623 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.74 | -0.0744 | -0.0744 | ||||||

| S&P 500 E-Mini Index / DE (N/A) | -0.89 | -0.0886 | -0.0886 | ||||||

| Euro STOXX 50 Index / DE (DE000C6ZNNN9) | -1.26 | -0.1258 | -0.1258 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -1.57 | -0.1573 | -0.1573 |