Mga Batayang Estadistika

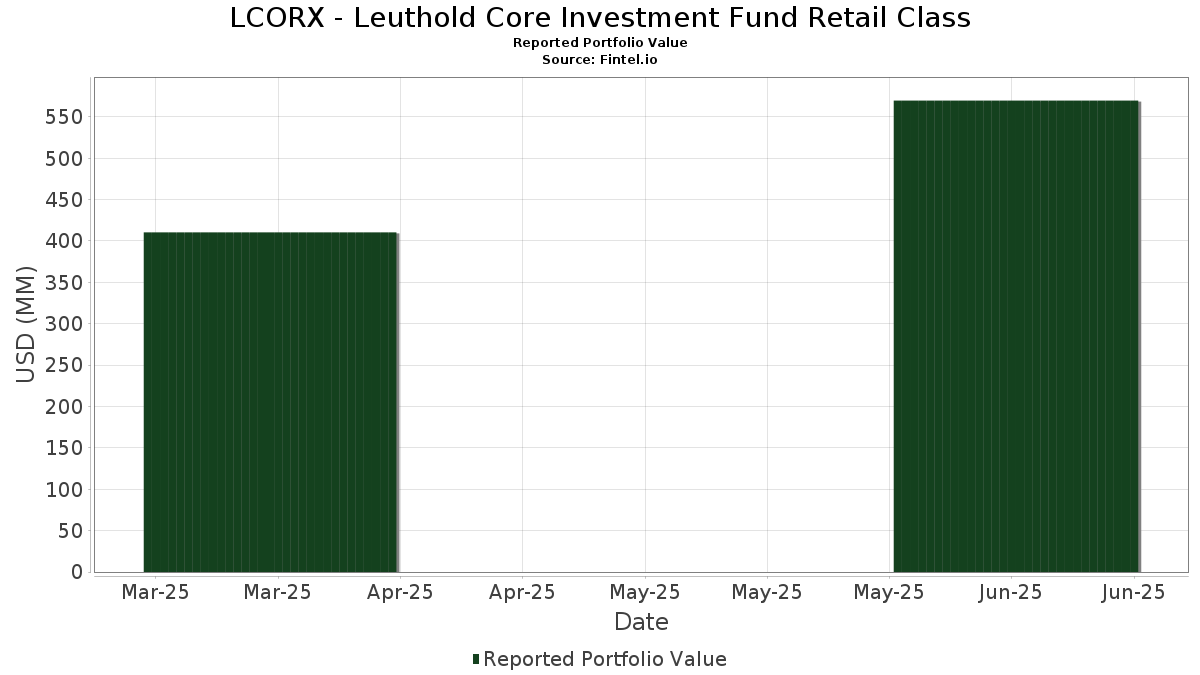

| Nilai Portofolio | $ 569,691,035 |

| Posisi Saat Ini | 218 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

LCORX - Leuthold Core Investment Fund Retail Class telah mengungkapkan total kepemilikan 218 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 569,691,035 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama LCORX - Leuthold Core Investment Fund Retail Class adalah Microsoft Corporation (US:MSFT) , Meta Platforms, Inc. (US:META) , SPDR Series Trust - SPDR Portfolio Intermediate Term Corporate Bond ETF (US:SPIB) , Netflix, Inc. (US:NFLX) , and US TNOTE 3.875% DUE 08/15/2033 (US:US91282CHT18) . Posisi baru LCORX - Leuthold Core Investment Fund Retail Class meliputi: US TNOTE 3.875% DUE 08/15/2033 (US:US91282CHT18) , FRANCE (GOVT OF) /EUR/ REGD REG S 3.00000000 (FR:FR001400H7V7) , Vanguard Malvern Funds - Vanguard Short-Term Inflation-Protected Securities ETF (US:VTIP) , Uber Technologies, Inc. (US:UBER) , and SPDR Series Trust - SPDR Bloomberg International Corporate Bond ETF (US:IBND) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 80.38 | 80.38 | 15.0251 | 15.0251 | |

| 80.38 | 80.38 | 15.0251 | 15.0251 | |

| 16.96 | 3.1701 | 3.1701 | ||

| 16.96 | 3.1701 | 3.1701 | ||

| -0.02 | -13.66 | -2.5542 | 2.8951 | |

| 0.10 | 4.86 | 0.9086 | 0.9086 | |

| 0.04 | 3.59 | 0.6706 | 0.6706 | |

| 0.10 | 3.17 | 0.5923 | 0.5923 | |

| 0.01 | 12.13 | 2.2679 | 0.5693 | |

| 0.03 | 15.70 | 2.9340 | 0.5540 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.00 | -0.4833 | ||

| 0.00 | 0.00 | -0.4833 | ||

| 0.00 | 0.00 | -0.4687 | ||

| 0.00 | 0.00 | -0.3763 | ||

| 0.00 | 0.00 | -0.3753 | ||

| 0.00 | 0.00 | -0.3499 | ||

| -0.01 | -5.09 | -0.9516 | -0.3232 | |

| 0.00 | 0.00 | -0.3115 | ||

| -0.02 | -1.55 | -0.2905 | -0.2905 | |

| 0.00 | 0.00 | -0.2861 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-26 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US BANK MMDA - USBGFS 9 / STIV (N/A) | 80.38 | 80.38 | 15.0251 | 15.0251 | |||||

| US BANK MMDA - USBGFS 9 / STIV (N/A) | 80.38 | 80.38 | 15.0251 | 15.0251 | |||||

| United States Treasury Bill / DBT (US912797QB69) | 16.96 | 3.1701 | 3.1701 | ||||||

| United States Treasury Bill / DBT (US912797QB69) | 16.96 | 3.1701 | 3.1701 | ||||||

| MSFT / Microsoft Corporation | 0.03 | -1.40 | 15.70 | 30.65 | 2.9340 | 0.5540 | |||

| META / Meta Platforms, Inc. | 0.02 | -1.66 | 13.68 | 25.94 | 2.5577 | 0.4054 | |||

| SPIB / SPDR Series Trust - SPDR Portfolio Intermediate Term Corporate Bond ETF | 0.38 | 19.16 | 12.80 | 20.39 | 2.3920 | 0.2862 | |||

| NFLX / Netflix, Inc. | 0.01 | -1.47 | 12.13 | 41.50 | 2.2679 | 0.5693 | |||

| US91282CHT18 / US TNOTE 3.875% DUE 08/15/2033 | 10.14 | 0.72 | 1.8963 | -0.0988 | |||||

| BWX / SPDR Series Trust - SPDR Bloomberg International Treasury Bond ETF | 0.41 | 0.00 | 9.68 | 7.45 | 1.8087 | 0.0249 | |||

| ORCL / Oracle Corporation | 0.04 | -1.52 | 9.24 | 54.02 | 1.7280 | 0.5388 | |||

| JBL / Jabil Inc. | 0.04 | -1.43 | 8.20 | 58.01 | 1.5328 | 0.5046 | |||

| IGOV / iShares Trust - iShares International Treasury Bond ETF | 0.18 | 0.00 | 7.59 | 9.33 | 1.4197 | 0.0436 | |||

| GOOGL / Alphabet Inc. | 0.04 | -1.30 | 7.47 | 12.48 | 1.3963 | 0.0808 | |||

| GS / The Goldman Sachs Group, Inc. | 0.01 | -1.52 | 7.22 | 27.59 | 1.3502 | 0.2286 | |||

| MCK / McKesson Corporation | 0.01 | -1.85 | 7.10 | 6.85 | 1.3266 | 0.0110 | |||

| URI / United Rentals, Inc. | 0.01 | -0.83 | 6.51 | 19.22 | 1.2174 | 0.1353 | |||

| CAH / Cardinal Health, Inc. | 0.04 | -1.31 | 6.44 | 20.34 | 1.2036 | 0.1437 | |||

| PHM / PulteGroup, Inc. | 0.06 | -1.41 | 6.30 | 1.14 | 1.1784 | -0.0564 | |||

| FLEX / Flex Ltd. | 0.12 | -1.39 | 6.20 | 48.84 | 1.1594 | 0.3337 | |||

| GB00BMV7TC88 / United Kingdom Gilt | 6.03 | 7.88 | 1.1265 | 0.0197 | |||||

| GB00BMV7TC88 / United Kingdom Gilt | 6.03 | 7.88 | 1.1265 | 0.0197 | |||||

| KGC / Kinross Gold Corporation | 0.38 | -1.42 | 5.93 | 22.20 | 1.1085 | 0.1471 | |||

| FR001400H7V7 / FRANCE (GOVT OF) /EUR/ REGD REG S 3.00000000 | 5.63 | 10.47 | 1.0516 | 0.0428 | |||||

| COR / Cencora, Inc. | 0.02 | -1.34 | 5.62 | 6.38 | 1.0507 | 0.0040 | |||

| JPM / JPMorgan Chase & Co. | 0.02 | -1.58 | 5.62 | 16.32 | 1.0498 | 0.0933 | |||

| MS / Morgan Stanley | 0.04 | -1.46 | 5.59 | 18.97 | 1.0448 | 0.1141 | |||

| TMUS / T-Mobile US, Inc. | 0.02 | -1.32 | 5.48 | -11.85 | 1.0251 | -0.2072 | |||

| CSCO / Cisco Systems, Inc. | 0.08 | 46.52 | 5.37 | 64.72 | 1.0030 | 0.3577 | |||

| MA / Mastercard Incorporated | 0.01 | -1.49 | 5.33 | 1.01 | 0.9955 | -0.0491 | |||

| DHI / D.R. Horton, Inc. | 0.04 | -1.42 | 5.09 | -0.04 | 0.9512 | -0.0572 | |||

| VTIP / Vanguard Malvern Funds - Vanguard Short-Term Inflation-Protected Securities ETF | 0.10 | 4.86 | 0.9086 | 0.9086 | |||||

| FXY / Invesco CurrencyShares Japanese Yen Trust | 0.08 | 44.87 | 4.84 | 50.64 | 0.9043 | 0.2680 | |||

| MTBA / Simplify Exchange Traded Funds - Simplify MBS ETF | 0.10 | 0.00 | 4.81 | -0.10 | 0.8996 | -0.0547 | |||

| BAC / Bank of America Corporation | 0.10 | -1.37 | 4.64 | 11.86 | 0.8678 | 0.0455 | |||

| V / Visa Inc. | 0.01 | -1.28 | 4.47 | 0.00 | 0.8363 | -0.0498 | |||

| C / Citigroup Inc. | 0.05 | -1.44 | 4.33 | 18.19 | 0.8103 | 0.0837 | |||

| T / AT&T Inc. | 0.15 | -1.44 | 4.28 | 0.85 | 0.7995 | -0.0406 | |||

| DBK / Deutsche Bank Aktiengesellschaft | 0.15 | -1.41 | 4.25 | 21.12 | 0.7946 | 0.0994 | |||

| TOL / Toll Brothers, Inc. | 0.04 | -1.53 | 4.14 | 6.43 | 0.7732 | 0.0033 | |||

| CHKP / Check Point Software Technologies Ltd. | 0.02 | -1.29 | 4.12 | -4.18 | 0.7710 | -0.0817 | |||

| TE Connectivity PLC / EC (IE000IVNQZ81) | 0.02 | -1.32 | 4.11 | 17.77 | 0.7684 | 0.0770 | |||

| TE Connectivity PLC / EC (IE000IVNQZ81) | 0.02 | -1.32 | 4.11 | 17.77 | 0.7684 | 0.0770 | |||

| FTNT / Fortinet, Inc. | 0.04 | -1.48 | 4.10 | 8.19 | 0.7656 | 0.0158 | |||

| DIS / The Walt Disney Company | 0.03 | -1.42 | 4.04 | 23.87 | 0.7556 | 0.1091 | |||

| IAG / IAMGOLD Corporation | 0.51 | -1.41 | 3.78 | 15.93 | 0.7061 | 0.0607 | |||

| HCA / HCA Healthcare, Inc. | 0.01 | -1.59 | 3.75 | 9.11 | 0.7010 | 0.0201 | |||

| ATGE / Adtalem Global Education Inc. | 0.03 | -1.39 | 3.60 | 24.71 | 0.6737 | 0.1010 | |||

| UBER / Uber Technologies, Inc. | 0.04 | 3.59 | 0.6706 | 0.6706 | |||||

| VRSN / VeriSign, Inc. | 0.01 | -1.27 | 3.58 | 12.34 | 0.6690 | 0.0378 | |||

| CM / Canadian Imperial Bank of Commerce | 0.05 | -1.39 | 3.50 | 24.04 | 0.6550 | 0.0955 | |||

| AEM / Agnico Eagle Mines Limited | 0.03 | -1.53 | 3.49 | 8.01 | 0.6529 | 0.0124 | |||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 0.18 | -1.39 | 3.42 | 19.38 | 0.6391 | 0.0716 | |||

| NOK / Nokia Oyj - Depositary Receipt (Common Stock) | 0.66 | 42.52 | 3.40 | 40.08 | 0.6364 | 0.1549 | |||

| FFIV / F5, Inc. | 0.01 | 43.66 | 3.40 | 58.81 | 0.6350 | 0.2112 | |||

| LRN / Stride, Inc. | 0.02 | -1.40 | 3.37 | 13.16 | 0.6303 | 0.0401 | |||

| ERIC / Telefonaktiebolaget LM Ericsson (publ) - Depositary Receipt (Common Stock) | 0.38 | 49.22 | 3.21 | 63.07 | 0.5993 | 0.2098 | |||

| THC / Tenet Healthcare Corporation | 0.02 | -1.32 | 3.19 | 29.16 | 0.5962 | 0.1069 | |||

| IBND / SPDR Series Trust - SPDR Bloomberg International Corporate Bond ETF | 0.10 | 3.17 | 0.5923 | 0.5923 | |||||

| UTI / Universal Technical Institute, Inc. | 0.09 | -1.37 | 2.90 | 30.17 | 0.5430 | 0.1009 | |||

| LAUR / Laureate Education, Inc. | 0.12 | -1.44 | 2.88 | 12.68 | 0.5384 | 0.0320 | |||

| TWLO / Twilio Inc. | 0.02 | -1.20 | 2.86 | 25.53 | 0.5350 | 0.0832 | |||

| CARG / CarGurus, Inc. | 0.08 | -1.47 | 2.79 | 13.20 | 0.5213 | 0.0333 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.01 | 2.70 | 0.5045 | 0.5045 | |||||

| TRV / The Travelers Companies, Inc. | 0.01 | -1.08 | 2.67 | 0.07 | 0.5000 | -0.0295 | |||

| USB / U.S. Bancorp | 0.06 | 2.59 | 0.4836 | 0.4836 | |||||

| HIG / The Hartford Insurance Group, Inc. | 0.02 | -1.60 | 2.58 | 0.90 | 0.4816 | -0.0243 | |||

| GDDY / GoDaddy Inc. | 0.01 | -1.40 | 2.48 | -1.43 | 0.4627 | -0.0348 | |||

| SSNC / SS&C Technologies Holdings, Inc. | 0.03 | -1.21 | 2.43 | -2.09 | 0.4546 | -0.0374 | |||

| ALL / The Allstate Corporation | 0.01 | -1.52 | 2.41 | -4.25 | 0.4507 | -0.0482 | |||

| CMCSA / Comcast Corporation | 0.07 | -1.45 | 2.38 | -4.69 | 0.4447 | -0.0497 | |||

| DY / Dycom Industries, Inc. | 0.01 | 2.32 | 0.4329 | 0.4329 | |||||

| EHC / Encompass Health Corporation | 0.02 | -1.30 | 2.31 | 19.49 | 0.4321 | 0.0489 | |||

| RJF / Raymond James Financial, Inc. | 0.01 | -1.51 | 2.30 | 8.75 | 0.4300 | 0.0109 | |||

| SANM / Sanmina Corporation | 0.02 | 2.22 | 0.4144 | 0.4144 | |||||

| PAAS / Pan American Silver Corp. | 0.08 | -1.38 | 2.20 | 8.42 | 0.4119 | 0.0093 | |||

| AKAM / Akamai Technologies, Inc. | 0.03 | -1.27 | 2.19 | -2.19 | 0.4099 | -0.0342 | |||

| FTDR / Frontdoor, Inc. | 0.04 | 2.19 | 0.4096 | 0.4096 | |||||

| EGO / Eldorado Gold Corporation | 0.11 | -1.41 | 2.19 | 19.26 | 0.4086 | 0.0454 | |||

| PYPL / PayPal Holdings, Inc. | 0.03 | -1.37 | 2.14 | 12.36 | 0.3993 | 0.0226 | |||

| PLXS / Plexus Corp. | 0.02 | 2.12 | 0.3971 | 0.3971 | |||||

| RCL / Royal Caribbean Cruises Ltd. | 0.01 | -1.14 | 2.12 | 50.71 | 0.3962 | 0.1176 | |||

| VIRT / Virtu Financial, Inc. | 0.05 | -1.50 | 2.10 | 15.74 | 0.3933 | 0.0332 | |||

| QLYS / Qualys, Inc. | 0.01 | -1.62 | 2.10 | 11.60 | 0.3922 | 0.0198 | |||

| UGI / UGI Corporation | 0.06 | -1.45 | 2.10 | 8.54 | 0.3921 | 0.0092 | |||

| MKL / Markel Group Inc. | 0.00 | -2.89 | 2.08 | 3.74 | 0.3887 | -0.0084 | |||

| AIZ / Assurant, Inc. | 0.01 | -1.78 | 2.08 | -7.52 | 0.3883 | -0.0567 | |||

| STRA / Strategic Education, Inc. | 0.02 | -1.28 | 2.06 | 0.10 | 0.3845 | -0.0226 | |||

| UHS / Universal Health Services, Inc. | 0.01 | -1.19 | 2.06 | -4.73 | 0.3844 | -0.0433 | |||

| OKTA / Okta, Inc. | 0.02 | -1.51 | 1.99 | -6.45 | 0.3717 | -0.0493 | |||

| CCL / Carnival Corporation & plc | 0.07 | -1.42 | 1.97 | 41.98 | 0.3673 | 0.0931 | |||

| ACGL / Arch Capital Group Ltd. | 0.02 | -1.28 | 1.89 | -6.54 | 0.3527 | -0.0473 | |||

| LTH / Life Time Group Holdings, Inc. | 0.06 | -1.33 | 1.88 | -0.90 | 0.3519 | -0.0245 | |||

| MDU / MDU Resources Group, Inc. | 0.11 | -1.39 | 1.87 | -2.75 | 0.3502 | -0.0316 | |||

| CNXC / Concentrix Corporation | 0.03 | -1.48 | 1.84 | -6.40 | 0.3447 | -0.0456 | |||

| OGS / ONE Gas, Inc. | 0.03 | -1.47 | 1.84 | -6.36 | 0.3441 | -0.0452 | |||

| CHTR / Charter Communications, Inc. | 0.00 | -2.23 | 1.83 | 8.48 | 0.3422 | 0.0078 | |||

| CI / The Cigna Group | 0.01 | 1.83 | 0.3415 | 0.3415 | |||||

| EQX / Equinox Gold Corp. | 0.32 | -1.42 | 1.82 | -17.62 | 0.3411 | -0.0976 | |||

| SR / Spire Inc. | 0.02 | -1.31 | 1.82 | -7.93 | 0.3410 | -0.0516 | |||

| VZ / Verizon Communications Inc. | 0.04 | -1.36 | 1.78 | -5.92 | 0.3327 | -0.0420 | |||

| CVS / CVS Health Corporation | 0.03 | 1.77 | 0.3316 | 0.3316 | |||||

| LAD / Lithia Motors, Inc. | 0.01 | 1.74 | 0.3262 | 0.3262 | |||||

| NJR / New Jersey Resources Corporation | 0.04 | -1.29 | 1.74 | -9.82 | 0.3246 | -0.0569 | |||

| EXPE / Expedia Group, Inc. | 0.01 | -1.02 | 1.72 | -0.69 | 0.3218 | -0.0216 | |||

| CSGS / CSG Systems International, Inc. | 0.03 | -1.20 | 1.72 | 6.70 | 0.3217 | 0.0022 | |||

| TNL / Travel + Leisure Co. | 0.03 | -1.33 | 1.71 | 10.01 | 0.3205 | 0.0118 | |||

| ABG / Asbury Automotive Group, Inc. | 0.01 | 1.70 | 0.3177 | 0.3177 | |||||

| MMS / Maximus, Inc. | 0.02 | -1.56 | 1.64 | 1.36 | 0.3061 | -0.0140 | |||

| ADT / ADT Inc. | 0.19 | 1.63 | 0.3052 | 0.3052 | |||||

| PRKS / United Parks & Resorts Inc. | 0.03 | -1.39 | 1.60 | 2.24 | 0.2992 | -0.0108 | |||

| WNS / WNS (Holdings) Limited | 0.03 | -1.48 | 1.59 | 1.34 | 0.2979 | -0.0137 | |||

| WNS / WNS (Holdings) Limited | 0.03 | -1.48 | 1.59 | 1.34 | 0.2979 | -0.0137 | |||

| H / Hyatt Hotels Corporation | 0.01 | -1.80 | 1.59 | 11.94 | 0.2963 | 0.0158 | |||

| THG / The Hanover Insurance Group, Inc. | 0.01 | -1.03 | 1.47 | -3.36 | 0.2745 | -0.0265 | |||

| NCLH / Norwegian Cruise Line Holdings Ltd. | 0.07 | -1.45 | 1.36 | 5.42 | 0.2546 | -0.0014 | |||

| KMPR / Kemper Corporation | 0.02 | -1.36 | 1.33 | -4.80 | 0.2488 | -0.0281 | |||

| DOCN / DigitalOcean Holdings, Inc. | 0.05 | -1.36 | 1.32 | -15.63 | 0.2463 | -0.0631 | |||

| WTM / White Mountains Insurance Group, Ltd. | 0.00 | -2.02 | 1.31 | -8.59 | 0.2447 | -0.0391 | |||

| W1X / Wix.com Ltd. | 0.01 | -1.58 | 1.19 | -4.50 | 0.2221 | -0.0245 | |||

| BHE / Benchmark Electronics, Inc. | 0.03 | 1.07 | 0.2006 | 0.2006 | |||||

| DGII / Digi International Inc. | 0.03 | -1.55 | 1.07 | 23.35 | 0.1995 | 0.0281 | |||

| CTS / CTS Corporation | 0.02 | 1.05 | 0.1972 | 0.1972 | |||||

| MRP / Millrose Properties, Inc. | 0.01 | -1.66 | 0.34 | 5.68 | 0.0627 | -0.0001 | |||

| G / Genpact Limited | 0.00 | -100.00 | 0.00 | -100.00 | -0.4833 | ||||

| 67 / CHINA LUMENA NEW MATERIALS COR COMMON STOCK USD.00001 | 0.02 | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| PINS / Pinterest, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2861 | ||||

| VOYA / Voya Financial, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.3763 | ||||

| FITB_* / Fifth Third Bancorp | 0.00 | -100.00 | 0.00 | -100.00 | -0.3499 | ||||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.00 | -100.00 | 0.00 | -100.00 | 0.2510 | ||||

| 1ONB / Old National Bancorp | 0.00 | -100.00 | 0.00 | -100.00 | -0.3753 | ||||

| G / Genpact Limited | 0.00 | -100.00 | 0.00 | -100.00 | -0.4833 | ||||

| IAC / IAC Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.3115 | ||||

| CGNX / Cognex Corporation | 0.00 | -100.00 | 0.00 | -100.00 | 0.0555 | ||||

| STZ / Constellation Brands, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0925 | ||||

| CFG / Citizens Financial Group, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.4687 | ||||

| SAIA / Saia, Inc. | Short | -0.00 | -0.00 | -0.18 | -21.46 | -0.0343 | 0.0120 | ||

| TECH / Bio-Techne Corporation | Short | -0.00 | -0.00 | -0.20 | -12.11 | -0.0367 | 0.0076 | ||

| SCL / Stepan Company | Short | -0.00 | -0.00 | -0.20 | -1.01 | -0.0368 | 0.0025 | ||

| FND / Floor & Decor Holdings, Inc. | Short | -0.00 | -0.00 | -0.20 | -5.63 | -0.0376 | 0.0046 | ||

| BRKR / Bruker Corporation | Short | -0.01 | -0.00 | -0.21 | -1.42 | -0.0390 | 0.0029 | ||

| WD / Walker & Dunlop, Inc. | Short | -0.00 | -0.00 | -0.21 | -17.72 | -0.0392 | 0.0111 | ||

| MTN / Vail Resorts, Inc. | Short | -0.00 | -0.00 | -0.23 | -1.75 | -0.0421 | 0.0033 | ||

| TREX / Trex Company, Inc. | Short | -0.00 | -0.00 | -0.23 | -6.48 | -0.0433 | 0.0057 | ||

| REXR / Rexford Industrial Realty, Inc. | Short | -0.01 | -0.00 | -0.23 | -8.95 | -0.0438 | 0.0073 | ||

| MRTN / Marten Transport, Ltd. | Short | -0.02 | -0.00 | -0.24 | -5.18 | -0.0446 | 0.0053 | ||

| FWRG / First Watch Restaurant Group, Inc. | Short | -0.02 | -0.00 | -0.25 | -3.82 | -0.0472 | 0.0047 | ||

| SITE / SiteOne Landscape Supply, Inc. | Short | -0.00 | -0.00 | -0.26 | -0.78 | -0.0480 | 0.0031 | ||

| POWI / Power Integrations, Inc. | Short | -0.00 | -0.00 | -0.26 | 10.78 | -0.0481 | -0.0020 | ||

| CZR / Caesars Entertainment, Inc. | Short | -0.01 | -0.00 | -0.26 | 13.60 | -0.0485 | -0.0032 | ||

| KNX / Knight-Swift Transportation Holdings Inc. | Short | -0.01 | -0.00 | -0.26 | 1.95 | -0.0488 | 0.0021 | ||

| BAX / Baxter International Inc. | Short | -0.01 | -0.00 | -0.27 | -11.63 | -0.0498 | 0.0099 | ||

| DAY / Dayforce Inc. | Short | -0.00 | -0.00 | -0.28 | -5.15 | -0.0517 | 0.0060 | ||

| RGEN / Repligen Corporation | Short | -0.00 | -0.00 | -0.28 | -2.12 | -0.0519 | 0.0044 | ||

| HLNE / Hamilton Lane Incorporated | Short | -0.00 | -0.00 | -0.28 | -4.42 | -0.0526 | 0.0057 | ||

| EXPO / Exponent, Inc. | Short | -0.00 | -0.00 | -0.28 | -7.84 | -0.0528 | 0.0079 | ||

| BOOT / Boot Barn Holdings, Inc. | Short | -0.00 | -0.28 | -0.0531 | -0.0531 | ||||

| SON / Sonoco Products Company | Short | -0.01 | -0.00 | -0.29 | -7.69 | -0.0539 | 0.0081 | ||

| OWL / Blue Owl Capital Inc. | Short | -0.02 | -0.00 | -0.30 | -4.19 | -0.0556 | 0.0059 | ||

| CWST / Casella Waste Systems, Inc. | Short | -0.00 | -0.00 | -0.30 | 3.46 | -0.0561 | 0.0014 | ||

| RRR / Red Rock Resorts, Inc. | Short | -0.01 | -0.00 | -0.31 | 19.92 | -0.0575 | -0.0067 | ||

| CBZ / CBIZ, Inc. | Short | -0.00 | -0.31 | -0.0583 | -0.0583 | ||||

| ORA / Ormat Technologies, Inc. | Short | -0.00 | -0.00 | -0.31 | 18.49 | -0.0588 | -0.0062 | ||

| ES / Eversource Energy | Short | -0.00 | -0.00 | -0.32 | 2.27 | -0.0590 | 0.0020 | ||

| CNS / Cohen & Steers, Inc. | Short | -0.00 | -0.33 | -0.0616 | -0.0616 | ||||

| FDS / FactSet Research Systems Inc. | Short | -0.00 | -0.00 | -0.34 | -1.47 | -0.0629 | 0.0049 | ||

| WERN / Werner Enterprises, Inc. | Short | -0.01 | -0.34 | -0.0635 | -0.0635 | ||||

| AIR / AAR Corp. | Short | -0.01 | -0.00 | -0.35 | 22.78 | -0.0645 | -0.0089 | ||

| IBP / Installed Building Products, Inc. | Short | -0.00 | -0.35 | -0.0648 | -0.0648 | ||||

| VSEC / VSE Corporation | Short | -0.00 | -0.35 | -0.0650 | -0.0650 | ||||

| BFB / Brown-Forman Corp. - Class B | Short | -0.01 | -0.00 | -0.35 | -20.63 | -0.0654 | 0.0220 | ||

| ALB / Albemarle Corporation | Short | -0.01 | -0.00 | -0.36 | -12.99 | -0.0664 | 0.0145 | ||

| AAON / AAON, Inc. | Short | -0.00 | -0.36 | -0.0669 | -0.0669 | ||||

| SPR / Spirit AeroSystems Holdings, Inc. | Short | -0.01 | -0.00 | -0.38 | 10.59 | -0.0704 | -0.0030 | ||

| MDB / MongoDB, Inc. | Short | -0.00 | -0.00 | -0.39 | 19.81 | -0.0725 | -0.0083 | ||

| WLK / Westlake Corporation | Short | -0.01 | -0.00 | -0.39 | -24.13 | -0.0736 | 0.0292 | ||

| TFIN / Triumph Financial, Inc. | Short | -0.01 | -0.40 | -0.0739 | -0.0739 | ||||

| MKTX / MarketAxess Holdings Inc. | Short | -0.00 | -0.00 | -0.40 | 3.13 | -0.0740 | 0.0020 | ||

| RYAN / Ryan Specialty Holdings, Inc. | Short | -0.01 | -0.00 | -0.40 | -8.01 | -0.0752 | 0.0114 | ||

| SWK / Stanley Black & Decker, Inc. | Short | -0.01 | -0.00 | -0.43 | -11.81 | -0.0810 | 0.0164 | ||

| TPG / TPG Inc. | Short | -0.01 | -0.44 | -0.0819 | -0.0819 | ||||

| VRNS / Varonis Systems, Inc. | Short | -0.01 | -0.46 | -0.0864 | -0.0864 | ||||

| Smurfit WestRock PLC / EC (IE00028FXN24) | Short | -0.01 | -0.00 | -0.49 | -4.34 | -0.0908 | 0.0097 | ||

| Smurfit WestRock PLC / EC (IE00028FXN24) | Short | -0.01 | -0.00 | -0.49 | -4.34 | -0.0908 | 0.0097 | ||

| IEX / IDEX Corporation | Short | -0.00 | -0.00 | -0.50 | -2.94 | -0.0926 | 0.0086 | ||

| PEP / PepsiCo, Inc. | Short | -0.00 | -0.00 | -0.50 | -11.90 | -0.0928 | 0.0189 | ||

| WOR / Worthington Enterprises, Inc. | Short | -0.01 | -0.51 | -0.0948 | -0.0948 | ||||

| ODFL / Old Dominion Freight Line, Inc. | Short | -0.00 | -0.00 | -0.51 | -1.93 | -0.0952 | 0.0076 | ||

| POOL / Pool Corporation | Short | -0.00 | -0.00 | -0.51 | -8.56 | -0.0961 | 0.0151 | ||

| IFF / International Flavors & Fragrances Inc. | Short | -0.01 | -0.00 | -0.52 | -5.26 | -0.0977 | 0.0116 | ||

| ERIE / Erie Indemnity Company | Short | -0.00 | -0.00 | -0.52 | -17.38 | -0.0980 | 0.0275 | ||

| ARES / Ares Management Corporation | Short | -0.00 | -0.00 | -0.52 | 18.28 | -0.0980 | -0.0101 | ||

| EFX / Equifax Inc. | Short | -0.00 | -0.00 | -0.54 | 6.50 | -0.1012 | -0.0005 | ||

| CLX / The Clorox Company | Short | -0.00 | -0.00 | -0.58 | -18.57 | -0.1084 | 0.0325 | ||

| D / Dominion Energy, Inc. | Short | -0.01 | -0.00 | -0.58 | 0.87 | -0.1091 | 0.0056 | ||

| AMD / Advanced Micro Devices, Inc. | Short | -0.00 | -36.22 | -0.58 | -11.93 | -0.1091 | 0.0222 | ||

| IR / Ingersoll Rand Inc. | Short | -0.01 | -0.00 | -0.60 | 3.83 | -0.1117 | 0.0022 | ||

| LIN / Linde plc | Short | -0.00 | -0.00 | -0.60 | 0.84 | -0.1120 | 0.0058 | ||

| QSR / Restaurant Brands International Inc. | Short | -0.01 | -0.00 | -0.61 | -0.66 | -0.1134 | 0.0074 | ||

| PSX / Phillips 66 | Short | -0.01 | -0.00 | -0.61 | -3.34 | -0.1137 | 0.0110 | ||

| XYL / Xylem Inc. | Short | -0.00 | -0.00 | -0.61 | 8.29 | -0.1149 | -0.0025 | ||

| INVH / Invitation Homes Inc. | Short | -0.02 | -0.00 | -0.62 | -5.82 | -0.1150 | 0.0145 | ||

| LLY / Eli Lilly and Company | Short | -0.00 | -0.63 | -0.1169 | -0.1169 | ||||

| CSGP / CoStar Group, Inc. | Short | -0.01 | -0.00 | -0.63 | 1.46 | -0.1169 | 0.0052 | ||

| ADI / Analog Devices, Inc. | Short | -0.00 | -0.63 | -0.1174 | -0.1174 | ||||

| MCO / Moody's Corporation | Short | -0.00 | -0.63 | -0.1177 | -0.1177 | ||||

| IRM / Iron Mountain Incorporated | Short | -0.01 | -0.64 | -0.1187 | -0.1187 | ||||

| ETN / Eaton Corporation plc | Short | -0.00 | -0.64 | -0.1191 | -0.1191 | ||||

| TSCO / Tractor Supply Company | Short | -0.01 | -0.66 | -0.1243 | -0.1243 | ||||

| EW / Edwards Lifesciences Corporation | Short | -0.01 | -0.69 | -0.1286 | -0.1286 | ||||

| VMC / Vulcan Materials Company | Short | -0.00 | -0.69 | -0.1293 | -0.1293 | ||||

| SYK / Stryker Corporation | Short | -0.00 | -0.69 | -0.1294 | -0.1294 | ||||

| MMC / Marsh & McLennan Companies, Inc. | Short | -0.00 | -0.70 | -0.1308 | -0.1308 | ||||

| CMG / Chipotle Mexican Grill, Inc. | Short | -0.01 | -0.70 | -0.1313 | -0.1313 | ||||

| ARM / Arm Holdings plc - Depositary Receipt (Common Stock) | Short | -0.00 | -0.00 | -0.72 | 51.59 | -0.1341 | -0.0403 | ||

| TDG / TransDigm Group Incorporated | Short | -0.00 | -0.00 | -0.72 | 9.92 | -0.1347 | -0.0048 | ||

| BX / Blackstone Inc. | Short | -0.00 | -0.73 | -0.1363 | -0.1363 | ||||

| TSLA / Tesla, Inc. | Short | -0.00 | -0.74 | -0.1391 | -0.1391 | ||||

| DKNG / DraftKings Inc. | Short | -0.02 | -0.00 | -0.75 | 29.19 | -0.1400 | -0.0251 | ||

| MSCI / MSCI Inc. | Short | -0.00 | -0.00 | -0.75 | 2.04 | -0.1400 | 0.0055 | ||

| ROK / Rockwell Automation, Inc. | Short | -0.00 | -0.00 | -0.78 | 28.52 | -0.1450 | -0.0255 | ||

| XLRE / The Select Sector SPDR Trust - The Real Estate Select Sector SPDR Fund | Short | -0.02 | -0.00 | -0.79 | -1.01 | -0.1474 | 0.0104 | ||

| BA / The Boeing Company | Short | -0.00 | -0.00 | -0.82 | 22.90 | -0.1536 | -0.0211 | ||

| DDOG / Datadog, Inc. | Short | -0.01 | -0.85 | -0.1589 | -0.1589 | ||||

| IYT / iShares Trust - iShares U.S. Transportation ETF | Short | -0.02 | -0.00 | -1.36 | 7.00 | -0.2546 | -0.0025 | ||

| XRT / SPDR Series Trust - SPDR S&P Retail ETF | Short | -0.02 | -1.55 | -0.2905 | -0.2905 | ||||

| SOXX / iShares Trust - iShares Semiconductor ETF | Short | -0.01 | -0.00 | -2.69 | 26.86 | -0.5024 | -0.0827 | ||

| IVW / iShares Trust - iShares S&P 500 Growth ETF | Short | -0.04 | -36.07 | -3.89 | -24.17 | -0.7274 | 0.2892 | ||

| SPY / SPDR S&P 500 ETF | Short | -0.01 | 45.31 | -5.09 | 60.52 | -0.9516 | -0.3232 | ||

| QQQ / Invesco QQQ Trust, Series 1 | Short | -0.02 | -57.78 | -13.66 | -50.33 | -2.5542 | 2.8951 |