Mga Batayang Estadistika

| Nilai Portofolio | $ 71,055,354 |

| Posisi Saat Ini | 100 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

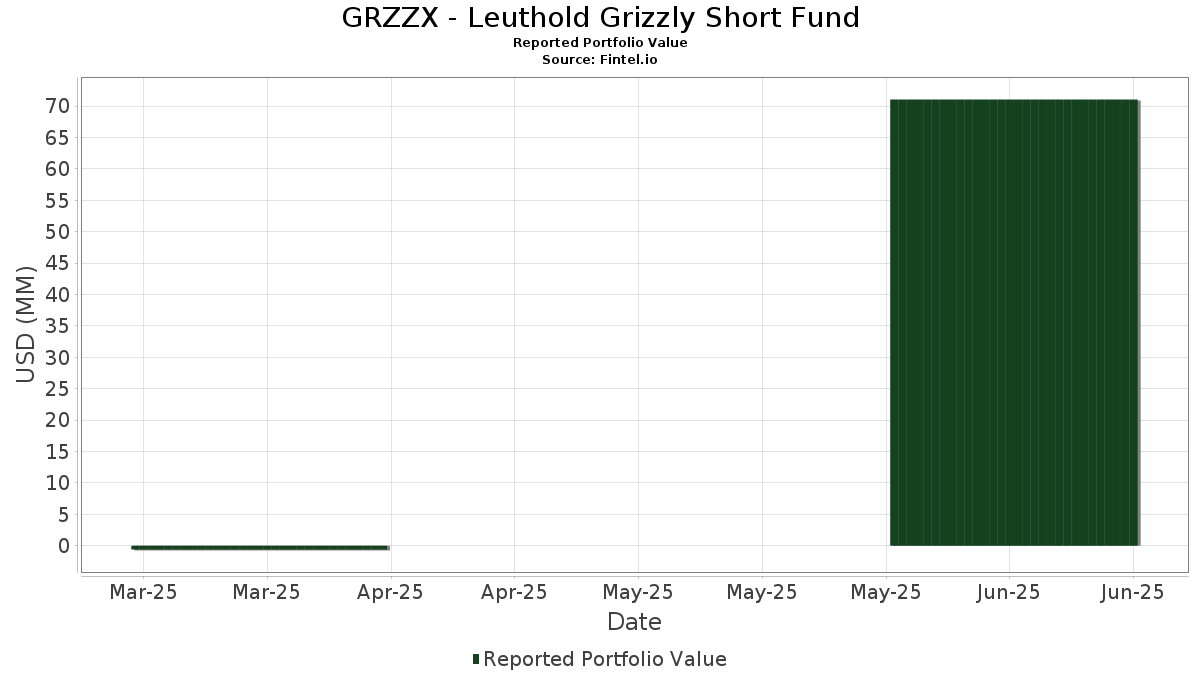

GRZZX - Leuthold Grizzly Short Fund telah mengungkapkan total kepemilikan 100 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 71,055,354 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama GRZZX - Leuthold Grizzly Short Fund adalah Vanguard Index Funds - Vanguard S&P 500 ETF (US:VOO) , Saia, Inc. (US:SAIA) , Bio-Techne Corporation (US:TECH) , Stepan Company (US:SCL) , and Floor & Decor Holdings, Inc. (US:FND) . Posisi baru GRZZX - Leuthold Grizzly Short Fund meliputi: Boot Barn Holdings, Inc. (US:BOOT) , CBIZ, Inc. (US:CBZ) , Cohen & Steers, Inc. (US:CNS) , Werner Enterprises, Inc. (US:WERN) , and Installed Building Products, Inc. (US:IBP) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 29.15 | 29.15 | 77.5527 | 77.5527 | |

| 29.15 | 29.15 | 77.5527 | 77.5527 | |

| 29.15 | 29.15 | 77.5527 | 77.5527 | |

| 6.98 | 18.5798 | 18.5798 | ||

| 6.98 | 18.5798 | 18.5798 | ||

| 6.98 | 18.5798 | 18.5798 | ||

| 0.00 | 0.00 | 2.0123 | ||

| -0.02 | -2.51 | -6.6850 | 1.5306 | |

| -0.00 | -0.25 | -0.6744 | 0.1496 | |

| -0.00 | -0.37 | -0.9932 | 0.1365 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| -0.01 | -3.28 | -8.7325 | -3.7031 | |

| -0.00 | -1.81 | -4.8084 | -2.6699 | |

| -0.01 | -1.00 | -2.6620 | -2.6620 | |

| -0.00 | -0.55 | -1.4561 | -1.4561 | |

| -0.00 | -0.48 | -1.2746 | -1.2746 | |

| -0.00 | -0.47 | -1.2481 | -1.2481 | |

| -0.01 | -1.73 | -4.6039 | -1.2404 | |

| -0.01 | -0.45 | -1.2024 | -1.2024 | |

| -0.00 | -0.45 | -1.1990 | -1.1990 | |

| -0.00 | -0.45 | -1.1909 | -1.1909 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-26 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US BANK MMDA - USBGFS 9 / STIV (N/A) | 29.15 | 29.15 | 77.5527 | 77.5527 | |||||

| US BANK MMDA - USBGFS 9 / STIV (N/A) | 29.15 | 29.15 | 77.5527 | 77.5527 | |||||

| US BANK MMDA - USBGFS 9 / STIV (N/A) | 29.15 | 29.15 | 77.5527 | 77.5527 | |||||

| United States Treasury Bill / DBT (US912797QB69) | 6.98 | 18.5798 | 18.5798 | ||||||

| United States Treasury Bill / DBT (US912797QB69) | 6.98 | 18.5798 | 18.5798 | ||||||

| United States Treasury Bill / DBT (US912797QB69) | 6.98 | 18.5798 | 18.5798 | ||||||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.00 | -100.00 | 0.00 | -100.00 | 2.0123 | ||||

| SAIA / Saia, Inc. | Short | -0.00 | -7.51 | -0.12 | -27.16 | -0.3142 | 0.0567 | ||

| TECH / Bio-Techne Corporation | Short | -0.00 | -7.88 | -0.13 | -19.23 | -0.3359 | 0.0199 | ||

| SCL / Stepan Company | Short | -0.00 | -7.67 | -0.13 | -8.70 | -0.3372 | -0.0219 | ||

| FND / Floor & Decor Holdings, Inc. | Short | -0.00 | -7.68 | -0.13 | -12.84 | -0.3448 | -0.0061 | ||

| BRKR / Bruker Corporation | Short | -0.00 | -7.67 | -0.13 | -8.84 | -0.3576 | -0.0217 | ||

| WD / Walker & Dunlop, Inc. | Short | -0.00 | -7.84 | -0.14 | -23.73 | -0.3593 | 0.0449 | ||

| MTN / Vail Resorts, Inc. | Short | -0.00 | -7.70 | -0.15 | -9.37 | -0.3859 | -0.0214 | ||

| TREX / Trex Company, Inc. | Short | -0.00 | -7.71 | -0.15 | -13.37 | -0.3965 | -0.0035 | ||

| REXR / Rexford Industrial Realty, Inc. | Short | -0.00 | -7.69 | -0.15 | -16.20 | -0.4011 | 0.0083 | ||

| MRTN / Marten Transport, Ltd. | Short | -0.01 | -7.69 | -0.15 | -12.57 | -0.4084 | -0.0084 | ||

| FWRG / First Watch Restaurant Group, Inc. | Short | -0.01 | -7.68 | -0.16 | -10.99 | -0.4328 | -0.0162 | ||

| SITE / SiteOne Landscape Supply, Inc. | Short | -0.00 | -8.68 | -0.17 | -8.84 | -0.4402 | -0.0258 | ||

| POWI / Power Integrations, Inc. | Short | -0.00 | -7.69 | -0.17 | 1.85 | -0.4407 | -0.0714 | ||

| CZR / Caesars Entertainment, Inc. | Short | -0.01 | -7.68 | -0.17 | 4.40 | -0.4442 | -0.0815 | ||

| KNX / Knight-Swift Transportation Holdings Inc. | Short | -0.00 | -7.67 | -0.17 | -6.15 | -0.4474 | -0.0395 | ||

| BAX / Baxter International Inc. | Short | -0.01 | -7.64 | -0.17 | -18.57 | -0.4567 | 0.0219 | ||

| DAY / Dayforce Inc. | Short | -0.00 | -7.70 | -0.18 | -12.32 | -0.4737 | -0.0110 | ||

| RGEN / Repligen Corporation | Short | -0.00 | -7.71 | -0.18 | -9.64 | -0.4752 | -0.0242 | ||

| HLNE / Hamilton Lane Incorporated | Short | -0.00 | -8.07 | -0.18 | -12.14 | -0.4821 | -0.0124 | ||

| EXPO / Exponent, Inc. | Short | -0.00 | -7.69 | -0.18 | -14.95 | -0.4846 | 0.0030 | ||

| BOOT / Boot Barn Holdings, Inc. | Short | -0.00 | -0.18 | -0.4865 | -0.4865 | ||||

| SON / Sonoco Products Company | Short | -0.00 | -7.72 | -0.19 | -15.07 | -0.4963 | 0.0030 | ||

| OWL / Blue Owl Capital Inc. | Short | -0.01 | -7.65 | -0.19 | -11.57 | -0.5097 | -0.0168 | ||

| CWST / Casella Waste Systems, Inc. | Short | -0.00 | -7.67 | -0.19 | -4.46 | -0.5136 | -0.0533 | ||

| RRR / Red Rock Resorts, Inc. | Short | -0.00 | -7.68 | -0.20 | 11.24 | -0.5272 | -0.1196 | ||

| CBZ / CBIZ, Inc. | Short | -0.00 | -0.20 | -0.5350 | -0.5350 | ||||

| ORA / Ormat Technologies, Inc. | Short | -0.00 | -7.67 | -0.20 | 9.19 | -0.5391 | -0.1167 | ||

| ES / Eversource Energy | Short | -0.00 | -7.66 | -0.20 | -5.14 | -0.5410 | -0.0513 | ||

| CNS / Cohen & Steers, Inc. | Short | -0.00 | -0.21 | -0.5660 | -0.5660 | ||||

| FDS / FactSet Research Systems Inc. | Short | -0.00 | -7.81 | -0.22 | -9.24 | -0.5760 | -0.0323 | ||

| WERN / Werner Enterprises, Inc. | Short | -0.01 | -0.22 | -0.5819 | -0.5819 | ||||

| AIR / AAR Corp. | Short | -0.00 | -7.69 | -0.22 | 13.85 | -0.5914 | -0.1450 | ||

| IBP / Installed Building Products, Inc. | Short | -0.00 | -0.22 | -0.5940 | -0.5940 | ||||

| BFB / Brown-Forman Corp. - Class B | Short | -0.01 | -7.68 | -0.23 | -26.71 | -0.5996 | 0.1017 | ||

| VSEC / VSE Corporation | Short | -0.00 | -0.23 | -0.5998 | -0.5998 | ||||

| ALB / Albemarle Corporation | Short | -0.00 | -7.69 | -0.23 | -19.72 | -0.6085 | 0.0401 | ||

| AAON / AAON, Inc. | Short | -0.00 | -0.23 | -0.6130 | -0.6130 | ||||

| SPR / Spirit AeroSystems Holdings, Inc. | Short | -0.01 | -7.68 | -0.24 | 2.11 | -0.6455 | -0.1048 | ||

| MDB / MongoDB, Inc. | Short | -0.00 | -7.69 | -0.25 | 10.67 | -0.6643 | -0.1497 | ||

| WLK / Westlake Corporation | Short | -0.00 | -7.69 | -0.25 | -29.92 | -0.6744 | 0.1496 | ||

| TFIN / Triumph Financial, Inc. | Short | -0.00 | -0.25 | -0.6774 | -0.6774 | ||||

| MKTX / MarketAxess Holdings Inc. | Short | -0.00 | -7.68 | -0.26 | -4.49 | -0.6786 | -0.0690 | ||

| RYAN / Ryan Specialty Holdings, Inc. | Short | -0.00 | -7.68 | -0.26 | -14.80 | -0.6892 | 0.0052 | ||

| SWK / Stanley Black & Decker, Inc. | Short | -0.00 | -7.86 | -0.28 | -18.95 | -0.7421 | 0.0403 | ||

| TPG / TPG Inc. | Short | -0.01 | -0.28 | -0.7508 | -0.7508 | ||||

| VRNS / Varonis Systems, Inc. | Short | -0.01 | -0.30 | -0.7918 | -0.7918 | ||||

| Smurfit WestRock PLC / EC (IE00028FXN24) | Short | -0.01 | -8.09 | -0.31 | -12.11 | -0.8323 | -0.0227 | ||

| Smurfit WestRock PLC / EC (IE00028FXN24) | Short | -0.01 | -8.09 | -0.31 | -12.11 | -0.8323 | -0.0227 | ||

| IEX / IDEX Corporation | Short | -0.00 | -7.72 | -0.32 | -10.39 | -0.8488 | -0.0371 | ||

| PEP / PepsiCo, Inc. | Short | -0.00 | -7.67 | -0.32 | -18.62 | -0.8498 | 0.0450 | ||

| WOR / Worthington Enterprises, Inc. | Short | -0.01 | -0.33 | -0.8685 | -0.8685 | ||||

| ODFL / Old Dominion Freight Line, Inc. | Short | -0.00 | -7.68 | -0.33 | -9.42 | -0.8719 | -0.0476 | ||

| POOL / Pool Corporation | Short | -0.00 | -7.74 | -0.33 | -15.38 | -0.8787 | 0.0118 | ||

| IFF / International Flavors & Fragrances Inc. | Short | -0.00 | -7.69 | -0.34 | -12.50 | -0.8955 | -0.0192 | ||

| ERIE / Erie Indemnity Company | Short | -0.00 | -8.03 | -0.34 | -23.93 | -0.8978 | 0.1121 | ||

| ARES / Ares Management Corporation | Short | -0.00 | -7.67 | -0.34 | 9.06 | -0.8982 | -0.1932 | ||

| EFX / Equifax Inc. | Short | -0.00 | -7.70 | -0.35 | -1.69 | -0.9268 | -0.1196 | ||

| CLX / The Clorox Company | Short | -0.00 | -7.69 | -0.37 | -24.65 | -0.9932 | 0.1365 | ||

| AMD / Advanced Micro Devices, Inc. | Short | -0.00 | -41.80 | -0.38 | -19.53 | -0.9979 | 0.0649 | ||

| D / Dominion Energy, Inc. | Short | -0.01 | -8.10 | -0.38 | -7.41 | -0.9993 | -0.0757 | ||

| IR / Ingersoll Rand Inc. | Short | -0.00 | -8.09 | -0.38 | -4.48 | -1.0238 | -0.1063 | ||

| LIN / Linde plc | Short | -0.00 | -8.16 | -0.39 | -7.45 | -1.0262 | -0.0768 | ||

| QSR / Restaurant Brands International Inc. | Short | -0.01 | -7.69 | -0.39 | -8.24 | -1.0394 | -0.0703 | ||

| PSX / Phillips 66 | Short | -0.00 | -7.65 | -0.39 | -10.73 | -1.0418 | -0.0421 | ||

| XYL / Xylem Inc. | Short | -0.00 | -7.69 | -0.40 | -0.25 | -1.0532 | -0.1511 | ||

| INVH / Invitation Homes Inc. | Short | -0.01 | -7.68 | -0.40 | -12.97 | -1.0538 | -0.0154 | ||

| LLY / Eli Lilly and Company | Short | -0.00 | -0.40 | -1.0682 | -1.0682 | ||||

| CSGP / CoStar Group, Inc. | Short | -0.01 | -7.69 | -0.40 | -6.29 | -1.0715 | -0.0923 | ||

| ADI / Analog Devices, Inc. | Short | -0.00 | -0.40 | -1.0754 | -1.0754 | ||||

| MCO / Moody's Corporation | Short | -0.00 | -0.41 | -1.0784 | -1.0784 | ||||

| IRM / Iron Mountain Incorporated | Short | -0.00 | -0.41 | -1.0886 | -1.0886 | ||||

| ETN / Eaton Corporation plc | Short | -0.00 | -0.41 | -1.0923 | -1.0923 | ||||

| TSCO / Tractor Supply Company | Short | -0.01 | -0.43 | -1.1445 | -1.1445 | ||||

| EW / Edwards Lifesciences Corporation | Short | -0.01 | -0.44 | -1.1801 | -1.1801 | ||||

| SYK / Stryker Corporation | Short | -0.00 | -0.45 | -1.1863 | -1.1863 | ||||

| VMC / Vulcan Materials Company | Short | -0.00 | -0.45 | -1.1909 | -1.1909 | ||||

| MMC / Marsh & McLennan Companies, Inc. | Short | -0.00 | -0.45 | -1.1990 | -1.1990 | ||||

| CMG / Chipotle Mexican Grill, Inc. | Short | -0.01 | -0.45 | -1.2024 | -1.2024 | ||||

| ARM / Arm Holdings plc - Depositary Receipt (Common Stock) | Short | -0.00 | -7.69 | -0.46 | 39.70 | -1.2291 | -0.4764 | ||

| TDG / TransDigm Group Incorporated | Short | -0.00 | -7.58 | -0.46 | 1.54 | -1.2340 | -0.1942 | ||

| BX / Blackstone Inc. | Short | -0.00 | -0.47 | -1.2481 | -1.2481 | ||||

| TSLA / Tesla, Inc. | Short | -0.00 | -0.48 | -1.2746 | -1.2746 | ||||

| DKNG / DraftKings Inc. | Short | -0.01 | -7.68 | -0.48 | 19.06 | -1.2825 | -0.3616 | ||

| MSCI / MSCI Inc. | Short | -0.00 | -7.62 | -0.48 | -5.86 | -1.2844 | -0.1173 | ||

| ROK / Rockwell Automation, Inc. | Short | -0.00 | -7.67 | -0.50 | 18.81 | -1.3293 | -0.3705 | ||

| XLRE / The Select Sector SPDR Trust - The Real Estate Select Sector SPDR Fund | Short | -0.01 | -7.68 | -0.51 | -8.65 | -1.3509 | -0.0851 | ||

| BA / The Boeing Company | Short | -0.00 | -7.68 | -0.53 | 13.30 | -1.4071 | -0.3450 | ||

| DDOG / Datadog, Inc. | Short | -0.00 | -0.55 | -1.4561 | -1.4561 | ||||

| IYT / iShares Trust - iShares U.S. Transportation ETF | Short | -0.01 | -7.68 | -0.88 | -1.24 | -2.3328 | -0.3119 | ||

| XRT / SPDR Series Trust - SPDR S&P Retail ETF | Short | -0.01 | -1.00 | -2.6620 | -2.6620 | ||||

| SOXX / iShares Trust - iShares Semiconductor ETF | Short | -0.01 | -7.62 | -1.73 | 17.21 | -4.6039 | -1.2404 | ||

| QQQ / Invesco QQQ Trust, Series 1 | Short | -0.00 | 63.64 | -1.81 | 92.64 | -4.8084 | -2.6699 | ||

| IVW / iShares Trust - iShares S&P 500 Growth ETF | Short | -0.02 | -41.26 | -2.51 | -30.34 | -6.6850 | 1.5306 | ||

| SPY / SPDR S&P 500 ETF | Short | -0.01 | 34.58 | -3.28 | 48.71 | -8.7325 | -3.7031 |