Mga Batayang Estadistika

| Nilai Portofolio | $ 177,312,565 |

| Posisi Saat Ini | 94 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

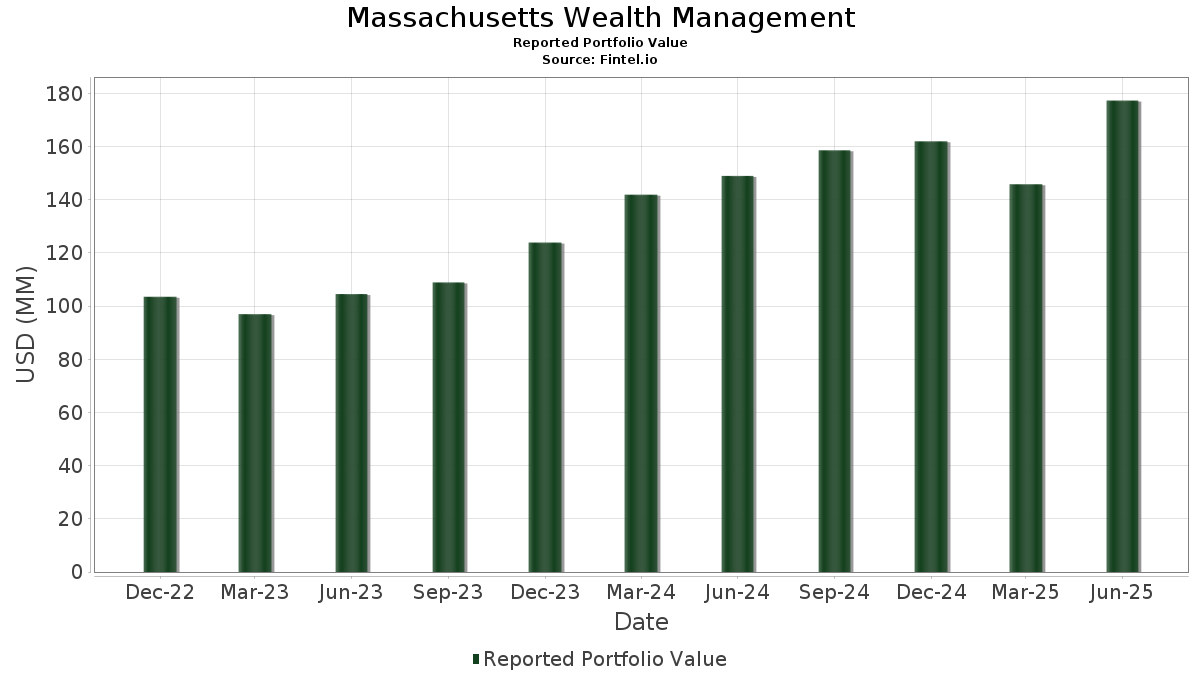

Massachusetts Wealth Management telah mengungkapkan total kepemilikan 94 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 177,312,565 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Massachusetts Wealth Management adalah The Select Sector SPDR Trust - The Technology Select Sector SPDR Fund (US:XLK) , JPMorgan Chase & Co. (US:JPM) , The Select Sector SPDR Trust - The Industrial Select Sector SPDR Fund (US:XLI) , Microsoft Corporation (US:MSFT) , and The Select Sector SPDR Trust - The Financial Select Sector SPDR Fund (US:XLF) . Posisi baru Massachusetts Wealth Management meliputi: Curtiss-Wright Corporation (US:CW) , Kontoor Brands, Inc. (US:KTB) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.02 | 4.45 | 2.5101 | 2.5101 | |

| 0.07 | 3.37 | 1.9011 | 1.9011 | |

| 0.00 | 2.68 | 1.5109 | 1.5109 | |

| 0.01 | 2.56 | 1.4457 | 1.4457 | |

| 0.01 | 1.92 | 1.0808 | 1.0808 | |

| 0.01 | 1.82 | 1.0264 | 1.0264 | |

| 0.01 | 1.20 | 0.6795 | 0.6795 | |

| 0.00 | 0.98 | 0.5536 | 0.5536 | |

| 0.01 | 3.20 | 1.8064 | 0.5506 | |

| 0.02 | 3.39 | 1.9114 | 0.3006 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.04 | 3.97 | 2.2371 | -0.7902 | |

| 0.02 | 2.90 | 1.6355 | -0.6888 | |

| 0.03 | 2.61 | 1.4721 | -0.6226 | |

| 0.06 | 4.76 | 2.6853 | -0.5945 | |

| 0.04 | 2.99 | 1.6867 | -0.5118 | |

| 0.05 | 1.68 | 0.9449 | -0.4715 | |

| 0.02 | 2.64 | 1.4901 | -0.4627 | |

| 0.02 | 2.67 | 1.5085 | -0.4224 | |

| 0.01 | 1.79 | 1.0108 | -0.4016 | |

| 0.02 | 1.74 | 0.9810 | -0.3668 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-23 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| XLK / The Select Sector SPDR Trust - The Technology Select Sector SPDR Fund | 0.04 | 2.61 | 10.26 | 25.84 | 5.7852 | 0.1956 | |||

| JPM / JPMorgan Chase & Co. | 0.02 | -2.14 | 5.91 | 15.66 | 3.3320 | -0.1706 | |||

| XLI / The Select Sector SPDR Trust - The Industrial Select Sector SPDR Fund | 0.03 | 5.64 | 4.87 | 18.91 | 2.7489 | -0.0620 | |||

| MSFT / Microsoft Corporation | 0.01 | 0.00 | 4.83 | 32.51 | 2.7267 | 0.2247 | |||

| XLF / The Select Sector SPDR Trust - The Financial Select Sector SPDR Fund | 0.09 | 2.08 | 4.83 | 7.33 | 2.7242 | -0.3620 | |||

| VCSH / Vanguard Scottsdale Funds - Vanguard Short-Term Corporate Bond ETF | 0.06 | -1.16 | 4.76 | -0.46 | 2.6853 | -0.5945 | |||

| AAPL / Apple Inc. | 0.02 | 4.45 | 2.5101 | 2.5101 | |||||

| C / Citigroup Inc. | 0.05 | 0.54 | 4.27 | 20.54 | 2.4097 | -0.0206 | |||

| XOM / Exxon Mobil Corporation | 0.04 | -0.88 | 3.97 | -10.15 | 2.2371 | -0.7902 | |||

| GE / General Electric Company | 0.01 | -0.14 | 3.75 | 28.41 | 2.1157 | 0.1127 | |||

| NVDA / NVIDIA Corporation | 0.02 | -1.03 | 3.39 | 44.27 | 1.9114 | 0.3006 | |||

| BAC / Bank of America Corporation | 0.07 | 3.37 | 1.9011 | 1.9011 | |||||

| GEV / GE Vernova Inc. | 0.01 | 0.90 | 3.20 | 74.88 | 1.8064 | 0.5506 | |||

| XLE / The Select Sector SPDR Trust - The Energy Select Sector SPDR Fund | 0.04 | 2.78 | 2.99 | -6.74 | 1.6867 | -0.5118 | |||

| CVX / Chevron Corporation | 0.02 | -0.05 | 2.90 | -14.43 | 1.6355 | -0.6888 | |||

| IGV / iShares Trust - iShares Expanded Tech-Software Sector ETF | 0.03 | 2.40 | 2.81 | 26.03 | 1.5866 | 0.0556 | |||

| WMT / Walmart Inc. | 0.03 | 3.30 | 2.79 | 15.07 | 1.5719 | -0.0892 | |||

| TT / Trane Technologies plc | 0.01 | 0.00 | 2.68 | 29.80 | 1.5134 | 0.0961 | |||

| QQQ / Invesco QQQ Trust, Series 1 | 0.00 | 2.68 | 1.5109 | 1.5109 | |||||

| XLV / The Select Sector SPDR Trust - The Health Care Select Sector SPDR Fund | 0.02 | 2.89 | 2.67 | -5.01 | 1.5085 | -0.4224 | |||

| JNJ / Johnson & Johnson | 0.02 | 0.73 | 2.64 | -7.20 | 1.4901 | -0.4627 | |||

| COP / ConocoPhillips | 0.03 | -0.01 | 2.61 | -14.54 | 1.4721 | -0.6226 | |||

| EMR / Emerson Electric Co. | 0.02 | 2.48 | 2.60 | 24.62 | 1.4650 | 0.0358 | |||

| COST / Costco Wholesale Corporation | 0.00 | -2.78 | 2.60 | 1.76 | 1.4639 | -0.2852 | |||

| WFC / Wells Fargo & Company | 0.03 | 0.62 | 2.59 | 12.32 | 1.4603 | -0.1207 | |||

| DE / Deere & Company | 0.01 | 0.70 | 2.58 | 9.11 | 1.4531 | -0.1664 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.01 | 2.56 | 1.4457 | 1.4457 | |||||

| KO / The Coca-Cola Company | 0.04 | 1.20 | 2.48 | -0.04 | 1.4014 | -0.3030 | |||

| CAT / Caterpillar Inc. | 0.01 | 1.87 | 2.43 | 19.88 | 1.3710 | -0.0191 | |||

| IR / Ingersoll Rand Inc. | 0.03 | -0.20 | 2.30 | 3.74 | 1.2987 | -0.2236 | |||

| MMM / 3M Company | 0.02 | -0.50 | 2.29 | 3.15 | 1.2921 | -0.2309 | |||

| BSV / Vanguard Bond Index Funds - Vanguard Short-Term Bond ETF | 0.03 | 1.97 | 2.28 | 2.52 | 1.2839 | -0.2387 | |||

| STT / State Street Corporation | 0.02 | 0.83 | 2.26 | 19.76 | 1.2720 | -0.0193 | |||

| PFE / Pfizer Inc. | 0.09 | 0.33 | 2.24 | -4.02 | 1.2645 | -0.3375 | |||

| XLP / The Select Sector SPDR Trust - The Consumer Staples Select Sector SPDR Fund | 0.03 | 2.56 | 2.20 | 1.71 | 1.2420 | -0.2430 | |||

| LLY / Eli Lilly and Company | 0.00 | 1.34 | 2.06 | -4.37 | 1.1606 | -0.3146 | |||

| HD / The Home Depot, Inc. | 0.01 | 1.41 | 1.98 | 1.44 | 1.1166 | -0.2216 | |||

| AMZN / Amazon.com, Inc. | 0.01 | 1.92 | 1.0808 | 1.0808 | |||||

| ITW / Illinois Tool Works Inc. | 0.01 | 1.13 | 1.89 | 0.80 | 1.0645 | -0.2193 | |||

| AMGN / Amgen Inc. | 0.01 | 1.82 | 1.0264 | 1.0264 | |||||

| ABBV / AbbVie Inc. | 0.01 | -1.78 | 1.79 | -12.97 | 1.0108 | -0.4016 | |||

| PEP / PepsiCo, Inc. | 0.01 | 1.41 | 1.78 | -10.73 | 1.0048 | -0.3633 | |||

| MRK / Merck & Co., Inc. | 0.02 | 0.34 | 1.74 | -11.50 | 0.9810 | -0.3668 | |||

| META / Meta Platforms, Inc. | 0.00 | 2.64 | 1.72 | 31.47 | 0.9707 | 0.0728 | |||

| PG / The Procter & Gamble Company | 0.01 | 1.65 | 1.72 | -4.98 | 0.9688 | -0.2707 | |||

| SLB / Schlumberger Limited | 0.05 | 0.30 | 1.68 | -18.89 | 0.9449 | -0.4715 | |||

| CMI / Cummins Inc. | 0.00 | 2.86 | 1.59 | 7.43 | 0.8971 | -0.1178 | |||

| CARR / Carrier Global Corporation | 0.02 | 2.72 | 1.55 | 18.53 | 0.8734 | -0.0221 | |||

| NSC / Norfolk Southern Corporation | 0.01 | 1.36 | 1.52 | 9.57 | 0.8591 | -0.0944 | |||

| ITA / iShares Trust - iShares U.S. Aerospace & Defense ETF | 0.01 | 2.03 | 1.47 | 25.71 | 0.8279 | 0.0272 | |||

| UNP / Union Pacific Corporation | 0.01 | 0.96 | 1.46 | -1.69 | 0.8210 | -0.1942 | |||

| VMC / Vulcan Materials Company | 0.01 | -2.95 | 1.42 | 8.51 | 0.7987 | -0.0963 | |||

| IBM / International Business Machines Corporation | 0.00 | -1.34 | 1.41 | 16.98 | 0.7968 | -0.0315 | |||

| GOOG / Alphabet Inc. | 0.01 | 2.90 | 1.32 | 16.78 | 0.7459 | -0.0303 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | 0.00 | 1.27 | 10.54 | 0.7157 | -0.0721 | |||

| CSX / CSX Corporation | 0.04 | 1.29 | 1.21 | 12.31 | 0.6843 | -0.0565 | |||

| SHW / The Sherwin-Williams Company | 0.00 | 0.28 | 1.21 | -1.38 | 0.6836 | -0.1593 | |||

| GLW / Corning Incorporated | 0.02 | 1.10 | 1.21 | 16.07 | 0.6807 | -0.0319 | |||

| RTX / RTX Corporation | 0.01 | 1.20 | 0.6795 | 0.6795 | |||||

| PBE / Invesco Exchange-Traded Fund Trust - Invesco Biotechnology & Genome ETF | 0.02 | 1.04 | 1.18 | 2.17 | 0.6650 | -0.1269 | |||

| CL / Colgate-Palmolive Company | 0.01 | 1.79 | 1.17 | -1.27 | 0.6573 | -0.1520 | |||

| MU / Micron Technology, Inc. | 0.01 | 0.22 | 1.13 | 42.16 | 0.6394 | 0.0925 | |||

| BKR / Baker Hughes Company | 0.03 | -2.89 | 1.09 | -15.34 | 0.6168 | -0.2685 | |||

| IYT / iShares Trust - iShares U.S. Transportation ETF | 0.02 | 1.50 | 1.09 | 8.66 | 0.6159 | -0.0733 | |||

| K / Kellanova | 0.01 | 0.74 | 1.08 | -2.89 | 0.6070 | -0.1528 | |||

| IHE / iShares Trust - iShares U.S. Pharmaceuticals ETF | 0.02 | 2.11 | 1.03 | -5.16 | 0.5811 | -0.1638 | |||

| HSY / The Hershey Company | 0.01 | 2.94 | 1.02 | -0.10 | 0.5739 | -0.1247 | |||

| GIS / General Mills, Inc. | 0.02 | 0.51 | 1.02 | -12.85 | 0.5737 | -0.2272 | |||

| GEHC / GE HealthCare Technologies Inc. | 0.01 | 2.06 | 1.01 | -6.39 | 0.5701 | -0.1700 | |||

| BA / The Boeing Company | 0.00 | 0.98 | 0.5536 | 0.5536 | |||||

| HAL / Halliburton Company | 0.04 | -2.29 | 0.87 | -21.54 | 0.4893 | -0.2687 | |||

| RSP / Invesco Exchange-Traded Fund Trust - Invesco S&P 500 Equal Weight ETF | 0.00 | 3.89 | 0.85 | 8.97 | 0.4796 | -0.0554 | |||

| QCOM / QUALCOMM Incorporated | 0.00 | 0.51 | 0.79 | 4.21 | 0.4467 | -0.0745 | |||

| UBS / UBS Group AG | 0.02 | 0.00 | 0.71 | 10.39 | 0.4021 | -0.0407 | |||

| TSLA / Tesla, Inc. | 0.00 | 0.10 | 0.61 | 22.92 | 0.3418 | 0.0031 | |||

| SWX / Southwest Gas Holdings, Inc. | 0.01 | 0.83 | 0.59 | 4.43 | 0.3327 | -0.0545 | |||

| PEG / Public Service Enterprise Group Incorporated | 0.01 | 2.50 | 0.43 | 4.87 | 0.2433 | -0.0389 | |||

| BIIB / Biogen Inc. | 0.00 | 4.17 | 0.36 | -4.51 | 0.2036 | -0.0553 | |||

| IBB / iShares Trust - iShares Biotechnology ETF | 0.00 | 12.57 | 0.35 | 11.32 | 0.2000 | -0.0184 | |||

| FCX / Freeport-McMoRan Inc. | 0.01 | -2.61 | 0.32 | 11.38 | 0.1826 | -0.0165 | |||

| ORCL / Oracle Corporation | 0.00 | 0.00 | 0.32 | 56.93 | 0.1788 | 0.0398 | |||

| AVGO / Broadcom Inc. | 0.00 | 0.30 | 0.1695 | 0.1695 | |||||

| FDX / FedEx Corporation | 0.00 | 0.00 | 0.30 | -6.65 | 0.1667 | -0.0507 | |||

| V / Visa Inc. | 0.00 | 0.00 | 0.28 | 1.07 | 0.1600 | -0.0320 | |||

| CW / Curtiss-Wright Corporation | 0.00 | 0.27 | 0.1502 | 0.1502 | |||||

| GSCE / GS Connect S&P GSCI Enhanced Commodity Total Return ETN | 0.00 | 0.00 | 0.27 | 29.90 | 0.1497 | 0.0092 | |||

| XLB / The Select Sector SPDR Trust - The Materials Select Sector SPDR Fund | 0.00 | 0.00 | 0.26 | 1.94 | 0.1488 | -0.0283 | |||

| KTB / Kontoor Brands, Inc. | 0.00 | 0.26 | 0.1473 | 0.1473 | |||||

| XOP / SPDR Series Trust - SPDR S&P Oil & Gas Exploration & Production ETF | 0.00 | -14.93 | 0.25 | -18.83 | 0.1415 | -0.0702 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.00 | -6.20 | 0.25 | -13.84 | 0.1406 | -0.0579 | |||

| MS / Morgan Stanley | 0.00 | -1.54 | 0.24 | 18.63 | 0.1370 | -0.0031 | |||

| ALLE / Allegion plc | 0.00 | 0.22 | 0.1235 | 0.1235 | |||||

| DOW / Dow Inc. | 0.01 | -3.22 | 0.21 | -26.80 | 0.1206 | -0.0792 | |||

| UPS / United Parcel Service, Inc. | 0.00 | -4.77 | 0.20 | -12.61 | 0.1136 | -0.0444 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | -100.00 | 0.00 | 0.0000 |