Mga Batayang Estadistika

| Nilai Portofolio | $ 853,025,092 |

| Posisi Saat Ini | 149 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

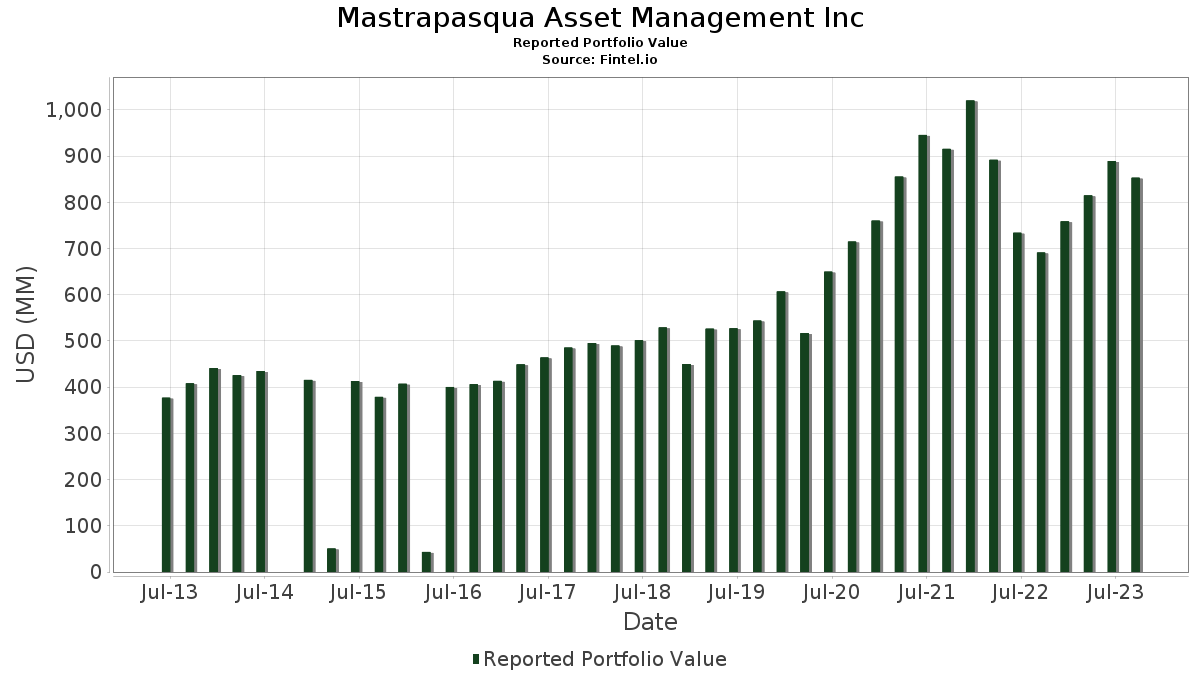

Mastrapasqua Asset Management Inc telah mengungkapkan total kepemilikan 149 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 853,025,092 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Mastrapasqua Asset Management Inc adalah NVIDIA Corporation (US:NVDA) , Microsoft Corporation (US:MSFT) , Apple Inc. (US:AAPL) , Broadcom Inc. (US:AVGO) , and Eli Lilly and Company (US:LLY) . Posisi baru Mastrapasqua Asset Management Inc meliputi: Alphabet Inc. (US:GOOGL) , Kratos Defense & Security Solutions, Inc. (US:KTOS) , Cameco Corporation (US:CCJ) , Digital Realty Trust, Inc. (US:DLR) , and Dell Technologies Inc. (US:DELL) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.04 | 23.65 | 2.7725 | 0.4394 | |

| 0.06 | 15.27 | 1.7905 | 0.3614 | |

| 0.16 | 21.52 | 2.5225 | 0.2850 | |

| 0.14 | 62.30 | 7.3033 | 0.2752 | |

| 0.07 | 22.07 | 2.5878 | 0.2051 | |

| 0.05 | 12.50 | 1.4652 | 0.1965 | |

| 0.03 | 17.67 | 2.0714 | 0.1602 | |

| 0.12 | 7.14 | 0.8376 | 0.1573 | |

| 0.03 | 2.32 | 0.2718 | 0.1255 | |

| 0.05 | 8.94 | 1.0483 | 0.1165 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.30 | 51.01 | 5.9793 | -0.6842 | |

| 0.19 | 13.75 | 1.6113 | -0.5050 | |

| 0.17 | 53.39 | 6.2593 | -0.2690 | |

| 0.00 | 0.00 | -0.1541 | ||

| 0.00 | 0.00 | -0.1410 | ||

| 0.14 | 10.57 | 1.2395 | -0.1387 | |

| 0.06 | 12.01 | 1.4085 | -0.1380 | |

| 0.06 | 8.94 | 1.0485 | -0.1173 | |

| 0.00 | 0.00 | -0.1163 | ||

| 0.00 | 0.00 | -0.1162 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2023-10-25 untuk periode pelaporan 2023-09-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NVDA / NVIDIA Corporation | 0.14 | -3.04 | 62.30 | -0.30 | 7.3033 | 0.2752 | |||

| MSFT / Microsoft Corporation | 0.17 | -0.78 | 53.39 | -8.01 | 6.2593 | -0.2690 | |||

| AAPL / Apple Inc. | 0.30 | -2.46 | 51.01 | -13.90 | 5.9793 | -0.6842 | |||

| AVGO / Broadcom Inc. | 0.03 | -1.10 | 27.18 | -5.31 | 3.1866 | -0.0421 | |||

| LLY / Eli Lilly and Company | 0.04 | -0.45 | 23.65 | 14.01 | 2.7725 | 0.4394 | |||

| META / Meta Platforms, Inc. | 0.07 | -0.39 | 22.07 | 4.21 | 2.5878 | 0.2051 | |||

| GOOG / Alphabet Inc. | 0.16 | -0.76 | 21.52 | 8.17 | 2.5225 | 0.2850 | |||

| AMZN / Amazon.com, Inc. | 0.17 | -0.42 | 21.04 | -2.89 | 2.4660 | 0.0295 | |||

| V / Visa Inc. | 0.09 | -0.51 | 19.59 | -3.64 | 2.2962 | 0.0100 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.04 | -0.79 | 18.54 | -3.75 | 2.1733 | 0.0068 | |||

| COST / Costco Wholesale Corporation | 0.03 | -0.90 | 17.67 | 3.99 | 2.0714 | 0.1602 | |||

| MMC / Marsh & McLennan Companies, Inc. | 0.09 | -0.65 | 16.59 | 0.52 | 1.9449 | 0.0885 | |||

| ZTS / Zoetis Inc. | 0.09 | -0.19 | 15.92 | 0.84 | 1.8666 | 0.0904 | |||

| HD / The Home Depot, Inc. | 0.05 | -0.08 | 15.32 | -2.81 | 1.7961 | 0.0230 | |||

| AMGN / Amgen Inc. | 0.06 | -0.69 | 15.27 | 20.20 | 1.7905 | 0.3614 | |||

| RTX / RTX Corporation | 0.19 | -0.57 | 13.75 | -26.95 | 1.6113 | -0.5050 | |||

| CAT / Caterpillar Inc. | 0.05 | -0.13 | 12.50 | 10.81 | 1.4652 | 0.1965 | |||

| IQV / IQVIA Holdings Inc. | 0.06 | -0.17 | 12.01 | -12.61 | 1.4085 | -0.1380 | |||

| WMT / Walmart Inc. | 0.07 | -0.40 | 11.35 | 1.35 | 1.3305 | 0.0708 | |||

| NXPI / NXP Semiconductors N.V. | 0.06 | -1.74 | 11.29 | -4.02 | 1.3231 | 0.0003 | |||

| AJG / Arthur J. Gallagher & Co. | 0.05 | -1.46 | 10.98 | 2.29 | 1.2878 | 0.0799 | |||

| MCHP / Microchip Technology Incorporated | 0.14 | -0.95 | 10.57 | -13.70 | 1.2395 | -0.1387 | |||

| ABT / Abbott Laboratories | 0.11 | 0.52 | 10.30 | -10.70 | 1.2071 | -0.0898 | |||

| PG / The Procter & Gamble Company | 0.07 | 0.20 | 10.09 | -3.68 | 1.1830 | 0.0045 | |||

| PEP / PepsiCo, Inc. | 0.06 | 0.54 | 9.70 | -8.02 | 1.1370 | -0.0491 | |||

| WM / Waste Management, Inc. | 0.06 | -0.40 | 9.61 | -12.44 | 1.1268 | -0.1080 | |||

| MRK / Merck & Co., Inc. | 0.09 | -0.17 | 9.54 | -10.93 | 1.1187 | -0.0865 | |||

| NSC / Norfolk Southern Corporation | 0.05 | 0.07 | 9.04 | -13.10 | 1.0592 | -0.1102 | |||

| C.WSA / Citigroup, Inc. | 0.01 | -0.51 | 9.02 | -6.95 | 1.0569 | -0.0328 | |||

| UPS / United Parcel Service, Inc. | 0.06 | -0.77 | 8.94 | -13.71 | 1.0485 | -0.1173 | |||

| LNG / Cheniere Energy, Inc. | 0.05 | -0.90 | 8.94 | 7.94 | 1.0483 | 0.1165 | |||

| BAC / Bank of America Corporation | 0.33 | -0.68 | 8.93 | -5.22 | 1.0470 | -0.0128 | |||

| HON / Honeywell International Inc. | 0.05 | 0.05 | 8.62 | -10.93 | 1.0099 | -0.0780 | |||

| GS / The Goldman Sachs Group, Inc. | 0.03 | -1.07 | 8.58 | -0.75 | 1.0063 | 0.0334 | |||

| IBM / International Business Machines Corporation | 0.06 | -0.13 | 8.44 | 4.72 | 0.9893 | 0.0829 | |||

| MCD / McDonald's Corporation | 0.03 | 0.79 | 8.11 | -11.02 | 0.9511 | -0.0745 | |||

| ROK / Rockwell Automation, Inc. | 0.03 | 0.96 | 8.04 | -12.39 | 0.9425 | -0.0897 | |||

| ZS / Zscaler, Inc. | 0.05 | -2.03 | 8.00 | 4.20 | 0.9375 | 0.0742 | |||

| LMT / Lockheed Martin Corporation | 0.02 | -2.83 | 7.82 | -13.68 | 0.9163 | -0.1022 | |||

| DE / Deere & Company | 0.02 | 0.26 | 7.39 | -6.63 | 0.8658 | -0.0238 | |||

| TJX / The TJX Companies, Inc. | 0.08 | -0.25 | 7.31 | 4.56 | 0.8569 | 0.0706 | |||

| SLB / Schlumberger Limited | 0.12 | -0.47 | 7.14 | 18.12 | 0.8376 | 0.1573 | |||

| PH / Parker-Hannifin Corporation | 0.02 | 0.24 | 7.02 | 0.11 | 0.8229 | 0.0342 | |||

| DHI / D.R. Horton, Inc. | 0.06 | 2.33 | 6.76 | -9.63 | 0.7922 | -0.0488 | |||

| ORCL / Oracle Corporation | 0.06 | 4.58 | 6.12 | -6.98 | 0.7176 | -0.0226 | |||

| GOOGL / Alphabet Inc. | 0.04 | 5.38 | 0.6311 | 0.0695 | |||||

| AKAM / Akamai Technologies, Inc. | 0.05 | -1.30 | 4.82 | 17.01 | 0.5645 | 0.1016 | |||

| INTU / Intuit Inc. | 0.01 | -1.94 | 4.55 | 9.36 | 0.5331 | 0.0653 | |||

| PANW / Palo Alto Networks, Inc. | 0.02 | -1.87 | 4.50 | -9.96 | 0.5277 | -0.0346 | |||

| TW / Tradeweb Markets Inc. | 0.06 | -1.72 | 4.44 | 15.11 | 0.5206 | 0.0866 | |||

| KEYS / Keysight Technologies, Inc. | 0.03 | 1.18 | 3.85 | -20.06 | 0.4519 | -0.0904 | |||

| LOW / Lowe's Companies, Inc. | 0.02 | -0.90 | 3.77 | -8.72 | 0.4420 | -0.0227 | |||

| A / Agilent Technologies, Inc. | 0.03 | -1.14 | 3.66 | -8.07 | 0.4288 | -0.0187 | |||

| CDW / CDW Corporation | 0.02 | -0.75 | 3.62 | 9.11 | 0.4240 | 0.0512 | |||

| VEEV / Veeva Systems Inc. | 0.02 | -0.42 | 3.58 | 2.46 | 0.4202 | 0.0267 | |||

| TSCO / Tractor Supply Company | 0.02 | -0.60 | 3.51 | -8.71 | 0.4116 | -0.0210 | |||

| QCOM / QUALCOMM Incorporated | 0.03 | -4.60 | 3.43 | -10.98 | 0.4019 | -0.0314 | |||

| LHX / L3Harris Technologies, Inc. | 0.02 | -6.56 | 3.28 | -16.89 | 0.3842 | -0.0594 | |||

| PLTR / Palantir Technologies Inc. | 0.20 | -0.63 | 3.25 | 3.73 | 0.3810 | 0.0285 | |||

| GTLS / Chart Industries, Inc. | 0.02 | -0.07 | 3.20 | 5.79 | 0.3751 | 0.0348 | |||

| STE / STERIS plc | 0.01 | -0.28 | 3.17 | -2.73 | 0.3712 | 0.0050 | |||

| TXT / Textron Inc. | 0.04 | -23.76 | 3.16 | -11.91 | 0.3701 | -0.0330 | |||

| VEA / Vanguard Tax-Managed Funds - Vanguard FTSE Developed Markets ETF | 0.07 | 0.00 | 3.01 | -5.34 | 0.3534 | -0.0048 | |||

| SHV / iShares Trust - iShares Short Treasury Bond ETF | 0.03 | -1.47 | 2.77 | -1.42 | 0.3247 | 0.0086 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.01 | -1.90 | 2.69 | -3.06 | 0.3156 | 0.0032 | |||

| BX / Blackstone Inc. | 0.02 | -7.21 | 2.55 | 6.92 | 0.2991 | 0.0307 | |||

| CRL / Charles River Laboratories International, Inc. | 0.01 | -0.43 | 2.48 | -7.22 | 0.2907 | -0.0098 | |||

| RVTY / Revvity, Inc. | 0.02 | -0.14 | 2.43 | -6.95 | 0.2844 | -0.0088 | |||

| FLEX / Flex Ltd. | 0.09 | -0.49 | 2.42 | -2.89 | 0.2836 | 0.0035 | |||

| MAS / Masco Corporation | 0.05 | -0.77 | 2.41 | -7.56 | 0.2825 | -0.0107 | |||

| AL / Air Lease Corporation | 0.06 | -1.03 | 2.40 | -6.79 | 0.2817 | -0.0083 | |||

| BWXT / BWX Technologies, Inc. | 0.03 | 70.19 | 2.32 | 78.31 | 0.2718 | 0.1255 | |||

| SNPS / Synopsys, Inc. | 0.01 | -2.95 | 2.31 | 2.30 | 0.2710 | 0.0168 | |||

| CSX / CSX Corporation | 0.08 | -2.57 | 2.31 | -12.11 | 0.2705 | -0.0249 | |||

| GPC / Genuine Parts Company | 0.02 | -0.91 | 2.29 | -15.47 | 0.2685 | -0.0362 | |||

| ONTO / Onto Innovation Inc. | 0.02 | -0.24 | 2.28 | 9.20 | 0.2671 | 0.0325 | |||

| ITT / ITT Inc. | 0.02 | -0.71 | 2.27 | 4.32 | 0.2660 | 0.0213 | |||

| NVT / nVent Electric plc | 0.04 | -0.20 | 2.17 | 2.36 | 0.2542 | 0.0159 | |||

| NDAQ / Nasdaq, Inc. | 0.04 | -0.66 | 2.15 | -3.19 | 0.2523 | 0.0023 | |||

| HXL / Hexcel Corporation | 0.03 | 67.02 | 2.12 | 43.12 | 0.2487 | 0.0820 | |||

| GPK / Graphic Packaging Holding Company | 0.09 | 71.58 | 2.07 | 59.05 | 0.2432 | 0.0965 | |||

| AMAT / Applied Materials, Inc. | 0.01 | -1.69 | 2.02 | -5.83 | 0.2369 | -0.0045 | |||

| DGX / Quest Diagnostics Incorporated | 0.02 | -1.12 | 1.98 | -14.30 | 0.2327 | -0.0278 | |||

| JPM / JPMorgan Chase & Co. | 0.01 | 8.52 | 1.95 | 8.17 | 0.2284 | 0.0259 | |||

| BRKR / Bruker Corporation | 0.03 | -1.00 | 1.92 | -16.55 | 0.2247 | -0.0337 | |||

| ROP / Roper Technologies, Inc. | 0.00 | -1.36 | 1.83 | -0.65 | 0.2144 | 0.0074 | |||

| PAYX / Paychex, Inc. | 0.01 | -2.91 | 1.71 | 0.06 | 0.2008 | 0.0083 | |||

| GD / General Dynamics Corporation | 0.01 | -1.74 | 1.71 | 0.94 | 0.2007 | 0.0099 | |||

| WSM / Williams-Sonoma, Inc. | 0.01 | -2.00 | 1.71 | 21.69 | 0.2007 | 0.0425 | |||

| XOM / Exxon Mobil Corporation | 0.01 | -0.67 | 1.68 | 8.96 | 0.1968 | 0.0234 | |||

| FFIV / F5, Inc. | 0.01 | -0.90 | 1.65 | 9.17 | 0.1940 | 0.0235 | |||

| CVX / Chevron Corporation | 0.01 | -13.59 | 1.63 | -7.40 | 0.1908 | -0.0069 | |||

| TER / Teradyne, Inc. | 0.02 | 0.43 | 1.63 | -9.36 | 0.1908 | -0.0112 | |||

| ULTA / Ulta Beauty, Inc. | 0.00 | -2.41 | 1.62 | -17.16 | 0.1897 | -0.0300 | |||

| MLM / Martin Marietta Materials, Inc. | 0.00 | -0.13 | 1.58 | -11.19 | 0.1852 | -0.0149 | |||

| DAR / Darling Ingredients Inc. | 0.03 | -3.42 | 1.50 | -20.97 | 0.1759 | -0.0376 | |||

| WWD / Woodward, Inc. | 0.01 | -0.46 | 1.49 | 3.99 | 0.1743 | 0.0135 | |||

| KO / The Coca-Cola Company | 0.03 | -1.07 | 1.48 | -8.03 | 0.1733 | -0.0075 | |||

| BMY / Bristol-Myers Squibb Company | 0.02 | -0.60 | 1.43 | -9.76 | 0.1680 | -0.0107 | |||

| TXN / Texas Instruments Incorporated | 0.01 | -1.35 | 1.35 | -12.89 | 0.1585 | -0.0160 | |||

| PFE / Pfizer Inc. | 0.04 | -0.14 | 1.32 | -9.70 | 0.1550 | -0.0097 | |||

| UNP / Union Pacific Corporation | 0.01 | -1.89 | 1.32 | -2.37 | 0.1548 | 0.0027 | |||

| KMB / Kimberly-Clark Corporation | 0.01 | -0.39 | 1.23 | -12.77 | 0.1442 | -0.0145 | |||

| TFX / Teleflex Incorporated | 0.01 | -0.98 | 1.15 | -19.65 | 0.1348 | -0.0262 | |||

| DOW / Dow Inc. | 0.02 | -1.21 | 1.14 | -4.37 | 0.1336 | -0.0004 | |||

| PHM / PulteGroup, Inc. | 0.02 | -0.64 | 1.12 | -5.31 | 0.1317 | -0.0017 | |||

| C / Citigroup Inc. | 0.03 | 0.00 | 1.12 | -10.73 | 0.1308 | -0.0097 | |||

| GIS / General Mills, Inc. | 0.02 | -0.53 | 1.09 | -16.97 | 0.1273 | -0.0199 | |||

| JNJ / Johnson & Johnson | 0.01 | 0.12 | 1.08 | -5.74 | 0.1270 | -0.0023 | |||

| HII / Huntington Ingalls Industries, Inc. | 0.01 | -0.18 | 1.05 | -10.21 | 0.1227 | -0.0085 | |||

| BA / The Boeing Company | 0.01 | -1.25 | 1.03 | -10.38 | 0.1204 | -0.0085 | |||

| AEP / American Electric Power Company, Inc. | 0.01 | -1.45 | 1.01 | -11.99 | 0.1180 | -0.0106 | |||

| VWO / Vanguard International Equity Index Funds - Vanguard FTSE Emerging Markets ETF | 0.03 | 0.00 | 1.01 | -3.64 | 0.1179 | 0.0005 | |||

| KBR / KBR, Inc. | 0.02 | -0.90 | 0.97 | -10.16 | 0.1141 | -0.0078 | |||

| BWA / BorgWarner Inc. | 0.02 | -5.28 | 0.97 | -21.83 | 0.1134 | -0.0258 | |||

| BOOT / Boot Barn Holdings, Inc. | 0.01 | -0.65 | 0.93 | -4.71 | 0.1090 | -0.0008 | |||

| SO / The Southern Company | 0.01 | 0.35 | 0.92 | -7.47 | 0.1075 | -0.0041 | |||

| KTOS / Kratos Defense & Security Solutions, Inc. | 0.06 | 0.91 | 0.1071 | 0.1071 | |||||

| TGT / Target Corporation | 0.01 | 0.90 | 0.1051 | 0.1051 | |||||

| PSA / Public Storage | 0.00 | -2.37 | 0.89 | -11.88 | 0.1044 | -0.0092 | |||

| CCJ / Cameco Corporation | 0.02 | 0.87 | 0.1022 | 0.1022 | |||||

| TSEM / Tower Semiconductor Ltd. | 0.03 | -6.11 | 0.86 | -38.54 | 0.1006 | -0.0564 | |||

| VZ / Verizon Communications Inc. | 0.03 | -0.04 | 0.86 | -12.91 | 0.1006 | -0.0102 | |||

| HSY / The Hershey Company | 0.00 | -38.33 | 0.84 | -50.59 | 0.0989 | -0.0931 | |||

| ETN / Eaton Corporation plc | 0.00 | -2.92 | 0.79 | 2.98 | 0.0932 | 0.0063 | |||

| GXO / GXO Logistics, Inc. | 0.01 | -5.52 | 0.77 | -11.77 | 0.0905 | -0.0079 | |||

| MKSI / MKS Inc. | 0.01 | -5.19 | 0.64 | -24.14 | 0.0752 | -0.0199 | |||

| DLR / Digital Realty Trust, Inc. | 0.00 | 0.57 | 0.0668 | 0.0668 | |||||

| DELL / Dell Technologies Inc. | 0.01 | 0.57 | 0.0666 | 0.0666 | |||||

| MMM / 3M Company | 0.01 | 1.97 | 0.53 | -4.51 | 0.0620 | -0.0004 | |||

| ENBBF / Enbridge Inc - FR PRF PERPETUAL USD 25 - Ser J | 0.02 | -1.85 | 0.50 | -12.08 | 0.0589 | -0.0054 | |||

| ABBV / AbbVie Inc. | 0.00 | -2.54 | 0.40 | 7.82 | 0.0469 | 0.0052 | |||

| MS / Morgan Stanley | 0.00 | 51.72 | 0.36 | 45.34 | 0.0421 | 0.0143 | |||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0.00 | 3.15 | 0.33 | 4.06 | 0.0391 | 0.0031 | |||

| GILD / Gilead Sciences, Inc. | 0.00 | 3.48 | 0.32 | 0.62 | 0.0379 | 0.0018 | |||

| CSCO / Cisco Systems, Inc. | 0.01 | -1.33 | 0.32 | 2.58 | 0.0373 | 0.0024 | |||

| IRM / Iron Mountain Incorporated | 0.00 | 3.22 | 0.29 | 7.78 | 0.0342 | 0.0038 | |||

| JEF / Jefferies Financial Group Inc. | 0.01 | 3.77 | 0.26 | 14.78 | 0.0310 | 0.0050 | |||

| K / Kellanova | 0.00 | 5.21 | 0.26 | -7.04 | 0.0310 | -0.0010 | |||

| HR / Healthcare Realty Trust Incorporated | 0.02 | 4.47 | 0.25 | -15.61 | 0.0299 | -0.0040 | |||

| AMD / Advanced Micro Devices, Inc. | 0.00 | -17.24 | 0.25 | -25.45 | 0.0289 | -0.0082 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | -5.73 | 0.25 | -8.89 | 0.0289 | -0.0016 | |||

| NI / NiSource Inc. | 0.01 | 4.58 | 0.23 | -5.83 | 0.0266 | -0.0004 | |||

| TRN / Trinity Industries, Inc. | 0.01 | 4.99 | 0.22 | -0.46 | 0.0256 | 0.0009 | |||

| FLO / Flowers Foods, Inc. | 0.01 | 5.08 | 0.22 | -6.47 | 0.0255 | -0.0006 | |||

| QQQ / Invesco QQQ Trust, Series 1 | 0.00 | 0.21 | 0.0251 | 0.0251 | |||||

| XBI / SPDR Series Trust - SPDR S&P Biotech ETF | 0.00 | 13.46 | 0.21 | -0.48 | 0.0242 | 0.0009 | |||

| IRT / Independence Realty Trust, Inc. | 0.01 | 6.70 | 0.15 | -18.03 | 0.0177 | -0.0029 | |||

| BB / BlackBerry Limited | 0.02 | 6.85 | 0.07 | -8.75 | 0.0086 | -0.0005 | |||

| FMC / FMC Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.1050 | ||||

| RSPT / Invesco Exchange-Traded Fund Trust - Invesco S&P 500 Equal Weight Technology ETF | 0.00 | -100.00 | 0.00 | -100.00 | -0.0341 | ||||

| CTVA / Corteva, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1541 | ||||

| TKR / The Timken Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.1163 | ||||

| FITB / Fifth Third Bancorp | 0.00 | -100.00 | 0.00 | -100.00 | -0.1162 | ||||

| BLMN / Bloomin' Brands, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1410 |