Mga Batayang Estadistika

| Nilai Portofolio | $ 141,723,593 |

| Posisi Saat Ini | 70 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

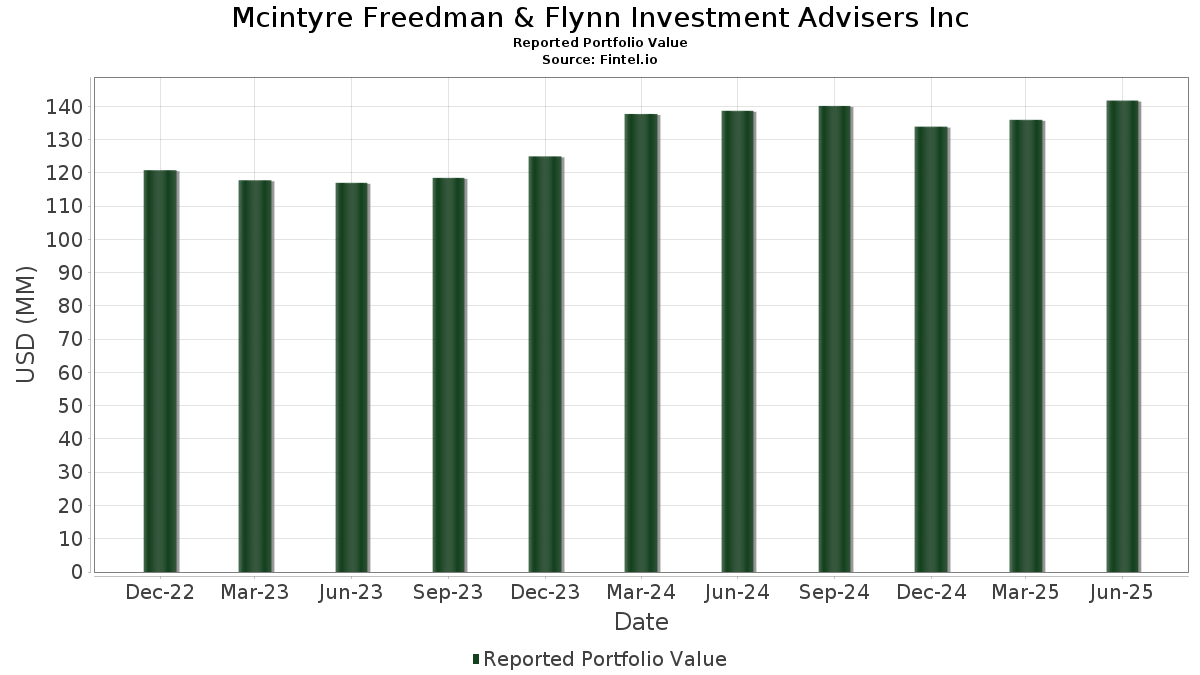

Mcintyre Freedman & Flynn Investment Advisers Inc telah mengungkapkan total kepemilikan 70 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 141,723,593 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Mcintyre Freedman & Flynn Investment Advisers Inc adalah Microsoft Corporation (US:MSFT) , Blackstone Inc. (US:BX) , Marathon Petroleum Corporation (US:MPC) , Applied Materials, Inc. (US:AMAT) , and RTX Corporation (US:RTX) . Posisi baru Mcintyre Freedman & Flynn Investment Advisers Inc meliputi: Valaris Limited (US:VAL) , ASML Holding N.V. - Depositary Receipt (Common Stock) (US:ASML) , Micron Technology, Inc. (US:MU) , Federal National Mortgage Association (US:FNMA) , and FTAI Infrastructure Inc. (US:FIP) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.03 | 15.51 | 10.9445 | 2.3221 | |

| 0.15 | 3.15 | 2.2218 | 2.0146 | |

| 0.04 | 7.52 | 5.3048 | 0.9223 | |

| 0.05 | 8.49 | 5.9896 | 0.5181 | |

| 0.08 | 4.57 | 3.2234 | 0.4385 | |

| 0.01 | 5.31 | 3.7433 | 0.4259 | |

| 0.05 | 3.77 | 2.6618 | 0.3174 | |

| 0.01 | 0.32 | 0.2228 | 0.2228 | |

| 0.06 | 4.18 | 2.9483 | 0.2144 | |

| 0.00 | 0.29 | 0.2064 | 0.2064 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.06 | 1.55 | 1.0920 | -0.3835 | |

| 0.11 | 3.49 | 2.4632 | -0.3462 | |

| 0.03 | 2.43 | 1.7121 | -0.3459 | |

| 0.03 | 2.55 | 1.7979 | -0.3143 | |

| 0.02 | 2.46 | 1.7337 | -0.3125 | |

| 0.06 | 2.16 | 1.5256 | -0.3122 | |

| 0.04 | 3.01 | 2.1256 | -0.2872 | |

| 0.03 | 2.54 | 1.7905 | -0.2664 | |

| 0.03 | 1.41 | 0.9930 | -0.2234 | |

| 0.01 | 1.85 | 1.3074 | -0.1724 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-11 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.03 | -0.13 | 15.51 | 32.34 | 10.9445 | 2.3221 | |||

| BX / Blackstone Inc. | 0.06 | 0.00 | 8.93 | 7.01 | 6.3009 | 0.1624 | |||

| MPC / Marathon Petroleum Corporation | 0.05 | 0.10 | 8.49 | 14.13 | 5.9896 | 0.5181 | |||

| AMAT / Applied Materials, Inc. | 0.04 | 0.04 | 7.52 | 26.20 | 5.3048 | 0.9223 | |||

| RTX / RTX Corporation | 0.04 | -0.05 | 5.35 | 10.19 | 3.7764 | 0.2029 | |||

| QQQ / Invesco QQQ Trust, Series 1 | 0.01 | 0.00 | 5.31 | 17.65 | 3.7433 | 0.4259 | |||

| NFG / National Fuel Gas Company | 0.06 | 0.00 | 5.18 | 6.98 | 3.6531 | 0.0927 | |||

| NEM / Newmont Corporation | 0.08 | 0.00 | 4.57 | 20.69 | 3.2234 | 0.4385 | |||

| CSCO / Cisco Systems, Inc. | 0.06 | 0.00 | 4.18 | 12.43 | 2.9483 | 0.2144 | |||

| CTVA / Corteva, Inc. | 0.05 | -0.05 | 3.77 | 18.39 | 2.6618 | 0.3174 | |||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 0.11 | 0.64 | 3.49 | -8.59 | 2.4632 | -0.3462 | |||

| ENB / Enbridge Inc. | 0.08 | 0.00 | 3.45 | 2.25 | 2.4336 | -0.0471 | |||

| MO / Altria Group, Inc. | 0.06 | 0.00 | 3.45 | -2.30 | 2.4324 | -0.1636 | |||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0.03 | -0.18 | 3.44 | 8.35 | 2.4253 | 0.0918 | |||

| HPE / Hewlett Packard Enterprise Company | 0.15 | 743.70 | 3.15 | 1,020.28 | 2.2218 | 2.0146 | |||

| DD / DuPont de Nemours, Inc. | 0.04 | 0.00 | 3.01 | -8.14 | 2.1256 | -0.2872 | |||

| SU / Suncor Energy Inc. | 0.07 | 0.00 | 2.58 | -3.27 | 1.8174 | -0.1416 | |||

| MRK / Merck & Co., Inc. | 0.03 | 0.63 | 2.55 | -11.25 | 1.7979 | -0.3143 | |||

| XLE / The Select Sector SPDR Trust - The Energy Select Sector SPDR Fund | 0.03 | 0.00 | 2.54 | -9.26 | 1.7905 | -0.2664 | |||

| MDT / Medtronic plc | 0.03 | 0.17 | 2.53 | -2.81 | 1.7825 | -0.1299 | |||

| PEP / PepsiCo, Inc. | 0.02 | 0.31 | 2.46 | -11.65 | 1.7337 | -0.3125 | |||

| V / Visa Inc. | 0.01 | 4.55 | 2.45 | 5.93 | 1.7274 | 0.0271 | |||

| COP / ConocoPhillips | 0.03 | 1.51 | 2.43 | -13.26 | 1.7121 | -0.3459 | |||

| GLW / Corning Incorporated | 0.04 | 0.00 | 2.27 | 14.85 | 1.6052 | 0.1484 | |||

| SLB / Schlumberger Limited | 0.06 | 7.03 | 2.16 | -13.45 | 1.5256 | -0.3122 | |||

| MTB / M&T Bank Corporation | 0.01 | 0.00 | 2.08 | 8.52 | 1.4657 | 0.0576 | |||

| JNJ / Johnson & Johnson | 0.01 | 0.01 | 1.85 | -7.91 | 1.3074 | -0.1724 | |||

| IBB / iShares Trust - iShares Biotechnology ETF | 0.01 | 0.00 | 1.70 | -1.10 | 1.2008 | -0.0649 | |||

| DEO / Diageo plc - Depositary Receipt (Common Stock) | 0.02 | 0.01 | 1.61 | -3.77 | 1.1334 | -0.0945 | |||

| DOW / Dow Inc. | 0.06 | 1.75 | 1.55 | -22.84 | 1.0920 | -0.3835 | |||

| HSY / The Hershey Company | 0.01 | 0.01 | 1.43 | -2.98 | 1.0104 | -0.0752 | |||

| OXY / Occidental Petroleum Corporation | 0.03 | 0.00 | 1.41 | -14.88 | 0.9930 | -0.2234 | |||

| MPLX / MPLX LP - Limited Partnership | 0.03 | 0.00 | 1.39 | -3.81 | 0.9813 | -0.0817 | |||

| AR / Antero Resources Corporation | 0.03 | 0.00 | 1.34 | -0.37 | 0.9464 | -0.0442 | |||

| EXE / Expand Energy Corporation | 0.01 | 0.00 | 1.21 | 5.04 | 0.8529 | 0.0064 | |||

| VIS / Vanguard World Fund - Vanguard Industrials ETF | 0.00 | 0.00 | 1.20 | 13.16 | 0.8498 | 0.0667 | |||

| VDC / Vanguard World Fund - Vanguard Consumer Staples ETF | 0.01 | 0.00 | 1.18 | 0.08 | 0.8328 | -0.0346 | |||

| EQT / EQT Corporation | 0.02 | 0.00 | 1.11 | 9.16 | 0.7819 | 0.0351 | |||

| VHT / Vanguard World Fund - Vanguard Health Care ETF | 0.00 | 0.00 | 1.09 | -6.26 | 0.7719 | -0.0860 | |||

| TXN / Texas Instruments Incorporated | 0.01 | 0.00 | 1.06 | 15.54 | 0.7457 | 0.0728 | |||

| OVV / Ovintiv Inc. | 0.03 | 0.00 | 1.01 | -11.07 | 0.7142 | -0.1234 | |||

| EPSN / Epsilon Energy Ltd. | 0.13 | 0.80 | 0.93 | 5.35 | 0.6530 | 0.0069 | |||

| MPTI / M-tron Industries, Inc. | 0.02 | 0.00 | 0.92 | -5.62 | 0.6520 | -0.0689 | |||

| BTU / Peabody Energy Corporation | 0.05 | 0.00 | 0.64 | -0.92 | 0.4545 | -0.0239 | |||

| ALC / Alcon Inc. | 0.01 | 9.58 | 0.61 | 1.85 | 0.4273 | -0.0099 | |||

| LGL / The LGL Group, Inc. | 0.07 | -3.61 | 0.54 | 12.71 | 0.3817 | 0.0279 | |||

| ARLP / Alliance Resource Partners, L.P. - Limited Partnership | 0.02 | 0.00 | 0.44 | -4.10 | 0.3136 | -0.0276 | |||

| OKE / ONEOK, Inc. | 0.00 | 9.16 | 0.37 | -10.22 | 0.2608 | -0.0420 | |||

| XOM / Exxon Mobil Corporation | 0.00 | 0.00 | 0.36 | -9.57 | 0.2540 | -0.0382 | |||

| ORCL / Oracle Corporation | 0.00 | 0.00 | 0.35 | 56.64 | 0.2502 | 0.0834 | |||

| PSX / Phillips 66 | 0.00 | -1.12 | 0.35 | -4.66 | 0.2462 | -0.0225 | |||

| ABT / Abbott Laboratories | 0.00 | 0.00 | 0.33 | 2.52 | 0.2294 | -0.0039 | |||

| VAL / Valaris Limited | 0.01 | 0.32 | 0.2228 | 0.2228 | |||||

| KRKNF / Kraken Robotics Inc. | 0.14 | 0.00 | 0.31 | 33.62 | 0.2193 | 0.0479 | |||

| ASML / ASML Holding N.V. - Depositary Receipt (Common Stock) | 0.00 | 0.29 | 0.2064 | 0.2064 | |||||

| BMY / Bristol-Myers Squibb Company | 0.01 | 20.00 | 0.28 | -8.88 | 0.1960 | -0.0284 | |||

| ET / Energy Transfer LP - Limited Partnership | 0.01 | 0.00 | 0.24 | -2.40 | 0.1726 | -0.0119 | |||

| AMGN / Amgen Inc. | 0.00 | 0.00 | 0.24 | -10.31 | 0.1659 | -0.0271 | |||

| MU / Micron Technology, Inc. | 0.00 | 0.22 | 0.1522 | 0.1522 | |||||

| AAPL / Apple Inc. | 0.00 | 0.00 | 0.21 | -7.79 | 0.1506 | -0.0194 | |||

| AM / Antero Midstream Corporation | 0.01 | 0.00 | 0.20 | 5.38 | 0.1387 | 0.0013 | |||

| FNMA / Federal National Mortgage Association | 0.01 | 0.11 | 0.0808 | 0.0808 | |||||

| RITM / Rithm Capital Corp. | 0.01 | 0.00 | 0.11 | -1.75 | 0.0797 | -0.0046 | |||

| PTALF / PetroTal Corp. | 0.23 | 0.00 | 0.11 | 4.67 | 0.0794 | 0.0006 | |||

| FMCC / Federal Home Loan Mortgage Corporation | 0.01 | 0.00 | 0.08 | 54.72 | 0.0581 | 0.0188 | |||

| FIP / FTAI Infrastructure Inc. | 0.01 | 0.08 | 0.0566 | 0.0566 | |||||

| JVA / Coffee Holding Co., Inc. | 0.01 | 0.04 | 0.0306 | 0.0306 | |||||

| LGL.WS / The LGL Group, Inc. - Equity Warrant | 0.06 | 0.00 | 0.03 | 83.33 | 0.0233 | 0.0099 | |||

| MPTI.WS / M-tron Industries, Inc. - Equity Warrant | 0.02 | 0.02 | 0.0161 | 0.0161 | |||||

| PTHRF / Pantheon Resources Plc | 0.04 | 0.00 | 0.01 | -63.64 | 0.0091 | -0.0155 | |||

| PG / The Procter & Gamble Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| KVUE / Kenvue Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| DELL / Dell Technologies Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| NSRGY / Nestlé S.A. - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SDZNY / Sandoz Group AG - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 |