Mga Batayang Estadistika

| Nilai Portofolio | $ 571,405,596 |

| Posisi Saat Ini | 115 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

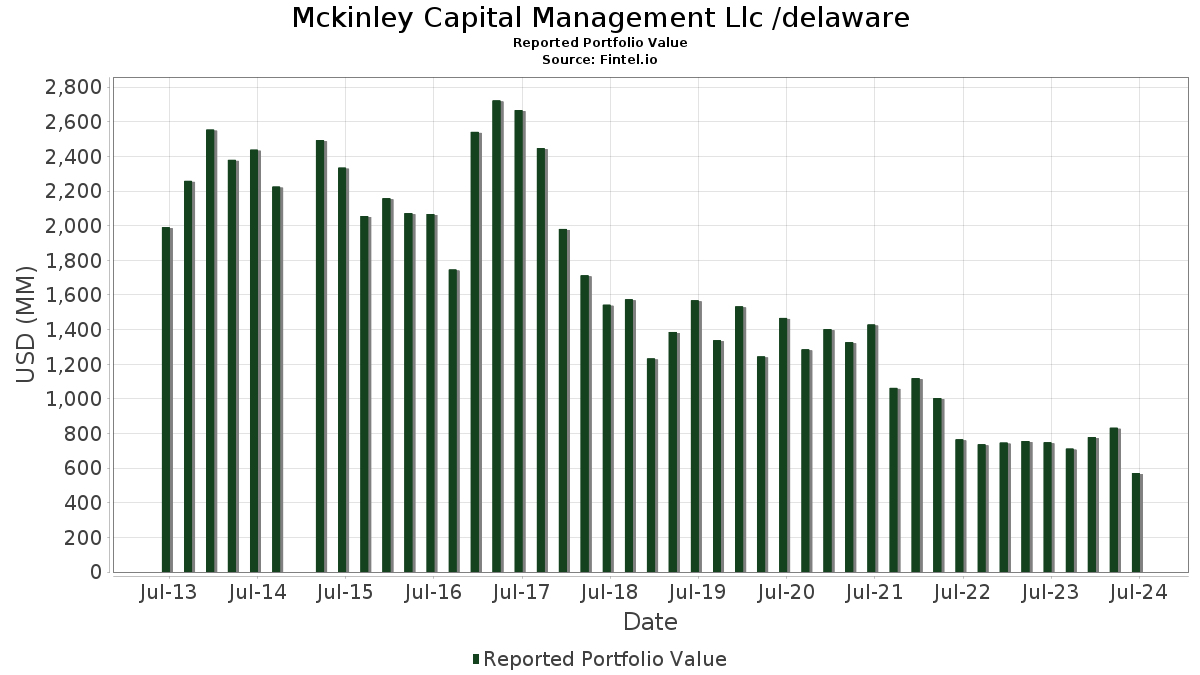

Mckinley Capital Management Llc /delaware telah mengungkapkan total kepemilikan 115 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 571,405,596 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Mckinley Capital Management Llc /delaware adalah Microsoft Corporation (US:MSFT) , NVIDIA Corporation (US:NVDA) , Apple Inc. (US:AAPL) , Amazon.com, Inc. (US:AMZN) , and Alphabet Inc. (US:GOOGL) . Posisi baru Mckinley Capital Management Llc /delaware meliputi: Gladstone Capital Corporation (US:GLAD) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.32 | 40.04 | 7.0076 | 2.9340 | |

| 0.16 | 32.80 | 5.7405 | 2.0495 | |

| 0.10 | 46.68 | 8.1698 | 1.5521 | |

| 0.12 | 22.06 | 3.8614 | 1.3280 | |

| 0.13 | 24.61 | 4.3069 | 1.1370 | |

| 0.01 | 17.60 | 3.0795 | 1.1369 | |

| 0.02 | 15.14 | 2.6494 | 0.9065 | |

| 0.04 | 20.07 | 3.5130 | 0.8539 | |

| 0.62 | 12.92 | 2.2618 | 0.8027 | |

| 0.72 | 11.12 | 1.9466 | 0.6171 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.76 | 0.1334 | -1.2987 | |

| 0.00 | 1.09 | 0.1902 | -1.1156 | |

| 0.00 | 1.73 | 0.3021 | -1.0306 | |

| 0.00 | 0.00 | -0.8384 | ||

| 0.01 | 1.03 | 0.1802 | -0.8254 | |

| 0.01 | 5.98 | 1.0460 | -0.7844 | |

| 0.00 | 0.00 | -0.7708 | ||

| 0.23 | 4.68 | 0.8197 | -0.3597 | |

| 0.00 | 0.00 | -0.3011 | ||

| 0.01 | 2.24 | 0.3923 | -0.1759 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2024-08-12 untuk periode pelaporan 2024-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.10 | -20.25 | 46.68 | -15.28 | 8.1698 | 1.5521 | |||

| NVDA / NVIDIA Corporation | 0.32 | 763.45 | 40.04 | 18.06 | 7.0076 | 2.9340 | |||

| AAPL / Apple Inc. | 0.16 | -13.10 | 32.80 | 6.74 | 5.7405 | 2.0495 | |||

| AMZN / Amazon.com, Inc. | 0.13 | -12.97 | 24.61 | -6.76 | 4.3069 | 1.1370 | |||

| GOOGL / Alphabet Inc. | 0.12 | -13.17 | 22.06 | 4.60 | 3.8614 | 1.3280 | |||

| META / Meta Platforms, Inc. | 0.04 | -12.69 | 20.07 | -9.34 | 3.5130 | 0.8539 | |||

| AVGO / Broadcom Inc. | 0.01 | -10.19 | 17.60 | 8.80 | 3.0795 | 1.1369 | |||

| LLY / Eli Lilly and Company | 0.02 | -10.36 | 15.14 | 4.32 | 2.6494 | 0.9065 | |||

| ARCC / Ares Capital Corporation | 0.62 | 6.28 | 12.92 | 6.39 | 2.2618 | 0.8027 | |||

| OBDC / Blue Owl Capital Corporation | 0.72 | 0.61 | 11.12 | 0.49 | 1.9466 | 0.6171 | |||

| BXSL / Blackstone Secured Lending Fund | 0.35 | 0.77 | 10.67 | -0.94 | 1.8665 | 0.5733 | |||

| COST / Costco Wholesale Corporation | 0.01 | -12.95 | 10.39 | 0.99 | 1.8178 | 0.5825 | |||

| NFLX / Netflix, Inc. | 0.01 | -12.57 | 9.82 | -2.84 | 1.7185 | 0.5046 | |||

| MAIN / Main Street Capital Corporation | 0.17 | 0.79 | 8.77 | 7.56 | 1.5342 | 0.5554 | |||

| HD / The Home Depot, Inc. | 0.02 | -22.57 | 8.47 | -30.51 | 1.4819 | 0.0183 | |||

| GJR / Strats Trust For Procter & Gambel Security - Preferred Security | 0.05 | -10.22 | 8.34 | -8.75 | 1.4587 | 0.3617 | |||

| PEP / PepsiCo, Inc. | 0.05 | -10.26 | 8.10 | -15.43 | 1.4174 | 0.2671 | |||

| V / Visa Inc. | 0.03 | -12.49 | 7.81 | -17.70 | 1.3667 | 0.2271 | |||

| GBDC / Golub Capital BDC, Inc. | 0.49 | 0.48 | 7.70 | -5.08 | 1.3482 | 0.3734 | |||

| XOM / Exxon Mobil Corporation | 0.07 | -10.95 | 7.62 | -11.81 | 1.3343 | 0.2960 | |||

| AMLP / ALPS ETF Trust - Alerian MLP ETF | 0.16 | -0.98 | 7.51 | 0.11 | 1.3146 | 0.4134 | |||

| NOW / ServiceNow, Inc. | 0.01 | -12.44 | 7.40 | -9.66 | 1.2952 | 0.3113 | |||

| HTGC / Hercules Capital, Inc. | 0.36 | 4.26 | 7.29 | 15.55 | 1.2756 | 0.5180 | |||

| FSK / FS KKR Capital Corp. | 0.34 | 0.62 | 6.70 | 4.12 | 1.1731 | 0.3998 | |||

| INTU / Intuit Inc. | 0.01 | -12.46 | 6.68 | -11.50 | 1.1690 | 0.2626 | |||

| PANW / Palo Alto Networks, Inc. | 0.02 | -12.93 | 6.57 | 3.91 | 1.1498 | 0.3903 | |||

| JPM / JPMorgan Chase & Co. | 0.03 | -22.51 | 6.15 | -21.75 | 1.0761 | 0.1323 | |||

| MCK / McKesson Corporation | 0.01 | -63.95 | 5.98 | -60.78 | 1.0460 | -0.7844 | |||

| GD / General Dynamics Corporation | 0.02 | 8.58 | 5.80 | 11.51 | 1.0157 | 0.3906 | |||

| WM / Waste Management, Inc. | 0.03 | -8.72 | 5.76 | -8.63 | 1.0082 | 0.2509 | |||

| ANET / Arista Networks Inc | 0.02 | -12.37 | 5.65 | 5.92 | 0.9891 | 0.3482 | |||

| COP / ConocoPhillips | 0.05 | -12.73 | 5.16 | -21.59 | 0.9035 | 0.1129 | |||

| STLD / Steel Dynamics, Inc. | 0.04 | -12.53 | 5.16 | -23.57 | 0.9033 | 0.0921 | |||

| SCCO / Southern Copper Corporation | 0.05 | 104.36 | 5.13 | 106.77 | 0.8975 | 0.5995 | |||

| MRK / Merck & Co., Inc. | 0.04 | 25.76 | 5.12 | 17.99 | 0.8952 | 0.3745 | |||

| TTEK / Tetra Tech, Inc. | 0.02 | -12.05 | 4.94 | -2.64 | 0.8643 | 0.2551 | |||

| MAR / Marriott International, Inc. | 0.02 | -26.31 | 4.94 | -29.38 | 0.8639 | 0.0243 | |||

| TSLX / Sixth Street Specialty Lending, Inc. | 0.23 | 0.57 | 4.86 | 0.19 | 0.8512 | 0.2681 | |||

| HIMS / Hims & Hers Health, Inc. | 0.23 | -63.45 | 4.68 | -52.30 | 0.8197 | -0.3597 | |||

| BWXT / BWX Technologies, Inc. | 0.05 | -11.94 | 4.65 | -18.48 | 0.8135 | 0.1286 | |||

| LIN / Linde plc | 0.01 | -14.99 | 4.51 | -19.67 | 0.7901 | 0.1152 | |||

| MELI / MercadoLibre, Inc. | 0.00 | -10.56 | 4.44 | -2.80 | 0.7768 | 0.2284 | |||

| FMX / Fomento Económico Mexicano, S.A.B. de C.V. - Depositary Receipt (Common Stock) | 0.04 | -9.87 | 4.12 | -25.53 | 0.7215 | 0.0566 | |||

| LNG / Cheniere Energy, Inc. | 0.02 | -12.24 | 4.01 | -4.86 | 0.7022 | 0.1956 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.01 | -11.92 | 4.00 | -14.81 | 0.6998 | 0.1362 | |||

| VST / Vistra Corp. | 0.05 | -22.43 | 3.88 | -4.26 | 0.6799 | 0.1926 | |||

| AMAT / Applied Materials, Inc. | 0.02 | -14.75 | 3.57 | -2.46 | 0.6241 | 0.1850 | |||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.02 | 20.13 | 3.32 | 33.56 | 0.5802 | 0.2821 | |||

| BLDR / Builders FirstSource, Inc. | 0.02 | -12.75 | 3.27 | -42.10 | 0.5720 | -0.1059 | |||

| MA / Mastercard Incorporated | 0.01 | -14.99 | 3.25 | -22.10 | 0.5681 | 0.0675 | |||

| CSWC / Capital Southwest Corporation | 0.12 | 0.05 | 3.14 | 4.59 | 0.5502 | 0.1891 | |||

| OCSL / Oaktree Specialty Lending Corporation | 0.16 | 0.29 | 3.08 | -4.05 | 0.5388 | 0.1534 | |||

| MCD / McDonald's Corporation | 0.01 | -6.54 | 3.00 | -15.54 | 0.5242 | 0.0983 | |||

| CGBD / Carlyle Secured Lending, Inc. | 0.17 | 0.20 | 2.96 | 9.16 | 0.5173 | 0.1922 | |||

| GSBD / Goldman Sachs BDC, Inc. | 0.19 | 0.36 | 2.85 | 0.71 | 0.4994 | 0.1591 | |||

| KKR / KKR & Co. Inc. | 0.03 | -1.19 | 2.71 | 3.39 | 0.4746 | 0.1596 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.01 | -2.36 | 2.60 | 24.75 | 0.4553 | 0.2048 | |||

| AEM / Agnico Eagle Mines Limited | 0.04 | 2.53 | 0.4421 | 0.4421 | |||||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0.02 | -0.23 | 2.45 | 9.82 | 0.4288 | 0.1608 | |||

| UNP / Union Pacific Corporation | 0.01 | -8.74 | 2.27 | -16.06 | 0.3972 | 0.0725 | |||

| PSEC / Prospect Capital Corporation | 0.41 | 0.25 | 2.26 | 0.44 | 0.3963 | 0.1255 | |||

| TSLA / Tesla, Inc. | 0.01 | -57.91 | 2.24 | -52.62 | 0.3923 | -0.1759 | |||

| SLRC / SLR Investment Corp. | 0.13 | -0.17 | 2.11 | 4.61 | 0.3696 | 0.1272 | |||

| AGG / iShares Trust - iShares Core U.S. Aggregate Bond ETF | 0.02 | 1.15 | 2.01 | 0.25 | 0.3515 | 0.1109 | |||

| ISRG / Intuitive Surgical, Inc. | 0.00 | -86.05 | 1.73 | -84.44 | 0.3021 | -1.0306 | |||

| CCAP / Crescent Capital BDC, Inc. | 0.09 | 1.19 | 1.70 | 10.09 | 0.2980 | 0.1123 | |||

| NMFC / New Mountain Finance Corporation | 0.14 | 1.41 | 1.66 | -2.06 | 0.2908 | 0.0871 | |||

| MFIC / MidCap Financial Investment Corporation | 0.10 | 0.64 | 1.56 | 1.30 | 0.2722 | 0.0878 | |||

| BBDC / Barings BDC, Inc. | 0.16 | 0.84 | 1.53 | 5.52 | 0.2678 | 0.0936 | |||

| ASML / ASML Holding N.V. - Depositary Receipt (Common Stock) | 0.00 | -3.76 | 1.46 | 1.39 | 0.2563 | 0.0829 | |||

| OHI / Omega Healthcare Investors, Inc. | 0.04 | -1.04 | 1.41 | 7.06 | 0.2470 | 0.0886 | |||

| BKFOF / Brookfield Corporation - Preferred Stock | 0.03 | 3.75 | 1.41 | 2.93 | 0.2462 | 0.0821 | |||

| IRM / Iron Mountain Incorporated | 0.02 | 12.83 | 1.38 | 26.03 | 0.2407 | 0.1097 | |||

| URI / United Rentals, Inc. | 0.00 | -12.38 | 1.35 | -21.42 | 0.2363 | 0.0299 | |||

| GLPI / Gaming and Leisure Properties, Inc. | 0.03 | -1.16 | 1.32 | -3.08 | 0.2317 | 0.0678 | |||

| ORLY / O'Reilly Automotive, Inc. | 0.00 | -15.05 | 1.32 | -20.54 | 0.2316 | 0.0316 | |||

| SHEL / Shell plc - Depositary Receipt (Common Stock) | 0.02 | -4.24 | 1.29 | 3.11 | 0.2263 | 0.0756 | |||

| WELL / Welltower Inc. | 0.01 | -1.03 | 1.23 | 10.46 | 0.2144 | 0.0812 | |||

| KDP / Keurig Dr Pepper Inc. | 0.04 | -1.23 | 1.22 | 7.56 | 0.2143 | 0.0776 | |||

| BP / BP p.l.c. - Depositary Receipt (Common Stock) | 0.03 | -2.49 | 1.17 | -6.56 | 0.2045 | 0.0543 | |||

| SGOV / iShares Trust - iShares 0-3 Month Treasury Bond ETF | 0.01 | 32.77 | 1.16 | 32.69 | 0.2033 | 0.0982 | |||

| AZN / AstraZeneca PLC - Depositary Receipt (Common Stock) | 0.01 | -8.32 | 1.16 | 5.57 | 0.2023 | 0.0708 | |||

| DHI / D.R. Horton, Inc. | 0.01 | -14.03 | 1.12 | -26.40 | 0.1952 | 0.0133 | |||

| TCPC / BlackRock TCP Capital Corp. | 0.10 | 1.33 | 1.11 | 5.00 | 0.1948 | 0.0674 | |||

| SYK / Stryker Corporation | 0.00 | -89.49 | 1.09 | -90.01 | 0.1902 | -1.1156 | |||

| DXCM / DexCom, Inc. | 0.01 | -84.95 | 1.03 | -87.71 | 0.1802 | -0.8254 | |||

| PDD / PDD Holdings Inc. - Depositary Receipt (Common Stock) | 0.01 | 1.03 | 0.1799 | 0.1799 | |||||

| FTXP / Foothills Exploration, Inc. | 0.00 | -14.86 | 1.02 | 0.50 | 0.1778 | 0.0564 | |||

| CAT / Caterpillar Inc. | 0.00 | -15.06 | 0.98 | -22.81 | 0.1713 | 0.0190 | |||

| PFLT / PennantPark Floating Rate Capital Ltd. | 0.08 | 1.13 | 0.93 | 2.53 | 0.1634 | 0.0540 | |||

| PNNT / PennantPark Investment Corporation | 0.12 | -0.20 | 0.90 | 9.52 | 0.1571 | 0.0587 | |||

| GLAD / Gladstone Capital Corporation | 0.04 | 0.88 | 0.1543 | 0.1543 | |||||

| CASY / Casey's General Stores, Inc. | 0.00 | -14.97 | 0.88 | 1.86 | 0.1536 | 0.0501 | |||

| T / AT&T Inc. | 0.04 | -0.81 | 0.86 | 7.80 | 0.1500 | 0.0544 | |||

| ADBE / Adobe Inc. | 0.00 | -54.63 | 0.83 | -50.09 | 0.1459 | -0.0545 | |||

| WDS / Woodside Energy Group Ltd - Depositary Receipt (Common Stock) | 0.04 | -1.21 | 0.83 | -6.95 | 0.1453 | 0.0381 | |||

| VTIP / Vanguard Malvern Funds - Vanguard Short-Term Inflation-Protected Securities ETF | 0.02 | 0.89 | 0.82 | 2.26 | 0.1430 | 0.0470 | |||

| JNJ / Johnson & Johnson | 0.01 | -21.56 | 0.81 | -27.50 | 0.1421 | 0.0075 | |||

| DLR / Digital Realty Trust, Inc. | 0.01 | 12.25 | 0.79 | 18.56 | 0.1387 | 0.0584 | |||

| VCSH / Vanguard Scottsdale Funds - Vanguard Short-Term Corporate Bond ETF | 0.01 | 1.14 | 0.77 | 1.05 | 0.1352 | 0.0434 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | -93.79 | 0.76 | -93.61 | 0.1334 | -1.2987 | |||

| RELX / RELX PLC - Depositary Receipt (Common Stock) | 0.02 | -3.89 | 0.76 | 1.75 | 0.1327 | 0.0433 | |||

| VCLT / Vanguard Scottsdale Funds - Vanguard Long-Term Corporate Bond ETF | 0.01 | 59.13 | 0.72 | 54.53 | 0.1255 | 0.0697 | |||

| COPX / Global X Funds - Global X Copper Miners ETF | 0.02 | 55.32 | 0.70 | 65.08 | 0.1217 | 0.0711 | |||

| BCSF / Bain Capital Specialty Finance, Inc. | 0.04 | 1.14 | 0.67 | 5.15 | 0.1180 | 0.0410 | |||

| VZ / Verizon Communications Inc. | 0.01 | -1.19 | 0.57 | -3.05 | 0.1003 | 0.0294 | |||

| CNQ / Canadian Natural Resources Limited | 0.02 | 94.13 | 0.57 | -9.55 | 0.0995 | 0.0241 | |||

| BHP / BHP Group Limited - Depositary Receipt (Common Stock) | 0.01 | -1.42 | 0.55 | -2.48 | 0.0963 | 0.0286 | |||

| BBVA / Banco Bilbao Vizcaya Argentaria, S.A. - Depositary Receipt (Common Stock) | 0.05 | -3.55 | 0.52 | -18.28 | 0.0916 | 0.0147 | |||

| HON / Honeywell International Inc. | 0.00 | -7.47 | 0.49 | -3.91 | 0.0861 | 0.0247 | |||

| STLA / Stellantis N.V. | 0.02 | -3.66 | 0.44 | -32.36 | 0.0768 | -0.0012 | |||

| IHG / InterContinental Hotels Group PLC - Depositary Receipt (Common Stock) | 0.00 | -0.08 | 0.41 | 0.24 | 0.0722 | 0.0227 | |||

| SAP / SAP SE - Depositary Receipt (Common Stock) | 0.00 | -0.05 | 0.39 | 3.46 | 0.0681 | 0.0229 | |||

| FERG / Ferguson Enterprises Inc. | 0.00 | -3.68 | 0.34 | -14.57 | 0.0595 | 0.0117 | |||

| CNI / Canadian National Railway Company | 0.00 | -0.04 | 0.32 | -10.53 | 0.0566 | 0.0133 | |||

| XP / XP Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TM / Toyota Motor Corporation - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ALC / Alcon Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VEEV / Veeva Systems Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VLTO / Veralto Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BSX / Boston Scientific Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| FTRE / Fortrea Holdings Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| EXAS / Exact Sciences Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BRKR / Bruker Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| AVTR / Avantor, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| RS / Reliance, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GLAD / Gladstone Capital Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CHE / Chemed Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CVS / CVS Health Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| STE / STERIS plc | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| QTRX / Quanterix Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ROP / Roper Technologies, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ACCD / Accolade, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| IWF / iShares Trust - iShares Russell 1000 Growth ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TS / Tenaris S.A. - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| NTRA / Natera, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| WST / West Pharmaceutical Services, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CI / The Cigna Group | 0.00 | -100.00 | 0.00 | -100.00 | -0.8384 | ||||

| DHR / Danaher Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.7708 | ||||

| GDRX / GoodRx Holdings, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ITGR / Integer Holdings Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ICLR / ICON Public Limited Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| IDXX / IDEXX Laboratories, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ABT / Abbott Laboratories | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| DGX / Quest Diagnostics Incorporated | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| IRTC / iRhythm Technologies, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| OPCH / Option Care Health, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PODD / Insulet Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ZTS / Zoetis Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MEDP / Medpace Holdings, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BDX / Becton, Dickinson and Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ASTH / Astrana Health, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GEHC / GE HealthCare Technologies Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| NEO / NeoGenomics, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ELV / Elevance Health, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| HOLX / Hologic, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| HQY / HealthEquity, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| HSTM / HealthStream, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PRVA / Privia Health Group, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MDT / Medtronic plc | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| IQV / IQVIA Holdings Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PGNY / Progyny, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| COO / The Cooper Companies, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.3011 | ||||

| EVH / Evolent Health, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| HCA / HCA Healthcare, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |