Mga Batayang Estadistika

| Nilai Portofolio | $ 316,215,069 |

| Posisi Saat Ini | 243 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

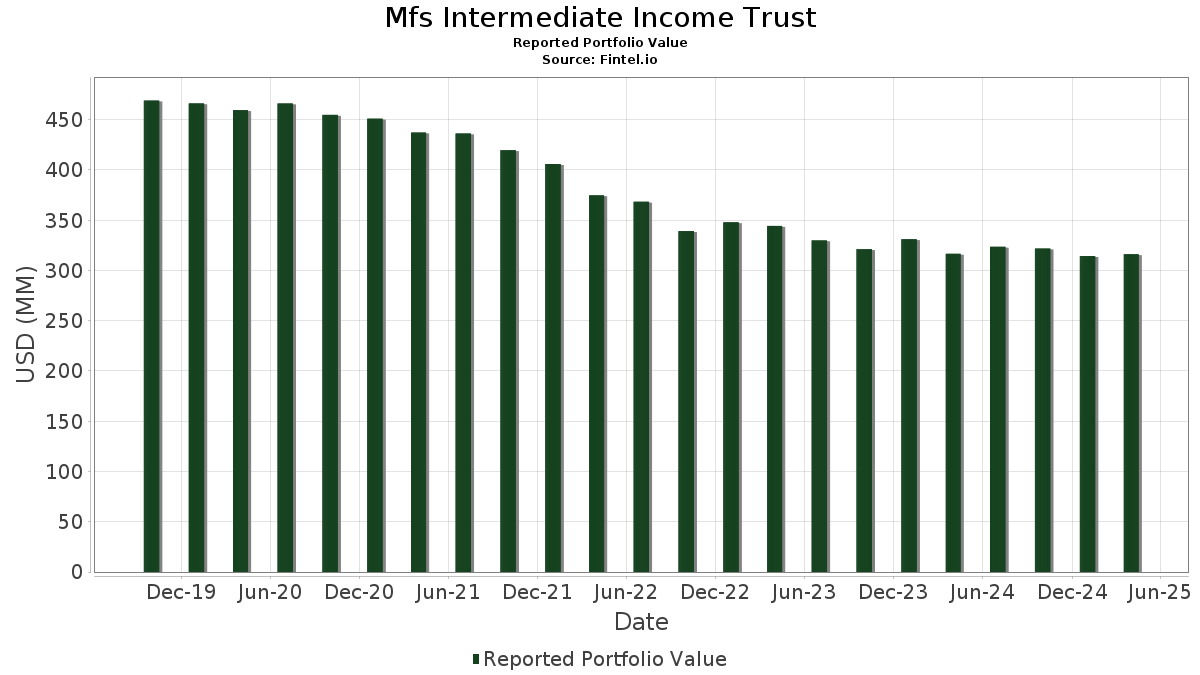

Mfs Intermediate Income Trust telah mengungkapkan total kepemilikan 243 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 316,215,069 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Mfs Intermediate Income Trust adalah United States Treasury Note/Bond (US:US91282CEC10) , United States Treasury Note/Bond (US:US912828YU85) , United States Treasury Note/Bond (US:US912828U246) , United States Treasury Note/Bond (US:US912828ZV59) , and Morgan Stanley Bond (US:US61746BDZ67) . Posisi baru Mfs Intermediate Income Trust meliputi: United States Treasury Note/Bond (US:US91282CEC10) , United States Treasury Note/Bond (US:US912828YU85) , United States Treasury Note/Bond (US:US912828U246) , United States Treasury Note/Bond (US:US912828ZV59) , and Morgan Stanley Bond (US:US61746BDZ67) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 2.01 | 0.6365 | 0.6365 | ||

| 1.92 | 0.6092 | 0.6092 | ||

| 1.67 | 0.5296 | 0.5296 | ||

| 1.67 | 0.5293 | 0.5293 | ||

| 1.49 | 0.4729 | 0.4729 | ||

| 1.47 | 0.4648 | 0.4648 | ||

| 1.45 | 0.4600 | 0.4600 | ||

| 1.41 | 0.4465 | 0.4465 | ||

| 1.25 | 0.3968 | 0.3968 | ||

| 1.13 | 0.3566 | 0.3566 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 4.19 | 4.19 | 1.3271 | -1.4292 | |

| 1.12 | 0.3555 | -0.1323 | ||

| 0.39 | 0.1224 | -0.0873 | ||

| 0.56 | 0.1760 | -0.0837 | ||

| 0.30 | 0.0934 | -0.0775 | ||

| 0.09 | 0.0297 | -0.0756 | ||

| 0.19 | 0.0613 | -0.0624 | ||

| 0.36 | 0.1127 | -0.0571 | ||

| 0.01 | 0.0043 | -0.0496 | ||

| 1.18 | 0.3732 | -0.0281 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-06-24 untuk periode pelaporan 2025-04-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| U.S. Treasury Notes / DBT (US91282CLG41) | 11.92 | 1.49 | 3.7739 | 0.0457 | |||||

| US91282CEC10 / United States Treasury Note/Bond | 9.75 | 1.58 | 3.0871 | 0.0402 | |||||

| US912828YU85 / United States Treasury Note/Bond | 7.51 | 1.39 | 2.3754 | 0.0268 | |||||

| US912828U246 / United States Treasury Note/Bond | 6.09 | 1.26 | 1.9287 | 0.0192 | |||||

| US912828ZV59 / United States Treasury Note/Bond | 6.08 | 2.20 | 1.9253 | 0.0365 | |||||

| US61746BDZ67 / Morgan Stanley Bond | 5.38 | 0.19 | 1.7018 | -0.0012 | |||||

| US91282CAL54 / United States Treasury Note/Bond | 5.25 | 2.44 | 1.6625 | 0.0353 | |||||

| US912828K742 / United States Treasury Note/Bond | 5.19 | 0.54 | 1.6423 | 0.0045 | |||||

| US912828M565 / United States Treasury Note/Bond | 5.03 | 0.56 | 1.5932 | 0.0046 | |||||

| US912828Z948 / United States Treasury Note/Bond | 4.56 | 3.57 | 1.4425 | 0.0460 | |||||

| US55291X1090 / MFS Institutional Money Market Portfolio | 4.19 | -51.72 | 4.19 | -51.73 | 1.3271 | -1.4292 | |||

| US912828YS30 / United States Treasury Note/Bond | 4.14 | 3.32 | 1.3113 | 0.0388 | |||||

| US912828X885 / United States Treasury Note/Bond | 3.98 | 1.64 | 1.2585 | 0.0171 | |||||

| US91282CFV81 / United States Treasury Note/Bond | 3.43 | 3.28 | 1.0866 | 0.0316 | |||||

| US3137BRQJ72 / FHLMC, Multifamily Structured Pass-Through Certificates, Series K057, Class A2 | 3.31 | 0.52 | 1.0475 | 0.0028 | |||||

| US21036PBB31 / Constellation Brands Inc | 3.30 | 0.03 | 1.0446 | -0.0023 | |||||

| US12594KAB89 / CNH Industrial NV | 3.01 | 0.70 | 0.9530 | 0.0042 | |||||

| US75884RBA05 / Regency Centers LP | 2.89 | 2.63 | 0.9135 | 0.0209 | |||||

| US361841AQ25 / GLP Capital LP / GLP Financing II Inc | 2.83 | 0.71 | 0.8967 | 0.0040 | |||||

| US756109BH64 / Realty Income Corp | 2.80 | 1.19 | 0.8876 | 0.0083 | |||||

| US337932AH00 / FirstEnergy Corp | 2.79 | 1.20 | 0.8843 | 0.0081 | |||||

| US465685AQ80 / ITC Holdings Corp | 2.76 | 2.45 | 0.8741 | 0.0186 | |||||

| US741503BC97 / Booking Holdings Inc | 2.70 | 1.62 | 0.8530 | 0.0113 | |||||

| US87172NBE76 / SYRACUSE NY INDL DEV AGY PILOT REVENUE | 2.69 | -1.97 | 0.8524 | -0.0195 | |||||

| US531546AB51 / Liberty Utilities Finance GP 1 | 2.59 | 2.21 | 0.8189 | 0.0157 | |||||

| US11271LAH50 / Brookfield Finance Inc | 2.52 | 1.49 | 0.7991 | 0.0098 | |||||

| US90352JAC71 / UBS Group AG | 2.43 | 1.00 | 0.7683 | 0.0058 | |||||

| US21871XAF69 / CORP. NOTE | 2.42 | 1.59 | 0.7668 | 0.0102 | |||||

| US87264ABF12 / CORP. NOTE | 2.41 | 2.07 | 0.7634 | 0.0136 | |||||

| US91282CDY49 / United States Treasury Note/Bond | 2.38 | 3.85 | 0.7518 | 0.0259 | |||||

| US778296AD58 / Ross Stores Inc | 2.36 | 1.86 | 0.7462 | 0.0117 | |||||

| US363060DW16 / GAINESVILLE TX HOSP DIST | 2.36 | 0.99 | 0.7458 | 0.0053 | |||||

| US253393AF94 / Dick's Sporting Goods, Inc. | 2.30 | -0.22 | 0.7292 | -0.0036 | |||||

| US11120VAJ26 / Brixmor Operating Partnership LP | 2.26 | 1.53 | 0.7137 | 0.0089 | |||||

| US59447TXW88 / MICHIGAN ST FIN AUTH REVENUE | 2.23 | 2.95 | 0.7062 | 0.0184 | |||||

| US05401AAP66 / Avolon Holdings Funding Ltd | 2.19 | 0.55 | 0.6929 | 0.0020 | |||||

| US06051GJS93 / Bank of America Corp | 2.15 | 1.03 | 0.6805 | 0.0052 | |||||

| US07274EAK91 / BAYER US FINANCE LLC 144A LIFE SR UNSEC 6.375% 11-21-30 | 2.11 | 1.98 | 0.6669 | 0.0112 | |||||

| US904678AU32 / UniCredit SpA | 2.07 | 0.73 | 0.6546 | 0.0030 | |||||

| US60687YCT47 / MIZUHO FINANCIAL GROUP INC | 2.06 | 0.78 | 0.6508 | 0.0034 | |||||

| BATBC / British American Tobacco Bangladesh Company Limited | 2.01 | 0.6365 | 0.6365 | ||||||

| US46647PCC86 / JPMorgan Chase & Co | 1.99 | 2.36 | 0.6310 | 0.0132 | |||||

| US05609GAC24 / BXMT 2021-FL4 Ltd | 1.95 | 1.88 | 0.6163 | 0.0099 | |||||

| P1AY34 / Paychex, Inc. - Depositary Receipt (Common Stock) | 1.92 | 0.6092 | 0.6092 | ||||||

| ANTX / AN2 Therapeutics, Inc. | 1.92 | 2.29 | 0.6087 | 0.0121 | |||||

| US79588TAE01 / Sammons Financial Group Inc | 1.88 | 2.07 | 0.5938 | 0.0106 | |||||

| US14040HDC60 / Capital One Financial Corp | 1.87 | 0.70 | 0.5912 | 0.0023 | |||||

| US718172CX57 / PHILIP MORRIS INTERNATIONAL INC | 1.86 | 1.75 | 0.5886 | 0.0085 | |||||

| US378272AQ19 / Glencore Funding LLC | 1.85 | 0.82 | 0.5867 | 0.0033 | |||||

| MASSACHUSETTS ST EDUCTNL FING AUTH / DBT (US57563RTW96) | 1.83 | 0.11 | 0.5805 | -0.0008 | |||||

| US47216QAB95 / JDE Peet's NV | 1.82 | 0.67 | 0.5747 | 0.0024 | |||||

| US54750AAB26 / Low Income Investment Fund | 1.81 | 2.37 | 0.5733 | 0.0119 | |||||

| US91412HGG20 / University of California | 1.78 | 3.20 | 0.5620 | 0.0162 | |||||

| US853254CQ11 / Standard Chartered plc | 1.77 | -0.23 | 0.5587 | -0.0027 | |||||

| US960386AM29 / Wabtec Corp | 1.77 | 1.09 | 0.5587 | 0.0045 | |||||

| US04316JAF66 / Arthur J Gallagher & Co | 1.76 | 0.97 | 0.5581 | 0.0039 | |||||

| US55608JAR95 / Macquarie Group Ltd | 1.74 | 0.98 | 0.5517 | 0.0040 | |||||

| A1GN34 / Allegion plc - Depositary Receipt (Common Stock) | 1.73 | 1.23 | 0.5489 | 0.0053 | |||||

| PFS Financing Corp / ABS-O (US69335PFC41) | 1.70 | -0.23 | 0.5388 | -0.0027 | |||||

| US775109CG49 / Rogers Communications, Inc. | 1.70 | 1.07 | 0.5382 | 0.0043 | |||||

| U.S. Treasury Notes / DBT (US91282CKN01) | 1.69 | 3.04 | 0.5358 | 0.0143 | |||||

| Rentokil Terminix Funding LLC / DBT (US760130AB09) | 1.67 | 0.5296 | 0.5296 | ||||||

| Mars Inc / DBT (US571676BA26) | 1.67 | 0.5293 | 0.5293 | ||||||

| US09659W2T04 / BNP Paribas SA | 1.66 | 1.16 | 0.5267 | 0.0045 | |||||

| AVGO / Broadcom Inc. - Depositary Receipt (Common Stock) | 1.64 | 1.74 | 0.5183 | 0.0075 | |||||

| US12595EAD76 / COMM 2017-COR2 Mortgage Trust | 1.63 | 1.12 | 0.5161 | 0.0046 | |||||

| US224044CR68 / COX COMMUNICATIONS INC REGD 144A P/P 5.45000000 | 1.61 | 1.65 | 0.5085 | 0.0070 | |||||

| US808513CD58 / Charles Schwab Corp. (The) | 1.59 | 1.21 | 0.5038 | 0.0048 | |||||

| US06051GKD06 / Bank of America Corp | 1.58 | 2.19 | 0.5014 | 0.0093 | |||||

| R2RX34 / Regal Rexnord Corporation - Depositary Receipt (Common Stock) | 1.57 | 0.58 | 0.4976 | 0.0016 | |||||

| US723787AQ06 / Pioneer Natural Resources Co | 1.54 | 2.61 | 0.4863 | 0.0113 | |||||

| US50212YAH71 / LPL Holdings, Inc. | 1.53 | 0.79 | 0.4834 | 0.0025 | |||||

| US04002VAC54 / AREIT 2022-CRE6 Trust | 1.51 | -0.39 | 0.4789 | -0.0034 | |||||

| CBRE Services Inc / DBT (US12505BAK61) | 1.49 | 0.4729 | 0.4729 | ||||||

| US53948HAC07 / LoanCore 2021-CRE6 Issuer Ltd | 1.49 | -0.73 | 0.4713 | -0.0047 | |||||

| US446413AS53 / HUNTINGTON INGALLS INDUS COMPANY GUAR 05/25 3.844 | 1.49 | 0.34 | 0.4703 | 0.0002 | |||||

| US57563RRZ46 / MASSACHUSETTS ST EDUCTNL FING AUTH | 1.49 | 1.78 | 0.4700 | 0.0070 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.47 | 0.4648 | 0.4648 | ||||||

| US08576PAF80 / Berry Global Inc | 1.46 | 0.97 | 0.4630 | 0.0031 | |||||

| Angel Oak Mortgage Trust 2024-10 / ABS-MBS (US034933AA90) | 1.46 | -3.64 | 0.4606 | -0.0188 | |||||

| Government National Mortgage Association / ABS-MBS (US38380LBW28) | 1.45 | 0.4600 | 0.4600 | ||||||

| US571903BH57 / Marriott International Inc/MD | 1.45 | 0.63 | 0.4578 | 0.0017 | |||||

| US74730DAC74 / Qatar Petroleum | 1.43 | 3.40 | 0.4521 | 0.0139 | |||||

| US72650RBN17 / Plains All American Pipeline LP / PAA Finance Corp | 1.42 | 1.21 | 0.4504 | 0.0040 | |||||

| Molex Electronic Technologies LLC / DBT (US60856BAF13) | 1.41 | 0.4465 | 0.4465 | ||||||

| US29250NAZ87 / Enbridge Inc | 1.41 | 1.88 | 0.4459 | 0.0070 | |||||

| US06738EBU82 / Barclays PLC | 1.38 | 0.88 | 0.4375 | 0.0028 | |||||

| US88032WBA36 / Tencent Holdings Ltd | 1.38 | 3.54 | 0.4353 | 0.0136 | |||||

| US55336VAR15 / MPLX LP | 1.38 | 1.33 | 0.4352 | 0.0044 | |||||

| US05635JAA88 / Bacardi Ltd / Bacardi-Martini BV | 1.37 | 1.25 | 0.4347 | 0.0044 | |||||

| US88948ABC09 / Toll Road Investors Partnership II LP | 1.37 | 2.63 | 0.4327 | 0.0098 | |||||

| US46590XAN66 / CORP. NOTE | 1.36 | 2.10 | 0.4317 | 0.0076 | |||||

| EFN / Element Fleet Management Corp. | 1.25 | 0.3968 | 0.3968 | ||||||

| US889184AD90 / Toledo Hospital/The | 1.24 | 0.57 | 0.3937 | 0.0011 | |||||

| US26874RAJ77 / Eni SpA | 1.24 | 1.98 | 0.3921 | 0.0066 | |||||

| US62878U2F87 / NBN Co Ltd | 1.23 | 1.32 | 0.3902 | 0.0043 | |||||

| US501889AF63 / LKQ Corp | 1.21 | 0.33 | 0.3839 | 0.0003 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.21 | -3.51 | 0.3833 | -0.0151 | |||||

| US67078AAF03 / nVent Finance Sarl | 1.20 | -0.58 | 0.3811 | -0.0032 | |||||

| US446150BC73 / Huntington Bancshares Inc/OH | 1.19 | 0.42 | 0.3758 | 0.0005 | |||||

| US442851AJ03 / Howard University, Series 2020 | 1.18 | 1.02 | 0.3744 | 0.0026 | |||||

| OBX 2024-NQM2 Trust / ABS-MBS (US67118HAA86) | 1.18 | -6.72 | 0.3732 | -0.0281 | |||||

| US378272BD96 / Glencore Funding LLC | 1.16 | 0.79 | 0.3657 | 0.0018 | |||||

| Government National Mortgage Association / ABS-MBS (US38384LAF67) | 1.13 | 0.3566 | 0.3566 | ||||||

| US034863AR12 / Anglo American Capital PLC | 1.12 | -26.94 | 0.3555 | -0.1323 | |||||

| US03880KAC80 / Arbor Realty Commercial Real Estate Notes 2021-FL3 Ltd | 1.10 | -0.90 | 0.3493 | -0.0039 | |||||

| US55903VBC63 / Warnermedia Holdings Inc | 1.09 | -3.02 | 0.3452 | -0.0117 | |||||

| US00500RAC97 / ACREC 2021-FL1 Ltd | 1.08 | -0.64 | 0.3416 | -0.0031 | |||||

| US88948ABE64 / Toll Road Investors Partnership II LP | 1.05 | 6.31 | 0.3307 | 0.0186 | |||||

| US042735BF63 / Arrow Electronics Inc | 1.03 | 1.18 | 0.3250 | 0.0030 | |||||

| Government National Mortgage Association / ABS-MBS (US38383KU425) | 0.99 | 0.3131 | 0.3131 | ||||||

| US44891ABZ93 / Hyundai Capital America | 0.96 | 1.05 | 0.3035 | 0.0021 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 0.95 | -1.45 | 0.3014 | -0.0053 | |||||

| US61747YEC57 / Morgan Stanley | 0.94 | 1.18 | 0.2985 | 0.0028 | |||||

| US108555GF49 / BRIDGEVIEW IL | 0.94 | 0.21 | 0.2984 | 0.0001 | |||||

| Penske Truck Leasing Co Lp / PTL Finance Corp / DBT (US709599BZ68) | 0.93 | 0.98 | 0.2935 | 0.0021 | |||||

| US22822VAH42 / Crown Castle International Corp | 0.93 | 0.76 | 0.2931 | 0.0015 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.92 | 0.2927 | 0.2927 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.92 | -3.05 | 0.2924 | -0.0097 | |||||

| US29278GAZ19 / Enel Finance International NV | 0.90 | -0.77 | 0.2853 | -0.0028 | |||||

| PFP 2024-11 Ltd / ABS-CBDO (US69291WAA09) | 0.90 | -0.44 | 0.2852 | -0.0021 | |||||

| US694308JF52 / Pacific Gas and Electric Co | 0.90 | 1.82 | 0.2837 | 0.0045 | |||||

| Palmer Square Loan Funding 2025-1 Ltd / ABS-CBDO (US69704CAC10) | 0.89 | 0.2809 | 0.2809 | ||||||

| US501889AD16 / LKQ Corp | 0.88 | 0.34 | 0.2786 | 0.0000 | |||||

| US92345YAH99 / Verisk Analytics Inc | 0.88 | 0.34 | 0.2785 | 0.0002 | |||||

| US38141GXM13 / Goldman Sachs Group Inc/The | 0.88 | 1.04 | 0.2769 | 0.0020 | |||||

| US22822VAT89 / CROWN CASTLE INTL CORP SR UNSECURED 01/31 2.25 | 0.86 | 2.13 | 0.2732 | 0.0048 | |||||

| US55608JBQ04 / Macquarie Group Ltd | 0.86 | 0.00 | 0.2721 | -0.0006 | |||||

| US842400EB53 / Southern California Edison 6.65% Notes 4/1/29 | 0.85 | 2.42 | 0.2682 | 0.0056 | |||||

| US444859BT81 / Humana, Inc. | 0.84 | 1.58 | 0.2643 | 0.0033 | |||||

| US674599ED34 / Occidental Petroleum Corp | 0.83 | 0.2619 | 0.2619 | ||||||

| US36264FAL58 / GSK Consumer Healthcare Capital US LLC | 0.83 | 1.97 | 0.2618 | 0.0044 | |||||

| US61746BEF94 / Morgan Stanley | 0.82 | 0.74 | 0.2584 | 0.0013 | |||||

| US05401AAR23 / Avolon Holdings Funding Ltd | 0.82 | 0.74 | 0.2582 | 0.0015 | |||||

| B1BT34 / Truist Financial Corporation - Depositary Receipt (Common Stock) | 0.81 | 1.13 | 0.2551 | 0.0019 | |||||

| US78448TAB89 / SMBC Aviation Capital Finance DAC | 0.80 | 0.88 | 0.2528 | 0.0016 | |||||

| US 5YR NOTE (CBT) JUN25 / DIR (000000000) | 0.78 | 0.2480 | 0.2480 | ||||||

| Government National Mortgage Association / ABS-MBS (US38380LCL53) | 0.78 | 0.2479 | 0.2479 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.77 | -1.78 | 0.2448 | -0.0051 | |||||

| US034863BA77 / Anglo American Capital PLC | 0.77 | 1.84 | 0.2447 | 0.0036 | |||||

| US055731AC71 / BSPDF 2021-FL1 Issuer Ltd | 0.77 | 0.92 | 0.2431 | 0.0015 | |||||

| LAD Auto Receivables Trust 2025-1 / ABS-O (US505712AB53) | 0.77 | 0.2422 | 0.2422 | ||||||

| Neuberger Berman Loan Advisers NBLA CLO 53 Ltd / ABS-CBDO (US64135WAN39) | 0.76 | -0.79 | 0.2398 | -0.0025 | |||||

| US85855CAA80 / Stellantis Finance US Inc | 0.72 | 0.84 | 0.2278 | 0.0013 | |||||

| PFS Financing Corp / ABS-O (US69335PFS92) | 0.72 | 0.2274 | 0.2274 | ||||||

| US571903BG74 / Marriott International Inc/MD | 0.72 | 1.70 | 0.2269 | 0.0032 | |||||

| US92345YAF34 / Verisk Analytics Inc. | 0.71 | 1.59 | 0.2234 | 0.0029 | |||||

| US54750AAA43 / Low Income Investment Fund | 0.69 | 1.02 | 0.2189 | 0.0016 | |||||

| Government National Mortgage Association / ABS-MBS (US38384LAY56) | 0.69 | 0.2184 | 0.2184 | ||||||

| US637417AS53 / NNN REIT, Inc. | 0.68 | 0.44 | 0.2163 | 0.0004 | |||||

| EFN / Element Fleet Management Corp. | 0.66 | 0.30 | 0.2102 | -0.0001 | |||||

| Verus Securitization Trust 2024-1 / ABS-MBS (US92540EAA10) | 0.66 | -10.72 | 0.2086 | -0.0254 | |||||

| CABK / CaixaBank, S.A. | 0.66 | 1.39 | 0.2079 | 0.0026 | |||||

| Penske Truck Leasing Co Lp / PTL Finance Corp / DBT (US709599BY93) | 0.66 | 0.31 | 0.2074 | 0.0000 | |||||

| GXO / GXO Logistics, Inc. | 0.64 | -1.09 | 0.2012 | -0.0027 | |||||

| FCNCO / First Citizens BancShares, Inc. - Preferred Stock | 0.63 | 0.1998 | 0.1998 | ||||||

| US106230AA39 / Brazos Securitization LLC | 0.63 | -4.13 | 0.1985 | -0.0091 | |||||

| Palmer Square Loan Funding 2025-1 Ltd / ABS-CBDO (US69704CAA53) | 0.60 | 0.1885 | 0.1885 | ||||||

| US87612GAC50 / Targa Resources Corporation | 0.59 | -0.50 | 0.1879 | -0.0013 | |||||

| Government National Mortgage Association / ABS-MBS (US38380LYS68) | 0.59 | 0.1873 | 0.1873 | ||||||

| US05401AAJ07 / Avolon Holdings Funding Ltd | 0.56 | 0.36 | 0.1786 | 0.0001 | |||||

| AmeriCredit Automobile Receivables Trust 2024-1 / ABS-O (US023947AC87) | 0.56 | -32.03 | 0.1760 | -0.0837 | |||||

| US00131LAJ44 / AIA Group Ltd | 0.54 | 2.29 | 0.1701 | 0.0032 | |||||

| US20848FAA84 / Conservation Fund | 0.53 | 4.30 | 0.1692 | 0.0065 | |||||

| AGCO / AGCO Corporation | 0.53 | -1.13 | 0.1663 | -0.0022 | |||||

| GreatAmerica Leasing Receivables Funding LLC / ABS-O (US39154GAH92) | 0.52 | 0.1631 | 0.1631 | ||||||

| US87612BBN10 / CORP. NOTE | 0.51 | 0.00 | 0.1612 | -0.0006 | |||||

| Morgan Stanley Residential Mortgage Loan Trust 2024-NQM3 / ABS-MBS (US61776UAA51) | 0.50 | -6.68 | 0.1594 | -0.0118 | |||||

| Government National Mortgage Association / ABS-MBS (US38382YKP78) | 0.49 | 0.1552 | 0.1552 | ||||||

| IQVIA Inc / DBT (US46266TAC27) | 0.48 | 0.21 | 0.1520 | -0.0001 | |||||

| US38122NB769 / GOLDEN ST TOBACCO SECURITIZATI GLDGEN 06/46 FIXED 3 | 0.47 | -5.81 | 0.1488 | -0.0096 | |||||

| Provident Funding Mortgage Trust 2024-1 / ABS-MBS (US74389BAC54) | 0.46 | -4.13 | 0.1468 | -0.0068 | |||||

| US88948ABB26 / Toll Road Investors Partnership II LP | 0.46 | 1.79 | 0.1446 | 0.0024 | |||||

| US251526CP29 / Deutsche Bank AG/New York NY | 0.44 | 1.15 | 0.1393 | 0.0010 | |||||

| US85855CAB63 / Stellantis Finance US Inc | 0.44 | -1.13 | 0.1388 | -0.0018 | |||||

| US808513CG89 / Charles Schwab Corp/The | 0.43 | 0.23 | 0.1371 | -0.0002 | |||||

| US88581EAF88 / 3650R 2021-PF1 Commercial Mortgage Trust | 0.41 | -3.06 | 0.1305 | -0.0045 | |||||

| SBNA Auto Lease Trust 2025-A / ABS-O (US78437KAB08) | 0.41 | 0.1298 | 0.1298 | ||||||

| US694308KF34 / Pacific Gas and Electric Co | 0.41 | 1.50 | 0.1285 | 0.0014 | |||||

| Business Jet Securities 2024-1 LLC / ABS-O (US12327CAA27) | 0.40 | -4.56 | 0.1260 | -0.0064 | |||||

| M&T Bank Auto Receivables Trust 2025-1 / ABS-O (US55287XAB10) | 0.40 | 0.1251 | 0.1251 | ||||||

| GLS Auto Receivables Issuer Trust 2024-2 / ABS-O (US37964VAB36) | 0.39 | -41.52 | 0.1224 | -0.0873 | |||||

| US161175CM43 / Charter Communications Operating LLC / Charter Communications Operating Capital | 0.38 | 0.00 | 0.1200 | -0.0003 | |||||

| OBX 2024-NQM12 Trust / ABS-MBS (US67448PAA12) | 0.37 | -3.87 | 0.1181 | -0.0052 | |||||

| US00135TAD63 / AIB Group PLC | 0.37 | 1.09 | 0.1178 | 0.0007 | |||||

| Kubota Credit Owner Trust 2025-1 / ABS-O (US50117FAB76) | 0.37 | 0.1175 | 0.1175 | ||||||

| IQVIA Inc / DBT (US46266TAF57) | 0.37 | 0.27 | 0.1161 | 0.0002 | |||||

| US0158578734 / Algonquin Power & Utilities Corp | 0.37 | 0.27 | 0.1159 | -0.0001 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0.36 | 0.28 | 0.1141 | 0.0001 | |||||

| Alinea CLO 2018-1 Ltd / ABS-CBDO (US016269AE22) | 0.36 | -33.46 | 0.1127 | -0.0571 | |||||

| OXYD / Occidental Petroleum Corporation - Depositary Receipt (Common Stock) | 0.35 | -3.85 | 0.1108 | -0.0050 | |||||

| US694308KL02 / Pacific Gas and Electric Co | 0.34 | 1.82 | 0.1066 | 0.0017 | |||||

| Berry Global Inc / DBT (US08576PAL58) | 0.33 | 1.22 | 0.1052 | 0.0010 | |||||

| US87612GAA94 / Targa Resources Corp | 0.33 | 0.31 | 0.1032 | -0.0001 | |||||

| US88948ABG13 / Toll Road Investors Partnership II LP | 0.32 | 8.42 | 0.1021 | 0.0076 | |||||

| US161175AY09 / Charter Communications Operating LLC / Charter Communications Operating Capital | 0.31 | 0.00 | 0.0986 | -0.0003 | |||||

| BDS 2024-FL13 LLC / ABS-CBDO (US05555MAA71) | 0.30 | -1.30 | 0.0961 | -0.0013 | |||||

| ARI Fleet Lease Trust 2025-A / ABS-O (US04033CAB28) | 0.30 | 0.0942 | 0.0942 | ||||||

| American Credit Acceptance Receivables Trust 2024-2 / ABS-O (US02531BAA70) | 0.30 | -45.17 | 0.0934 | -0.0775 | |||||

| US00774MAX39 / AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 0.29 | 0.69 | 0.0928 | 0.0004 | |||||

| US61761JZN26 / Morgan Stanley | 0.29 | 0.70 | 0.0910 | 0.0006 | |||||

| Chase Auto Owner Trust 2024-5 / ABS-O (US16144QAB14) | 0.29 | -19.21 | 0.0907 | -0.0219 | |||||

| US05493NAA00 / BDS 2021-FL9 Ltd | 0.28 | 0.00 | 0.0900 | -0.0003 | |||||

| US 2YR NOTE (CBT) JUN25 / DIR (000000000) | 0.28 | 0.0877 | 0.0877 | ||||||

| OBX 2024-NQM1 Trust / ABS-MBS (US67448LAA08) | 0.26 | -6.20 | 0.0815 | -0.0056 | |||||

| Verus Securitization Trust 2024-8 / ABS-MBS (US92540PAA66) | 0.26 | -4.49 | 0.0809 | -0.0040 | |||||

| ENRSIS / Enel Americas SA | 0.25 | 0.40 | 0.0790 | 0.0002 | |||||

| US75575WAA45 / Ready Capital Mortgage Financing 2021-FL7 LLC | 0.25 | -0.81 | 0.0776 | -0.0010 | |||||

| EQT Trust 2024-EXTR / ABS-MBS (US29439DAC56) | 0.24 | 0.42 | 0.0756 | 0.0003 | |||||

| COMM 2024-CBM Mortgage Trust / ABS-MBS (US12674GAC87) | 0.22 | 0.92 | 0.0693 | 0.0003 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.20 | 0.00 | 0.0638 | -0.0001 | |||||

| US75575WAC01 / Ready Capital Mortgage Financing 2021-FL7 LLC | 0.20 | 0.00 | 0.0631 | -0.0002 | |||||

| US36269EAB56 / GLS Auto Select Receivables Trust 2023-2 | 0.20 | -21.96 | 0.0631 | -0.0180 | |||||

| US31385HZC95 / Fannie Mae Pool | 0.20 | -5.26 | 0.0629 | -0.0035 | |||||

| Westlake Automobile Receivables Trust 2024-1 / ABS-O (US96043RAC16) | 0.19 | -50.39 | 0.0613 | -0.0624 | |||||

| Enterprise Fleet Financing 2025-1 LLC / ABS-O (US29390HAB50) | 0.19 | 0.00 | 0.0596 | -0.0001 | |||||

| Verus Securitization Trust 2024-1 / ABS-MBS (US92540EAB92) | 0.18 | -10.68 | 0.0583 | -0.0072 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.18 | 0.0568 | 0.0568 | ||||||

| US04033GAB32 / ARI Fleet Lease Trust 2023-B | 0.17 | -17.22 | 0.0549 | -0.0114 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.16 | -3.64 | 0.0505 | -0.0020 | |||||

| US251526CS67 / Deutsche Bank AG/New York NY | 0.16 | 0.64 | 0.0498 | 0.0002 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.15 | -1.32 | 0.0475 | -0.0010 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.13 | -0.75 | 0.0421 | -0.0005 | |||||

| US 10YR NOTE (CBT)JUN25 / DIR (000000000) | 0.13 | 0.0397 | 0.0397 | ||||||

| US36200MN333 / Ginnie Mae I Pool | 0.12 | -5.56 | 0.0378 | -0.0023 | |||||

| Government National Mortgage Association / ABS-MBS (US38380LQE64) | 0.12 | 0.0377 | 0.0377 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.12 | -4.84 | 0.0375 | -0.0020 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.11 | -1.79 | 0.0349 | -0.0007 | |||||

| US40064REK14 / GUAM INTERNATIONAL ARPT AUTH | 0.10 | 3.23 | 0.0307 | 0.0011 | |||||

| Bridgecrest Lending Auto Securitization Trust 2024-2 / ABS-O (US10805MAB37) | 0.09 | -71.90 | 0.0297 | -0.0756 | |||||

| OBX 2024-NQM1 Trust / ABS-MBS (US67448LAB80) | 0.08 | -6.02 | 0.0247 | -0.0017 | |||||

| US36241KK568 / Ginnie Mae I Pool | 0.05 | -3.92 | 0.0158 | -0.0006 | |||||

| US762323BU65 / RHODE ISLAND ST STUDENT LOAN AUTH LOAN REVENUE | 0.04 | 2.38 | 0.0137 | 0.0001 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.04 | 0.0119 | 0.0119 | ||||||

| US055731AA16 / BSPDF 2021-FL1 Issuer Ltd | 0.03 | -45.00 | 0.0107 | -0.0084 | |||||

| US24702EAB65 / Dell Equipment Finance Trust 2023-3 | 0.03 | -73.15 | 0.0094 | -0.0250 | |||||

| Santander Drive Auto Receivables Trust 2024-1 / ABS-O (US80288AAB89) | 0.02 | -83.84 | 0.0052 | -0.0263 | |||||

| US59447TH891 / Michigan Finance Authority | 0.01 | 0.00 | 0.0046 | 0.0001 | |||||

| SBNA Auto Lease Trust 2024-A / ABS-O (US78414SAC89) | 0.01 | -92.35 | 0.0043 | -0.0496 | |||||

| US83162CPX55 / United States Small Business Administration | 0.01 | 0.00 | 0.0038 | -0.0000 | |||||

| US83162CPY39 / United States Small Business Administration | 0.01 | 0.00 | 0.0027 | -0.0000 | |||||

| American Credit Acceptance Receivables Trust 2024-1 / ABS-O (US02531AAA97) | 0.01 | -93.59 | 0.0017 | -0.0230 | |||||

| US31297C5V83 / Freddie Mac Gold Pool | 0.00 | 0.00 | 0.0011 | -0.0000 |