Mga Batayang Estadistika

| Nilai Portofolio | $ 890,293,629 |

| Posisi Saat Ini | 161 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

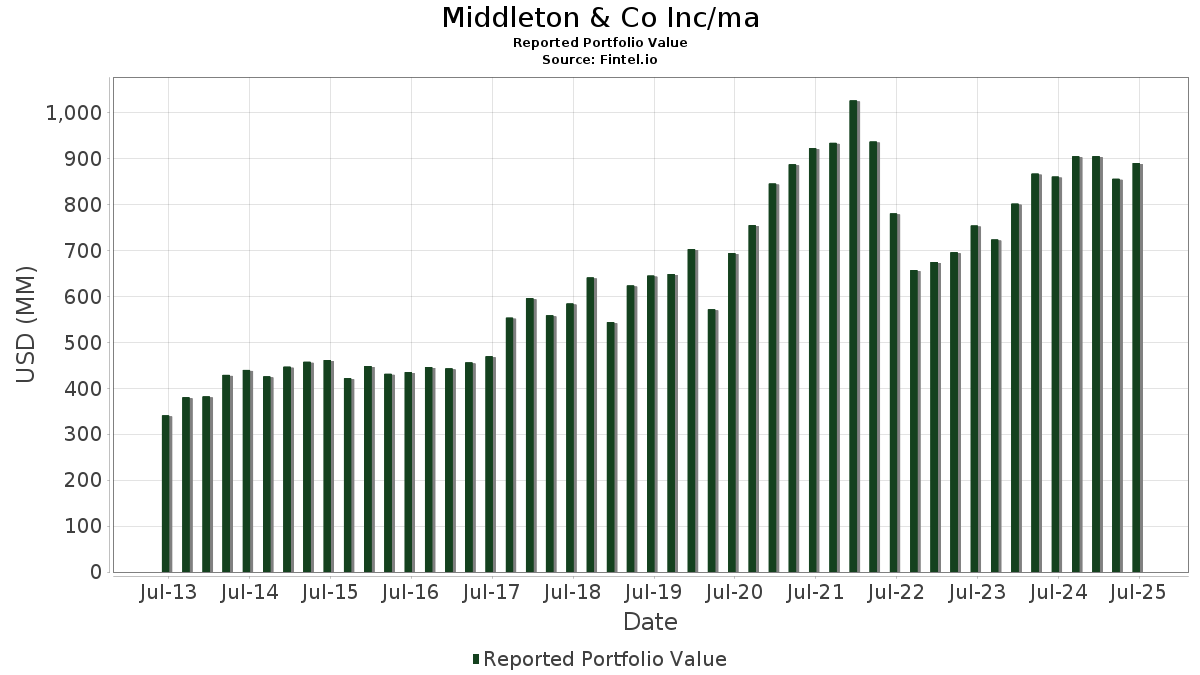

Middleton & Co Inc/ma telah mengungkapkan total kepemilikan 161 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 890,293,629 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Middleton & Co Inc/ma adalah Amazon.com, Inc. (US:AMZN) , Apple Inc. (US:AAPL) , Alphabet Inc. (US:GOOG) , Broadcom Inc. (US:AVGO) , and iShares Trust - iShares Core S&P 500 ETF (US:IVV) . Posisi baru Middleton & Co Inc/ma meliputi: American Water Works Company, Inc. (US:AWK) , Ralliant Corporation (US:RAL) , The Kroger Co. (US:KR) , iShares Trust - iShares 1-3 Year International Treasury Bond ETF (US:ISHG) , and Netflix, Inc. (US:NFLX) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.14 | 37.86 | 4.2528 | 1.4501 | |

| 0.06 | 29.41 | 3.3035 | 0.6870 | |

| 0.25 | 55.52 | 6.2356 | 0.4835 | |

| 0.02 | 20.09 | 2.2562 | 0.4351 | |

| 0.23 | 41.13 | 4.6203 | 0.3799 | |

| 0.06 | 9.24 | 1.0378 | 0.3610 | |

| 0.02 | 2.98 | 0.3343 | 0.3343 | |

| 0.02 | 18.21 | 2.0456 | 0.3069 | |

| 0.02 | 5.95 | 0.6686 | 0.3043 | |

| 0.10 | 19.92 | 2.2380 | 0.2817 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.24 | 48.28 | 5.4234 | -1.1102 | |

| 0.03 | 8.34 | 0.9365 | -0.7147 | |

| 0.21 | 19.07 | 2.1415 | -0.4271 | |

| 0.08 | 15.39 | 1.7285 | -0.3905 | |

| 0.12 | 6.30 | 0.7071 | -0.3714 | |

| 0.05 | 8.10 | 0.9099 | -0.2906 | |

| 0.12 | 12.60 | 1.4151 | -0.2885 | |

| 0.15 | 11.55 | 1.2977 | -0.2260 | |

| 0.08 | 26.76 | 3.0052 | -0.2231 | |

| 0.03 | 12.45 | 1.3982 | -0.2085 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-06 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AMZN / Amazon.com, Inc. | 0.25 | -2.22 | 55.52 | 12.75 | 6.2356 | 0.4835 | |||

| AAPL / Apple Inc. | 0.24 | -6.53 | 48.28 | -13.66 | 5.4234 | -1.1102 | |||

| GOOG / Alphabet Inc. | 0.23 | -0.56 | 41.13 | 13.33 | 4.6203 | 0.3799 | |||

| AVGO / Broadcom Inc. | 0.14 | -4.14 | 37.86 | 57.82 | 4.2528 | 1.4501 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.05 | -3.87 | 31.18 | 6.22 | 3.5019 | 0.0730 | |||

| MSFT / Microsoft Corporation | 0.06 | -0.90 | 29.41 | 31.32 | 3.3035 | 0.6870 | |||

| V / Visa Inc. | 0.08 | -4.43 | 26.76 | -3.18 | 3.0052 | -0.2231 | |||

| COST / Costco Wholesale Corporation | 0.03 | -4.87 | 24.89 | -0.43 | 2.7958 | -0.1247 | |||

| JPM / JPMorgan Chase & Co. | 0.08 | -6.51 | 22.17 | 10.49 | 2.4899 | 0.1460 | |||

| NOW / ServiceNow, Inc. | 0.02 | -0.21 | 20.09 | 28.86 | 2.2562 | 0.4351 | |||

| PANW / Palo Alto Networks, Inc. | 0.10 | -0.78 | 19.92 | 18.98 | 2.2380 | 0.2817 | |||

| ORLY / O'Reilly Automotive, Inc. | 0.21 | 1,278.31 | 19.07 | -13.28 | 2.1415 | -0.4271 | |||

| INTU / Intuit Inc. | 0.02 | -4.61 | 18.21 | 22.37 | 2.0456 | 0.3069 | |||

| CRM / Salesforce, Inc. | 0.06 | -0.22 | 16.19 | 1.39 | 1.8189 | -0.0470 | |||

| ABBV / AbbVie Inc. | 0.08 | -4.23 | 15.39 | -15.16 | 1.7285 | -0.3905 | |||

| DHR / Danaher Corporation | 0.07 | -3.28 | 14.27 | -6.80 | 1.6025 | -0.1859 | |||

| QCOM / QUALCOMM Incorporated | 0.09 | -0.32 | 13.62 | 3.35 | 1.5298 | -0.0098 | |||

| VRSK / Verisk Analytics, Inc. | 0.04 | -2.88 | 13.17 | 1.65 | 1.4794 | -0.0344 | |||

| IEF / iShares Trust - iShares 7-10 Year Treasury Bond ETF | 0.13 | -1.99 | 12.90 | -1.57 | 1.4489 | -0.0822 | |||

| NEE / NextEra Energy, Inc. | 0.19 | -4.47 | 12.89 | -6.45 | 1.4477 | -0.1618 | |||

| XOM / Exxon Mobil Corporation | 0.12 | -4.68 | 12.60 | -13.60 | 1.4151 | -0.2885 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.03 | -0.77 | 12.45 | -9.49 | 1.3982 | -0.2085 | |||

| AMT / American Tower Corporation | 0.06 | -2.95 | 12.37 | -1.43 | 1.3895 | -0.0766 | |||

| STE / STERIS plc | 0.05 | -2.73 | 11.87 | 3.10 | 1.3335 | -0.0118 | |||

| MRK / Merck & Co., Inc. | 0.15 | 0.45 | 11.55 | -11.42 | 1.2977 | -0.2260 | |||

| SPGI / S&P Global Inc. | 0.02 | -4.28 | 11.38 | -0.66 | 1.2785 | -0.0602 | |||

| META / Meta Platforms, Inc. | 0.01 | -4.00 | 10.95 | 22.93 | 1.2301 | 0.1894 | |||

| XYL / Xylem Inc. | 0.08 | 1.85 | 10.53 | 10.29 | 1.1824 | 0.0673 | |||

| SNPS / Synopsys, Inc. | 0.02 | 2.24 | 10.06 | 22.22 | 1.1300 | 0.1684 | |||

| VGSH / Vanguard Scottsdale Funds - Vanguard Short-Term Treasury ETF | 0.16 | 9.98 | 9.67 | 10.16 | 1.0856 | 0.0605 | |||

| ADBE / Adobe Inc. | 0.02 | 8.53 | 9.48 | 9.47 | 1.0646 | 0.0532 | |||

| NVDA / NVIDIA Corporation | 0.06 | 9.40 | 9.24 | 59.49 | 1.0378 | 0.3610 | |||

| EQIX / Equinix, Inc. | 0.01 | -0.76 | 9.16 | -3.18 | 1.0293 | -0.0764 | |||

| SYK / Stryker Corporation | 0.02 | -2.02 | 8.84 | 4.13 | 0.9935 | 0.0012 | |||

| ECL / Ecolab Inc. | 0.03 | -4.20 | 8.77 | 1.82 | 0.9850 | -0.0212 | |||

| MDLZ / Mondelez International, Inc. | 0.12 | -1.07 | 8.39 | -1.66 | 0.9428 | -0.0545 | |||

| UNH / UnitedHealth Group Incorporated | 0.03 | -0.97 | 8.34 | -41.01 | 0.9365 | -0.7147 | |||

| FI / Fiserv, Inc. | 0.05 | 0.97 | 8.10 | -21.18 | 0.9099 | -0.2906 | |||

| VGIT / Vanguard Scottsdale Funds - Vanguard Intermediate-Term Treasury ETF | 0.12 | 14.83 | 7.25 | 15.62 | 0.8142 | 0.0818 | |||

| MSCI / MSCI Inc. | 0.01 | 0.72 | 7.17 | 2.72 | 0.8056 | -0.0101 | |||

| IDXX / IDEXX Laboratories, Inc. | 0.01 | 5.51 | 7.14 | 34.76 | 0.8017 | 0.1829 | |||

| IQV / IQVIA Holdings Inc. | 0.04 | -4.40 | 6.95 | -14.55 | 0.7805 | -0.1695 | |||

| IQLT / iShares Trust - iShares MSCI Intl Quality Factor ETF | 0.15 | 5.46 | 6.69 | 14.84 | 0.7512 | 0.0709 | |||

| GOOG / Alphabet Inc. | 0.04 | -9.18 | 6.40 | 3.13 | 0.7183 | -0.0062 | |||

| FTV / Fortive Corporation | 0.12 | -4.27 | 6.30 | -31.81 | 0.7071 | -0.3714 | |||

| ETN / Eaton Corporation plc | 0.02 | 45.37 | 5.95 | 90.95 | 0.6686 | 0.3043 | |||

| CEG / Constellation Energy Corporation | 0.02 | -12.06 | 5.86 | 40.77 | 0.6586 | 0.1720 | |||

| VCSH / Vanguard Scottsdale Funds - Vanguard Short-Term Corporate Bond ETF | 0.07 | -5.70 | 5.48 | -5.03 | 0.6156 | -0.0586 | |||

| CB / Chubb Limited | 0.02 | -0.86 | 5.16 | -4.89 | 0.5791 | -0.0542 | |||

| IJH / iShares Trust - iShares Core S&P Mid-Cap ETF | 0.08 | -4.97 | 5.10 | 1.01 | 0.5725 | -0.0170 | |||

| IJR / iShares Trust - iShares Core S&P Small-Cap ETF | 0.04 | -3.32 | 4.78 | 1.06 | 0.5368 | -0.0157 | |||

| ABT / Abbott Laboratories | 0.03 | -1.03 | 4.49 | 1.47 | 0.5042 | -0.0126 | |||

| PAAA / PGIM ETF Trust - PGIM AAA CLO ETF | 0.08 | 2.25 | 4.32 | 2.54 | 0.4855 | -0.0070 | |||

| EXC / Exelon Corporation | 0.10 | 3.58 | 4.24 | -2.39 | 0.4764 | -0.0313 | |||

| ODFL / Old Dominion Freight Line, Inc. | 0.03 | -1.51 | 4.23 | -3.40 | 0.4756 | -0.0364 | |||

| BR / Broadridge Financial Solutions, Inc. | 0.02 | -6.90 | 4.12 | -6.69 | 0.4624 | -0.0530 | |||

| PEP / PepsiCo, Inc. | 0.03 | 4.95 | 4.00 | -7.57 | 0.4496 | -0.0564 | |||

| ROP / Roper Technologies, Inc. | 0.01 | -11.58 | 3.81 | -14.98 | 0.4277 | -0.0956 | |||

| WCN / Waste Connections, Inc. | 0.02 | 44.22 | 3.49 | 37.99 | 0.3917 | 0.0964 | |||

| WSO / Watsco, Inc. | 0.01 | -2.07 | 3.45 | -14.92 | 0.3877 | -0.0862 | |||

| SPY / SPDR S&P 500 ETF | 0.01 | 0.17 | 3.31 | 10.64 | 0.3714 | 0.0222 | |||

| RNR / RenaissanceRe Holdings Ltd. | 0.01 | -3.05 | 3.28 | -1.89 | 0.3680 | -0.0221 | |||

| HD / The Home Depot, Inc. | 0.01 | -6.19 | 3.25 | -6.15 | 0.3652 | -0.0395 | |||

| IWF / iShares Trust - iShares Russell 1000 Growth ETF | 0.01 | -0.61 | 3.09 | 16.86 | 0.3472 | 0.0382 | |||

| AWK / American Water Works Company, Inc. | 0.02 | 2.98 | 0.3343 | 0.3343 | |||||

| USFR / WisdomTree Trust - WisdomTree Floating Rate Treasury Fund | 0.06 | -4.68 | 2.82 | -4.70 | 0.3168 | -0.0290 | |||

| ROL / Rollins, Inc. | 0.04 | -4.64 | 2.49 | -0.44 | 0.2802 | -0.0125 | |||

| IWR / iShares Trust - iShares Russell Mid-Cap ETF | 0.03 | -6.93 | 2.34 | 0.60 | 0.2624 | -0.0088 | |||

| CVX / Chevron Corporation | 0.02 | -12.47 | 2.25 | -25.06 | 0.2530 | -0.0982 | |||

| APTV / Aptiv PLC | 0.03 | -2.53 | 2.24 | 11.73 | 0.2514 | 0.0174 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | 0.00 | 2.19 | -8.73 | 0.2456 | -0.0343 | |||

| MA / Mastercard Incorporated | 0.00 | 4.86 | 2.12 | 7.51 | 0.2381 | 0.0078 | |||

| ZTS / Zoetis Inc. | 0.01 | 4.05 | 2.11 | -1.45 | 0.2364 | -0.0131 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.01 | -1.31 | 2.10 | -19.56 | 0.2360 | -0.0693 | |||

| PG / The Procter & Gamble Company | 0.01 | -10.14 | 2.05 | -16.00 | 0.2300 | -0.0548 | |||

| LOW / Lowe's Companies, Inc. | 0.01 | -12.44 | 1.98 | -16.70 | 0.2218 | -0.0552 | |||

| RAL / Ralliant Corporation | 0.04 | 1.95 | 0.2192 | 0.2192 | |||||

| SBUX / Starbucks Corporation | 0.02 | -26.40 | 1.85 | -31.26 | 0.2083 | -0.1068 | |||

| RTX / RTX Corporation | 0.01 | 0.00 | 1.75 | 10.25 | 0.1971 | 0.0111 | |||

| MNST / Monster Beverage Corporation | 0.03 | -1.59 | 1.68 | 5.34 | 0.1884 | 0.0024 | |||

| JNJ / Johnson & Johnson | 0.01 | -1.26 | 1.63 | -9.06 | 0.1828 | -0.0263 | |||

| LRCX / Lam Research Corporation | 0.02 | 0.00 | 1.58 | 33.93 | 0.1775 | 0.0396 | |||

| ADP / Automatic Data Processing, Inc. | 0.01 | -1.66 | 1.56 | -0.70 | 0.1748 | -0.0083 | |||

| VTEB / Vanguard Municipal Bond Funds - Vanguard Tax-Exempt Bond ETF | 0.03 | 0.00 | 1.52 | -1.23 | 0.1713 | -0.0090 | |||

| DIS / The Walt Disney Company | 0.01 | -15.42 | 1.51 | 6.25 | 0.1699 | 0.0036 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.01 | -4.82 | 1.49 | 0.95 | 0.1674 | -0.0051 | |||

| KR / The Kroger Co. | 0.02 | 1.46 | 0.1637 | 0.1637 | |||||

| EOG / EOG Resources, Inc. | 0.01 | -0.21 | 1.40 | -6.93 | 0.1570 | -0.0184 | |||

| UNP / Union Pacific Corporation | 0.01 | -2.49 | 1.35 | -5.06 | 0.1519 | -0.0145 | |||

| MDY / SPDR S&P MidCap 400 ETF Trust | 0.00 | -2.59 | 1.34 | 3.46 | 0.1510 | -0.0008 | |||

| PSA / Public Storage | 0.00 | -15.94 | 1.28 | -17.57 | 0.1434 | -0.0376 | |||

| BLK / BlackRock, Inc. | 0.00 | 9.51 | 1.21 | 21.43 | 0.1357 | 0.0194 | |||

| IWD / iShares Trust - iShares Russell 1000 Value ETF | 0.01 | 0.00 | 1.11 | 3.27 | 0.1243 | -0.0009 | |||

| ISHG / iShares Trust - iShares 1-3 Year International Treasury Bond ETF | 0.01 | 1.05 | 0.1178 | 0.1178 | |||||

| IWM / iShares Trust - iShares Russell 2000 ETF | 0.00 | -18.47 | 1.05 | -11.79 | 0.1177 | -0.0211 | |||

| MAXJ / iShares Trust - iShares Large Cap Max Buffer Jun ETF | 0.04 | 0.00 | 0.99 | 6.66 | 0.1116 | 0.0028 | |||

| AVUV / American Century ETF Trust - Avantis U.S. Small Cap Value ETF | 0.01 | -8.80 | 0.99 | -4.71 | 0.1114 | -0.0102 | |||

| WMT / Walmart Inc. | 0.01 | 0.00 | 0.98 | 11.34 | 0.1104 | 0.0073 | |||

| AVY / Avery Dennison Corporation | 0.01 | -4.65 | 0.95 | -6.02 | 0.1071 | -0.0114 | |||

| XPO / XPO, Inc. | 0.01 | -9.13 | 0.94 | 6.68 | 0.1059 | 0.0026 | |||

| PAYX / Paychex, Inc. | 0.01 | 0.00 | 0.86 | -5.68 | 0.0970 | -0.0100 | |||

| ORCL / Oracle Corporation | 0.00 | -2.51 | 0.85 | 52.52 | 0.0953 | 0.0303 | |||

| IVW / iShares Trust - iShares S&P 500 Growth ETF | 0.01 | -0.33 | 0.83 | 18.16 | 0.0937 | 0.0113 | |||

| APD / Air Products and Chemicals, Inc. | 0.00 | -4.55 | 0.83 | -8.71 | 0.0931 | -0.0130 | |||

| NOC / Northrop Grumman Corporation | 0.00 | -2.95 | 0.82 | -5.19 | 0.0924 | -0.0090 | |||

| STIP / iShares Trust - iShares 0-5 Year TIPS Bond ETF | 0.01 | 0.00 | 0.70 | -0.42 | 0.0791 | -0.0036 | |||

| NKE / NIKE, Inc. | 0.01 | -29.21 | 0.69 | -20.78 | 0.0780 | -0.0244 | |||

| GLDM / World Gold Trust - SPDR Gold MiniShares Trust | 0.01 | 0.00 | 0.60 | 5.83 | 0.0673 | 0.0012 | |||

| ELV / Elevance Health, Inc. | 0.00 | 0.00 | 0.59 | -10.56 | 0.0666 | -0.0109 | |||

| IVE / iShares Trust - iShares S&P 500 Value ETF | 0.00 | 1.69 | 0.59 | 4.26 | 0.0660 | 0.0002 | |||

| IWP / iShares Trust - iShares Russell Mid-Cap Growth ETF | 0.00 | 0.00 | 0.53 | 18.08 | 0.0595 | 0.0071 | |||

| LLY / Eli Lilly and Company | 0.00 | 0.00 | 0.53 | -5.57 | 0.0591 | -0.0060 | |||

| CGW / Invesco Exchange-Traded Fund Trust II - Invesco S&P Global Water Index ETF | 0.01 | 0.21 | 0.53 | 12.63 | 0.0591 | 0.0044 | |||

| IBM / International Business Machines Corporation | 0.00 | 0.00 | 0.52 | 18.59 | 0.0588 | 0.0072 | |||

| VLTO / Veralto Corporation | 0.01 | -16.38 | 0.52 | -13.33 | 0.0585 | -0.0117 | |||

| CI / The Cigna Group | 0.00 | 0.00 | 0.50 | 0.40 | 0.0566 | -0.0020 | |||

| ACN / Accenture plc | 0.00 | 0.00 | 0.48 | -4.17 | 0.0542 | -0.0047 | |||

| TIP / iShares Trust - iShares TIPS Bond ETF | 0.00 | 0.00 | 0.47 | -0.85 | 0.0525 | -0.0026 | |||

| IBB / iShares Trust - iShares Biotechnology ETF | 0.00 | 0.00 | 0.46 | -1.09 | 0.0512 | -0.0026 | |||

| URI / United Rentals, Inc. | 0.00 | 0.00 | 0.45 | 20.21 | 0.0508 | 0.0068 | |||

| PH / Parker-Hannifin Corporation | 0.00 | -7.58 | 0.43 | 6.23 | 0.0479 | 0.0010 | |||

| ISRG / Intuitive Surgical, Inc. | 0.00 | 0.00 | 0.43 | 9.82 | 0.0478 | 0.0025 | |||

| VB / Vanguard Index Funds - Vanguard Small-Cap ETF | 0.00 | 0.00 | 0.41 | 6.79 | 0.0460 | 0.0012 | |||

| MTD / Mettler-Toledo International Inc. | 0.00 | 0.00 | 0.41 | -0.49 | 0.0455 | -0.0021 | |||

| XHLF / BondBloxx ETF Trust - BondBloxx Bloomberg Six Month Target Duration US Treasury ETF | 0.01 | 0.00 | 0.40 | 0.00 | 0.0452 | -0.0018 | |||

| QQQ / Invesco QQQ Trust, Series 1 | 0.00 | -4.70 | 0.39 | 12.03 | 0.0440 | 0.0032 | |||

| HEQT / Simplify Exchange Traded Funds - Simplify Hedged Equity ETF | 0.01 | 0.00 | 0.39 | 5.11 | 0.0440 | 0.0005 | |||

| ICE / Intercontinental Exchange, Inc. | 0.00 | 0.00 | 0.39 | 6.27 | 0.0439 | 0.0010 | |||

| KO / The Coca-Cola Company | 0.01 | -32.81 | 0.38 | -33.69 | 0.0423 | -0.0240 | |||

| AXP / American Express Company | 0.00 | -5.66 | 0.37 | 11.93 | 0.0412 | 0.0029 | |||

| BAC / Bank of America Corporation | 0.01 | -3.22 | 0.36 | 9.88 | 0.0400 | 0.0021 | |||

| KKR / KKR & Co. Inc. | 0.00 | 0.00 | 0.35 | 14.85 | 0.0392 | 0.0038 | |||

| GLD / SPDR Gold Trust | 0.00 | 0.00 | 0.34 | 5.63 | 0.0381 | 0.0006 | |||

| AGG / iShares Trust - iShares Core U.S. Aggregate Bond ETF | 0.00 | 0.00 | 0.32 | 0.31 | 0.0362 | -0.0013 | |||

| BKNG / Booking Holdings Inc. | 0.00 | 0.00 | 0.30 | 25.94 | 0.0338 | 0.0058 | |||

| AMGN / Amgen Inc. | 0.00 | -15.67 | 0.30 | -24.43 | 0.0337 | -0.0127 | |||

| CL / Colgate-Palmolive Company | 0.00 | 0.00 | 0.29 | -2.99 | 0.0329 | -0.0024 | |||

| EPAM / EPAM Systems, Inc. | 0.00 | 0.00 | 0.27 | 4.58 | 0.0309 | 0.0002 | |||

| IGV / iShares Trust - iShares Expanded Tech-Software Sector ETF | 0.00 | 0.00 | 0.27 | 22.97 | 0.0307 | 0.0048 | |||

| PLD / Prologis, Inc. | 0.00 | 0.00 | 0.26 | -6.09 | 0.0295 | -0.0031 | |||

| WELL / Welltower Inc. | 0.00 | 0.00 | 0.26 | 0.38 | 0.0294 | -0.0011 | |||

| DMAX / iShares Trust - iShares Large Cap Max Buffer Dec ETF | 0.01 | 0.00 | 0.25 | 3.36 | 0.0277 | -0.0002 | |||

| VCIT / Vanguard Scottsdale Funds - Vanguard Intermediate-Term Corporate Bond ETF | 0.00 | -14.81 | 0.24 | -13.45 | 0.0268 | -0.0055 | |||

| IGSB / iShares Trust - iShares 1-5 Year Investment Grade Corporate Bond ETF | 0.00 | 0.00 | 0.24 | 0.85 | 0.0267 | -0.0009 | |||

| IGM / iShares Trust - iShares Expanded Tech Sector ETF | 0.00 | 0.24 | 0.0265 | 0.0265 | |||||

| HON / Honeywell International Inc. | 0.00 | -4.96 | 0.23 | 4.61 | 0.0256 | 0.0001 | |||

| BX / Blackstone Inc. | 0.00 | 0.00 | 0.22 | 7.18 | 0.0252 | 0.0007 | |||

| FTXP / Foothills Exploration, Inc. | 0.00 | 0.22 | 0.0252 | 0.0252 | |||||

| DVY / iShares Trust - iShares Select Dividend ETF | 0.00 | 0.00 | 0.22 | -0.89 | 0.0250 | -0.0013 | |||

| NXPI / NXP Semiconductors N.V. | 0.00 | 0.22 | 0.0249 | 0.0249 | |||||

| CSCO / Cisco Systems, Inc. | 0.00 | 0.22 | 0.0249 | 0.0249 | |||||

| CSX / CSX Corporation | 0.01 | 0.22 | 0.0248 | 0.0248 | |||||

| VO / Vanguard Index Funds - Vanguard Mid-Cap ETF | 0.00 | 0.00 | 0.22 | 8.42 | 0.0246 | 0.0010 | |||

| NFLX / Netflix, Inc. | 0.00 | 0.22 | 0.0245 | 0.0245 | |||||

| MCD / McDonald's Corporation | 0.00 | -6.28 | 0.22 | -12.10 | 0.0245 | -0.0046 | |||

| JMST / J.P. Morgan Exchange-Traded Fund Trust - JPMorgan Ultra-Short Municipal Income ETF | 0.00 | -19.23 | 0.21 | -19.32 | 0.0240 | -0.0069 | |||

| CVS / CVS Health Corporation | 0.00 | -11.43 | 0.21 | -10.13 | 0.0240 | -0.0037 | |||

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.00 | 0.21 | 0.0238 | 0.0238 | |||||

| GXO / GXO Logistics, Inc. | 0.00 | -31.14 | 0.21 | -14.40 | 0.0235 | -0.0050 | |||

| UBER / Uber Technologies, Inc. | 0.00 | 0.20 | 0.0227 | 0.0227 | |||||

| ARRY / Array Technologies, Inc. | 0.02 | -23.19 | 0.14 | -6.80 | 0.0154 | -0.0018 | |||

| NYF / iShares Trust - iShares New York Muni Bond ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| FDS / FactSet Research Systems Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PFE / Pfizer Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PYPL / PayPal Holdings, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ROK / Rockwell Automation, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MMC / Marsh & McLennan Companies, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BDX / Becton, Dickinson and Company | 0.00 | -100.00 | 0.00 | 0.0000 |