Mga Batayang Estadistika

| Nilai Portofolio | $ 164,772,000 |

| Posisi Saat Ini | 102 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

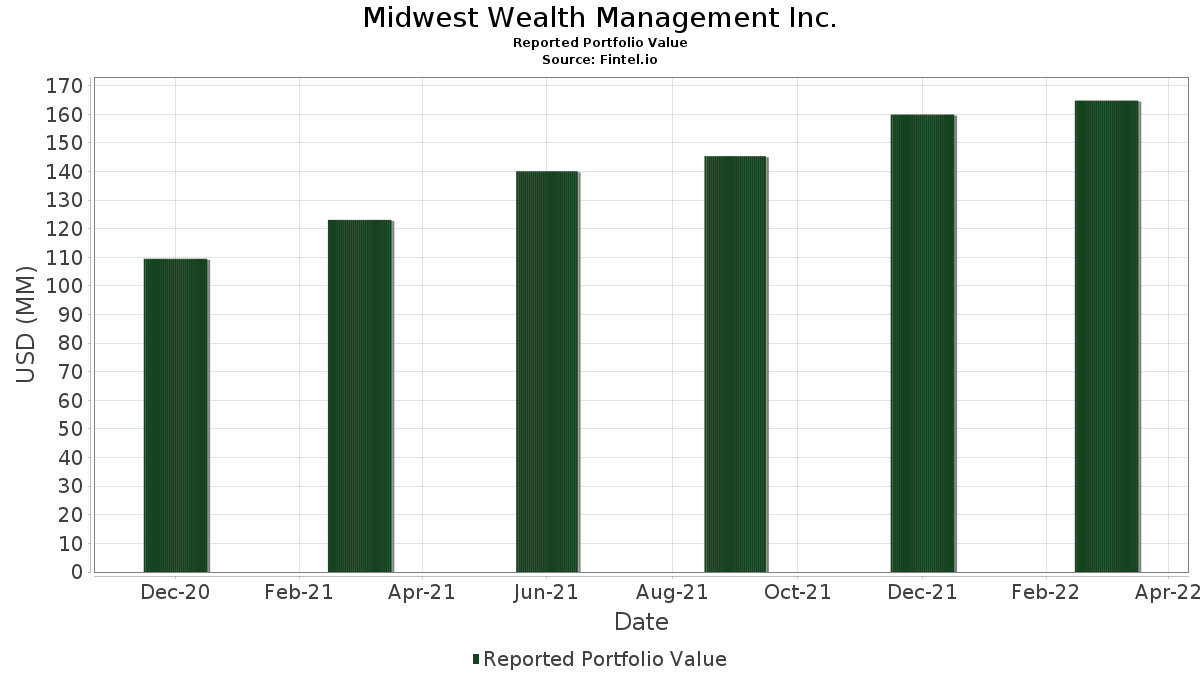

Midwest Wealth Management Inc. telah mengungkapkan total kepemilikan 102 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 164,772,000 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Midwest Wealth Management Inc. adalah Apple Inc. (US:AAPL) , Monolithic Power Systems, Inc. (US:MPWR) , NVIDIA Corporation (US:NVDA) , Broadcom Inc. (US:AVGO) , and UnitedHealth Group Incorporated (US:UNH) . Posisi baru Midwest Wealth Management Inc. meliputi: Broadcom Inc. (US:AVGO) , Antero Resources Corporation (US:AR) , APA Corporation (US:APA) , Chesapeake Energy Corporation (US:CHK) , and Westlake Corporation (US:WLK) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.10 | 3.17 | 1.9257 | 1.9257 | |

| 0.07 | 2.80 | 1.6999 | 1.6999 | |

| 0.07 | 2.71 | 1.6465 | 0.6684 | |

| 0.06 | 3.44 | 2.0865 | 0.4967 | |

| 0.02 | 2.29 | 1.3880 | 0.4129 | |

| 0.06 | 2.17 | 1.3176 | 0.2906 | |

| 0.00 | 0.41 | 0.2519 | 0.2519 | |

| 0.01 | 1.63 | 0.9892 | 0.2281 | |

| 0.00 | 0.37 | 0.2264 | 0.2264 | |

| 0.03 | 2.25 | 1.3649 | 0.2254 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.20 | 0.1226 | -2.2847 | |

| 0.01 | 1.44 | 0.8721 | -0.5670 | |

| 0.01 | 2.74 | 1.6641 | -0.4580 | |

| 0.02 | 2.25 | 1.3686 | -0.4383 | |

| 0.01 | 2.85 | 1.7297 | -0.4012 | |

| 0.02 | 2.69 | 1.6301 | -0.3994 | |

| 0.04 | 2.05 | 1.2441 | -0.3526 | |

| 0.02 | 1.80 | 1.0930 | -0.2960 | |

| 0.01 | 1.74 | 1.0542 | -0.2892 | |

| 0.02 | 3.08 | 1.8674 | -0.2734 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2022-05-25 untuk periode pelaporan 2022-03-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AAPL / Apple Inc. | 0.03 | 2.56 | 4.95 | 0.86 | 3.0011 | -0.0653 | |||

| MPWR / Monolithic Power Systems, Inc. | 0.01 | 2.11 | 4.09 | 0.52 | 2.4810 | -0.0626 | |||

| NVDA / NVIDIA Corporation | 0.01 | 1.37 | 3.79 | -5.96 | 2.2989 | -0.2203 | |||

| AVGO / Broadcom Inc. | 0.01 | 3.74 | 0.0000 | ||||||

| UNH / UnitedHealth Group Incorporated | 0.01 | 2.02 | 3.52 | 3.62 | 2.1375 | 0.0117 | |||

| DVN / Devon Energy Corporation | 0.06 | 0.76 | 3.44 | 35.25 | 2.0865 | 0.4967 | |||

| MANH / Manhattan Associates, Inc. | 0.02 | 2.91 | 3.23 | -8.20 | 1.9633 | -0.2407 | |||

| AR / Antero Resources Corporation | 0.10 | 3.17 | 1.9257 | 1.9257 | |||||

| XLK / The Select Sector SPDR Trust - The Technology Select Sector SPDR Fund | 0.02 | -1.68 | 3.08 | -10.11 | 1.8674 | -0.2734 | |||

| ADBE / Adobe Inc. | 0.01 | 4.13 | 2.85 | -16.35 | 1.7297 | -0.4012 | |||

| APA / APA Corporation | 0.07 | 2.80 | 1.6999 | 1.6999 | |||||

| LOW / Lowe's Companies, Inc. | 0.01 | 3.31 | 2.74 | -19.19 | 1.6641 | -0.4580 | |||

| HAL / Halliburton Company | 0.07 | 4.77 | 2.71 | 73.47 | 1.6465 | 0.6684 | |||

| NKE / NIKE, Inc. | 0.02 | 2.52 | 2.69 | -17.23 | 1.6301 | -0.3994 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | 3.11 | 2.64 | -8.71 | 1.6022 | -0.2065 | |||

| V / Visa Inc. | 0.01 | 3.12 | 2.52 | 5.54 | 1.5270 | 0.0359 | |||

| MSFT / Microsoft Corporation | 0.01 | 2.18 | 2.45 | -6.32 | 1.4851 | -0.1485 | |||

| EOS / Eaton Vance Enhanced Equity Income Fund II | 0.11 | 2.95 | 2.39 | -12.10 | 1.4505 | -0.2500 | |||

| COP / ConocoPhillips | 0.02 | 5.86 | 2.29 | 46.70 | 1.3880 | 0.4129 | |||

| JNJ / Johnson & Johnson | 0.01 | 6.58 | 2.29 | 10.39 | 1.3868 | 0.0921 | |||

| DIS / The Walt Disney Company | 0.02 | 3.06 | 2.28 | -8.76 | 1.3843 | -0.1792 | |||

| AMD / Advanced Micro Devices, Inc. | 0.02 | 2.75 | 2.25 | -21.95 | 1.3686 | -0.4383 | |||

| OKE / ONEOK, Inc. | 0.03 | 2.67 | 2.25 | 23.44 | 1.3649 | 0.2254 | |||

| ELY / Topgolf Callaway Brands Corp | 0.09 | 5.34 | 2.21 | -10.10 | 1.3400 | -0.1960 | |||

| OMF / OneMain Holdings, Inc. | 0.05 | 3.82 | 2.18 | -1.62 | 1.3230 | -0.0629 | |||

| WMB / The Williams Companies, Inc. | 0.06 | 3.04 | 2.17 | 32.22 | 1.3176 | 0.2906 | |||

| PLD / Prologis, Inc. | 0.01 | 3.90 | 2.15 | -0.32 | 1.3067 | -0.0443 | |||

| AMJ / JPMorgan Alerian MLP Index ETN - Corporate Bond/Note | 0.02 | 4.65 | 2.13 | -9.92 | 1.2951 | -0.1865 | |||

| CIWV / Citizens Financial Corp. | 0.05 | 4.50 | 2.13 | 0.24 | 1.2939 | -0.0364 | |||

| CZR / Caesars Entertainment, Inc. | 0.03 | 5.13 | 2.12 | -13.06 | 1.2891 | -0.2389 | |||

| AMAT / Applied Materials, Inc. | 0.02 | 3.06 | 2.10 | -13.67 | 1.2727 | -0.2465 | |||

| FSK / FS KKR Capital Corp. | 0.09 | 5.48 | 2.07 | 14.91 | 1.2581 | 0.1298 | |||

| KKR / KKR & Co. Inc. | 0.04 | 2.33 | 2.05 | -19.70 | 1.2441 | -0.3526 | |||

| HON / Honeywell International Inc. | 0.01 | 6.31 | 2.00 | -0.79 | 1.2138 | -0.0471 | |||

| ARCC / Ares Capital Corporation | 0.09 | 4.21 | 1.98 | 3.03 | 1.1986 | -0.0003 | |||

| NVST / Envista Holdings Corporation | 0.04 | 6.58 | 1.97 | 15.25 | 1.1968 | 0.1267 | |||

| ETN / Eaton Corporation plc | 0.01 | 5.62 | 1.96 | -7.24 | 1.1901 | -0.1320 | |||

| CRM / Salesforce, Inc. | 0.01 | 5.42 | 1.92 | -11.92 | 1.1659 | -0.1982 | |||

| MAIN / Main Street Capital Corporation | 0.04 | 3.54 | 1.89 | -1.61 | 1.1476 | -0.0544 | |||

| BSX / Boston Scientific Corporation | 0.04 | 6.63 | 1.89 | 11.18 | 1.1464 | 0.0838 | |||

| PH / Parker-Hannifin Corporation | 0.01 | 4.11 | 1.85 | -7.13 | 1.1222 | -0.1231 | |||

| AON / Aon plc | 0.01 | 4.65 | 1.82 | 13.40 | 1.1039 | 0.1008 | |||

| SBUX / Starbucks Corporation | 0.02 | 4.24 | 1.80 | -18.91 | 1.0930 | -0.2960 | |||

| HBAN / Huntington Bancshares Incorporated | 0.12 | 8.71 | 1.80 | 3.04 | 1.0906 | -0.0001 | |||

| XPO / XPO, Inc. | 0.02 | 5.10 | 1.76 | -1.18 | 1.0700 | -0.0458 | |||

| ZTS / Zoetis Inc. | 0.01 | 4.66 | 1.74 | -19.13 | 1.0542 | -0.2892 | |||

| FE / FirstEnergy Corp. | 0.04 | 4.13 | 1.74 | 14.81 | 1.0536 | 0.1079 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.01 | 6.75 | 1.72 | -1.82 | 1.0463 | -0.0520 | |||

| SYK / Stryker Corporation | 0.01 | 5.23 | 1.71 | 5.22 | 1.0390 | 0.0214 | |||

| BA / The Boeing Company | 0.01 | 4.69 | 1.71 | -0.41 | 1.0378 | -0.0361 | |||

| GXO / GXO Logistics, Inc. | 0.02 | 5.22 | 1.70 | -17.38 | 1.0329 | -0.2554 | |||

| EA / Electronic Arts Inc. | 0.01 | 8.83 | 1.68 | 4.41 | 1.0202 | 0.0133 | |||

| ELAN / Elanco Animal Health Incorporated | 0.06 | 10.49 | 1.64 | 1.55 | 0.9929 | -0.0147 | |||

| SRE / Sempra | 0.01 | 5.45 | 1.63 | 33.94 | 0.9892 | 0.2281 | |||

| MU / Micron Technology, Inc. | 0.02 | 3.20 | 1.61 | -13.69 | 0.9759 | -0.1893 | |||

| VICI / VICI Properties Inc. | 0.06 | 4.26 | 1.60 | -1.42 | 0.9698 | -0.0440 | |||

| MDT / Medtronic plc | 0.01 | 7.95 | 1.60 | 15.81 | 0.9692 | 0.1068 | |||

| EVRG / Evergy, Inc. | 0.02 | 4.77 | 1.59 | 4.33 | 0.9662 | 0.0118 | |||

| BMY / Bristol-Myers Squibb Company | 0.02 | 11.70 | 1.57 | 30.83 | 0.9504 | 0.2018 | |||

| OLN / Olin Corporation | 0.03 | 6.33 | 1.55 | -3.36 | 0.9413 | -0.0625 | |||

| DTE / DTE Energy Company | 0.01 | 6.44 | 1.54 | 17.76 | 0.9377 | 0.1171 | |||

| MFC / HEXAOM | 0.07 | 4.11 | 1.52 | 16.55 | 0.9231 | 0.1069 | |||

| ATRC / AtriCure, Inc. | 0.02 | 4.16 | 1.51 | -1.63 | 0.9176 | -0.0436 | |||

| LADR / Ladder Capital Corp | 0.12 | 6.46 | 1.47 | 5.44 | 0.8940 | 0.0202 | |||

| WY / Weyerhaeuser Company | 0.04 | 4.18 | 1.46 | -4.13 | 0.8873 | -0.0665 | |||

| HLT / Hilton Worldwide Holdings Inc. | 0.01 | 4.39 | 1.46 | 1.53 | 0.8836 | -0.0132 | |||

| PYPL / PayPal Holdings, Inc. | 0.01 | 1.81 | 1.44 | -37.55 | 0.8721 | -0.5670 | |||

| FAF / First American Financial Corporation | 0.02 | 5.79 | 1.39 | -12.33 | 0.8418 | -0.1477 | |||

| RITM / Rithm Capital Corp. | 0.12 | 8.03 | 1.32 | 10.76 | 0.7999 | 0.0556 | |||

| MTG / MGIC Investment Corporation | 0.10 | 2.79 | 1.30 | -3.43 | 0.7865 | -0.0528 | |||

| HTA / Healthcare Realty Trust Inc - Class A | 0.04 | 7.44 | 1.27 | 0.79 | 0.7732 | -0.0173 | |||

| CHCT / Community Healthcare Trust Incorporated | 0.03 | 0.40 | 1.20 | -10.35 | 0.7252 | -0.1084 | |||

| C / Citigroup Inc. | 0.02 | 7.76 | 1.19 | -4.72 | 0.7222 | -0.0589 | |||

| DHI / D.R. Horton, Inc. | 0.01 | 7.00 | 1.11 | -26.50 | 0.6749 | -0.2714 | |||

| KIDS / OrthoPediatrics Corp. | 0.02 | 0.00 | 1.05 | -9.79 | 0.6379 | -0.0908 | |||

| OSTK / Overstock.com Inc | 0.01 | -0.32 | 0.65 | -25.71 | 0.3963 | -0.1534 | |||

| QQQ / Invesco QQQ Trust, Series 1 | 0.00 | 16.23 | 0.50 | 5.92 | 0.3041 | 0.0082 | |||

| CHK / Chesapeake Energy Corporation | 0.00 | 0.41 | 0.2519 | 0.2519 | |||||

| XLY / The Select Sector SPDR Trust - The Consumer Discretionary Select Sector SPDR Fund | 0.00 | 5.60 | 0.40 | -4.52 | 0.2434 | -0.0193 | |||

| SCHX / Schwab Strategic Trust - Schwab U.S. Large-Cap ETF | 0.01 | 100.00 | 0.39 | -5.37 | 0.2355 | -0.0209 | |||

| BX / Blackstone Inc. | 0.00 | 0.00 | 0.39 | -1.79 | 0.2337 | -0.0115 | |||

| WLK / Westlake Corporation | 0.00 | 0.37 | 0.2264 | 0.2264 | |||||

| WSR / Whitestone REIT | 0.03 | 0.36 | 0.2215 | 0.2215 | |||||

| SPIP / SPDR Series Trust - SPDR Portfolio TIPS ETF | 0.01 | -4.51 | 0.35 | -8.33 | 0.2136 | -0.0265 | |||

| SPTS / SPDR Series Trust - SPDR Portfolio Short Term Treasury ETF | 0.01 | -2.82 | 0.33 | -5.16 | 0.2009 | -0.0174 | |||

| ANTM / Anthem Inc | 0.00 | 0.00 | 0.32 | 5.98 | 0.1936 | 0.0053 | |||

| BIL / SPDR Series Trust - SPDR Bloomberg 1-3 Month T-Bill ETF | 0.00 | -1.64 | 0.32 | -1.55 | 0.1930 | -0.0090 | |||

| NEAR / iShares U.S. ETF Trust - iShares Short Duration Bond Active ETF | 0.01 | 0.00 | 0.30 | -1.00 | 0.1802 | -0.0074 | |||

| VVV / Valvoline Inc. | 0.01 | 0.29 | 0.1790 | 0.1790 | |||||

| AEP / American Electric Power Company, Inc. | 0.00 | 0.00 | 0.27 | 12.08 | 0.1633 | 0.0132 | |||

| PHM / PulteGroup, Inc. | 0.01 | 0.26 | 0.1584 | 0.1584 | |||||

| AMLP / ALPS ETF Trust - Alerian MLP ETF | 0.01 | 0.00 | 0.26 | 17.04 | 0.1584 | 0.0189 | |||

| APO / Apollo Global Management, Inc. | 0.00 | 0.00 | 0.25 | -14.43 | 0.1511 | -0.0309 | |||

| EXAS / Exact Sciences Corporation | 0.00 | -14.41 | 0.23 | -23.00 | 0.1402 | -0.0474 | |||

| SCHB / Schwab Strategic Trust - Schwab U.S. Broad Market ETF | 0.00 | 100.00 | 0.22 | -5.56 | 0.1341 | -0.0122 | |||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 0.01 | 0.21 | 0.1250 | 0.1250 | |||||

| AVGO / Broadcom Inc. | 0.00 | -98.22 | 0.20 | -94.75 | 0.1226 | -2.2847 | |||

| BIZD / VanEck ETF Trust - VanEck BDC Income ETF | 0.01 | 0.18 | 0.1092 | 0.1092 | |||||

| BHR / Braemar Hotels & Resorts Inc. | 0.01 | 0.00 | 0.09 | 21.92 | 0.0540 | 0.0084 | |||

| SQFT / Presidio Property Trust, Inc. | 0.01 | -9.33 | 0.05 | -13.79 | 0.0303 | -0.0059 | |||

| AMRN / Amarin Corporation plc - Depositary Receipt (Common Stock) | 0.01 | 0.00 | 0.04 | -2.56 | 0.0231 | -0.0013 | |||

| US74102L1136 / PRESIDIO PROPERTY TR INC CL A WT | 0.01 | 0.00 | 0.0018 | 0.0018 | |||||

| IEFA / iShares Trust - iShares Core MSCI EAFE ETF | 0.00 | -100.00 | 0.00 | -100.00 | -0.1257 | ||||

| PG / The Procter & Gamble Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.1307 |