Mga Batayang Estadistika

| Nilai Portofolio | $ 226,389,396 |

| Posisi Saat Ini | 144 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

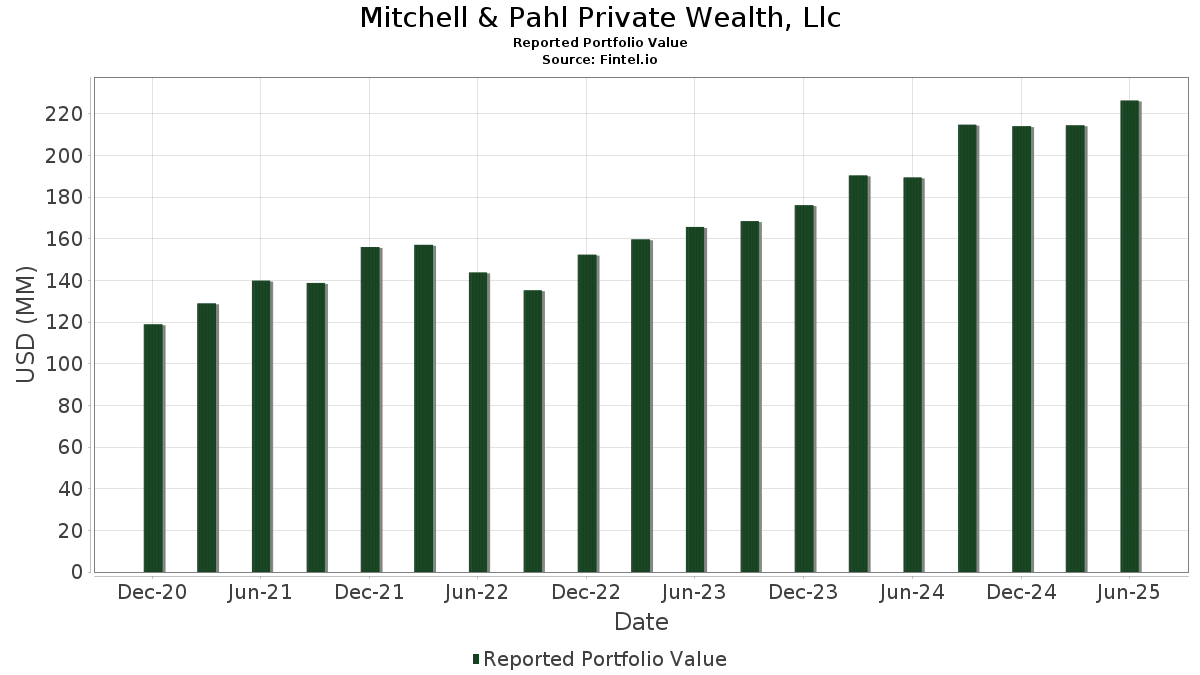

Mitchell & Pahl Private Wealth, Llc telah mengungkapkan total kepemilikan 144 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 226,389,396 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Mitchell & Pahl Private Wealth, Llc adalah Microsoft Corporation (US:MSFT) , Broadcom Inc. (US:AVGO) , Apple Inc. (US:AAPL) , Linde plc (US:LIN) , and Waste Management, Inc. (US:WM) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.02 | 6.77 | 2.9885 | 1.0366 | |

| 0.02 | 7.82 | 3.4536 | 0.7185 | |

| 0.00 | 3.26 | 1.4394 | 0.2986 | |

| 0.02 | 2.86 | 1.2622 | 0.2423 | |

| 0.01 | 1.39 | 0.6155 | 0.2327 | |

| 0.02 | 2.70 | 1.1920 | 0.1970 | |

| 0.01 | 1.82 | 0.8059 | 0.1948 | |

| 0.03 | 1.73 | 0.7648 | 0.1875 | |

| 0.01 | 3.00 | 1.3258 | 0.1758 | |

| 0.00 | 1.45 | 0.6425 | 0.1324 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.01 | 2.89 | 1.2746 | -0.9013 | |

| 0.03 | 6.21 | 2.7410 | -0.3325 | |

| 0.02 | 3.04 | 1.3425 | -0.2168 | |

| 0.03 | 3.42 | 1.5123 | -0.2163 | |

| 0.05 | 2.44 | 1.0763 | -0.1792 | |

| 0.02 | 3.33 | 1.4693 | -0.1613 | |

| 0.01 | 2.02 | 0.8912 | -0.1556 | |

| 0.02 | 2.87 | 1.2697 | -0.1554 | |

| 0.01 | 2.91 | 1.2860 | -0.1374 | |

| 0.03 | 2.79 | 1.2334 | -0.1156 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-11 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.02 | 0.58 | 7.82 | 33.28 | 3.4536 | 0.7185 | |||

| AVGO / Broadcom Inc. | 0.02 | -1.85 | 6.77 | 61.61 | 2.9885 | 1.0366 | |||

| AAPL / Apple Inc. | 0.03 | 1.90 | 6.21 | -5.87 | 2.7410 | -0.3325 | |||

| LIN / Linde plc | 0.01 | 0.79 | 3.70 | 1.54 | 1.6348 | -0.0641 | |||

| WM / Waste Management, Inc. | 0.02 | 0.81 | 3.49 | -0.37 | 1.5398 | -0.0912 | |||

| ECL / Ecolab Inc. | 0.01 | 1.07 | 3.45 | 7.41 | 1.5239 | 0.0265 | |||

| XOM / Exxon Mobil Corporation | 0.03 | 1.87 | 3.42 | -7.66 | 1.5123 | -0.2163 | |||

| PG / The Procter & Gamble Company | 0.02 | 1.72 | 3.33 | -4.89 | 1.4693 | -0.1613 | |||

| HD / The Home Depot, Inc. | 0.01 | 2.26 | 3.31 | 2.32 | 1.4613 | -0.0463 | |||

| MMM / 3M Company | 0.02 | 1.21 | 3.28 | 4.92 | 1.4507 | -0.0086 | |||

| GS / The Goldman Sachs Group, Inc. | 0.00 | 2.79 | 3.26 | 33.20 | 1.4394 | 0.2986 | |||

| CMCSA / Comcast Corporation | 0.09 | 2.35 | 3.21 | -0.99 | 1.4164 | -0.0936 | |||

| ABBV / AbbVie Inc. | 0.02 | 2.57 | 3.04 | -9.12 | 1.3425 | -0.2168 | |||

| TXN / Texas Instruments Incorporated | 0.01 | 5.31 | 3.00 | 21.70 | 1.3258 | 0.1758 | |||

| CSCO / Cisco Systems, Inc. | 0.04 | 2.25 | 2.95 | 14.98 | 1.3025 | 0.1068 | |||

| BLK / BlackRock, Inc. | 0.00 | 3.53 | 2.93 | 14.78 | 1.2931 | 0.1040 | |||

| MCD / McDonald's Corporation | 0.01 | 1.94 | 2.91 | -4.65 | 1.2860 | -0.1374 | |||

| MDLZ / Mondelez International, Inc. | 0.04 | 1.40 | 2.89 | 0.80 | 1.2767 | -0.0602 | |||

| UNH / UnitedHealth Group Incorporated | 0.01 | 3.79 | 2.89 | -38.18 | 1.2746 | -0.9013 | |||

| GD / General Dynamics Corporation | 0.01 | 2.02 | 2.88 | 9.14 | 1.2711 | 0.0421 | |||

| JNJ / Johnson & Johnson | 0.02 | 2.09 | 2.87 | -5.96 | 1.2697 | -0.1554 | |||

| DIS / The Walt Disney Company | 0.02 | 3.96 | 2.86 | 30.64 | 1.2622 | 0.2423 | |||

| COST / Costco Wholesale Corporation | 0.00 | 1.00 | 2.81 | 5.72 | 1.2411 | 0.0020 | |||

| WEC / WEC Energy Group, Inc. | 0.03 | 1.38 | 2.79 | -3.09 | 1.2340 | -0.1096 | |||

| AFL / Aflac Incorporated | 0.03 | 1.74 | 2.79 | -3.49 | 1.2334 | -0.1156 | |||

| APD / Air Products and Chemicals, Inc. | 0.01 | 2.75 | 2.73 | -1.76 | 1.2063 | -0.0893 | |||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0.02 | 1.44 | 2.73 | 10.13 | 1.2051 | 0.0500 | |||

| NEE / NextEra Energy, Inc. | 0.04 | 2.79 | 2.73 | 0.66 | 1.2048 | -0.0585 | |||

| EMR / Emerson Electric Co. | 0.02 | 3.98 | 2.70 | 26.43 | 1.1920 | 0.1970 | |||

| T / AT&T Inc. | 0.09 | 2.28 | 2.65 | 4.66 | 1.1700 | -0.0098 | |||

| ADP / Automatic Data Processing, Inc. | 0.01 | 1.72 | 2.63 | 2.65 | 1.1630 | -0.0325 | |||

| SHW / The Sherwin-Williams Company | 0.01 | 1.66 | 2.63 | -0.04 | 1.1616 | -0.0648 | |||

| VZ / Verizon Communications Inc. | 0.06 | 1.97 | 2.46 | -2.73 | 1.0857 | -0.0924 | |||

| IP / International Paper Company | 0.05 | 3.07 | 2.44 | -9.54 | 1.0763 | -0.1792 | |||

| PSX / Phillips 66 | 0.02 | 5.08 | 2.43 | 1.50 | 1.0738 | -0.0425 | |||

| SRE / Sempra | 0.03 | 3.83 | 2.30 | 10.26 | 1.0158 | 0.0434 | |||

| USB / U.S. Bancorp | 0.05 | 4.28 | 2.23 | 11.79 | 0.9848 | 0.0549 | |||

| RTX / RTX Corporation | 0.02 | -1.55 | 2.22 | 8.55 | 0.9812 | 0.0270 | |||

| CB / Chubb Limited | 0.01 | 2.55 | 2.13 | -1.62 | 0.9402 | -0.0684 | |||

| ITW / Illinois Tool Works Inc. | 0.01 | 2.95 | 2.09 | 2.66 | 0.9215 | -0.0261 | |||

| VLO / Valero Energy Corporation | 0.02 | 5.95 | 2.03 | 7.88 | 0.8950 | 0.0191 | |||

| CVX / Chevron Corporation | 0.01 | 4.98 | 2.02 | -10.16 | 0.8912 | -0.1556 | |||

| UPS / United Parcel Service, Inc. | 0.02 | 6.02 | 1.92 | -2.69 | 0.8474 | -0.0718 | |||

| BX / Blackstone Inc. | 0.01 | -1.66 | 1.90 | 5.20 | 0.8409 | -0.0025 | |||

| UBS / UBS Group AG | 0.05 | 1.71 | 1.85 | 12.33 | 0.8168 | 0.0492 | |||

| AMGN / Amgen Inc. | 0.01 | 4.69 | 1.85 | -6.20 | 0.8156 | -0.1019 | |||

| SYY / Sysco Corporation | 0.02 | 3.67 | 1.83 | 4.64 | 0.8078 | -0.0070 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.01 | 2.01 | 1.82 | 39.24 | 0.8059 | 0.1948 | |||

| SBUX / Starbucks Corporation | 0.02 | 6.04 | 1.78 | -0.89 | 0.7854 | -0.0514 | |||

| XEL / Xcel Energy Inc. | 0.03 | 3.35 | 1.75 | -0.57 | 0.7715 | -0.0475 | |||

| IBKR / Interactive Brokers Group, Inc. | 0.03 | 317.87 | 1.73 | 39.82 | 0.7648 | 0.1875 | |||

| AWK / American Water Works Company, Inc. | 0.01 | 3.68 | 1.72 | -2.22 | 0.7598 | -0.0604 | |||

| FICO / Fair Isaac Corporation | 0.00 | 2.58 | 1.67 | 1.70 | 0.7388 | -0.0281 | |||

| DOCU / DocuSign, Inc. | 0.02 | 2.68 | 1.66 | -1.78 | 0.7319 | -0.0543 | |||

| PEP / PepsiCo, Inc. | 0.01 | 6.50 | 1.65 | -6.21 | 0.7269 | -0.0911 | |||

| NKE / NIKE, Inc. | 0.02 | 13.39 | 1.63 | 26.95 | 0.7180 | 0.1208 | |||

| WRB / W. R. Berkley Corporation | 0.02 | 2.26 | 1.59 | 5.58 | 0.7027 | 0.0002 | |||

| LII / Lennox International Inc. | 0.00 | 3.48 | 1.53 | 5.79 | 0.6776 | 0.0015 | |||

| SAP / SAP SE - Depositary Receipt (Common Stock) | 0.00 | 1.05 | 1.50 | 14.53 | 0.6617 | 0.0516 | |||

| TT / Trane Technologies plc | 0.00 | 2.40 | 1.45 | 32.91 | 0.6425 | 0.1324 | |||

| APO / Apollo Global Management, Inc. | 0.01 | -2.30 | 1.45 | 1.26 | 0.6416 | -0.0274 | |||

| HSBC / HSBC Holdings plc - Depositary Receipt (Common Stock) | 0.02 | 2.01 | 1.42 | 7.97 | 0.6288 | 0.0142 | |||

| STX / Seagate Technology Holdings plc | 0.01 | -0.11 | 1.39 | 69.67 | 0.6155 | 0.2327 | |||

| TGT / Target Corporation | 0.01 | 9.04 | 1.38 | 3.07 | 0.6079 | -0.0145 | |||

| IHG / InterContinental Hotels Group PLC - Depositary Receipt (Common Stock) | 0.01 | 3.13 | 1.35 | 8.51 | 0.5970 | 0.0165 | |||

| V / Visa Inc. | 0.00 | -0.89 | 1.30 | 0.46 | 0.5743 | -0.0294 | |||

| BTI / British American Tobacco p.l.c. - Depositary Receipt (Common Stock) | 0.03 | 1.71 | 1.29 | 16.37 | 0.5686 | 0.0529 | |||

| TMUS / T-Mobile US, Inc. | 0.01 | 5.66 | 1.28 | -5.59 | 0.5674 | -0.0670 | |||

| BAC / Bank of America Corporation | 0.03 | -2.16 | 1.27 | 11.01 | 0.5610 | 0.0273 | |||

| UL / Unilever PLC - Depositary Receipt (Common Stock) | 0.02 | 1.58 | 1.17 | 4.38 | 0.5160 | -0.0059 | |||

| DLB / Dolby Laboratories, Inc. | 0.02 | 5.18 | 1.16 | -2.78 | 0.5105 | -0.0435 | |||

| ASML / ASML Holding N.V. - Depositary Receipt (Common Stock) | 0.00 | 4.93 | 1.13 | 26.94 | 0.4977 | 0.0838 | |||

| KO / The Coca-Cola Company | 0.02 | -0.80 | 1.10 | -2.05 | 0.4857 | -0.0374 | |||

| RELX / RELX PLC - Depositary Receipt (Common Stock) | 0.02 | 2.74 | 1.09 | 10.70 | 0.4800 | 0.0226 | |||

| WMB / The Williams Companies, Inc. | 0.02 | -5.85 | 1.07 | -1.01 | 0.4745 | -0.0316 | |||

| SONY / Sony Group Corporation - Depositary Receipt (Common Stock) | 0.04 | 3.47 | 1.04 | 6.13 | 0.4590 | 0.0023 | |||

| CPRT / Copart, Inc. | 0.02 | 4.31 | 1.02 | -9.62 | 0.4488 | -0.0749 | |||

| NDSN / Nordson Corporation | 0.00 | 7.90 | 1.01 | 14.72 | 0.4476 | 0.0356 | |||

| TM / Toyota Motor Corporation - Depositary Receipt (Common Stock) | 0.01 | 3.40 | 1.01 | 0.90 | 0.4464 | -0.0205 | |||

| AZN / AstraZeneca PLC - Depositary Receipt (Common Stock) | 0.01 | 5.24 | 1.00 | 0.00 | 0.4434 | -0.0243 | |||

| JKHY / Jack Henry & Associates, Inc. | 0.01 | 3.51 | 0.99 | 2.17 | 0.4370 | -0.0146 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.00 | -0.23 | 0.95 | -8.36 | 0.4216 | -0.0641 | |||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.01 | 6.24 | 0.95 | 5.56 | 0.4200 | 0.0002 | |||

| MA / Mastercard Incorporated | 0.00 | -1.87 | 0.94 | 0.64 | 0.4170 | -0.0205 | |||

| TDY / Teledyne Technologies Incorporated | 0.00 | 4.69 | 0.94 | 7.82 | 0.4146 | 0.0085 | |||

| POOL / Pool Corporation | 0.00 | 6.67 | 0.93 | -2.32 | 0.4097 | -0.0330 | |||

| FDS / FactSet Research Systems Inc. | 0.00 | 5.29 | 0.93 | 3.58 | 0.4090 | -0.0077 | |||

| SU / Suncor Energy Inc. | 0.02 | 4.28 | 0.91 | 0.89 | 0.4027 | -0.0187 | |||

| NGG / National Grid plc - Depositary Receipt (Common Stock) | 0.01 | 4.48 | 0.89 | 18.59 | 0.3945 | 0.0431 | |||

| PHG / Koninklijke Philips N.V. - Depositary Receipt (Common Stock) | 0.04 | 5.59 | 0.89 | -0.34 | 0.3912 | -0.0230 | |||

| EFX / Equifax Inc. | 0.00 | 8.43 | 0.88 | 15.49 | 0.3890 | 0.0334 | |||

| TEL / TE Connectivity plc | 0.01 | 0.00 | 0.88 | 19.37 | 0.3867 | 0.0447 | |||

| TRV / The Travelers Companies, Inc. | 0.00 | -1.75 | 0.87 | -0.57 | 0.3857 | -0.0238 | |||

| PPG / PPG Industries, Inc. | 0.01 | -1.77 | 0.86 | 2.25 | 0.3818 | -0.0126 | |||

| TER / Teradyne, Inc. | 0.01 | 13.39 | 0.85 | 23.33 | 0.3763 | 0.0546 | |||

| MTDR / Matador Resources Company | 0.02 | 11.00 | 0.85 | 3.68 | 0.3736 | -0.0067 | |||

| JCI / Johnson Controls International plc | 0.01 | 0.00 | 0.84 | 31.87 | 0.3711 | 0.0740 | |||

| FTS / Fortis Inc. | 0.02 | 4.67 | 0.84 | 9.69 | 0.3703 | 0.0137 | |||

| RIO / Rio Tinto Group - Depositary Receipt (Common Stock) | 0.01 | 5.44 | 0.84 | 2.32 | 0.3701 | -0.0115 | |||

| MRK / Merck & Co., Inc. | 0.01 | -0.61 | 0.82 | -12.35 | 0.3636 | -0.0742 | |||

| TEF / Telefónica, S.A. - Depositary Receipt (Common Stock) | 0.15 | 4.78 | 0.81 | 17.59 | 0.3577 | 0.0367 | |||

| LHX / L3Harris Technologies, Inc. | 0.00 | 18.49 | 0.81 | 41.98 | 0.3558 | 0.0913 | |||

| SMG / The Scotts Miracle-Gro Company | 0.01 | 14.01 | 0.77 | 36.99 | 0.3420 | 0.0785 | |||

| MET / MetLife, Inc. | 0.01 | -1.97 | 0.77 | -1.78 | 0.3408 | -0.0255 | |||

| ELAN / Elanco Animal Health Incorporated | 0.05 | 16.91 | 0.76 | 59.12 | 0.3354 | 0.1128 | |||

| NTR / Nutrien Ltd. | 0.01 | 5.23 | 0.75 | 23.24 | 0.3330 | 0.0482 | |||

| BP / BP p.l.c. - Depositary Receipt (Common Stock) | 0.02 | 9.03 | 0.75 | -3.49 | 0.3300 | -0.0306 | |||

| PARA / Paramount Global | 0.06 | 10.01 | 0.74 | 18.71 | 0.3254 | 0.0360 | |||

| LMT / Lockheed Martin Corporation | 0.00 | 2.12 | 0.74 | 5.76 | 0.3251 | 0.0010 | |||

| ADSK / Autodesk, Inc. | 0.00 | 0.00 | 0.73 | 18.26 | 0.3235 | 0.0348 | |||

| UNP / Union Pacific Corporation | 0.00 | -0.66 | 0.73 | -3.18 | 0.3225 | -0.0293 | |||

| CRL / Charles River Laboratories International, Inc. | 0.00 | 18.66 | 0.69 | 19.55 | 0.3056 | 0.0359 | |||

| COO / The Cooper Companies, Inc. | 0.01 | 12.00 | 0.69 | -5.47 | 0.3054 | -0.0357 | |||

| SITE / SiteOne Landscape Supply, Inc. | 0.01 | 13.03 | 0.69 | 12.60 | 0.3041 | 0.0190 | |||

| DEO / Diageo plc - Depositary Receipt (Common Stock) | 0.01 | 5.07 | 0.68 | 1.19 | 0.3017 | -0.0132 | |||

| BCE / BCE Inc. | 0.03 | 8.78 | 0.65 | 5.02 | 0.2868 | -0.0014 | |||

| CHE / Chemed Corporation | 0.00 | 7.70 | 0.63 | -14.83 | 0.2768 | -0.0660 | |||

| AIG / American International Group, Inc. | 0.01 | -3.03 | 0.62 | -4.61 | 0.2746 | -0.0290 | |||

| FCX / Freeport-McMoRan Inc. | 0.01 | 0.00 | 0.60 | 14.61 | 0.2668 | 0.0209 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 0.00 | 0.60 | -8.74 | 0.2631 | -0.0413 | |||

| ZTS / Zoetis Inc. | 0.00 | -1.46 | 0.59 | -6.65 | 0.2609 | -0.0341 | |||

| AMT / American Tower Corporation | 0.00 | -4.97 | 0.58 | -3.48 | 0.2578 | -0.0241 | |||

| EXPO / Exponent, Inc. | 0.01 | 14.26 | 0.57 | 5.34 | 0.2530 | -0.0005 | |||

| MTN / Vail Resorts, Inc. | 0.00 | 16.84 | 0.57 | 14.89 | 0.2523 | 0.0202 | |||

| AMZN / Amazon.com, Inc. | 0.00 | -5.15 | 0.56 | 9.36 | 0.2481 | 0.0087 | |||

| PII / Polaris Inc. | 0.01 | 21.24 | 0.55 | 20.39 | 0.2429 | 0.0299 | |||

| NUE / Nucor Corporation | 0.00 | 0.00 | 0.50 | 7.73 | 0.2220 | 0.0043 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.00 | -1.97 | 0.47 | 3.96 | 0.2093 | -0.0032 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | 5.64 | 0.45 | 25.00 | 0.1966 | 0.0304 | |||

| ENB / Enbridge Inc. | 0.01 | -5.13 | 0.44 | -2.90 | 0.1926 | -0.0169 | |||

| VYM / Vanguard Whitehall Funds - Vanguard High Dividend Yield ETF | 0.00 | 0.00 | 0.43 | 3.58 | 0.1917 | -0.0040 | |||

| KMI / Kinder Morgan, Inc. | 0.01 | 0.00 | 0.42 | 3.20 | 0.1852 | -0.0045 | |||

| IBM / International Business Machines Corporation | 0.00 | 1.15 | 0.39 | 19.75 | 0.1716 | 0.0206 | |||

| BA / The Boeing Company | 0.00 | 0.00 | 0.39 | 22.86 | 0.1711 | 0.0241 | |||

| CARR / Carrier Global Corporation | 0.01 | 0.00 | 0.37 | 15.36 | 0.1628 | 0.0140 | |||

| GOOG / Alphabet Inc. | 0.00 | 0.72 | 0.32 | 14.23 | 0.1421 | 0.0110 | |||

| PEG / Public Service Enterprise Group Incorporated | 0.00 | -3.02 | 0.31 | -0.97 | 0.1359 | -0.0087 | |||

| ASX / ASE Technology Holding Co., Ltd. - Depositary Receipt (Common Stock) | 0.03 | -3.55 | 0.28 | 13.60 | 0.1256 | 0.0090 | |||

| TTE / TotalEnergies SE - Depositary Receipt (Common Stock) | 0.00 | -3.63 | 0.28 | -8.64 | 0.1218 | -0.0188 | |||

| NOC / Northrop Grumman Corporation | 0.00 | 0.00 | 0.24 | -2.45 | 0.1058 | -0.0085 | |||

| MFC / Manulife Financial Corporation | 0.01 | 0.00 | 0.24 | 2.62 | 0.1039 | -0.0030 | |||

| MMC / Marsh & McLennan Companies, Inc. | 0.00 | -13.59 | 0.23 | -22.41 | 0.0995 | -0.0361 | |||

| BDX / Becton, Dickinson and Company | 0.00 | -2.76 | 0.22 | -26.85 | 0.0966 | -0.0428 | |||

| PFE / Pfizer Inc. | 0.01 | -4.47 | 0.20 | -8.56 | 0.0899 | -0.0139 | |||

| SNY / Sanofi - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 |