Mga Batayang Estadistika

| Nilai Portofolio | $ 450,189,133 |

| Posisi Saat Ini | 685 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

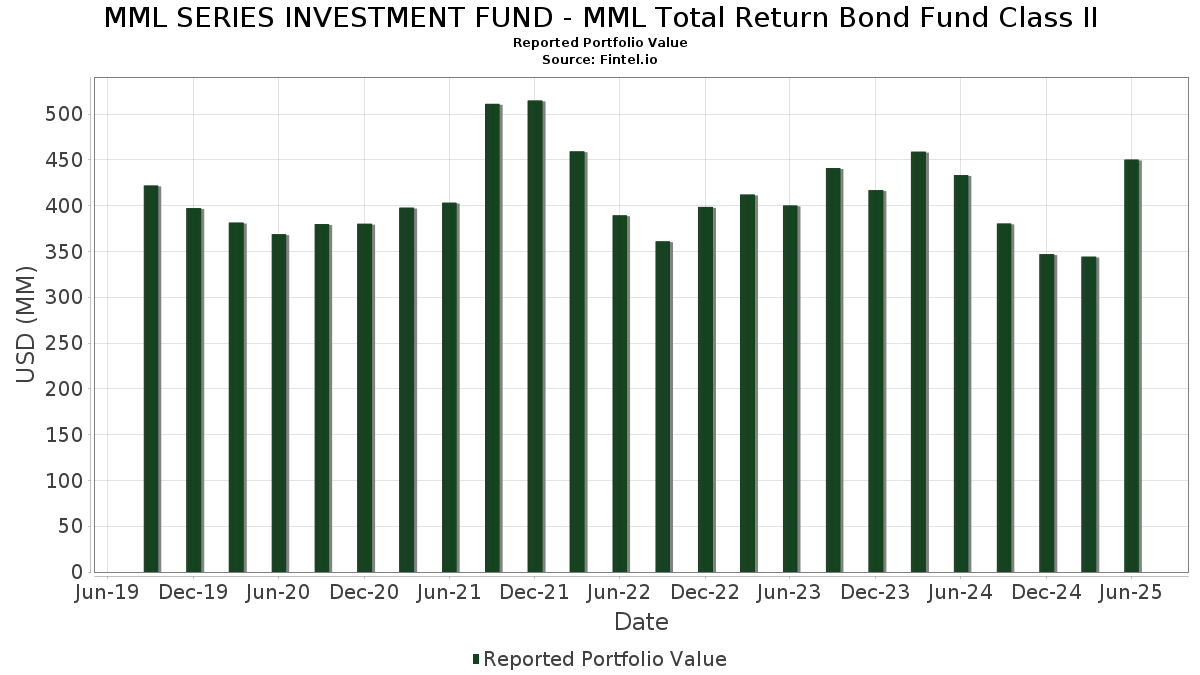

MML SERIES INVESTMENT FUND - MML Total Return Bond Fund Class II telah mengungkapkan total kepemilikan 685 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 450,189,133 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama MML SERIES INVESTMENT FUND - MML Total Return Bond Fund Class II adalah Edwards Lifesciences Corporation (US:EW) , Edwards Lifesciences Corporation (US:EW) , Ginnie Mae (US:US21H0506723) , UMBS, 30 Year, Single Family (US:US01F0206791) , and Freddie Mac Pool (US:US3132DWDJ99) . Posisi baru MML SERIES INVESTMENT FUND - MML Total Return Bond Fund Class II meliputi: Edwards Lifesciences Corporation (US:EW) , Edwards Lifesciences Corporation (US:EW) , Ginnie Mae (US:US21H0506723) , UMBS, 30 Year, Single Family (US:US01F0206791) , and Freddie Mac Pool (US:US3132DWDJ99) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 44.55 | 11.6577 | 11.6577 | ||

| 38.45 | 10.0597 | 10.0597 | ||

| 19.74 | 5.1658 | 5.1658 | ||

| 18.97 | 4.9634 | 4.9634 | ||

| 18.34 | 4.7987 | 4.7987 | ||

| 12.96 | 3.3901 | 3.3901 | ||

| 9.73 | 2.5459 | 2.5459 | ||

| 5.93 | 1.5523 | 1.5523 | ||

| 3.67 | 0.9605 | 0.9605 | ||

| 6.55 | 1.7148 | 0.5264 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 4.54 | 1.1884 | -1.1549 | ||

| 1.71 | 0.4469 | -1.0889 | ||

| 1.49 | 0.3905 | -0.5068 | ||

| 4.73 | 1.2372 | -0.4776 | ||

| 3.75 | 0.9808 | -0.4200 | ||

| 5.50 | 1.4389 | -0.3715 | ||

| 3.04 | 0.7949 | -0.2419 | ||

| 3.56 | 0.9310 | -0.2336 | ||

| 4.44 | 1.1619 | -0.2173 | ||

| 2.99 | 0.7816 | -0.2165 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-25 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| U.S. Treasury Notes / DBT (US91282CNK35) | 44.55 | 11.6577 | 11.6577 | ||||||

| FIXED INC CLEARING CORP.REPO / RA (000000000) | 38.45 | 10.0597 | 10.0597 | ||||||

| U.S. Treasury Notes / DBT (US91282CNL18) | 19.74 | 5.1658 | 5.1658 | ||||||

| U.S. Treasury Notes / DBT (US91282CNH06) | 18.97 | 4.9634 | 4.9634 | ||||||

| U.S. Treasury Bonds / DBT (US912810UK24) | 18.34 | 4.7987 | 4.7987 | ||||||

| U.S. Treasury Bonds / DBT (US912810UL07) | 12.96 | 3.3901 | 3.3901 | ||||||

| U.S. Treasury Notes / DBT (US91282CNJ61) | 9.73 | 2.5459 | 2.5459 | ||||||

| EW / Edwards Lifesciences Corporation | 8.96 | 43.12 | 2.3433 | 0.3791 | |||||

| EW / Edwards Lifesciences Corporation | 6.55 | 44.31 | 1.7148 | 0.5264 | |||||

| U.S. Treasury Notes / DBT (US91282CNC19) | 5.93 | 1.5523 | 1.5523 | ||||||

| US21H0506723 / Ginnie Mae | 5.52 | 28.92 | 1.4452 | 0.1006 | |||||

| US01F0206791 / UMBS, 30 Year, Single Family | 5.50 | -4.66 | 1.4389 | -0.3715 | |||||

| US3132DWDJ99 / Freddie Mac Pool | 4.82 | 87.00 | 1.2611 | 0.4165 | |||||

| EW / Edwards Lifesciences Corporation | 4.73 | -27.85 | 1.2372 | -0.4776 | |||||

| EW / Edwards Lifesciences Corporation | 4.54 | -49.29 | 1.1884 | -1.1549 | |||||

| US21H0226710 / GNII II 2.5% 07/01/2050 #TBA | 4.44 | 1.05 | 1.1619 | -0.2173 | |||||

| US3132DWDZ32 / FREDDIE MAC POOL UMBS P#SD8220 3.00000000 | 4.09 | 113.08 | 1.0701 | 0.4411 | |||||

| US01F0526727 / Uniform Mortgage-Backed Security, TBA | 3.75 | -16.00 | 0.9808 | -0.4200 | |||||

| US21H0406734 / Ginnie Mae | 3.67 | 0.9605 | 0.9605 | ||||||

| U.S. Treasury Inflation-Indexed Notes / DBT (US91282CML27) | 3.56 | 0.08 | 0.9310 | -0.2336 | |||||

| US21H0526788 / Ginnie Mae | 3.33 | 36.95 | 0.8709 | 0.1079 | |||||

| US21H0426799 / Ginnie Mae | 3.04 | -8.05 | 0.7949 | -0.2419 | |||||

| US31418EB825 / Fannie Mae Pool | 2.99 | -1.97 | 0.7816 | -0.2165 | |||||

| US3140KSYC56 / Fannie Mae Pool | 2.49 | -1.93 | 0.6527 | -0.1809 | |||||

| US3132DWDR16 / UMBS | 2.40 | 92.00 | 0.6281 | 0.2185 | |||||

| US3140QMVY79 / FEDERAL NATIONAL MORTGAGE ASSOCIATION | 2.17 | -2.47 | 0.5686 | -0.1615 | |||||

| US31418EU999 / Fannie Mae Pool | 2.02 | -2.69 | 0.5292 | -0.1520 | |||||

| US3132DWFQ15 / FHLG 30YR 4.5% 12/01/2052# | 1.94 | -2.07 | 0.5083 | -0.1417 | |||||

| US54251WAC64 / Long Beach Mortgage Loan Trust 2006-9 | 1.79 | 1.94 | 0.4686 | -0.1068 | |||||

| US19521UAA16 / Cologix Data Centers US Issuer LLC | 1.74 | 0.4559 | 0.4559 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.72 | 0.4494 | 0.4494 | ||||||

| US01F0306781 / UMBS TBA | 1.71 | -65.11 | 0.4469 | -1.0889 | |||||

| US3140KSVF15 / Fannie Mae Pool | 1.58 | -2.34 | 0.4144 | -0.1167 | |||||

| US46630KAD81 / JP Morgan Mortgage Acquisition Trust 2007-HE1 | 1.55 | 4.16 | 0.4065 | -0.0821 | |||||

| US3133KNSC82 / FEDERAL HOME LOAN MORTGAGE CORPORATION | 1.55 | -3.13 | 0.4045 | -0.1183 | |||||

| US36179XHY58 / GINNIE MAE II POOL | 1.52 | -2.87 | 0.3985 | -0.1150 | |||||

| GCAT 2025-INV2 Trust / ABS-MBS (US36173QAA58) | 1.51 | 0.3955 | 0.3955 | ||||||

| US3133B5AN23 / Freddie Mac Pool | 1.51 | -1.57 | 0.3947 | -0.1075 | |||||

| Sequoia Mortgage Trust 2025-6 / ABS-MBS (US81749YAE14) | 1.51 | 0.3940 | 0.3940 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.50 | -2.15 | 0.3929 | -0.1100 | |||||

| US69377TAC09 / PRKCM 2022-AFC2 Trust | 1.50 | 0.3918 | 0.3918 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.50 | -2.10 | 0.3913 | -0.1092 | |||||

| US01F0226757 / Uniform Mortgage-Backed Security, TBA | 1.49 | -47.80 | 0.3905 | -0.5068 | |||||

| US3133B6E894 / Freddie Mac Pool | 1.48 | -0.94 | 0.3864 | -0.1021 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.46 | -1.88 | 0.3832 | -0.1059 | |||||

| US3132XCR492 / Freddie Mac Gold Pool | 1.44 | -2.51 | 0.3769 | -0.1072 | |||||

| FIGRE Trust 2025-HE3 / ABS-O (US31684LAA98) | 1.41 | 0.3699 | 0.3699 | ||||||

| US46647PCJ30 / JPMORGAN CHASE and CO 2.069/VAR 06/01/2029 | 1.41 | 1.30 | 0.3681 | -0.0869 | |||||

| US3137BTEH01 / FREDDIE MAC REMICS SER 4639 CL HZ V/R 3.25000000 | 1.40 | 0.86 | 0.3669 | -0.0886 | |||||

| US68383NCH44 / Opteum Mortgage Acceptance Corp Asset Backed Pass-Through Certificates 2005-4 | 1.40 | -1.13 | 0.3661 | -0.0976 | |||||

| US3140QQKN48 / FNCL UMBS 4.5 CB4800 10-01-52 | 1.37 | -1.23 | 0.3587 | -0.0960 | |||||

| US90932LAJ61 / United Airlines 2023-1 Class A Pass Through Trust | 1.37 | 229.09 | 0.3582 | 0.2218 | |||||

| Rockford Tower CLO 2019-2 Ltd / ABS-CBDO (US77341GAS93) | 1.36 | -3.75 | 0.3558 | -0.1071 | |||||

| US3133KPYS19 / Federal Home Loan Mortgage Corporation | 1.32 | -4.57 | 0.3448 | -0.1074 | |||||

| STZB34 / Constellation Brands, Inc. - Depositary Receipt (Common Stock) | 1.31 | 0.3430 | 0.3430 | ||||||

| US3132DQA714 / FR 04/53 FIXED 4.5 | 1.29 | -1.52 | 0.3381 | -0.0919 | |||||

| US67114JAA88 / OBX 2021-NQM3 Trust | 1.28 | 0.3361 | 0.3361 | ||||||

| US595620AL95 / MidAmerican Energy Co. | 1.28 | -0.08 | 0.3337 | -0.0846 | |||||

| US126673DR05 / CWABS ASSET-BACKED CERTIFICATES TRUST 2004-7 SER 2004-7 CL MF2 V/R REGD 5.64900000 | 1.27 | -0.94 | 0.3310 | -0.0875 | |||||

| US38141GYG36 / Goldman Sachs Group Inc/The | 1.26 | 0.97 | 0.3284 | -0.0791 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.25 | -2.27 | 0.3262 | -0.0916 | |||||

| US86361WAC55 / Structured Asset Mortgage Investments II Trust 2006-AR8 | 1.23 | -0.57 | 0.3217 | -0.0833 | |||||

| US31418EAN04 / FN MA4512 | 1.21 | -2.10 | 0.3173 | -0.0886 | |||||

| US31418D7E66 / UMBS | 1.21 | -1.87 | 0.3166 | -0.0876 | |||||

| US92922F5T14 / WaMu Mortgage Pass-Through Certificates Series 2005-AR15 Trust | 1.19 | -2.06 | 0.3113 | -0.0867 | |||||

| US31418EB908 / FNMA UMBS, 30 Year | 1.19 | -2.30 | 0.3107 | -0.0876 | |||||

| Cross 2025-H4 Mortgage Trust / ABS-MBS (US22790AAD72) | 1.18 | 0.3097 | 0.3097 | ||||||

| Ginnie Mae II Pool / ABS-MBS (US36180AB857) | 1.17 | -1.10 | 0.3073 | -0.0820 | |||||

| US31418EBS81 / FNMA UMBS, 30 Year | 1.16 | -2.19 | 0.3044 | -0.0855 | |||||

| US3132DWC767 / Freddie Mac Pool | 1.15 | -2.14 | 0.2998 | -0.0839 | |||||

| US3140XGX460 / FNMA 30YR UMBS SUPER | 1.13 | -2.16 | 0.2961 | -0.0828 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.13 | -2.16 | 0.2959 | -0.0826 | |||||

| US41162CAA99 / HARBORVIEW MORTGAGE LOAN TRUST 2006-10 SER 2006-10 CL 1A1A V/R REGD 1.93325000 | 1.10 | 0.74 | 0.2868 | -0.0694 | |||||

| US36261WAA53 / GS MORTGAGE BACKED SECURITIES GSMBS 2021 RPL1 A1 144A | 1.07 | -3.00 | 0.2791 | -0.0813 | |||||

| US05608MAA45 / BX Commercial Mortgage Trust 2020-VIV4 | 1.06 | 0.86 | 0.2764 | -0.0668 | |||||

| U.S. Treasury Bills / STIV (US912797PF82) | 1.05 | 1.06 | 0.2753 | -0.0658 | |||||

| US74333WAN20 / Progress Residential 2021-SFR10 Trust | 1.05 | -0.38 | 0.2736 | -0.0702 | |||||

| US20753XAB01 / Fannie Mae Connecticut Avenue Securities | 1.04 | 0.19 | 0.2718 | -0.0679 | |||||

| US24381JAA51 / Deephaven Residential Mortgage Trust 2021-4 | 1.03 | -2.27 | 0.2708 | -0.0760 | |||||

| US40440XAA90 / Highbridge Loan Management Ltd | 1.00 | 0.10 | 0.2620 | -0.0659 | |||||

| Rockford Tower CLO 2020-1 Ltd / ABS-CBDO (US77341EBE41) | 1.00 | 0.2610 | 0.2610 | ||||||

| US33767WAN39 / FirstKey Homes 2020-SFR1 Trust | 0.97 | 0.2541 | 0.2541 | ||||||

| Regatta 32 Funding Ltd / ABS-CBDO (US75884AAA88) | 0.95 | 0.2494 | 0.2494 | ||||||

| AMMC CLO 24 Ltd / ABS-CBDO (US00177LAJ98) | 0.95 | 0.42 | 0.2487 | -0.0615 | |||||

| US80556YAD76 / Saxon Asset Securities Trust 2007-2 | 0.94 | 0.21 | 0.2466 | -0.0614 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.92 | 0.2397 | 0.2397 | ||||||

| PMT Loan Trust 2024-INV1 / ABS-MBS (US73015BAC90) | 0.92 | -2.56 | 0.2394 | -0.0683 | |||||

| US3140HSHJ30 / Fannie Mae Pool | 0.91 | 0.66 | 0.2380 | -0.0581 | |||||

| US95000U2S19 / Wells Fargo & Co | 0.91 | 0.89 | 0.2370 | -0.0570 | |||||

| US31418DUA89 / FN 10/40 FIXED 2 | 0.90 | -1.85 | 0.2360 | -0.0653 | |||||

| Clover CLO 2021-3 LLC / ABS-CBDO (US18915FAA03) | 0.90 | 0.67 | 0.2356 | -0.0573 | |||||

| US31418EHK91 / Fannie Mae Pool | 0.90 | -2.18 | 0.2353 | -0.0661 | |||||

| US05610BAL09 / BXSC Commercial Mortgage Trust 2022-WSS | 0.90 | 0.34 | 0.2345 | -0.0582 | |||||

| Appalachian Power Co / DBT (US037735DB08) | 0.90 | 1.47 | 0.2342 | -0.0548 | |||||

| US251510DF77 / Deutsche Alt-A Securities Inc Mortgage Loan Trust Series 2005-1 | 0.88 | -2.88 | 0.2295 | -0.0661 | |||||

| US30958QAA94 / Farmers Exchange Capital III | 0.88 | 0.34 | 0.2295 | -0.0566 | |||||

| BRAVO RESIDENTIAL FUNDING TRUS / ABS-MBS (US105925AC54) | 0.87 | 0.2280 | 0.2280 | ||||||

| US78413MAE84 / SFAVE Commercial Mortgage Securities Trust 2015-5AVE | 0.87 | 0.2273 | 0.2273 | ||||||

| US3128MABR92 / Freddie Mac Gold Pool | 0.86 | -2.62 | 0.2239 | -0.0639 | |||||

| US77341KAA97 / Rockford Tower CLO 2021-1 Ltd | 0.85 | 0.12 | 0.2228 | -0.0558 | |||||

| CVS / CVS Health Corporation | 0.83 | 527.27 | 0.2169 | 0.1736 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.83 | -1.90 | 0.2162 | -0.0598 | |||||

| Bain Capital Credit CLO 2021-6 Ltd / ABS-CBDO (US05684PAL04) | 0.83 | 0.12 | 0.2160 | -0.0540 | |||||

| US010392FQ67 / Alabama Power Co Senior Note C Allable M/w 2.45 3/30/2022 Bond | 0.82 | 164.08 | 0.2136 | 0.1120 | |||||

| BlueMountain CLO 2018-3 Ltd / ABS-CBDO (US09630AAS50) | 0.80 | 1.01 | 0.2099 | -0.0504 | |||||

| US31335AAY47 / FG 04/45 FIXED 3.5 | 0.79 | -3.06 | 0.2077 | -0.0604 | |||||

| US38406JAA60 / Grace Trust 2020-GRCE | 0.79 | 2.59 | 0.2070 | -0.0459 | |||||

| US3140QNDG49 / Fannie Mae Pool | 0.79 | -2.71 | 0.2068 | -0.0593 | |||||

| Ares XXVII CLO Ltd / ABS-CBDO (US00190YBR53) | 0.79 | 0.38 | 0.2068 | -0.0511 | |||||

| Northern States Power Co/MN / DBT (US665772CZ03) | 0.79 | 0.2061 | 0.2061 | ||||||

| SBUX / Starbucks Corporation - Depositary Receipt (Common Stock) | 0.78 | 0.2053 | 0.2053 | ||||||

| US720186AK13 / Piedmont Natural Gas Co. Inc. | 0.78 | 0.2040 | 0.2040 | ||||||

| Dryden 95 CLO Ltd / ABS-CBDO (US262487AL52) | 0.78 | -0.13 | 0.2040 | -0.0516 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.77 | -2.04 | 0.2013 | -0.0561 | |||||

| US55903VBD47 / Warnermedia Holdings Inc | 0.77 | 6.36 | 0.2013 | -0.0359 | |||||

| Switch ABS Issuer LLC / ABS-O (US871044AL72) | 0.76 | 2.15 | 0.1987 | -0.0450 | |||||

| US3140XLP938 / FNCL UMBS 4.0 FS4947 01-01-53 | 0.74 | -2.63 | 0.1941 | -0.0555 | |||||

| US78444YAE59 / SLM Student Loan Trust 2008-5 | 0.72 | 0.28 | 0.1871 | -0.0468 | |||||

| US06051GJZ37 / Bank of America Corp | 0.71 | 1.42 | 0.1864 | -0.0439 | |||||

| US12433XAG43 / BX COML MTG TR 2020-VIVA CSTR 03/09/2044 144A | 0.71 | 2.45 | 0.1859 | -0.0415 | |||||

| NYC Commercial Mortgage Trust 2025-1155 / ABS-MBS (US67122BAA52) | 0.71 | 0.1855 | 0.1855 | ||||||

| US31418DTQ50 / Fannie Mae Pool | 0.71 | -1.80 | 0.1853 | -0.0512 | |||||

| US80281LAM72 / Santander UK Group Holdings PLC | 0.71 | 0.86 | 0.1849 | -0.0446 | |||||

| US07274NAN30 / Bayer US Finance II LLC | 0.70 | 2.48 | 0.1840 | -0.0409 | |||||

| Dryden 45 Senior Loan Fund / ABS-CBDO (US26244MBA99) | 0.70 | 1.45 | 0.1832 | -0.0429 | |||||

| US05610MAA09 / BX_22-CSMO | 0.70 | 0.43 | 0.1819 | -0.0450 | |||||

| US07274NAL73 / Bayer Us Finance Ii Llc 4.375% 12/15/2028 144a Bond | 0.69 | 1.77 | 0.1809 | -0.0418 | |||||

| US6499022E20 / New York State Dormitory Authority | 0.69 | 1.18 | 0.1796 | -0.0427 | |||||

| US03465VAA17 / AOMT_22-6 | 0.68 | -1.30 | 0.1785 | -0.0480 | |||||

| US26442CAN48 / Duke Energy Carolinas 4.0% 09/30/2042 | 0.68 | 0.74 | 0.1773 | -0.0432 | |||||

| US45254NML81 / Impac CMB Trust Series 2005-1 | 0.67 | -1.32 | 0.1765 | -0.0475 | |||||

| US8575093013 / State Street Navigator Securities Lending Government Money Market Portfolio | 0.67 | 0.67 | 0.1760 | 0.1760 | |||||

| Barings CLO Ltd 2018-IV / ABS-CBDO (US06760XAL82) | 0.66 | -5.60 | 0.1721 | -0.0562 | |||||

| US49338CAD56 / KeySpan Gas East Corp | 0.65 | 1.40 | 0.1713 | -0.0402 | |||||

| US19458LBC37 / COELT 2005 A A4 | 0.65 | -4.12 | 0.1705 | -0.0522 | |||||

| US02343UAG04 / Amcor Finance USA Inc | 0.64 | 0.16 | 0.1687 | -0.0420 | |||||

| US46647PCB04 / JPMorgan Chase & Co | 0.63 | 0.81 | 0.1636 | -0.0398 | |||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 0.62 | 0.1622 | 0.1622 | ||||||

| US06051GKJ75 / Bank of America Corp | 0.62 | 0.82 | 0.1615 | -0.0392 | |||||

| US78457JAQ58 / SMRT 2022-MINI SOFR30A+330 01/15/2024 144A | 0.62 | 3.89 | 0.1609 | -0.0331 | |||||

| US05491YAA82 / BAMLL Commercial Mortgage Securities Trust 2018-PARK | 0.60 | 1.01 | 0.1577 | -0.0379 | |||||

| GWT 2024-WLF2 / ABS-MBS (US362414AC83) | 0.60 | 0.33 | 0.1577 | -0.0393 | |||||

| US12668BE331 / Alternative Loan Trust, Series 2006-OA6, Class 1A2 | 0.60 | -2.61 | 0.1565 | -0.0448 | |||||

| BIIB / Biogen Inc. - Depositary Receipt (Common Stock) | 0.60 | 0.1563 | 0.1563 | ||||||

| US3140N27K13 / Fannie Mae Pool | 0.59 | -3.11 | 0.1550 | -0.0455 | |||||

| US617451DR76 / Morgan Stanley Capital I Incorporated Trust | 0.59 | -5.19 | 0.1532 | -0.0493 | |||||

| US12667GZB21 / Alternative Loan Trust 2005-31 | 0.58 | -0.85 | 0.1526 | -0.0402 | |||||

| US12654PAE88 / CSMC 2018-RPL9 TRUST CSMC 2018-RPL9 A | 0.58 | -1.52 | 0.1523 | -0.0415 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0.58 | 0.1509 | 0.1509 | ||||||

| GCAT 2024-INV4 Trust / ABS-MBS (US367919AB34) | 0.55 | -5.64 | 0.1445 | -0.0475 | |||||

| US78413MAA62 / SFAVE Commercial Mortgage Securities Trust 2015-5AVE | 0.55 | -3.16 | 0.1444 | -0.0423 | |||||

| US31418EGK01 / Federal National Mortgage Association | 0.55 | -2.30 | 0.1443 | -0.0407 | |||||

| US832248BD93 / Smithfield Foods Inc | 0.55 | 1.48 | 0.1432 | -0.0337 | |||||

| US55955GAA13 / Magnetite XXV Ltd | 0.54 | -6.71 | 0.1421 | -0.0484 | |||||

| US36179TNR22 / Ginnie Mae II Pool | 0.54 | -2.70 | 0.1415 | -0.0404 | |||||

| US3128MJZF08 / Freddie Mac Gold Pool | 0.54 | -2.00 | 0.1413 | -0.0393 | |||||

| US3128MJYY06 / Freddie Mac Gold Pool | 0.54 | -2.37 | 0.1401 | -0.0396 | |||||

| US3133B9KZ64 / FHLMC 30YR UMBS | 0.53 | -2.57 | 0.1391 | -0.0397 | |||||

| TIAA CLO IV Ltd / ABS-CBDO (US88631YAL11) | 0.52 | -6.76 | 0.1373 | -0.0469 | |||||

| US64966HYM68 / New York (City of), NY, Series 2010 G-1, GO Bonds | 0.52 | -0.38 | 0.1372 | -0.0354 | |||||

| XS2264968665 / Ivory Coast Government International Bond | 0.52 | 0.1368 | 0.1368 | ||||||

| US00764MGH43 / Aegis Asset Backed Securities Trust Mortgage Pass-Through Ctfs Ser 2005-4 | 0.52 | -0.77 | 0.1351 | -0.0353 | |||||

| US91845AAA34 / VZ Secured Financing BV | 0.51 | 64.08 | 0.1329 | 0.0316 | |||||

| US459506AQ49 / CORPORATE BONDS | 0.50 | 2.24 | 0.1318 | -0.0296 | |||||

| US31418AH275 / FN 08/42 FIXED 3.5 | 0.49 | -2.57 | 0.1289 | -0.0369 | |||||

| US12658YAA38 / COLT Funding LLC | 0.49 | -1.01 | 0.1278 | -0.0339 | |||||

| US32027NZM63 / First Franklin Mortgage Loan Trust, Series 2006-FFH1, Class M1 | 0.49 | -3.37 | 0.1276 | -0.0376 | |||||

| US06051GHG73 / Bank of America Corp | 0.48 | 0.63 | 0.1255 | -0.0306 | |||||

| US3132XCR807 / FREDDIE MAC GOLD POOL FG G67711 | 0.48 | -2.66 | 0.1246 | -0.0359 | |||||

| Volkswagen Financial Services AG / DBT (XS2941605235) | 0.47 | 10.26 | 0.1239 | -0.0169 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 0.47 | 0.1234 | 0.1234 | ||||||

| Bain Capital Credit CLO 2019-2 / ABS-CBDO (US05682LBA44) | 0.47 | 0.1228 | 0.1228 | ||||||

| CyrusOne Data Centers Issuer I LLC / ABS-O (US23284BAJ35) | 0.47 | 0.00 | 0.1226 | -0.0310 | |||||

| US3132DWF406 / FNCL UMBS 4.5 SD8287 01-01-53 | 0.47 | 0.1218 | 0.1218 | ||||||

| 2914 / Japan Tobacco Inc. | 0.46 | 0.1212 | 0.1212 | ||||||

| H1UM34 / Humana Inc. - Depositary Receipt (Common Stock) | 0.46 | 41.72 | 0.1210 | 0.0141 | |||||

| US64971XYT98 / New York City Transitional Finance Authority Future Tax Secured Revenue | 0.46 | 0.66 | 0.1208 | -0.0296 | |||||

| US06051GHD43 / Bank of America Corp | 0.46 | 0.88 | 0.1202 | -0.0290 | |||||

| US45661LAC28 / INDX 2006 AR27 1A3 | 0.45 | -4.42 | 0.1188 | -0.0369 | |||||

| US315289AC26 / Ferrellgas Escrow LLC / FG Operating Finance Escrow Corp | 0.45 | 105.99 | 0.1172 | 0.0460 | |||||

| US68236JAA97 / One Bryant Park Trust 2019-OBP | 0.45 | 2.06 | 0.1165 | -0.0265 | |||||

| US78446YAA10 / SLM Student Loan Trust 2012-2 | 0.44 | -1.99 | 0.1164 | -0.0323 | |||||

| ANTX / AN2 Therapeutics, Inc. | 0.44 | 217.14 | 0.1163 | 0.0703 | |||||

| US33938MAA71 / Flexential Issuer 2021-1 | 0.44 | 0.45 | 0.1158 | -0.0285 | |||||

| US05609TAE01 / BX Trust 2022-VAMF | 0.44 | 0.68 | 0.1156 | -0.0282 | |||||

| US92212KAB26 / Vantage Data Centers LLC | 0.44 | 0.92 | 0.1153 | -0.0278 | |||||

| US45660LXA24 / IndyMac INDX Mortgage Loan Trust 2005-AR19 | 0.44 | 0.00 | 0.1142 | -0.0289 | |||||

| US31335ALZ92 / Freddie Mac Gold Pool | 0.44 | -2.68 | 0.1140 | -0.0327 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.43 | -2.47 | 0.1137 | -0.0322 | |||||

| Government National Mortgage Association / ABS-MBS (US38384JMH40) | 0.42 | -3.44 | 0.1103 | -0.0327 | |||||

| Bank of America Corp / DBT (US06051GMM86) | 0.42 | 0.1090 | 0.1090 | ||||||

| US36179SSP38 / Ginnie Mae II Pool | 0.42 | -2.81 | 0.1086 | -0.0313 | |||||

| US06051GGF00 / Bank of America Corp | 0.41 | 0.49 | 0.1076 | -0.0266 | |||||

| US126307AZ02 / CSC Holdings, LLC | 0.41 | -1.69 | 0.1068 | -0.0293 | |||||

| US15135BAW19 / Centene Corp | 0.40 | 2.02 | 0.1059 | -0.0239 | |||||

| US36256BAC46 / GS MORTGAGE-BACKED SECURITIES TRUST 2018-RPL1 SER 2018-RPL1 CL A1A REGD 144A P/P 3.75000000 | 0.40 | -3.59 | 0.1055 | -0.0317 | |||||

| US3140MNM371 / FN 05/52 FIXED 3 | 0.40 | -3.59 | 0.1055 | -0.0315 | |||||

| LVS / Las Vegas Sands Corp. - Depositary Receipt (Common Stock) | 0.40 | 0.1053 | 0.1053 | ||||||

| FHF Issuer Trust 2025-1 / ABS-O (US30340RAF38) | 0.40 | 0.25 | 0.1052 | -0.0261 | |||||

| US95000U3B74 / Wells Fargo & Co | 0.40 | 1.52 | 0.1047 | -0.0245 | |||||

| US3132XCRV97 / Freddie Mac Gold Pool | 0.40 | -2.47 | 0.1035 | -0.0294 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0.40 | 0.1034 | 0.1034 | ||||||

| UNH / UnitedHealth Group Incorporated - Depositary Receipt (Common Stock) | 0.39 | 157.89 | 0.1028 | 0.0529 | |||||

| US341081FU66 / Florida Power & Light Co. | 0.39 | -1.02 | 0.1020 | -0.0268 | |||||

| US08576PAH47 / Berry Global Inc | 0.39 | 0.52 | 0.1013 | -0.0246 | |||||

| US33767JAJ16 / FirstKey Homes 2020-SFR2 Trust | 0.39 | 0.79 | 0.1009 | -0.0246 | |||||

| UNH / UnitedHealth Group Incorporated - Depositary Receipt (Common Stock) | 0.38 | 0.1004 | 0.1004 | ||||||

| US78447KAC62 / SLM Student Loan Trust 2012-7 | 0.38 | -2.31 | 0.0998 | -0.0281 | |||||

| 081437AG0 / Bemis Inc Notes 5.65% 08/01/14 | 0.38 | 1.06 | 0.0996 | -0.0237 | |||||

| American Medical Systems Europe BV / DBT (XS2993376693) | 0.38 | 10.91 | 0.0985 | -0.0129 | |||||

| US913903AZ35 / Universal Health Services Inc | 0.37 | 0.82 | 0.0973 | -0.0235 | |||||

| US87264ABD63 / CORP. NOTE | 0.37 | 0.54 | 0.0971 | -0.0240 | |||||

| US36179T7L33 / Ginnie Mae II Pool | 0.37 | -2.88 | 0.0971 | -0.0283 | |||||

| US31418EBR09 / Fannie Mae Pool | 0.37 | -2.12 | 0.0968 | -0.0269 | |||||

| US05401AAR23 / Avolon Holdings Funding Ltd | 0.37 | 1.37 | 0.0968 | -0.0226 | |||||

| US00914AAT97 / AIR LEASE CORPORATION | 0.37 | 0.55 | 0.0961 | -0.0237 | |||||

| Consolidated Communications LLC/Fidium Fiber Finance Holdco LLC / ABS-O (US209031AA16) | 0.37 | 0.0957 | 0.0957 | ||||||

| US529537AA08 / Lexington Realty Trust | 0.36 | 1.40 | 0.0950 | -0.0225 | |||||

| US72147KAH14 / Pilgrim's Pride Corp. | 0.36 | 2.26 | 0.0949 | -0.0212 | |||||

| US44421GAA13 / Hudson Yards 2019-30HY Mortgage Trust | 0.36 | 1.69 | 0.0947 | -0.0218 | |||||

| US46651EAA29 / J.P. Morgan Chase Commercial Mortgage Securities Trust 2019-OSB | 0.36 | 1.12 | 0.0944 | -0.0225 | |||||

| US93934FKP61 / Washington Mutual Mortgage Pass-Through Certificates WMALT Trust, Series 2006-1, Class 3A2 | 0.36 | -2.19 | 0.0937 | -0.0263 | |||||

| US3131XU6Q59 / Freddie Mac Pool | 0.36 | -2.20 | 0.0934 | -0.0260 | |||||

| US88732JBB35 / Time Warner Cable Inc. 5.50% 09/01/41 | 0.35 | 5.11 | 0.0916 | -0.0178 | |||||

| GOOGL / Alphabet Inc. - Depositary Receipt (Common Stock) | 0.35 | 0.0915 | 0.0915 | ||||||

| US78446WAC10 / SLM STUDENT LOAN TRUST 2012-1 SLMA 2012-1 A3 | 0.35 | -1.97 | 0.0911 | -0.0252 | |||||

| US44421MAA80 / Hudson Yards 2019-55HY Mortgage Trust | 0.35 | 2.97 | 0.0908 | -0.0197 | |||||

| BE6312822628 / Anheuser-Busch InBev SA/NV | 0.35 | 11.25 | 0.0906 | -0.0115 | |||||

| US23312BAA89 / DC Office Trust 2019-MTC | 0.35 | 2.37 | 0.0904 | -0.0202 | |||||

| US98919XAE13 / Zayo Group Holdings Inc | 0.34 | 233.98 | 0.0902 | 0.0563 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 0.34 | 0.0899 | 0.0899 | ||||||

| XS2644969425 / Realty Income Corp | 0.34 | 0.0893 | 0.0893 | ||||||

| US55903VBE20 / Warnermedia Holdings Inc | 0.34 | -4.25 | 0.0885 | -0.0273 | |||||

| Blackrock Inc / DBT (XS3038485689) | 0.34 | 0.0881 | 0.0881 | ||||||

| US3128MJYN41 / Freddie Mac Gold Pool | 0.34 | -2.05 | 0.0879 | -0.0245 | |||||

| US 2YR NOTE (CBT) SEP25 / DIR (000000000) | 0.33 | 0.0871 | 0.0871 | ||||||

| US38141GYA65 / Goldman Sachs Group Inc/The | 0.33 | 0.91 | 0.0870 | -0.0210 | |||||

| XS2607040958 / NATL GAS TRANSM | 0.33 | 9.93 | 0.0869 | -0.0123 | |||||

| US31335BWR31 / Freddie Mac Gold Pool | 0.33 | -3.24 | 0.0859 | -0.0253 | |||||

| US35805BAC28 / FRESENIUS MEDICAL CARE US FIN III | 0.33 | 0.62 | 0.0855 | -0.0209 | |||||

| US3140Q83U76 / UMBS, 30 Year | 0.32 | -2.99 | 0.0848 | -0.0247 | |||||

| US12654YAA73 / Century Plaza Towers 2019-CPT | 0.32 | 1.26 | 0.0843 | -0.0199 | |||||

| UBERD / Uber Technologies, Inc. - Depositary Receipt (Common Stock) | 0.32 | 1.27 | 0.0835 | -0.0199 | |||||

| LU2445093128 / INTELSAT EMERGENCE SA | 0.01 | 0.00 | 0.31 | 17.11 | 0.0808 | -0.0054 | |||

| US03027XBS80 / American Tower Corp | 0.31 | 1.32 | 0.0808 | -0.0189 | |||||

| US55903VBC63 / Warnermedia Holdings Inc | 0.31 | -15.62 | 0.0808 | -0.0390 | |||||

| US44409MAC01 / Hudson Pacific Properties LP | 0.31 | 18.99 | 0.0804 | -0.0044 | |||||

| US84762LAX38 / Spectrum Brands Inc | 0.31 | -5.83 | 0.0804 | -0.0265 | |||||

| US172967LW98 / Citigroup Inc | 0.31 | 0.66 | 0.0803 | -0.0196 | |||||

| US29273RBF55 / Energy Transfer Operating LP | 0.30 | 0.68 | 0.0772 | -0.0188 | |||||

| US26250UAQ85 / Dryden XXVI Senior Loan Fund | 0.29 | -15.52 | 0.0771 | -0.0371 | |||||

| US95000U2G70 / Wells Fargo & Co | 0.29 | 1.40 | 0.0758 | -0.0178 | |||||

| US404280CL16 / HSBC Holdings PLC | 0.29 | 1.40 | 0.0756 | -0.0179 | |||||

| US91087BAT70 / Mexico Government International Bond | 0.28 | 2.55 | 0.0740 | -0.0161 | |||||

| Invitation Homes Operating Partnership LP 2024 Term Loan / LON (US46187CAJ09) | 0.28 | 0.0739 | 0.0739 | ||||||

| EOAN / E.ON SE | 0.28 | 0.0731 | 0.0731 | ||||||

| US476624BH32 / JERSEY CITY NJ MUNI UTILITIES REGD N/C B/E NATL 5.47000000 | 0.28 | -31.09 | 0.0726 | -0.0592 | |||||

| XS2241825111 / Global Switch Finance BV | 0.28 | 9.13 | 0.0722 | -0.0107 | |||||

| US3128MJZG80 / Freddie Mac Gold Pool | 0.27 | -1.79 | 0.0718 | -0.0199 | |||||

| US05606FAN33 / BX TRUST BX 2019 OC11 E 144A | 0.27 | 1.11 | 0.0717 | -0.0169 | |||||

| US78445CAD48 / SLM Student Loan Trust 2008-6 | 0.27 | -2.85 | 0.0716 | -0.0206 | |||||

| US970648AJ01 / Willis North America Inc | 0.27 | 1.87 | 0.0714 | -0.0163 | |||||

| JBS USA Holding Lux Sarl/ JBS USA Food Co/ JBS Lux Co Sarl / DBT (US47214BAC28) | 0.27 | 1.14 | 0.0700 | -0.0167 | |||||

| US20268JAF03 / CommonSpirit Health | 0.27 | 1.92 | 0.0695 | -0.0160 | |||||

| Teva Pharmaceutical Finance Netherlands II BV / DBT (XS3081797964) | 0.26 | 0.0674 | 0.0674 | ||||||

| US161175BN35 / Charter Communications Operating LLC / Charter Communications Operating Capital | 0.25 | 5.39 | 0.0666 | -0.0125 | |||||

| US706451BG56 / Petroleos Mexicanos | 0.25 | 5.44 | 0.0662 | -0.0124 | |||||

| Apidos CLO XXX / ABS-CBDO (US03768CAN92) | 0.25 | 0.0653 | 0.0653 | ||||||

| US95000U3E14 / Wells Fargo & Co. | 0.25 | 0.41 | 0.0648 | -0.0159 | |||||

| US836205BC70 / Republic of South Africa Government International Bond | 0.24 | 2.95 | 0.0640 | -0.0139 | |||||

| T1OW34 / American Tower Corporation - Depositary Receipt (Common Stock) | 0.24 | 0.83 | 0.0637 | -0.0154 | |||||

| US3128MJYH72 / Freddie Mac Gold Pool | 0.24 | -1.23 | 0.0628 | -0.0171 | |||||

| US65535VJB53 / NOMURA ASSET ACCEPTANCE CORP ALTERNATIVE LOAN TRUST SERIES 2005-AR1 | 0.24 | -27.58 | 0.0628 | -0.0456 | |||||

| US91412HJV69 / University of California, Series 2021 BI, Ref. RB | 0.24 | 2.14 | 0.0627 | -0.0143 | |||||

| ORCL / Oracle Corporation - Depositary Receipt (Common Stock) | 0.24 | 0.85 | 0.0625 | -0.0151 | |||||

| Government National Mortgage Association / ABS-MBS (US38384PYX22) | 0.24 | -11.19 | 0.0624 | -0.0257 | |||||

| Magnetite XII Ltd / ABS-CBDO (US55953HBD44) | 0.23 | -34.08 | 0.0613 | -0.0551 | |||||

| US78444EAD13 / SLM Student Loan Trust 2007-7 | 0.23 | -2.94 | 0.0607 | -0.0173 | |||||

| US36179SWX16 / Ginnie Mae II Pool | 0.23 | -2.97 | 0.0600 | -0.0173 | |||||

| US36179SSQ11 / Ginnie Mae II Pool | 0.23 | -2.58 | 0.0596 | -0.0169 | |||||

| Icahn Enterprises LP / Icahn Enterprises Finance Corp / DBT (US451102CJ41) | 0.22 | -0.88 | 0.0587 | -0.0156 | |||||

| US55316PAA57 / MKT_20-525M | 0.22 | 2.28 | 0.0586 | -0.0134 | |||||

| US45262BAB99 / IMPERIAL BRANDS FIN PLC REGD 144A P/P 3.50000000 | 0.22 | 0.45 | 0.0582 | -0.0145 | |||||

| FR001400AFO9 / Suez SACA | 0.22 | 11.11 | 0.0577 | -0.0075 | |||||

| US92332YAD31 / Venture Global LNG Inc | 0.22 | 263.33 | 0.0571 | 0.0372 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0.22 | 0.00 | 0.0570 | -0.0141 | |||||

| US46590XAX49 / JBS USA LUX SA / JBS USA Food Co / JBS USA Finance Inc | 0.22 | 0.00 | 0.0570 | -0.0143 | |||||

| Equinix Europe 2 Financing Corp LLC / DBT (XS2941363637) | 0.22 | 0.0570 | 0.0570 | ||||||

| Prologis Euro Finance LLC / DBT (XS2810794680) | 0.22 | 0.0567 | 0.0567 | ||||||

| US46647PBE51 / JPMorgan Chase & Co | 0.21 | 1.42 | 0.0561 | -0.0130 | |||||

| US61747YEL56 / Morgan Stanley | 0.21 | 145.98 | 0.0560 | 0.0273 | |||||

| 1261229 BC Ltd / DBT (US68288AAA51) | 0.21 | 0.0554 | 0.0554 | ||||||

| US49272YAB92 / Kevlar SpA | 0.21 | 0.96 | 0.0551 | -0.0131 | |||||

| US92922F4M79 / WaMu Mortgage Pass-Through Certificates Series 2005-AR13 Trust | 0.21 | -5.07 | 0.0542 | -0.0172 | |||||

| MVM Energetika Zrt / DBT (XS2783579704) | 0.21 | 0.98 | 0.0541 | -0.0130 | |||||

| S56431109 / Northam Platinum Holdings Ltd | 0.20 | 1.00 | 0.0533 | -0.0127 | |||||

| US31418AHY73 / Fannie Mae Pool | 0.20 | -3.33 | 0.0533 | -0.0158 | |||||

| Severn Trent Utilities Finance PLC / DBT (XS2991273462) | 0.20 | 0.0527 | 0.0527 | ||||||

| US486661AF87 / Kazakhstan Government International Bond | 0.20 | 0.0525 | 0.0525 | ||||||

| US36179UCB61 / Ginnie Mae II Pool | 0.20 | -3.40 | 0.0522 | -0.0154 | |||||

| US928668AU66 / Volkswagen Group of America Finance LLC | 0.20 | 0.0521 | 0.0521 | ||||||

| USP75744AJ47 / Paraguay Government International Bond | 0.20 | 2.06 | 0.0520 | -0.0117 | |||||

| 421915EH8 / Health Care Ppty Investor 5.65% Notes 12/15/13 | 0.20 | 0.0518 | 0.0518 | ||||||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 0.20 | 1.55 | 0.0518 | -0.0119 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 0.20 | 0.0517 | 0.0517 | ||||||

| CVS / CVS Health Corporation - Depositary Receipt (Common Stock) | 0.20 | 2.09 | 0.0513 | -0.0115 | |||||

| US3128MJY619 / Freddie Mac Gold Pool | 0.20 | -2.01 | 0.0512 | -0.0143 | |||||

| US698813AA06 / Papa John's International Inc | 0.19 | 3.74 | 0.0508 | -0.0106 | |||||

| US698299BT07 / PANAMA (REPUBLIC OF) | 0.19 | 3.74 | 0.0508 | -0.0108 | |||||

| Fiserv Funding ULC / DBT (XS3060660563) | 0.19 | 0.0507 | 0.0507 | ||||||

| US3128MJ4A51 / Federal Home Loan Mortgage Corp. | 0.19 | -1.53 | 0.0505 | -0.0140 | |||||

| US59408UAB35 / Michaels Cos Inc/The | 0.19 | 12.94 | 0.0504 | -0.0055 | |||||

| US315289AA69 / Ferrellgas Escrow LLC / FG Operating Finance Escrow Corp | 0.19 | 27.03 | 0.0492 | 0.0006 | |||||

| US31418AYD44 / Fannie Mae Pool | 0.19 | -4.08 | 0.0492 | -0.0151 | |||||

| US00435TAA97 / Access Group Inc 2015-1 | 0.19 | -3.65 | 0.0485 | -0.0146 | |||||

| US69370PAH47 / Pertamina Persero PT | 0.18 | 1.67 | 0.0480 | -0.0112 | |||||

| US3140Q9N257 / Fannie Mae Pool | 0.18 | -3.19 | 0.0478 | -0.0138 | |||||

| US3136B1Z723 / Fannie Mae REMICS | 0.18 | -3.19 | 0.0477 | -0.0139 | |||||

| Lonza Finance International NV / DBT (BE6355215664) | 0.18 | 0.0473 | 0.0473 | ||||||

| AAT / American Assets Trust, Inc. | 0.18 | 0.00 | 0.0471 | -0.0119 | |||||

| US36179TUB96 / Ginnie Mae II Pool | 0.18 | -3.26 | 0.0467 | -0.0138 | |||||

| US71567RAS58 / Perusahaan Penerbit SBSN Indonesia III | 0.18 | 2.89 | 0.0467 | -0.0103 | |||||

| US38380Y2X28 / Government National Mortgage Association | 0.18 | -3.83 | 0.0463 | -0.0138 | |||||

| HTHROW / Heathrow Funding Ltd | 0.17 | 0.0456 | 0.0456 | ||||||

| ANTX / AN2 Therapeutics, Inc. | 0.17 | 0.58 | 0.0455 | -0.0109 | |||||

| UNH / UnitedHealth Group Incorporated - Depositary Receipt (Common Stock) | 0.17 | 0.0453 | 0.0453 | ||||||

| FR0013439304 / Worldline SA | 0.17 | 2.38 | 0.0451 | -0.0100 | |||||

| CBRE Global Investors Open-Ended Funds SCA SICAV-SIF-Pan European Core Fund / DBT (XS2793256137) | 0.17 | 9.62 | 0.0450 | -0.0063 | |||||

| XS2328823104 / Heathrow Funding Ltd | 0.17 | 10.46 | 0.0443 | -0.0059 | |||||

| US05606FAA12 / BX TRUST BX 2019 OC11 A 144A | 0.17 | 1.21 | 0.0439 | -0.0104 | |||||

| US125523CQ19 / Cigna Corp | 0.17 | 0.00 | 0.0438 | -0.0111 | |||||

| US61772BAB99 / Morgan Stanley | 0.17 | 0.61 | 0.0434 | -0.0105 | |||||

| US36179R4E62 / Ginnie Mae II Pool | 0.17 | -2.37 | 0.0432 | -0.0125 | |||||

| US92922FD478 / WaMu Mortgage Pass-Through Certificates Trust, Series 2005-AR2, Class 2A21 | 0.16 | -6.86 | 0.0429 | -0.0148 | |||||

| US05400KAJ97 / Avolon TLB Borrower 1 (US) LLC 2023 Term Loan B6 | 0.16 | 0.00 | 0.0427 | -0.0108 | |||||

| US88732JAY47 / Time Warner Cable Inc. 5.875% 11/15/40 | 0.16 | 5.16 | 0.0427 | -0.0084 | |||||

| US43289DAK90 / HILTON HOTELS 11/30/30 | 0.16 | 1,372.73 | 0.0424 | 0.0387 | |||||

| US161630BK37 / CHASE 2007 A1 11A4 | 0.16 | -2.47 | 0.0415 | -0.0118 | |||||

| US61747YEH45 / Morgan Stanley | 0.16 | -43.32 | 0.0412 | -0.0530 | |||||

| US36179TLR40 / Ginnie Mae II Pool | 0.16 | -3.09 | 0.0412 | -0.0119 | |||||

| US31418DGV82 / Fannie Mae Pool | 0.16 | -1.27 | 0.0409 | -0.0110 | |||||

| US085770AA31 / Berry Global Escrow Corp. | 0.15 | 0.00 | 0.0402 | -0.0101 | |||||

| US126650DZ02 / CVS HEALTH CORP | 0.15 | 0.66 | 0.0400 | -0.0095 | |||||

| 72018QAB7 / Piedmont Natl Gas Inc Mtn Be Fr 6.87% 10/06/23 | 0.15 | 1.35 | 0.0394 | -0.0093 | |||||

| US03464JAA97 / Angel Oak Mortgage Trust 2021-7 | 0.15 | 0.00 | 0.0393 | -0.0099 | |||||

| US36179TLS23 / Ginnie Mae II Pool | 0.15 | -2.61 | 0.0391 | -0.0114 | |||||

| Citibank NA / DBT (US17325FBP27) | 0.15 | 0.0387 | 0.0387 | ||||||

| XS2580220171 / AA BOND CO LTD | 0.15 | 7.35 | 0.0382 | -0.0066 | |||||

| Venture Global Plaquemines LNG LLC / DBT (US922966AB20) | 0.15 | 0.0382 | 0.0382 | ||||||

| US458140BJ82 / Intel Corp | 0.15 | 0.0381 | 0.0381 | ||||||

| US31418EQ864 / Fannie Mae Pool | 0.15 | -2.68 | 0.0381 | -0.0108 | |||||

| US31418CLH50 / Fannie Mae Pool | 0.15 | -1.36 | 0.0380 | -0.0105 | |||||

| V / Visa Inc. - Depositary Receipt (Common Stock) | 0.14 | 0.0369 | 0.0369 | ||||||

| US91159HJL50 / US Bancorp | 0.14 | -32.35 | 0.0362 | -0.0307 | |||||

| US31417AWY18 / FN 01/32 FIXED 3.5 | 0.14 | -5.56 | 0.0358 | -0.0117 | |||||

| US55916AAA25 / Magic Mergeco Inc | 0.14 | 16.38 | 0.0356 | -0.0027 | |||||

| US02666TAD90 / American Homes 4 Rent LP | 0.14 | 0.00 | 0.0353 | -0.0092 | |||||

| US02666TAC18 / American Homes 4 Rent, LP | 0.13 | 1.52 | 0.0353 | -0.0083 | |||||

| US31418DY712 / Fannie Mae Pool | 0.13 | -2.19 | 0.0352 | -0.0097 | |||||

| XS2058557344 / Thermo Fisher Scientific Inc | 0.13 | 0.0349 | 0.0349 | ||||||

| XS2675884733 / Volkswagen International Finance NV | 0.13 | 10.83 | 0.0348 | -0.0047 | |||||

| US32051GXQ36 / FHASI 2005 AR5 2A1 | 0.13 | -1.50 | 0.0345 | -0.0091 | |||||

| US36179U3S95 / GINNIE MAE II POOL G2 MA6209 | 0.13 | -3.68 | 0.0344 | -0.0102 | |||||

| US03969AAP57 / Ardagh Packaging Finance PLC / Ardagh Holdings USA Inc | 0.13 | -2.96 | 0.0344 | -0.0098 | |||||

| US04685A3L31 / Athene Global Funding | 0.13 | 0.77 | 0.0344 | -0.0083 | |||||

| US 5YR NOTE (CBT) SEP25 / DIR (000000000) | 0.13 | 0.0339 | 0.0339 | ||||||

| US476556CP82 / Jersey Cent Pwr & Lt Co Senior Notes 6.4% 05/15/36 | 0.13 | 0.00 | 0.0335 | -0.0086 | |||||

| XS2549715618 / TenneT Holding BV | 0.13 | 9.48 | 0.0334 | -0.0032 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0.13 | 0.79 | 0.0333 | -0.0081 | |||||

| US29278NAF06 / Energy Transfer Operating LP | 0.13 | 0.80 | 0.0332 | -0.0080 | |||||

| US20903XAH61 / Consolidated Communications Inc | 0.13 | 0.0331 | 0.0331 | ||||||

| GRF / Greiffenberger AG | 0.12 | 8.85 | 0.0322 | -0.0048 | |||||

| GC / Goldcana Resources Inc. | 0.12 | 0.0320 | 0.0320 | ||||||

| US06051GJT76 / Bank of America Corp | 0.12 | 26.04 | 0.0317 | -0.0010 | |||||

| US36179TLT06 / Ginnie Mae II Pool | 0.12 | -3.23 | 0.0316 | -0.0093 | |||||

| US404119CB31 / HCA Inc | 0.12 | 0.00 | 0.0315 | -0.0078 | |||||

| CVS / CVS Health Corporation - Depositary Receipt (Common Stock) | 0.12 | 0.84 | 0.0315 | -0.0077 | |||||

| ELI / Elia Group SA/NV | 0.12 | 10.09 | 0.0314 | -0.0044 | |||||

| US161175BV50 / Charter Communications Operating LLC / Charter Communications Operating Capital | 0.12 | -66.29 | 0.0314 | -0.0843 | |||||

| XS2589260996 / Enel Finance International NV | 0.12 | 0.0313 | 0.0313 | ||||||

| S1YK34 / Stryker Corporation - Depositary Receipt (Common Stock) | 0.12 | 10.28 | 0.0310 | -0.0043 | |||||

| XS2527319979 / Eurogrid GmbH | 0.12 | 0.0309 | 0.0309 | ||||||

| UU / UNITED UTILITIES GROUP PLC | 0.12 | 0.0308 | 0.0308 | ||||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0.12 | 0.0305 | 0.0305 | ||||||

| US17307GW795 / Citigroup Mortgage Loan Trust 2005-11 | 0.12 | -0.85 | 0.0304 | -0.0081 | |||||

| La Francaise des Jeux SACA / DBT (FR001400U678) | 0.12 | 0.0304 | 0.0304 | ||||||

| US35908MAE03 / Frontier Communications Holdings LLC | 0.12 | -0.86 | 0.0303 | -0.0077 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0.12 | 0.0302 | 0.0302 | ||||||

| US27004GAJ22 / EagleView Technology Corporation 2018 Add On Term Loan B | 0.11 | 0.00 | 0.0301 | -0.0076 | |||||

| DE000A28VQD2 / VONOVIA BV | 0.11 | 10.78 | 0.0297 | -0.0039 | |||||

| CPR / Davide Campari-Milano N.V. | 0.11 | 11.88 | 0.0296 | -0.0038 | |||||

| MODVQ / ModivCare Inc. | 0.11 | -26.32 | 0.0294 | -0.0207 | |||||

| US38381RME61 / GOVERNMENT NATIONAL MORTGAGE ASSOCIATION GNR 2019-15 GT | 0.11 | -1.79 | 0.0290 | -0.0079 | |||||

| US845437BT80 / SOUTHWESTERN ELECTRIC POWER CO | 0.11 | -0.91 | 0.0287 | -0.0075 | |||||

| FR001400KWR6 / ELO SACA | 0.11 | 11.22 | 0.0287 | -0.0035 | |||||

| PNCS34 / The PNC Financial Services Group, Inc. - Depositary Receipt (Common Stock) | 0.11 | 136.96 | 0.0285 | 0.0135 | |||||

| US36179TG742 / Ginnie Mae II Pool | 0.11 | -2.70 | 0.0285 | -0.0079 | |||||

| US131347CK09 / Calpine Corp. Bond | 0.11 | 0.0281 | 0.0281 | ||||||

| MOH / Molina Healthcare, Inc. | 0.11 | 0.0280 | 0.0280 | ||||||

| US878091BF35 / Teachers Insurance & Annuity Association of America | 0.11 | 0.00 | 0.0276 | -0.0070 | |||||

| INTC / Intel Corporation - Depositary Receipt (Common Stock) | 0.11 | 0.96 | 0.0276 | -0.0067 | |||||

| US3140Q83V59 / Fannie Mae Pool | 0.11 | -2.78 | 0.0276 | -0.0081 | |||||

| Xerox Corp / DBT (US984121CS05) | 0.10 | 0.0274 | 0.0274 | ||||||

| US36179S5P82 / GINNIE MAE II POOL G2 MA4454 | 0.10 | -2.80 | 0.0273 | -0.0080 | |||||

| US46590XAQ97 / JBS USA LUX S.A. / JBS USA Food Company / JBS USA Finance, Inc. | 0.10 | 0.00 | 0.0272 | -0.0071 | |||||

| US3137FGVJ17 / Freddie Mac REMICS | 0.10 | -2.86 | 0.0269 | -0.0077 | |||||

| US030981AM61 / AmeriGas Partners LP / AmeriGas Finance Corp | 0.10 | 436.84 | 0.0267 | 0.0202 | |||||

| MODVQ / ModivCare Inc. | 0.10 | -1.94 | 0.0266 | -0.0072 | |||||

| Edgewater Generation LLC 2025 Repriced Term Loan / LON (US28031FAM23) | 0.10 | 0.0262 | 0.0262 | ||||||

| Heartland Dental LLC 2024 Term Loan / LON (US42236WAW73) | 0.10 | 0.0262 | 0.0262 | ||||||

| EOAN / E.ON SE | 0.10 | 0.0262 | 0.0262 | ||||||

| US39843PAG81 / Grifols Worldwide Operations USA, Inc. USD 2019 Term Loan B | 0.10 | -57.33 | 0.0261 | -0.0444 | |||||

| AmeriGas Partners LP / AmeriGas Finance Corp / DBT (US030981AP92) | 0.10 | 0.0261 | 0.0261 | ||||||

| 421915EH8 / Health Care Ppty Investor 5.65% Notes 12/15/13 | 0.10 | 1.02 | 0.0260 | -0.0064 | |||||

| 421915EH8 / Health Care Ppty Investor 5.65% Notes 12/15/13 | 0.10 | 1.02 | 0.0260 | -0.0064 | |||||

| DE000A3MP4V7 / Vonovia SE | 0.10 | 15.66 | 0.0253 | -0.0021 | |||||

| US95000U2U64 / Wells Fargo & Co | 0.10 | -50.52 | 0.0251 | -0.0381 | |||||

| XS2333297625 / Eurogrid GmbH | 0.10 | 9.20 | 0.0250 | -0.0035 | |||||

| US458140BW93 / Intel Corp | 0.10 | 1.06 | 0.0250 | -0.0060 | |||||

| US3138WK4Q59 / FANNIE MAE POOL FN AS9830 | 0.10 | -2.06 | 0.0249 | -0.0070 | |||||

| US64072TAC99 / CSC Holdings LLC | 0.10 | -1.04 | 0.0249 | -0.0069 | |||||

| US3140Q8DA09 / Fannie Mae Pool | 0.09 | -2.08 | 0.0248 | -0.0069 | |||||

| XS2201851172 / Romanian Government International Bond | 0.09 | 3.30 | 0.0246 | -0.0055 | |||||

| US46647PBT21 / JPMORGAN CHASE and CO 1.045%/VAR 11/19/2026 | 0.09 | 1.09 | 0.0245 | -0.0059 | |||||

| DE000A3E5VX4 / AMPRION GMBH /EUR/ REGD REG S EMTN 0.62500000 | 0.09 | 10.71 | 0.0245 | -0.0031 | |||||

| US3128MJ5D81 / Freddie Mac Gold Pool | 0.09 | -3.12 | 0.0245 | -0.0070 | |||||

| US172967MY46 / Citigroup Inc | 0.09 | 2.20 | 0.0243 | -0.0055 | |||||

| US59909TAC80 / Milano Acqusition/DXC State & Local HHS First-lien Term Loan 400 2027-08-03 | 0.09 | 2.22 | 0.0243 | -0.0054 | |||||

| Peer Holding III BV 2025 USD Term Loan B5B / LON (XAN6872NAN65) | 0.09 | 0.0239 | 0.0239 | ||||||

| US161175BJ23 / Charter Communications Operating LLC / Charter Communications Operating Capital | 0.09 | 1.12 | 0.0236 | -0.0056 | |||||

| US28414BAF31 / ELANCO ANIMAL HEALTH INCORPORA TERM LOAN B | 0.09 | -46.67 | 0.0233 | -0.0287 | |||||

| Voyager Parent LLC / DBT (US92921EAA01) | 0.09 | 0.0231 | 0.0231 | ||||||

| US3138WLCJ03 / FANNIE MAE POOL FN AS9972 | 0.09 | -1.12 | 0.0231 | -0.0063 | |||||

| US42225UAG94 / Healthcare Trust of America Holdings LP | 0.09 | 1.15 | 0.0231 | -0.0055 | |||||

| Public Service Co of Oklahoma / DBT (US744533BR07) | 0.08 | 1.20 | 0.0222 | -0.0053 | |||||

| ALPHA GENERATION LLC 2025 TERM LOAN B / LON (000000000) | 0.08 | 0.0218 | 0.0218 | ||||||

| US70533DAF78 / Pediatric Associates Holding Company, LLC 2021 Term Loan B | 0.08 | 0.0213 | 0.0213 | ||||||

| US31418AVE53 / FN 07/33 FIXED 3.5 | 0.08 | -4.76 | 0.0210 | -0.0067 | |||||

| US131347CK09 / Calpine Corp. Bond | 0.08 | 0.0202 | 0.0202 | ||||||

| FR0013526803 / Worldline SA | 0.08 | 7.04 | 0.0201 | -0.0032 | |||||

| US6174468X01 / Morgan Stanley | 0.08 | 1.33 | 0.0201 | -0.0046 | |||||

| US539830BK40 / Lockheed Martin Corp | 0.08 | 0.0201 | 0.0201 | ||||||

| Venture Global LNG Inc / DBT (US92332YAF88) | 0.08 | 0.0201 | 0.0201 | ||||||

| US3138AGBB39 / FN 05/41 FIXED 5 | 0.08 | -1.30 | 0.0200 | -0.0054 | |||||

| Element Materials Technology Group US Holdings Inc 2022 USD Term Loan / LON (000000000) | 0.08 | 0.0200 | 0.0200 | ||||||

| US36179SB893 / Ginnie Mae II Pool | 0.07 | -3.90 | 0.0196 | -0.0056 | |||||

| US26444HAQ48 / DUKE ENERGY FLORIDA LLC SR SEC 1ST LIEN 5.875% 11-15-33 | 0.07 | 1.37 | 0.0195 | -0.0047 | |||||

| US76009NAL47 / Rent-A-Center Inc/TX | 0.07 | 131.25 | 0.0194 | 0.0095 | |||||

| Renaissance Holding Corp 2024 1st Lien Term Loan / LON (US75972JAK07) | 0.07 | 100.00 | 0.0194 | 0.0070 | |||||

| VOYAGER PARENT LLC TERM LOAN B / LON (000000000) | 0.07 | 0.0192 | 0.0192 | ||||||

| US693475BU84 / PNC Financial Services Group Inc/The | 0.07 | 1.41 | 0.0190 | -0.0045 | |||||

| US88233FAK66 / Vistra Operations Co. LLC, Term Loan | 0.07 | 75.61 | 0.0189 | 0.0053 | |||||

| US36179TG411 / Ginnie Mae II Pool | 0.07 | -4.05 | 0.0188 | -0.0054 | |||||

| US31415TFT25 / FN 08/38 FIXED 5.5 | 0.07 | -2.74 | 0.0188 | -0.0052 | |||||

| US03027XBM11 / CORPORATE BONDS | 0.07 | 1.43 | 0.0188 | -0.0044 | |||||

| AI Aqua Merger Sub Inc 2024 1st Lien Term Loan B / LON (US00132UAP93) | 0.07 | 255.00 | 0.0186 | 0.0119 | |||||

| US3128MJYG99 / Federal Home Loan Mortgage Corp. | 0.07 | -2.78 | 0.0186 | -0.0052 | |||||

| US361841AQ25 / GLP Capital LP / GLP Financing II Inc | 0.07 | 1.45 | 0.0185 | -0.0044 | |||||

| US98919VAA35 / Front Range BidCo Inc | 0.07 | 0.0184 | 0.0184 | ||||||

| US3128MJZX14 / Freddie Mac Gold Pool | 0.07 | -2.82 | 0.0182 | -0.0051 | |||||

| SNAP / Snap Inc. - Depositary Receipt (Common Stock) | 0.07 | 0.0177 | 0.0177 | ||||||

| Charter Communications Operating LLC 2024 Term Loan B5 / LON (US16117LCE74) | 0.07 | 0.0176 | 0.0176 | ||||||

| AmWINS Group Inc 2025 Term Loan B / LON (US03234TBA51) | 0.07 | 0.0173 | 0.0173 | ||||||

| US06051GKD06 / Bank of America Corp | 0.07 | 3.13 | 0.0173 | -0.0039 | |||||

| US30225VAQ05 / Extra Space Storage LP | 0.07 | 3.13 | 0.0173 | -0.0039 | |||||

| US459506AP65 / INTERNATIONAL FLAVORS and FRAGRANCES INC 1.832% 10/15/2027 144A | 0.07 | 0.00 | 0.0173 | -0.0041 | |||||

| US20903XAF06 / Consolidated Communications Inc | 0.07 | 0.0170 | 0.0170 | ||||||

| US91740PAF53 / USA Compression Partners LP / USA Compression Finance Corp | 0.07 | -32.29 | 0.0170 | -0.0108 | |||||

| US36179SUY17 / GINNIE MAE II POOL G2 MA4199 | 0.06 | -4.48 | 0.0169 | -0.0051 | |||||

| US36179SCB16 / GINNIE MAE II POOL G2 MA3666 | 0.06 | -4.55 | 0.0167 | -0.0050 | |||||

| US3128MJ4T43 / Freddie Mac Gold Pool | 0.06 | -3.08 | 0.0166 | -0.0047 | |||||

| US458140BG44 / Intel Corp | 0.06 | 1.61 | 0.0166 | -0.0039 | |||||

| Delivery Hero SE 2024 USD Term Loan B / LON (XAD2007ZAE79) | 0.06 | 29.17 | 0.0164 | 0.0004 | |||||

| Vmed O2 UK Financing I PLC / DBT (US92858RAD26) | 0.06 | 0.0163 | 0.0163 | ||||||

| US36179SLS40 / Ginnie Mae II Pool | 0.06 | -3.17 | 0.0162 | -0.0046 | |||||

| Twitter Inc Term Loan / LON (US90184NAG34) | 0.06 | 165.22 | 0.0162 | 0.0084 | |||||

| Foundry JV Holdco LLC / DBT (US350930AF07) | 0.06 | 1.67 | 0.0161 | -0.0039 | |||||

| US07274NAQ60 / Bayer US Finance II LLC | 0.06 | -63.47 | 0.0161 | -0.0389 | |||||

| US92943GAE17 / WR Grace Holdings LLC | 0.06 | 3.39 | 0.0161 | -0.0036 | |||||

| BCPE Flavor Debt Merger Sub LLC and BCPE Flavor Issuer Inc / DBT (US072933AA25) | 0.06 | 0.0161 | 0.0161 | ||||||

| US06051GJL41 / Bank of America Corp | 0.06 | 3.39 | 0.0160 | -0.0037 | |||||

| M1GM34 / MGM Resorts International - Depositary Receipt (Common Stock) | 0.06 | 0.0160 | 0.0160 | ||||||

| US61747YED31 / Morgan Stanley | 0.06 | 1.69 | 0.0159 | -0.0037 | |||||

| US458140CJ73 / Intel Corp | 0.06 | 1.69 | 0.0158 | -0.0037 | |||||

| US126650CY46 / CVS Health Corp | 0.06 | 1.72 | 0.0156 | -0.0035 | |||||

| US36179S2P10 / Ginnie Mae II Pool | 0.06 | -3.33 | 0.0154 | -0.0044 | |||||

| US3128MJYU83 / Freddie Mac Gold Pool | 0.06 | -3.33 | 0.0154 | -0.0043 | |||||

| US06051GKK49 / Bank of America Corp | 0.06 | -63.98 | 0.0152 | -0.0396 | |||||

| US38528UAE64 / Grand Canyon University | 0.06 | 0.0152 | 0.0152 | ||||||

| US3128MJ5E64 / Freddie Mac Gold Pool | 0.06 | -1.69 | 0.0152 | -0.0043 | |||||

| US02660TDH32 / AHM_05-1 | 0.06 | -35.56 | 0.0152 | -0.0144 | |||||

| US92564RAL96 / VICI Properties LP / VICI Note Co., Inc. | 0.06 | 1.75 | 0.0152 | -0.0036 | |||||

| FLUTTER FINANCING BV 2025 TERM LOAN B / LON (XAN3313EAJ90) | 0.06 | 0.0149 | 0.0149 | ||||||

| Alpha Generation LLC / DBT (US02073LAA98) | 0.06 | 1.82 | 0.0148 | -0.0032 | |||||

| IQVIA Inc 2025 Repriced Term Loan B / LON (US44969CBP41) | 0.06 | 0.00 | 0.0148 | -0.0037 | |||||

| US24440EAB39 / Deerfield (Duff & Phelps/Dakota Holdings) T/L B (2/20) | 0.06 | 1.85 | 0.0146 | -0.0033 | |||||

| Volkswagen Group of America Finance LLC / DBT (US928668CS92) | 0.06 | 0.0145 | 0.0145 | ||||||

| Oregon Tool Inc 2025 2nd Lien Term Loan / LON (XAL7266PAE50) | 0.06 | 10.00 | 0.0144 | -0.0020 | |||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.05 | 0.0141 | 0.0141 | ||||||

| Showtime Acquisition LLC 2024 1st Lien Term Loan / LON (US82540EAC84) | 0.05 | 0.00 | 0.0140 | -0.0035 | |||||

| US36179TNS05 / Ginnie Mae II Pool | 0.05 | -3.70 | 0.0139 | -0.0040 | |||||

| US683715AF36 / Open Text Corp | 0.05 | 0.00 | 0.0135 | -0.0034 | |||||

| US36179R7J23 / Ginnie Mae II Pool | 0.05 | -3.77 | 0.0135 | -0.0039 | |||||

| US06051GJB68 / Bank of America Corp | 0.05 | 2.04 | 0.0132 | -0.0030 | |||||

| US126307BA42 / CSC Holdings, LLC | 0.05 | 71.43 | 0.0128 | 0.0036 | |||||

| US88033GDR83 / Tenet Healthcare Corp | 0.05 | 0.0127 | 0.0127 | ||||||

| US161175AY09 / Charter Communications Operating LLC / Charter Communications Operating Capital | 0.05 | 0.00 | 0.0126 | -0.0032 | |||||

| US70468BAC72 / Pelican Products, Inc. 2021 Term Loan | 0.05 | 0.0124 | 0.0124 | ||||||

| 1011778 BC Unlimited Liability Company 2024 Term Loan B6 / LON (XAC6901LAM90) | 0.05 | -11.32 | 0.0124 | -0.0050 | |||||

| US03969AAN00 / Ardagh Packaging Finance PLC / Ardagh Holdings USA, Inc. | 0.05 | 2.22 | 0.0123 | -0.0028 | |||||

| US62984CAD56 / Naked Juice LLC, First Lien Term Loan | 0.05 | -34.29 | 0.0123 | -0.0109 | |||||

| Modena Buyer LLC Term Loan / LON (US60753DAC83) | 0.05 | 0.0121 | 0.0121 | ||||||

| US71360HAB33 / PERATON CORP | 0.05 | -51.58 | 0.0121 | -0.0177 | |||||

| US44409MAA45 / HUDSON PACIFIC PROPERTIE COMPANY GUAR 11/27 3.95 | 0.05 | 9.52 | 0.0120 | -0.0019 | |||||

| MH Sub I LLC 2024 Term Loan B4 / LON (US45567YAP07) | 0.05 | -6.25 | 0.0120 | -0.0039 | |||||

| Jane Street Group LLC 2024 Term Loan B1 / LON (US47077DAM20) | 0.05 | 12.50 | 0.0120 | -0.0014 | |||||

| 09238EAB0 / Blackhawk Network Holdings, Inc. Bond 1.500% 1/1 | 0.05 | 0.0119 | 0.0119 | ||||||

| US89787RAH57 / TruGreen Limited Partnership 2020 Term Loan | 0.05 | 104.55 | 0.0119 | 0.0046 | |||||

| Jazz Financing Lux Sarl 2024 1st Lien Term Loan B / LON (XAG5080AAJ16) | 0.05 | -47.67 | 0.0118 | -0.0164 | |||||

| US34965KAA51 / Fortrea Holdings Inc | 0.05 | 0.00 | 0.0118 | -0.0031 | |||||

| US71654QDE98 / Petroleos Mexicanos | 0.05 | 7.14 | 0.0118 | -0.0020 | |||||

| HDI Aerospace Intermediate Holding III Corporation Term Loan B / LON (US40415WAB00) | 0.04 | 0.0118 | 0.0118 | ||||||

| US36179TG338 / Ginnie Mae II Pool | 0.04 | -4.35 | 0.0117 | -0.0034 | |||||

| US31416B2P25 / Fannie Mae Pool | 0.04 | -2.22 | 0.0116 | -0.0034 | |||||

| US42225UAK07 / Healthcare Realty Holdings LP | 0.04 | 0.00 | 0.0115 | -0.0028 | |||||

| RUBI / Rubico Inc. | 0.04 | 0.00 | 0.0114 | -0.0029 | |||||

| Southern Veterinary Partners LLC 2024 1st Lien Term Loan / LON (US84410HAN08) | 0.04 | 0.0113 | 0.0113 | ||||||

| BCPE Empire Holdings Inc 2025 Term Loan B / LON (US05550HAQ83) | 0.04 | 48.28 | 0.0113 | 0.0017 | |||||

| U2NF34 / United Natural Foods, Inc. - Depositary Receipt (Common Stock) | 0.04 | -23.64 | 0.0112 | -0.0070 | |||||

| ABG Intermediate Holdings 2 LLC 2024 1st Lien Term Loan B / LON (US00076VBL36) | 0.04 | 0.0111 | 0.0111 | ||||||

| BDL297PP7 FWDP 2Y RTP SWAPTION / DIR (000000000) | 0.04 | 0.0111 | 0.0111 | ||||||

| Artera Services LLC / DBT (US04302XAA28) | 0.04 | -10.87 | 0.0109 | -0.0044 | |||||

| USB / U.S. Bancorp - Depositary Receipt (Common Stock) | 0.04 | 2.50 | 0.0109 | -0.0025 | |||||

| Helios Software Holdings Inc / ION Corporate Solutions Finance Sarl / DBT (US42329HAB42) | 0.04 | 41.38 | 0.0108 | 0.0010 | |||||

| US05552DAD49 / Dessert Holdings Inc. Term Loan | 0.04 | 2.56 | 0.0105 | -0.0025 | |||||

| Advantage Sales & Marketing Inc 2024 Term Loan / LON (US00769EBA73) | 0.04 | 0.0103 | 0.0103 | ||||||

| Red Ventures LLC 2024 Term Loan B / LON (US75703UAL98) | 0.04 | 0.0102 | 0.0102 | ||||||

| Dave & Buster's Inc 2024 1st Lien Term Loan B / LON (US23833EAY05) | 0.04 | 8.57 | 0.0102 | -0.0015 | |||||

| Teva Pharmaceutical Finance Netherlands III BV / DBT (US88167AAT88) | 0.04 | 0.0102 | 0.0102 | ||||||

| Teva Pharmaceutical Finance Netherlands IV BV / DBT (US881937AA41) | 0.04 | 0.0101 | 0.0101 | ||||||

| US72584DAF15 / KFC Holding Co | 0.04 | 0.00 | 0.0101 | -0.0025 | |||||

| Opal Bidco SAS USD Term Loan B / LON (XAF7000QAB77) | 0.04 | 0.0100 | 0.0100 | ||||||

| Rivers Enterprise Borrower LLC / Rivers Enterprise Finance Corp / DBT (US76883NAA90) | 0.04 | 0.0100 | 0.0100 | ||||||

| WEC US Holdings Ltd 2024 Term Loan / LON (US92943LAC46) | 0.04 | 48.00 | 0.0098 | 0.0013 | |||||

| US05765WAA18 / TIBCO Software Inc | 0.04 | 0.0097 | 0.0097 | ||||||

| US25470MAG42 / DISH Network Corp | 0.04 | 0.0097 | 0.0097 | ||||||

| Boost Newco Borrower LLC 2025 USD Term Loan B / LON (US92943EAG17) | 0.04 | 0.0097 | 0.0097 | ||||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 0.04 | 0.0094 | 0.0094 | ||||||

| ANTYLIA SCIENTIFIC TERM LOAN / LON (US12592HAG65) | 0.04 | 0.0093 | 0.0093 | ||||||

| TCP Sunbelt Acquisition Co 2024 Term Loan B / LON (US87233DAB38) | 0.03 | 0.0091 | 0.0091 | ||||||

| US16384YAJ64 / CHEMOURS CO TL 08/10/28 | 0.03 | 0.00 | 0.0091 | -0.0023 | |||||

| US80281LAR69 / Santander UK Group Holdings PLC | 0.03 | 0.00 | 0.0089 | -0.0022 | |||||

| US02154CAH60 / Altice Financing SA | 0.03 | 0.00 | 0.0086 | -0.0022 | |||||

| US26844HAJ68 / EFS COGEN HOLDINGS I LLC 2020 TERM LOAN B | 0.03 | 0.00 | 0.0083 | -0.0021 | |||||

| Celsius Holdings Inc Term Loan / LON (US15118XAB01) | 0.03 | 0.0082 | 0.0082 | ||||||

| US31412P3M18 / FNMA 4.50% 7/39 #931504 | 0.03 | 0.00 | 0.0082 | -0.0023 | |||||

| US03969AAR14 / Ardagh Packaging Finance PLC / Ardagh Holdings USA Inc | 0.03 | -3.12 | 0.0082 | -0.0023 | |||||

| CVS / CVS Health Corporation - Depositary Receipt (Common Stock) | 0.03 | 0.0081 | 0.0081 | ||||||

| US361841AP42 / GLP Capital LP / GLP Financing II Inc | 0.03 | 0.00 | 0.0080 | -0.0019 | |||||

| US LONG BOND(CBT) SEP25 / DIR (000000000) | 0.03 | 0.0080 | 0.0080 | ||||||

| US31935HAD98 / First Brands Group LLC, First Lien Term Loan | 0.03 | 0.00 | 0.0080 | -0.0019 | |||||

| US45567YAN58 / MH Sub I, LLC 2023 Term Loan | 0.03 | 233.33 | 0.0080 | 0.0047 | |||||

| Altice Financing SA / DBT (US02154CAJ27) | 0.03 | 3.45 | 0.0079 | -0.0018 | |||||

| Artera Services LLC 2024 Term Loan / LON (US73937UAL26) | 0.03 | -11.76 | 0.0079 | -0.0033 | |||||

| US04649VBA70 / Asurion LLC, Term Loan | 0.03 | 163.64 | 0.0078 | 0.0038 | |||||

| TripAdvisor Inc Term Loan / LON (US89677NAE40) | 0.03 | 0.0077 | 0.0077 | ||||||

| US36179TE275 / Ginnie Mae II Pool | 0.03 | -3.33 | 0.0077 | -0.0022 | |||||

| US92332YAA91 / Venture Global LNG, Inc. | 0.03 | 0.0076 | 0.0076 | ||||||

| US39843UAA07 / Grifols Escrow Issuer SA | 0.03 | -62.16 | 0.0075 | -0.0158 | |||||

| TransDigm Inc 2024 Term Loan I / LON (US89364MCC64) | 0.03 | -30.00 | 0.0074 | -0.0061 | |||||

| US05526DBK00 / BAT Capital Corp. | 0.03 | 3.70 | 0.0073 | -0.0017 | |||||

| XAC0787FAG72 / BAUSCH + LOMB CORP | 0.03 | 0.00 | 0.0072 | -0.0018 | |||||

| GC FERRY ACQUISITION I INC TERM LOAN / LON (000000000) | 0.03 | 0.0072 | 0.0072 | ||||||

| US ULTRA BOND CBT SEP25 / DIR (000000000) | 0.03 | 0.0071 | 0.0071 | ||||||

| Planet US Buyer LLC 2024 Term Loan B / LON (US72706RAB24) | 0.03 | 0.0068 | 0.0068 | ||||||

| US89364MCA09 / TRANSDIGM INC | 0.03 | 0.0068 | 0.0068 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.03 | 0.0067 | 0.0067 | ||||||

| BDL28N7H1 FWDP 2Y RTP SWAPTION / DIR (000000000) | 0.03 | 0.0066 | 0.0066 | ||||||

| TNETBB / Telenet Financing USD LLC 2020 USD Term Loan AR | 0.03 | 4.17 | 0.0066 | -0.0016 | |||||

| US893830BX61 / Transocean Inc | 0.02 | 0.0065 | 0.0065 | ||||||

| Sabre GLBL Inc 2024 Term Loan B1 / LON (US78571YBK55) | 0.02 | 0.0064 | 0.0064 | ||||||

| Balcan Innovations Inc Term Loan B / LON (XAC0564DAB29) | 0.02 | -7.69 | 0.0064 | -0.0024 | |||||

| US03952HAD61 / Arches Buyer Inc 2021 Term Loan B | 0.02 | 0.00 | 0.0063 | -0.0015 | |||||

| US3128MJ3J79 / Freddie Mac Gold Pool | 0.02 | 0.00 | 0.0063 | -0.0018 | |||||

| Twitter Inc 2025 Fixed Term Loan / LON (US90184NAK46) | 0.02 | 0.0062 | 0.0062 | ||||||

| Belron Finance 2019 LLC 2024 USD Term Loan B / LON (US08078UAM53) | 0.02 | 0.00 | 0.0061 | -0.0015 | |||||

| EURO-BUND FUTURE SEP25 / DIR (000000000) | 0.02 | 0.0058 | 0.0058 | ||||||

| US459506AR22 / International Flavors & Fragrances Inc | 0.02 | 0.00 | 0.0057 | -0.0014 | |||||

| Oregon Tool Lux LP / DBT (US68610BAA26) | 0.02 | -4.55 | 0.0057 | -0.0017 | |||||

| Genesys Cloud Services Holdings II LLC 2025 USD Term Loan B / LON (US39479UAY91) | 0.02 | 0.0056 | 0.0056 | ||||||

| ENT / Entain Plc | 0.02 | 0.0055 | 0.0055 | ||||||

| DK Crown Holdings Inc 2025 Term Loan B / LON (000000000) | 0.02 | 0.0055 | 0.0055 | ||||||

| NEP Group Inc 2023 Term Loan B / LON (US62908HAM79) | 0.02 | 0.00 | 0.0054 | -0.0014 | |||||

| Cotiviti Corporation 2025 2nd Amendment Term Loan / LON (US22164MAF41) | 0.02 | 0.0054 | 0.0054 | ||||||

| Potomac Energy Center LLC Term Loan / LON (000000000) | 0.02 | 0.0053 | 0.0053 | ||||||

| ECI Macola Max Holding LLC 2024 Term Loan / LON (US26825UAM36) | 0.02 | 0.0053 | 0.0053 | ||||||

| LMT / Lockheed Martin Corporation - Depositary Receipt (Common Stock) | 0.02 | 0.0052 | 0.0052 | ||||||

| US82967NBA54 / Sirius XM Radio Inc | 0.02 | 0.0052 | 0.0052 | ||||||

| SATS / EchoStar Corporation | 0.02 | 0.0051 | 0.0051 | ||||||

| DTI Holdco Inc 2025 Term Loan B / LON (US23358EAK55) | 0.02 | 0.0051 | 0.0051 | ||||||

| South Field LLC 2025 Term Loan B / LON (US83783XAD84) | 0.02 | 0.00 | 0.0051 | -0.0014 | |||||

| XAG9368PBC77 / Virgin Media Bristol LLC USD Term Loan N | 0.02 | 0.00 | 0.0051 | -0.0012 | |||||

| Shell Finance US Inc / DBT (US822905AH87) | 0.02 | 0.00 | 0.0050 | -0.0013 | |||||

| Kestrel Acquisition LLC 2024 Term Loan B / LON (US44579UAB89) | 0.02 | 0.00 | 0.0049 | -0.0013 | |||||

| UFC Holdings LLC 2024 Term Loan B / LON (US90266UAK97) | 0.02 | 0.0049 | 0.0049 | ||||||

| US31418CU779 / FANNIE MAE 3.50% 03/01/2048 FNMA | 0.02 | 0.00 | 0.0048 | -0.0014 | |||||

| Guggenheim Partners LLC 2024 Term Loan B / LON (US36173YAB65) | 0.02 | 0.00 | 0.0048 | -0.0012 | |||||

| US92564RAE53 / VICI PROPERTIES / NOTE 4.125% 08/15/2030 144A | 0.02 | 5.88 | 0.0048 | -0.0011 | |||||

| Frontier Communications Corp 2025 Term Loan B / LON (US35906EAU47) | 0.02 | 0.0046 | 0.0046 | ||||||

| US80854EAJ73 / MATIV HOLDINGS 05/06/27 | 0.02 | 0.00 | 0.0045 | -0.0012 | |||||

| US02154CAF05 / Altice Financing SA | 0.02 | 0.00 | 0.0045 | -0.0011 | |||||

| PUG LLC 2024 Extended Term Loan B / LON (US74530DAH89) | 0.02 | 0.00 | 0.0045 | -0.0013 | |||||

| Research Now Group Inc 2024 First Lien Second Out Term Loan / LON (US76100MAC47) | 0.02 | -5.88 | 0.0044 | -0.0014 | |||||

| US06832FAB31 / Barracuda Networks, Inc., 1st Lien Term Loan | 0.02 | -5.88 | 0.0044 | -0.0014 | |||||

| US98415LAY20 / Xerox Holdings Corp 2023 Term Loan B | 0.02 | -20.00 | 0.0044 | -0.0023 | |||||

| RRR / Red Rock Resorts, Inc. | 0.02 | 0.0043 | 0.0043 | ||||||

| US87169DAB10 / Syneos Health (INC Research/inVentiv Health) T/L B (09/23) | 0.02 | -48.39 | 0.0043 | -0.0062 | |||||

| Global Partners LP / GLP Finance Corp / DBT (US37954FAK03) | 0.02 | 0.0041 | 0.0041 | ||||||

| US78571YBJ82 / SABRE TERM B 1LN 06/30/2028 | 0.02 | 7.14 | 0.0040 | -0.0009 | |||||

| US12510MAD11 / INHEAL TLB INCR | 0.02 | 15.38 | 0.0039 | -0.0006 | |||||

| US3137FKHV13 / Freddie Mac REMICS | 0.01 | -22.22 | 0.0039 | -0.0023 | |||||

| US14835JAQ31 / CAST and CREW TERM B INCR 1LN 12/30/2028 | 0.01 | 0.00 | 0.0038 | -0.0011 | |||||

| BDL26KEL2 FWDP 5Y RTP SWAPTION / DIR (000000000) | 0.01 | 0.0037 | 0.0037 | ||||||

| BDL26KEE8 SWAPTION / DIR (000000000) | 0.01 | 0.0033 | 0.0033 | ||||||

| US3742751130 / Getty Images Holdings, Inc. | 0.01 | 0.0031 | 0.0031 | ||||||

| KUEHG Corp 2024 Term Loan / LON (US50118YAG44) | 0.01 | 0.0031 | 0.0031 | ||||||

| US08576PAF80 / Berry Global Inc | 0.01 | 0.00 | 0.0030 | -0.0007 | |||||

| US31415PYV48 / FN 06/38 FIXED 5.5 | 0.01 | 0.00 | 0.0030 | -0.0008 | |||||

| Venture Global Plaquemines LNG LLC / DBT (US922966AA47) | 0.01 | 0.0028 | 0.0028 | ||||||

| Castle US Holding Corporation 2025 USD FLSO Term Loan B1 / LON (US14852DAJ00) | 0.01 | 0.0027 | 0.0027 | ||||||

| Sinclair Television Group Inc / DBT (US829259BH26) | 0.01 | 0.0026 | 0.0026 | ||||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 0.01 | 0.0026 | 0.0026 | ||||||

| TBA CITIBANK COC / STIV (000000000) | 0.01 | 0.01 | 0.0026 | 0.0026 | |||||

| US44409MAD83 / Hudson Pacific Properties LP | 0.01 | 12.50 | 0.0026 | -0.0003 | |||||

| Icahn Enterprises LP / Icahn Enterprises Finance Corp / DBT (US451102CF29) | 0.01 | 0.00 | 0.0025 | -0.0007 | |||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0.01 | 0.0024 | 0.0024 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0.01 | 0.0022 | 0.0022 | ||||||

| Primo Brands Corporation 2025 Term Loan B / LON (US89678QAD88) | 0.01 | 0.0021 | 0.0021 | ||||||

| McAfee LLC 2024 USD 1st Lien Term Loan B / LON (US57906HAF47) | 0.01 | 0.0020 | 0.0020 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0.01 | 0.0019 | 0.0019 | ||||||

| US28253PAC32 / 8th Avenue Food & Provisions, Inc., First Lien Term Loan | 0.01 | 0.00 | 0.0019 | -0.0004 | |||||

| Albion Financing 3 SARL 2025 USD Term Loan B / LON (US00847NAE67) | 0.01 | 0.0018 | 0.0018 | ||||||

| EURO-BUXL 30Y BND SEP25 / DIR (000000000) | 0.01 | 0.0017 | 0.0017 | ||||||

| US62984CAB90 / NAKED JUICE LLC | 0.01 | 0.00 | 0.0017 | -0.0003 | |||||

| US31418UCL61 / Fannie Mae Pool | 0.01 | 0.00 | 0.0017 | -0.0005 | |||||

| US31414U3X45 / FN 05/38 FIXED 5.5 | 0.01 | -16.67 | 0.0016 | -0.0004 | |||||

| US3136B2ZR67 / FANNIE MAE REMICS SER 2018-57 CL QA 3.50000000 | 0.01 | -58.33 | 0.0016 | -0.0027 | |||||

| US12510MAB54 / CCRR Parent, Inc Term Loan B | 0.01 | 0.00 | 0.0014 | -0.0004 | |||||

| US720186AQ82 / Piedmont Natural Gas Co Inc | 0.01 | 0.00 | 0.0013 | -0.0003 | |||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0.00 | 0.0013 | 0.0013 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0.00 | 0.0012 | 0.0012 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0.00 | 0.0011 | 0.0011 | ||||||

| US76169XAB01 / Rexford Industrial Realty LP | 0.00 | 0.00 | 0.0011 | -0.0002 | |||||

| EURO-BOBL FUTURE SEP25 / DIR (000000000) | 0.00 | 0.0011 | 0.0011 | ||||||

| US13077DQP05 / CALIFORNIA ST UNIV REVENUE | 0.00 | 0.00 | 0.0010 | -0.0003 | |||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0.00 | 0.0010 | 0.0010 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0.00 | 0.0010 | 0.0010 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0.00 | 0.0009 | 0.0009 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0.00 | 0.0009 | 0.0009 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0.00 | 0.0007 | 0.0007 | ||||||

| US31329NU486 / Freddie Mac Pool | 0.00 | 0.00 | 0.0007 | -0.0002 | |||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0.00 | 0.0007 | 0.0007 | ||||||

| US3132XCSA42 / Federal Home Loan Mortgage Corp. | 0.00 | -50.00 | 0.0005 | -0.0001 | |||||

| Amspec Parent LLC 2024 Delayed Draw Term Loan / LON (US03218AAC36) | 0.00 | 0.00 | 0.0005 | -0.0001 | |||||

| US44409MAB28 / Hudson Pacific Properties LP | 0.00 | -99.02 | 0.0005 | -0.0330 | |||||

| South Field LLC 2025 Term Loan C / LON (US83783XAE67) | 0.00 | 0.00 | 0.0003 | -0.0001 | |||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | ||||||

| Great Outdoors Group LLC 2025 Term Loan B / LON (US07014QAP63) | 0.00 | 0.0000 | 0.0000 | ||||||

| US56085UAB98 / BANK LOAN NOTE | 0.00 | -100.00 | 0.0000 | -0.0166 | |||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0.00 | -0.0010 | -0.0010 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0.00 | -0.0011 | -0.0011 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0.00 | -0.0011 | -0.0011 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0.00 | -0.0012 | -0.0012 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0.01 | -0.0016 | -0.0016 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0.01 | -0.0017 | -0.0017 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0.01 | -0.0019 | -0.0019 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0.01 | -0.0020 | -0.0020 | ||||||

| PURCHASED USD / SOLD GBP / DFE (000000000) | -0.01 | -0.0022 | -0.0022 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0.01 | -0.0024 | -0.0024 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0.01 | -0.0027 | -0.0027 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0.01 | -0.0027 | -0.0027 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0.02 | -0.0062 | -0.0062 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0.03 | -0.0066 | -0.0066 | ||||||

| US 10YR ULTRA FUT SEP25 / DIR (000000000) | -0.06 | -0.0167 | -0.0167 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0.08 | -0.0219 | -0.0219 | ||||||

| TBA GOLDMAN SACHS BOC / STIV (000000000) | Short | -0.28 | -0.28 | -0.0733 | -0.0733 | ||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0.42 | -0.1088 | -0.1088 |