Mga Batayang Estadistika

| Nilai Portofolio | $ 257,270,193 |

| Posisi Saat Ini | 90 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

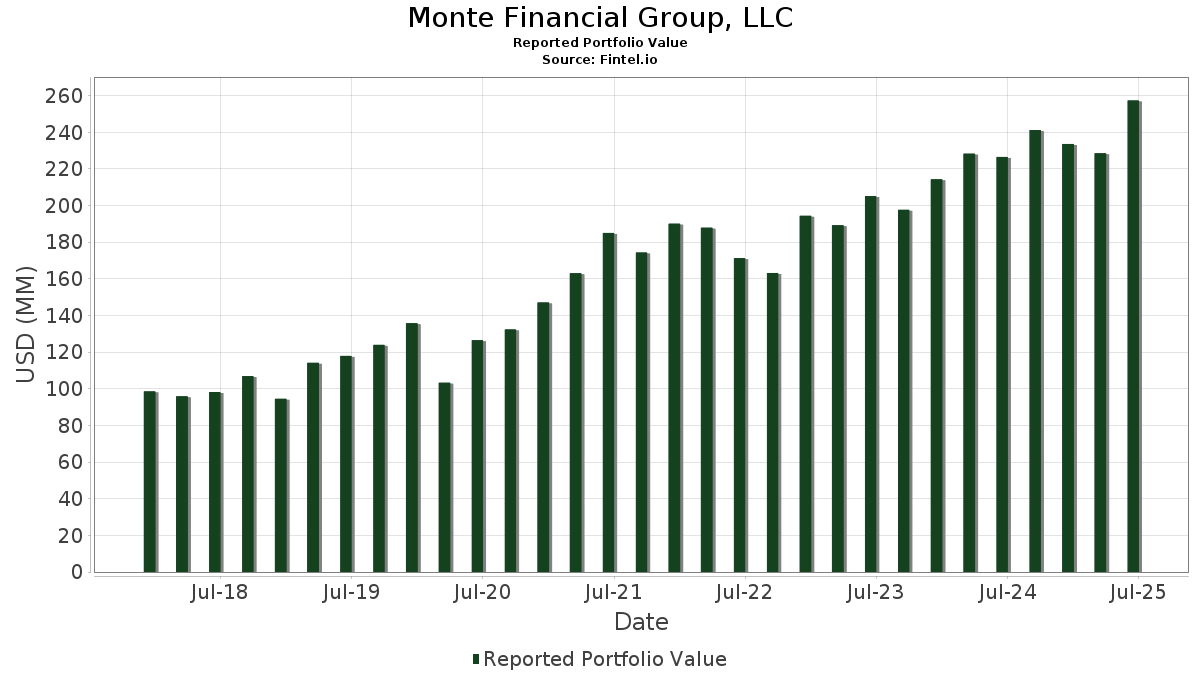

Monte Financial Group, LLC telah mengungkapkan total kepemilikan 90 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 257,270,193 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Monte Financial Group, LLC adalah Wells Fargo & Company (US:WFC) , Target Corporation (US:TGT) , Abbott Laboratories (US:ABT) , RTX Corporation (US:RTX) , and The Home Depot, Inc. (US:HD) . Posisi baru Monte Financial Group, LLC meliputi: The Gap, Inc. (US:GPS) , Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) (US:TSM) , Axon Enterprise, Inc. (US:AXON) , Fidelity Covington Trust - Fidelity MSCI Consumer Discretionary Index ETF (US:FDIS) , and .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.03 | 2.80 | 1.0884 | 1.0884 | |

| 0.12 | 2.59 | 1.0079 | 1.0079 | |

| 0.12 | 4.51 | 1.7538 | 0.6132 | |

| 0.01 | 4.46 | 1.7318 | 0.3727 | |

| 0.00 | 0.96 | 0.3717 | 0.3717 | |

| 0.02 | 4.31 | 1.6744 | 0.3367 | |

| 0.11 | 8.66 | 3.3665 | 0.2853 | |

| 0.01 | 1.62 | 0.6304 | 0.2767 | |

| 0.12 | 6.54 | 2.5438 | 0.2608 | |

| 0.06 | 6.88 | 2.6735 | 0.2583 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.15 | 4.64 | 1.8052 | -0.6489 | |

| 0.05 | 3.89 | 1.5105 | -0.6446 | |

| 0.05 | 7.05 | 2.7399 | -0.6222 | |

| 0.19 | 6.90 | 2.6810 | -0.6200 | |

| 0.01 | 4.45 | 1.7309 | -0.4954 | |

| 0.04 | 5.60 | 2.1785 | -0.3466 | |

| 0.04 | 6.86 | 2.6682 | -0.3296 | |

| 0.00 | 1.43 | 0.5542 | -0.3221 | |

| 0.09 | 5.96 | 2.3181 | -0.3047 | |

| 0.23 | 5.59 | 2.1718 | -0.2709 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-23 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| WFC / Wells Fargo & Company | 0.11 | -0.63 | 8.66 | 23.03 | 3.3665 | 0.2853 | |||

| TGT / Target Corporation | 0.07 | 1.82 | 7.16 | 7.88 | 2.7828 | -0.1220 | |||

| ABT / Abbott Laboratories | 0.05 | -11.63 | 7.05 | -8.23 | 2.7399 | -0.6222 | |||

| RTX / RTX Corporation | 0.05 | 0.61 | 6.97 | 13.98 | 2.7092 | 0.0328 | |||

| HD / The Home Depot, Inc. | 0.02 | 0.41 | 6.95 | 3.68 | 2.7024 | -0.2326 | |||

| CMCSA / Comcast Corporation | 0.19 | -12.85 | 6.90 | -8.54 | 2.6810 | -0.6200 | |||

| DELL / Dell Technologies Inc. | 0.06 | -13.78 | 6.88 | 24.67 | 2.6735 | 0.2583 | |||

| HSY / The Hershey Company | 0.04 | 0.61 | 6.86 | 0.22 | 2.6682 | -0.3296 | |||

| GLW / Corning Incorporated | 0.12 | -0.94 | 6.54 | 25.48 | 2.5438 | 0.2608 | |||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0.05 | -0.93 | 6.35 | 8.14 | 2.4676 | -0.1019 | |||

| EOG / EOG Resources, Inc. | 0.05 | 1.52 | 6.22 | 9.90 | 2.4175 | -0.0598 | |||

| GRMN / Garmin Ltd. | 0.03 | 0.00 | 6.00 | 9.51 | 2.3326 | -0.0661 | |||

| CSCO / Cisco Systems, Inc. | 0.09 | -20.01 | 5.96 | -0.48 | 2.3181 | -0.3047 | |||

| CME / CME Group Inc. | 0.02 | -1.43 | 5.82 | 3.48 | 2.2636 | -0.1996 | |||

| MTB / M&T Bank Corporation | 0.03 | -0.34 | 5.77 | 20.68 | 2.2432 | 0.1498 | |||

| HIG / The Hartford Insurance Group, Inc. | 0.05 | -1.12 | 5.77 | 6.50 | 2.2409 | -0.1287 | |||

| CVX / Chevron Corporation | 0.04 | 0.21 | 5.70 | 4.07 | 2.2171 | -0.1817 | |||

| RF / Regions Financial Corporation | 0.24 | 0.14 | 5.64 | 21.95 | 2.1926 | 0.1683 | |||

| JNJ / Johnson & Johnson | 0.04 | 0.15 | 5.60 | -2.86 | 2.1785 | -0.3466 | |||

| PFE / Pfizer Inc. | 0.23 | -8.56 | 5.59 | 0.13 | 2.1718 | -0.2709 | |||

| UPS / United Parcel Service, Inc. | 0.05 | 2.34 | 5.43 | 7.14 | 2.1107 | -0.1079 | |||

| ADP / Automatic Data Processing, Inc. | 0.02 | -1.54 | 5.20 | 3.55 | 2.0197 | -0.1770 | |||

| APD / Air Products and Chemicals, Inc. | 0.02 | 0.13 | 5.19 | 7.43 | 2.0170 | -0.0972 | |||

| SWK / Stanley Black & Decker, Inc. | 0.07 | -8.87 | 4.90 | 7.91 | 1.9049 | -0.0828 | |||

| OMC / Omnicom Group Inc. | 0.07 | 1.76 | 4.79 | -0.04 | 1.8627 | -0.2358 | |||

| AVY / Avery Dennison Corporation | 0.03 | 22.73 | 4.79 | 26.06 | 1.8616 | 0.1985 | |||

| SBUX / Starbucks Corporation | 0.05 | 2.44 | 4.71 | 15.17 | 1.8292 | 0.0408 | |||

| CPB / The Campbell's Company | 0.15 | 1.42 | 4.64 | -17.16 | 1.8052 | -0.6489 | |||

| PPG / PPG Industries, Inc. | 0.04 | 0.40 | 4.59 | 14.15 | 1.7846 | 0.0240 | |||

| BKR / Baker Hughes Company | 0.12 | 75.73 | 4.51 | 73.17 | 1.7538 | 0.6132 | |||

| MSFT / Microsoft Corporation | 0.01 | 6.09 | 4.46 | 43.48 | 1.7318 | 0.3727 | |||

| WSO / Watsco, Inc. | 0.01 | 0.44 | 4.45 | -12.45 | 1.7309 | -0.4954 | |||

| TXN / Texas Instruments Incorporated | 0.02 | 0.77 | 4.31 | 40.94 | 1.6744 | 0.3367 | |||

| MRK / Merck & Co., Inc. | 0.05 | -22.23 | 3.89 | -21.08 | 1.5105 | -0.6446 | |||

| MDT / Medtronic plc | 0.03 | 2.80 | 1.0884 | 1.0884 | |||||

| GPS / The Gap, Inc. | 0.12 | 2.59 | 1.0079 | 1.0079 | |||||

| AAPL / Apple Inc. | 0.01 | 17.41 | 2.54 | 22.31 | 0.9868 | 0.0782 | |||

| JPM / JPMorgan Chase & Co. | 0.01 | 0.90 | 2.50 | 26.11 | 0.9727 | 0.1041 | |||

| NVDD / Direxion Shares ETF Trust - Direxion Daily NVDA Bear 1X Shares | 0.01 | 1.82 | 2.16 | 58.52 | 0.8395 | 0.2431 | |||

| V / Visa Inc. | 0.01 | -0.18 | 1.93 | 7.51 | 0.7516 | -0.0355 | |||

| APH / Amphenol Corporation | 0.02 | -1.35 | 1.89 | 49.68 | 0.7346 | 0.1821 | |||

| PH / Parker-Hannifin Corporation | 0.00 | 0.00 | 1.88 | 24.55 | 0.7296 | 0.0698 | |||

| AXP / American Express Company | 0.01 | 1.06 | 1.83 | 28.30 | 0.7103 | 0.0867 | |||

| FTXP / Foothills Exploration, Inc. | 0.00 | 0.10 | 1.75 | 41.31 | 0.6797 | 0.1382 | |||

| SO / The Southern Company | 0.02 | 0.00 | 1.66 | 0.00 | 0.6448 | -0.0811 | |||

| MCO / Moody's Corporation | 0.00 | 0.73 | 1.66 | 18.88 | 0.6440 | 0.0342 | |||

| AMZN / Amazon.com, Inc. | 0.01 | 57.90 | 1.62 | 100.62 | 0.6304 | 0.2767 | |||

| GNRC / Generac Holdings Inc. | 0.01 | -6.71 | 1.61 | 19.57 | 0.6250 | 0.0364 | |||

| AZN / AstraZeneca PLC - Depositary Receipt (Common Stock) | 0.02 | -0.12 | 1.59 | 3.32 | 0.6165 | -0.0558 | |||

| CB / Chubb Limited | 0.01 | 3.42 | 1.56 | 4.91 | 0.6061 | -0.0444 | |||

| TT / Trane Technologies plc | 0.00 | 1.81 | 1.45 | 33.64 | 0.5640 | 0.0889 | |||

| DECK / Deckers Outdoor Corporation | 0.01 | 8.15 | 1.44 | 5.48 | 0.5612 | -0.0378 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | 3.65 | 1.43 | -28.79 | 0.5542 | -0.3221 | |||

| LULU / lululemon athletica inc. | 0.01 | 13.74 | 1.41 | 7.58 | 0.5465 | -0.0253 | |||

| CDNS / Cadence Design Systems, Inc. | 0.00 | 0.62 | 1.40 | 19.15 | 0.5444 | 0.0299 | |||

| SYK / Stryker Corporation | 0.00 | 1.23 | 1.40 | 15.63 | 0.5436 | 0.0140 | |||

| TREX / Trex Company, Inc. | 0.02 | 5.67 | 1.35 | 3.38 | 0.5233 | -0.0469 | |||

| LIN / Linde plc | 0.00 | 12.05 | 1.31 | 16.36 | 0.5089 | 0.0161 | |||

| IBM / International Business Machines Corporation | 0.00 | -9.54 | 1.26 | 11.63 | 0.4889 | -0.0041 | |||

| GOOGL / Alphabet Inc. | 0.01 | 6.55 | 1.25 | 24.21 | 0.4870 | 0.0455 | |||

| BRO / Brown & Brown, Inc. | 0.01 | 1.34 | 1.17 | -4.17 | 0.4554 | -0.0796 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | 4.63 | 1.16 | -0.77 | 0.4527 | -0.0610 | |||

| ORLY / O'Reilly Automotive, Inc. | 0.01 | 1,425.39 | 1.16 | -1.19 | 0.4505 | -0.0627 | |||

| AME / AMETEK, Inc. | 0.01 | 2.65 | 1.13 | 17.75 | 0.4386 | 0.0190 | |||

| TJX / The TJX Companies, Inc. | 0.01 | 1.53 | 1.11 | -1.78 | 0.4301 | -0.0629 | |||

| GE / General Electric Company | 0.00 | 1.74 | 0.98 | 44.17 | 0.3796 | 0.0829 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.00 | 0.96 | 0.3717 | 0.3717 | |||||

| META / Meta Platforms, Inc. | 0.00 | 0.00 | 0.93 | 47.31 | 0.3621 | 0.0851 | |||

| ED / Consolidated Edison, Inc. | 0.01 | 0.00 | 0.83 | -10.48 | 0.3225 | -0.0832 | |||

| IT / Gartner, Inc. | 0.00 | 1.91 | 0.80 | 2.57 | 0.3102 | -0.0304 | |||

| RSP / Invesco Exchange-Traded Fund Trust - Invesco S&P 500 Equal Weight ETF | 0.00 | -1.36 | 0.74 | 10.13 | 0.2876 | -0.0062 | |||

| EFA / iShares Trust - iShares MSCI EAFE ETF | 0.01 | 10.19 | 0.61 | 21.56 | 0.2368 | 0.0172 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.00 | 5.88 | 0.57 | 24.24 | 0.2216 | 0.0209 | |||

| XOM / Exxon Mobil Corporation | 0.00 | 0.00 | 0.54 | 0.94 | 0.2093 | -0.0245 | |||

| TSLA / Tesla, Inc. | 0.00 | -0.61 | 0.51 | 30.79 | 0.1999 | 0.0278 | |||

| GEV / GE Vernova Inc. | 0.00 | 0.97 | 0.50 | 65.33 | 0.1929 | 0.0614 | |||

| CAT / Caterpillar Inc. | 0.00 | 0.00 | 0.47 | 32.11 | 0.1824 | 0.0267 | |||

| GOOG / Alphabet Inc. | 0.00 | 0.00 | 0.37 | 15.67 | 0.1438 | 0.0038 | |||

| FNCL / Fidelity Covington Trust - Fidelity MSCI Financials Index ETF | 0.00 | 6.16 | 0.31 | 21.24 | 0.1221 | 0.0086 | |||

| UBER / Uber Technologies, Inc. | 0.00 | 0.30 | 0.31 | 24.39 | 0.1193 | 0.0113 | |||

| DE / Deere & Company | 0.00 | 0.00 | 0.29 | 12.74 | 0.1136 | -0.0001 | |||

| FHLC / Fidelity Covington Trust - Fidelity MSCI Health Care Index ETF | 0.00 | 13.77 | 0.29 | 14.74 | 0.1121 | 0.0020 | |||

| FTEC / Fidelity Covington Trust - Fidelity MSCI Information Technology Index ETF | 0.00 | 2.31 | 0.28 | 34.13 | 0.1088 | 0.0176 | |||

| DIS / The Walt Disney Company | 0.00 | 0.27 | 0.1052 | 0.1052 | |||||

| ETN / Eaton Corporation plc | 0.00 | 0.27 | 0.1043 | 0.1043 | |||||

| FIDU / Fidelity Covington Trust - Fidelity MSCI Industrials Index ETF | 0.00 | -1.71 | 0.27 | 15.65 | 0.1037 | 0.0030 | |||

| AXON / Axon Enterprise, Inc. | 0.00 | 0.26 | 0.0991 | 0.0991 | |||||

| FDIS / Fidelity Covington Trust - Fidelity MSCI Consumer Discretionary Index ETF | 0.00 | 0.24 | 0.0921 | 0.0921 | |||||

| BA / The Boeing Company | 0.00 | 0.23 | 0.0883 | 0.0883 | |||||

| IWR / iShares Trust - iShares Russell Mid-Cap ETF | 0.00 | 0.22 | 0.0866 | 0.0866 | |||||

| ULTA / Ulta Beauty, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |