Mga Batayang Estadistika

| Nilai Portofolio | $ 472,541,774 |

| Posisi Saat Ini | 425 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

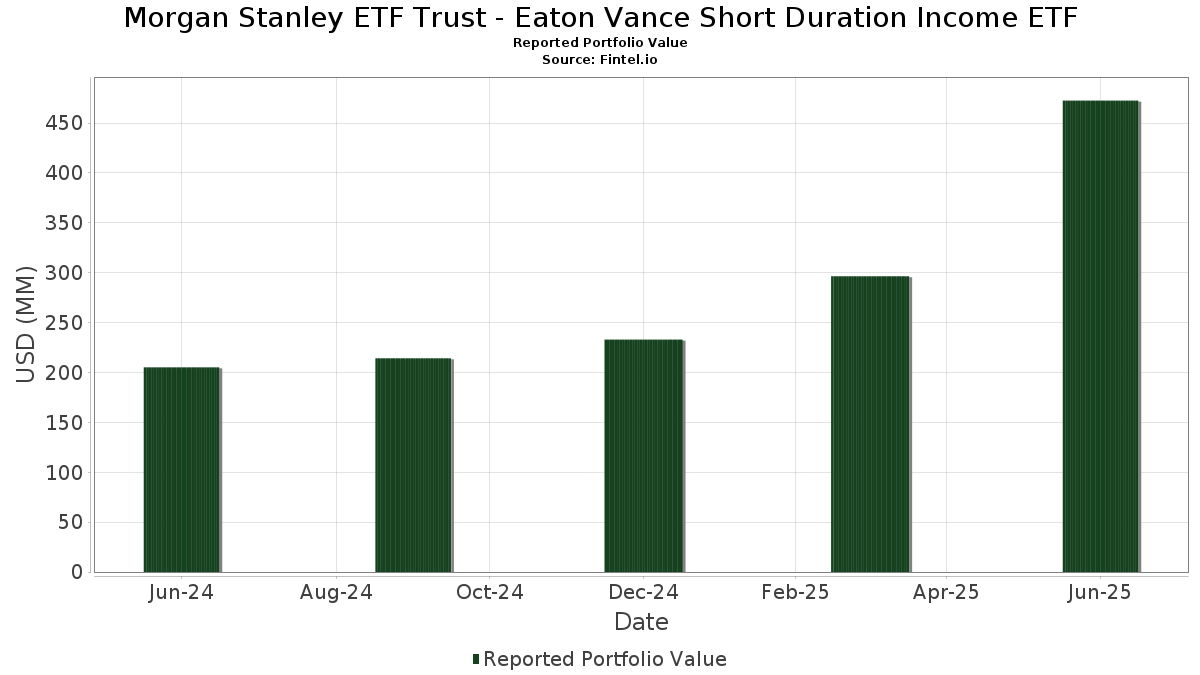

Morgan Stanley ETF Trust - Eaton Vance Short Duration Income ETF telah mengungkapkan total kepemilikan 425 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 472,541,774 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Morgan Stanley ETF Trust - Eaton Vance Short Duration Income ETF adalah Morgan Stanley Institutional Liquidity Funds Government Portfolio, Institutional Class (US:US61747C7074) , Uniform Mortgage-Backed Security, TBA (US:US01F0606750) , United States Treasury Note/Bond (US:US91282CJE21) , United States Treasury Note/Bond (US:US91282CFW64) , and Morgan Stanley ETF Trust - Eaton Vance Floating-Rate ETF (US:EVLN) . Posisi baru Morgan Stanley ETF Trust - Eaton Vance Short Duration Income ETF meliputi: Uniform Mortgage-Backed Security, TBA (US:US01F0606750) , United States Treasury Note/Bond (US:US91282CJE21) , United States Treasury Note/Bond (US:US91282CFW64) , UBS Group AG (CH:US90352JAC71) , and Bank of America Corp (US:US06051GKP36) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 16.61 | 3.6737 | 3.6737 | ||

| 13.00 | 2.8755 | 2.8755 | ||

| 7.20 | 1.5912 | 1.5912 | ||

| 3.84 | 0.8500 | 0.8500 | ||

| 3.69 | 0.8170 | 0.8170 | ||

| 3.69 | 0.8162 | 0.8162 | ||

| 3.04 | 0.6716 | 0.6716 | ||

| 2.90 | 0.6414 | 0.6414 | ||

| 2.85 | 0.6299 | 0.6299 | ||

| 2.81 | 0.6203 | 0.6203 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 23.20 | 23.20 | 5.1298 | -4.3051 | |

| 17.98 | 3.9751 | -2.2461 | ||

| 0.10 | 5.04 | 1.1135 | -0.9548 | |

| 4.88 | 1.0794 | -0.5980 | ||

| 0.38 | 0.0838 | -0.5792 | ||

| 4.58 | 1.0125 | -0.5598 | ||

| 0.64 | 0.1416 | -0.5256 | ||

| 0.85 | 0.1875 | -0.4582 | ||

| 1.88 | 0.4164 | -0.3352 | ||

| 4.15 | 0.9180 | -0.2858 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-22 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US61747C7074 / Morgan Stanley Institutional Liquidity Funds Government Portfolio, Institutional Class | 23.20 | -15.04 | 23.20 | -15.04 | 5.1298 | -4.3051 | |||

| U.S. Treasury Notes / DBT (US91282CKY65) | 17.98 | -0.16 | 3.9751 | -2.2461 | |||||

| US01F0606750 / Uniform Mortgage-Backed Security, TBA | 16.61 | 3.6737 | 3.6737 | ||||||

| US91282CJE21 / United States Treasury Note/Bond | 13.00 | 2.8755 | 2.8755 | ||||||

| US91282CFW64 / United States Treasury Note/Bond | 7.20 | 1.5912 | 1.5912 | ||||||

| EVLN / Morgan Stanley ETF Trust - Eaton Vance Floating-Rate ETF | 0.10 | -16.57 | 5.04 | -15.89 | 1.1135 | -0.9548 | |||

| U.S. Treasury Notes / DBT (US91282CKT70) | 4.88 | 0.56 | 1.0794 | -0.5980 | |||||

| US90352JAC71 / UBS Group AG | 4.73 | 54.17 | 1.0468 | -0.0141 | |||||

| U.S. Treasury Notes / DBT (US91282CKG59) | 4.58 | 0.64 | 1.0125 | -0.5598 | |||||

| EVSB / Morgan Stanley ETF Trust - Eaton Vance Ultra-Short Income ETF | 0.09 | 233.33 | 4.57 | 233.48 | 1.0112 | 0.5373 | |||

| US06051GKP36 / Bank of America Corp | 4.15 | 19.14 | 0.9180 | -0.2858 | |||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 3.84 | 0.8500 | 0.8500 | ||||||

| US0158578734 / Algonquin Power & Utilities Corp | 3.72 | 75.22 | 0.8227 | 0.0889 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 3.69 | 0.8170 | 0.8170 | ||||||

| US01F0526727 / Uniform Mortgage-Backed Security, TBA | 3.69 | 0.8162 | 0.8162 | ||||||

| US46647PDX15 / JPMorgan Chase & Co | 3.50 | 70.07 | 0.7740 | 0.0627 | |||||

| AU3FN0029609 / AAI Ltd | 3.24 | 73.50 | 0.7168 | 0.0710 | |||||

| US46115HAW79 / Intesa Sanpaolo SpA | 3.06 | 31.71 | 0.6760 | -0.1262 | |||||

| Capital Power US Holdings, Inc. / DBT (US14041TAA60) | 3.04 | 0.6716 | 0.6716 | ||||||

| US832248AZ15 / Smithfield Foods Inc | 2.90 | 0.6414 | 0.6414 | ||||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 2.88 | 165.16 | 0.6362 | 0.2611 | |||||

| ING / ING Groep N.V. - Depositary Receipt (Common Stock) | 2.85 | 0.6299 | 0.6299 | ||||||

| N1WG34 / NatWest Group plc - Depositary Receipt (Common Stock) | 2.81 | 0.6203 | 0.6203 | ||||||

| Charter Communications Operating LLC / DBT (US161175CQ56) | 2.76 | 33.25 | 0.6097 | -0.1055 | |||||

| US09659W2V59 / BNP Paribas SA | 2.67 | 43.82 | 0.5893 | -0.0509 | |||||

| US904678AU32 / UniCredit SpA | 2.61 | 13.57 | 0.5777 | -0.2172 | |||||

| US345397B280 / FORD MTR CR CO LLC 3.375% 11/13/2025 | 2.60 | 88.14 | 0.5755 | 0.0975 | |||||

| AASET Ltd., Series 2025-2A, Class A / ABS-O (US00039NAA28) | 2.58 | 0.5707 | 0.5707 | ||||||

| US345397ZR75 / Ford Motor Credit Co., LLC | 2.57 | 0.5691 | 0.5691 | ||||||

| US55903VBA08 / Warnermedia Holdings Inc | 2.57 | 8.58 | 0.5681 | -0.2494 | |||||

| US928881AB78 / Vontier Corp. | 2.50 | 24.99 | 0.5531 | -0.1383 | |||||

| US05964HAU95 / BANCO SANTANDER SA 5.588000% 08/08/2028 | 2.48 | 0.5483 | 0.5483 | ||||||

| CA125491AG54 / CI FINANCIAL CO | 2.43 | 0.5376 | 0.5376 | ||||||

| US37959GAA58 / Global Atlantic Fin Co. | 2.40 | 55.55 | 0.5302 | -0.0023 | |||||

| U.S. Treasury Notes / DBT (US91282CMP31) | 2.33 | 0.5162 | 0.5162 | ||||||

| Hyundai Capital America / DBT (US44891ADV61) | 2.32 | 0.5123 | 0.5123 | ||||||

| US34417MAB37 / FOCUS Brands Funding LLC | 2.24 | 324.05 | 0.4953 | 0.3126 | |||||

| US15135BAT89 / CORPORATE BONDS | 2.21 | 179.27 | 0.4885 | 0.2152 | |||||

| Lendbuzz Securitization Trust, Series 2025-2A, Class A2 / ABS-O (US52611JAB61) | 2.21 | 0.4878 | 0.4878 | ||||||

| Athene Global Funding / DBT (US04685A3T66) | 2.17 | 49.41 | 0.4795 | -0.0219 | |||||

| PNCS34 / The PNC Financial Services Group, Inc. - Depositary Receipt (Common Stock) | 2.14 | 0.4733 | 0.4733 | ||||||

| US750236AW16 / RADIAN GROUP INC | 2.13 | 26.83 | 0.4705 | -0.1090 | |||||

| US06738EBZ79 / Barclays PLC | 2.10 | 30.99 | 0.4647 | -0.0895 | |||||

| US92556VAD82 / UPJOHN INC 2.7 6/30 | 2.02 | 0.4475 | 0.4475 | ||||||

| US12530QAB23 / CFMT 23-HB12 M1 144A FRN 04-25-33/04-26-27 | 1.99 | 0.40 | 0.4407 | -0.2454 | |||||

| US02005NBU37 / Ally Financial Inc | 1.99 | 38.76 | 0.4395 | -0.0554 | |||||

| Foundry JV Holdco LLC / DBT (US350930AG89) | 1.99 | 39.93 | 0.4394 | -0.0515 | |||||

| GNMA, Series 2025-2, Class FB / ABS-MBS (US38385BP536) | 1.99 | -1.59 | 0.4390 | -0.2580 | |||||

| INTOWN Mortgage Trust, Series 2025-STAY, Class C / ABS-MBS (US46117WAE21) | 1.97 | 0.31 | 0.4363 | -0.2435 | |||||

| US830867AB33 / Delta Air Lines Inc / SkyMiles IP Ltd | 1.95 | 29.58 | 0.4322 | -0.0889 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.95 | 331.19 | 0.4311 | 0.2749 | |||||

| USB / U.S. Bancorp - Depositary Receipt (Common Stock) | 1.94 | 0.4298 | 0.4298 | ||||||

| CABK / CaixaBank, S.A. | 1.93 | 30.96 | 0.4275 | -0.0826 | |||||

| GNMA, Series 2023-101, Class FM / ABS-MBS (US38384CBT53) | 1.93 | 0.4272 | 0.4272 | ||||||

| Bank of America Corp. / DBT (US06051GML04) | 1.93 | 0.4266 | 0.4266 | ||||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 1.93 | 0.4263 | 0.4263 | ||||||

| US87166FAD50 / Synchrony Bank | 1.92 | 2.51 | 0.4238 | -0.2222 | |||||

| Castlelake Aircraft Structured Trust, Series 2025-1A, Class A / ABS-O (US14856VAA52) | 1.90 | -1.25 | 0.4196 | -0.2442 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 1.90 | 0.4196 | 0.4196 | ||||||

| Enact Holdings, Inc. / DBT (US29249EAA73) | 1.88 | -13.43 | 0.4164 | -0.3352 | |||||

| Citadel LP / DBT (US17288XAD66) | 1.88 | 45.36 | 0.4160 | -0.0312 | |||||

| ESNT / Essent Group Ltd. | 1.87 | 74.65 | 0.4129 | 0.0433 | |||||

| US26208LAE83 / DRIVEN BRANDS FUNDING LLC | 1.87 | 34.61 | 0.4129 | -0.0664 | |||||

| US26884UAE91 / EPR Properties | 1.85 | 115.35 | 0.4095 | 0.1121 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 1.82 | 11.86 | 0.4027 | -0.1598 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.82 | 0.4027 | 0.4027 | ||||||

| US87264ACB98 / T-Mobile USA Inc | 1.82 | 0.4020 | 0.4020 | ||||||

| US68268VAB18 / OneMain Financial Issuance Trust 2022-2 | 1.81 | 0.3996 | 0.3996 | ||||||

| DGZ / DB Gold Short ETN | 1.80 | 23.83 | 0.3988 | -0.1043 | |||||

| Var Energi ASA / DBT (US92212WAF77) | 1.78 | 0.3944 | 0.3944 | ||||||

| SNV.PRD / Synovus Financial Corp. - Preferred Stock | 1.77 | 115.71 | 0.3916 | 0.1078 | |||||

| BFLD Mortgage Trust, Series 2024-VICT, Class A / ABS-MBS (US05555VAA70) | 1.77 | 213.65 | 0.3912 | 0.1963 | |||||

| GMZB / Ally Financial Inc. - Preferred Stock | 1.76 | 0.3899 | 0.3899 | ||||||

| US57110PAC59 / Marlette Funding Trust, Series 2023-1A, Class C | 1.74 | -0.80 | 0.3857 | -0.2217 | |||||

| ACM Auto Trust, Series 2025-2A, Class A / ABS-O (US00161TAA97) | 1.70 | 0.3753 | 0.3753 | ||||||

| RAM LLC, Series 2025-1, Class A / ABS-O (US748950AA02) | 1.68 | 0.3723 | 0.3723 | ||||||

| Willis Engine Structured Trust VIII, Series 2025-A, Class A / ABS-O (US97063RAA86) | 1.68 | 0.3721 | 0.3721 | ||||||

| BX Trust, Series 2025-GW, Class B / ABS-MBS (US12433GAC06) | 1.68 | 0.3718 | 0.3718 | ||||||

| ANG.PRD / American National Group Inc. - Preferred Stock | 1.68 | 201.98 | 0.3713 | 0.1789 | |||||

| US10638AAA43 / Brean Asset Backed Securities Trust 2023-RM6 | 1.63 | -1.74 | 0.3615 | -0.2133 | |||||

| US90932LAG23 / United Airlines Inc | 1.63 | 0.3611 | 0.3611 | ||||||

| US30259RAP01 / FMC GMSR Issuer Trust, Series 2022-GT2, Class A | 1.63 | -0.43 | 0.3598 | -0.2048 | |||||

| US06279JAC36 / Bank of Ireland Group PLC | 1.63 | 9.80 | 0.3594 | -0.1521 | |||||

| Tricon Residential Trust, Series 2025-SFR1, Class C / ABS-O (US895974AC76) | 1.62 | 0.00 | 0.3583 | -0.2016 | |||||

| US50155QAL41 / Kyndryl Holdings, Inc. | 1.61 | 104.96 | 0.3568 | 0.0848 | |||||

| US418751AD59 / HAT Holdings I LLC / HAT Holdings II LLC | 1.60 | 366.96 | 0.3533 | 0.2350 | |||||

| Chase Auto Credit Linked Notes, Series 2025-1, Class B / ABS-O (US46591HCS76) | 1.57 | 0.3461 | 0.3461 | ||||||

| Athene Global Funding / DBT (US04685A4E88) | 1.56 | 56.58 | 0.3447 | 0.0006 | |||||

| US87020PAX50 / Swedbank AB | 1.55 | 3.20 | 0.3425 | -0.1761 | |||||

| US47216QAB95 / JDE Peet's NV | 1.53 | 0.3386 | 0.3386 | ||||||

| U.S. Treasury Bills / STIV (US912797QH30) | 1.52 | 0.3369 | 0.3369 | ||||||

| US68269MAC82 / OneMain Financial Issuance Trust 2021-1 | 1.52 | 0.3366 | 0.3366 | ||||||

| AIG / American International Group, Inc. - Depositary Receipt (Common Stock) | 1.51 | 0.3349 | 0.3349 | ||||||

| US20602DAA90 / Concentrix Corp | 1.50 | 44.72 | 0.3306 | -0.0266 | |||||

| US404119BS74 / Hca Inc Bond | 1.48 | 11.77 | 0.3276 | -0.1303 | |||||

| XS1040508167 / Imperial Brands Finance plc | 1.48 | 24.77 | 0.3266 | -0.0824 | |||||

| US05964HAQ83 / Banco Santander SA | 1.47 | 42.83 | 0.3261 | -0.0307 | |||||

| US30259RAE53 / FMC GMSR Issuer Trust | 1.47 | 0.14 | 0.3245 | -0.1818 | |||||

| US37045VAU44 / General Motors Co | 1.45 | 28.24 | 0.3213 | -0.0705 | |||||

| US71654QCG55 / Petroleos Mexicanos | 1.45 | 29.54 | 0.3201 | -0.0661 | |||||

| LVS / Las Vegas Sands Corp. - Depositary Receipt (Common Stock) | 1.43 | 0.3163 | 0.3163 | ||||||

| US536797AG85 / LITHIA MOTORS INC 3.875% 06/01/2029 144A | 1.40 | 77.15 | 0.3102 | 0.0363 | |||||

| Great Wolf Trust, Series 2024-WOLF, Class A / ABS-MBS (US39152MAA36) | 1.39 | 56.28 | 0.3084 | 0.0000 | |||||

| US06051GLE79 / Bank of America Corporation | 1.39 | 5.06 | 0.3078 | -0.1500 | |||||

| US92212KAB26 / Vantage Data Centers LLC | 1.39 | 117.37 | 0.3072 | 0.0862 | |||||

| US92564RAL96 / VICI Properties LP / VICI Note Co., Inc. | 1.39 | 38.92 | 0.3063 | -0.0383 | |||||

| US61945LAB99 / Mosaic Solar Loan Trust 2019-2 | 1.38 | 0.3045 | 0.3045 | ||||||

| US50212YAD67 / LPL Holdings Inc | 1.38 | 135.45 | 0.3042 | 0.1023 | |||||

| US62854AAN46 / Mylan NV | 1.37 | 0.3030 | 0.3030 | ||||||

| U.S. Treasury Notes / DBT (US91282CKS97) | 1.37 | -0.22 | 0.3025 | -0.1712 | |||||

| US38145GAM24 / Goldman Sachs Group Inc/The | 1.36 | 40.19 | 0.3003 | -0.0345 | |||||

| US74841CAA99 / Quicken Loans LLC / Quicken Loans Co-Issuer Inc | 1.34 | 128.67 | 0.2965 | 0.0940 | |||||

| MRX / Marex Group plc | 1.34 | 127.21 | 0.2956 | 0.0921 | |||||

| PNCS34 / The PNC Financial Services Group, Inc. - Depositary Receipt (Common Stock) | 1.34 | 4.13 | 0.2952 | -0.1479 | |||||

| US12803VAA35 / CAJUN 2021-1 A2 11/51 | 1.32 | 1.30 | 0.2928 | -0.1588 | |||||

| NLG Global Funding / DBT (US62915W2A05) | 1.30 | 147.25 | 0.2883 | 0.1060 | |||||

| US14732KAA97 / Cascade MH Asset Trust, Series 2022-MH1, Class A | 1.30 | -1.07 | 0.2868 | -0.1658 | |||||

| CBOM / Credit Bank of Moscow (public joint-stock company) | 1.29 | 19.04 | 0.2862 | -0.0897 | |||||

| HCA, Inc. / DBT (US404119DA49) | 1.29 | 35.86 | 0.2859 | -0.0429 | |||||

| loanDepot GMSR Trust, Series 2025-GT1, Class A / ABS-O (US53946TAD46) | 1.28 | 0.2835 | 0.2835 | ||||||

| STAR Trust, Series 2025-SFR5, Class A / ABS-O (US85520CAA36) | 1.28 | -0.16 | 0.2833 | -0.1602 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.28 | -5.27 | 0.2825 | -0.1836 | |||||

| US912828YB05 / Us Treasury N/b 1.625000% 08/15/2029 Bond | 1.27 | 0.2819 | 0.2819 | ||||||

| BIIB / Biogen Inc. - Depositary Receipt (Common Stock) | 1.23 | 0.2720 | 0.2720 | ||||||

| US83438LAA98 / SOLRR 21-1 A 144A 2.636% 10-15-46/09-15-28 | 1.21 | -3.50 | 0.2685 | -0.1662 | |||||

| Research-Driven Pagaya Motor Asset Trust, Series 2025-1A, Class B / ABS-O (US76089YAB56) | 1.20 | -0.33 | 0.2650 | -0.1503 | |||||

| Athene Global Funding / DBT (US04685A3V13) | 1.19 | 20.12 | 0.2642 | -0.0794 | |||||

| HASI / HA Sustainable Infrastructure Capital, Inc. | 1.19 | 0.2642 | 0.2642 | ||||||

| US12663TAA79 / CSMC_22-RPL4 | 1.19 | -1.90 | 0.2629 | -0.1561 | |||||

| US19521UAA16 / Cologix Data Centers US Issuer LLC | 1.19 | 1.11 | 0.2623 | -0.1432 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 1.18 | 29.89 | 0.2614 | -0.0533 | |||||

| US38178HAA68 / Golub Capital Partners ABS Funding 2019-1 Ltd | 1.18 | -2.24 | 0.2604 | -0.1556 | |||||

| Lendbuzz Securitization Trust, Series 2025-2A, Class B / ABS-O (US52611JAC45) | 1.17 | 0.2592 | 0.2592 | ||||||

| US912810FM54 / Usa Treasury 6 1/4% 30yr Notes 05/15/2030 | 1.17 | 10.69 | 0.2588 | -0.1066 | |||||

| US89788MAN20 / Truist Financial Corp | 1.17 | 54.83 | 0.2586 | -0.0024 | |||||

| US65339KBS87 / NextEra Energy Capital Holdings Inc | 1.17 | -0.26 | 0.2580 | -0.1462 | |||||

| US64016NAA54 / NEIGHBORLY ISSUER LLC NBLY 2021 1A A2 144A | 1.16 | 173.24 | 0.2575 | 0.1102 | |||||

| US12659XAA46 / Credit Suisse Mortgage Capital Certificates | 1.16 | 423.53 | 0.2560 | 0.1794 | |||||

| A/S Mileage Plan IP Ltd. / DBT (US00218QAA85) | 1.16 | 37.01 | 0.2555 | -0.0360 | |||||

| US00253XAA90 / American Airlines Inc/AAdvantage Loyalty IP Ltd | 1.15 | 70.52 | 0.2547 | 0.0212 | |||||

| US345397XL24 / FORD MOTOR CREDIT CO LLC | 1.14 | 0.2518 | 0.2518 | ||||||

| Citadel Securities Global Holdings LLC / DBT (US17289RAA41) | 1.14 | 0.2518 | 0.2518 | ||||||

| US161175AY09 / Charter Communications Operating LLC / Charter Communications Operating Capital | 1.14 | 40.42 | 0.2514 | -0.0284 | |||||

| US35564KSQ30 / STACR_22-DNA2 | 1.13 | 0.2507 | 0.2507 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.13 | -18.61 | 0.2495 | -0.2297 | |||||

| US65342QAL68 / NextEra Energy Operating Partners LP | 1.12 | 46.54 | 0.2479 | -0.0166 | |||||

| Oaktree Strategic Credit Fund / DBT (US67403AAE91) | 1.12 | 475.26 | 0.2469 | 0.1799 | |||||

| Hudson Yards Mortgage Trust, Series 2025-SPRL, Class D / ABS-MBS (US44855PAG37) | 1.11 | 1.92 | 0.2465 | -0.1314 | |||||

| US55608JBF49 / Macquarie Group Ltd | 1.11 | 1.09 | 0.2455 | -0.1340 | |||||

| US46115HBU05 / INTESA SANPAOLO SPA | 1.10 | -0.54 | 0.2443 | -0.1393 | |||||

| US76134KAA25 / Retained Vantage Data Centers Issuer LLC | 1.10 | 0.2428 | 0.2428 | ||||||

| US25470DAR08 / Discovery, Inc. Bond | 1.10 | 175.63 | 0.2427 | 0.1049 | |||||

| Horizon Aircraft Finance IV Ltd., Series 2024-1, Class A / ABS-O (US43990EAA91) | 1.09 | -0.09 | 0.2411 | -0.1361 | |||||

| US05608GAA76 / BX Commercial Mortgage Trust 2021-MC | 1.08 | 0.18 | 0.2397 | -0.1342 | |||||

| Planet Fitness Master Issuer LLC, Series 2024-1A, Class A2I / ABS-O (US72703PAF09) | 1.07 | 60.48 | 0.2373 | 0.0062 | |||||

| US817743AA56 / N/A | 1.06 | 0.09 | 0.2338 | -0.1312 | |||||

| US03666HAD35 / Antares Holdings LP | 1.05 | 20.05 | 0.2331 | -0.0706 | |||||

| US15089QAM69 / Celanese US Holdings LLC | 1.05 | 22.69 | 0.2321 | -0.0635 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 1.04 | 0.2301 | 0.2301 | ||||||

| STARR / START Ireland | 1.04 | -3.36 | 0.2289 | -0.1415 | |||||

| US43730VAE83 / CORP CMO | 1.03 | 0.2280 | 0.2280 | ||||||

| US30227FAE07 / Extended Stay America Trust | 1.03 | -0.87 | 0.2278 | -0.1314 | |||||

| US81180WBM29 / Seagate HDD Cayman | 1.02 | 43.56 | 0.2245 | -0.0198 | |||||

| ACM Auto Trust, Series 2025-1A, Class B / ABS-O (US00161EAC84) | 1.01 | -0.10 | 0.2243 | -0.1266 | |||||

| Bank of New York Mellon (The) / DBT (US06405LAH42) | 1.01 | 0.2232 | 0.2232 | ||||||

| US47233JBH05 / Jefferies Group LLC / Jefferies Group Capital Finance Inc | 1.00 | 0.2204 | 0.2204 | ||||||

| US05610MAD48 / BX Commercial Mortgage Trust 2022-CSMO | 0.99 | 0.2199 | 0.2199 | ||||||

| SoFi Consumer Loan Program Trust, Series 2025-2, Class B / ABS-O (US83407HAB33) | 0.95 | 0.2110 | 0.2110 | ||||||

| US30334RAA23 / FS 23-4SZN A 144A 7.06626% 11-10-27 | 0.94 | -0.11 | 0.2085 | -0.1177 | |||||

| US69120VAU52 / BLUE OWL CREDIT 7.75 1/29 | 0.93 | 0.2060 | 0.2060 | ||||||

| US90353TAK60 / Uber Technologies Inc | 0.92 | 0.2024 | 0.2024 | ||||||

| US88104LAE39 / TERRAFORM POWER OPERATIN | 0.91 | 52.53 | 0.2004 | -0.0051 | |||||

| Research-Driven Pagaya Motor Asset Trust, Series 2025-1A, Class A / ABS-O (US76089YAA73) | 0.91 | -4.74 | 0.2003 | -0.1280 | |||||

| US37046US851 / General Motors Financial Co Inc | 0.90 | 8.27 | 0.1999 | -0.0883 | |||||

| XS2201851172 / Romanian Government International Bond | 0.89 | 0.1978 | 0.1978 | ||||||

| US315289AA69 / Ferrellgas Escrow LLC / FG Operating Finance Escrow Corp | 0.89 | 94.09 | 0.1962 | 0.0381 | |||||

| US28628BAA61 / ELFI Graduate Loan Program LLC, Series 2021-A, Class A | 0.88 | -4.26 | 0.1937 | -0.1226 | |||||

| US610331AA87 / Monroe Capital ABS Funding 2021-1 Ltd | 0.87 | -19.85 | 0.1930 | -0.1829 | |||||

| US74736KAJ07 / Qorvo, Inc. | 0.87 | 0.1926 | 0.1926 | ||||||

| US882925AB67 / Theorem Funding Trust 2022-3 | 0.87 | -0.80 | 0.1925 | -0.1107 | |||||

| US233046AN14 / DB Master Finance LLC | 0.87 | 0.70 | 0.1922 | -0.1062 | |||||

| US53948QAA40 / Loanpal Solar Loan 2021-2 Ltd | 0.86 | 0.47 | 0.1912 | -0.1062 | |||||

| US428291AN87 / Hexcel Corp | 0.86 | 0.1906 | 0.1906 | ||||||

| FHN.PRF / First Horizon Corporation - Preferred Stock | 0.86 | 42.45 | 0.1900 | -0.0184 | |||||

| O1KE34 / ONEOK, Inc. - Depositary Receipt (Common Stock) | 0.85 | 0.1886 | 0.1886 | ||||||

| Goldman Sachs Bank USA / DBT (US38151LAG59) | 0.85 | -54.60 | 0.1875 | -0.4582 | |||||

| US05571AAR68 / BPCE SA | 0.85 | 0.59 | 0.1872 | -0.1037 | |||||

| US71951QAC69 / Physicians Realty LP | 0.83 | 0.1835 | 0.1835 | ||||||

| Alterna Funding III LLC, Series 2024-1A, Class A / ABS-O (US02157JAA34) | 0.83 | 0.12 | 0.1832 | -0.1027 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.83 | 0.1824 | 0.1824 | ||||||

| US83545GBD34 / Sonic Automotive Inc | 0.82 | 0.1804 | 0.1804 | ||||||

| IMB / Imperial Brands PLC | 0.81 | 17.05 | 0.1792 | -0.0599 | |||||

| Raizen Fuels Finance SA / DBT (US75102XAF33) | 0.81 | 0.1784 | 0.1784 | ||||||

| Oportun Funding Trust, Series 2024-3, Class B / ABS-O (US68377NAB73) | 0.80 | 0.00 | 0.1771 | -0.0997 | |||||

| US81254UAK25 / Seaspan Corp | 0.80 | 35.59 | 0.1769 | -0.0271 | |||||

| US26209XAD30 / DRIVEN BRANDS FUNDING LLC | 0.79 | 0.1754 | 0.1754 | ||||||

| US11135FBH38 / Broadcom Inc | 0.79 | 0.1750 | 0.1750 | ||||||

| Cloud Capital Holdco LP, Series 2024-1A, Class A2 / ABS-O (US102104AA49) | 0.79 | 0.51 | 0.1750 | -0.0971 | |||||

| US91282CDP32 / United States Treasury Note/Bond - When Issued | 0.78 | 0.1726 | 0.1726 | ||||||

| Aircastle Ltd. / DBT (US00929JAA43) | 0.77 | 0.78 | 0.1711 | -0.0940 | |||||

| ALTDE Trust, Series 2025-1A, Class A / ABS-O (US00166NAA72) | 0.77 | -0.77 | 0.1706 | -0.0979 | |||||

| US05610MAA09 / BX_22-CSMO | 0.76 | 0.1671 | 0.1671 | ||||||

| Lendbuzz Securitization Trust, Series 2025-1A, Class A2 / ABS-O (US525938AC09) | 0.75 | 0.13 | 0.1664 | -0.0931 | |||||

| US212015AV31 / Continental Resources Inc/OK | 0.75 | 0.1657 | 0.1657 | ||||||

| US87164DVJ61 / Synovus Bank/Columbus GA | 0.75 | 7.97 | 0.1648 | -0.0738 | |||||

| US476681AA97 / Jersey Mike's Funding | 0.74 | 0.00 | 0.1642 | -0.0924 | |||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | 0.74 | 10.94 | 0.1636 | -0.0670 | |||||

| US85572RAA77 / Start Ltd/Bermuda | 0.74 | -2.64 | 0.1631 | -0.0988 | |||||

| US35564KNE54 / Freddie Mac Structured Agency Credit Risk Debt Notes | 0.74 | 0.1628 | 0.1628 | ||||||

| NYCT Trust, Series 2024-3ELV, Class A / ABS-MBS (US62956HAA41) | 0.73 | 0.41 | 0.1614 | -0.0899 | |||||

| Oportun Issuance Trust, Series 2025-A, Class C / ABS-O (US68377TAC27) | 0.72 | 0.28 | 0.1590 | -0.0889 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.71 | -7.28 | 0.1577 | -0.1082 | |||||

| ORL Trust, Series 2024-GLKS, Class A / ABS-MBS (US67120DAA37) | 0.71 | -0.28 | 0.1576 | -0.0892 | |||||

| US22003BAM81 / Corporate Office Properties LP | 0.71 | 0.1575 | 0.1575 | ||||||

| PNMAC GMSR Issuer Trust, Series 2024-GT1, Class A / ABS-O (US69354WAJ53) | 0.71 | -0.56 | 0.1571 | -0.0898 | |||||

| Lendbuzz Securitization Trust, Series 2024-1A, Class A2 / ABS-O (US525935AB86) | 0.70 | -17.08 | 0.1558 | -0.1378 | |||||

| BK / The Bank of New York Mellon Corporation - Depositary Receipt (Common Stock) | 0.70 | 0.1558 | 0.1558 | ||||||

| Westpac New Zealand Ltd. / DBT (US96122FAB31) | 0.70 | 11.22 | 0.1557 | -0.0632 | |||||

| US1248EPBT92 / CCO Holdings LLC / CCO Holdings Capital Corp | 0.70 | 0.1553 | 0.1553 | ||||||

| Chase Auto Credit Linked Notes, Series 2025-1, Class C / ABS-O (US46591HCT59) | 0.70 | 0.1552 | 0.1552 | ||||||

| US92660FAN42 / Videotron Ltd | 0.68 | 1.64 | 0.1506 | -0.0808 | |||||

| US53948PAA66 / Loanpal Solar Loan 2021-1 Ltd | 0.67 | -0.30 | 0.1479 | -0.0838 | |||||

| US26209XAA90 / DRIVEN BRANDS FUNDING LLC | 0.67 | 0.1474 | 0.1474 | ||||||

| Goddard Funding LLC, Series 2024-1A, Class A2 / ABS-O (US380241AC35) | 0.67 | 0.00 | 0.1471 | -0.0829 | |||||

| US37045XEF96 / General Motors Financial Co Inc | 0.66 | 0.15 | 0.1457 | -0.0819 | |||||

| US172967NX53 / Citigroup, Inc. | 0.65 | 44.69 | 0.1447 | -0.0115 | |||||

| US65339KCM09 / NextEra Energy Capital Holdings Inc | 0.65 | 0.1446 | 0.1446 | ||||||

| American National Global Funding / DBT (US02771D2B95) | 0.65 | 0.1445 | 0.1445 | ||||||

| US63306A4114 / National Bank of Canada into Bristol-Myers Squibb Co. | 0.65 | 0.00 | 0.1438 | -0.0811 | |||||

| US15135BAR24 / Centene Corp | 0.64 | -54.42 | 0.1416 | -0.5256 | |||||

| Gilead Aviation LLC, Series 2025-1A, Class A / ABS-O (US37556TAA43) | 0.64 | 0.16 | 0.1404 | -0.0788 | |||||

| LAD Auto Receivables Trust, Series 2024-1A, Class A3 / ABS-O (US501689AC76) | 0.63 | -15.23 | 0.1391 | -0.1175 | |||||

| Subway Funding LLC, Series 2024-3A, Class A2I / ABS-O (US864300AG32) | 0.62 | 0.65 | 0.1378 | -0.0761 | |||||

| LHOME Mortgage Trust, Series 2024-RTL1, Class A1 / ABS-MBS (US50205DAA72) | 0.62 | -0.16 | 0.1363 | -0.0773 | |||||

| US808513CG89 / Charles Schwab Corp/The | 0.61 | -0.16 | 0.1349 | -0.0763 | |||||

| GNMA, Series 2024-43, Class FB / ABS-MBS (US38384KNV97) | 0.60 | 0.1336 | 0.1336 | ||||||

| PRM5 Trust, Series 2025-PRM5, Class D / ABS-MBS (US693980AG99) | 0.60 | 1.19 | 0.1322 | -0.0717 | |||||

| US20268WAA27 / Commonbond Student Loan Trust 2021-A-GS | 0.59 | -0.51 | 0.1304 | -0.0741 | |||||

| Navigator Aviation Ltd., Series 2024-1, Class A / ABS-O (US63943DAA72) | 0.58 | -2.20 | 0.1280 | -0.0763 | |||||

| US87332PAA84 / TYSN 2023-CRNR A VAR 12/10/2038 144A | 0.57 | 1.24 | 0.1266 | -0.0687 | |||||

| US25265LAA89 / Diamond Infrastructure Funding LLC | 0.57 | 0.35 | 0.1263 | -0.0702 | |||||

| US476681AB70 / Jersey Mike's Funding | 0.57 | 0.1260 | 0.1260 | ||||||

| US62954PAA84 / BF 2018-NYT Mortgage Trust | 0.57 | -0.18 | 0.1257 | -0.0712 | |||||

| US86746EAA55 / HELIOS ISSUER LLC SER 2021-A CL A REGD 144A P/P 1.80000000 | 0.56 | -2.25 | 0.1247 | -0.0749 | |||||

| US02772AAA79 / American National Group Inc | 0.56 | 223.70 | 0.1239 | 0.0640 | |||||

| US75050KAA43 / Radnor RE Ltd., Series 2023-1, Class M1A | 0.56 | -21.35 | 0.1238 | -0.1222 | |||||

| Chesapeake Funding II LLC, Series 2024-1A, Class A1 / ABS-O (US165183DE19) | 0.56 | -11.59 | 0.1232 | -0.0948 | |||||

| US05492PAE88 / BANC OF AMERICA MERRILL LYNCH BAMLL 2019 BPR BNM 144A | 0.55 | 2.21 | 0.1227 | -0.0647 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.54 | -16.23 | 0.1201 | -0.1037 | |||||

| NJ, Series 2025-WBRK, Class C / ABS-MBS (US65486BAG68) | 0.54 | 0.00 | 0.1199 | -0.0676 | |||||

| BAMLL Trust, Series 2024-BHP, Class A / ABS-MBS (US05493WAA09) | 0.54 | 0.37 | 0.1189 | -0.0662 | |||||

| US61947DAB55 / Mosaic Solar Loan Trust 2021-1 | 0.54 | -3.42 | 0.1187 | -0.0731 | |||||

| Pagaya AI Debt Grantor Trust, Series 2025-1, Class A2 / ABS-O (US69544NAB38) | 0.53 | 0.00 | 0.1175 | -0.0659 | |||||

| US00135TAD63 / AIB Group PLC | 0.53 | 0.1170 | 0.1170 | ||||||

| Hawaii Hotel Trust, Series 2025-MAUI, Class A / ABS-MBS (US419909AA44) | 0.52 | 0.58 | 0.1152 | -0.0638 | |||||

| 081437AG0 / Bemis Inc Notes 5.65% 08/01/14 | 0.52 | 0.1147 | 0.1147 | ||||||

| U.S. Treasury 2 Year Notes / DIR (N/A) | 0.52 | 0.1147 | 0.1147 | ||||||

| US49327M3F97 / KEYBANK NATIONAL ASSOCIATION | 0.52 | -20.37 | 0.1142 | -0.2325 | |||||

| Oscar US Funding XVII LLC, Series 2024-2A, Class A2 / ABS-O (US68784BAB09) | 0.51 | -16.29 | 0.1138 | -0.0987 | |||||

| Fortitude Group Holdings LLC / DBT (US34966XAA63) | 0.51 | 0.1138 | 0.1138 | ||||||

| US46657FAA30 / JP Morgan Mortgage Trust 2023-HE2 | 0.51 | -16.18 | 0.1135 | -0.0981 | |||||

| US25755TAJ97 / Domino's Pizza Master Issuer LLC | 0.51 | 0.20 | 0.1132 | -0.0634 | |||||

| US78474LAL09 / STAR 2021-SFR2 Trust | 0.51 | 0.1128 | 0.1128 | ||||||

| Oaktree Strategic Credit Fund / DBT (US67403AAB52) | 0.51 | 261.43 | 0.1121 | 0.0634 | |||||

| GLS Auto Select Receivables Trust, Series 2024-1A, Class A2 / ABS-O (US37988XAB10) | 0.50 | -15.58 | 0.1116 | -0.0948 | |||||

| US25216CAB63 / Dext ABS 2023-2 LLC | 0.50 | -21.74 | 0.1115 | -0.1111 | |||||

| BFLD Commercial Mortgage Trust, Series 2024-UNIV, Class B / ABS-MBS (US08861RAC51) | 0.50 | 0.00 | 0.1109 | -0.0623 | |||||

| SHR Trust, Series 2024-LXRY, Class A / ABS-MBS (US784234AA47) | 0.50 | -0.20 | 0.1107 | -0.0627 | |||||

| NRM FHT1 Excess Owner LLC, Series 2025-FHT1, Class A / ABS-MBS (US64832EAA73) | 0.50 | -4.40 | 0.1106 | -0.0703 | |||||

| Oportun Issuance Trust, Series 2025-A, Class A / ABS-O (US68377TAA60) | 0.50 | -0.20 | 0.1105 | -0.0623 | |||||

| STAR Trust, Series 2025-SFR5, Class C / ABS-O (US85520CAE57) | 0.50 | -0.20 | 0.1100 | -0.0621 | |||||

| Subway Funding LLC, Series 2024-3A, Class A2II / ABS-O (US864300AJ70) | 0.50 | 0.1099 | 0.1099 | ||||||

| Liberty Utilities Co. / DBT (US531542AA64) | 0.50 | 0.1097 | 0.1097 | ||||||

| US65254RAA41 / Newtek Small Business Loan Trust, Series 2023-1, Class A | 0.49 | -4.68 | 0.1081 | -0.0694 | |||||

| NRTH Mortgage Trust, Series 2024-PARK, Class A / ABS-MBS (US67021HAA41) | 0.48 | -0.21 | 0.1063 | -0.0599 | |||||

| ACM Auto Trust, Series 2024-2A, Class A / ABS-O (US00461WAA99) | 0.48 | -31.86 | 0.1061 | -0.1368 | |||||

| US03666HAE18 / Antares Holdings LP | 0.48 | 0.1053 | 0.1053 | ||||||

| US47233JDX37 / Jefferies Group LLC | 0.47 | 0.1049 | 0.1049 | ||||||

| US05335JAB98 / Auxilior Term Funding 2023-1 LLC | 0.47 | -23.65 | 0.1029 | -0.1076 | |||||

| US25755TAE01 / Domino's Pizza Master Issuer LLC | 0.46 | 0.22 | 0.1025 | -0.0575 | |||||

| MFA Trust, Series 2024-NPL1, Class A1 / ABS-MBS (US58004YAA73) | 0.46 | -5.13 | 0.1023 | -0.0660 | |||||

| US72703PAE34 / Planet Fitness Master Issuer LLC | 0.45 | 0.0990 | 0.0990 | ||||||

| PEAC Solutions Receivables LLC, Series 2025-1A, Class A3 / ABS-O (US69392HAC79) | 0.44 | 0.69 | 0.0966 | -0.0531 | |||||

| JW Commercial Mortgage Trust, Series 2024-MRCO, Class B / ABS-MBS (US46657XAC02) | 0.44 | 0.00 | 0.0966 | -0.0543 | |||||

| SDR Commercial Mortgage Trust, Series 2024-DSNY, Class B / ABS-MBS (US811304AE49) | 0.44 | 0.00 | 0.0963 | -0.0541 | |||||

| US26833BAB99 / ECMC GROUP STUDENT LOAN TRUST ECMC 2020 3A A1B 144A | 0.43 | -1.81 | 0.0959 | -0.0568 | |||||

| Post Road Equipment Finance LLC, Series 2024-1A, Class A2 / ABS-O (US737473AB44) | 0.42 | -15.37 | 0.0938 | -0.0793 | |||||

| US78474PAN78 / STARWOOD MORTGAGE RESIDENTIAL TRUST 2021-4 TSFR1M+450 05/17/2024 144A | 0.42 | 0.0931 | 0.0931 | ||||||

| Crockett Partners Equipment Co. IIA LLC, Series 2024-1C, Class A / ABS-O (US22689LAA35) | 0.42 | -5.44 | 0.0923 | -0.0603 | |||||

| US38177UAA88 / Golub Capital Partners ABS Funding 2020-1 Ltd | 0.41 | -1.91 | 0.0907 | -0.0537 | |||||

| HLTN Commercial Mortgage Trust, Series 2024-DPLO, Class B / ABS-MBS (US40424UAC18) | 0.40 | -39.58 | 0.0886 | -0.1403 | |||||

| US95058XAG34 / Wendy's Funding LLC | 0.40 | 0.00 | 0.0885 | -0.0498 | |||||

| US87161CAN56 / Synovus Financial Corp | 0.39 | 56.22 | 0.0862 | -0.0001 | |||||

| US694308KL02 / Pacific Gas and Electric Co | 0.38 | 0.0848 | 0.0848 | ||||||

| HYT Commercial Mortgage Trust, Series 2024-RGCY, Class A / ABS-MBS (US449173AA16) | 0.38 | 0.00 | 0.0842 | -0.0472 | |||||

| US35563PMF35 / Seasoned Credit Risk Transfer Trust Series 2019-4 | 0.38 | -4.29 | 0.0840 | -0.0530 | |||||

| US05964HAY18 / Banco Santander SA | 0.38 | -80.29 | 0.0838 | -0.5792 | |||||

| 30064K105 / Exacttarget, Inc. | 0.38 | 1.07 | 0.0834 | -0.0457 | |||||

| TX Trust, Series 2024-HOU, Class A / ABS-MBS (US90216DAA00) | 0.37 | -0.27 | 0.0825 | -0.0470 | |||||

| US08860FAA66 / BANKERS HEALTHCARE GROUP SECURITIZATION TRUST | 0.37 | -29.36 | 0.0825 | -0.1001 | |||||

| US65246QAA76 / NZES_21-GNT1 | 0.36 | -4.27 | 0.0795 | -0.0504 | |||||

| TLWND / GAIA Aviation Ltd | 0.36 | -1.38 | 0.0792 | -0.0464 | |||||

| US68377GAB23 / OPTN_21-B | 0.36 | -23.98 | 0.0787 | -0.0829 | |||||

| US00969YAA29 / AJAX MORTGAGE LOAN TRUST 2020-B SER 2020-B CL A1 V/R REGD 144A P/P 0.00000000 | 0.35 | -3.02 | 0.0782 | -0.0478 | |||||

| US26884UAF66 / EPR Properties | 0.35 | -17.26 | 0.0775 | -0.0687 | |||||

| US81761TAA34 / SERVICEMASTER BRANDS SERV 2020 1 A2I 144A | 0.35 | 0.58 | 0.0774 | -0.0428 | |||||

| Wingspire Equipment Finance LLC, Series 2024-1A, Class A2 / ABS-O (US97415AAB89) | 0.35 | 0.00 | 0.0768 | -0.0432 | |||||

| Lendbuzz Securitization Trust, Series 2024-3A, Class A2 / ABS-O (US52609YAB74) | 0.34 | -13.49 | 0.0753 | -0.0607 | |||||

| PEAC Solutions Receivables LLC, Series 2024-1A, Class A2 / ABS-O (US69433BAB36) | 0.34 | -16.38 | 0.0747 | -0.0646 | |||||

| US62955MAB28 / NRZ Excess Spread-Collateralized Notes | 0.34 | -3.99 | 0.0746 | -0.0469 | |||||

| US03465BAA52 / Angel Oak SB Commercial Mortgage Trust 2020-SBC1 | 0.33 | -19.56 | 0.0728 | -0.0686 | |||||

| US69120VAU52 / BLUE OWL CREDIT 7.75 1/29 | 0.33 | 0.0728 | 0.0728 | ||||||

| OXYD / Occidental Petroleum Corporation - Depositary Receipt (Common Stock) | 0.33 | 0.0721 | 0.0721 | ||||||

| ACHV ABS Trust, Series 2024-3AL, Class B / ABS-O (US00092KAB08) | 0.33 | -23.71 | 0.0719 | -0.0756 | |||||

| HLTN Commercial Mortgage Trust, Series 2024-DPLO, Class A / ABS-MBS (US40424UAA51) | 0.32 | 0.00 | 0.0715 | -0.0404 | |||||

| US22003BAN64 / Corporate Office Properties LP | 0.32 | 0.0711 | 0.0711 | ||||||

| PK Alift Loan Funding 3 LP, Series 2024-1, Class A1 / ABS-O (US69291VAB09) | 0.32 | -2.16 | 0.0702 | -0.0420 | |||||

| NRM FNT1 Excess LLC, Series 2024-FNT1, Class A / ABS-O (US62956YAA73) | 0.31 | -5.44 | 0.0694 | -0.0450 | |||||

| American National Global Funding / DBT (US02771D2A13) | 0.31 | -65.44 | 0.0685 | -0.2407 | |||||

| ACM Auto Trust, Series 2025-1A, Class A / ABS-O (US00161EAA29) | 0.30 | -24.18 | 0.0666 | -0.0708 | |||||

| HYT Commercial Mortgage Trust, Series 2024-RGCY, Class C / ABS-MBS (US449173AE38) | 0.30 | 0.00 | 0.0657 | -0.0371 | |||||

| US30225VAF40 / Extra Space Storage LP | 0.30 | 0.0655 | 0.0655 | ||||||

| US830867AA59 / Delta Air Lines Inc / SkyMiles IP Ltd | 0.30 | -33.18 | 0.0655 | -0.0878 | |||||

| J.P. Morgan Mortgage Trust, Series 2024-HE2, Class A1 / ABS-O (US46593HAA68) | 0.29 | -13.21 | 0.0640 | -0.0512 | |||||

| US47233JGT97 / Jefferies Group LLC / Jefferies Group Capital Finance Inc | 0.28 | 0.0626 | 0.0626 | ||||||

| Oportun Issuance Trust, Series 2025-A, Class B / ABS-O (US68377TAB44) | 0.27 | 0.00 | 0.0605 | -0.0339 | |||||

| US91282CCY57 / UNITED STATES TREASURY NOTE 1.25000000 | 0.27 | 0.0589 | 0.0589 | ||||||

| US25470DBF50 / Discovery Communications LLC | 0.27 | 0.0586 | 0.0586 | ||||||

| US80290CBB90 / Santander Bank Auto Credit-Linked Notes Series 2022-B | 0.26 | -54.42 | 0.0582 | -0.1415 | |||||

| US03236YAB11 / Amur Equipment Finance Receivables XII LLC | 0.26 | -17.25 | 0.0573 | -0.0511 | |||||

| J.P. Morgan Mortgage Trust, Series 2024-HE1, Class A1 / ABS-O (US46658AAA34) | 0.26 | -16.56 | 0.0570 | -0.0496 | |||||

| ORL Trust, Series 2024-GLKS, Class D / ABS-MBS (US67120DAG07) | 0.25 | 0.00 | 0.0562 | -0.0318 | |||||

| Stream Innovations Issuer Trust, Series 2024-1A, Class A / ABS-O (US86324CAA99) | 0.25 | -7.01 | 0.0558 | -0.0379 | |||||

| Oscar US Funding XVI LLC, Series 2024-1A, Class A2 / ABS-O (US68784GAB95) | 0.24 | -30.57 | 0.0539 | -0.0674 | |||||

| U.S. Treasury Notes / DBT (US91282CJV46) | 0.24 | 0.0535 | 0.0535 | ||||||

| Crossroads Asset Trust, Series 2024-A, Class A2 / ABS-O (US227927AB63) | 0.24 | -13.50 | 0.0525 | -0.0422 | |||||

| US125491AN04 / CI Financial Corp | 0.23 | -74.07 | 0.0507 | -0.2545 | |||||

| US91282CJS17 / United States Treasury Note/Bond - When Issued | 0.22 | 0.0475 | 0.0475 | ||||||

| US55292RAA95 / MAPS 2021-1 Trust | 0.21 | -2.36 | 0.0459 | -0.0274 | |||||

| Reach ABS Trust, Series 2024-2A, Class A / ABS-O (US75525HAA86) | 0.19 | -24.90 | 0.0428 | -0.0461 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.19 | -2.55 | 0.0423 | -0.0255 | |||||

| A/S Mileage Plan IP Ltd. / DBT (US00218QAB68) | 0.19 | 1.08 | 0.0414 | -0.0229 | |||||

| ACHV ABS Trust, Series 2024-3AL, Class C / ABS-O (US00092KAC80) | 0.18 | -32.22 | 0.0406 | -0.0527 | |||||

| US92243RAA23 / SER 2021-1A CL A REGD 144A P/P 2.15200000 | 0.18 | -0.55 | 0.0398 | -0.0230 | |||||

| US674599ED34 / Occidental Petroleum Corp | 0.18 | 0.0398 | 0.0398 | ||||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 0.17 | 0.0380 | 0.0380 | ||||||

| GLS Auto Select Receivables Trust, Series 2024-2A, Class A2 / ABS-O (US379924AC72) | 0.16 | -14.75 | 0.0346 | -0.0289 | |||||

| US62482BAB80 / MOZART DEBT MERGER SUB INC | 0.16 | 0.0345 | 0.0345 | ||||||

| MAACH / MACH 1 Cayman 2019-1 Ltd | 0.16 | -16.67 | 0.0344 | -0.0300 | |||||

| US62955MAA45 / NRZ FHT Excess LLC, Series 2020-FHT1, Class A | 0.16 | -4.32 | 0.0344 | -0.0217 | |||||

| Auxilior Term Funding LLC, Series 2024-1A, Class A2 / ABS-O (US05335FAB76) | 0.15 | -27.80 | 0.0329 | -0.0381 | |||||

| US91282CHM64 / U.S. Treasury Notes | 0.14 | 0.0307 | 0.0307 | ||||||

| US64830CAA36 / NEW RESIDENTIAL MORTGAGE LOAN TRUST 2019-1 NRZT 2019-1A A1 | 0.14 | -3.57 | 0.0301 | -0.0183 | |||||

| US26884UAG40 / EPR Properties | 0.13 | 0.0293 | 0.0293 | ||||||

| US676477AA09 / OCEANVIEW MTG LN TR 2020-1 1.73291% 05/28/2050 144A | 0.13 | -7.41 | 0.0277 | -0.0189 | |||||

| US61946NAA63 / Mosaic Solar Loan Trust 2020-1 | 0.12 | -3.15 | 0.0273 | -0.0169 | |||||

| US67571BAA17 / Octane Receivables Trust 2023-1 | 0.12 | -36.65 | 0.0269 | -0.0392 | |||||

| US30610GAA13 / Falcon 2019-1 Aerospace Ltd | 0.11 | -8.13 | 0.0252 | -0.0175 | |||||

| US31300LTB17 / Freddie Mac Non Gold Pool | 0.10 | -3.74 | 0.0229 | -0.0143 | |||||

| US780097BL47 / Natwest Group PLC | 0.10 | 0.0219 | 0.0219 | ||||||

| US552848AG81 / MGIC Investment Corp | 0.09 | -88.15 | 0.0192 | -0.2346 | |||||

| Reach Abs Trust, Series 2024-1A, Class A / ABS-MBS (US75526PAA93) | 0.09 | -41.10 | 0.0190 | -0.0315 | |||||

| US91282CCE93 / United States Treasury Note/Bond | 0.08 | 0.0186 | 0.0186 | ||||||

| US82773XAA81 / Silver Hill Trust 2019-SBC1 | 0.08 | -26.13 | 0.0182 | -0.0203 | |||||

| US31300LBF13 / Freddie Mac Non Gold Pool | 0.08 | -8.99 | 0.0181 | -0.0127 | |||||

| US31300LTA34 / Freddie Mac Non Gold Pool | 0.08 | -3.57 | 0.0180 | -0.0113 | |||||

| US912828ZQ64 / United States Treasury Note/Bond - When Issued | 0.07 | 0.0148 | 0.0148 | ||||||

| US91282CCR07 / U.S. Treasury Notes | 0.07 | 0.0145 | 0.0145 | ||||||

| US3133TM7G51 / Freddie Mac REMICs | 0.06 | -13.24 | 0.0132 | -0.0104 | |||||

| U.S. Treasury 5 Year Notes / DIR (N/A) | 0.05 | 0.0120 | 0.0120 | ||||||

| US64829EAA29 / New Residential Mortgage Loan Trust REMIC | 0.05 | -1.85 | 0.0118 | -0.0069 | |||||

| US38375BVQ21 / GNMA, Series 2012-H20, Class BA | 0.05 | -8.00 | 0.0102 | -0.0074 | |||||

| US12062RAA86 / BUNKER HILL LOAN DEPOSITARY TRUST 2020-1 BHLD 2020-1 A1 | 0.05 | -22.41 | 0.0101 | -0.0102 | |||||

| US92873FAA57 / VOLT XCVI LLC, Series 2021-NPL5, Class A1 | 0.05 | -74.43 | 0.0100 | -0.0510 | |||||

| US912810SN90 / UNITED STATES TREASURY BOND 1.25% 05/15/2050 | 0.04 | 0.0099 | 0.0099 | ||||||

| Clarios Global LP / DBT (US18060TAD72) | 0.04 | 0.0092 | 0.0092 | ||||||

| US31385JB981 / Fannie Mae Pool | 0.04 | -6.98 | 0.0090 | -0.0059 | |||||

| US81744FCW59 / Sequoia Mortgage Trust 2004-7 | 0.04 | -14.89 | 0.0089 | -0.0075 | |||||

| US36296DNA27 / Ginnie Mae I Pool | 0.04 | 0.00 | 0.0086 | -0.0051 | |||||

| US3128S5PL22 / Freddie Mac Non Gold Pool | 0.04 | -2.78 | 0.0079 | -0.0046 | |||||

| US91282CDF59 / U.S. Treasury Notes | 0.03 | 0.0076 | 0.0076 | ||||||

| US88338QAA85 / THRM_23-1A | 0.03 | -45.90 | 0.0074 | -0.0139 | |||||

| US31390QQS74 / Fannie Mae Pool | 0.03 | -3.12 | 0.0069 | -0.0042 | |||||

| US68389FBH64 / OPTION ONE MORTGAGE LOAN TRUST OOMLT 2000 5 A | 0.03 | 0.00 | 0.0058 | -0.0033 | |||||

| US75576QAA67 / ReadyCap Lending Small Business Loan Trust 2019-2 | 0.03 | -19.35 | 0.0056 | -0.0053 | |||||

| US31416JAZ49 / Fannie Mae Pool | 0.02 | 0.00 | 0.0049 | -0.0029 | |||||

| US882925AA84 / Theorem Funding Trust 2022-3 | 0.02 | -56.82 | 0.0043 | -0.0111 | |||||

| US38375BLN00 / GNMA, Series 2011-H11, Class FA | 0.02 | -13.64 | 0.0042 | -0.0037 | |||||

| US3138EGTR52 / Fannie Mae Pool | 0.01 | -6.67 | 0.0032 | -0.0021 | |||||

| US31418MJQ69 / Federal National Mortgage Association | 0.01 | 0.00 | 0.0027 | -0.0018 | |||||

| US38375UEJ51 / GNMA, Series 2014-H03, Class FA | 0.01 | -21.43 | 0.0026 | -0.0024 | |||||

| US48020RAB15 / Jones Deslauriers Insurance Management Inc | 0.01 | 0.0023 | 0.0023 | ||||||

| US31383HYG37 / Federal National Mortgage Association | 0.01 | -9.09 | 0.0023 | -0.0015 | |||||

| US31418MJP86 / Federal National Mortgage Association | 0.01 | -12.50 | 0.0017 | -0.0011 | |||||

| US31418MJT09 / Federal National Mortgage Association | 0.01 | -14.29 | 0.0014 | -0.0010 | |||||

| US3128M7SU11 / Federal Home Loan Mortgage Corp. | 0.01 | 0.00 | 0.0014 | -0.0009 | |||||

| US64829CAD02 / New Residential Mortgage Loan Trust 2015-1 | 0.00 | -82.61 | 0.0011 | -0.0070 | |||||

| US31384WMS60 / Fannie Mae Pool | 0.00 | 0.00 | 0.0010 | -0.0007 | |||||

| U.S. Treasury Long Bonds / DIR (N/A) | 0.00 | 0.0009 | 0.0009 | ||||||

| US31384V4M16 / Fannie Mae Pool | 0.00 | -25.00 | 0.0008 | -0.0006 | |||||

| US31391C5N19 / Fannie Mae Pool | 0.00 | 0.00 | 0.0008 | -0.0005 | |||||

| US31387KBA07 / Fannie Mae Pool | 0.00 | 0.00 | 0.0007 | -0.0005 | |||||

| US3128M7S565 / Federal Home Loan Mortgage Corp. | 0.00 | 0.00 | 0.0007 | -0.0005 | |||||

| US31382M2J24 / Fannie Mae Pool | 0.00 | 0.00 | 0.0007 | -0.0005 | |||||

| US31390ABQ22 / Federal National Mortgage Association | 0.00 | 0.00 | 0.0006 | -0.0004 | |||||

| US3128M7S490 / Federal Home Loan Mortgage Corp. | 0.00 | -33.33 | 0.0006 | -0.0004 | |||||

| US38376RCN44 / GNR 2015-H13 FL 1ML+28 05/63 | 0.00 | 0.00 | 0.0006 | -0.0003 | |||||

| US31389FLF70 / Federal National Mortgage Association | 0.00 | 0.00 | 0.0005 | -0.0003 | |||||

| US31391FP854 / FNMA POOL 665647 FN 10/32 FIXED 6.5 | 0.00 | 0.00 | 0.0005 | -0.0003 | |||||

| US85501YAA82 / STWH_21-NPB1 | 0.00 | -98.25 | 0.0004 | -0.0194 | |||||

| US31390HG331 / Fannie Mae Pool | 0.00 | 0.00 | 0.0003 | -0.0002 | |||||

| US31371HTA67 / Fannie Mae Pool | 0.00 | 0.0002 | -0.0001 | ||||||

| US31371HQX97 / UMBS, 30 Year | 0.00 | 0.0002 | -0.0001 | ||||||

| US31378XA633 / Fannie Mae Pool | 0.00 | 0.0002 | -0.0001 | ||||||

| US31382LM452 / Fannie Mae Pool | 0.00 | 0.0002 | -0.0001 | ||||||

| US31389L2Y48 / Fannie Mae Pool | 0.00 | 0.0002 | -0.0001 | ||||||

| US31388UNK24 / Fannie Mae Pool | 0.00 | 0.0001 | -0.0001 | ||||||

| US31382KWD61 / Fannie Mae Pool | 0.00 | 0.0001 | -0.0001 | ||||||

| US31391PBD78 / Fannie Mae Pool | 0.00 | 0.0001 | -0.0000 | ||||||

| US31384VYU06 / Federal National Mortgage Association | 0.00 | 0.0000 | -0.0000 | ||||||

| US36241LCE48 / Ginnie Mae I Pool | 0.00 | 0.0000 | -0.0000 | ||||||

| US38375BUB60 / GNMA, Series 2012-H15, Class FA | 0.00 | 0.0000 | -0.0000 | ||||||

| US31380EJH80 / Federal National Mortgage Association | 0.00 | 0.0000 | -0.0000 | ||||||

| U.S. Treasury 10 Year Ultra Bonds / DIR (N/A) | -0.09 | -0.0197 | -0.0197 | ||||||

| U.S. Treasury 10 Year Notes / DIR (N/A) | -0.40 | -0.0888 | -0.0888 |