Mga Batayang Estadistika

| Nilai Portofolio | $ 402,342,538 |

| Posisi Saat Ini | 111 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

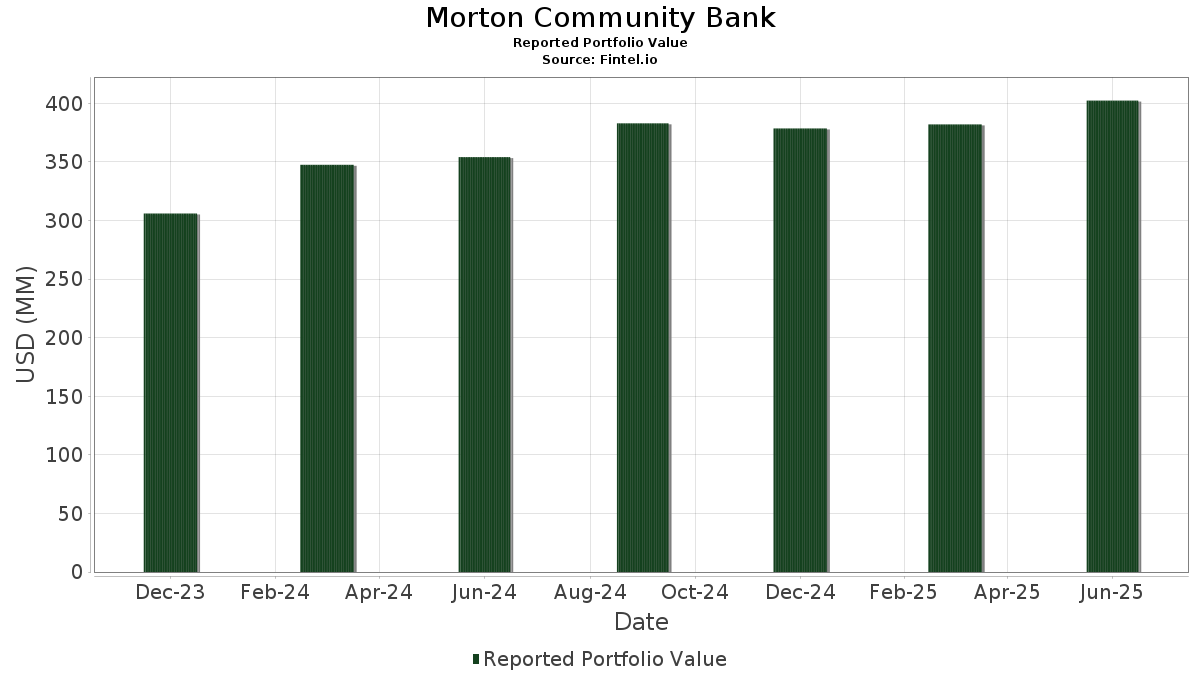

Morton Community Bank telah mengungkapkan total kepemilikan 111 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 402,342,538 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Morton Community Bank adalah iShares Trust - iShares Core Dividend Growth ETF (US:DGRO) , Schwab Strategic Trust - Schwab U.S. Dividend Equity ETF (US:SCHD) , Broadcom Inc. (US:AVGO) , The Select Sector SPDR Trust - The Utilities Select Sector SPDR Fund (US:XLU) , and Microsoft Corporation (US:MSFT) . Posisi baru Morton Community Bank meliputi: Salesforce, Inc. (US:CRM) , The Select Sector SPDR Trust - The Technology Select Sector SPDR Fund (US:XLK) , The Select Sector SPDR Trust - The Industrial Select Sector SPDR Fund (US:XLI) , Vanguard Index Funds - Vanguard S&P 500 ETF (US:VOO) , and Nuvation Bio Inc. (US:NUVB) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.24 | 4.11 | 1.0206 | 0.9706 | |

| 0.01 | 3.00 | 0.7453 | 0.7453 | |

| 0.02 | 5.61 | 1.3953 | 0.4826 | |

| 0.03 | 9.05 | 1.6010 | 0.4696 | |

| 0.03 | 6.47 | 1.1443 | 0.3447 | |

| 0.09 | 5.39 | 1.3398 | 0.3439 | |

| 0.00 | 1.13 | 0.2820 | 0.2820 | |

| 0.01 | 1.04 | 0.2594 | 0.2594 | |

| 0.01 | 7.29 | 1.2891 | 0.2444 | |

| 0.04 | 4.33 | 1.0762 | 0.2293 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.06 | 1.30 | 0.2299 | -0.7692 | |

| 0.02 | 0.96 | 0.1699 | -0.5451 | |

| 0.59 | 15.65 | 2.7670 | -0.4824 | |

| 0.01 | 2.83 | 0.5013 | -0.3176 | |

| 0.03 | 4.93 | 0.8720 | -0.1872 | |

| 0.04 | 3.53 | 0.6246 | -0.1314 | |

| 0.02 | 4.02 | 0.7104 | -0.1264 | |

| 0.06 | 5.22 | 0.9235 | -0.1161 | |

| 0.27 | 5.24 | 0.9275 | -0.1159 | |

| 0.04 | 3.11 | 0.5506 | -0.1017 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-13 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| DGRO / iShares Trust - iShares Core Dividend Growth ETF | 0.28 | 4.32 | 18.09 | 7.97 | 3.1988 | -0.0346 | |||

| SCHD / Schwab Strategic Trust - Schwab U.S. Dividend Equity ETF | 0.59 | -1.95 | 15.65 | -7.07 | 2.7670 | -0.4824 | |||

| AVGO / Broadcom Inc. | 0.03 | -6.20 | 9.05 | 54.42 | 1.6010 | 0.4696 | |||

| XLU / The Select Sector SPDR Trust - The Utilities Select Sector SPDR Fund | 0.09 | -0.11 | 7.58 | 3.44 | 1.3403 | -0.0737 | |||

| MSFT / Microsoft Corporation | 0.01 | 1.63 | 7.29 | 34.66 | 1.2891 | 0.2444 | |||

| JPM / JPMorgan Chase & Co. | 0.02 | 0.29 | 6.95 | 18.55 | 1.2288 | 0.0974 | |||

| ORCL / Oracle Corporation | 0.03 | -0.13 | 6.47 | 56.17 | 1.1443 | 0.3447 | |||

| ETN / Eaton Corporation plc | 0.02 | 2.09 | 5.66 | 34.09 | 1.0017 | 0.1863 | |||

| AXP / American Express Company | 0.02 | 0.13 | 5.61 | 18.71 | 1.3953 | 0.4826 | |||

| PM / Philip Morris International Inc. | 0.03 | -2.15 | 5.59 | 12.27 | 0.9885 | 0.0276 | |||

| LRCX / Lam Research Corporation | 0.06 | 2.39 | 5.41 | 37.12 | 0.9571 | 0.1952 | |||

| WMB / The Williams Companies, Inc. | 0.09 | -0.60 | 5.39 | 4.48 | 1.3398 | 0.3439 | |||

| BSCS / Invesco Exchange-Traded Self-Indexed Fund Trust - Invesco BulletShares 2028 Corporate Bond ETF | 0.26 | -1.11 | 5.34 | -0.43 | 0.9441 | -0.0907 | |||

| T / AT&T Inc. | 0.18 | -0.33 | 5.32 | 1.99 | 0.9411 | -0.0659 | |||

| BSCT / Invesco Exchange-Traded Self-Indexed Fund Trust - Invesco BulletShares 2029 Corporate Bond ETF | 0.28 | -0.52 | 5.32 | 0.38 | 0.9404 | -0.0819 | |||

| BSCR / Invesco Exchange-Traded Self-Indexed Fund Trust - Invesco BulletShares 2027 Corporate Bond ETF | 0.27 | -1.79 | 5.30 | -1.49 | 0.9364 | -0.1010 | |||

| BSCQ / Invesco Exchange-Traded Self-Indexed Fund Trust - Invesco BulletShares 2026 Corporate Bond ETF | 0.27 | -3.18 | 5.24 | -3.00 | 0.9275 | -0.1159 | |||

| ETR / Entergy Corporation | 0.06 | -0.29 | 5.22 | -3.06 | 0.9235 | -0.1161 | |||

| APO / Apollo Global Management, Inc. | 0.04 | 1.70 | 5.22 | 5.35 | 0.9229 | -0.0330 | |||

| GS / The Goldman Sachs Group, Inc. | 0.01 | 3.18 | 5.05 | 33.70 | 0.8933 | 0.1640 | |||

| DE / Deere & Company | 0.01 | -0.40 | 5.02 | 7.89 | 0.8876 | -0.0101 | |||

| ABBV / AbbVie Inc. | 0.03 | 1.41 | 4.93 | -10.17 | 0.8720 | -0.1872 | |||

| RF / Regions Financial Corporation | 0.20 | 2.55 | 4.81 | 10.99 | 0.8504 | 0.0142 | |||

| ICE / Intercontinental Exchange, Inc. | 0.03 | 2.60 | 4.63 | 9.13 | 0.8181 | -0.0000 | |||

| NI / NiSource Inc. | 0.11 | 1.05 | 4.62 | 1.67 | 0.8166 | -0.0598 | |||

| RMD / ResMed Inc. | 0.02 | 1.45 | 4.59 | 16.93 | 0.8126 | 0.0542 | |||

| RGA / Reinsurance Group of America, Incorporated | 0.02 | 2.94 | 4.51 | 3.70 | 0.7973 | -0.0417 | |||

| SO / The Southern Company | 0.05 | 3.71 | 4.35 | 3.57 | 0.7686 | -0.0413 | |||

| WEC / WEC Energy Group, Inc. | 0.04 | 3.20 | 4.33 | -1.32 | 1.0762 | 0.2293 | |||

| CSCO / Cisco Systems, Inc. | 0.06 | 3.00 | 4.26 | 15.82 | 0.7538 | 0.0434 | |||

| HON / Honeywell International Inc. | 0.02 | 3.67 | 4.23 | 14.00 | 0.7488 | 0.0320 | |||

| ALL / The Allstate Corporation | 0.02 | 3.68 | 4.23 | 0.79 | 0.7477 | -0.0619 | |||

| CI / The Cigna Group | 0.01 | 3.07 | 4.16 | 3.56 | 0.7362 | -0.0396 | |||

| DUK / Duke Energy Corporation | 0.04 | 2.78 | 4.15 | -0.58 | 1.0304 | 0.2257 | |||

| LECO / Lincoln Electric Holdings, Inc. | 0.02 | 2.80 | 4.11 | 12.66 | 0.7270 | 0.0228 | |||

| BSCU / Invesco Exchange-Traded Self-Indexed Fund Trust - Invesco BulletShares 2030 Corporate Bond ETF | 0.24 | 1,466.70 | 4.11 | 1,485.33 | 1.0206 | 0.9706 | |||

| LNG / Cheniere Energy, Inc. | 0.02 | 3.73 | 4.10 | 9.18 | 0.7254 | 0.0002 | |||

| BLK / BlackRock, Inc. | 0.00 | 2.37 | 4.08 | 13.51 | 0.7209 | 0.0277 | |||

| JNJ / Johnson & Johnson | 0.03 | 4.54 | 4.07 | -3.71 | 1.0125 | 0.1960 | |||

| HD / The Home Depot, Inc. | 0.01 | 4.24 | 4.06 | 4.30 | 0.7171 | -0.0334 | |||

| SPGI / S&P Global Inc. | 0.01 | 2.90 | 4.02 | 6.80 | 0.7109 | -0.0156 | |||

| MMC / Marsh & McLennan Companies, Inc. | 0.02 | 3.41 | 4.02 | -7.34 | 0.7104 | -0.1264 | |||

| AEP / American Electric Power Company, Inc. | 0.04 | 3.44 | 4.01 | -1.79 | 0.7095 | -0.0788 | |||

| ABT / Abbott Laboratories | 0.03 | 3.92 | 3.98 | 6.56 | 0.7037 | -0.0170 | |||

| C / Citigroup Inc. | 0.05 | 6.27 | 3.93 | 27.44 | 0.6949 | 0.0998 | |||

| XEL / Xcel Energy Inc. | 0.06 | 3.56 | 3.90 | -0.36 | 0.6899 | -0.0658 | |||

| LNT / Alliant Energy Corporation | 0.06 | 2.70 | 3.90 | -3.49 | 0.6890 | -0.0901 | |||

| DTE / DTE Energy Company | 0.03 | 3.60 | 3.89 | -0.76 | 0.6884 | -0.0686 | |||

| CVX / Chevron Corporation | 0.03 | 4.00 | 3.89 | -10.98 | 0.9670 | 0.1235 | |||

| LMT / Lockheed Martin Corporation | 0.01 | 2.96 | 3.87 | 6.77 | 0.6837 | -0.0153 | |||

| GOOGL / Alphabet Inc. | 0.02 | 16.33 | 3.83 | 32.59 | 0.6771 | 0.1197 | |||

| DOX / Amdocs Limited | 0.04 | 5.55 | 3.78 | 5.24 | 0.6678 | -0.0247 | |||

| XLF / The Select Sector SPDR Trust - The Financial Select Sector SPDR Fund | 0.07 | 10.85 | 3.70 | 16.54 | 0.6545 | 0.0417 | |||

| VZ / Verizon Communications Inc. | 0.08 | 2.04 | 3.66 | -2.66 | 0.6464 | -0.0784 | |||

| DIS / The Walt Disney Company | 0.03 | 3.48 | 3.64 | 30.02 | 0.6435 | 0.1034 | |||

| SCI / Service Corporation International | 0.04 | 4.72 | 3.64 | 6.32 | 0.6430 | -0.0172 | |||

| KO / The Coca-Cola Company | 0.05 | 2.82 | 3.61 | 1.58 | 0.6383 | -0.0475 | |||

| NEE / NextEra Energy, Inc. | 0.05 | 4.58 | 3.57 | 2.44 | 0.6315 | -0.0415 | |||

| COP / ConocoPhillips | 0.04 | 5.52 | 3.53 | -9.85 | 0.6246 | -0.1314 | |||

| PG / The Procter & Gamble Company | 0.02 | 4.27 | 3.46 | -2.53 | 0.6127 | -0.0733 | |||

| ACN / Accenture plc | 0.01 | 6.64 | 3.45 | 2.16 | 0.6109 | -0.0418 | |||

| BAH / Booz Allen Hamilton Holding Corporation | 0.03 | 7.27 | 3.42 | 6.81 | 0.6049 | -0.0132 | |||

| USB / U.S. Bancorp | 0.08 | 4.46 | 3.41 | 11.97 | 0.6039 | 0.0152 | |||

| XOM / Exxon Mobil Corporation | 0.03 | 4.55 | 3.38 | -5.22 | 0.5976 | -0.0906 | |||

| MDLZ / Mondelez International, Inc. | 0.05 | 2.96 | 3.37 | 2.37 | 0.5965 | -0.0396 | |||

| MDT / Medtronic plc | 0.04 | 5.16 | 3.37 | 2.00 | 0.5959 | -0.0416 | |||

| SYY / Sysco Corporation | 0.04 | 6.35 | 3.36 | 7.31 | 0.5944 | -0.0099 | |||

| EXC / Exelon Corporation | 0.08 | 3.44 | 3.35 | -2.53 | 0.5929 | -0.0710 | |||

| EOG / EOG Resources, Inc. | 0.03 | 7.09 | 3.32 | -0.12 | 0.8259 | 0.1838 | |||

| GPC / Genuine Parts Company | 0.03 | 9.74 | 3.29 | 11.72 | 0.5818 | 0.0136 | |||

| AZN / AstraZeneca PLC - Depositary Receipt (Common Stock) | 0.05 | 5.13 | 3.27 | -0.06 | 0.8120 | 0.1811 | |||

| AMGN / Amgen Inc. | 0.01 | 5.50 | 3.16 | -5.45 | 0.5586 | -0.0861 | |||

| APD / Air Products and Chemicals, Inc. | 0.01 | 8.93 | 3.13 | 4.19 | 0.5536 | -0.0263 | |||

| OMC / Omnicom Group Inc. | 0.04 | 6.17 | 3.11 | -7.87 | 0.5506 | -0.1017 | |||

| CRM / Salesforce, Inc. | 0.01 | 3.00 | 0.7453 | 0.7453 | |||||

| ZTS / Zoetis Inc. | 0.02 | 9.18 | 2.99 | 3.43 | 0.5283 | -0.0292 | |||

| PEP / PepsiCo, Inc. | 0.02 | 7.00 | 2.95 | -5.79 | 0.5213 | -0.0825 | |||

| KMB / Kimberly-Clark Corporation | 0.02 | 2.92 | 2.91 | -6.70 | 0.5151 | -0.0874 | |||

| CVS / CVS Health Corporation | 0.04 | 5.18 | 2.89 | 7.07 | 0.5120 | -0.0098 | |||

| D / Dominion Energy, Inc. | 0.05 | 5.32 | 2.88 | 6.16 | 0.5092 | -0.0142 | |||

| UNH / UnitedHealth Group Incorporated | 0.01 | 12.16 | 2.83 | -33.21 | 0.5013 | -0.3176 | |||

| PPG / PPG Industries, Inc. | 0.02 | 7.66 | 2.81 | 11.98 | 0.4975 | 0.0127 | |||

| UPS / United Parcel Service, Inc. | 0.03 | 4.69 | 2.73 | -3.95 | 0.6778 | 0.1300 | |||

| MRK / Merck & Co., Inc. | 0.03 | 1.93 | 2.66 | -10.11 | 0.4701 | -0.1006 | |||

| XLC / The Select Sector SPDR Trust - The Communication Services Select Sector SPDR Fund | 0.02 | 2.26 | 2.55 | 15.08 | 0.4508 | 0.0233 | |||

| SLB / Schlumberger Limited | 0.07 | 11.25 | 2.40 | -10.02 | 0.4241 | -0.0904 | |||

| TGT / Target Corporation | 0.02 | 8.77 | 2.35 | 2.85 | 0.4149 | -0.0255 | |||

| STZ / Constellation Brands, Inc. | 0.01 | 6.44 | 2.34 | -5.65 | 0.4136 | -0.0648 | |||

| CEG / Constellation Energy Corporation | 0.01 | -21.14 | 1.82 | 26.25 | 0.3224 | 0.0437 | |||

| XLV / The Select Sector SPDR Trust - The Health Care Select Sector SPDR Fund | 0.01 | 6.16 | 1.42 | -2.00 | 0.2514 | -0.0286 | |||

| BSCP / Invesco Exchange-Traded Self-Indexed Fund Trust - Invesco BulletShares 2025 Corporate Bond ETF | 0.06 | -74.88 | 1.30 | -74.88 | 0.2299 | -0.7692 | |||

| XLK / The Select Sector SPDR Trust - The Technology Select Sector SPDR Fund | 0.00 | 1.13 | 0.2820 | 0.2820 | |||||

| XLI / The Select Sector SPDR Trust - The Industrial Select Sector SPDR Fund | 0.01 | 1.04 | 0.2594 | 0.2594 | |||||

| FE / FirstEnergy Corp. | 0.02 | -73.96 | 0.96 | -74.08 | 0.1699 | -0.5451 | |||

| LLY / Eli Lilly and Company | 0.00 | -0.93 | 0.83 | -6.40 | 0.1475 | -0.0246 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | 0.00 | 0.59 | 10.51 | 0.1042 | 0.0012 | |||

| AIG / American International Group, Inc. | 0.01 | -17.20 | 0.49 | -18.48 | 0.0874 | -0.0296 | |||

| AAPL / Apple Inc. | 0.00 | 0.00 | 0.48 | -7.66 | 0.1199 | 0.0191 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.00 | -22.62 | 0.42 | -18.07 | 0.0739 | -0.0244 | |||

| CBSH / Commerce Bancshares, Inc. | 0.01 | 0.00 | 0.39 | -0.26 | 0.0693 | -0.0064 | |||

| WMT / Walmart Inc. | 0.00 | 0.00 | 0.33 | 11.49 | 0.0584 | 0.0012 | |||

| STIP / iShares Trust - iShares 0-5 Year TIPS Bond ETF | 0.00 | 0.00 | 0.33 | -0.60 | 0.0582 | -0.0057 | |||

| TXN / Texas Instruments Incorporated | 0.00 | -8.43 | 0.32 | 5.70 | 0.0558 | -0.0018 | |||

| ANGL / VanEck ETF Trust - VanEck Fallen Angel High Yield Bond ETF | 0.01 | 0.00 | 0.30 | 1.34 | 0.0537 | -0.0041 | |||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.00 | 0.30 | 0.0738 | 0.0738 | |||||

| SCHW / The Charles Schwab Corporation | 0.00 | -14.87 | 0.29 | -1.03 | 0.0513 | -0.0051 | |||

| DTM / DT Midstream, Inc. | 0.00 | 0.00 | 0.25 | 14.03 | 0.0447 | 0.0019 | |||

| CAT / Caterpillar Inc. | 0.00 | 0.23 | 0.0410 | 0.0410 | |||||

| QCOM / QUALCOMM Incorporated | 0.00 | 0.00 | 0.23 | 3.67 | 0.0564 | 0.0142 | |||

| AMZN / Amazon.com, Inc. | 0.00 | 0.21 | 0.0372 | 0.0372 | |||||

| NUVB / Nuvation Bio Inc. | 0.03 | 0.06 | 0.0147 | 0.0147 | |||||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PAYX / Paychex, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| XLE / The Select Sector SPDR Trust - The Energy Select Sector SPDR Fund | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GIS / General Mills, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |