Mga Batayang Estadistika

| Nilai Portofolio | $ 385,675,782 |

| Posisi Saat Ini | 156 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

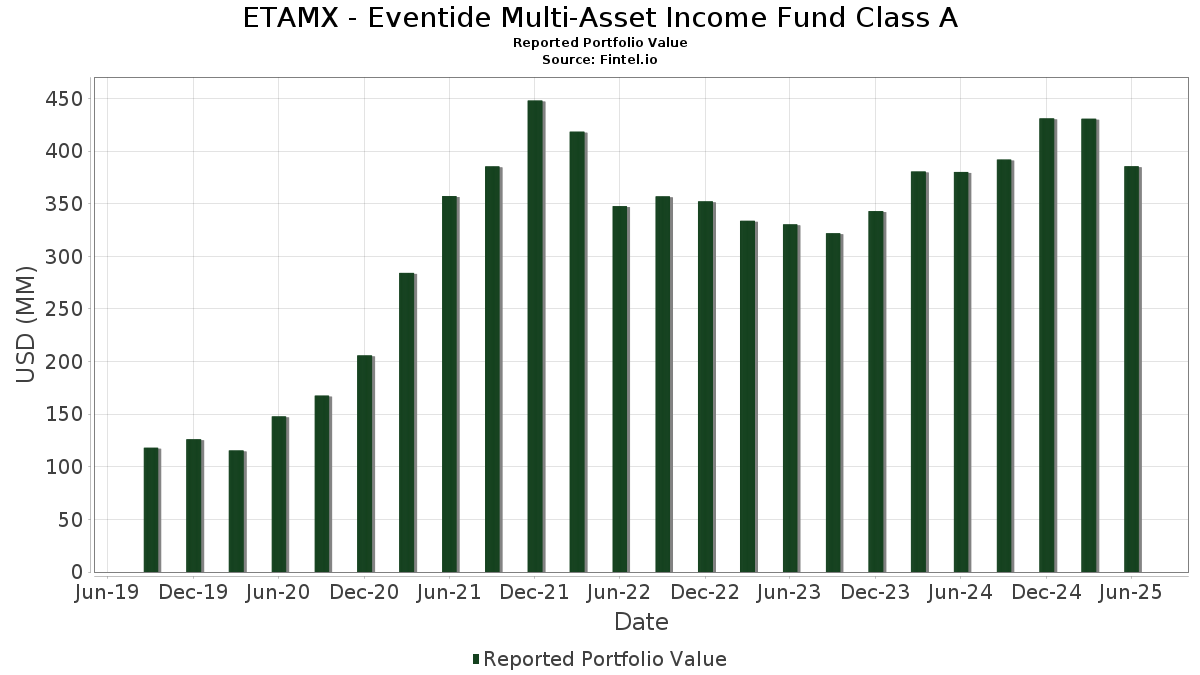

ETAMX - Eventide Multi-Asset Income Fund Class A telah mengungkapkan total kepemilikan 156 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 385,675,782 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama ETAMX - Eventide Multi-Asset Income Fund Class A adalah Trane Technologies plc (US:TT) , Arthur J. Gallagher & Co. (US:AJG) , The Williams Companies, Inc. (US:WMB) , Nasdaq, Inc. (US:NDAQ) , and Roper Technologies, Inc. (US:ROP) . Posisi baru ETAMX - Eventide Multi-Asset Income Fund Class A meliputi: NextEra Energy Capital Holdings Inc (US:US65339KBW99) , Federal Ntnl Mo 6.62530 Due 11/15/30 Bond (US:US31359MGK36) , JPMorgan Chase & Co (US:US46647PDW32) , FNMA (US:US31359MEU36) , and UMBS (US:US3132DWHE66) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.07 | 3.93 | 1.0150 | 1.0150 | |

| 3.62 | 0.9338 | 0.9338 | ||

| 0.06 | 5.52 | 1.4250 | 0.9181 | |

| 0.02 | 4.23 | 1.0917 | 0.6017 | |

| 2.31 | 0.5967 | 0.5967 | ||

| 2.31 | 0.5956 | 0.5956 | ||

| 2.05 | 0.5285 | 0.5285 | ||

| 2.02 | 0.5206 | 0.5206 | ||

| 0.02 | 2.00 | 0.5179 | 0.5179 | |

| 1.76 | 0.4540 | 0.4540 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.02 | 3.15 | 0.8136 | -1.0238 | |

| 0.03 | 1.99 | 0.5152 | -0.5518 | |

| 0.02 | 1.83 | 0.4724 | -0.4904 | |

| 0.03 | 3.18 | 0.8211 | -0.4803 | |

| 0.03 | 9.22 | 2.3819 | -0.4285 | |

| 1.00 | 0.2573 | -0.3070 | ||

| 0.07 | 6.16 | 1.5902 | -0.2780 | |

| 0.03 | 5.79 | 1.4965 | -0.2571 | |

| 1.02 | 0.2625 | -0.2033 | ||

| 1.98 | 0.5114 | -0.1988 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-28 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| TT / Trane Technologies plc | 0.02 | -10.59 | 10.50 | 16.07 | 2.7134 | 0.3303 | |||

| AJG / Arthur J. Gallagher & Co. | 0.03 | -6.82 | 9.22 | -13.60 | 2.3819 | -0.4285 | |||

| WMB / The Williams Companies, Inc. | 0.12 | -10.35 | 7.45 | -5.78 | 1.9254 | -0.1577 | |||

| NDAQ / Nasdaq, Inc. | 0.07 | 6.99 | 6.63 | 26.11 | 1.7120 | 0.3282 | |||

| ROP / Roper Technologies, Inc. | 0.01 | 0.00 | 6.58 | -3.85 | 1.6989 | -0.1024 | |||

| NVT / nVent Electric plc | 0.08 | 0.00 | 6.21 | 39.75 | 1.6039 | 0.4338 | |||

| STE / STERIS plc | 0.03 | 0.00 | 6.18 | 5.98 | 1.5976 | 0.0610 | |||

| ETR / Entergy Corporation | 0.07 | -10.75 | 6.16 | -13.22 | 1.5902 | -0.2780 | |||

| PNR / Pentair plc | 0.06 | 21.92 | 5.88 | 43.11 | 1.5178 | 0.4364 | |||

| EGP / EastGroup Properties, Inc. | 0.03 | -8.30 | 5.79 | -13.00 | 1.4965 | -0.2571 | |||

| RPRX / Royalty Pharma plc | 0.16 | 0.00 | 5.63 | 15.74 | 1.4534 | 0.1733 | |||

| LRCX / Lam Research Corporation | 0.06 | 114.03 | 5.52 | 186.55 | 1.4250 | 0.9181 | |||

| ROL / Rollins, Inc. | 0.09 | 0.00 | 5.10 | 4.43 | 1.3162 | 0.0313 | |||

| VRSK / Verisk Analytics, Inc. | 0.02 | 7.82 | 4.88 | 12.84 | 1.2604 | 0.1218 | |||

| AIT / Applied Industrial Technologies, Inc. | 0.02 | 0.00 | 4.83 | 3.16 | 1.2476 | 0.0147 | |||

| DHI / D.R. Horton, Inc. | 0.04 | 4.80 | 4.61 | 6.27 | 1.1906 | 0.0486 | |||

| KLAC / KLA Corporation | 0.01 | -12.43 | 4.53 | 15.41 | 1.1707 | 0.1365 | |||

| SHW / The Sherwin-Williams Company | 0.01 | 0.00 | 4.35 | -1.67 | 1.1225 | -0.0412 | |||

| HLI / Houlihan Lokey, Inc. | 0.02 | -21.78 | 4.33 | -12.85 | 1.1196 | -0.1899 | |||

| GEV / GE Vernova Inc. | 0.01 | -14.97 | 4.33 | 47.41 | 1.1189 | 0.3450 | |||

| IP / International Paper Company | 0.09 | 0.00 | 4.32 | -12.22 | 1.1157 | -0.1800 | |||

| HBAN / Huntington Bancshares Incorporated | 0.25 | -14.24 | 4.23 | -4.24 | 1.0917 | -0.0705 | |||

| CDW / CDW Corporation | 0.02 | 103.79 | 4.23 | 127.08 | 1.0917 | 0.6017 | |||

| MSI / Motorola Solutions, Inc. | 0.01 | 0.00 | 4.19 | -3.96 | 1.0827 | -0.0666 | |||

| WDAY / Workday, Inc. | 0.02 | 0.00 | 4.14 | 2.78 | 1.0694 | 0.0086 | |||

| EQT / EQT Corporation | 0.07 | 3.93 | 1.0150 | 1.0150 | |||||

| VST / Vistra Corp. | 0.02 | 8.97 | 3.84 | 79.91 | 0.9922 | 0.4298 | |||

| FERG / Ferguson Enterprises Inc. | 0.02 | -34.30 | 3.75 | -10.72 | 0.9680 | -0.1372 | |||

| US BANK MMDA - USBGFS 9 / STIV (N/A) | 3.62 | 0.9338 | 0.9338 | ||||||

| ODFL / Old Dominion Freight Line, Inc. | 0.02 | 0.00 | 3.60 | -1.91 | 0.9287 | -0.0364 | |||

| ESI / Element Solutions Inc | 0.16 | 0.00 | 3.51 | 0.17 | 0.9071 | -0.0160 | |||

| US65339KBW99 / NextEra Energy Capital Holdings Inc | 3.36 | 1.36 | 0.8690 | -0.0052 | |||||

| US31359MGK36 / Federal Ntnl Mo 6.62530 Due 11/15/30 Bond | 3.28 | 0.52 | 0.8478 | -0.0122 | |||||

| US46647PDW32 / JPMorgan Chase & Co | 3.27 | -0.15 | 0.8447 | -0.0178 | |||||

| NI / NiSource Inc. | 0.08 | 0.00 | 3.23 | 0.62 | 0.8350 | -0.0109 | |||

| SO / The Southern Company | 0.03 | -35.60 | 3.18 | -35.69 | 0.8211 | -0.4803 | |||

| TRGP / Targa Resources Corp. | 0.02 | -48.02 | 3.15 | -54.87 | 0.8136 | -1.0238 | |||

| GRMN / Garmin Ltd. | 0.02 | 112.80 | 3.15 | 104.55 | 0.8128 | 0.4078 | |||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 3.08 | -4.37 | 0.7963 | -0.0524 | |||||

| LAD / Lithia Motors, Inc. | 0.01 | 0.00 | 3.03 | 15.07 | 0.7833 | 0.0895 | |||

| US31359MEU36 / FNMA | 3.00 | 22.65 | 0.7738 | 0.1306 | |||||

| US3132DWHE66 / UMBS | 2.99 | -2.00 | 0.7722 | -0.0309 | |||||

| US31418EPA28 / FNCL UMBS 4.0 MA4916 02-01-53 | 2.96 | -2.12 | 0.7642 | -0.0318 | |||||

| US3132DWF570 / FNCL UMBS 5.0 SD8288 01-01-53 | 2.96 | -2.15 | 0.7638 | -0.0321 | |||||

| DTM / DT Midstream, Inc. | 0.03 | 0.00 | 2.95 | 13.89 | 0.7627 | 0.0802 | |||

| US637432NW12 / National Rural Utilities Cooperative Finance Corp | 2.93 | 2.38 | 0.7559 | 0.0032 | |||||

| US31418EE555 / UMBS, 30 Year | 2.89 | -2.43 | 0.7458 | -0.0334 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 2.84 | -1.01 | 0.7337 | -0.0218 | |||||

| US3132DWEK53 / Freddie Mac Pool | 2.81 | -2.02 | 0.7263 | -0.0293 | |||||

| US31418EKT63 / FNMA 30YR 4.5% 11/52#MA4805 | 2.80 | -2.16 | 0.7243 | -0.0305 | |||||

| US3132DWHH97 / FHLG 30YR 6% 06/01/2053# | 2.79 | -3.49 | 0.7206 | -0.0406 | |||||

| US31418EMT46 / Fannie Mae Pool | 2.77 | -2.95 | 0.7145 | -0.0360 | |||||

| US31418EDE77 / Fannie Mae Pool | 2.69 | -2.22 | 0.6947 | -0.0297 | |||||

| TYL / Tyler Technologies, Inc. | 0.00 | -12.09 | 2.68 | -10.37 | 0.6925 | -0.0950 | |||

| US16411QAG64 / Cheniere Energy Partners LP | 2.55 | 1.80 | 0.6581 | -0.0010 | |||||

| US871829BK24 / Sysco Corp | 2.54 | 1.85 | 0.6559 | -0.0008 | |||||

| US62954HBA59 / NXP BV / NXP Funding LLC / NXP USA Inc | 2.47 | 2.11 | 0.6389 | 0.0010 | |||||

| IEX / IDEX Corporation | 0.01 | 0.00 | 2.47 | -2.99 | 0.6373 | -0.0324 | |||

| MSCI / MSCI Inc. | 0.00 | 0.00 | 2.45 | 1.96 | 0.6318 | 0.0003 | |||

| US72650RBM34 / Plains All American Pipeline LP / PAA Finance Corp | 2.39 | 1.49 | 0.6173 | -0.0026 | |||||

| US3132DWDT71 / Freddie Mac Pool | 2.38 | -2.22 | 0.6152 | -0.0261 | |||||

| US776743AF34 / Roper Technologies Inc | 2.34 | 0.82 | 0.6049 | -0.0065 | |||||

| US31418EW300 / Fannie Mae Pool | 2.34 | -2.58 | 0.6045 | -0.0281 | |||||

| FHN.PRF / First Horizon Corporation - Preferred Stock | 2.33 | 78.85 | 0.6031 | 0.2593 | |||||

| US57587GTL94 / Massachusetts Housing Finance Agency, Series 2022, RB | 2.33 | -0.94 | 0.6020 | -0.0175 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 2.31 | 0.5967 | 0.5967 | ||||||

| US31418ET678 / Fannie Mae Pool | 2.31 | -2.54 | 0.5956 | -0.0273 | |||||

| CARMX 2024-2 D / ABS-O (US14319EAJ55) | 2.31 | 0.5956 | 0.5956 | ||||||

| H1BA34 / Huntington Bancshares Incorporated - Depositary Receipt (Common Stock) | 2.28 | 34.62 | 0.5876 | 0.1426 | |||||

| M1TB34 / M&T Bank Corporation - Depositary Receipt (Common Stock) | 2.27 | 0.80 | 0.5860 | -0.0065 | |||||

| PFSFC 2024-C A / ABS-O (US69335PFG54) | 2.26 | -0.09 | 0.5825 | -0.0120 | |||||

| CEG / Constellation Energy Corporation | 0.01 | -30.30 | 2.26 | 11.58 | 0.5825 | 0.0503 | |||

| US115236AB74 / Brown & Brown Inc | 2.25 | 0.81 | 0.5811 | -0.0064 | |||||

| MNSHSG 5.588 07/1/2039 / DBT (US60416UCA16) | 2.24 | -1.02 | 0.5790 | -0.0172 | |||||

| US31418ED722 / Fannie Mae Pool | 2.05 | -2.15 | 0.5299 | -0.0223 | |||||

| US04621XAM02 / ASSURANT INC SR UNSECURED 02/30 3.7 | 2.05 | 0.5285 | 0.5285 | ||||||

| FFCB 4 04/01/30 / DBT (US3133ETBF31) | 2.02 | 0.5206 | 0.5206 | ||||||

| PLD / Prologis, Inc. | 0.02 | 2.00 | 0.5179 | 0.5179 | |||||

| FFCB 4.67 12/02/27 / DBT (US3133ERG475) | 2.00 | -0.10 | 0.5166 | -0.0103 | |||||

| EQR / Equity Residential | 0.03 | -47.80 | 1.99 | -50.79 | 0.5152 | -0.5518 | |||

| AVB / AvalonBay Communities, Inc. | 0.01 | -1.52 | 1.98 | -8.91 | 0.5124 | -0.0587 | |||

| US3140QM5X87 / Uniform Mortgage-Backed Securities | 1.98 | -26.62 | 0.5114 | -0.1988 | |||||

| US576323AP42 / MasTec Inc | 1.97 | 1.08 | 0.5097 | -0.0044 | |||||

| US6944PL2E89 / PACIFIC LIFE GLOBAL FUNDING II | 1.96 | 0.77 | 0.5051 | -0.0059 | |||||

| MKC / McCormick & Company, Incorporated | 0.03 | 0.00 | 1.94 | -7.90 | 0.5002 | -0.0534 | |||

| US210385AD21 / Constellation Energy Generation LLC | 1.89 | 2.44 | 0.4873 | 0.0025 | |||||

| US418751AL75 / HAT HOLDINGS I LLC/HAT REGD 144A P/P 8.00000000 | 1.85 | 0.65 | 0.4782 | -0.0061 | |||||

| US74762EAF97 / Quanta Services Inc | 1.84 | 2.50 | 0.4764 | 0.0026 | |||||

| W1MC34 / Waste Management, Inc. - Depositary Receipt (Common Stock) | 1.84 | 0.99 | 0.4748 | -0.0046 | |||||

| US624758AF53 / MUELLER WTR PRODS INC 4% 06/15/2029 144A | 1.83 | 3.10 | 0.4728 | 0.0054 | |||||

| PEG / Public Service Enterprise Group Incorporated | 0.02 | -51.10 | 1.83 | -50.00 | 0.4724 | -0.4904 | |||

| US88023UAH41 / Tempur Sealy International Inc | 1.83 | 2.93 | 0.4723 | 0.0047 | |||||

| US31359MFJ71 / Federal National Mortgage Association | 1.82 | 0.50 | 0.4701 | -0.0068 | |||||

| US12008RAP29 / Builders FirstSource Inc | 1.81 | 3.55 | 0.4670 | 0.0075 | |||||

| US98419MAM29 / Xylem Inc/NY | 1.77 | 1.37 | 0.4583 | -0.0027 | |||||

| FFCB 4 01/13/31 / DBT (US3133ETGR24) | 1.76 | 0.4540 | 0.4540 | ||||||

| VASHSG 4.914 04/1/2030 / DBT (US92812U6W36) | 1.76 | 0.06 | 0.4534 | -0.0086 | |||||

| I1RM34 / Iron Mountain Incorporated - Depositary Receipt (Common Stock) | 1.75 | 3.68 | 0.4518 | 0.0074 | |||||

| US703343AD59 / Patrick Industries Inc | 1.75 | 3.49 | 0.4518 | 0.0068 | |||||

| POOL / Pool Corporation | 0.01 | 0.00 | 1.75 | -8.44 | 0.4511 | -0.0511 | |||

| US55305BAV36 / M/I Homes, Inc. | 1.74 | 2.48 | 0.4483 | 0.0024 | |||||

| US043436AU81 / Asbury Automotive Group Inc | 1.73 | 2.61 | 0.4462 | 0.0029 | |||||

| US911365BG81 / United Rentals North America Inc | 1.69 | 1.62 | 0.4376 | -0.0015 | |||||

| US546347AM73 / Louisiana-Pacific Corp | 1.69 | 0.84 | 0.4359 | -0.0048 | |||||

| US25278XAN93 / Diamondback Energy Inc | 1.67 | 1.21 | 0.4325 | -0.0031 | |||||

| US31398AFD90 / Federal National Mortgage Association | 1.65 | 48.87 | 0.4252 | 0.1326 | |||||

| FAST / Fastenal Company | 0.04 | 52.80 | 1.64 | -17.23 | 0.4244 | -0.0984 | |||

| US3132DQLF18 / Freddie Mac Pool | 1.64 | -3.70 | 0.4234 | -0.0250 | |||||

| US051595CC81 / AURWTR 2.098 08/1/2034 | 1.62 | -1.04 | 0.4194 | -0.0125 | |||||

| FLSHSG 5.561 07/1/2049 / DBT (US34074M2Q33) | 1.62 | -1.82 | 0.4173 | -0.0160 | |||||

| FFCB 4 5/8 04/05/29 / DBT (US3133EPXV21) | 1.55 | 0.91 | 0.3992 | -0.0042 | |||||

| FFCB 4.28 12/17/26 / DBT (US3133ERL251) | 1.50 | -0.20 | 0.3865 | -0.0083 | |||||

| US873519MN94 / City of Tacoma WA Electric System Revenue | 1.50 | 0.07 | 0.3862 | -0.0074 | |||||

| US95040QAK04 / WELLTOWER INC SR UNSECURED 02/27 2.7 | 1.47 | 0.96 | 0.3788 | -0.0038 | |||||

| RRC / Range Resources Corporation | 0.04 | 10.53 | 1.47 | 12.61 | 0.3786 | 0.0358 | |||

| RF / Regions Financial Corporation | 0.06 | 1.44 | 0.3718 | 0.3718 | |||||

| US45780RAA95 / Installed Building Products Inc | 1.44 | 1.34 | 0.3710 | -0.0022 | |||||

| US3133KMKH78 / FR RA5696 | 1.38 | -4.37 | 0.3567 | -0.0233 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.30 | -2.41 | 0.3349 | -0.0149 | |||||

| US00790RAA23 / Advanced Drainage Systems Inc | 1.29 | 0.94 | 0.3329 | -0.0033 | |||||

| QUIKHO 6 3/8 03/01/32 / DBT (US74843PAA84) | 1.29 | 70.60 | 0.3327 | 0.1339 | |||||

| MCDHSG 5.463 03/1/2034 / DBT (US57419UUW60) | 1.28 | 0.3309 | 0.3309 | ||||||

| TLN / Talen Energy Corporation | 0.00 | 1.21 | 0.3132 | 0.3132 | |||||

| US00130HCE36 / CORP. NOTE | 1.21 | 0.83 | 0.3130 | -0.0033 | |||||

| US031652BK50 / Amkor Technology Inc 6.625% 09/15/2027 144A | 1.19 | -0.08 | 0.3071 | -0.0060 | |||||

| US87157DAG43 / Synaptics Inc | 1.14 | -35.54 | 0.2945 | -0.1710 | |||||

| US92345YAH99 / Verisk Analytics Inc | 1.05 | 1.45 | 0.2718 | -0.0015 | |||||

| US31418DSJ27 / Fannie Mae Pool | 1.02 | -2.01 | 0.2646 | -0.0106 | |||||

| PGR / The Progressive Corporation | 0.00 | 0.00 | 1.02 | -5.72 | 0.2638 | -0.0214 | |||

| FFCB 4 3/8 02/28/28 / DBT (US3133EP3Z65) | 1.02 | -42.53 | 0.2625 | -0.2033 | |||||

| VASHSG 5.662 10/1/2039 / DBT (US92812U7J16) | 1.00 | -1.48 | 0.2586 | -0.0090 | |||||

| US11135FAL58 / Broadcom Inc | 1.00 | -53.50 | 0.2573 | -0.3070 | |||||

| US001055BK72 / Aflac Inc | 0.99 | 0.81 | 0.2561 | -0.0028 | |||||

| US595620AQ82 / MidAmerican Energy Co. | 0.98 | 0.82 | 0.2542 | -0.0030 | |||||

| US843646AW05 / Southern Power Co | 0.98 | 0.93 | 0.2530 | -0.0025 | |||||

| US3137FMCZ38 / Freddie Mac Multifamily Structured Pass Through Certificates | 0.96 | 0.95 | 0.2474 | -0.0023 | |||||

| US896215AH37 / TriMas Corp | 0.95 | 2.15 | 0.2454 | 0.0005 | |||||

| US3137FPHR97 / FEDERAL HOME LOAN MORTGAGE CORP. | 0.94 | 1.30 | 0.2421 | -0.0016 | |||||

| US26444HAH49 / Duke Energy Florida LLC | 0.93 | 1.64 | 0.2400 | -0.0007 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.90 | -2.39 | 0.2323 | -0.0105 | |||||

| US053484AB76 / AvalonBay Communities, Inc. | 0.86 | 2.13 | 0.2231 | 0.0005 | |||||

| US976826BP11 / Wisconsin Power and Light Co | 0.86 | 1.78 | 0.2218 | -0.0003 | |||||

| US3132DWEJ80 / Freddie Mac Pool | 0.79 | -2.24 | 0.2032 | -0.0087 | |||||

| ILSHSG 5.244 04/1/2031 / DBT (US45203MWU16) | 0.52 | -0.19 | 0.1333 | -0.0029 | |||||

| ILSHSG 5.294 10/1/2031 / DBT (US45203MWV98) | 0.52 | -0.39 | 0.1333 | -0.0031 | |||||

| F1AN34 / Diamondback Energy, Inc. - Depositary Receipt (Common Stock) | 0.51 | 0.79 | 0.1321 | -0.0015 | |||||

| US3132AAFC36 / FR ZS9163 | 0.50 | -4.55 | 0.1302 | -0.0090 | |||||

| COP 5 01/15/35 / DBT (US20826FBL94) | 0.50 | 0.1291 | 0.1291 | ||||||

| US68609TUW60 / ORS 1.315 05/01/2027 | 0.48 | 0.85 | 0.1234 | -0.0012 | |||||

| US3140JAUA48 / FN BM5976 | 0.29 | -2.05 | 0.0743 | -0.0030 | |||||

| US36179RXC86 / Ginnie Mae II Pool | 0.26 | -2.27 | 0.0667 | -0.0031 | |||||

| US53945CHJ27 / LOS ANGELES CA WSTWTR | 0.19 | 0.53 | 0.0493 | -0.0005 | |||||

| US4386705Y39 / CITY & CNTY OF HONOLULU | 0.15 | 0.68 | 0.0381 | -0.0005 | |||||

| FIGXX / Fidelity Colchester Street Trust - Fidelity Institutional Money Market Funds Government Portfolio Class I | 0.12 | 0.87 | 0.0301 | -0.0003 | |||||

| US630337AM51 / NAPA CA SOL WST REVENUE T | 0.10 | 0.00 | 0.0258 | -0.0004 | |||||

| US31418CGZ14 / FN MA2915 | 0.07 | -18.82 | 0.0180 | -0.0045 |