Mga Batayang Estadistika

| Nilai Portofolio | $ 138,934,778 |

| Posisi Saat Ini | 32 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

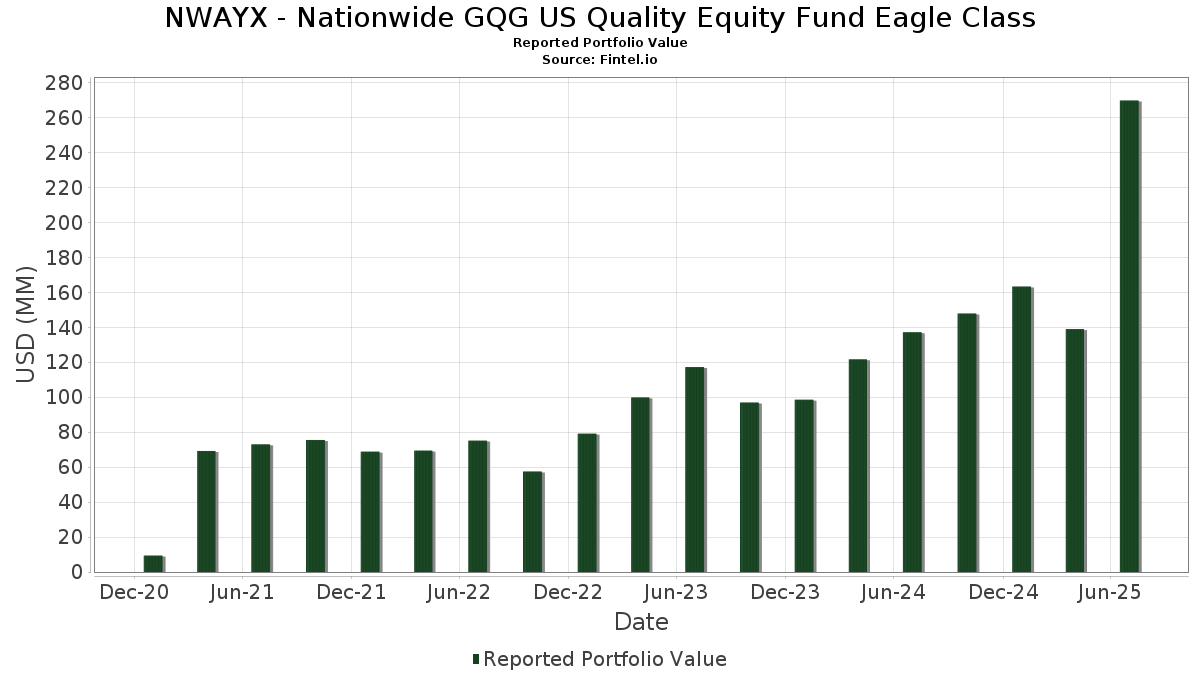

NWAYX - Nationwide GQG US Quality Equity Fund Eagle Class telah mengungkapkan total kepemilikan 32 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 138,934,778 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama NWAYX - Nationwide GQG US Quality Equity Fund Eagle Class adalah Philip Morris International Inc. (US:PM) , AT&T Inc. (US:T) , Verizon Communications Inc. (US:VZ) , The Progressive Corporation (US:PGR) , and American Electric Power Company, Inc. (US:AEP) . Posisi baru NWAYX - Nationwide GQG US Quality Equity Fund Eagle Class meliputi: Cincinnati Financial Corporation (US:CINF) , CME Group Inc. (US:CME) , CenterPoint Energy, Inc. (US:CNP) , The Kroger Co. (US:KR) , and International Business Machines Corporation (US:IBM) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.11 | 6.43 | 4.0956 | 4.0956 | |

| 0.19 | 8.31 | 5.2959 | 3.9656 | |

| 0.10 | 4.52 | 2.8830 | 2.8830 | |

| 0.06 | 4.53 | 2.8898 | 2.8437 | |

| 0.08 | 6.63 | 4.2281 | 2.3098 | |

| 0.06 | 6.92 | 4.4123 | 2.2013 | |

| 0.02 | 3.36 | 2.1443 | 2.1443 | |

| 0.01 | 3.35 | 2.1336 | 2.1336 | |

| 0.08 | 3.17 | 2.0187 | 2.0187 | |

| 0.04 | 3.08 | 1.9627 | 1.9627 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.00 | -3.2109 | ||

| 0.00 | 4.00 | 2.5478 | -3.1068 | |

| 0.00 | 0.00 | -2.0136 | ||

| 0.00 | 0.00 | -1.7903 | ||

| 0.00 | 0.00 | -1.5098 | ||

| 0.00 | 0.00 | -1.5025 | ||

| 0.01 | 3.24 | 2.0635 | -1.3857 | |

| 0.00 | 0.00 | -1.2374 | ||

| 0.00 | 0.00 | -0.4688 | ||

| 0.00 | 5.51 | 3.5141 | -0.3524 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-06-18 untuk periode pelaporan 2025-04-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| PM / Philip Morris International Inc. | 0.07 | -15.85 | 11.23 | 10.75 | 7.1585 | 1.1783 | |||

| T / AT&T Inc. | 0.36 | -1.54 | 9.98 | 14.94 | 6.3600 | 1.2401 | |||

| VZ / Verizon Communications Inc. | 0.19 | 295.42 | 8.31 | 313.59 | 5.2959 | 3.9656 | |||

| PGR / The Progressive Corporation | 0.03 | 26.59 | 7.24 | 44.71 | 4.6149 | 1.6645 | |||

| AEP / American Electric Power Company, Inc. | 0.06 | 67.64 | 6.92 | 84.66 | 4.4123 | 2.2013 | |||

| AIG / American International Group, Inc. | 0.08 | 180.04 | 6.63 | 341.09 | 4.2281 | 2.3098 | |||

| MO / Altria Group, Inc. | 0.11 | 6.43 | 4.0956 | 4.0956 | |||||

| CI / The Cigna Group | 0.02 | -4.01 | 6.00 | 10.94 | 3.8249 | 0.6349 | |||

| NFLX / Netflix, Inc. | 0.00 | -27.42 | 5.51 | -15.91 | 3.5141 | -0.3524 | |||

| MSFT / Microsoft Corporation | 0.01 | -12.20 | 4.96 | -16.40 | 3.1617 | -0.3370 | |||

| DUK / Duke Energy Corporation | 0.04 | 36.09 | 4.59 | 44.07 | 2.9278 | 0.8165 | |||

| KO / The Coca-Cola Company | 0.06 | 4,972.97 | 4.53 | 5,712.82 | 2.8898 | 2.8437 | |||

| EXC / Exelon Corporation | 0.10 | 4.52 | 2.8830 | 2.8830 | |||||

| XOM / Exxon Mobil Corporation | 0.04 | 77.72 | 4.24 | 75.75 | 2.7022 | 1.2794 | |||

| LLY / Eli Lilly and Company | 0.00 | -62.39 | 4.00 | -58.32 | 2.5478 | -3.1068 | |||

| ALL / The Allstate Corporation | 0.02 | 13.77 | 3.70 | 17.36 | 2.3572 | 0.4989 | |||

| CINF / Cincinnati Financial Corporation | 0.02 | 3.36 | 2.1443 | 2.1443 | |||||

| NEE / NextEra Energy, Inc. | 0.05 | 2.79 | 3.35 | -3.93 | 2.1374 | 0.0789 | |||

| CME / CME Group Inc. | 0.01 | 3.35 | 2.1336 | 2.1336 | |||||

| V / Visa Inc. | 0.01 | -45.24 | 3.24 | -44.66 | 2.0635 | -1.3857 | |||

| CNP / CenterPoint Energy, Inc. | 0.08 | 3.17 | 2.0187 | 2.0187 | |||||

| KR / The Kroger Co. | 0.04 | 3.08 | 1.9627 | 1.9627 | |||||

| IBM / International Business Machines Corporation | 0.01 | 3.06 | 1.9478 | 1.9478 | |||||

| BDX / Becton, Dickinson and Company | 0.01 | 2.84 | 1.8100 | 1.8100 | |||||

| ELV / Elevance Health, Inc. | 0.01 | 43.77 | 2.68 | 14.40 | 1.7064 | -0.1305 | |||

| FI / Fiserv, Inc. | 0.01 | 2.63 | 1.6766 | 1.6766 | |||||

| BMY / Bristol-Myers Squibb Company | 0.05 | 2.58 | 1.6472 | 1.6472 | |||||

| PPL / PPL Corporation | 0.06 | 2.32 | 1.4783 | 1.4783 | |||||

| XEL / Xcel Energy Inc. | 0.03 | 2.07 | 1.3164 | 1.3164 | |||||

| ATO / Atmos Energy Corporation | 0.01 | 1.55 | 0.9848 | 0.9848 | |||||

| MCK / McKesson Corporation | 0.00 | 0.74 | 0.4715 | 0.4715 | |||||

| PLTR / Palantir Technologies Inc. | 0.00 | 0.12 | 0.0743 | 0.0743 | |||||

| IBKR / Interactive Brokers Group, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1460 | ||||

| HOOD / Robinhood Markets, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.7903 | ||||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | -100.00 | -2.0136 | ||||

| RBLX / Roblox Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.4688 | ||||

| GE / General Electric Company | 0.00 | -100.00 | 0.00 | -100.00 | -3.2109 | ||||

| RDDT / Reddit, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.2374 | ||||

| CCL / Carnival Corporation & plc | 0.00 | -100.00 | 0.00 | -100.00 | -1.5025 | ||||

| AXON / Axon Enterprise, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.5098 |