Mga Batayang Estadistika

| Nilai Portofolio | $ 1,552,061,224 |

| Posisi Saat Ini | 1,427 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

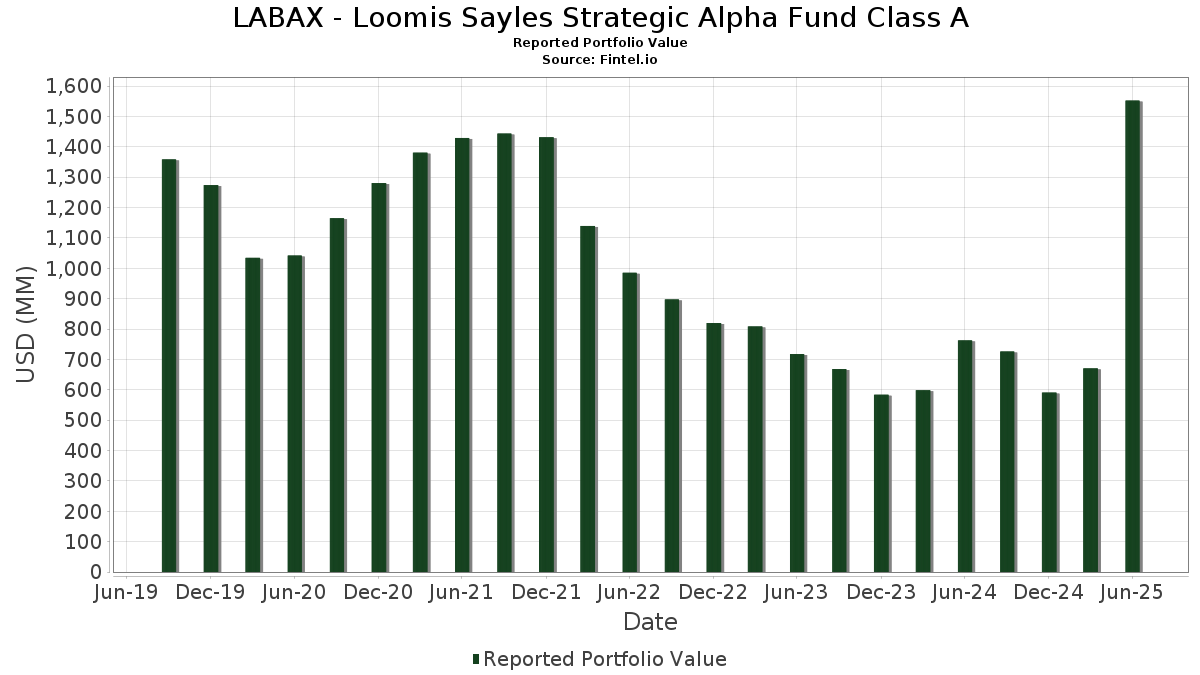

LABAX - Loomis Sayles Strategic Alpha Fund Class A telah mengungkapkan total kepemilikan 1,427 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 1,552,061,224 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama LABAX - Loomis Sayles Strategic Alpha Fund Class A adalah United States Treasury Note/Bond - When Issued (US:US912828ZQ64) , TREASURY NOTE (US:US91282CHV63) , United States Treasury Note/Bond (US:US91282CGV72) , South Africa - Sovereign or Government Agency Debt (ZA:R2037) , and Republic of South Africa Government Bond (ZA:ZAG000125980) . Posisi baru LABAX - Loomis Sayles Strategic Alpha Fund Class A meliputi: United States Treasury Note/Bond - When Issued (US:US912828ZQ64) , TREASURY NOTE (US:US91282CHV63) , United States Treasury Note/Bond (US:US91282CGV72) , South Africa - Sovereign or Government Agency Debt (ZA:R2037) , and Republic of South Africa Government Bond (ZA:ZAG000125980) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 42.68 | 5.0619 | 5.0619 | ||

| 31.26 | 3.7068 | 3.7068 | ||

| 25.68 | 3.0457 | 3.0457 | ||

| 25.68 | 3.0457 | 3.0457 | ||

| 9.92 | 1.1766 | 1.1766 | ||

| 9.92 | 1.1766 | 1.1766 | ||

| 9.92 | 1.1766 | 1.1766 | ||

| 9.92 | 1.1766 | 1.1766 | ||

| 5.62 | 0.6661 | 0.6661 | ||

| 5.62 | 0.6661 | 0.6661 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 27.74 | 3.2892 | -0.7732 | ||

| 27.74 | 3.2892 | -0.7732 | ||

| 27.74 | 3.2892 | -0.7732 | ||

| 27.74 | 3.2892 | -0.7732 | ||

| 18.01 | 2.1362 | -0.4972 | ||

| -1.81 | -0.2146 | -0.2146 | ||

| -1.81 | -0.2146 | -0.2146 | ||

| -1.81 | -0.2146 | -0.2146 | ||

| -1.81 | -0.2146 | -0.2146 | ||

| 11.91 | 1.4125 | -0.1942 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-29 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US912828ZQ64 / United States Treasury Note/Bond - When Issued | 42.68 | 5.0619 | 5.0619 | ||||||

| US91282CHV63 / TREASURY NOTE | 31.26 | 3.7068 | 3.7068 | ||||||

| U.S. Treasury Notes / DBT (US91282CKH33) | 27.74 | -0.14 | 3.2892 | -0.7732 | |||||

| U.S. Treasury Notes / DBT (US91282CKH33) | 27.74 | -0.14 | 3.2892 | -0.7732 | |||||

| U.S. Treasury Notes / DBT (US91282CKH33) | 27.74 | -0.14 | 3.2892 | -0.7732 | |||||

| U.S. Treasury Notes / DBT (US91282CKH33) | 27.74 | -0.14 | 3.2892 | -0.7732 | |||||

| U.S. Treasury Bills / STIV (US912797PE18) | 25.68 | 3.0457 | 3.0457 | ||||||

| U.S. Treasury Bills / STIV (US912797PE18) | 25.68 | 3.0457 | 3.0457 | ||||||

| US91282CGV72 / United States Treasury Note/Bond | 18.01 | 0.06 | 2.1362 | -0.4972 | |||||

| SATS / EchoStar Corporation | 12.53 | 39.89 | 1.4856 | 0.1758 | |||||

| SATS / EchoStar Corporation | 12.53 | 39.89 | 1.4856 | 0.1758 | |||||

| R2037 / South Africa - Sovereign or Government Agency Debt | 11.91 | 8.43 | 1.4125 | -0.1942 | |||||

| FIXED INC CLEARING CORP.REPO / RA (000000000) | 9.92 | 1.1766 | 1.1766 | ||||||

| FIXED INC CLEARING CORP.REPO / RA (000000000) | 9.92 | 1.1766 | 1.1766 | ||||||

| FIXED INC CLEARING CORP.REPO / RA (000000000) | 9.92 | 1.1766 | 1.1766 | ||||||

| FIXED INC CLEARING CORP.REPO / RA (000000000) | 9.92 | 1.1766 | 1.1766 | ||||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 8.23 | 162.64 | 0.9762 | 0.5178 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 8.23 | 162.64 | 0.9762 | 0.5178 | |||||

| ABBVD / AbbVie Inc. - Depositary Receipt (Common Stock) | 6.61 | 0.70 | 0.7837 | -0.1762 | |||||

| ABBVD / AbbVie Inc. - Depositary Receipt (Common Stock) | 6.61 | 0.70 | 0.7837 | -0.1762 | |||||

| LLY / Eli Lilly and Company - Depositary Receipt (Common Stock) | 6.56 | 0.34 | 0.7780 | -0.1785 | |||||

| LLY / Eli Lilly and Company - Depositary Receipt (Common Stock) | 6.56 | 0.34 | 0.7780 | -0.1785 | |||||

| IBM / International Business Machines Corporation - Depositary Receipt (Common Stock) | 6.52 | 0.51 | 0.7737 | -0.1758 | |||||

| IBM / International Business Machines Corporation - Depositary Receipt (Common Stock) | 6.52 | 0.51 | 0.7737 | -0.1758 | |||||

| PEP / PepsiCo, Inc. - Depositary Receipt (Common Stock) | 6.49 | 0.14 | 0.7701 | -0.1783 | |||||

| PEP / PepsiCo, Inc. - Depositary Receipt (Common Stock) | 6.49 | 0.14 | 0.7701 | -0.1783 | |||||

| ZAG000125980 / Republic of South Africa Government Bond | 5.74 | 63.90 | 0.6806 | 0.1684 | |||||

| GB00BMV7TC88 / United Kingdom Gilt | 5.62 | 0.6661 | 0.6661 | ||||||

| GB00BMV7TC88 / United Kingdom Gilt | 5.62 | 0.6661 | 0.6661 | ||||||

| US378272BQ00 / Glencore Funding LLC | 5.55 | 1.28 | 0.6584 | -0.1436 | |||||

| TEVA/46 / Teva Pharmaceutical Finance Netherlands III BV | 5.45 | -0.48 | 0.6460 | -0.1545 | |||||

| US06051GKL22 / BAC 3.846 03/08/37 | 5.38 | 66.39 | 0.6376 | 0.1649 | |||||

| XS2264968665 / Ivory Coast Government International Bond | 4.99 | 1,083.18 | 0.5921 | 0.5304 | |||||

| XS2264968665 / Ivory Coast Government International Bond | 4.99 | 1,083.18 | 0.5921 | 0.5304 | |||||

| XS2264968665 / Ivory Coast Government International Bond | 4.99 | 1,083.18 | 0.5921 | 0.5304 | |||||

| MX0MGO0000U2 / Mexican Bonos | 4.79 | 0.5675 | 0.5675 | ||||||

| US212015AT84 / Continental Resources Inc/OK | 4.24 | 0.19 | 0.5023 | -0.1161 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 4.14 | 69.30 | 0.4911 | 0.1334 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 4.14 | 69.30 | 0.4911 | 0.1334 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 4.14 | 69.30 | 0.4911 | 0.1334 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 4.14 | 69.30 | 0.4911 | 0.1334 | |||||

| US11135FBP53 / SR UNSECURED 144A 11/35 3.137 | 4.13 | 34.64 | 0.4896 | 0.0410 | |||||

| U.S. Treasury Notes / DBT (US91282CKS97) | 4.03 | -0.22 | 0.4777 | -0.1128 | |||||

| U.S. Treasury Notes / DBT (US91282CKS97) | 4.03 | -0.22 | 0.4777 | -0.1128 | |||||

| US25470XBE40 / DISH DBS Corp | 4.01 | -1.13 | 0.4757 | -0.1178 | |||||

| US1248EPBT92 / CCO Holdings LLC / CCO Holdings Capital Corp | 3.91 | 31.37 | 0.4634 | 0.0283 | |||||

| US64110LAV80 / Netflix Inc | 3.76 | 1.27 | 0.4459 | -0.0973 | |||||

| HCA Inc / DBT (US404119CU12) | 3.74 | 47.81 | 0.4441 | 0.0734 | |||||

| HCA Inc / DBT (US404119CU12) | 3.74 | 47.81 | 0.4441 | 0.0734 | |||||

| A1PP34 / AppLovin Corporation - Depositary Receipt (Common Stock) | 3.68 | 137.25 | 0.4359 | 0.2092 | |||||

| A1PP34 / AppLovin Corporation - Depositary Receipt (Common Stock) | 3.68 | 137.25 | 0.4359 | 0.2092 | |||||

| A1PP34 / AppLovin Corporation - Depositary Receipt (Common Stock) | 3.68 | 137.25 | 0.4359 | 0.2092 | |||||

| A1PP34 / AppLovin Corporation - Depositary Receipt (Common Stock) | 3.68 | 137.25 | 0.4359 | 0.2092 | |||||

| US12649AAQ22 / CSMC 2014-USA OA LLC | 3.66 | 15.77 | 0.4345 | -0.0284 | |||||

| US77313LAB99 / Rocket Mortgage LLC / Rocket Mortgage Co-Issuer Inc | 3.54 | 10.87 | 0.4196 | -0.0471 | |||||

| BRSTNCNTF204 / Brazil Notas do Tesouro Nacional Serie F | 3.44 | 0.4080 | 0.4080 | ||||||

| John Deere Capital Corp / DBT (US24422EYA18) | 3.34 | -0.09 | 0.3956 | -0.0927 | |||||

| John Deere Capital Corp / DBT (US24422EYA18) | 3.34 | -0.09 | 0.3956 | -0.0927 | |||||

| John Deere Capital Corp / DBT (US24422EYA18) | 3.34 | -0.09 | 0.3956 | -0.0927 | |||||

| John Deere Capital Corp / DBT (US24422EYA18) | 3.34 | -0.09 | 0.3956 | -0.0927 | |||||

| Cisco Systems Inc / DBT (US17275RBW16) | 3.30 | 0.49 | 0.3911 | -0.0890 | |||||

| Cisco Systems Inc / DBT (US17275RBW16) | 3.30 | 0.49 | 0.3911 | -0.0890 | |||||

| Cisco Systems Inc / DBT (US17275RBW16) | 3.30 | 0.49 | 0.3911 | -0.0890 | |||||

| Cisco Systems Inc / DBT (US17275RBW16) | 3.30 | 0.49 | 0.3911 | -0.0890 | |||||

| Chevron USA Inc / DBT (US166756BA36) | 3.27 | 0.09 | 0.3881 | -0.0901 | |||||

| Chevron USA Inc / DBT (US166756BA36) | 3.27 | 0.09 | 0.3881 | -0.0901 | |||||

| Cargill Inc / DBT (US141781CC68) | 3.24 | -0.15 | 0.3839 | -0.0904 | |||||

| Cargill Inc / DBT (US141781CC68) | 3.24 | -0.15 | 0.3839 | -0.0904 | |||||

| US87612GAF81 / TARGA RES CORP 6.5% 03/30/2034 | 3.04 | 0.66 | 0.3606 | -0.0813 | |||||

| US63935CAC55 / Navient Private Education Refi Loan Trust 2019-F | 3.00 | 0.91 | 0.3561 | -0.0791 | |||||

| USU0733RAD36 / BBCMS 2020-BID MORTGAGE TRUST | 3.00 | 0.07 | 0.3552 | -0.0826 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 2.97 | 244.38 | 0.3525 | 0.2262 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 2.97 | 244.38 | 0.3525 | 0.2262 | |||||

| Var Energi ASA / DBT (US92212WAG50) | 2.95 | 0.3501 | 0.3501 | ||||||

| Var Energi ASA / DBT (US92212WAG50) | 2.95 | 0.3501 | 0.3501 | ||||||

| US595112CB74 / Micron Technology Inc | 2.95 | 0.44 | 0.3500 | -0.0798 | |||||

| TMCL VII Holdings Ltd / ABS-O (US87257FAA12) | 2.95 | 0.3499 | 0.3499 | ||||||

| TMCL VII Holdings Ltd / ABS-O (US87257FAA12) | 2.95 | 0.3499 | 0.3499 | ||||||

| TMCL VII Holdings Ltd / ABS-O (US87257FAA12) | 2.95 | 0.3499 | 0.3499 | ||||||

| TMCL VII Holdings Ltd / ABS-O (US87257FAA12) | 2.95 | 0.3499 | 0.3499 | ||||||

| BX Trust 2025-VLT6 / ABS-MBS (US12433KAA51) | 2.93 | -0.71 | 0.3474 | -0.0841 | |||||

| BX Trust 2025-VLT6 / ABS-MBS (US12433KAA51) | 2.93 | -0.71 | 0.3474 | -0.0841 | |||||

| DJNJ3 / Johnson & Johnson - Depositary Receipt (Common Stock) | 2.92 | 0.14 | 0.3467 | -0.0803 | |||||

| DJNJ3 / Johnson & Johnson - Depositary Receipt (Common Stock) | 2.92 | 0.14 | 0.3467 | -0.0803 | |||||

| DJNJ3 / Johnson & Johnson - Depositary Receipt (Common Stock) | 2.92 | 0.14 | 0.3467 | -0.0803 | |||||

| US925650AD55 / VICI Properties LP | 2.88 | 80.25 | 0.3421 | 0.1080 | |||||

| XS1944412748 / Oman Government International Bond | 2.88 | 0.3414 | 0.3414 | ||||||

| US097023CW33 / BOEING CO 5.805 5/50 | 2.86 | 0.74 | 0.3389 | -0.0760 | |||||

| US55903VBC63 / Warnermedia Holdings Inc | 2.86 | 25.15 | 0.3387 | -0.0534 | |||||

| US35910EAA29 / Frontier Issuer LLC | 2.84 | -0.14 | 0.3373 | -0.0794 | |||||

| Ares Loan Funding VIII Ltd / ABS-CBDO (US04021MAE84) | 2.84 | 0.3370 | 0.3370 | ||||||

| Ares Loan Funding VIII Ltd / ABS-CBDO (US04021MAE84) | 2.84 | 0.3370 | 0.3370 | ||||||

| Ares Loan Funding VIII Ltd / ABS-CBDO (US04021MAE84) | 2.84 | 0.3370 | 0.3370 | ||||||

| Ares Loan Funding VIII Ltd / ABS-CBDO (US04021MAE84) | 2.84 | 0.3370 | 0.3370 | ||||||

| 30064K105 / Exacttarget, Inc. | 2.82 | 0.3340 | 0.3340 | ||||||

| 30064K105 / Exacttarget, Inc. | 2.82 | 0.3340 | 0.3340 | ||||||

| Applebee's Funding LLC / IHOP Funding LLC / ABS-O (US03789XAH17) | 2.81 | 0.3334 | 0.3334 | ||||||

| Applebee's Funding LLC / IHOP Funding LLC / ABS-O (US03789XAH17) | 2.81 | 0.3334 | 0.3334 | ||||||

| T1XT34 / Textron Inc. - Depositary Receipt (Common Stock) | 2.81 | 0.3330 | 0.3330 | ||||||

| T1XT34 / Textron Inc. - Depositary Receipt (Common Stock) | 2.81 | 0.3330 | 0.3330 | ||||||

| US143658BN13 / Carnival Corp | 2.77 | 47.10 | 0.3282 | 0.0531 | |||||

| US72703PAC77 / Planet Fitness Master Issuer LLC | 2.77 | 0.91 | 0.3281 | -0.0730 | |||||

| US 5YR NOTE (CBT) SEP25 / DIR (000000000) | 2.73 | 0.3232 | 0.3232 | ||||||

| US 5YR NOTE (CBT) SEP25 / DIR (000000000) | 2.73 | 0.3232 | 0.3232 | ||||||

| US 5YR NOTE (CBT) SEP25 / DIR (000000000) | 2.73 | 0.3232 | 0.3232 | ||||||

| US 5YR NOTE (CBT) SEP25 / DIR (000000000) | 2.73 | 0.3232 | 0.3232 | ||||||

| US03666HAE18 / Antares Holdings LP | 2.68 | 0.60 | 0.3181 | -0.0719 | |||||

| TRT061124T11 / Turkey Government Bond | 2.61 | 51.78 | 0.3091 | 0.0579 | |||||

| TRT061124T11 / Turkey Government Bond | 2.61 | 51.78 | 0.3091 | 0.0579 | |||||

| TRT061124T11 / Turkey Government Bond | 2.61 | 51.78 | 0.3091 | 0.0579 | |||||

| US77340GAN16 / Rockford Tower CLO 2017-2 Ltd | 2.57 | 0.19 | 0.3049 | -0.0703 | |||||

| Wise CLO 2025-1 Ltd / ABS-CBDO (US97719NAC11) | 2.55 | 0.3027 | 0.3027 | ||||||

| Wise CLO 2025-1 Ltd / ABS-CBDO (US97719NAC11) | 2.55 | 0.3027 | 0.3027 | ||||||

| US151290BZ57 / Cemex SAB de CV | 2.53 | 2.93 | 0.3001 | -0.0595 | |||||

| US00774MAX39 / AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 2.51 | 69.64 | 0.2976 | 0.0812 | |||||

| UBERD / Uber Technologies, Inc. - Depositary Receipt (Common Stock) | 2.49 | 1.10 | 0.2953 | -0.0648 | |||||

| UBERD / Uber Technologies, Inc. - Depositary Receipt (Common Stock) | 2.49 | 1.10 | 0.2953 | -0.0648 | |||||

| UBERD / Uber Technologies, Inc. - Depositary Receipt (Common Stock) | 2.49 | 1.10 | 0.2953 | -0.0648 | |||||

| UBERD / Uber Technologies, Inc. - Depositary Receipt (Common Stock) | 2.49 | 1.10 | 0.2953 | -0.0648 | |||||

| XS2066744231 / Carnival PLC | 2.48 | 0.12 | 0.2940 | -0.0682 | |||||

| XS2066744231 / Carnival PLC | 2.48 | 0.12 | 0.2940 | -0.0682 | |||||

| Quikrete Holdings Inc / DBT (US74843PAA84) | 2.47 | 25.10 | 0.2927 | 0.0042 | |||||

| Quikrete Holdings Inc / DBT (US74843PAA84) | 2.47 | 25.10 | 0.2927 | 0.0042 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 2.43 | 611.40 | 0.2886 | 0.2385 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 2.43 | 611.40 | 0.2886 | 0.2385 | |||||

| US75513ECW93 / RTX CORP SR UNSEC 6.1% 03-15-34 | 2.43 | 0.83 | 0.2878 | -0.0643 | |||||

| US212015AV31 / Continental Resources Inc/OK | 2.35 | 76.25 | 0.2791 | 0.0838 | |||||

| AIMCO CLO 10 Ltd / ABS-CBDO (US00901AAU16) | 2.34 | 0.2775 | 0.2775 | ||||||

| AIMCO CLO 10 Ltd / ABS-CBDO (US00901AAU16) | 2.34 | 0.2775 | 0.2775 | ||||||

| AIMCO CLO 10 Ltd / ABS-CBDO (US00901AAU16) | 2.34 | 0.2775 | 0.2775 | ||||||

| AIMCO CLO 10 Ltd / ABS-CBDO (US00901AAU16) | 2.34 | 0.2775 | 0.2775 | ||||||

| MTH / Meritage Homes Corporation | 2.34 | 1.92 | 0.2771 | -0.0582 | |||||

| MTH / Meritage Homes Corporation | 2.34 | 1.92 | 0.2771 | -0.0582 | |||||

| MTH / Meritage Homes Corporation | 2.34 | 1.92 | 0.2771 | -0.0582 | |||||

| MTH / Meritage Homes Corporation | 2.34 | 1.92 | 0.2771 | -0.0582 | |||||

| US126307BD80 / CSC HOLDINGS LLC SR UNSECURED 144A 12/30 4.625 | 2.31 | -4.43 | 0.2738 | -0.0796 | |||||

| US12624PAL94 / COMM 2012-CCRE3 Mortgage Trust | 2.30 | 0.00 | 0.2728 | -0.0637 | |||||

| US23345AAG85 / DT Auto Owner Trust 2022-2 | 2.29 | -0.22 | 0.2719 | -0.0642 | |||||

| US151290CA97 / Cemex SAB de CV | 2.29 | 0.44 | 0.2718 | -0.0620 | |||||

| US12513GBF54 / CDW LLC / CDW Finance Corp | 2.28 | 1.29 | 0.2707 | -0.0590 | |||||

| IMB / Imperial Brands PLC | 2.28 | 1.02 | 0.2704 | -0.0597 | |||||

| IMB / Imperial Brands PLC | 2.28 | 1.02 | 0.2704 | -0.0597 | |||||

| IMB / Imperial Brands PLC | 2.28 | 1.02 | 0.2704 | -0.0597 | |||||

| IMB / Imperial Brands PLC | 2.28 | 1.02 | 0.2704 | -0.0597 | |||||

| US195325EF88 / Colombia Government International Bond | 2.28 | 0.2704 | 0.2704 | ||||||

| XS1953916290 / Republic of Uzbekistan Bond | 2.22 | 331.71 | 0.2632 | 0.1880 | |||||

| XS1953916290 / Republic of Uzbekistan Bond | 2.22 | 331.71 | 0.2632 | 0.1880 | |||||

| US73743CAA09 / Post CLO 2023-1 Ltd | 2.11 | 0.09 | 0.2506 | -0.0581 | |||||

| J1EF34 / Jefferies Financial Group Inc. - Depositary Receipt (Common Stock) | 2.11 | 2.63 | 0.2500 | -0.0505 | |||||

| J1EF34 / Jefferies Financial Group Inc. - Depositary Receipt (Common Stock) | 2.11 | 2.63 | 0.2500 | -0.0505 | |||||

| J1EF34 / Jefferies Financial Group Inc. - Depositary Receipt (Common Stock) | 2.11 | 2.63 | 0.2500 | -0.0505 | |||||

| J1EF34 / Jefferies Financial Group Inc. - Depositary Receipt (Common Stock) | 2.11 | 2.63 | 0.2500 | -0.0505 | |||||

| US05592CAQ96 / BPR Trust 2021-NRD | 2.11 | 0.19 | 0.2497 | -0.0576 | |||||

| US15135BAT89 / CORPORATE BONDS | 2.09 | 1.55 | 0.2480 | -0.0533 | |||||

| MSI / Motorola Solutions, Inc. - Depositary Receipt (Common Stock) | 2.09 | 48.29 | 0.2473 | 0.0416 | |||||

| MSI / Motorola Solutions, Inc. - Depositary Receipt (Common Stock) | 2.09 | 48.29 | 0.2473 | 0.0416 | |||||

| CLI Funding VIII LLC / ABS-O (US12572DAA28) | 2.08 | 0.2472 | 0.2472 | ||||||

| CLI Funding VIII LLC / ABS-O (US12572DAA28) | 2.08 | 0.2472 | 0.2472 | ||||||

| US126307BM89 / CSC Holdings LLC | 2.08 | 0.2469 | 0.2469 | ||||||

| Glencore Funding LLC / DBT (US378272CA49) | 2.08 | 0.2462 | 0.2462 | ||||||

| Glencore Funding LLC / DBT (US378272CA49) | 2.08 | 0.2462 | 0.2462 | ||||||

| Glencore Funding LLC / DBT (US378272CA49) | 2.08 | 0.2462 | 0.2462 | ||||||

| Glencore Funding LLC / DBT (US378272CA49) | 2.08 | 0.2462 | 0.2462 | ||||||

| SNX / TD SYNNEX Corporation | 2.07 | 135.84 | 0.2459 | 0.1172 | |||||

| SNX / TD SYNNEX Corporation | 2.07 | 135.84 | 0.2459 | 0.1172 | |||||

| US72147KAH14 / Pilgrim's Pride Corp. | 2.07 | 0.2455 | 0.2455 | ||||||

| Benefit Street Partners CLO XVI Ltd / ABS-CBDO (US08181VBC81) | 2.01 | 0.2383 | 0.2383 | ||||||

| Benefit Street Partners CLO XVI Ltd / ABS-CBDO (US08181VBC81) | 2.01 | 0.2383 | 0.2383 | ||||||

| US52532XAJ46 / Leidos Inc | 2.01 | 19,950.00 | 0.2378 | 0.2361 | |||||

| N1CL34 / Norwegian Cruise Line Holdings Ltd. - Depositary Receipt (Common Stock) | 2.00 | 227.12 | 0.2375 | 0.1479 | |||||

| N1CL34 / Norwegian Cruise Line Holdings Ltd. - Depositary Receipt (Common Stock) | 2.00 | 227.12 | 0.2375 | 0.1479 | |||||

| N1CL34 / Norwegian Cruise Line Holdings Ltd. - Depositary Receipt (Common Stock) | 2.00 | 227.12 | 0.2375 | 0.1479 | |||||

| N1CL34 / Norwegian Cruise Line Holdings Ltd. - Depositary Receipt (Common Stock) | 2.00 | 227.12 | 0.2375 | 0.1479 | |||||

| FM / First Quantum Minerals Ltd. | 2.00 | 0.91 | 0.2373 | -0.0527 | |||||

| FM / First Quantum Minerals Ltd. | 2.00 | 0.91 | 0.2373 | -0.0527 | |||||

| HP / Helmerich & Payne, Inc. | 1.98 | -3.69 | 0.2352 | -0.0659 | |||||

| HP / Helmerich & Payne, Inc. | 1.98 | -3.69 | 0.2352 | -0.0659 | |||||

| HP / Helmerich & Payne, Inc. | 1.98 | -3.69 | 0.2352 | -0.0659 | |||||

| CNQ / Canadian Natural Resources Limited | 1.98 | 0.2351 | 0.2351 | ||||||

| CNQ / Canadian Natural Resources Limited | 1.98 | 0.2351 | 0.2351 | ||||||

| Atlassian Corp / DBT (US049468AB74) | 1.98 | 0.2344 | 0.2344 | ||||||

| Atlassian Corp / DBT (US049468AB74) | 1.98 | 0.2344 | 0.2344 | ||||||

| US81728UAB08 / Sensata Technologies Inc | 1.96 | 0.2329 | 0.2329 | ||||||

| Palmer Square BDC CLO 1 Ltd / ABS-CBDO (US696928AC42) | 1.96 | 0.41 | 0.2322 | -0.0529 | |||||

| Palmer Square BDC CLO 1 Ltd / ABS-CBDO (US696928AC42) | 1.96 | 0.41 | 0.2322 | -0.0529 | |||||

| US88163VAD10 / Teva Pharmaceutical Finance Co LLC | 1.95 | 0.2317 | 0.2317 | ||||||

| BMRN / BioMarin Pharmaceutical Inc. | 0.04 | 74.15 | 1.95 | 35.42 | 0.2308 | 0.0206 | |||

| US68245XAM11 / 1011778 BC ULC / New Red Finance Inc | 1.94 | 36.00 | 0.2299 | 0.0214 | |||||

| Carval Clo X-C Ltd / ABS-CBDO (US146918AC16) | 1.93 | 0.10 | 0.2289 | -0.0531 | |||||

| Carval Clo X-C Ltd / ABS-CBDO (US146918AC16) | 1.93 | 0.10 | 0.2289 | -0.0531 | |||||

| US96042VAG41 / Westlake Automobile Receivables Trust 2022-2 | 1.92 | -0.41 | 0.2281 | -0.0544 | |||||

| US05602HAA14 / BPR Trust 2022-SSP | 1.92 | -0.21 | 0.2281 | -0.0538 | |||||

| Madison Park Funding LIX Ltd / ABS-CBDO (US55822EAQ26) | 1.91 | 0.58 | 0.2267 | -0.0514 | |||||

| Madison Park Funding LIX Ltd / ABS-CBDO (US55822EAQ26) | 1.91 | 0.58 | 0.2267 | -0.0514 | |||||

| RCO X Mortgage LLC 2025-1 / ABS-MBS (US75523XAA54) | 1.91 | -10.38 | 0.2265 | -0.0851 | |||||

| RCO X Mortgage LLC 2025-1 / ABS-MBS (US75523XAA54) | 1.91 | -10.38 | 0.2265 | -0.0851 | |||||

| RCO X Mortgage LLC 2025-1 / ABS-MBS (US75523XAA54) | 1.91 | -10.38 | 0.2265 | -0.0851 | |||||

| RCO X Mortgage LLC 2025-1 / ABS-MBS (US75523XAA54) | 1.91 | -10.38 | 0.2265 | -0.0851 | |||||

| US05552CAB00 / BINOM Securitization Trust 2022-RPL1 | 1.88 | 0.37 | 0.2228 | -0.0509 | |||||

| United Rentals North America Inc / DBT (US911365BR47) | 1.84 | 24.61 | 0.2180 | 0.0022 | |||||

| United Rentals North America Inc / DBT (US911365BR47) | 1.84 | 24.61 | 0.2180 | 0.0022 | |||||

| MA / Mastercard Incorporated - Depositary Receipt (Common Stock) | 1.82 | 0.28 | 0.2162 | -0.0498 | |||||

| MA / Mastercard Incorporated - Depositary Receipt (Common Stock) | 1.82 | 0.28 | 0.2162 | -0.0498 | |||||

| US92890NAY58 / COMMERCIAL MORTGAGE BACKED SECURITIES | 1.82 | -2.51 | 0.2161 | -0.0573 | |||||

| US46635TAX00 / JP Morgan Chase Commercial Mortgage Securities Trust | 1.82 | 1.45 | 0.2154 | -0.0464 | |||||

| US05377REC43 / Avis Budget Rental Car Funding AESOP LLC, Series 2020-2A, Class C | 1.79 | 0.28 | 0.2122 | -0.0487 | |||||

| CX / CEMEX, S.A.B. de C.V. - Depositary Receipt (Common Stock) | 0.26 | -10.43 | 1.79 | 10.65 | 0.2120 | -0.0243 | |||

| TRGP / Targa Resources Corp. | 1.78 | 0.62 | 0.2116 | -0.0477 | |||||

| TRGP / Targa Resources Corp. | 1.78 | 0.62 | 0.2116 | -0.0477 | |||||

| TRGP / Targa Resources Corp. | 1.78 | 0.62 | 0.2116 | -0.0477 | |||||

| TRGP / Targa Resources Corp. | 1.78 | 0.62 | 0.2116 | -0.0477 | |||||

| GITSIT Mortgage Loan Trust 2025-NPL1 / ABS-O (US375926AA05) | 1.78 | -22.31 | 0.2115 | -0.1243 | |||||

| GITSIT Mortgage Loan Trust 2025-NPL1 / ABS-O (US375926AA05) | 1.78 | -22.31 | 0.2115 | -0.1243 | |||||

| Garnet CLO 2025-1 Ltd / ABS-CBDO (US36626AAD72) | 1.77 | 0.2095 | 0.2095 | ||||||

| Garnet CLO 2025-1 Ltd / ABS-CBDO (US36626AAD72) | 1.77 | 0.2095 | 0.2095 | ||||||

| Garnet CLO 2025-1 Ltd / ABS-CBDO (US36626AAD72) | 1.77 | 0.2095 | 0.2095 | ||||||

| SATS / EchoStar Corporation | 1.77 | -3.55 | 0.2094 | -0.0583 | |||||

| SATS / EchoStar Corporation | 1.77 | -3.55 | 0.2094 | -0.0583 | |||||

| US17322MAA45 / COMMERCIAL MORTGAGE BACKED SECURITIES | 1.76 | -3.40 | 0.2087 | -0.0578 | |||||

| CIFC Funding 2017-V Ltd / ABS-CBDO (US12551MAN92) | 1.76 | 0.63 | 0.2082 | -0.0471 | |||||

| CIFC Funding 2017-V Ltd / ABS-CBDO (US12551MAN92) | 1.76 | 0.63 | 0.2082 | -0.0471 | |||||

| US958667AE72 / Western Midstream Operating LP | 1.73 | 0.76 | 0.2055 | -0.0460 | |||||

| US718286CH84 / Philippine Government International Bond | 1.68 | 554.09 | 0.1994 | 0.1563 | |||||

| Wellfleet CLO 2022-1 Ltd / ABS-CBDO (US94950TAW99) | 1.66 | 0.1974 | 0.1974 | ||||||

| Wellfleet CLO 2022-1 Ltd / ABS-CBDO (US94950TAW99) | 1.66 | 0.1974 | 0.1974 | ||||||

| Wellfleet CLO 2022-1 Ltd / ABS-CBDO (US94950TAW99) | 1.66 | 0.1974 | 0.1974 | ||||||

| Wellfleet CLO 2022-1 Ltd / ABS-CBDO (US94950TAW99) | 1.66 | 0.1974 | 0.1974 | ||||||

| US78448TAB89 / SMBC Aviation Capital Finance DAC | 1.66 | 1.22 | 0.1973 | -0.0432 | |||||

| US78448TAB89 / SMBC Aviation Capital Finance DAC | 1.66 | 1.22 | 0.1973 | -0.0432 | |||||

| Ares XXXIX CLO Ltd / ABS-CBDO (US04015WBN39) | 1.66 | 0.06 | 0.1972 | -0.0458 | |||||

| Ares XXXIX CLO Ltd / ABS-CBDO (US04015WBN39) | 1.66 | 0.06 | 0.1972 | -0.0458 | |||||

| US88603UAA79 / THRUST ENGINE LEASING THRST 2021 1A A 144A | 1.65 | 0.1960 | 0.1960 | ||||||

| Palmer Square CLO 2024-2 LTD / ABS-CBDO (US69703LAE83) | 1.65 | 0.24 | 0.1960 | -0.0452 | |||||

| Palmer Square CLO 2024-2 LTD / ABS-CBDO (US69703LAE83) | 1.65 | 0.24 | 0.1960 | -0.0452 | |||||

| PRPM 2024-5 LLC / ABS-MBS (US69381KAB52) | 1.65 | 0.1953 | 0.1953 | ||||||

| PRPM 2024-5 LLC / ABS-MBS (US69381KAB52) | 1.65 | 0.1953 | 0.1953 | ||||||

| PRPM 2024-5 LLC / ABS-MBS (US69381KAB52) | 1.65 | 0.1953 | 0.1953 | ||||||

| PRPM 2024-5 LLC / ABS-MBS (US69381KAB52) | 1.65 | 0.1953 | 0.1953 | ||||||

| Molex Electronic Technologies LLC / DBT (US60856BAE48) | 1.64 | 0.1945 | 0.1945 | ||||||

| Molex Electronic Technologies LLC / DBT (US60856BAE48) | 1.64 | 0.1945 | 0.1945 | ||||||

| Molex Electronic Technologies LLC / DBT (US60856BAE48) | 1.64 | 0.1945 | 0.1945 | ||||||

| Molex Electronic Technologies LLC / DBT (US60856BAE48) | 1.64 | 0.1945 | 0.1945 | ||||||

| RCO IX Mortgage LLC 2025-2 / ABS-MBS (US754930AA39) | 1.64 | 0.1944 | 0.1944 | ||||||

| RCO IX Mortgage LLC 2025-2 / ABS-MBS (US754930AA39) | 1.64 | 0.1944 | 0.1944 | ||||||

| US225401AZ15 / Credit Suisse Group AG | 1.63 | 1.62 | 0.1935 | -0.0413 | |||||

| BA.PRA / The Boeing Company - Preferred Security | 0.02 | -21.80 | 1.62 | -11.14 | 0.1921 | -0.0745 | |||

| US054977AB94 / BHG 22-A B 144A 2.7% 02-20-35 | 1.61 | -22.54 | 0.1913 | -0.1132 | |||||

| Subway Funding LLC / ABS-O (US864300AA61) | 1.61 | 0.81 | 0.1913 | -0.0428 | |||||

| Subway Funding LLC / ABS-O (US864300AA61) | 1.61 | 0.81 | 0.1913 | -0.0428 | |||||

| JBS USA LUX Sarl / JBS USA Food Co / JBS USA Foods Group / DBT (US472140AA00) | 1.61 | 0.75 | 0.1910 | -0.0427 | |||||

| JBS USA LUX Sarl / JBS USA Food Co / JBS USA Foods Group / DBT (US472140AA00) | 1.61 | 0.75 | 0.1910 | -0.0427 | |||||

| JBS USA LUX Sarl / JBS USA Food Co / JBS USA Foods Group / DBT (US472140AA00) | 1.61 | 0.75 | 0.1910 | -0.0427 | |||||

| JBS USA LUX Sarl / JBS USA Food Co / JBS USA Foods Group / DBT (US472140AA00) | 1.61 | 0.75 | 0.1910 | -0.0427 | |||||

| US92936CAY57 / WFRBS 2011-C4 E 5.248784% 6/44 | 1.60 | 3.57 | 0.1895 | -0.0362 | |||||

| Birch Grove CLO 12 Ltd / ABS-CBDO (US09090MAG87) | 1.60 | 0.1894 | 0.1894 | ||||||

| Birch Grove CLO 12 Ltd / ABS-CBDO (US09090MAG87) | 1.60 | 0.1894 | 0.1894 | ||||||

| XS2264968665 / Ivory Coast Government International Bond | 1.59 | 52.44 | 0.1886 | 0.0359 | |||||

| XS2264968665 / Ivory Coast Government International Bond | 1.59 | 52.44 | 0.1886 | 0.0359 | |||||

| US071734AN72 / Bausch Health Cos Inc | 1.59 | 35.90 | 0.1886 | 0.0173 | |||||

| Blue Owl Finance LLC / DBT (US09581JAT34) | 1.57 | 0.51 | 0.1861 | -0.0424 | |||||

| Blue Owl Finance LLC / DBT (US09581JAT34) | 1.57 | 0.51 | 0.1861 | -0.0424 | |||||

| US95000MBU45 / Wells Fargo Commercial Mortgage Trust 2016-C36 | 1.57 | 3.63 | 0.1861 | -0.0355 | |||||

| XS2066744231 / Carnival PLC | 1.57 | 3.85 | 0.1856 | -0.0349 | |||||

| XS2066744231 / Carnival PLC | 1.57 | 3.85 | 0.1856 | -0.0349 | |||||

| XS2066744231 / Carnival PLC | 1.57 | 3.85 | 0.1856 | -0.0349 | |||||

| XS2066744231 / Carnival PLC | 1.57 | 3.85 | 0.1856 | -0.0349 | |||||

| DCAL / AIM Aviation Finance Ltd | 1.56 | 7.37 | 0.1849 | -0.0275 | |||||

| OHA Loan Funding 2016-1 Ltd / ABS-CBDO (US67110UBE82) | 1.54 | 0.46 | 0.1831 | -0.0417 | |||||

| OHA Loan Funding 2016-1 Ltd / ABS-CBDO (US67110UBE82) | 1.54 | 0.46 | 0.1831 | -0.0417 | |||||

| OHA Loan Funding 2016-1 Ltd / ABS-CBDO (US67110UBE82) | 1.54 | 0.46 | 0.1831 | -0.0417 | |||||

| OHA Loan Funding 2016-1 Ltd / ABS-CBDO (US67110UBE82) | 1.54 | 0.46 | 0.1831 | -0.0417 | |||||

| Hertz Vehicle Financing III LLC / ABS-O (US42806MDD83) | 1.54 | 0.1830 | 0.1830 | ||||||

| Hertz Vehicle Financing III LLC / ABS-O (US42806MDD83) | 1.54 | 0.1830 | 0.1830 | ||||||

| Hertz Vehicle Financing III LLC / ABS-O (US42806MDD83) | 1.54 | 0.1830 | 0.1830 | ||||||

| Hertz Vehicle Financing III LLC / ABS-O (US42806MDD83) | 1.54 | 0.1830 | 0.1830 | ||||||

| JBS USA Holding Lux Sarl / JBS USA Foods Group Holdings Inc / JBS USA Food Co / DBT (US472140AE22) | 1.54 | 0.1829 | 0.1829 | ||||||

| JBS USA Holding Lux Sarl / JBS USA Foods Group Holdings Inc / JBS USA Food Co / DBT (US472140AE22) | 1.54 | 0.1829 | 0.1829 | ||||||

| US94354KAC45 / WAVE 2019-1 LLC | 1.54 | 22.87 | 0.1829 | -0.0008 | |||||

| US097023DC69 / Boeing Co/The | 1.54 | 1.59 | 0.1821 | -0.0389 | |||||

| M1TT34 / Marriott International, Inc. - Depositary Receipt (Common Stock) | 1.54 | 1.19 | 0.1821 | -0.0400 | |||||

| M1TT34 / Marriott International, Inc. - Depositary Receipt (Common Stock) | 1.54 | 1.19 | 0.1821 | -0.0400 | |||||

| M1TT34 / Marriott International, Inc. - Depositary Receipt (Common Stock) | 1.54 | 1.19 | 0.1821 | -0.0400 | |||||

| M1TT34 / Marriott International, Inc. - Depositary Receipt (Common Stock) | 1.54 | 1.19 | 0.1821 | -0.0400 | |||||

| US03789XAF50 / Applebee's Funding LLC / IHOP Funding LLC | 1.53 | -1.35 | 0.1817 | -0.0454 | |||||

| US126307BF39 / CSC Holdings LLC | 1.52 | -3.12 | 0.1808 | -0.0494 | |||||

| US12662GAC24 / CSMC 2021-RPL4 Trust | 1.52 | -3.37 | 0.1802 | -0.0498 | |||||

| Venture Global Plaquemines LNG LLC / DBT (US922966AB20) | 1.52 | 0.1797 | 0.1797 | ||||||

| Venture Global Plaquemines LNG LLC / DBT (US922966AB20) | 1.52 | 0.1797 | 0.1797 | ||||||

| JH North America Holdings Inc / DBT (US46593WAB19) | 1.50 | 0.1782 | 0.1782 | ||||||

| JH North America Holdings Inc / DBT (US46593WAB19) | 1.50 | 0.1782 | 0.1782 | ||||||

| Venture Global Plaquemines LNG LLC / DBT (US922966AA47) | 1.49 | 0.1771 | 0.1771 | ||||||

| Venture Global Plaquemines LNG LLC / DBT (US922966AA47) | 1.49 | 0.1771 | 0.1771 | ||||||

| Venture Global Plaquemines LNG LLC / DBT (US922966AA47) | 1.49 | 0.1771 | 0.1771 | ||||||

| Venture Global Plaquemines LNG LLC / DBT (US922966AA47) | 1.49 | 0.1771 | 0.1771 | ||||||

| XS2365195978 / Republic of Uzbekistan Bond | 1.47 | 780.24 | 0.1744 | 0.1500 | |||||

| US94353WAA36 / WAVE 2017-1 Trust | 1.46 | 34.07 | 0.1737 | 0.0139 | |||||

| Flutter Financing BV 2024 Term Loan B / LON (XAN3313EAG51) | 1.44 | -0.14 | 0.1710 | -0.0403 | |||||

| Flutter Financing BV 2024 Term Loan B / LON (XAN3313EAG51) | 1.44 | -0.14 | 0.1710 | -0.0403 | |||||

| LAFL / Labrador Aviation Finance Ltd 2016-1A | 1.43 | -17.08 | 0.1699 | -0.0828 | |||||

| US12649AAN90 / CSMC OA LLC, Series 2014-USA, Class D | 1.43 | 0.42 | 0.1695 | -0.0386 | |||||

| XS2264968665 / Ivory Coast Government International Bond | 1.43 | 0.1695 | 0.1695 | ||||||

| Aramark Services Inc 2024 Term Loan B8 / LON (US03852JAV35) | 1.42 | -1.52 | 0.1686 | -0.0426 | |||||

| Aramark Services Inc 2024 Term Loan B8 / LON (US03852JAV35) | 1.42 | -1.52 | 0.1686 | -0.0426 | |||||

| Aramark Services Inc 2024 Term Loan B8 / LON (US03852JAV35) | 1.42 | -1.52 | 0.1686 | -0.0426 | |||||

| Aramark Services Inc 2024 Term Loan B8 / LON (US03852JAV35) | 1.42 | -1.52 | 0.1686 | -0.0426 | |||||

| US883199AR25 / Textron Financial Corp | 1.42 | -1.60 | 0.1683 | -0.0426 | |||||

| UBSG34 / UBS Group AG - Depositary Receipt (Common Stock) | 1.41 | 0.1667 | 0.1667 | ||||||

| UBSG34 / UBS Group AG - Depositary Receipt (Common Stock) | 1.41 | 0.1667 | 0.1667 | ||||||

| XS1953916290 / Republic of Uzbekistan Bond | 1.36 | 58.14 | 0.1614 | 0.0355 | |||||

| XS1953916290 / Republic of Uzbekistan Bond | 1.36 | 58.14 | 0.1614 | 0.0355 | |||||

| US63940VAC63 / Navient Private Education Refi Loan Trust 2018-C | 1.36 | -8.80 | 0.1612 | -0.0567 | |||||

| Birch Grove Clo 9 Ltd / ABS-CBDO (US09077WAA62) | 1.34 | 0.22 | 0.1586 | -0.0366 | |||||

| Birch Grove Clo 9 Ltd / ABS-CBDO (US09077WAA62) | 1.34 | 0.22 | 0.1586 | -0.0366 | |||||

| Birch Grove Clo 9 Ltd / ABS-CBDO (US09077WAA62) | 1.34 | 0.22 | 0.1586 | -0.0366 | |||||

| Birch Grove Clo 9 Ltd / ABS-CBDO (US09077WAA62) | 1.34 | 0.22 | 0.1586 | -0.0366 | |||||

| XA68371YAP80 / Open Text Corporation 2023 Term Loan B | 1.32 | -0.53 | 0.1570 | -0.0377 | |||||

| BNP Paribas Issuance BV / SN (XS3047643765) | 1.29 | 0.1536 | 0.1536 | ||||||

| BNP Paribas Issuance BV / SN (XS3047643765) | 1.29 | 0.1536 | 0.1536 | ||||||

| US097023CY98 / BOEING CO 5.15 5/30 | 1.29 | 1.18 | 0.1527 | -0.0334 | |||||

| US90932KAA79 / United Airlines Pass Through Trust, Series 2019-2, Class B | 1.28 | -13.50 | 0.1521 | -0.0647 | |||||

| F2IC34 / Fair Isaac Corporation - Depositary Receipt (Common Stock) | 1.28 | 0.1514 | 0.1514 | ||||||

| F2IC34 / Fair Isaac Corporation - Depositary Receipt (Common Stock) | 1.28 | 0.1514 | 0.1514 | ||||||

| IL0011736738 / Energean Israel Finance Ltd | 1.27 | 45.43 | 0.1512 | 0.0230 | |||||

| US225401BB38 / Credit Suisse Group AG | 1.27 | 1.19 | 0.1510 | -0.0331 | |||||

| US168863DU93 / Chile Government International Bond | 1.26 | 0.1494 | 0.1494 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 1.25 | 0.1477 | 0.1477 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 1.25 | 0.1477 | 0.1477 | ||||||

| Novelis Corporation 2025 Term Loan B / LON (US67000LAB80) | 1.24 | 0.00 | 0.1475 | -0.0344 | |||||

| Novelis Corporation 2025 Term Loan B / LON (US67000LAB80) | 1.24 | 0.00 | 0.1475 | -0.0344 | |||||

| US00928QAX97 / Aircastle Ltd. | 1.24 | 0.24 | 0.1473 | -0.0340 | |||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 1.24 | 0.1468 | 0.1468 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 1.24 | 0.1468 | 0.1468 | ||||||

| US21873AAJ60 / Corevest American Finance 2020-4 Trust | 1.23 | 1.66 | 0.1456 | -0.0310 | |||||

| US896239AE08 / Trimble Inc | 1.21 | -17.56 | 0.1436 | -0.1024 | |||||

| AASET 2024-2 Ltd / ABS-O (US00038QAA67) | 1.21 | -0.74 | 0.1432 | -0.0348 | |||||

| AASET 2024-2 Ltd / ABS-O (US00038QAA67) | 1.21 | -0.74 | 0.1432 | -0.0348 | |||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 1.20 | 0.1426 | 0.1426 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 1.20 | 0.1426 | 0.1426 | ||||||

| US852060AT99 / Sprint Capital Corp 8.750% Notes 03/15/32 | 1.19 | 0.1417 | 0.1417 | ||||||

| US21872GAG01 / CoreVest American Finance Trust, Series 2019-2, Class B | 1.19 | -6.77 | 0.1406 | -0.0453 | |||||

| PRPM 2025-2 LLC / ABS-MBS (US69382HAB15) | 1.17 | 0.1383 | 0.1383 | ||||||

| PRPM 2025-2 LLC / ABS-MBS (US69382HAB15) | 1.17 | 0.1383 | 0.1383 | ||||||

| VCAT 2025-NPL3 LLC / ABS-MBS (US92243QAA40) | 1.16 | -12.31 | 0.1378 | -0.0559 | |||||

| VCAT 2025-NPL3 LLC / ABS-MBS (US92243QAA40) | 1.16 | -12.31 | 0.1378 | -0.0559 | |||||

| TRT061124T11 / Turkey Government Bond | 1.16 | 0.1372 | 0.1372 | ||||||

| US097023CV59 / BOEING CO 5.705% 05/01/2040 | 1.16 | 1.58 | 0.1371 | -0.0293 | |||||

| US83406TAC62 / SoFi Professional Loan Program 2020-ATrust | 1.15 | 0.79 | 0.1369 | -0.0307 | |||||

| US436440AP62 / Hologic Inc | 1.14 | -64.73 | 0.1356 | -0.0774 | |||||

| US92564RAL96 / VICI Properties LP / VICI Note Co., Inc. | 1.14 | 1.33 | 0.1354 | -0.0294 | |||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 1.14 | 0.1351 | 0.1351 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 1.14 | 0.1351 | 0.1351 | ||||||

| Directv Financing LLC / Directv Financing Co-Obligor Inc / DBT (US25461LAD47) | 1.13 | 28.09 | 0.1341 | 0.0049 | |||||

| Directv Financing LLC / Directv Financing Co-Obligor Inc / DBT (US25461LAD47) | 1.13 | 28.09 | 0.1341 | 0.0049 | |||||

| Fortiva Retail Credit Master Note Business Trust / ABS-O (US34962AAW27) | 1.12 | 0.36 | 0.1324 | -0.0303 | |||||

| Fortiva Retail Credit Master Note Business Trust / ABS-O (US34962AAW27) | 1.12 | 0.36 | 0.1324 | -0.0303 | |||||

| XS2406607171 / Teva Pharmaceutical Finance Netherlands II BV | 1.11 | 10.96 | 0.1322 | -0.0148 | |||||

| Kyrgyz Republic International Bond / DBT (US50158LAA61) | 1.11 | 0.1320 | 0.1320 | ||||||

| Kyrgyz Republic International Bond / DBT (US50158LAA61) | 1.11 | 0.1320 | 0.1320 | ||||||

| US89613JAJ97 / ABS SER.2020-SFR2 CL.E1 | 1.11 | 0.73 | 0.1312 | -0.0294 | |||||

| U.S. Treasury Notes / DBT (US91282CJV46) | 1.10 | -0.18 | 0.1310 | -0.0308 | |||||

| U.S. Treasury Notes / DBT (US91282CJV46) | 1.10 | -0.18 | 0.1310 | -0.0308 | |||||

| XS1953916290 / Republic of Uzbekistan Bond | 1.10 | 53.91 | 0.1308 | 0.0259 | |||||

| US29365BAA17 / ENTG 4 3/4 04/15/29 | 1.10 | 0.1308 | 0.1308 | ||||||

| OHA Credit Partners XI Ltd / ABS-CBDO (US67109FBC86) | 1.10 | 0.27 | 0.1300 | -0.0300 | |||||

| OHA Credit Partners XI Ltd / ABS-CBDO (US67109FBC86) | 1.10 | 0.27 | 0.1300 | -0.0300 | |||||

| OHA Credit Partners XI Ltd / ABS-CBDO (US67109FBC86) | 1.10 | 0.27 | 0.1300 | -0.0300 | |||||

| OHA Credit Partners XI Ltd / ABS-CBDO (US67109FBC86) | 1.10 | 0.27 | 0.1300 | -0.0300 | |||||

| US63941XAB38 / Navient Private Education Refi Loan Trust 2020-F | 1.09 | 0.65 | 0.1296 | -0.0292 | |||||

| BNP Paribas Issuance BV / SN (XS3006845211) | 1.08 | 0.1282 | 0.1282 | ||||||

| BNP Paribas Issuance BV / SN (XS3006845211) | 1.08 | 0.1282 | 0.1282 | ||||||

| BNP Paribas Issuance BV / SN (XS2979435026) | 1.08 | 4.36 | 0.1278 | -0.0233 | |||||

| BNP Paribas Issuance BV / SN (XS2979435026) | 1.08 | 4.36 | 0.1278 | -0.0233 | |||||

| BNP Paribas Issuance BV / SN (XS2979435026) | 1.08 | 4.36 | 0.1278 | -0.0233 | |||||

| BNP Paribas Issuance BV / SN (XS2979435026) | 1.08 | 4.36 | 0.1278 | -0.0233 | |||||

| Wellfleet CLO 2024-1 Ltd / ABS-CBDO (US94951AAE91) | 1.06 | 0.09 | 0.1255 | -0.0291 | |||||

| Wellfleet CLO 2024-1 Ltd / ABS-CBDO (US94951AAE91) | 1.06 | 0.09 | 0.1255 | -0.0291 | |||||

| OWN Equipment Fund II LLC / ABS-O (US690912AA86) | 1.05 | 0.1249 | 0.1249 | ||||||

| OWN Equipment Fund II LLC / ABS-O (US690912AA86) | 1.05 | 0.1249 | 0.1249 | ||||||

| ACA / Crédit Agricole S.A. | 1.05 | 1.74 | 0.1245 | -0.0265 | |||||

| ACA / Crédit Agricole S.A. | 1.05 | 1.74 | 0.1245 | -0.0265 | |||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 1.05 | 0.96 | 0.1243 | -0.0274 | |||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 1.05 | 0.96 | 0.1243 | -0.0274 | |||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 1.05 | 0.96 | 0.1243 | -0.0274 | |||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 1.05 | 0.96 | 0.1243 | -0.0274 | |||||

| Bain Capital Credit CLO 2020-1 Ltd / ABS-CBDO (US05684DAS27) | 1.05 | 0.00 | 0.1240 | -0.0289 | |||||

| Bain Capital Credit CLO 2020-1 Ltd / ABS-CBDO (US05684DAS27) | 1.05 | 0.00 | 0.1240 | -0.0289 | |||||

| Bain Capital Credit CLO 2020-1 Ltd / ABS-CBDO (US05684DAS27) | 1.05 | 0.00 | 0.1240 | -0.0289 | |||||

| Bain Capital Credit CLO 2020-1 Ltd / ABS-CBDO (US05684DAS27) | 1.05 | 0.00 | 0.1240 | -0.0289 | |||||

| JH North America Holdings Inc / DBT (US46593WAA36) | 1.04 | 0.1238 | 0.1238 | ||||||

| JH North America Holdings Inc / DBT (US46593WAA36) | 1.04 | 0.1238 | 0.1238 | ||||||

| US87248TAQ85 / TICP CLO VII Ltd | 1.03 | 0.10 | 0.1223 | -0.0284 | |||||

| Galaxy XXVI CLO Ltd / ABS-CBDO (US36321LAL36) | 1.03 | 0.19 | 0.1222 | -0.0283 | |||||

| Galaxy XXVI CLO Ltd / ABS-CBDO (US36321LAL36) | 1.03 | 0.19 | 0.1222 | -0.0283 | |||||

| Galaxy XXVI CLO Ltd / ABS-CBDO (US36321LAL36) | 1.03 | 0.19 | 0.1222 | -0.0283 | |||||

| Galaxy XXVI CLO Ltd / ABS-CBDO (US36321LAL36) | 1.03 | 0.19 | 0.1222 | -0.0283 | |||||

| BNP Paribas Issuance BV / SN (XS2999233716) | 1.03 | 0.1222 | 0.1222 | ||||||

| BNP Paribas Issuance BV / SN (XS2999233716) | 1.03 | 0.1222 | 0.1222 | ||||||

| US86772FAA93 / SUNRUN ATLAS ISSUER 2019-2 LLC SER 2019-2 CL A REGD 144A P/P 3.61000000 | 1.03 | 0.1216 | 0.1216 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 1.02 | 6.01 | 0.1214 | -0.0199 | |||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 1.02 | 6.01 | 0.1214 | -0.0199 | |||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 1.02 | 6.01 | 0.1214 | -0.0199 | |||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 1.02 | 6.01 | 0.1214 | -0.0199 | |||||

| US89613GAE61 / Tricon American Homes, Series 2020-SFR1, Class E | 1.02 | 0.10 | 0.1209 | -0.0281 | |||||

| BNP Paribas Issuance BV / SN (XS2966728821) | 1.01 | 6.07 | 0.1203 | -0.0196 | |||||

| BNP Paribas Issuance BV / SN (XS2966728821) | 1.01 | 6.07 | 0.1203 | -0.0196 | |||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 1.01 | 0.1202 | 0.1202 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 1.01 | 0.1202 | 0.1202 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 1.01 | 0.1202 | 0.1202 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 1.01 | 0.1202 | 0.1202 | ||||||

| US26884LAN91 / EQT CORP 3.625% 05/15/2031 144A | 1.01 | 1.51 | 0.1198 | -0.0258 | |||||

| BNP / BNP Paribas SA | 1.01 | -1.08 | 0.1196 | -0.0296 | |||||

| BNP / BNP Paribas SA | 1.01 | -1.08 | 0.1196 | -0.0296 | |||||

| BNP / BNP Paribas SA | 1.01 | -1.08 | 0.1196 | -0.0296 | |||||

| BNP / BNP Paribas SA | 1.01 | -1.08 | 0.1196 | -0.0296 | |||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 1.00 | 0.1184 | 0.1184 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 1.00 | 0.1184 | 0.1184 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 1.00 | 0.1184 | 0.1184 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 1.00 | 0.1184 | 0.1184 | ||||||

| US30168DAF33 / EXETER AUTOMOBILE RECEIVABLES TRUST 2023-5 7.13% 02/15/2030 | 1.00 | 0.00 | 0.1184 | -0.0277 | |||||

| CDW LLC / CDW Finance Corp / DBT (US12513GBL23) | 0.99 | 0.1177 | 0.1177 | ||||||

| CDW LLC / CDW Finance Corp / DBT (US12513GBL23) | 0.99 | 0.1177 | 0.1177 | ||||||

| S1NP34 / Synopsys, Inc. - Depositary Receipt (Common Stock) | 0.99 | 0.20 | 0.1173 | -0.0272 | |||||

| S1NP34 / Synopsys, Inc. - Depositary Receipt (Common Stock) | 0.99 | 0.20 | 0.1173 | -0.0272 | |||||

| Santander Drive Auto Receivables Trust 2024-3 / ABS-O (US80287LAF67) | 0.98 | 1.44 | 0.1166 | -0.0252 | |||||

| Santander Drive Auto Receivables Trust 2024-3 / ABS-O (US80287LAF67) | 0.98 | 1.44 | 0.1166 | -0.0252 | |||||

| Santander Drive Auto Receivables Trust 2024-3 / ABS-O (US80287LAF67) | 0.98 | 1.44 | 0.1166 | -0.0252 | |||||

| 720 East CLO V Ltd / ABS-CBDO (US81789MAJ71) | 0.98 | 0.51 | 0.1162 | -0.0264 | |||||

| 720 East CLO V Ltd / ABS-CBDO (US81789MAJ71) | 0.98 | 0.51 | 0.1162 | -0.0264 | |||||

| US168863DQ81 / Chile Government International Bond | 0.97 | 0.1155 | 0.1155 | ||||||

| US682696AC34 / OneMain Financial Issuance Trust 2020-2 | 0.97 | 0.31 | 0.1154 | -0.0266 | |||||

| US40056XCT19 / GS FLOAT 09/25/23 3.75 | 0.97 | -2.81 | 0.1151 | -0.0310 | |||||

| US40056XCT19 / GS FLOAT 09/25/23 3.75 | 0.97 | -2.81 | 0.1151 | -0.0310 | |||||

| Redwood Funding Trust 2025-1 / ABS-MBS (US757912AA83) | 0.97 | 0.62 | 0.1150 | -0.0261 | |||||

| Redwood Funding Trust 2025-1 / ABS-MBS (US757912AA83) | 0.97 | 0.62 | 0.1150 | -0.0261 | |||||

| BNP Paribas Issuance BV / SN (XS3031190948) | 0.97 | 0.1149 | 0.1149 | ||||||

| BNP Paribas Issuance BV / SN (XS3031190948) | 0.97 | 0.1149 | 0.1149 | ||||||

| BNP Paribas Issuance BV / SN (XS3031190948) | 0.97 | 0.1149 | 0.1149 | ||||||

| BNP Paribas Issuance BV / SN (XS3031190948) | 0.97 | 0.1149 | 0.1149 | ||||||

| Avis Budget Rental Car Funding AESOP LLC / ABS-O (US05377RKS21) | 0.97 | 0.1148 | 0.1148 | ||||||

| Avis Budget Rental Car Funding AESOP LLC / ABS-O (US05377RKS21) | 0.97 | 0.1148 | 0.1148 | ||||||

| Avis Budget Rental Car Funding AESOP LLC / ABS-O (US05377RKS21) | 0.97 | 0.1148 | 0.1148 | ||||||

| Avis Budget Rental Car Funding AESOP LLC / ABS-O (US05377RKS21) | 0.97 | 0.1148 | 0.1148 | ||||||

| US92890FAY25 / WFRBS Commercial Mortgage Trust 2014-C20 | 0.96 | -0.21 | 0.1143 | -0.0269 | |||||

| Avis Budget Rental Car Funding AESOP LLC / ABS-O (US05377RJL96) | 0.96 | 1.16 | 0.1142 | -0.0250 | |||||

| Avis Budget Rental Car Funding AESOP LLC / ABS-O (US05377RJL96) | 0.96 | 1.16 | 0.1142 | -0.0250 | |||||

| Avis Budget Rental Car Funding AESOP LLC / ABS-O (US05377RJL96) | 0.96 | 1.16 | 0.1142 | -0.0250 | |||||

| Avis Budget Rental Car Funding AESOP LLC / ABS-O (US05377RJL96) | 0.96 | 1.16 | 0.1142 | -0.0250 | |||||

| US15135BAV36 / CENTENE CORP 3.375% 02/15/2030 | 0.96 | 1.81 | 0.1136 | -0.0240 | |||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0.96 | -6.18 | 0.1135 | -0.0356 | |||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0.96 | -6.18 | 0.1135 | -0.0356 | |||||

| US17329T1613 / Citigroup Global Markets Holdings, Inc. into Bristol Myers Squibb Co. | 0.95 | -3.94 | 0.1129 | -0.0321 | |||||

| US17329T1613 / Citigroup Global Markets Holdings, Inc. into Bristol Myers Squibb Co. | 0.95 | -3.94 | 0.1129 | -0.0321 | |||||

| US17329T1613 / Citigroup Global Markets Holdings, Inc. into Bristol Myers Squibb Co. | 0.95 | -3.94 | 0.1129 | -0.0321 | |||||

| US17329T1613 / Citigroup Global Markets Holdings, Inc. into Bristol Myers Squibb Co. | 0.95 | -3.94 | 0.1129 | -0.0321 | |||||

| US24023AAE01 / DC Commercial Mortgage Trust 2023-DC | 0.95 | 0.32 | 0.1128 | -0.0258 | |||||

| US57108UAB08 / Marlette Funding Trust 2023-4 | 0.95 | 0.53 | 0.1127 | -0.0255 | |||||

| US760942BF85 / Uruguay Government International Bond | 0.95 | 9.98 | 0.1125 | -0.0136 | |||||

| Trafigura Securitisation Finance PLC / ABS-O (US892725AW22) | 0.95 | -0.42 | 0.1123 | -0.0267 | |||||

| Trafigura Securitisation Finance PLC / ABS-O (US892725AW22) | 0.95 | -0.42 | 0.1123 | -0.0267 | |||||

| US00038PAA84 / Aaset 2021-1 Trust | 0.93 | -3.02 | 0.1105 | -0.0302 | |||||

| Macquarie Airfinance Holdings Ltd / DBT (US55609NAF50) | 0.93 | 1.09 | 0.1103 | -0.0243 | |||||

| Macquarie Airfinance Holdings Ltd / DBT (US55609NAF50) | 0.93 | 1.09 | 0.1103 | -0.0243 | |||||

| Macquarie Airfinance Holdings Ltd / DBT (US55609NAF50) | 0.93 | 1.09 | 0.1103 | -0.0243 | |||||

| Macquarie Airfinance Holdings Ltd / DBT (US55609NAF50) | 0.93 | 1.09 | 0.1103 | -0.0243 | |||||

| Roc Mortgage Trust 2024-RTL1 / ABS-MBS (US77118UAA88) | 0.93 | 0.22 | 0.1102 | -0.0255 | |||||

| Roc Mortgage Trust 2024-RTL1 / ABS-MBS (US77118UAA88) | 0.93 | 0.22 | 0.1102 | -0.0255 | |||||

| US863579TM05 / Structured Adjustable Rate Mortgage Loan Trust | 0.92 | -0.97 | 0.1095 | -0.0269 | |||||

| US67572YBU55 / Octagon Investment Partners XXII Ltd | 0.92 | 0.11 | 0.1095 | -0.0253 | |||||

| US38016LAC90 / Go Daddy Operating Co LLC / GD Finance Co Inc | 0.92 | -43.07 | 0.1087 | -0.0254 | |||||

| US60855RAL42 / Molina Healthcare Inc | 0.91 | -4.21 | 0.1079 | 0.0287 | |||||

| US904678AY53 / UniCredit SpA | 0.91 | 1.69 | 0.1074 | -0.0228 | |||||

| XAC0787FAG72 / BAUSCH + LOMB CORP | 0.90 | 0.11 | 0.1072 | -0.0249 | |||||

| US17329T1613 / Citigroup Global Markets Holdings, Inc. into Bristol Myers Squibb Co. | 0.90 | -4.75 | 0.1072 | -0.0316 | |||||

| US17329T1613 / Citigroup Global Markets Holdings, Inc. into Bristol Myers Squibb Co. | 0.90 | -4.75 | 0.1072 | -0.0316 | |||||

| US17329T1613 / Citigroup Global Markets Holdings, Inc. into Bristol Myers Squibb Co. | 0.90 | -4.75 | 0.1072 | -0.0316 | |||||

| US17329T1613 / Citigroup Global Markets Holdings, Inc. into Bristol Myers Squibb Co. | 0.90 | -4.75 | 0.1072 | -0.0316 | |||||

| USP80557BV53 / Uruguay Government International Bond | 0.90 | 7.13 | 0.1069 | -0.0162 | |||||

| US74333FAE97 / PROG_21-SFR5 | 0.90 | 0.67 | 0.1068 | -0.0241 | |||||

| UBSG34 / UBS Group AG - Depositary Receipt (Common Stock) | 0.90 | 1.24 | 0.1065 | -0.0232 | |||||

| UBSG34 / UBS Group AG - Depositary Receipt (Common Stock) | 0.90 | 1.24 | 0.1065 | -0.0232 | |||||

| UBSG34 / UBS Group AG - Depositary Receipt (Common Stock) | 0.90 | 1.24 | 0.1065 | -0.0232 | |||||

| UBSG34 / UBS Group AG - Depositary Receipt (Common Stock) | 0.90 | 1.24 | 0.1065 | -0.0232 | |||||

| US64110LAU08 / Netflix Inc | 0.90 | 1.24 | 0.1065 | -0.0233 | |||||

| Bridgecrest Lending Auto Securitization Trust 2024-2 / ABS-O (US10805MAF41) | 0.90 | -0.11 | 0.1064 | -0.0251 | |||||

| Bridgecrest Lending Auto Securitization Trust 2024-2 / ABS-O (US10805MAF41) | 0.90 | -0.11 | 0.1064 | -0.0251 | |||||

| Bridgecrest Lending Auto Securitization Trust 2024-2 / ABS-O (US10805MAF41) | 0.90 | -0.11 | 0.1064 | -0.0251 | |||||

| Bridgecrest Lending Auto Securitization Trust 2024-2 / ABS-O (US10805MAF41) | 0.90 | -0.11 | 0.1064 | -0.0251 | |||||

| Charter Communications Operating LLC / Charter Communications Operating Capital / DBT (US161175CR30) | 0.90 | 0.1063 | 0.1063 | ||||||

| Charter Communications Operating LLC / Charter Communications Operating Capital / DBT (US161175CR30) | 0.90 | 0.1063 | 0.1063 | ||||||

| Charter Communications Operating LLC / Charter Communications Operating Capital / DBT (US161175CR30) | 0.90 | 0.1063 | 0.1063 | ||||||

| Charter Communications Operating LLC / Charter Communications Operating Capital / DBT (US161175CR30) | 0.90 | 0.1063 | 0.1063 | ||||||

| US00774MAY12 / AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 0.90 | 2.29 | 0.1061 | -0.0220 | |||||

| OHA Loan Funding 2013-1 Ltd / ABS-CBDO (US67706HCA41) | 0.89 | 0.45 | 0.1056 | -0.0240 | |||||

| OHA Loan Funding 2013-1 Ltd / ABS-CBDO (US67706HCA41) | 0.89 | 0.45 | 0.1056 | -0.0240 | |||||

| Stream Innovations 2025-1 Issuer Trust / ABS-O (US86324XAC92) | 0.89 | 0.1053 | 0.1053 | ||||||

| Stream Innovations 2025-1 Issuer Trust / ABS-O (US86324XAC92) | 0.89 | 0.1053 | 0.1053 | ||||||

| Stream Innovations 2025-1 Issuer Trust / ABS-O (US86324XAC92) | 0.89 | 0.1053 | 0.1053 | ||||||

| Stream Innovations 2025-1 Issuer Trust / ABS-O (US86324XAC92) | 0.89 | 0.1053 | 0.1053 | ||||||

| US17329T1613 / Citigroup Global Markets Holdings, Inc. into Bristol Myers Squibb Co. | 0.88 | 0.1047 | 0.1047 | ||||||

| US17329T1613 / Citigroup Global Markets Holdings, Inc. into Bristol Myers Squibb Co. | 0.88 | 0.1047 | 0.1047 | ||||||

| US17329T1613 / Citigroup Global Markets Holdings, Inc. into Bristol Myers Squibb Co. | 0.88 | 0.1047 | 0.1047 | ||||||

| US17329T1613 / Citigroup Global Markets Holdings, Inc. into Bristol Myers Squibb Co. | 0.88 | 0.1047 | 0.1047 | ||||||

| STLD / Steel Dynamics, Inc. | 0.88 | 1.03 | 0.1045 | -0.0230 | |||||

| STLD / Steel Dynamics, Inc. | 0.88 | 1.03 | 0.1045 | -0.0230 | |||||

| US46639EAL56 / JP Morgan Chase Commercial Mortgage Securities Trust 2012-LC9 | 0.87 | -7.26 | 0.1030 | -0.0340 | |||||

| US694308KM84 / Pacific Gas and Electric Co. | 0.87 | 0.00 | 0.1029 | -0.0240 | |||||

| BNP Paribas Issuance BV / SN (XS2962629866) | 0.87 | 5.36 | 0.1026 | -0.0176 | |||||

| BNP Paribas Issuance BV / SN (XS2962629866) | 0.87 | 5.36 | 0.1026 | -0.0176 | |||||

| US36197VAG32 / GS MORTGAGE SECURITIES CORP TRUST 2013-PEMB SER 2013-PEMB CL D V/R REGD 144A P/P 3.54950000 | 0.86 | -5.27 | 0.1023 | -0.0309 | |||||

| Planet Fitness Master Issuer LLC / ABS-O (US72703PAF09) | 0.86 | -38.22 | 0.1020 | -0.1016 | |||||

| Planet Fitness Master Issuer LLC / ABS-O (US72703PAF09) | 0.86 | -38.22 | 0.1020 | -0.1016 | |||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0.85 | 0.1013 | 0.1013 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0.85 | 0.1013 | 0.1013 | ||||||

| US49255PAA12 / Kestrel Aircraft Funding Ltd | 0.85 | -9.36 | 0.1011 | -0.0365 | |||||

| S1NP34 / Synopsys, Inc. - Depositary Receipt (Common Stock) | 0.85 | 0.24 | 0.1010 | -0.0232 | |||||

| S1NP34 / Synopsys, Inc. - Depositary Receipt (Common Stock) | 0.85 | 0.24 | 0.1010 | -0.0232 | |||||

| Avis Budget Rental Car Funding AESOP LLC / ABS-O (US05377RJS40) | 0.85 | 0.1009 | 0.1009 | ||||||

| Avis Budget Rental Car Funding AESOP LLC / ABS-O (US05377RJS40) | 0.85 | 0.1009 | 0.1009 | ||||||

| US96041AAN63 / WESTLAKE AUTOMOBILE RECEIVABLE TR 2023-4A D 7.19% 07/16/2029 144A | 0.85 | -0.24 | 0.1006 | -0.0238 | |||||

| IHRT / iHeartMedia, Inc. | 0.85 | 4.57 | 0.1005 | -0.0180 | |||||

| IHRT / iHeartMedia, Inc. | 0.85 | 4.57 | 0.1005 | -0.0180 | |||||

| US25470XBF15 / DISH DBS Corp. | 0.84 | 2.55 | 0.1001 | -0.0202 | |||||

| DK Crown Holdings Inc 2025 Term Loan B / LON (000000000) | 0.83 | 0.0990 | 0.0990 | ||||||

| DK Crown Holdings Inc 2025 Term Loan B / LON (000000000) | 0.83 | 0.0990 | 0.0990 | ||||||

| SM / SM Energy Company | 0.83 | 0.0987 | 0.0987 | ||||||

| SM / SM Energy Company | 0.83 | 0.0987 | 0.0987 | ||||||

| TEVA / Teva Pharmaceutical Industries Limited - Depositary Receipt (Common Stock) | 0.05 | 0.83 | 0.0986 | 0.0986 | |||||

| US92328MAC73 / Venture Global Calcasieu Pass LLC | 0.83 | 1.59 | 0.0985 | -0.0211 | |||||

| NYMT Loan Trust Series 2024-BPL2 / ABS-MBS (US67120TAA88) | 0.83 | -0.24 | 0.0983 | -0.0232 | |||||

| NYMT Loan Trust Series 2024-BPL2 / ABS-MBS (US67120TAA88) | 0.83 | -0.24 | 0.0983 | -0.0232 | |||||

| NYMT Loan Trust Series 2024-BPL2 / ABS-MBS (US67120TAA88) | 0.83 | -0.24 | 0.0983 | -0.0232 | |||||

| NYMT Loan Trust Series 2024-BPL2 / ABS-MBS (US67120TAA88) | 0.83 | -0.24 | 0.0983 | -0.0232 | |||||

| U.S. Treasury Notes / DBT (US91282CLB53) | 0.83 | -0.12 | 0.0982 | -0.0230 | |||||

| U.S. Treasury Notes / DBT (US91282CLB53) | 0.83 | -0.12 | 0.0982 | -0.0230 | |||||

| U.S. Treasury Notes / DBT (US91282CLB53) | 0.83 | -0.12 | 0.0982 | -0.0230 | |||||

| U.S. Treasury Notes / DBT (US91282CLB53) | 0.83 | -0.12 | 0.0982 | -0.0230 | |||||

| S1YF34 / Synchrony Financial - Depositary Receipt (Common Stock) | 0.83 | 1.35 | 0.0981 | -0.0213 | |||||

| S1YF34 / Synchrony Financial - Depositary Receipt (Common Stock) | 0.83 | 1.35 | 0.0981 | -0.0213 | |||||

| Golub Capital Partners CLO 74 B Ltd / ABS-CBDO (US38190BAC90) | 0.82 | 0.12 | 0.0969 | -0.0225 | |||||

| Golub Capital Partners CLO 74 B Ltd / ABS-CBDO (US38190BAC90) | 0.82 | 0.12 | 0.0969 | -0.0225 | |||||

| Golub Capital Partners CLO 74 B Ltd / ABS-CBDO (US38190BAC90) | 0.82 | 0.12 | 0.0969 | -0.0225 | |||||

| Golub Capital Partners CLO 74 B Ltd / ABS-CBDO (US38190BAC90) | 0.82 | 0.12 | 0.0969 | -0.0225 | |||||

| Philippines Government International Bonds / DBT (US718286DH75) | 0.82 | 0.0968 | 0.0968 | ||||||

| Philippines Government International Bonds / DBT (US718286DH75) | 0.82 | 0.0968 | 0.0968 | ||||||

| US842587DT18 / Southern Co. (The) | 0.82 | 1.24 | 0.0967 | -0.0212 | |||||

| Global Auto Holdings Ltd/AAG FH UK Ltd / DBT (US00033YAA47) | 0.81 | 93.33 | 0.0963 | 0.0348 | |||||

| Global Auto Holdings Ltd/AAG FH UK Ltd / DBT (US00033YAA47) | 0.81 | 93.33 | 0.0963 | 0.0348 | |||||

| Global Auto Holdings Ltd/AAG FH UK Ltd / DBT (US00033YAA47) | 0.81 | 93.33 | 0.0963 | 0.0348 | |||||

| US17888HAA14 / Civitas Resources Inc | 0.81 | 0.0959 | 0.0959 | ||||||

| US40056XCT19 / GS FLOAT 09/25/23 3.75 | 0.81 | 10.23 | 0.0959 | -0.0115 | |||||

| US40056XCT19 / GS FLOAT 09/25/23 3.75 | 0.81 | 10.23 | 0.0959 | -0.0115 | |||||

| US85022WAP95 / SpringCastle America Funding LLC | 0.81 | -6.29 | 0.0955 | -0.0302 | |||||

| US12567UAC71 / CLAF_21-1 | 0.80 | -0.25 | 0.0951 | -0.0226 | |||||

| XS2592804194 / Teva Pharmaceutical Finance Netherlands II BV | 0.80 | 9.90 | 0.0948 | -0.0116 | |||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0.80 | 12.91 | 0.0945 | -0.0087 | |||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0.80 | 12.91 | 0.0945 | -0.0087 | |||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0.80 | 12.91 | 0.0945 | -0.0087 | |||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0.80 | 12.91 | 0.0945 | -0.0087 | |||||

| Amrize Finance US LLC / DBT (US43475RAD89) | 0.80 | 0.0945 | 0.0945 | ||||||

| Amrize Finance US LLC / DBT (US43475RAD89) | 0.80 | 0.0945 | 0.0945 | ||||||

| OCP CLO 2016-12 Ltd / ABS-CBDO (US67092RBC16) | 0.80 | 0.0944 | 0.0944 | ||||||

| OCP CLO 2016-12 Ltd / ABS-CBDO (US67092RBC16) | 0.80 | 0.0944 | 0.0944 | ||||||

| New Residential Mortgage Loan Trust 2024-RTL1 / ABS-MBS (US64831PAA30) | 0.79 | -0.25 | 0.0938 | -0.0223 | |||||

| New Residential Mortgage Loan Trust 2024-RTL1 / ABS-MBS (US64831PAA30) | 0.79 | -0.25 | 0.0938 | -0.0223 | |||||

| Ziply Fiber Issuer LLC / ABS-O (US98979QAA13) | 0.79 | -0.13 | 0.0932 | -0.0219 | |||||

| Ziply Fiber Issuer LLC / ABS-O (US98979QAA13) | 0.79 | -0.13 | 0.0932 | -0.0219 | |||||

| Ziply Fiber Issuer LLC / ABS-O (US98979QAA13) | 0.79 | -0.13 | 0.0932 | -0.0219 | |||||

| Ziply Fiber Issuer LLC / ABS-O (US98979QAA13) | 0.79 | -0.13 | 0.0932 | -0.0219 | |||||

| Foundation Finance Trust 2025-1 / ABS-O (US35040WAB37) | 0.78 | 2.09 | 0.0926 | -0.0192 | |||||

| Foundation Finance Trust 2025-1 / ABS-O (US35040WAB37) | 0.78 | 2.09 | 0.0926 | -0.0192 | |||||

| Foundation Finance Trust 2025-2 / ABS-O (US35042NAD75) | 0.78 | 0.0925 | 0.0925 | ||||||

| Foundation Finance Trust 2025-2 / ABS-O (US35042NAD75) | 0.78 | 0.0925 | 0.0925 | ||||||

| Foundation Finance Trust 2025-2 / ABS-O (US35042NAD75) | 0.78 | 0.0925 | 0.0925 | ||||||

| Hilton Grand Vacations Borrower LLC / Hilton Grand Vacations Borrower Inc / DBT (US43283QAC42) | 0.78 | 0.0921 | 0.0921 | ||||||

| Hilton Grand Vacations Borrower LLC / Hilton Grand Vacations Borrower Inc / DBT (US43283QAC42) | 0.78 | 0.0921 | 0.0921 | ||||||

| Hilton Grand Vacations Borrower LLC / Hilton Grand Vacations Borrower Inc / DBT (US43283QAC42) | 0.78 | 0.0921 | 0.0921 | ||||||

| Hilton Grand Vacations Borrower LLC / Hilton Grand Vacations Borrower Inc / DBT (US43283QAC42) | 0.78 | 0.0921 | 0.0921 | ||||||

| US019736AG29 / Allison Transmission Inc | 0.77 | -52.24 | 0.0913 | -0.0428 | |||||

| US77342JAA16 / Rockford Tower CLO 2018-1 Ltd | 0.77 | -8.02 | 0.0912 | -0.0310 | |||||

| CyrusOne Data Centers Issuer I LLC / ABS-O (US23284BAJ35) | 0.77 | 0.00 | 0.0912 | -0.0213 | |||||

| CyrusOne Data Centers Issuer I LLC / ABS-O (US23284BAJ35) | 0.77 | 0.00 | 0.0912 | -0.0213 | |||||

| US225401AV01 / Credit Suisse Group AG | 0.77 | 0.13 | 0.0912 | -0.0211 | |||||

| US896288AA51 / TriNet Group Inc | 0.77 | 0.53 | 0.0908 | 0.0168 | |||||

| OWN Equipment Fund I LLC / ABS-O (US69121NAA63) | 0.76 | -4.18 | 0.0899 | -0.0258 | |||||

| OWN Equipment Fund I LLC / ABS-O (US69121NAA63) | 0.76 | -4.18 | 0.0899 | -0.0258 | |||||

| OWN Equipment Fund I LLC / ABS-O (US69121NAA63) | 0.76 | -4.18 | 0.0899 | -0.0258 | |||||

| OWN Equipment Fund I LLC / ABS-O (US69121NAA63) | 0.76 | -4.18 | 0.0899 | -0.0258 | |||||

| US02530CAG33 / American Credit Acceptance Receivables Trust 2023-4 | 0.76 | -0.39 | 0.0899 | -0.0214 | |||||

| US92328MAB90 / Venture Global Calcasieu Pass LLC | 0.75 | 1.89 | 0.0895 | -0.0189 | |||||

| US78449AAC62 / Slam 2021-1 Ltd | 0.75 | -1.83 | 0.0894 | -0.0229 | |||||

| AerCap Ireland Capital DAC / AerCap Global Aviation Trust / DBT (US00774MBP95) | 0.75 | 1.50 | 0.0885 | -0.0191 | |||||

| AerCap Ireland Capital DAC / AerCap Global Aviation Trust / DBT (US00774MBP95) | 0.75 | 1.50 | 0.0885 | -0.0191 | |||||

| AerCap Ireland Capital DAC / AerCap Global Aviation Trust / DBT (US00774MBP95) | 0.75 | 1.50 | 0.0885 | -0.0191 | |||||

| AerCap Ireland Capital DAC / AerCap Global Aviation Trust / DBT (US00774MBP95) | 0.75 | 1.50 | 0.0885 | -0.0191 | |||||

| IQVIA Inc 2025 Repriced Term Loan B / LON (US44969CBP41) | 0.74 | 12.05 | 0.0882 | -0.0090 | |||||

| IQVIA Inc 2025 Repriced Term Loan B / LON (US44969CBP41) | 0.74 | 12.05 | 0.0882 | -0.0090 | |||||

| US20754NAB10 / Connecticut Avenue Securities Trust 2022-R06 | 0.74 | -7.38 | 0.0878 | -0.0292 | |||||

| CAFL 2023-RTL1 Issuer LLC / ABS-MBS (US124762AA38) | 0.74 | -0.41 | 0.0873 | -0.0208 | |||||

| CAFL 2023-RTL1 Issuer LLC / ABS-MBS (US124762AA38) | 0.74 | -0.41 | 0.0873 | -0.0208 | |||||

| CAFL 2023-RTL1 Issuer LLC / ABS-MBS (US124762AA38) | 0.74 | -0.41 | 0.0873 | -0.0208 | |||||

| CAFL 2023-RTL1 Issuer LLC / ABS-MBS (US124762AA38) | 0.74 | -0.41 | 0.0873 | -0.0208 | |||||

| US68269MAE49 / OneMain Financial Issuance Trust 2021-1 | 0.74 | -0.81 | 0.0872 | -0.0213 | |||||

| Westlake Automobile Receivables Trust 2024-1 / ABS-O (US96043RAG20) | 0.73 | 0.14 | 0.0871 | -0.0201 | |||||

| Westlake Automobile Receivables Trust 2024-1 / ABS-O (US96043RAG20) | 0.73 | 0.14 | 0.0871 | -0.0201 | |||||

| Teva Pharmaceutical Finance Netherlands IV BV / DBT (US881937AA41) | 0.73 | 0.0869 | 0.0869 | ||||||

| Teva Pharmaceutical Finance Netherlands IV BV / DBT (US881937AA41) | 0.73 | 0.0869 | 0.0869 | ||||||

| Teva Pharmaceutical Finance Netherlands IV BV / DBT (US881937AA41) | 0.73 | 0.0869 | 0.0869 | ||||||

| Teva Pharmaceutical Finance Netherlands IV BV / DBT (US881937AA41) | 0.73 | 0.0869 | 0.0869 | ||||||

| US12549BAU26 / CIFC Funding 2013-II Ltd | 0.73 | 0.00 | 0.0867 | -0.0202 | |||||

| US168863DY16 / Chile Government International Bond | 0.73 | 44.62 | 0.0861 | 0.0020 | |||||

| Mars Inc / DBT (US571676BA26) | 0.72 | 0.70 | 0.0858 | -0.0193 | |||||

| Mars Inc / DBT (US571676BA26) | 0.72 | 0.70 | 0.0858 | -0.0193 | |||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0.72 | 9.38 | 0.0857 | -0.0110 | |||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0.72 | 9.38 | 0.0857 | -0.0110 | |||||

| US64034YAC57 / Nelnet Student Loan Trust 2021-D | 0.72 | 1.69 | 0.0857 | -0.0183 | |||||

| NFAS3 LLC / ABS-O (US62909DAA19) | 0.72 | 0.0850 | 0.0850 | ||||||

| NFAS3 LLC / ABS-O (US62909DAA19) | 0.72 | 0.0850 | 0.0850 | ||||||

| NFAS3 LLC / ABS-O (US62909DAA19) | 0.72 | 0.0850 | 0.0850 | ||||||

| NFAS3 LLC / ABS-O (US62909DAA19) | 0.72 | 0.0850 | 0.0850 | ||||||

| ALTDE 2025-1 Trust / ABS-O (US00166NAA72) | 0.71 | -0.42 | 0.0847 | -0.0203 | |||||

| ALTDE 2025-1 Trust / ABS-O (US00166NAA72) | 0.71 | -0.42 | 0.0847 | -0.0203 | |||||

| ALTDE 2025-1 Trust / ABS-O (US00166NAA72) | 0.71 | -0.42 | 0.0847 | -0.0203 | |||||

| ALTDE 2025-1 Trust / ABS-O (US00166NAA72) | 0.71 | -0.42 | 0.0847 | -0.0203 | |||||

| Alliant Holdings Intermediate LLC / Alliant Holdings Co-Issuer / DBT (US01883LAG86) | 0.71 | 0.0846 | 0.0846 | ||||||

| Alliant Holdings Intermediate LLC / Alliant Holdings Co-Issuer / DBT (US01883LAG86) | 0.71 | 0.0846 | 0.0846 | ||||||

| Alliant Holdings Intermediate LLC / Alliant Holdings Co-Issuer / DBT (US01883LAG86) | 0.71 | 0.0846 | 0.0846 | ||||||

| Alliant Holdings Intermediate LLC / Alliant Holdings Co-Issuer / DBT (US01883LAG86) | 0.71 | 0.0846 | 0.0846 | ||||||

| XS2291692890 / Chile Government International Bond | 0.71 | 0.0843 | 0.0843 | ||||||

| XS2291692890 / Chile Government International Bond | 0.71 | 0.0843 | 0.0843 | ||||||

| Slam Ltd / ABS-O (US83100AAA07) | 0.71 | 0.42 | 0.0841 | -0.0193 | |||||

| Slam Ltd / ABS-O (US83100AAA07) | 0.71 | 0.42 | 0.0841 | -0.0193 | |||||

| Slam Ltd / ABS-O (US83100AAA07) | 0.71 | 0.42 | 0.0841 | -0.0193 | |||||

| Slam Ltd / ABS-O (US83100AAA07) | 0.71 | 0.42 | 0.0841 | -0.0193 | |||||

| R1CL34 / Royal Caribbean Cruises Ltd. - Depositary Receipt (Common Stock) | 0.70 | -2.49 | 0.0835 | -0.0375 | |||||

| R1CL34 / Royal Caribbean Cruises Ltd. - Depositary Receipt (Common Stock) | 0.70 | -2.49 | 0.0835 | -0.0375 | |||||

| R1CL34 / Royal Caribbean Cruises Ltd. - Depositary Receipt (Common Stock) | 0.70 | -2.49 | 0.0835 | -0.0375 | |||||

| R1CL34 / Royal Caribbean Cruises Ltd. - Depositary Receipt (Common Stock) | 0.70 | -2.49 | 0.0835 | -0.0375 | |||||

| AIMCO CLO 16 Ltd / ABS-CBDO (US00901FAN69) | 0.70 | 1.15 | 0.0833 | -0.0182 | |||||

| AIMCO CLO 16 Ltd / ABS-CBDO (US00901FAN69) | 0.70 | 1.15 | 0.0833 | -0.0182 | |||||

| M1TT34 / Marriott International, Inc. - Depositary Receipt (Common Stock) | 0.70 | 1.45 | 0.0828 | -0.0179 | |||||

| M1TT34 / Marriott International, Inc. - Depositary Receipt (Common Stock) | 0.70 | 1.45 | 0.0828 | -0.0179 | |||||

| M1TT34 / Marriott International, Inc. - Depositary Receipt (Common Stock) | 0.70 | 1.45 | 0.0828 | -0.0179 | |||||

| M1TT34 / Marriott International, Inc. - Depositary Receipt (Common Stock) | 0.70 | 1.45 | 0.0828 | -0.0179 | |||||

| US37959GAB32 / Global Atlantic Fin Co | 0.69 | 0.73 | 0.0822 | -0.0184 | |||||

| US23345WAD74 / DT Auto Owner Trust 2023-3 | 0.69 | 0.88 | 0.0819 | -0.0182 | |||||

| N1TA34 / NetApp, Inc. - Depositary Receipt (Common Stock) | 0.69 | 2.22 | 0.0818 | -0.0169 | |||||

| N1TA34 / NetApp, Inc. - Depositary Receipt (Common Stock) | 0.69 | 2.22 | 0.0818 | -0.0169 | |||||

| N1TA34 / NetApp, Inc. - Depositary Receipt (Common Stock) | 0.69 | 2.22 | 0.0818 | -0.0169 | |||||

| N1TA34 / NetApp, Inc. - Depositary Receipt (Common Stock) | 0.69 | 2.22 | 0.0818 | -0.0169 | |||||

| DE0001174068 / CHINA UNIVERSAL EX INC | 0.69 | 0.0815 | 0.0815 | ||||||

| DE0001174068 / CHINA UNIVERSAL EX INC | 0.69 | 0.0815 | 0.0815 | ||||||

| DE0001174068 / CHINA UNIVERSAL EX INC | 0.69 | 0.0815 | 0.0815 | ||||||

| DE0001174068 / CHINA UNIVERSAL EX INC | 0.69 | 0.0815 | 0.0815 | ||||||

| US78443CAN48 / SLM PRIVATE CREDIT STUDENT LOAN TRUST 2003-B | 0.68 | -4.34 | 0.0811 | -0.0235 | |||||

| US38016LAA35 / Go Daddy Operating Co LLC / GD Finance Co Inc | 0.68 | -27.77 | 0.0805 | -0.0755 | |||||

| NLT 2023-1 Trust / ABS-MBS (US62917MAA18) | 0.66 | -3.35 | 0.0788 | -0.0218 | |||||

| NLT 2023-1 Trust / ABS-MBS (US62917MAA18) | 0.66 | -3.35 | 0.0788 | -0.0218 | |||||

| RFS Asset Securitization II LLC / ABS-O (US74969DAL91) | 0.66 | 0.15 | 0.0778 | -0.0181 | |||||

| RFS Asset Securitization II LLC / ABS-O (US74969DAL91) | 0.66 | 0.15 | 0.0778 | -0.0181 | |||||

| RFS Asset Securitization II LLC / ABS-O (US74969DAL91) | 0.66 | 0.15 | 0.0778 | -0.0181 | |||||

| US96041CAN20 / WLAKE 23-3 D 144A 6.47% 03-15-29 | 0.66 | 0.92 | 0.0777 | -0.0173 | |||||

| US718286CL96 / Philippine Government International Bond | 0.65 | 34.72 | 0.0769 | -0.0037 | |||||

| Compass Datacenters Issuer III LLC / ABS-O (US20469BAA52) | 0.64 | -0.78 | 0.0759 | -0.0185 | |||||

| Compass Datacenters Issuer III LLC / ABS-O (US20469BAA52) | 0.64 | -0.78 | 0.0759 | -0.0185 | |||||

| JP Morgan Chase Commercial Mortgage Securities Trust 2025-BMS / ABS-MBS (US46596CAE66) | 0.64 | 0.00 | 0.0754 | -0.0176 | |||||

| JP Morgan Chase Commercial Mortgage Securities Trust 2025-BMS / ABS-MBS (US46596CAE66) | 0.64 | 0.00 | 0.0754 | -0.0176 | |||||

| JP Morgan Chase Commercial Mortgage Securities Trust 2025-BMS / ABS-MBS (US46596CAE66) | 0.64 | 0.00 | 0.0754 | -0.0176 | |||||

| JP Morgan Chase Commercial Mortgage Securities Trust 2025-BMS / ABS-MBS (US46596CAE66) | 0.64 | 0.00 | 0.0754 | -0.0176 | |||||

| USB Auto Owner Trust 2025-1 / ABS-O (US90367VAG41) | 0.63 | 0.0748 | 0.0748 | ||||||

| USB Auto Owner Trust 2025-1 / ABS-O (US90367VAG41) | 0.63 | 0.0748 | 0.0748 | ||||||

| USB Auto Owner Trust 2025-1 / ABS-O (US90367VAG41) | 0.63 | 0.0748 | 0.0748 | ||||||

| USB Auto Owner Trust 2025-1 / ABS-O (US90367VAG41) | 0.63 | 0.0748 | 0.0748 | ||||||

| US00792FAA66 / Affirm Asset Securitization Trust, Series 2023-B, Class A | 0.63 | -0.32 | 0.0744 | -0.0177 | |||||

| US60510MAT53 / Mission Lane Credit Card Master Trust | 0.63 | -0.32 | 0.0742 | -0.0176 | |||||

| US63935BAB99 / Navient Private Education Refi Loan Trust 2020-H | 0.63 | 0.81 | 0.0742 | -0.0166 | |||||

| A1PP34 / AppLovin Corporation - Depositary Receipt (Common Stock) | 0.62 | 0.97 | 0.0739 | -0.0164 | |||||

| A1PP34 / AppLovin Corporation - Depositary Receipt (Common Stock) | 0.62 | 0.97 | 0.0739 | -0.0164 | |||||

| US63941JAB44 / Navient Private Education Refi Loan Trust 2019-G | 0.62 | -0.16 | 0.0737 | -0.0173 | |||||

| US46284VAN10 / Iron Mountain, Inc. | 0.61 | 0.0729 | 0.0729 | ||||||

| N1TA34 / NetApp, Inc. - Depositary Receipt (Common Stock) | 0.61 | 13.36 | 0.0725 | -0.0064 | |||||

| N1TA34 / NetApp, Inc. - Depositary Receipt (Common Stock) | 0.61 | 13.36 | 0.0725 | -0.0064 | |||||

| N1TA34 / NetApp, Inc. - Depositary Receipt (Common Stock) | 0.61 | 13.36 | 0.0725 | -0.0064 | |||||

| N1TA34 / NetApp, Inc. - Depositary Receipt (Common Stock) | 0.61 | 13.36 | 0.0725 | -0.0064 | |||||

| PRET 2025-NPL6 LLC / ABS-O (US740936AA73) | 0.61 | 0.0723 | 0.0723 | ||||||

| PRET 2025-NPL6 LLC / ABS-O (US740936AA73) | 0.61 | 0.0723 | 0.0723 | ||||||

| AASET 2025-1 / ABS-O (US00258PAA12) | 0.60 | -0.33 | 0.0716 | -0.0170 | |||||

| AASET 2025-1 / ABS-O (US00258PAA12) | 0.60 | -0.33 | 0.0716 | -0.0170 | |||||

| AASET 2025-1 / ABS-O (US00258PAA12) | 0.60 | -0.33 | 0.0716 | -0.0170 | |||||

| AASET 2025-1 / ABS-O (US00258PAA12) | 0.60 | -0.33 | 0.0716 | -0.0170 | |||||

| Midocean Credit CLO XV Ltd / ABS-CBDO (US59801FAE34) | 0.60 | 0.17 | 0.0714 | -0.0165 | |||||

| Midocean Credit CLO XV Ltd / ABS-CBDO (US59801FAE34) | 0.60 | 0.17 | 0.0714 | -0.0165 | |||||

| US97064FAA30 / Willis Engine Structured Trust V | 0.59 | -0.50 | 0.0704 | -0.0168 | |||||

| PRET 2025-NPL3 LLC / ABS-O (US74143HAA32) | 0.59 | 0.0696 | 0.0696 | ||||||

| PRET 2025-NPL3 LLC / ABS-O (US74143HAA32) | 0.59 | 0.0696 | 0.0696 | ||||||

| US143658BR27 / Carnival Corp | 0.59 | 1.91 | 0.0695 | -0.0147 | |||||

| CABK / CaixaBank, S.A. | 0.59 | 0.0695 | 0.0695 | ||||||

| CABK / CaixaBank, S.A. | 0.59 | 0.0695 | 0.0695 | ||||||

| CABK / CaixaBank, S.A. | 0.59 | 0.0695 | 0.0695 | ||||||

| Hilton Grand Vacations Borrower LLC 2024 Incremental Term Loan B / LON (US43283LAK70) | 0.58 | 0.34 | 0.0693 | -0.0158 | |||||

| Hilton Grand Vacations Borrower LLC 2024 Incremental Term Loan B / LON (US43283LAK70) | 0.58 | 0.34 | 0.0693 | -0.0158 | |||||

| Hilton Grand Vacations Borrower LLC 2024 Incremental Term Loan B / LON (US43283LAK70) | 0.58 | 0.34 | 0.0693 | -0.0158 | |||||

| Hilton Grand Vacations Borrower LLC 2024 Incremental Term Loan B / LON (US43283LAK70) | 0.58 | 0.34 | 0.0693 | -0.0158 | |||||

| Benefit Street Partners CLO Ltd / ABS-CBDO (US08182DAN49) | 0.57 | 0.17 | 0.0681 | -0.0158 | |||||

| Benefit Street Partners CLO Ltd / ABS-CBDO (US08182DAN49) | 0.57 | 0.17 | 0.0681 | -0.0158 | |||||

| US36197QAG47 / GS Mortgage Securities Trust 2013-G1 | 0.57 | -0.35 | 0.0680 | -0.0162 | |||||

| US60855RAJ95 / Molina Healthcare Inc | 0.57 | 2.51 | 0.0678 | -0.0137 | |||||

| US08862GAB05 / BHG Securitization Trust 2023-B | 0.57 | -0.35 | 0.0677 | -0.0161 | |||||

| US74333HAL96 / ABS SER.2021-SFR6 CL.E2 | 0.57 | 0.89 | 0.0675 | -0.0150 | |||||

| Wellfleet CLO 2024-1 Ltd / ABS-CBDO (US94951AAG40) | 0.57 | 0.35 | 0.0673 | -0.0153 | |||||

| Wellfleet CLO 2024-1 Ltd / ABS-CBDO (US94951AAG40) | 0.57 | 0.35 | 0.0673 | -0.0153 | |||||

| XS1953916290 / Republic of Uzbekistan Bond | 0.57 | 10.53 | 0.0673 | -0.0078 | |||||

| XS1953916290 / Republic of Uzbekistan Bond | 0.57 | 10.53 | 0.0673 | -0.0078 | |||||

| MFA 2024-NPL1 Trust / ABS-MBS (US58004YAA73) | 0.57 | -4.38 | 0.0673 | -0.0195 | |||||

| MFA 2024-NPL1 Trust / ABS-MBS (US58004YAA73) | 0.57 | -4.38 | 0.0673 | -0.0195 | |||||

| MFA 2024-NPL1 Trust / ABS-MBS (US58004YAA73) | 0.57 | -4.38 | 0.0673 | -0.0195 | |||||

| MFA 2024-NPL1 Trust / ABS-MBS (US58004YAA73) | 0.57 | -4.38 | 0.0673 | -0.0195 | |||||

| US74333VAJ35 / Progress Residential 2021-SFR3 | 0.56 | 1.27 | 0.0665 | -0.0145 | |||||

| E1CO34 / Ecopetrol S.A. - Depositary Receipt (Common Stock) | 0.56 | -21.93 | 0.0664 | -0.0384 | |||||

| E1CO34 / Ecopetrol S.A. - Depositary Receipt (Common Stock) | 0.56 | -21.93 | 0.0664 | -0.0384 | |||||

| E1CO34 / Ecopetrol S.A. - Depositary Receipt (Common Stock) | 0.56 | -21.93 | 0.0664 | -0.0384 | |||||

| E1CO34 / Ecopetrol S.A. - Depositary Receipt (Common Stock) | 0.56 | -21.93 | 0.0664 | -0.0384 | |||||

| MU / Micron Technology, Inc. - Depositary Receipt (Common Stock) | 0.55 | 0.0658 | 0.0658 | ||||||

| MU / Micron Technology, Inc. - Depositary Receipt (Common Stock) | 0.55 | 0.0658 | 0.0658 | ||||||

| US617459AJ14 / Morgan Stanley Capital I Trust 2011-C2 | 0.55 | -7.59 | 0.0650 | -0.0219 | |||||

| P1AY34 / Paychex, Inc. - Depositary Receipt (Common Stock) | 0.55 | 0.0650 | 0.0650 | ||||||

| P1AY34 / Paychex, Inc. - Depositary Receipt (Common Stock) | 0.55 | 0.0650 | 0.0650 | ||||||

| US98877DAE58 / ZF North America Capital Inc | 0.55 | 1.48 | 0.0649 | -0.0140 | |||||

| SEB Funding LLC / ABS-O (US78433DAC83) | 0.55 | -1.26 | 0.0649 | -0.0163 | |||||

| SEB Funding LLC / ABS-O (US78433DAC83) | 0.55 | -1.26 | 0.0649 | -0.0163 | |||||

| SEB Funding LLC / ABS-O (US78433DAC83) | 0.55 | -1.26 | 0.0649 | -0.0163 | |||||

| SEB Funding LLC / ABS-O (US78433DAC83) | 0.55 | -1.26 | 0.0649 | -0.0163 | |||||

| US28141PAA30 / Education Funding Trust | 0.54 | -6.86 | 0.0645 | -0.0208 | |||||

| Foundation Finance Trust 2025-1 / ABS-O (US35040WAD92) | 0.54 | 0.75 | 0.0641 | -0.0143 | |||||

| Foundation Finance Trust 2025-1 / ABS-O (US35040WAD92) | 0.54 | 0.75 | 0.0641 | -0.0143 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 0.53 | 1.33 | 0.0632 | -0.0137 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 0.53 | 1.33 | 0.0632 | -0.0137 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 0.53 | 1.33 | 0.0632 | -0.0137 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 0.53 | 1.33 | 0.0632 | -0.0137 | |||||

| BX Trust 2024-VLT4 / ABS-MBS (US05612TAA34) | 0.53 | -0.19 | 0.0628 | -0.0147 | |||||

| BX Trust 2024-VLT4 / ABS-MBS (US05612TAA34) | 0.53 | -0.19 | 0.0628 | -0.0147 | |||||

| BX Trust 2024-VLT4 / ABS-MBS (US05612TAA34) | 0.53 | -0.19 | 0.0628 | -0.0147 | |||||

| BX Trust 2024-VLT4 / ABS-MBS (US05612TAA34) | 0.53 | -0.19 | 0.0628 | -0.0147 | |||||

| US30227FAJ93 / Extended Stay America Trust | 0.53 | -0.75 | 0.0626 | -0.0152 | |||||

| TVC Mortgage Trust 2024-RRTL1 / ABS-MBS (US87306WAB37) | 0.53 | 0.00 | 0.0624 | -0.0145 | |||||

| TVC Mortgage Trust 2024-RRTL1 / ABS-MBS (US87306WAB37) | 0.53 | 0.00 | 0.0624 | -0.0145 | |||||

| US42806MBG33 / Hertz Vehicle Financing LLC, Series 2022-4A, Class D | 0.52 | -50.05 | 0.0622 | -0.0913 | |||||

| PRPM 2024-2 LLC / ABS-MBS (US74448BAA89) | 0.52 | -4.44 | 0.0613 | -0.0178 | |||||

| PRPM 2024-2 LLC / ABS-MBS (US74448BAA89) | 0.52 | -4.44 | 0.0613 | -0.0178 | |||||

| Ziply Fiber Issuer LLC / ABS-O (US98979QAC78) | 0.51 | 0.79 | 0.0608 | -0.0136 | |||||

| Ziply Fiber Issuer LLC / ABS-O (US98979QAC78) | 0.51 | 0.79 | 0.0608 | -0.0136 | |||||

| BGC / BGC Group, Inc. | 0.51 | 1.81 | 0.0601 | -0.0127 | |||||

| BGC / BGC Group, Inc. | 0.51 | 1.81 | 0.0601 | -0.0127 | |||||

| BGC / BGC Group, Inc. | 0.51 | 1.81 | 0.0601 | -0.0127 | |||||

| BGC / BGC Group, Inc. | 0.51 | 1.81 | 0.0601 | -0.0127 | |||||

| US05401AAB70 / Avolon Holdings Funding Ltd | 0.50 | 1.82 | 0.0598 | -0.0127 | |||||

| US05401AAB70 / Avolon Holdings Funding Ltd | 0.50 | 1.82 | 0.0598 | -0.0127 | |||||

| US63940PAD78 / Navient Private Education Refi Loan Trust 2018-A | 0.50 | -12.59 | 0.0594 | -0.0244 | |||||

| US466247EV13 / JP Morgan Mortgage Trust 2004-S1 | 0.50 | -0.79 | 0.0593 | -0.0145 | |||||

| US36168QAP90 / GFL Environmental Inc | 0.50 | 0.0593 | 0.0593 | ||||||

| Kapitus Asset Securitization IV LLC / ABS-O (US48555MAA71) | 0.50 | -0.40 | 0.0592 | -0.0141 | |||||

| Kapitus Asset Securitization IV LLC / ABS-O (US48555MAA71) | 0.50 | -0.40 | 0.0592 | -0.0141 | |||||

| US78449QAD97 / SMB Private Education Loan Trust Series 2018-C Class B | 0.49 | 0.20 | 0.0587 | -0.0136 | |||||

| ZF North America Capital Inc / DBT (US98877DAG07) | 0.49 | -0.40 | 0.0586 | -0.0140 | |||||

| ZF North America Capital Inc / DBT (US98877DAG07) | 0.49 | -0.40 | 0.0586 | -0.0140 | |||||

| OHA Credit Partners XI Ltd / ABS-CBDO (US67109FAY16) | 0.49 | 0.21 | 0.0577 | -0.0133 | |||||

| OHA Credit Partners XI Ltd / ABS-CBDO (US67109FAY16) | 0.49 | 0.21 | 0.0577 | -0.0133 | |||||

| OHA Credit Partners XI Ltd / ABS-CBDO (US67109FAY16) | 0.49 | 0.21 | 0.0577 | -0.0133 | |||||

| OHA Credit Partners XI Ltd / ABS-CBDO (US67109FAY16) | 0.49 | 0.21 | 0.0577 | -0.0133 | |||||

| US92763MAB19 / Viper Energy Partners LP | 0.48 | 1.47 | 0.0573 | -0.0123 | |||||

| US03765LAV45 / Apidos CLO XX | 0.48 | -0.21 | 0.0570 | -0.0134 | |||||

| US34535CAD83 / Ford Credit Auto Owner Trust 2023-REV2 | 0.48 | 0.00 | 0.0567 | -0.0132 | |||||

| BNH / Brookfield Finance Inc. - Corporate Bond/Note | 0.48 | 0.0566 | 0.0566 | ||||||

| BNH / Brookfield Finance Inc. - Corporate Bond/Note | 0.48 | 0.0566 | 0.0566 | ||||||

| US36191YAJ73 / GSMS 2011-GC5 C 5.47 8/44 | 0.48 | 1.93 | 0.0564 | -0.0119 | |||||

| US88167AAS06 / Teva Pharmaceutical Finance Netherlands III BV | 0.47 | 1.50 | 0.0563 | -0.0122 | |||||

| Aircastle Ltd / Aircastle Ireland DAC / DBT (US00929JAA43) | 0.47 | 0.64 | 0.0561 | -0.0126 | |||||