Mga Batayang Estadistika

| Nilai Portofolio | $ 27,992,849 |

| Posisi Saat Ini | 166 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

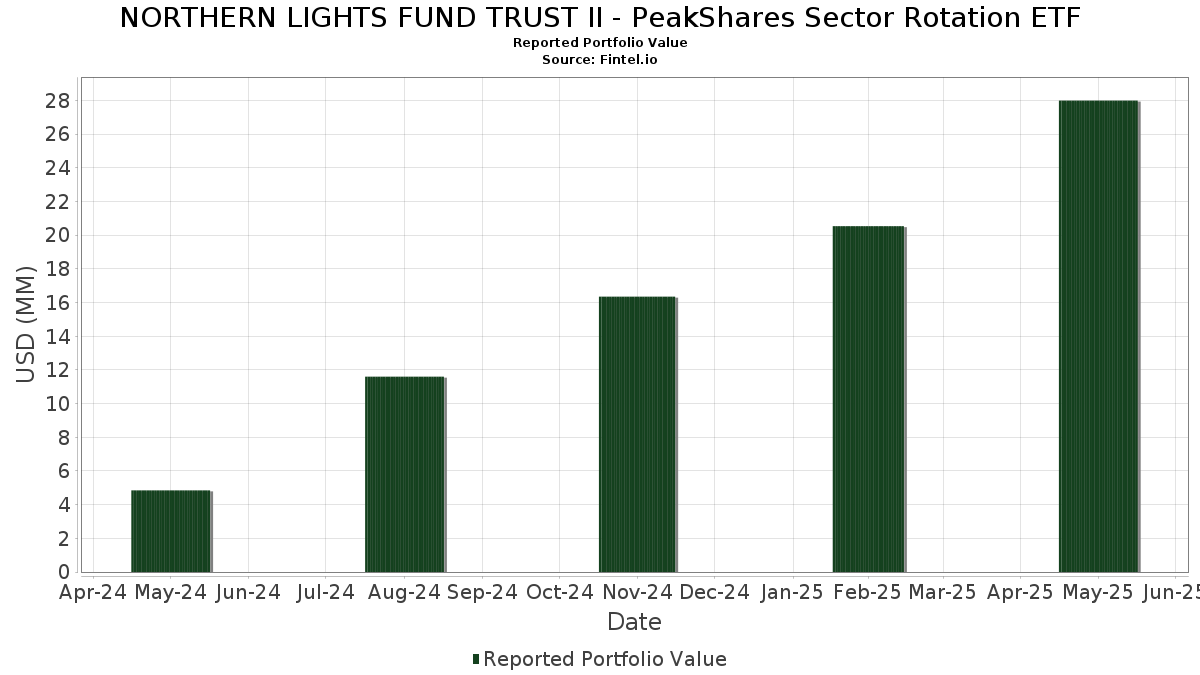

NORTHERN LIGHTS FUND TRUST II - PeakShares Sector Rotation ETF telah mengungkapkan total kepemilikan 166 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 27,992,849 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama NORTHERN LIGHTS FUND TRUST II - PeakShares Sector Rotation ETF adalah The Select Sector SPDR Trust - The Financial Select Sector SPDR Fund (US:XLF) , The Select Sector SPDR Trust - The Technology Select Sector SPDR Fund (US:XLK) , Vanguard World Fund - Vanguard Information Technology ETF (US:VGT) , The Select Sector SPDR Trust - The Health Care Select Sector SPDR Fund (US:XLV) , and The Select Sector SPDR Trust - The Industrial Select Sector SPDR Fund (US:XLI) . Posisi baru NORTHERN LIGHTS FUND TRUST II - PeakShares Sector Rotation ETF meliputi: Meta Platforms, Inc. (US:META) , VanEck ETF Trust - VanEck Semiconductor ETF (US:SMH) , Amazon.com, Inc. (US:AMZN) , Palantir Technologies Inc. (US:PLTR) , and The Boeing Company (US:BA) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 1.23 | 4.4082 | 4.4082 | ||

| 0.00 | 0.41 | 1.4522 | 1.4522 | |

| 0.00 | 0.43 | 1.5526 | 1.1358 | |

| 0.01 | 0.44 | 1.5711 | 0.9246 | |

| 0.00 | 0.24 | 0.8589 | 0.8589 | |

| 0.00 | 0.34 | 1.2315 | 0.8001 | |

| 0.00 | 0.19 | 0.6867 | 0.6867 | |

| 0.00 | 0.17 | 0.6138 | 0.6138 | |

| 0.00 | 0.29 | 1.0322 | 0.5824 | |

| 0.00 | 0.28 | 0.9966 | 0.5443 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.01 | 1.13 | 4.0566 | -2.0740 | |

| 0.02 | 1.74 | 6.2474 | -1.7816 | |

| 0.00 | 2.66 | 9.5326 | -1.6018 | |

| -0.29 | -1.0265 | -1.0265 | ||

| 0.01 | 1.83 | 6.5503 | -0.8442 | |

| 0.06 | 3.02 | 10.8356 | -0.5542 | |

| -0.10 | -0.3611 | -0.3611 | ||

| 0.00 | 0.05 | 0.1645 | -0.2994 | |

| 0.00 | 0.12 | 0.4284 | -0.2874 | |

| 0.01 | 0.12 | 0.4130 | -0.2597 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-06-30 untuk periode pelaporan 2025-05-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| XLF / The Select Sector SPDR Trust - The Financial Select Sector SPDR Fund | 0.06 | 30.71 | 3.02 | 27.65 | 10.8356 | -0.5542 | |||

| XLK / The Select Sector SPDR Trust - The Technology Select Sector SPDR Fund | 0.01 | 32.20 | 2.98 | 35.36 | 10.6727 | 0.0919 | |||

| VGT / Vanguard World Fund - Vanguard Information Technology ETF | 0.00 | 13.39 | 2.66 | 14.85 | 9.5326 | -1.6018 | |||

| XLV / The Select Sector SPDR Trust - The Health Care Select Sector SPDR Fund | 0.01 | 33.46 | 1.83 | 18.86 | 6.5503 | -0.8442 | |||

| XLI / The Select Sector SPDR Trust - The Industrial Select Sector SPDR Fund | 0.01 | 25.65 | 1.77 | 31.65 | 6.3515 | -0.1231 | |||

| XLC / The Select Sector SPDR Trust - The Communication Services Select Sector SPDR Fund | 0.02 | 5.03 | 1.74 | 4.37 | 6.2474 | -1.7816 | |||

| XLP / The Select Sector SPDR Trust - The Consumer Staples Select Sector SPDR Fund | 0.02 | 29.08 | 1.43 | 28.74 | 5.1220 | -0.2188 | |||

| BBH SWEEP VEHICLE / STIV (N/A) | 1.23 | 4.4082 | 4.4082 | ||||||

| XLY / The Select Sector SPDR Trust - The Consumer Discretionary Select Sector SPDR Fund | 0.01 | -10.31 | 1.13 | -11.22 | 4.0566 | -2.0740 | |||

| XLU / The Select Sector SPDR Trust - The Utilities Select Sector SPDR Fund | 0.01 | 29.97 | 0.74 | 34.24 | 2.6579 | 0.0042 | |||

| XLRE / The Select Sector SPDR Trust - The Real Estate Select Sector SPDR Fund | 0.01 | 32.17 | 0.58 | 27.81 | 2.0748 | -0.1033 | |||

| XLE / The Select Sector SPDR Trust - The Energy Select Sector SPDR Fund | 0.01 | 62.61 | 0.57 | 45.62 | 2.0263 | 0.1600 | |||

| XLB / The Select Sector SPDR Trust - The Materials Select Sector SPDR Fund | 0.01 | 33.31 | 0.48 | 30.00 | 1.7233 | -0.0599 | |||

| ONON / On Holding AG | 0.01 | 166.19 | 0.44 | 226.87 | 1.5711 | 0.9246 | |||

| NVDA / NVIDIA Corporation | 0.00 | 362.10 | 0.43 | 403.49 | 1.5526 | 1.1358 | |||

| META / Meta Platforms, Inc. | 0.00 | 0.41 | 1.4522 | 1.4522 | |||||

| GOOG / Alphabet Inc. | 0.00 | 99.62 | 0.37 | 101.10 | 1.3128 | 0.4336 | |||

| AVGO / Broadcom Inc. | 0.00 | 215.56 | 0.34 | 285.39 | 1.2315 | 0.8001 | |||

| GM / General Motors Company | 0.01 | 51.92 | 0.29 | 53.44 | 1.0401 | 0.1303 | |||

| AMD / Advanced Micro Devices, Inc. | 0.00 | 177.69 | 0.29 | 209.68 | 1.0322 | 0.5824 | |||

| AAPL / Apple Inc. | 0.00 | 131.67 | 0.28 | 93.10 | 1.0053 | 0.3042 | |||

| MU / Micron Technology, Inc. | 0.00 | 193.03 | 0.28 | 195.74 | 0.9966 | 0.5443 | |||

| SMH / VanEck ETF Trust - VanEck Semiconductor ETF | 0.00 | 0.24 | 0.8589 | 0.8589 | |||||

| UNH / UnitedHealth Group Incorporated | 0.00 | 165.41 | 0.23 | 68.84 | 0.8383 | 0.1716 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.00 | 136.07 | 0.21 | 154.22 | 0.7570 | 0.3552 | |||

| AMZN / Amazon.com, Inc. | 0.00 | 0.19 | 0.6867 | 0.6867 | |||||

| PLTR / Palantir Technologies Inc. | 0.00 | 0.17 | 0.6138 | 0.6138 | |||||

| BAC / Bank of America Corporation | 0.00 | 54.75 | 0.17 | 48.65 | 0.5921 | 0.0558 | |||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | 0.00 | 22.16 | 0.16 | 4.70 | 0.5620 | -0.1565 | |||

| TSLA / Tesla, Inc. | 0.00 | 98.22 | 0.15 | 136.92 | 0.5536 | 0.2367 | |||

| THC / Tenet Healthcare Corporation | 0.00 | 32.85 | 0.15 | 77.91 | 0.5502 | 0.1334 | |||

| ULTA / Ulta Beauty, Inc. | 0.00 | 30.86 | 0.15 | 67.42 | 0.5371 | 0.1092 | |||

| BA / The Boeing Company | 0.00 | 0.15 | 0.5199 | 0.5199 | |||||

| CB / Chubb Limited | 0.00 | 35.41 | 0.14 | 42.00 | 0.5090 | 0.0245 | |||

| DPZ / Domino's Pizza, Inc. | 0.00 | 33.48 | 0.14 | 29.36 | 0.5076 | -0.0198 | |||

| ABT / Abbott Laboratories | 0.00 | 31.25 | 0.14 | 27.27 | 0.5025 | -0.0283 | |||

| KO / The Coca-Cola Company | 0.00 | 30.12 | 0.14 | 32.08 | 0.5022 | -0.0093 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | 0.14 | 0.4947 | 0.4947 | |||||

| CAT / Caterpillar Inc. | 0.00 | 0.14 | 0.4925 | 0.4925 | |||||

| EA / Electronic Arts Inc. | 0.00 | 35.46 | 0.14 | 50.55 | 0.4919 | 0.0543 | |||

| GEN / Gen Digital Inc. | 0.00 | 30.97 | 0.14 | 36.36 | 0.4854 | 0.0082 | |||

| MCD / McDonald's Corporation | 0.00 | 32.15 | 0.13 | 34.74 | 0.4621 | 0.0012 | |||

| CVX / Chevron Corporation | 0.00 | 27.43 | 0.13 | 9.57 | 0.4550 | -0.1009 | |||

| ZTS / Zoetis Inc. | 0.00 | 36.17 | 0.13 | 36.96 | 0.4549 | 0.0103 | |||

| WMT / Walmart Inc. | 0.00 | 0.13 | 0.4524 | 0.4524 | |||||

| LMT / Lockheed Martin Corporation | 0.00 | 41.21 | 0.12 | 51.85 | 0.4442 | 0.0501 | |||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.00 | 0.12 | 0.4434 | 0.4434 | |||||

| MSFT / Microsoft Corporation | 0.00 | -15.71 | 0.12 | -1.63 | 0.4338 | -0.1617 | |||

| NFLX / Netflix, Inc. | 0.00 | 0.12 | 0.4325 | 0.4325 | |||||

| UPS / United Parcel Service, Inc. | 0.00 | -2.00 | 0.12 | -19.59 | 0.4284 | -0.2874 | |||

| USB / U.S. Bancorp | 0.00 | 31.71 | 0.12 | 21.88 | 0.4217 | -0.0405 | |||

| INTC / Intel Corporation | 0.01 | 0.00 | 0.12 | -17.27 | 0.4130 | -0.2597 | |||

| CRM / Salesforce, Inc. | 0.00 | 30.40 | 0.11 | 16.49 | 0.4079 | -0.0632 | |||

| XBI / SPDR Series Trust - SPDR S&P Biotech ETF | 0.00 | 33.43 | 0.11 | 19.57 | 0.3963 | -0.0502 | |||

| MRK / Merck & Co., Inc. | 0.00 | 35.55 | 0.11 | 12.37 | 0.3937 | -0.0742 | |||

| ADBE / Adobe Inc. | 0.00 | 39.89 | 0.11 | 32.93 | 0.3911 | -0.0052 | |||

| NKE / NIKE, Inc. | 0.00 | 31.98 | 0.11 | 0.95 | 0.3807 | -0.1267 | |||

| LLY / Eli Lilly and Company | 0.00 | 21.19 | 0.11 | -2.78 | 0.3779 | -0.1443 | |||

| XOM / Exxon Mobil Corporation | 0.00 | 0.10 | 0.3665 | 0.3665 | |||||

| KHC / The Kraft Heinz Company | 0.00 | 41.09 | 0.10 | 22.50 | 0.3535 | -0.0327 | |||

| FTNT / Fortinet, Inc. | 0.00 | 0.00 | 0.09 | -5.15 | 0.3296 | -0.1398 | |||

| T / AT&T Inc. | 0.00 | 28.20 | 0.08 | 29.31 | 0.2717 | -0.0087 | |||

| UAL / United Airlines Holdings, Inc. | 0.00 | 19.18 | 0.07 | 1.37 | 0.2653 | -0.0874 | |||

| DAL / Delta Air Lines, Inc. | 0.00 | -3.22 | 0.07 | -22.58 | 0.2609 | -0.1885 | |||

| C / Citigroup Inc. | 0.00 | -22.32 | 0.07 | -26.97 | 0.2348 | -0.1957 | |||

| ABBV / AbbVie Inc. | 0.00 | 27.99 | 0.06 | 12.50 | 0.2287 | -0.0406 | |||

| VZ / Verizon Communications Inc. | 0.00 | 37.20 | 0.06 | 39.53 | 0.2178 | 0.0090 | |||

| PFE / Pfizer Inc. | 0.00 | 110.06 | 0.05 | 86.21 | 0.1968 | 0.0553 | |||

| SLB / Schlumberger Limited | 0.00 | 18.98 | 0.05 | -5.56 | 0.1855 | -0.0782 | |||

| CVS / CVS Health Corporation | 0.00 | 0.00 | 0.05 | -3.85 | 0.1824 | -0.0688 | |||

| OXY / Occidental Petroleum Corporation | 0.00 | -43.02 | 0.05 | -53.12 | 0.1645 | -0.2994 | |||

| TGT / Target Corporation | 0.00 | 40.58 | 0.04 | 5.26 | 0.1458 | -0.0381 | |||

| RTX / RTX Corporation | 0.00 | -68.75 | 0.02 | -67.92 | 0.0611 | -0.1946 | |||

| T US 06/06/25 C28.5 / DE (N/A) | -0.00 | -0.0002 | -0.0002 | ||||||

| KHC US 06/06/25 C28 / DE (N/A) | -0.00 | -0.0003 | -0.0003 | ||||||

| SLB US 06/06/25 C34.5 / DE (N/A) | -0.00 | -0.0004 | -0.0004 | ||||||

| TGT US 06/06/25 C98 / DE (N/A) | -0.00 | -0.0005 | -0.0005 | ||||||

| OXY US 06/06/25 C42.5 / DE (N/A) | -0.00 | -0.0006 | -0.0006 | ||||||

| BABA US 06/06/25 C120 / DE (N/A) | -0.00 | -0.0008 | -0.0008 | ||||||

| INTC US 06/06/25 C21 / DE (N/A) | -0.00 | -0.0008 | -0.0008 | ||||||

| VZ US 06/06/25 C44.5 / DE (N/A) | -0.00 | -0.0008 | -0.0008 | ||||||

| ABT US 06/06/25 C136 / DE (N/A) | -0.00 | -0.0009 | -0.0009 | ||||||

| INTC US 06/13/25 C21.5 / DE (N/A) | -0.00 | -0.0010 | -0.0010 | ||||||

| EA US 06/06/25 C146 / DE (N/A) | -0.00 | -0.0010 | -0.0010 | ||||||

| GEN US 06/20/25 C29 / DE (N/A) | -0.00 | -0.0011 | -0.0011 | ||||||

| XOM US 06/06/25 C105 / DE (N/A) | -0.00 | -0.0014 | -0.0014 | ||||||

| MRK US 06/06/25 C80 / DE (N/A) | -0.00 | -0.0016 | -0.0016 | ||||||

| CVX US 06/06/25 C140 / DE (N/A) | -0.00 | -0.0016 | -0.0016 | ||||||

| PFE US 06/06/25 C23.5 / DE (N/A) | -0.00 | -0.0017 | -0.0017 | ||||||

| ABT US 06/06/25 C135 / DE (N/A) | -0.00 | -0.0018 | -0.0018 | ||||||

| DAL US 06/06/25 C50 / DE (N/A) | -0.00 | -0.0019 | -0.0019 | ||||||

| XLB US 06/06/25 C87 / DE (N/A) | -0.00 | -0.0023 | -0.0023 | ||||||

| KO US 06/06/25 C72 / DE (N/A) | -0.00 | -0.0025 | -0.0025 | ||||||

| SMH US 06/06/25 C235 / DE (N/A) | -0.00 | -0.0028 | -0.0028 | ||||||

| C US 06/06/25 C75 / DE (N/A) | -0.00 | -0.0030 | -0.0030 | ||||||

| CVS US 06/06/25 C63 / DE (N/A) | -0.00 | -0.0031 | -0.0031 | ||||||

| MU US 06/06/25 C93 / DE (N/A) | -0.00 | -0.0036 | -0.0036 | ||||||

| BABA US 06/06/25 C115 / DE (N/A) | -0.00 | -0.0037 | -0.0037 | ||||||

| CRM US 06/06/25 C262.5 / DE (N/A) | -0.00 | -0.0040 | -0.0040 | ||||||

| UPS US 06/06/25 C98 / DE (N/A) | -0.00 | -0.0041 | -0.0041 | ||||||

| XLRE US 06/20/25 C42 / DE (N/A) | -0.00 | -0.0042 | -0.0042 | ||||||

| MCD US 06/06/25 C310 / DE (N/A) | -0.00 | -0.0047 | -0.0047 | ||||||

| FTNT US 06/06/25 C102 / DE (N/A) | -0.00 | -0.0048 | -0.0048 | ||||||

| ABBV US 06/13/25 C185 / DE (N/A) | -0.00 | -0.0054 | -0.0054 | ||||||

| XBI US 06/06/25 C78.5 / DE (N/A) | -0.00 | -0.0064 | -0.0064 | ||||||

| ZTS US 06/20/25 C170 / DE (N/A) | -0.00 | -0.0067 | -0.0067 | ||||||

| XLF US 06/06/25 C51 / DE (N/A) | -0.00 | -0.0073 | -0.0073 | ||||||

| XLF US 06/13/25 C51.5 / DE (N/A) | -0.00 | -0.0075 | -0.0075 | ||||||

| AMD US 06/06/25 C104 / DE (N/A) | -0.00 | -0.0083 | -0.0083 | ||||||

| LLY US 06/06/25 C725 / DE (N/A) | -0.00 | -0.0085 | -0.0085 | ||||||

| DPZ US 06/20/25 C470 / DE (N/A) | -0.00 | -0.0086 | -0.0086 | ||||||

| AAPL US 06/06/25 C202.5 / DE (N/A) | -0.00 | -0.0086 | -0.0086 | ||||||

| UNH US 06/06/25 C305 / DE (N/A) | -0.00 | -0.0086 | -0.0086 | ||||||

| NVDA US 06/06/25 C123 / DE (N/A) | -0.00 | -0.0089 | -0.0089 | ||||||

| XLY US 06/06/25 C210 / DE (N/A) | -0.00 | -0.0099 | -0.0099 | ||||||

| XLC US 06/06/25 C98.5 / DE (N/A) | -0.00 | -0.0102 | -0.0102 | ||||||

| NKE US 06/06/25 C58 / DE (N/A) | -0.00 | -0.0104 | -0.0104 | ||||||

| CB US 06/20/25 C290 / DE (N/A) | -0.00 | -0.0107 | -0.0107 | ||||||

| XLE US 06/06/25 C82 / DE (N/A) | -0.00 | -0.0107 | -0.0107 | ||||||

| LMT US 06/06/25 C465 / DE (N/A) | -0.00 | -0.0118 | -0.0118 | ||||||

| XLK US 06/06/25 C222.5 / DE (N/A) | -0.00 | -0.0119 | -0.0119 | ||||||

| XLP US 06/20/25 C80 / DE (N/A) | -0.00 | -0.0122 | -0.0122 | ||||||

| MSFT US 06/06/25 C442.5 / DE (N/A) | -0.00 | -0.0139 | -0.0139 | ||||||

| GEN US 06/20/25 C27 / DE (N/A) | -0.00 | -0.0157 | -0.0157 | ||||||

| USB US 06/13/25 C41.5 / DE (N/A) | -0.00 | -0.0161 | -0.0161 | ||||||

| XLI US 06/20/25 C139 / DE (N/A) | -0.00 | -0.0172 | -0.0172 | ||||||

| XLV US 06/06/25 C135 / DE (N/A) | -0.00 | -0.0176 | -0.0176 | ||||||

| GOOG US 06/06/25 C162.5 / DE (N/A) | -0.01 | -0.0190 | -0.0190 | ||||||

| T US 06/20/25 C22 / DE (N/A) | -0.01 | -0.0204 | -0.0204 | ||||||

| UAL US 06/06/25 C68 / DE (N/A) | -0.01 | -0.0210 | -0.0210 | ||||||

| WMT US 06/06/25 C93 / DE (N/A) | -0.01 | -0.0215 | -0.0215 | ||||||

| XLP US 06/06/25 C81.5 / DE (N/A) | -0.01 | -0.0219 | -0.0219 | ||||||

| XLRE US 06/20/25 C41 / DE (N/A) | -0.01 | -0.0224 | -0.0224 | ||||||

| XLP US 06/06/25 C81 / DE (N/A) | -0.01 | -0.0240 | -0.0240 | ||||||

| NVO US 06/13/25 C67 / DE (N/A) | -0.01 | -0.0250 | -0.0250 | ||||||

| XLF US 06/13/25 C49.5 / DE (N/A) | -0.01 | -0.0270 | -0.0270 | ||||||

| ADBE US 06/06/25 C375 / DE (N/A) | -0.01 | -0.0306 | -0.0306 | ||||||

| JPM US 06/06/25 C242.5 / DE (N/A) | -0.01 | -0.0315 | -0.0315 | ||||||

| CAT US 06/06/25 C315 / DE (N/A) | -0.01 | -0.0355 | -0.0355 | ||||||

| BAC US 06/06/25 C39 / DE (N/A) | -0.01 | -0.0375 | -0.0375 | ||||||

| XLU US 06/06/25 C79 / DE (N/A) | -0.01 | -0.0417 | -0.0417 | ||||||

| GM US 06/13/25 C45.5 / DE (N/A) | -0.01 | -0.0465 | -0.0465 | ||||||

| AMZN US 06/06/25 C187.5 / DE (N/A) | -0.01 | -0.0510 | -0.0510 | ||||||

| XLF US 06/06/25 C49 / DE (N/A) | -0.02 | -0.0645 | -0.0645 | ||||||

| ULTA US 06/06/25 C380 / DE (N/A) | -0.02 | -0.0656 | -0.0656 | ||||||

| GOOG US 06/06/25 C160 / DE (N/A) | -0.02 | -0.0672 | -0.0672 | ||||||

| NFLX US 06/13/25 C1010 / DE (N/A) | -0.02 | -0.0715 | -0.0715 | ||||||

| AVGO US 06/06/25 C190 / DE (N/A) | -0.02 | -0.0743 | -0.0743 | ||||||

| TSLA US 06/13/25 C290 / DE (N/A) | -0.02 | -0.0838 | -0.0838 | ||||||

| TSM US 06/06/25 C167.5 / DE (N/A) | -0.02 | -0.0877 | -0.0877 | ||||||

| THC US 06/20/25 C140 / DE (N/A) | -0.02 | -0.0880 | -0.0880 | ||||||

| XLF US 06/06/25 C48.5 / DE (N/A) | -0.03 | -0.0903 | -0.0903 | ||||||

| BA US 06/06/25 C165 / DE (N/A) | -0.03 | -0.0913 | -0.0913 | ||||||

| AMD US 06/06/25 C99 / DE (N/A) | -0.03 | -0.0961 | -0.0961 | ||||||

| SMH US 06/06/25 C205 / DE (N/A) | -0.03 | -0.1123 | -0.1123 | ||||||

| PLTR US 06/06/25 C99 / DE (N/A) | -0.04 | -0.1479 | -0.1479 | ||||||

| META US 06/06/25 C575 / DE (N/A) | -0.04 | -0.1572 | -0.1572 | ||||||

| ONON US 06/06/25 C49 / DE (N/A) | -0.05 | -0.1644 | -0.1644 | ||||||

| MU US 06/06/25 C76 / DE (N/A) | -0.05 | -0.1720 | -0.1720 | ||||||

| XLY US 06/06/25 C198 / DE (N/A) | -0.05 | -0.1730 | -0.1730 | ||||||

| NVDA US 06/06/25 C116 / DE (N/A) | -0.06 | -0.1993 | -0.1993 | ||||||

| XLC US 06/06/25 C95.5 / DE (N/A) | -0.06 | -0.2114 | -0.2114 | ||||||

| XLI US 06/06/25 C131 / DE (N/A) | -0.07 | -0.2379 | -0.2379 | ||||||

| AVGO US 06/06/25 C175 / DE (N/A) | -0.07 | -0.2389 | -0.2389 | ||||||

| VGT US 06/20/25 C585 / DE (N/A) | -0.10 | -0.3611 | -0.3611 | ||||||

| XLK US 06/06/25 C200 / DE (N/A) | -0.29 | -1.0265 | -1.0265 |