Mga Batayang Estadistika

| Nilai Portofolio | $ 103,214,878 |

| Posisi Saat Ini | 100 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

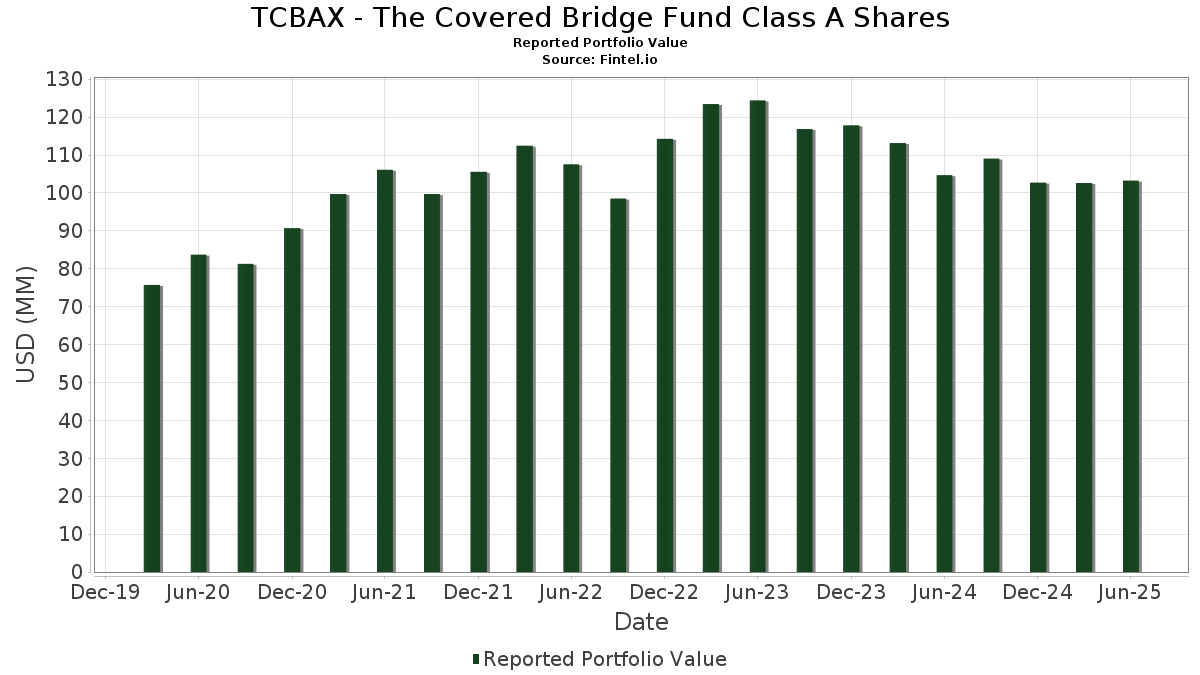

TCBAX - The Covered Bridge Fund Class A Shares telah mengungkapkan total kepemilikan 100 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 103,214,878 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama TCBAX - The Covered Bridge Fund Class A Shares adalah JPMorgan Trust II - JPMorgan US Treasury Plus Money Market Fund Institutional Class (US:IJTXX) , QUALCOMM Incorporated (US:QCOM) , The Home Depot, Inc. (US:HD) , Microsoft Corporation (US:MSFT) , and Verizon Communications Inc. (US:VZ) . Posisi baru TCBAX - The Covered Bridge Fund Class A Shares meliputi: JPMorgan Trust II - JPMorgan US Treasury Plus Money Market Fund Institutional Class (US:IJTXX) , Salesforce, Inc. (US:CRM) , First American Funds Inc - First American Treasury Obligations Fund Class X (US:FXFXX) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.01 | 2.46 | 2.3366 | 2.3366 | |

| 0.02 | 2.24 | 2.1278 | 1.3606 | |

| 0.00 | 1.09 | 1.0352 | 1.0352 | |

| 10.03 | 9.5174 | 0.9752 | ||

| 0.12 | 2.35 | 2.2320 | 0.7388 | |

| 0.03 | 2.13 | 2.0227 | 0.6712 | |

| 0.01 | 2.93 | 2.7837 | 0.6558 | |

| 0.01 | 1.37 | 1.3044 | 0.5925 | |

| 0.01 | 1.43 | 1.3609 | 0.3713 | |

| 0.03 | 2.27 | 2.1573 | 0.3618 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.01 | 2.74 | 2.5964 | -2.4895 | |

| 0.01 | 1.24 | 1.1769 | -0.7334 | |

| 0.01 | 2.49 | 2.3625 | -0.6167 | |

| 0.04 | 1.85 | 1.7573 | -0.6036 | |

| 0.01 | 0.58 | 0.5549 | -0.5224 | |

| 0.00 | 0.31 | 0.2963 | -0.4502 | |

| 0.01 | 1.42 | 1.3487 | -0.4102 | |

| 0.04 | 1.52 | 1.4435 | -0.3768 | |

| 0.01 | 0.69 | 0.6513 | -0.3698 | |

| 0.02 | 0.42 | 0.3952 | -0.3573 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-01 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| IJTXX / JPMorgan Trust II - JPMorgan US Treasury Plus Money Market Fund Institutional Class | 10.03 | 13.61 | 9.5174 | 0.9752 | |||||

| QCOM / QUALCOMM Incorporated | 0.02 | 0.00 | 3.19 | 3.68 | 3.0230 | 0.0499 | |||

| HD / The Home Depot, Inc. | 0.01 | 33.33 | 2.93 | 33.44 | 2.7837 | 0.6558 | |||

| MSFT / Microsoft Corporation | 0.01 | -60.71 | 2.74 | -47.95 | 2.5964 | -2.4895 | |||

| VZ / Verizon Communications Inc. | 0.06 | 0.00 | 2.64 | -4.59 | 2.5050 | -0.1726 | |||

| MDT / Medtronic plc | 0.03 | 0.00 | 2.62 | -2.97 | 2.4819 | -0.1269 | |||

| HSY / The Hershey Company | 0.01 | -16.67 | 2.49 | -19.14 | 2.3625 | -0.6167 | |||

| AAPL / Apple Inc. | 0.01 | 2.46 | 2.3366 | 2.3366 | |||||

| PFE / Pfizer Inc. | 0.10 | 0.00 | 2.42 | -4.34 | 2.3005 | -0.1517 | |||

| ACN / Accenture plc | 0.01 | 6.67 | 2.39 | 2.18 | 2.2693 | 0.0046 | |||

| XOM / Exxon Mobil Corporation | 0.02 | 0.00 | 2.37 | -9.37 | 2.2508 | -0.2812 | |||

| CVX / Chevron Corporation | 0.02 | 17.86 | 2.36 | 0.85 | 2.2423 | -0.0242 | |||

| HPE / Hewlett Packard Enterprise Company | 0.12 | 15.00 | 2.35 | 52.37 | 2.2320 | 0.7388 | |||

| NTR / Nutrien Ltd. | 0.04 | 0.00 | 2.33 | 17.27 | 2.2110 | 0.2883 | |||

| UPS / United Parcel Service, Inc. | 0.02 | 0.00 | 2.32 | -8.22 | 2.2034 | -0.2448 | |||

| JNJ / Johnson & Johnson | 0.01 | 0.00 | 2.29 | -7.88 | 2.1746 | -0.2328 | |||

| AVY / Avery Dennison Corporation | 0.01 | 0.00 | 2.28 | -1.38 | 2.1649 | -0.0740 | |||

| SRE / Sempra | 0.03 | 15.38 | 2.27 | 22.53 | 2.1573 | 0.3618 | |||

| SYY / Sysco Corporation | 0.03 | 0.00 | 2.27 | 0.93 | 2.1565 | -0.0221 | |||

| DUK / Duke Energy Corporation | 0.02 | 192.31 | 2.24 | 183.08 | 2.1278 | 1.3606 | |||

| NKE / NIKE, Inc. | 0.03 | 36.36 | 2.13 | 52.65 | 2.0227 | 0.6712 | |||

| USB / U.S. Bancorp | 0.04 | 0.00 | 1.90 | 7.16 | 1.8037 | 0.0877 | |||

| BMY / Bristol-Myers Squibb Company | 0.04 | 0.00 | 1.85 | -24.11 | 1.7573 | -0.6036 | |||

| MCHP / Microchip Technology Incorporated | 0.03 | -16.13 | 1.83 | 21.93 | 1.7364 | 0.2842 | |||

| D / Dominion Energy, Inc. | 0.03 | 0.00 | 1.76 | 0.80 | 1.6682 | -0.0193 | |||

| TFC / Truist Financial Corporation | 0.04 | 0.00 | 1.74 | 4.50 | 1.6524 | 0.0396 | |||

| T / AT&T Inc. | 0.06 | 20.00 | 1.74 | 22.77 | 1.6480 | 0.2796 | |||

| TGT / Target Corporation | 0.02 | 16.67 | 1.73 | 10.29 | 1.6384 | 0.1236 | |||

| INTC / Intel Corporation | 0.07 | 0.00 | 1.57 | -1.32 | 1.4881 | -0.0503 | |||

| SLB / Schlumberger Limited | 0.04 | 0.00 | 1.52 | -19.14 | 1.4435 | -0.3768 | |||

| GIS / General Mills, Inc. | 0.03 | 0.00 | 1.45 | -13.38 | 1.3768 | -0.2433 | |||

| PG / The Procter & Gamble Company | 0.01 | 50.00 | 1.43 | 40.22 | 1.3609 | 0.3713 | |||

| ETN / Eaton Corporation plc | 0.00 | 0.00 | 1.43 | 31.28 | 1.3552 | 0.3030 | |||

| ORCL / Oracle Corporation | 0.01 | -50.00 | 1.42 | -21.79 | 1.3487 | -0.4102 | |||

| HON / Honeywell International Inc. | 0.01 | -25.00 | 1.40 | -17.53 | 1.3261 | -0.3132 | |||

| WBA / Walgreens Boots Alliance, Inc. | 0.12 | 0.00 | 1.38 | 2.76 | 1.3074 | 0.0103 | |||

| SBUX / Starbucks Corporation | 0.01 | 100.00 | 1.37 | 86.94 | 1.3044 | 0.5925 | |||

| DIS / The Walt Disney Company | 0.01 | -50.00 | 1.24 | -37.18 | 1.1769 | -0.7334 | |||

| KHC / The Kraft Heinz Company | 0.05 | 0.00 | 1.21 | -15.17 | 1.1517 | -0.2323 | |||

| EOG / EOG Resources, Inc. | 0.01 | 0.00 | 1.20 | -6.71 | 1.1352 | -0.1058 | |||

| BAC / Bank of America Corporation | 0.03 | 0.00 | 1.18 | 13.42 | 1.1227 | 0.1132 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | -33.33 | 1.16 | -21.21 | 1.1006 | -0.3237 | |||

| WY / Weyerhaeuser Company | 0.04 | 0.00 | 1.16 | -12.22 | 1.0972 | -0.1779 | |||

| HRL / Hormel Foods Corporation | 0.04 | 0.00 | 1.13 | -2.24 | 1.0766 | -0.0462 | |||

| GILD / Gilead Sciences, Inc. | 0.01 | 42.86 | 1.11 | 41.33 | 1.0522 | 0.2932 | |||

| CMCSA / Comcast Corporation | 0.03 | 19.23 | 1.11 | 15.33 | 1.0500 | 0.1216 | |||

| CRM / Salesforce, Inc. | 0.00 | 1.09 | 1.0352 | 1.0352 | |||||

| CC / The Chemours Company | 0.10 | 26.67 | 1.09 | 7.20 | 1.0323 | 0.0503 | |||

| MO / Altria Group, Inc. | 0.02 | 20.00 | 1.06 | 17.22 | 1.0016 | 0.1303 | |||

| GLW / Corning Incorporated | 0.02 | 0.00 | 1.05 | 14.86 | 0.9982 | 0.1122 | |||

| WFC / Wells Fargo & Company | 0.01 | 0.00 | 0.80 | 11.72 | 0.7604 | 0.0657 | |||

| HAS / Hasbro, Inc. | 0.01 | 0.00 | 0.74 | 20.20 | 0.7006 | 0.1055 | |||

| DG / Dollar General Corporation | 0.01 | -50.00 | 0.69 | -34.98 | 0.6513 | -0.3698 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | 200.00 | 0.66 | 78.96 | 0.6218 | 0.2670 | |||

| EXE / Expand Energy Corporation | 0.01 | -50.00 | 0.58 | -47.53 | 0.5549 | -0.5224 | |||

| KSS / Kohl's Corporation | 0.06 | 0.00 | 0.47 | 3.49 | 0.4507 | 0.0074 | |||

| B / Barrick Mining Corporation | 0.02 | -50.00 | 0.42 | -46.46 | 0.3952 | -0.3573 | |||

| CSCO / Cisco Systems, Inc. | 0.00 | -64.00 | 0.31 | -59.53 | 0.2963 | -0.4502 | |||

| FXFXX / First American Funds Inc - First American Treasury Obligations Fund Class X | 0.13 | -4.44 | 0.1226 | -0.0081 | |||||

| SPY US 07/18/25 P580 / DE (N/A) | 0.00 | 0.0020 | 0.0020 | ||||||

| EOG US 07/18/25 C130 / DE (N/A) | -0.00 | -0.0009 | -0.0009 | ||||||

| XOM US 07/18/25 C115 / DE (N/A) | -0.00 | -0.0009 | -0.0009 | ||||||

| CVX US 07/18/25 C150 / DE (N/A) | -0.00 | -0.0016 | -0.0016 | ||||||

| MO US 07/18/25 C60 / DE (N/A) | -0.00 | -0.0030 | -0.0030 | ||||||

| EXE US 07/18/25 C120 / DE (N/A) | -0.00 | -0.0039 | -0.0039 | ||||||

| PG US 07/18/25 C160 / DE (N/A) | -0.01 | -0.0052 | -0.0052 | ||||||

| UNH US 07/18/25 C310 / DE (N/A) | -0.01 | -0.0064 | -0.0064 | ||||||

| CMCSA US 07/18/25 C34 / DE (N/A) | -0.01 | -0.0071 | -0.0071 | ||||||

| JNJ US 07/18/25 C150 / DE (N/A) | -0.01 | -0.0075 | -0.0075 | ||||||

| SBUX US 07/18/25 C95 / DE (N/A) | -0.01 | -0.0076 | -0.0076 | ||||||

| NTR US 07/18/25 C60 / DE (N/A) | -0.01 | -0.0083 | -0.0083 | ||||||

| B US 07/18/25 C21 / DE (N/A) | -0.01 | -0.0084 | -0.0084 | ||||||

| AVY US 08/15/25 C180 / DE (N/A) | -0.01 | -0.0100 | -0.0100 | ||||||

| T US 07/18/25 C28 / DE (N/A) | -0.01 | -0.0102 | -0.0102 | ||||||

| MDT US 07/18/25 C85 / DE (N/A) | -0.01 | -0.0121 | -0.0121 | ||||||

| TGT US 07/18/25 C95 / DE (N/A) | -0.01 | -0.0123 | -0.0123 | ||||||

| SYY US 07/18/25 C75 / DE (N/A) | -0.01 | -0.0128 | -0.0128 | ||||||

| DG US 07/18/25 C110 / DE (N/A) | -0.02 | -0.0146 | -0.0146 | ||||||

| HAS US 07/18/25 C67.5 / DE (N/A) | -0.02 | -0.0159 | -0.0159 | ||||||

| CSCO US 07/18/25 C65 / DE (N/A) | -0.02 | -0.0190 | -0.0190 | ||||||

| D US 07/18/25 C55 / DE (N/A) | -0.02 | -0.0192 | -0.0192 | ||||||

| CC US 07/18/25 C11 / DE (N/A) | -0.02 | -0.0201 | -0.0201 | ||||||

| DIS US 07/18/25 C120 / DE (N/A) | -0.03 | -0.0244 | -0.0244 | ||||||

| CRM US 07/18/25 C260 / DE (N/A) | -0.03 | -0.0274 | -0.0274 | ||||||

| WFC US 07/18/25 C75 / DE (N/A) | -0.03 | -0.0278 | -0.0278 | ||||||

| GLW US 07/18/25 C50 / DE (N/A) | -0.03 | -0.0295 | -0.0295 | ||||||

| JPM US 07/18/25 C275 / DE (N/A) | -0.03 | -0.0310 | -0.0310 | ||||||

| HD US 07/18/25 C352.5 / DE (N/A) | -0.03 | -0.0319 | -0.0319 | ||||||

| BAC US 07/18/25 C45 / DE (N/A) | -0.03 | -0.0321 | -0.0321 | ||||||

| GILD US 07/18/25 C105 / DE (N/A) | -0.03 | -0.0323 | -0.0323 | ||||||

| DUK US 07/18/25 C115 / DE (N/A) | -0.04 | -0.0345 | -0.0345 | ||||||

| ACN US 07/18/25 C280 / DE (N/A) | -0.04 | -0.0347 | -0.0347 | ||||||

| ORCL US 07/18/25 C210 / DE (N/A) | -0.04 | -0.0383 | -0.0383 | ||||||

| HON US 07/18/25 C220 / DE (N/A) | -0.04 | -0.0393 | -0.0393 | ||||||

| AAPL US 07/18/25 C200 / DE (N/A) | -0.05 | -0.0456 | -0.0456 | ||||||

| MCHP US 07/18/25 C67.5 / DE (N/A) | -0.05 | -0.0478 | -0.0478 | ||||||

| ETN US 07/18/25 C330 / DE (N/A) | -0.06 | -0.0550 | -0.0550 | ||||||

| MSFT US 07/18/25 C480 / DE (N/A) | -0.07 | -0.0655 | -0.0655 | ||||||

| NKE US 07/18/25 C62.5 / DE (N/A) | -0.07 | -0.0661 | -0.0661 | ||||||

| HPE US 07/18/25 C18 / DE (N/A) | -0.10 | -0.0934 | -0.0934 |