Mga Batayang Estadistika

| Nilai Portofolio | $ 167,674,552 |

| Posisi Saat Ini | 52 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

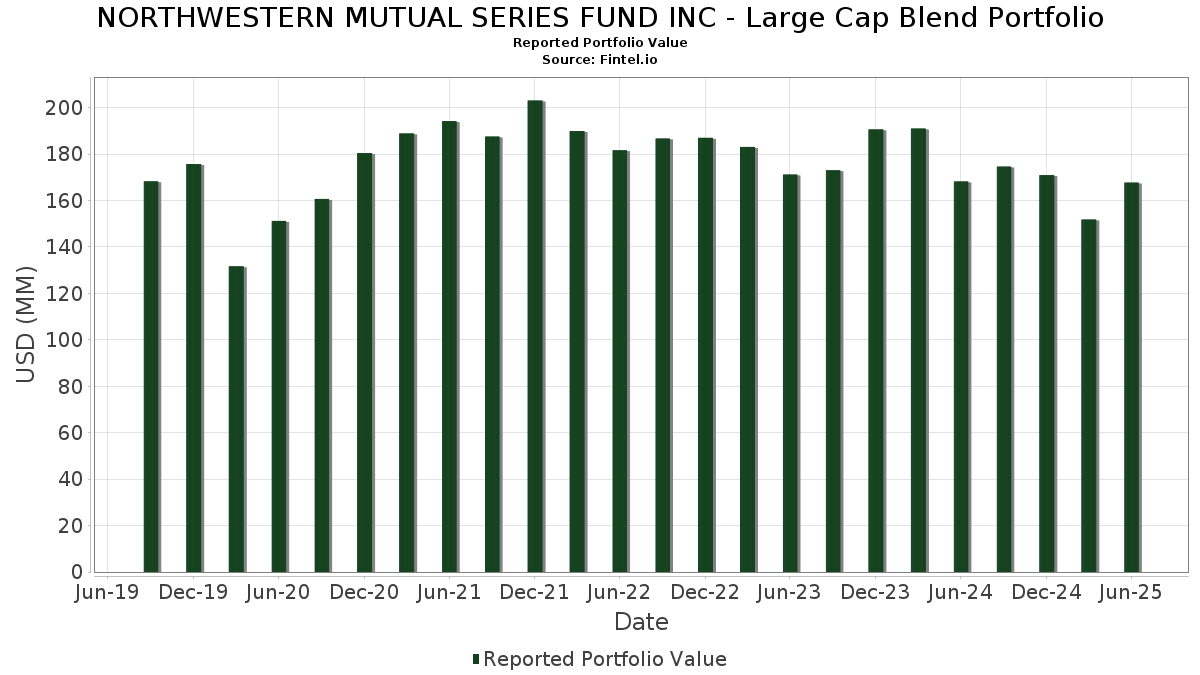

NORTHWESTERN MUTUAL SERIES FUND INC - Large Cap Blend Portfolio telah mengungkapkan total kepemilikan 52 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 167,674,552 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama NORTHWESTERN MUTUAL SERIES FUND INC - Large Cap Blend Portfolio adalah Microsoft Corporation (US:MSFT) , NVIDIA Corporation (US:NVDA) , Apple Inc. (US:AAPL) , Amazon.com, Inc. (US:AMZN) , and Meta Platforms, Inc. (US:META) . Posisi baru NORTHWESTERN MUTUAL SERIES FUND INC - Large Cap Blend Portfolio meliputi: The Walt Disney Company (CH:DIS) , United Rentals, Inc. (IT:1URI) , Blackstone Inc. (US:BX) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.07 | 11.44 | 6.7688 | 1.5289 | |

| 0.02 | 2.54 | 1.5029 | 1.5029 | |

| 0.03 | 15.38 | 9.0983 | 1.3392 | |

| 0.02 | 3.39 | 2.0040 | 0.7335 | |

| 0.00 | 1.16 | 0.6876 | 0.6876 | |

| 0.02 | 5.10 | 3.0176 | 0.5840 | |

| 0.03 | 2.32 | 1.3729 | 0.4795 | |

| 0.04 | 3.67 | 2.1700 | 0.4201 | |

| 0.00 | 0.62 | 0.3653 | 0.3653 | |

| 0.01 | 3.94 | 2.3294 | 0.3002 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.05 | 9.84 | 5.8224 | -1.4973 | |

| 0.06 | 0.77 | 0.4543 | -0.9328 | |

| 0.00 | 1.04 | 0.6143 | -0.7021 | |

| 0.03 | 3.06 | 1.8079 | -0.5580 | |

| 0.01 | 2.70 | 1.5989 | -0.4930 | |

| 0.11 | 4.13 | 2.4431 | -0.4461 | |

| 0.01 | 3.34 | 1.9736 | -0.4400 | |

| 0.00 | 1.31 | 0.7731 | -0.4156 | |

| 0.00 | 2.04 | 1.2058 | -0.3504 | |

| 0.00 | 1.29 | 0.7647 | -0.2301 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-19 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.03 | -1.98 | 15.38 | 29.87 | 9.0983 | 1.3392 | |||

| NVDA / NVIDIA Corporation | 0.07 | -1.85 | 11.44 | 43.09 | 6.7688 | 1.5289 | |||

| AAPL / Apple Inc. | 0.05 | -4.61 | 9.84 | -11.90 | 5.8224 | -1.4973 | |||

| AMZN / Amazon.com, Inc. | 0.04 | 2.25 | 7.97 | 17.90 | 4.7144 | 0.2858 | |||

| META / Meta Platforms, Inc. | 0.01 | -11.96 | 6.79 | 12.75 | 4.0184 | 0.0709 | |||

| WFC / Wells Fargo & Company | 0.07 | 2.45 | 5.70 | 14.33 | 3.3738 | 0.1057 | |||

| AVGO / Broadcom Inc. | 0.02 | -16.58 | 5.10 | 37.35 | 3.0176 | 0.5840 | |||

| MA / Mastercard Incorporated | 0.01 | 2.16 | 4.56 | 4.75 | 2.6987 | -0.1551 | |||

| AXP / American Express Company | 0.01 | 1.66 | 4.30 | 20.53 | 2.5425 | 0.2060 | |||

| GOOGL / Alphabet Inc. | 0.02 | 4.44 | 4.26 | 19.02 | 2.5214 | 0.1750 | |||

| BKR / Baker Hughes Company | 0.11 | 7.36 | 4.13 | -6.33 | 2.4431 | -0.4461 | |||

| ETN / Eaton Corporation plc | 0.01 | -3.19 | 3.94 | 27.12 | 2.3294 | 0.3002 | |||

| WMT / Walmart Inc. | 0.04 | 23.32 | 3.67 | 37.38 | 2.1700 | 0.4201 | |||

| VNX / NXP Semiconductors N.V. | 0.02 | 11.52 | 3.64 | 28.19 | 2.1525 | 0.2929 | |||

| LOW / Lowe's Companies, Inc. | 0.02 | 6.29 | 3.45 | 1.11 | 2.0393 | -0.1945 | |||

| ORCL / Oracle Corporation | 0.02 | 11.72 | 3.39 | 74.68 | 2.0040 | 0.7335 | |||

| MCD / McDonald's Corporation | 0.01 | 8.65 | 3.39 | 1.62 | 2.0027 | -0.1799 | |||

| AJG / Arthur J. Gallagher & Co. | 0.01 | -2.32 | 3.34 | -9.45 | 1.9736 | -0.4400 | |||

| VMC / Vulcan Materials Company | 0.01 | -0.92 | 3.10 | 10.77 | 1.8317 | 0.0002 | |||

| XOM / Exxon Mobil Corporation | 0.03 | -6.62 | 3.06 | -15.37 | 1.8079 | -0.5580 | |||

| AMP / Ameriprise Financial, Inc. | 0.01 | -3.91 | 2.97 | 5.95 | 1.7594 | -0.0801 | |||

| SYK / Stryker Corporation | 0.01 | -2.02 | 2.96 | 4.16 | 1.7486 | -0.1112 | |||

| NOC / Northrop Grumman Corporation | 0.01 | -0.40 | 2.77 | -2.74 | 1.6405 | -0.2276 | |||

| ABBV / AbbVie Inc. | 0.01 | -4.44 | 2.70 | -15.35 | 1.5989 | -0.4930 | |||

| HWM / Howmet Aerospace Inc. | 0.01 | -17.21 | 2.59 | 18.80 | 1.5329 | 0.1035 | |||

| DIS / The Walt Disney Company | 0.02 | 2.54 | 1.5029 | 1.5029 | |||||

| CARR / Carrier Global Corporation | 0.03 | 47.44 | 2.32 | 70.21 | 1.3729 | 0.4795 | |||

| INTU / Intuit Inc. | 0.00 | -9.53 | 2.28 | 16.04 | 1.3483 | 0.0615 | |||

| NEE / NextEra Energy, Inc. | 0.03 | 37.70 | 2.28 | 34.89 | 1.3469 | 0.2406 | |||

| MS / Morgan Stanley | 0.02 | 2.11 | 2.21 | 23.26 | 1.3076 | 0.1328 | |||

| MDT / Medtronic plc | 0.02 | 13.19 | 2.15 | 9.79 | 1.2738 | -0.0111 | |||

| SO / The Southern Company | 0.02 | -0.03 | 2.11 | -0.19 | 1.2497 | -0.1366 | |||

| DE / Deere & Company | 0.00 | -20.79 | 2.04 | -14.19 | 1.2058 | -0.3504 | |||

| MAR / Marriott International, Inc. | 0.01 | 7.83 | 2.03 | 23.67 | 1.1994 | 0.1253 | |||

| TSLA / Tesla, Inc. | 0.01 | -14.10 | 1.87 | 5.31 | 1.1035 | -0.0573 | |||

| CMG / Chipotle Mexican Grill, Inc. | 0.03 | -10.11 | 1.79 | 0.51 | 1.0598 | -0.1079 | |||

| TRV / The Travelers Companies, Inc. | 0.01 | 13.59 | 1.74 | 14.92 | 1.0302 | 0.0373 | |||

| MDLZ / Mondelez International, Inc. | 0.03 | -0.40 | 1.73 | -0.97 | 1.0242 | -0.1216 | |||

| CSX / CSX Corporation | 0.05 | -11.97 | 1.72 | -2.39 | 1.0154 | -0.1369 | |||

| EW / Edwards Lifesciences Corporation | 0.02 | 16.90 | 1.65 | 26.18 | 0.9780 | 0.1193 | |||

| LLY / Eli Lilly and Company | 0.00 | 29.08 | 1.46 | 21.87 | 0.8636 | 0.0785 | |||

| TT / Trane Technologies plc | 0.00 | -44.51 | 1.31 | -28.00 | 0.7731 | -0.4156 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.00 | -7.28 | 1.29 | -14.89 | 0.7647 | -0.2301 | |||

| USB / U.S. Bancorp | 0.03 | 3.77 | 1.28 | 11.22 | 0.7566 | 0.0031 | |||

| MU / Micron Technology, Inc. | 0.01 | 9.19 | 1.25 | 54.95 | 0.7409 | 0.2111 | |||

| 1URI / United Rentals, Inc. | 0.00 | 1.16 | 0.6876 | 0.6876 | |||||

| REGN / Regeneron Pharmaceuticals, Inc. | 0.00 | -37.56 | 1.04 | -48.33 | 0.6143 | -0.7021 | |||

| PLD / Prologis, Inc. | 0.01 | -0.41 | 1.02 | -6.37 | 0.6009 | -0.1098 | |||

| ETR / Entergy Corporation | 0.01 | -10.18 | 0.89 | -12.66 | 0.5266 | -0.1413 | |||

| PCG / PG&E Corporation | 0.06 | -55.29 | 0.77 | -63.72 | 0.4543 | -0.9328 | |||

| ASML / ASML Holding N.V. - Depositary Receipt (Common Stock) | 0.00 | 31.23 | 0.68 | 58.84 | 0.4043 | 0.1222 | |||

| BX / Blackstone Inc. | 0.00 | 0.62 | 0.3653 | 0.3653 |