Mga Batayang Estadistika

| Nilai Portofolio | $ 153,544,034 |

| Posisi Saat Ini | 50 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

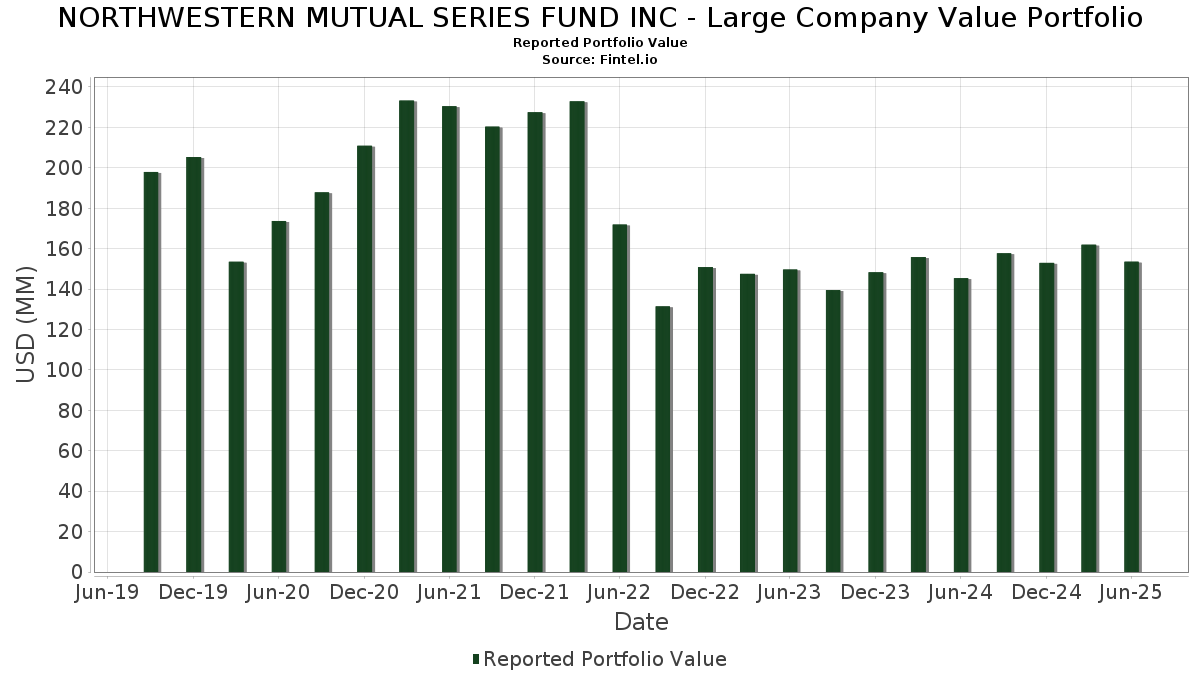

NORTHWESTERN MUTUAL SERIES FUND INC - Large Company Value Portfolio telah mengungkapkan total kepemilikan 50 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 153,544,034 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama NORTHWESTERN MUTUAL SERIES FUND INC - Large Company Value Portfolio adalah Johnson & Johnson (US:JNJ) , Truist Financial Corporation (US:TFC) , JPMorgan Chase & Co. (US:JPM) , Kenvue Inc. (US:KVUE) , and Duke Energy Corporation (US:DUK) . Posisi baru NORTHWESTERN MUTUAL SERIES FUND INC - Large Company Value Portfolio meliputi: Reinsurance Group of America, Incorporated (US:RGA) , Atmos Energy Corporation (DE:AEO) , Marsh & McLennan Companies, Inc. (US:MMC) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.02 | 4.55 | 2.9027 | 2.9027 | |

| 0.27 | 5.62 | 3.5845 | 2.2789 | |

| 0.15 | 6.25 | 3.9838 | 1.9016 | |

| 0.02 | 2.97 | 1.8963 | 1.8963 | |

| 0.03 | 3.46 | 2.2081 | 1.7371 | |

| 0.16 | 5.08 | 3.2374 | 1.7216 | |

| 0.06 | 8.60 | 5.4809 | 1.6957 | |

| 0.05 | 5.52 | 3.5202 | 1.5724 | |

| 0.01 | 2.43 | 1.5510 | 1.5510 | |

| 0.01 | 2.40 | 1.5305 | 1.5305 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.00 | -0.7712 | ||

| 0.04 | 3.64 | 2.3217 | -0.7431 | |

| 0.00 | 0.00 | -0.5265 | ||

| 0.01 | 2.52 | 1.6064 | -0.5085 | |

| 0.04 | 3.85 | 2.4561 | -0.4256 | |

| 0.02 | 1.98 | 1.2609 | -0.4144 | |

| 0.01 | 1.51 | 0.9616 | -0.3290 | |

| -0.14 | -0.0898 | -0.0898 | ||

| 0.02 | 2.32 | 1.4760 | -0.0893 | |

| -0.14 | -0.0864 | -0.0864 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-19 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| JNJ / Johnson & Johnson | 0.06 | 50.69 | 8.60 | 38.81 | 5.4809 | 1.6957 | |||

| TFC / Truist Financial Corporation | 0.15 | 75.55 | 6.25 | 83.42 | 3.9838 | 1.9016 | |||

| JPM / JPMorgan Chase & Co. | 0.02 | -14.03 | 5.93 | 1.61 | 3.7827 | 0.2140 | |||

| KVUE / Kenvue Inc. | 0.27 | 201.54 | 5.62 | 163.25 | 3.5845 | 2.2789 | |||

| DUK / Duke Energy Corporation | 0.05 | 79.07 | 5.52 | 73.27 | 3.5202 | 1.5724 | |||

| NSC / Norfolk Southern Corporation | 0.02 | 20.93 | 5.20 | 30.68 | 3.3155 | 0.8837 | |||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 0.16 | 125.39 | 5.08 | 104.80 | 3.2374 | 1.7216 | |||

| BDX / Becton, Dickinson and Company | 0.03 | 106.17 | 4.88 | 55.03 | 3.1122 | 1.1879 | |||

| UL / Unilever PLC - Depositary Receipt (Common Stock) | 0.08 | 85.87 | 4.71 | 90.92 | 3.0014 | 1.4945 | |||

| BLK / BlackRock, Inc. | 0.00 | 29.95 | 4.69 | 44.10 | 2.9889 | 1.0001 | |||

| RGA / Reinsurance Group of America, Incorporated | 0.02 | 4.55 | 2.9027 | 2.9027 | |||||

| ADI / Analog Devices, Inc. | 0.02 | 78.67 | 4.29 | 110.93 | 2.7324 | 1.4903 | |||

| XOM / Exxon Mobil Corporation | 0.04 | 10.41 | 4.05 | 0.07 | 2.5839 | 0.1089 | |||

| SCHW / The Charles Schwab Corporation | 0.04 | -9.19 | 3.92 | 5.83 | 2.4997 | 0.2358 | |||

| MDT / Medtronic plc | 0.04 | -15.78 | 3.85 | -18.30 | 2.4561 | -0.4256 | |||

| ZBH / Zimmer Biomet Holdings, Inc. | 0.04 | -9.89 | 3.64 | -27.38 | 2.3217 | -0.7431 | |||

| IQV / IQVIA Holdings Inc. | 0.02 | 70.03 | 3.50 | 52.02 | 2.2338 | 0.8249 | |||

| PEP / PepsiCo, Inc. | 0.03 | 522.44 | 3.46 | 384.48 | 2.2081 | 1.7371 | |||

| CSCO / Cisco Systems, Inc. | 0.05 | -14.15 | 3.13 | -3.49 | 1.9946 | 0.0136 | |||

| MDLZ / Mondelez International, Inc. | 0.05 | 42.24 | 3.13 | 41.39 | 1.9945 | 0.6422 | |||

| HSIC / Henry Schein, Inc. | 0.04 | 29.99 | 3.11 | 38.67 | 1.9818 | 0.6116 | |||

| TE Connectivity PLC / EC (IE000IVNQZ81) | 0.02 | 67.57 | 3.11 | 100.06 | 1.9805 | 1.0313 | |||

| AEO / Atmos Energy Corporation | 0.02 | 2.97 | 1.8963 | 1.8963 | |||||

| GPK / Graphic Packaging Holding Company | 0.14 | 42.69 | 2.93 | 15.81 | 1.8679 | 0.3219 | |||

| AMT / American Tower Corporation | 0.01 | 27.73 | 2.75 | 29.73 | 1.7527 | 0.4577 | |||

| VZ / Verizon Communications Inc. | 0.06 | -0.85 | 2.65 | -5.43 | 1.6891 | -0.0227 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.01 | -20.17 | 2.52 | -27.19 | 1.6064 | -0.5085 | |||

| SIE / Siemens Aktiengesellschaft | 0.01 | 107.73 | 2.48 | 132.43 | 1.5809 | 0.9283 | |||

| MMC / Marsh & McLennan Companies, Inc. | 0.01 | 2.43 | 1.5510 | 1.5510 | |||||

| CRH / CRH plc | 0.03 | 132.28 | 2.43 | 142.36 | 1.5468 | 0.9351 | |||

| GOOGL / Alphabet Inc. | 0.01 | 2.40 | 1.5305 | 1.5305 | |||||

| PKG / Packaging Corporation of America | 0.01 | 139.29 | 2.35 | 109.44 | 1.4996 | 0.8031 | |||

| BK / The Bank of New York Mellon Corporation | 0.03 | -8.81 | 2.32 | -0.94 | 1.4810 | 0.0478 | |||

| RTX / RTX Corporation | 0.02 | -18.00 | 2.32 | -9.61 | 1.4760 | -0.0893 | |||

| EL / The Estée Lauder Companies Inc. | 0.03 | -25.44 | 2.27 | -8.71 | 1.4439 | -0.0724 | |||

| HEIO / Heineken Holding N.V. | 0.03 | -5.90 | 2.16 | -3.35 | 1.3783 | 0.0115 | |||

| ROG / Roche Holding AG | 0.01 | 75.39 | 2.03 | 74.35 | 1.2919 | 0.5817 | |||

| CMI / Cummins Inc. | 0.01 | 1.99 | 1.2690 | 1.2690 | |||||

| UPS / United Parcel Service, Inc. | 0.02 | -21.38 | 1.98 | -27.84 | 1.2609 | -0.4144 | |||

| FFIV / F5, Inc. | 0.01 | 2.83 | 1.97 | 13.70 | 1.2539 | 0.1964 | |||

| NVT / nVent Electric plc | 0.03 | -14.03 | 1.95 | 20.17 | 1.2458 | 0.2517 | |||

| OSK / Oshkosh Corporation | 0.02 | -7.83 | 1.83 | 11.24 | 1.1674 | 0.1613 | |||

| TTE / TotalEnergies SE - Depositary Receipt (Common Stock) | 0.03 | 142.61 | 1.80 | 130.35 | 1.1467 | 0.6693 | |||

| UNH / UnitedHealth Group Incorporated | 0.01 | 145.45 | 1.79 | 46.17 | 1.1426 | 0.3935 | |||

| RBGPF / Reckitt Benckiser Group plc | 0.03 | 45.67 | 1.79 | 46.72 | 1.1411 | 0.3952 | |||

| ALL / The Allstate Corporation | 0.01 | -26.54 | 1.51 | -28.60 | 0.9616 | -0.3290 | |||

| PURCHASED GBP / SOLD USD / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | ||||||

| RS / Reliance, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.5265 | ||||

| AOS / A. O. Smith Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.7712 | ||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.05 | -0.0316 | -0.0316 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.14 | -0.0864 | -0.0864 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0.14 | -0.0898 | -0.0898 |