Mga Batayang Estadistika

| Nilai Portofolio | $ 1,175,994,104 |

| Posisi Saat Ini | 601 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

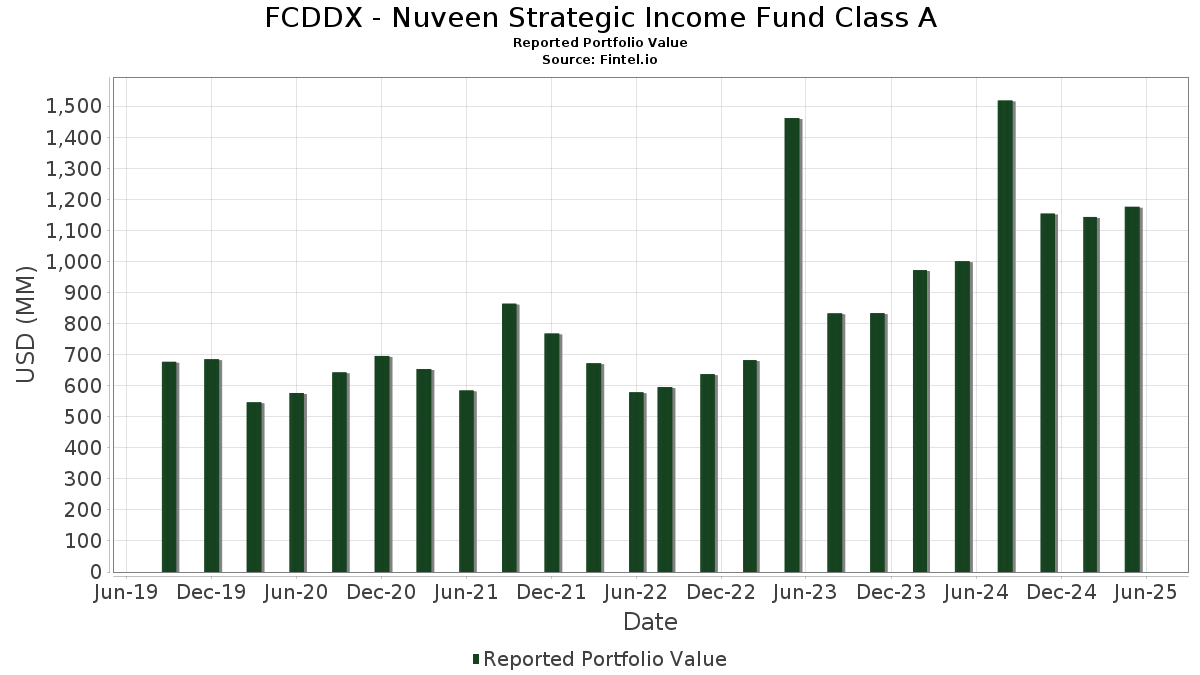

FCDDX - Nuveen Strategic Income Fund Class A telah mengungkapkan total kepemilikan 601 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 1,175,994,104 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama FCDDX - Nuveen Strategic Income Fund Class A adalah Fannie Mae Pool (US:US31418ES506) , Fannie Mae Pool (US:US31418EW300) , Fannie Mae Pool (US:US31418EU999) , State Street Navigator Securities Lending Government Money Market Portfolio (US:US8575093013) , and Fannie Mae Pool (US:US31418EPD66) . Posisi baru FCDDX - Nuveen Strategic Income Fund Class A meliputi: Fannie Mae Pool (US:US31418ES506) , Fannie Mae Pool (US:US31418EW300) , Fannie Mae Pool (US:US31418EU999) , Fannie Mae Pool (US:US31418EPD66) , and FANNIE MAE CAS CAS 2022 R06 1B2 144A (US:US20754NAR61) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 45.11 | 4.2807 | 4.2807 | ||

| 26.11 | 2.4779 | 2.4779 | ||

| 25.93 | 2.4604 | 2.4604 | ||

| 19.52 | 1.8524 | 1.8524 | ||

| 16.23 | 1.5399 | 1.5399 | ||

| 8.31 | 0.7882 | 0.7882 | ||

| 6.98 | 0.6622 | 0.6622 | ||

| 6.06 | 0.5751 | 0.5751 | ||

| 5.20 | 0.4934 | 0.4934 | ||

| 5.10 | 0.4838 | 0.4838 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 1.43 | 0.1357 | -2.1550 | ||

| 3.05 | 0.2899 | -0.1671 | ||

| 1.75 | 0.1661 | -0.1324 | ||

| 0.36 | 0.0343 | -0.1217 | ||

| 3.80 | 0.3610 | -0.1153 | ||

| 0.83 | 0.0788 | -0.1128 | ||

| 0.92 | 0.0877 | -0.1017 | ||

| 0.92 | 0.0870 | -0.1015 | ||

| 0.92 | 0.0873 | -0.0920 | ||

| 1.47 | 0.1393 | -0.0855 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-29 untuk periode pelaporan 2025-05-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US LONG BOND(CBT) Sep25 / DIR (N/A) | 45.11 | 4.2807 | 4.2807 | ||||||

| US ULTRA BOND CBT Sep25 / DIR (N/A) | 26.11 | 2.4779 | 2.4779 | ||||||

| US 2YR NOTE (CBT) Sep25 / DIR (N/A) | 25.93 | 2.4604 | 2.4604 | ||||||

| United States Treasury Note/Bond / DBT (US912810UJ50) | 19.52 | 1.8524 | 1.8524 | ||||||

| US 5YR NOTE (CBT) Sep25 / DIR (N/A) | 16.23 | 1.5399 | 1.5399 | ||||||

| US31418ES506 / Fannie Mae Pool | 13.14 | -3.44 | 1.2470 | -0.0796 | |||||

| US31418EW300 / Fannie Mae Pool | 12.78 | -3.82 | 1.2128 | -0.0825 | |||||

| US31418EU999 / Fannie Mae Pool | 12.58 | -3.63 | 1.1934 | -0.0788 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 11.46 | -3.88 | 1.0874 | -0.0748 | |||||

| US8575093013 / State Street Navigator Securities Lending Government Money Market Portfolio | 10.09 | 97.82 | 10.09 | 97.84 | 0.9575 | 0.4603 | |||

| US 10YR NOTE (CBT)Sep25 / DIR (N/A) | 8.31 | 0.7882 | 0.7882 | ||||||

| US31418EPD66 / Fannie Mae Pool | 7.83 | -4.02 | 0.7433 | -0.0523 | |||||

| United States Treasury Note/Bond / DBT (US91282CMY48) | 6.98 | 0.6622 | 0.6622 | ||||||

| US20754NAR61 / FANNIE MAE CAS CAS 2022 R06 1B2 144A | 6.89 | 136.18 | 0.6535 | 0.3693 | |||||

| US20754QAF54 / Fannie Mae Connecticut Avenue Securities | 6.79 | -1.51 | 0.6442 | -0.0278 | |||||

| US35564KWG02 / FHLMC STACR REMIC Trust, Series 2022-DNA3, Class B2 | 6.74 | -1.33 | 0.6392 | -0.0263 | |||||

| US35564KSQ30 / STACR_22-DNA2 | 6.56 | -1.01 | 0.6228 | -0.0236 | |||||

| US31418EPC83 / FNMA 30YR 5% 02/01/2053#MA4918 | 6.50 | -3.96 | 0.6164 | -0.0430 | |||||

| US20754BAJ08 / CAS_22-R02 | 6.46 | 18.63 | 0.6134 | 0.0822 | |||||

| US35564KQZ56 / FHLMC STACR REMIC Trust, Series 2022-DNA1, Class B2 | 6.42 | -0.67 | 0.6092 | -0.0207 | |||||

| US20754EAJ47 / Fannie Mae Connecticut Avenue Securities | 6.40 | 70.32 | 0.6072 | 0.2409 | |||||

| US20755CAF59 / CORP CMO | 6.33 | -0.36 | 0.6004 | -0.0186 | |||||

| US35564KSJ96 / STACR_22-DNA2 | 6.18 | -0.82 | 0.5866 | -0.0210 | |||||

| United States Treasury Note/Bond / DBT (US912810UL07) | 6.06 | 0.5751 | 0.5751 | ||||||

| US428357AA59 / HI-FI MUSIC IP ISSUER II L.P | 5.97 | 435.91 | 0.5665 | 0.4578 | |||||

| Connecticut Avenue Securities Trust 2023-R04 / ABS-CBDO (US20754QAJ76) | 5.64 | -2.17 | 0.5347 | -0.0268 | |||||

| US20753YAL65 / Connecticut Avenue Securities Trust, Series 2022-R04, Class 1B2 | 5.59 | -1.48 | 0.5305 | -0.0227 | |||||

| US20755AAD46 / Connecticut Avenue Securities Trust, Series 2023-R02, Class 1B1 | 5.51 | -1.45 | 0.5224 | -0.0222 | |||||

| US35564KUE71 / Freddie Mac STACR REMIC Trust 2022-HQA1 | 5.44 | -1.16 | 0.5165 | -0.0203 | |||||

| US20754DAJ63 / Connecticut Avenue Securities Trust 2022-R05 | 5.43 | -0.98 | 0.5153 | -0.0193 | |||||

| US207942AC73 / Fannie Mae Connecticut Avenue Securities | 5.39 | -1.32 | 0.5119 | -0.0210 | |||||

| US35564KWA32 / Freddie Mac STACR REMIC Trust, Series 2022-DNA3, Class B1 | 5.36 | -0.91 | 0.5085 | -0.0186 | |||||

| US35564KLV97 / Freddie Mac STACR REMIC Trust 2021-DNA6 | 5.33 | -1.19 | 0.5059 | -0.0201 | |||||

| US20754EAF25 / Connecticut Avenue Securities Trust, Series 2023-R06, Class 1B1 | 5.27 | -1.12 | 0.5005 | -0.0194 | |||||

| US20754LAJ89 / Connecticut Avenue Securities Trust, Series 2022-R01, Class 1B2 | 5.26 | -0.64 | 0.4990 | -0.0169 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 5.20 | 0.4934 | 0.4934 | ||||||

| US36263NBM65 / GS Mortgage-Backed Securities Trust 2022-PJ1 | 5.13 | -3.32 | 0.4869 | -0.0304 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 5.10 | 0.4838 | 0.4838 | ||||||

| US20753XAJ37 / Connecticut Avenue Securities Trust 2022-R03 | 5.06 | 10.73 | 0.4798 | 0.0346 | |||||

| US20754AAJ25 / Connecticut Avenue Securities Trust 2021-R03 | 5.04 | -0.59 | 0.4786 | -0.0160 | |||||

| JETD / MAX Airlines -3X Inverse Leveraged ETNs due May 28, 2043 - Structured Product | 5.00 | 0.4748 | 0.4748 | ||||||

| Carvana Auto Receivables Trust 2024-N3 / ABS-O (US14687WAE03) | 4.97 | -0.66 | 0.4719 | -0.0161 | |||||

| Bank of America Corp / DBT (US06055HAH66) | 4.88 | 0.4627 | 0.4627 | ||||||

| US20754MAL19 / CAS_22-R07 | 4.71 | -1.73 | 0.4469 | -0.0202 | |||||

| Zayo Issuer LLC / ABS-O (US98919WAA18) | 4.52 | 196.65 | 0.4290 | 0.2804 | |||||

| P2OD34 / Insulet Corporation - Depositary Receipt (Common Stock) | 3.99 | -0.18 | 0.3788 | -0.0110 | |||||

| Lyra Music Assets Delaware LP / ABS-O (US552339AA18) | 3.93 | -2.26 | 0.3734 | -0.0191 | |||||

| US46655LAV62 / J.P. Morgan Mortgage Trust 2022-LTV2 | 3.90 | -2.18 | 0.3704 | -0.0186 | |||||

| US26929HAB15 / EWC Master Issuer LLC | 3.81 | -0.55 | 0.3618 | -0.0120 | |||||

| US35564KB324 / Freddie Mac Structured Agency Credit Risk Debt Notes | 3.80 | -22.14 | 0.3610 | -0.1153 | |||||

| Connecticut Avenue Securities Trust 2023-R02 / ABS-CBDO (US20755AAE29) | 3.74 | -2.76 | 0.3544 | -0.0200 | |||||

| US05547HAN17 / BBCMS Trust 2015-SRCH | 3.66 | 1.44 | 0.3470 | -0.0044 | |||||

| Broadstreet Partners, Inc., Term Loan B4 / LON (US11132VAY56) | 3.65 | 37.53 | 0.3464 | 0.0876 | |||||

| Javelin Buyer, Inc., First Lien Term Loan / LON (US47189BAC37) | 3.51 | 0.3332 | 0.3332 | ||||||

| BAMLL Trust 2025-ASHF / ABS-MBS (US05494CAC91) | 3.49 | -0.60 | 0.3315 | -0.0111 | |||||

| Bank of America Corp / DBT (US06051GMQ90) | 3.48 | -1.22 | 0.3302 | -0.0132 | |||||

| US46645JBG67 / JPMBB Commercial Mortgage Securities Trust 2015-C33 | 3.41 | 51.31 | 0.3236 | 0.1038 | |||||

| US91835CAA18 / VR FUNDING LLC | 3.31 | -2.33 | 0.3141 | -0.0163 | |||||

| Brex Commercial Charge Card Master Trust / ABS-O (US05601DAF06) | 3.26 | -0.46 | 0.3094 | -0.0098 | |||||

| US12659TBQ76 / Credit Suisse Mortgage Capital Certificates | 3.24 | -2.27 | 0.3071 | -0.0157 | |||||

| Planet US Buyer LLC, Term Loan B / LON (US72706RAB24) | 3.22 | 1,404.21 | 0.3055 | 0.2846 | |||||

| NYCT Trust 2024-3ELV / ABS-MBS (US62956HAE62) | 3.18 | -1.36 | 0.3022 | -0.0125 | |||||

| N1WG34 / NatWest Group plc - Depositary Receipt (Common Stock) | 3.18 | -0.44 | 0.3018 | -0.0095 | |||||

| US12594PBB67 / CSMC Trust 2016-NXSR | 3.12 | 0.2957 | 0.2957 | ||||||

| US25470MAG42 / DISH Network Corp | 3.10 | -2.21 | 0.2937 | -0.0149 | |||||

| Wells Fargo Commercial Mortgage Trust 2024-C63 / ABS-MBS (US94990FAH47) | 3.05 | -34.84 | 0.2899 | -0.1671 | |||||

| Houston Galleria Mall Trust 2025-HGLR / ABS-MBS (US44216XAA37) | 3.04 | -1.68 | 0.2880 | -0.0130 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 3.02 | -1.21 | 0.2870 | -0.0114 | |||||

| US36255NAZ87 / GS Mortgage Securities Trust 2018-GS9 | 3.01 | 0.2861 | 0.2861 | ||||||

| Legends Outlets Kansas City KS Mortgage Secured Pass-Through Trust / ABS-MBS (US524947AB44) | 3.01 | -1.22 | 0.2853 | -0.0113 | |||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | 2.98 | 0.2826 | 0.2826 | ||||||

| US38384CKS79 / Government National Mortgage Association | 2.94 | -6.01 | 0.2792 | -0.0259 | |||||

| US12595VAG23 / COMM 2018-COR3 Mortgage Trust | 2.90 | -4.91 | 0.2756 | -0.0221 | |||||

| US12529MAL28 / Cantor Commercial Real Estate Lending 2019-CF1 | 2.90 | 0.2751 | 0.2751 | ||||||

| US225638AA35 / Crescendo Royalty Funding LP | 2.89 | -0.14 | 0.2747 | -0.0078 | |||||

| US05549RAC16 / BARCLAYS COMMERCIAL MORTGAGE S BBCMS 2018 CBM B 144A | 2.88 | -1.61 | 0.2728 | -0.0121 | |||||

| US949746TD35 / Wells Fargo & Co | 2.86 | 0.42 | 0.2709 | -0.0063 | |||||

| US91823AAY73 / VB-S1 Issuer LLC - VBTEL | 2.85 | -1.86 | 0.2706 | -0.0126 | |||||

| US08162PBB67 / BENCHMARK 2018-B1 Mortgage Trust | 2.85 | -3.75 | 0.2702 | -0.0181 | |||||

| Horizon Aircraft Finance IV Ltd / ABS-O (US43990EAA91) | 2.83 | 0.2688 | 0.2688 | ||||||

| US12593QBJ85 / COMM 2015-CCRE26 Mortgage Trust | 2.80 | 0.61 | 0.2661 | -0.0056 | |||||

| US29429CAG06 / COMMERCIAL MORTGAGE BACKED SECURITIES | 2.80 | 0.2656 | 0.2656 | ||||||

| US720198AG56 / Piedmont Operating Partnership LP | 2.76 | -0.04 | 0.2620 | -0.0073 | |||||

| US411707AH55 / Hardee's Funding LLC | 2.74 | -0.62 | 0.2597 | -0.0087 | |||||

| US483548AF00 / Kaman Corp Bond | 2.73 | -0.11 | 0.2588 | -0.0074 | |||||

| US08161CAL54 / BENCHMARK 2018-B2 Mortgage Trust | 2.70 | 25.17 | 0.2558 | 0.0459 | |||||

| US05463HAC51 / AXIS Specialty Finance LLC | 2.69 | 0.37 | 0.2553 | -0.0060 | |||||

| Centersquare Issuer LLC / ABS-O (US15201EAB02) | 2.66 | 0.49 | 0.2521 | -0.0056 | |||||

| US36266CAA45 / GS Mortgage Securities Corp II | 2.59 | 0.27 | 0.2461 | -0.0061 | |||||

| US097023CW33 / BOEING CO 5.805 5/50 | 2.58 | 2.71 | 0.2444 | -0.0001 | |||||

| Rogers Communications Inc / DBT (US775109DH13) | 2.55 | -0.43 | 0.2417 | -0.0077 | |||||

| US05971KAQ22 / Banco Santander SA | 2.53 | -0.71 | 0.2400 | -0.0083 | |||||

| Consolidated Communications LLC/Fidium Fiber Finance Holdco LLC / ABS-O (US209031AA16) | 2.53 | 0.2398 | 0.2398 | ||||||

| Brightline East LLC / DBT (US093536AA89) | 2.52 | -21.27 | 0.2391 | -0.0729 | |||||

| US69689QAG01 / Palmer Square CLO Ltd., Series 2022-1A, Class D | 2.51 | -0.52 | 0.2379 | -0.0078 | |||||

| US46593EAJ47 / JP Morgan Chase Commercial Mortgage Securities Corp | 2.51 | -0.12 | 0.2377 | -0.0068 | |||||

| US12567WAJ80 / CIFC Funding 2022-IV Ltd | 2.51 | -0.56 | 0.2377 | -0.0079 | |||||

| BX Commercial Mortgage Trust 2024-BRBK / ABS-MBS (US05613NAJ63) | 2.50 | 24.08 | 0.2376 | 0.0409 | |||||

| Mission Lane Credit Card Master Trust / ABS-O (US60510MBP23) | 2.50 | 0.2372 | 0.2372 | ||||||

| Wells Fargo Commercial Mortgage Trust 2025-DWHP / ABS-MBS (US95004EAE59) | 2.50 | 0.2369 | 0.2369 | ||||||

| Les Schwab Tire Centers, Term Loan B / LON (US50220KAD63) | 2.50 | -0.52 | 0.2368 | -0.0078 | |||||

| Barnes Group Inc, Term Loan B / LON (US38021CAC29) | 2.49 | 0.00 | 0.2367 | -0.0064 | |||||

| Drive Auto Receivables Trust 2024-2 / ABS-O (US26207AAF03) | 2.49 | -0.48 | 0.2359 | -0.0076 | |||||

| Boxer Parent Company Inc., Term Loan B / LON (US05988HAQ02) | 2.49 | -0.52 | 0.2359 | -0.0077 | |||||

| US514666AK27 / LAND O'LAKES INC 8% /PERP/ | 2.48 | -2.32 | 0.2357 | -0.0122 | |||||

| US29273VAM28 / Energy Transfer LP | 2.48 | 0.2354 | 0.2354 | ||||||

| US91087BAQ32 / Mexico Government International Bond | 2.46 | -3.31 | 0.2331 | -0.0146 | |||||

| ESGRF / Enstar Group Limited - Preferred Stock | 2.45 | 0.2329 | 0.2329 | ||||||

| PCG.PRX / PG&E Corporation - Preferred Security | 2.45 | -0.89 | 0.2323 | -0.0086 | |||||

| Bojangles Issuer LLC / ABS-O (US09748RAC25) | 2.44 | 0.04 | 0.2319 | -0.0062 | |||||

| Petronas Capital Ltd / DBT (US716743AW96) | 2.43 | 0.2308 | 0.2308 | ||||||

| US68373BAE11 / OPEN Trust 2023-AIR | 2.41 | -0.45 | 0.2286 | -0.0073 | |||||

| Blue Stream Issuer LLC / ABS-O (US09606BAG95) | 2.40 | -0.91 | 0.2279 | -0.0083 | |||||

| US90276XBA28 / UBS Commercial Mortgage Trust 2018-C11 | 2.38 | 0.80 | 0.2262 | -0.0043 | |||||

| Cotiviti Corporation, Term Loan / LON (US22164MAB37) | 2.38 | 0.25 | 0.2262 | -0.0056 | |||||

| FNA 8 LLC / ABS-O (US30340WAA36) | 2.37 | 0.2244 | 0.2244 | ||||||

| US17326FAK30 / CGCMT 2017 C4 C | 2.36 | 0.64 | 0.2243 | -0.0046 | |||||

| US90276EAJ64 / UBSCM 2017 C1 B | 2.35 | 0.2233 | 0.2233 | ||||||

| US902613BE74 / UBS Group AG | 2.35 | -1.38 | 0.2232 | -0.0092 | |||||

| ENT / Entain Plc | 2.35 | -0.09 | 0.2231 | -0.0062 | |||||

| US87342RAH75 / TACO BELL FUNDING LLC BELL 2021-1A A2II | 2.34 | 0.39 | 0.2221 | -0.0052 | |||||

| Exeter Automobile Receivables Trust 2024-5 / ABS-O (US30165BAF04) | 2.34 | -0.47 | 0.2218 | -0.0071 | |||||

| US19521UAA16 / Cologix Data Centers US Issuer LLC | 2.32 | 1.09 | 0.2198 | -0.0036 | |||||

| US08162YAJ10 / Benchmark 2019-B14 Mortgage Trust, Series 2019-B14, Class C | 2.28 | -4.40 | 0.2166 | -0.0162 | |||||

| EUSHI Finance Inc / DBT (US29882DAB91) | 2.27 | -2.28 | 0.2159 | -0.0110 | |||||

| US38382ET646 / Government National Mortgage Association | 2.26 | -3.66 | 0.2146 | -0.0143 | |||||

| US055742AA88 / BSST MORTGAGE TRUST BSST 2022 1700 A 144A | 2.25 | 0.81 | 0.2138 | -0.0041 | |||||

| US065402BH15 / BANK 2019-BNK18 | 2.25 | 0.94 | 0.2131 | -0.0037 | |||||

| US95001CAA09 / Wells Fargo Commercial Mortgage Trust 2017-SMP | 2.24 | 0.2122 | 0.2122 | ||||||

| Wand NewCo 3, Inc., Repriced Term Loan B / LON (US93369PAM68) | 2.24 | -1.80 | 0.2121 | -0.0098 | |||||

| US466317AN46 / J.P. Morgan Chase Commercial Mortgage Securities Trust 2022-NLP | 2.23 | -4.86 | 0.2121 | -0.0169 | |||||

| Dominican Republic International Bond / DBT (US25714PFB94) | 2.23 | 0.2118 | 0.2118 | ||||||

| US02343UAG04 / Amcor Finance USA Inc | 2.23 | 0.18 | 0.2114 | -0.0054 | |||||

| Affirm Asset Securitization Trust 2024-B / ABS-O (US00835AAC27) | 2.18 | -0.86 | 0.2073 | -0.0075 | |||||

| Centersquare Issuer LLC / ABS-O (US15201EAA29) | 2.18 | -0.37 | 0.2069 | -0.0064 | |||||

| XS2384704800 / NIGERIA GOVERNMENT INTERNATIONAL BOND MTN 8.250000% 09/28/2051 | 2.15 | -4.10 | 0.2040 | -0.0146 | |||||

| US92556HAE71 / Paramount Global | 2.14 | 0.61 | 0.2027 | -0.0043 | |||||

| US12555QAW69 / CIFC Funding 2020-I Ltd | 2.13 | -0.09 | 0.2025 | -0.0058 | |||||

| US12543DBN93 / CHS/Community Health Systems Inc | 2.13 | 4.21 | 0.2023 | 0.0028 | |||||

| SREIT Trust 2021-PALM / ABS-MBS (US85237AAG85) | 2.13 | 0.33 | 0.2020 | -0.0049 | |||||

| US195325CU73 / Colombia Government International Bond | 2.11 | -5.07 | 0.2006 | -0.0165 | |||||

| D1OM34 / Dominion Energy, Inc. - Depositary Receipt (Common Stock) | 2.10 | -0.43 | 0.1994 | -0.0063 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 2.09 | -0.71 | 0.1979 | -0.0068 | |||||

| US91823AAU51 / VB-S1 Issuer LLC - VBTEL | 2.08 | 0.73 | 0.1969 | -0.0039 | |||||

| US12655TBR95 / COMM 2019-GC44 Mortgage Trust | 2.07 | 20.47 | 0.1966 | 0.0289 | |||||

| BPR 2023-STON Mortgage Trust / ABS-MBS (US05593GAE61) | 2.07 | -0.14 | 0.1963 | -0.0056 | |||||

| BANK5 2024-5YR5 / ABS-MBS (US065931BM83) | 2.06 | -0.96 | 0.1956 | -0.0073 | |||||

| US006346AW02 / Adams Outdoor Advertising LP | 2.05 | -0.44 | 0.1945 | -0.0062 | |||||

| US38141GA385 / GOLDMAN SACHS GROUP INC REGD V/R /PERP/ SER W 7.50000000 | 2.04 | -1.30 | 0.1940 | -0.0079 | |||||

| Arcos Dorados BV / DBT (US03965TAC71) | 2.04 | -0.20 | 0.1935 | -0.0057 | |||||

| US59170JAA60 / MetroNet Infrastructure Issuer LLC | 2.03 | -0.54 | 0.1928 | -0.0063 | |||||

| ITUB3 / Itaú Unibanco Holding S.A. - Depositary Receipt (Common Stock) | 2.03 | 0.84 | 0.1925 | -0.0036 | |||||

| US35910EAA29 / Frontier Issuer LLC | 2.03 | -0.59 | 0.1925 | -0.0065 | |||||

| US46644YBB56 / JPMBB 15-C31 C 4.61737% 08-15-48/25 | 2.03 | 0.00 | 0.1922 | -0.0053 | |||||

| US816851BK46 / Sempra Energy | 2.02 | 0.05 | 0.1919 | -0.0052 | |||||

| HTL Commercial Mortgage Trust 2024-T53 / ABS-MBS (US404300AE54) | 2.02 | -1.46 | 0.1918 | -0.0082 | |||||

| US20633KAA60 / Concord Music Royalties LLC | 2.01 | -0.89 | 0.1910 | -0.0070 | |||||

| S1TT34 / State Street Corporation - Depositary Receipt (Common Stock) | 2.01 | -0.20 | 0.1908 | -0.0055 | |||||

| US38410JAC62 / GRACIE POINT INTERNATIONAL FUNDING 2023-2 | 2.01 | -0.84 | 0.1903 | -0.0068 | |||||

| US682051AF48 / Oman Government International Bond | 2.01 | -4.52 | 0.1903 | -0.0144 | |||||

| Ivory Coast Government International Bond / DBT (US221625AU01) | 2.00 | 87.37 | 0.1901 | 0.0858 | |||||

| US19075QAC69 / Cobank Acb Bond | 2.00 | 0.05 | 0.1900 | -0.0050 | |||||

| TX Trust 2024-HOU / ABS-MBS (US90216DAG79) | 2.00 | -0.60 | 0.1899 | -0.0064 | |||||

| AssuredPartners, Inc., Incremental Term Loan B5 / LON (US04621HAW34) | 2.00 | 0.1898 | 0.1898 | ||||||

| US81527CAP23 / Sedgwick Claims Management Services Inc | 2.00 | 0.1898 | 0.1898 | ||||||

| US36251XAY31 / GS Mortgage Securities Trust | 2.00 | 1.47 | 0.1898 | -0.0024 | |||||

| IP 2025-IP Mortgage Trust / ABS-MBS (US449843AL54) | 2.00 | 0.1898 | 0.1898 | ||||||

| US61747YET82 / Morgan Stanley | 2.00 | 0.1898 | 0.1898 | ||||||

| Windfall Mining Group Inc / Groupe Minier Windfall Inc / DBT (US973244AA44) | 2.00 | 0.1894 | 0.1894 | ||||||

| US17326DAH52 / Citigroup Commercial Mortgage Trust 2017-P8 | 1.99 | 0.1893 | 0.1893 | ||||||

| XS1632632037 / Ivory Coast Government International Bond | 1.99 | 88.36 | 0.1890 | 0.0859 | |||||

| US08160KAK07 / Benchmark Mortgage Trust | 1.99 | -0.55 | 0.1889 | -0.0062 | |||||

| South Bow Canadian Infrastructure Holdings Ltd / DBT (US836720AH56) | 1.99 | -3.21 | 0.1886 | -0.0116 | |||||

| US89832QAD16 / Truist Financial Corp | 1.99 | -0.15 | 0.1886 | -0.0055 | |||||

| BANK 2024-BNK48 / ABS-MBS (US06541GAH02) | 1.98 | 0.1881 | 0.1881 | ||||||

| US126307BM89 / CSC Holdings LLC | 1.98 | 1.70 | 0.1878 | -0.0019 | |||||

| US12636FBP71 / COMM 2015-LC23 Mortgage Trust | 1.96 | 0.56 | 0.1862 | -0.0040 | |||||

| Wells Fargo Commercial Mortgage Trust 2015-P2 / ABS-MBS (US95000ABA43) | 1.95 | 0.05 | 0.1853 | -0.0050 | |||||

| US36266CAL00 / GS Mortgage Securities Corp II | 1.95 | -1.51 | 0.1853 | -0.0080 | |||||

| US48128BAN10 / JPMORGAN CHASE and CO 3.65/VAR PERP | 1.95 | -0.10 | 0.1851 | -0.0052 | |||||

| XAC0787FAB85 / Bausch + Lomb Corp | 1.94 | -0.26 | 0.1842 | -0.0055 | |||||

| US78396YAA10 / Sesac Finance LLC | 1.94 | -0.82 | 0.1839 | -0.0066 | |||||

| Parexel International Corporation, Term Loan B / LON (US71911KAE47) | 1.93 | -0.36 | 0.1834 | -0.0057 | |||||

| P1DT34 / Prudential Financial, Inc. - Depositary Receipt (Common Stock) | 1.93 | -0.92 | 0.1830 | -0.0067 | |||||

| US37045XCA28 / General Motors Finl Co Bond | 1.93 | 76.93 | 0.1827 | 0.0158 | |||||

| Ardonagh Group Finance Ltd / DBT (US039956AA59) | 1.92 | -0.47 | 0.1819 | -0.0059 | |||||

| TRT061124T11 / Turkey Government Bond | 1.91 | 70.20 | 0.1816 | 0.0720 | |||||

| US693475BC86 / PNC Financial Services Group Inc/The | 1.90 | 0.26 | 0.1806 | -0.0044 | |||||

| US69356GAA76 / PKHL Commercial Mortgage Trust, Series 2021-MF, Class A | 1.89 | -1.41 | 0.1796 | -0.0075 | |||||

| US17323VBD64 / Citigroup Commercial Mortgage Trust 2015-GC29 | 1.89 | -29.34 | 0.1792 | -0.0813 | |||||

| Affirm Asset Securitization Trust 2024-B / ABS-O (US00835AAD00) | 1.89 | -0.89 | 0.1790 | -0.0066 | |||||

| Venture Global LNG Inc / DBT (US92332YAF88) | 1.89 | -7.28 | 0.1790 | -0.0193 | |||||

| US98919VAA35 / Front Range BidCo Inc | 1.88 | -0.27 | 0.1785 | -0.0054 | |||||

| US17290XAW02 / Citigroup Commercial Mortgage Trust | 1.85 | 0.82 | 0.1760 | -0.0034 | |||||

| US445545AF36 / Hungary Government International Bond | 1.83 | -4.14 | 0.1736 | -0.0125 | |||||

| US452760AD32 / IMPRL_20-NQM1 | 1.83 | 0.50 | 0.1735 | -0.0038 | |||||

| US75606DAS09 / CORP. NOTE | 1.83 | -1.08 | 0.1734 | -0.0067 | |||||

| VSTWF / Vast Renewables Limited - Equity Warrant | 1.83 | 0.33 | 0.1733 | -0.0042 | |||||

| US513075BW03 / Lamar Media Corp | 1.82 | 4.97 | 0.1724 | 0.0037 | |||||

| US38384B2S90 / Government National Mortgage Association | 1.81 | -6.90 | 0.1717 | -0.0178 | |||||

| US55037LAA26 / LUNRR 2020 1A A 144A | 1.80 | -3.11 | 0.1712 | -0.0104 | |||||

| US05530SAL07 / BAMLL Commercial Mortgage Securities Trust 2022-DKLX | 1.80 | -0.17 | 0.1707 | -0.0050 | |||||

| US83546DAG34 / Sonic Capital LLC | 1.79 | -0.06 | 0.1701 | -0.0047 | |||||

| US78458MAG96 / SMR 2022-IND Mortgage Trust | 1.79 | 0.28 | 0.1699 | -0.0042 | |||||

| USP1507SAG23 / Banco Santander Mexico SA Institucion de Banca Multiple Grupo Financiero Santand | 1.79 | -0.22 | 0.1694 | -0.0050 | |||||

| USP3143NBK92 / Corp Nacional del Cobre de Chile | 1.78 | -1.22 | 0.1693 | -0.0068 | |||||

| US12547LAU26 / CIFC Funding 2020-II Ltd | 1.77 | 0.00 | 0.1677 | -0.0045 | |||||

| US035198AF76 / Angolan Government International Bond | 1.76 | 87.95 | 0.1673 | 0.0759 | |||||

| US172967PE54 / Citigroup, Inc., 7.625%, due 11/15/2028 | 1.76 | -0.45 | 0.1668 | -0.0054 | |||||

| US05946KAM36 / Banco Bilbao Vizcaya Argentaria SA | 1.76 | -0.34 | 0.1666 | -0.0052 | |||||

| US05608WAN48 / BX Trust | 1.75 | 0.1663 | 0.1663 | ||||||

| Bank of America Corp / DBT (US06051GML04) | 1.75 | -42.85 | 0.1661 | -0.1324 | |||||

| US12594PBA84 / CSMC Trust 2016-NXSR | 1.75 | 0.98 | 0.1657 | -0.0028 | |||||

| US28249NAA90 / EIG PEARL HOLDINGS SARL 3.545% 08/31/2036 144A | 1.74 | -0.57 | 0.1654 | -0.0055 | |||||

| FCT / Fincantieri S.p.A. | 1.74 | -5.39 | 0.1650 | -0.0141 | |||||

| US038461AM14 / Egypt Government International Bond | 1.73 | -3.08 | 0.1642 | -0.0098 | |||||

| Proampac PG Borrower LLC, Term Loan / LON (US74274NAL73) | 1.73 | -0.40 | 0.1641 | -0.0051 | |||||

| US89356BAE83 / Transcanada Trust | 1.72 | 0.00 | 0.1629 | -0.0044 | |||||

| TRGP / Targa Resources Corp. | 1.71 | 20.56 | 0.1625 | 0.0167 | |||||

| US465968AL91 / JPMCC Commercial Mortgage Securities Trust 2017-JP7 | 1.66 | 49.95 | 0.1579 | 0.0497 | |||||

| US12592XBJ46 / COMM 2015-CCRE22 Mortgage Trust | 1.66 | 1.35 | 0.1572 | -0.0021 | |||||

| US08160JAH05 / Benchmark Mortgage Trust | 1.66 | 0.1571 | 0.1571 | ||||||

| US715638CE05 / REPUBLIC OF PERU SR UNSECURED REGS 02/29 5.94 | 1.65 | -4.06 | 0.1570 | -0.0110 | |||||

| IL0069508369 / Mizrahi Tefahot Bank Ltd | 1.65 | 0.67 | 0.1564 | -0.0032 | |||||

| US018820AC48 / ALLIANZ SE | 1.65 | -1.50 | 0.1562 | -0.0068 | |||||

| US42225UAL89 / Healthcare Realty Holdings LP | 1.65 | -0.24 | 0.1561 | -0.0046 | |||||

| US47987EAC12 / JONAH ENERGY ABS I LLC JONAH 2022-1 A1 | 1.64 | -9.53 | 0.1559 | -0.0211 | |||||

| US64135GAJ76 / Neuberger Berman CLO Ltd | 1.63 | -0.55 | 0.1546 | -0.0051 | |||||

| US48128KAZ49 / JPMCC Commercial Mortgage Securities Trust, Series 2017-JP6, Class C | 1.63 | 0.62 | 0.1542 | -0.0033 | |||||

| US281020AS67 / Edison International | 1.60 | -1.11 | 0.1518 | -0.0059 | |||||

| Honduras Government International Bond / DBT (US438180AK75) | 1.60 | 2.96 | 0.1517 | 0.0004 | |||||

| US20754MCB19 / Connecticut Avenue Securities Trust 2022-R07 | 1.60 | -1.05 | 0.1516 | -0.0058 | |||||

| Truist Insurance Holdings LLC, Term Loan B / LON (US89788VAG77) | 1.59 | -0.13 | 0.1513 | -0.0044 | |||||

| US05565AS207 / BNP Paribas SA | 1.59 | -0.99 | 0.1512 | -0.0057 | |||||

| US020564AD27 / Alpek SAB de CV | 1.59 | -0.13 | 0.1511 | -0.0043 | |||||

| Benchmark Mortgage Trust Series - 2019 B12 (Class C) / ABS-MBS (US08162FAJ21) | 1.59 | -3.76 | 0.1506 | -0.0102 | |||||

| US46652BBE83 / JP Morgan Chase Commercial Mortgage Securities Trust 2020-NNN | 1.57 | 97.24 | 0.1492 | 0.0715 | |||||

| Charter Communications Operating LLC / Charter Communications Operating Capital / DBT (US161175CR30) | 1.57 | 0.97 | 0.1489 | -0.0026 | |||||

| BMO 2024-C9 Mortgage Trust / ABS-MBS (US05593MAJ27) | 1.57 | 0.1487 | 0.1487 | ||||||

| US168863DS48 / Chile Government International Bond | 1.56 | -1.51 | 0.1482 | -0.0063 | |||||

| US040114HT09 / Argentine Republic Government International Bond | 1.56 | 6.19 | 0.1481 | 0.0048 | |||||

| B00FM5901 / BANCO BRADESCO SA PREFERENCE | 1.56 | 1.56 | 0.1479 | -0.0017 | |||||

| US446150AT18 / HUNTINGTON BANCSHARES INC 5.625/VAR PERP | 1.56 | 0.84 | 0.1476 | -0.0027 | |||||

| US01449NAJ54 / Alen 2021-ACEN Mortgage Trust | 1.55 | -1.40 | 0.1474 | -0.0061 | |||||

| US817477AH51 / Serbia International Bond | 1.55 | -1.09 | 0.1469 | -0.0057 | |||||

| 4020 / Saudi Real Estate Company | 1.55 | 0.72 | 0.1469 | -0.0030 | |||||

| US438180AJ03 / Honduras Government International Bond | 1.55 | 3.34 | 0.1467 | 0.0008 | |||||

| US207942AD56 / Connecticut Avenue Securities Trust 2023-R05 | 1.54 | -2.71 | 0.1466 | -0.0082 | |||||

| UZBEK / Republic of Uzbekistan International Bond | 1.54 | 0.78 | 0.1465 | -0.0028 | |||||

| US17323VBE48 / Citigroup Commercial Mortgage Trust 2015-GC29 | 1.54 | -4.23 | 0.1463 | -0.0106 | |||||

| Queen MergerCo Inc / DBT (US74825NAA54) | 1.54 | 0.1459 | 0.1459 | ||||||

| Prime Healthcare Services Inc / DBT (US74165HAC25) | 1.53 | 7.35 | 0.1456 | 0.0062 | |||||

| US95002YAA10 / Wells Fargo & Co | 1.53 | 0.13 | 0.1456 | -0.0037 | |||||

| US92538GAD43 / Verus Securitization Trust | 1.53 | -2.61 | 0.1452 | -0.0079 | |||||

| US95000MBV28 / Wells Fargo Commercial Mortgage Trust 2016-C36 | 1.53 | 0.1448 | 0.1448 | ||||||

| Uniti Fiber Abs Issuer Llc / ABS-O (US91326EAA38) | 1.52 | -0.78 | 0.1445 | -0.0052 | |||||

| Windstream Escrow LLC / Windstream Escrow Finance Corp / DBT (US97381AAA07) | 1.52 | 0.66 | 0.1442 | -0.0029 | |||||

| Hertz Vehicle Financing III LLC / ABS-O (US42806MCM91) | 1.52 | -1.30 | 0.1440 | -0.0058 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 1.52 | 0.1440 | 0.1440 | ||||||

| US12593ABF12 / COMM 2015-CCRE23 Mortgage Trust | 1.52 | -29.16 | 0.1439 | -0.0648 | |||||

| Zayo Issuer LLC / ABS-O (US98919WAE30) | 1.52 | -2.26 | 0.1438 | -0.0073 | |||||

| PTPP / PT PP (Persero) Tbk | 1.52 | 0.1438 | 0.1438 | ||||||

| Hungary Government International Bond / DBT (US445545AU03) | 1.51 | 0.1437 | 0.1437 | ||||||

| Elmwood CLO 26 Ltd / ABS-O (US29004CAJ71) | 1.51 | -1.37 | 0.1436 | -0.0059 | |||||

| US06055HAB96 / Bank of America Corp | 1.51 | -0.53 | 0.1433 | -0.0047 | |||||

| US05610DAC65 / BX Trust | 1.51 | -0.20 | 0.1433 | -0.0042 | |||||

| Omnis Funding Trust / DBT (US68218WAA27) | 1.51 | 0.1432 | 0.1432 | ||||||

| Compass Datacenters Issuer III LLC / ABS-O (US20469BAA52) | 1.51 | -1.18 | 0.1431 | -0.0056 | |||||

| Subway Funding LLC / ABS-O (US864300AA61) | 1.51 | -1.44 | 0.1430 | -0.0061 | |||||

| Continuum Green Energy India Pvt / Co-Issuers / DBT (US89629LAA52) | 1.51 | -1.44 | 0.1430 | -0.0061 | |||||

| Mars Inc / DBT (US571676AX38) | 1.51 | 0.1430 | 0.1430 | ||||||

| Citibank NA / DBT (US17325FBN78) | 1.50 | 0.1425 | 0.1425 | ||||||

| US449652AC06 / ILPT Commercial Mortgage Trust 2022-LPF2 | 1.50 | 0.07 | 0.1424 | -0.0038 | |||||

| Vitality Re XVI Ltd / DBT (US92849FAA66) | 1.50 | 0.00 | 0.1424 | -0.0039 | |||||

| Panama Government International Bond / DBT (US698299BY91) | 1.50 | -0.99 | 0.1422 | -0.0053 | |||||

| US744320BK76 / Prudential Financial Inc | 1.50 | -0.13 | 0.1421 | -0.0041 | |||||

| US251525AX97 / Deutsche Bank AG | 1.50 | -0.27 | 0.1420 | -0.0043 | |||||

| US55352NAL10 / MSCG Trust | 1.49 | 6.79 | 0.1418 | 0.0054 | |||||

| Mars Inc / DBT (US571676BA26) | 1.49 | 0.1418 | 0.1418 | ||||||

| US87301QAA31 / TCW CLO Ltd | 1.49 | -1.26 | 0.1412 | -0.0057 | |||||

| XS1678625515 / Republic of Azerbaijan International Bond | 1.49 | 0.1412 | 0.1412 | ||||||

| US06540BAJ89 / BANK 2019-BNK21 | 1.49 | 3.34 | 0.1411 | 0.0008 | |||||

| XS2318315921 / Asian Infrastructure Investment Bank/The | 1.49 | -0.13 | 0.1411 | -0.0041 | |||||

| S56431109 / Northam Platinum Holdings Ltd | 1.49 | 163.30 | 0.1409 | 0.0859 | |||||

| H1PE34 / Hewlett Packard Enterprise Company - Depositary Receipt (Common Stock) | 1.48 | 0.1409 | 0.1409 | ||||||

| IHS / IHS Holding Limited | 1.48 | -0.94 | 0.1405 | -0.0052 | |||||

| US91086QBB32 / Mexico Government International Bond | 1.48 | -4.21 | 0.1405 | -0.0102 | |||||

| US401494AW96 / Guatemala Government Bond | 1.48 | 193.44 | 0.1401 | 0.0910 | |||||

| OGN / Organon & Co. | 1.48 | -2.32 | 0.1401 | -0.0072 | |||||

| Windsor Holdings III, LLC, Term Loan B / LON (US97360BAH87) | 1.48 | 0.1400 | 0.1400 | ||||||

| Republic of Poland Government International Bond / DBT (US857524AH50) | 1.47 | 0.1399 | 0.1399 | ||||||

| US08163ABR32 / BMARK 2020 B18 AGNF 144A | 1.47 | 1.59 | 0.1398 | -0.0016 | |||||

| US315289AC26 / Ferrellgas Escrow LLC / FG Operating Finance Escrow Corp | 1.47 | -3.10 | 0.1396 | -0.0084 | |||||

| US15089QAM69 / Celanese US Holdings LLC | 1.47 | -36.34 | 0.1393 | -0.0855 | |||||

| US24229JAA16 / DEALER TIRE LLC/DT ISSR SR UNSECURED 144A 02/28 8 | 1.47 | 0.1391 | 0.1391 | ||||||

| US12631DBE22 / COMM 2014-CCRE17 Mortgage Trust | 1.46 | -1.22 | 0.1385 | -0.0056 | |||||

| US195325DQ52 / Colombia Government International Bond | 1.46 | -5.45 | 0.1384 | -0.0120 | |||||

| US715638DS81 / Peruvian Government International Bond | 1.45 | 85.64 | 0.1375 | 0.0613 | |||||

| US23284BAC81 / CyrusOne Data Centers Issuer I | 1.45 | -4.24 | 0.1373 | -0.0100 | |||||

| US29360AAB61 / Enstar Finance LLC | 1.44 | 0.00 | 0.1370 | -0.0038 | |||||

| US18972FAC68 / CLYDESDALE ACQUISITION HOLDINGS T/L B (HILEX POLY/ | 1.44 | -0.35 | 0.1364 | -0.0042 | |||||

| S&S Holdings LLC / DBT (US78525CAA36) | 1.43 | -4.28 | 0.1358 | -0.0099 | |||||

| US12591YBH71 / Commercial Mortgage Trust, Series 2014-UBS3, Class C | 1.43 | -0.07 | 0.1358 | -0.0039 | |||||

| US25714PED69 / Dominican Republic International Bond | 1.43 | 0.63 | 0.1357 | -0.0028 | |||||

| US85748R0096 / Dreyfus Institutional Preferred Government Plus Money Market Fund | 1.43 | -93.91 | 0.1357 | -2.1550 | |||||

| US55348UAS78 / MRCD 2019-MARK Mortgage Trust | 1.42 | -2.73 | 0.1352 | -0.0075 | |||||

| US46645LBF31 / JPMBB Commercial Mortgage Securities Trust 2016-C1 | 1.42 | 1.57 | 0.1351 | -0.0016 | |||||

| Paraguay Government International Bond / DBT (US699149AN04) | 1.42 | 108.20 | 0.1350 | 0.0684 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 1.42 | 0.1350 | 0.1350 | ||||||

| Flagstar Mortgage Trust 2021-11INV / ABS-CBDO (US33851TBU07) | 1.42 | -3.72 | 0.1350 | -0.0090 | |||||

| US25159XAD57 / Development Bank of Kazakhstan JSC | 1.42 | -1.73 | 0.1350 | -0.0062 | |||||

| Benin Government International Bond / DBT (US08205QAA67) | 1.42 | -2.74 | 0.1348 | -0.0076 | |||||

| US36321PAB67 / Galaxy Pipeline Assets Bidco Ltd | 1.42 | -0.21 | 0.1347 | -0.0040 | |||||

| US46644YBA73 / JPMBB Commercial Mortgage Securities Trust 2015-C31 | 1.42 | -0.98 | 0.1344 | -0.0051 | |||||

| Grupo Aeromexico SAB de CV / DBT (US40054JAC36) | 1.42 | -4.71 | 0.1343 | -0.0105 | |||||

| US731011AW25 / Republic of Poland Government International Bond | 1.42 | 133.88 | 0.1343 | 0.0752 | |||||

| US699149AF79 / Paraguay Government International Bond | 1.41 | -3.43 | 0.1335 | -0.0085 | |||||

| US75973PAA75 / ReNew Wind Energy AP2 / ReNew Power Pvt Ltd other 9 Subsidiaries | 1.41 | -0.64 | 0.1334 | -0.0046 | |||||

| US06738EBX22 / Barclays PLC | 1.40 | 0.14 | 0.1326 | -0.0034 | |||||

| US836205AS32 / Republic of South Africa Government International Bond | 1.40 | -3.86 | 0.1324 | -0.0091 | |||||

| US361841AP42 / GLP Capital LP / GLP Financing II Inc | 1.39 | -0.29 | 0.1322 | -0.0040 | |||||

| Raizen Fuels Finance SA / DBT (US75102XAD84) | 1.39 | -2.05 | 0.1318 | -0.0064 | |||||

| AerCap Ireland Capital DAC / AerCap Global Aviation Trust / DBT (US00774MBK09) | 1.39 | -0.50 | 0.1318 | -0.0042 | |||||

| US89832QAF63 / TRUIST FINANCIAL CORP JR SUBORDINA 12/99 VAR | 1.38 | -0.29 | 0.1306 | -0.0040 | |||||

| US14576AAC62 / Cars Net Lease Mortgage Notes, Series 2020-1A, Class A3 | 1.37 | -0.15 | 0.1303 | -0.0037 | |||||

| US80413TAR05 / Saudi Government International Bond | 1.37 | -4.93 | 0.1299 | -0.0104 | |||||

| ULKER / Ülker Bisküvi Sanayi A.S. | 1.37 | 0.15 | 0.1298 | -0.0034 | |||||

| US12592XAJ54 / COMM 2015-CCRE22 Mortgage Trust | 1.36 | -1.59 | 0.1295 | -0.0057 | |||||

| US836205BE37 / Republic of South Africa Government International Bond | 1.36 | -5.22 | 0.1293 | -0.0108 | |||||

| US36252SAZ02 / GS Mortgage Securities Trust 2019-GC38 | 1.36 | 0.29 | 0.1293 | -0.0032 | |||||

| US25755TAL44 / Domino's Pizza Master Issuer LLC, Series 2019-1A, Class A2 | 1.36 | -0.44 | 0.1291 | -0.0041 | |||||

| US17328FBA21 / CGCMT 2019 GC41 C | 1.36 | 0.1289 | 0.1289 | ||||||

| Mars Inc / DBT (US571676BC81) | 1.36 | 0.1289 | 0.1289 | ||||||

| US95058XAE85 / Wendy's Funding LLC, Series 2018-1A, Class A2II | 1.35 | -0.59 | 0.1280 | -0.0043 | |||||

| US281020AT41 / Edison International | 1.34 | -2.41 | 0.1270 | -0.0067 | |||||

| US12530MAC91 / CF Hippolyta LLC, Series 2020-1, Class B1 | 1.34 | 1.06 | 0.1268 | -0.0020 | |||||

| US71643VAB18 / Petroleos Mexicanos | 1.33 | 1.53 | 0.1262 | -0.0014 | |||||

| US55977YAA64 / Magyar Export-Import Bank Zrt | 1.32 | -0.30 | 0.1254 | -0.0038 | |||||

| US00206RMT67 / AT&T Inc | 1.32 | 0.1250 | 0.1250 | ||||||

| US03217KAB44 / America Movil SAB de CV | 1.32 | -0.53 | 0.1249 | -0.0041 | |||||

| NEXT34 / NextEra Energy, Inc. - Depositary Receipt (Common Stock) | 1.31 | 0.1244 | 0.1244 | ||||||

| DBSG 2024-ALTA Mortgage Trust / ABS-MBS (US239918AG07) | 1.31 | -0.68 | 0.1243 | -0.0043 | |||||

| Elmwood CLO 20 Ltd / ABS-O (US29002AAS33) | 1.31 | -1.13 | 0.1242 | -0.0049 | |||||

| FCT / Fincantieri S.p.A. | 1.29 | -5.17 | 0.1220 | -0.0102 | |||||

| US86964WAK80 / Suzano Austria GmbH | 1.28 | 0.23 | 0.1217 | -0.0030 | |||||

| Sauer Brands Inc, Term Loan B / LON (US80536AAB89) | 1.28 | 0.1217 | 0.1217 | ||||||

| Sisecam UK PLC / DBT (US829688AB65) | 1.28 | -1.54 | 0.1211 | -0.0052 | |||||

| US97064YAA29 / Willis Engine Structured Trust VII | 1.27 | -2.68 | 0.1209 | -0.0067 | |||||

| US361841AK54 / GLP Capital LP / GLP Financing II Inc | 1.27 | 0.1208 | 0.1208 | ||||||

| US16411QAG64 / Cheniere Energy Partners LP | 1.27 | -22.58 | 0.1208 | -0.0395 | |||||

| US22113AAB17 / Cosan Ltd | 1.27 | 1.36 | 0.1201 | -0.0015 | |||||

| US12593JBL98 / COMM 2015-CCRE24 Mortgage Trust | 1.25 | 0.80 | 0.1189 | -0.0023 | |||||

| AmWINS Group, Inc., Term Loan B / LON (US03234TBA51) | 1.25 | -0.24 | 0.1183 | -0.0035 | |||||

| US833636AN33 / Sociedad Quimica y Minera de Chile SA | 1.23 | -2.53 | 0.1170 | -0.0064 | |||||

| US46645LAC19 / JPMBB Commercial Mortgage Securities Trust, Series 2016-C1, Class D1 | 1.23 | 0.57 | 0.1164 | -0.0025 | |||||

| Ghana Government International Bond / DBT (US374422AP83) | 1.23 | 500.98 | 0.1163 | 0.0964 | |||||

| Benchmark 2019-B14 Mortgage Trust / ABS-MBS (US08162YAH53) | 1.21 | -2.18 | 0.1151 | -0.0058 | |||||

| US36264FAM32 / CORP. NOTE | 1.19 | 0.59 | 0.1130 | -0.0024 | |||||

| ORCL / Oracle Corporation - Depositary Receipt (Common Stock) | 1.19 | -5.12 | 0.1127 | -0.0093 | |||||

| Duke Energy Progress LLC / DBT (US26442UAU88) | 1.18 | 0.1124 | 0.1124 | ||||||

| US87422LAV27 / Talen Energy Supply, LLC 2023 Term Loan B | 1.18 | -0.17 | 0.1123 | -0.0033 | |||||

| US77586RAC43 / Romanian Government International Bond | 1.17 | -3.46 | 0.1112 | -0.0070 | |||||

| US14576AAE29 / Cars Net Lease Mortgage Notes Series | 1.16 | 0.43 | 0.1098 | -0.0025 | |||||

| Mars Inc / DBT (US571676AY11) | 1.16 | 0.1098 | 0.1098 | ||||||

| Interstate Power and Light Co / DBT (US461070AX26) | 1.16 | 0.1098 | 0.1098 | ||||||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 1.16 | -4.31 | 0.1097 | -0.0081 | |||||

| US78347YAL74 / Rwanda International Government Bond | 1.16 | 6.94 | 0.1096 | 0.0043 | |||||

| US81720TAC99 / Senegal Government International Bond | 1.15 | -7.93 | 0.1092 | -0.0126 | |||||

| US491798AL85 / Kenya Government International Bond | 1.15 | -1.88 | 0.1091 | -0.0051 | |||||

| JP Morgan Mortgage Trust 2020-INV1 / ABS-CBDO (US46591VCA52) | 1.15 | -2.30 | 0.1091 | -0.0057 | |||||

| US06541WBC55 / BANK 2017-BNK5 | 1.15 | -0.52 | 0.1090 | -0.0035 | |||||

| US00206RMN97 / AT&T Inc | 1.15 | -13.70 | 0.1088 | -0.0207 | |||||

| US7593518852 / Reinsurance Group of America Inc | 1.14 | -1.30 | 0.1082 | -0.0044 | |||||

| R2RX34 / Regal Rexnord Corporation - Depositary Receipt (Common Stock) | 1.14 | 9.53 | 0.1080 | 0.0066 | |||||

| US105756CF53 / Brazilian Government International Bond | 1.12 | 1.17 | 0.1066 | -0.0016 | |||||

| BBVA Bancomer SA Institucion de Banca Multiple Grupo Financiero BBVA Mexico / DBT (US072912AA61) | 1.11 | -0.89 | 0.1057 | -0.0039 | |||||

| CommScope, Inc., Term Loan / LON (BL4902708) | 1.11 | 0.1056 | 0.1056 | ||||||

| XS0240295658 / Iraq International Bond | 1.11 | 0.00 | 0.1054 | -0.0029 | |||||

| US233046AN14 / DB Master Finance LLC | 1.11 | 0.00 | 0.1053 | -0.0028 | |||||

| US45605PAZ18 / Industrial DPR Funding Ltd | 1.11 | 1.00 | 0.1051 | -0.0017 | |||||

| US12510HAH30 / CARS-DB4 LP | 1.11 | -0.09 | 0.1050 | -0.0030 | |||||

| US69377FAB22 / Freeport Indonesia PT | 1.11 | -1.07 | 0.1049 | -0.0040 | |||||

| PAL634445XA3 / Panama Bonos del Tesoro | 1.10 | -0.36 | 0.1043 | -0.0032 | |||||

| US90385KAJ07 / BANK LOAN NOTE | 1.09 | -0.09 | 0.1038 | -0.0029 | |||||

| US63875FAL04 / Natixis Commercial Mortgage Securities Trust | 1.08 | 0.74 | 0.1027 | -0.0021 | |||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 1.08 | -1.19 | 0.1026 | -0.0041 | |||||

| Ziply Fiber Issuer LLC / ABS-O (US98979QAE35) | 1.07 | -1.11 | 0.1017 | -0.0040 | |||||

| US83438LAC54 / Lunar 2021-1 Structured Aircraft Portfolio Notes | 1.07 | -6.87 | 0.1017 | -0.0104 | |||||

| US61771MAZ32 / MORGAN STANLEY CAPITAL I TRUST 2019-H7 SER 2019-H7 CL AS REGD 3.52400000 | 1.07 | -0.37 | 0.1016 | -0.0032 | |||||

| US35566CBD65 / Freddie Mac STACR REMIC Trust 2020-DNA6 | 1.07 | -1.65 | 0.1016 | -0.0045 | |||||

| US530371AA13 / Liberty Costa Rica Senior Secured Finance | 1.07 | -1.39 | 0.1013 | -0.0042 | |||||

| US233046AQ45 / DB Master Finance LLC | 1.06 | -0.56 | 0.1009 | -0.0033 | |||||

| US204429AA25 / Cia Cervecerias Unidas SA | 1.05 | 1.45 | 0.0999 | -0.0012 | |||||

| US35910EAC84 / Frontier Issuer, LLC 11.5%, Due 08/20/2053 | 1.05 | -1.31 | 0.0999 | -0.0040 | |||||

| US44148JAB52 / Hotwire Funding LLC | 1.05 | 0.29 | 0.0999 | -0.0024 | |||||

| USP3143NBK92 / Corp Nacional del Cobre de Chile | 1.05 | -1.50 | 0.0996 | -0.0043 | |||||

| US031162DT45 / Amgen Inc | 1.05 | -4.99 | 0.0994 | -0.0082 | |||||

| US07336UAA16 / BBVA Bancomer SA/Texas | 1.04 | -1.14 | 0.0988 | -0.0039 | |||||

| US05971PAB40 / Banco Mercantil del Norte SA/Grand Cayman | 1.04 | 0.00 | 0.0988 | -0.0027 | |||||

| Ziply Fiber Issuer LLC / ABS-O (US98979QAC78) | 1.04 | -0.58 | 0.0983 | -0.0033 | |||||

| US68236JAA97 / One Bryant Park Trust 2019-OBP | 1.04 | 0.68 | 0.0983 | -0.0019 | |||||

| US59170DAB73 / MetroNet Infrastructure Issuer LLC | 1.04 | -0.86 | 0.0983 | -0.0035 | |||||

| US929089AG55 / Voya Financial Inc | 1.03 | -1.90 | 0.0978 | -0.0047 | |||||

| US35910EAB02 / FRONTIER ISSUER LLC | 1.03 | -0.68 | 0.0976 | -0.0034 | |||||

| TRT061124T11 / Turkey Government Bond | 1.02 | -2.84 | 0.0973 | -0.0056 | |||||

| US40441TAF66 / HPEFS EQUIPMENT TRUST 2022 2 | 1.02 | -0.19 | 0.0973 | -0.0028 | |||||

| US92851QAA76 / Vitality Re XIV Ltd | 1.02 | -0.39 | 0.0972 | -0.0030 | |||||

| US89378TAD54 / Transnet SOC Ltd | 1.02 | 0.10 | 0.0968 | -0.0026 | |||||

| US02379KAA25 / American Airlines 2021-1 Class A Pass Through Trust | 1.02 | -0.29 | 0.0965 | -0.0029 | |||||

| Vitality Re XV Ltd / DBT (US92847CAA53) | 1.02 | -0.29 | 0.0965 | -0.0029 | |||||

| Hotwire Funding LLC / ABS-O (US44148JAK51) | 1.02 | -0.78 | 0.0964 | -0.0035 | |||||

| Hertz Vehicle Financing III LLC / ABS-O (US42806MCQ06) | 1.01 | -0.49 | 0.0960 | -0.0031 | |||||

| W1MC34 / Waste Management, Inc. - Depositary Receipt (Common Stock) | 1.01 | -1.37 | 0.0960 | -0.0040 | |||||

| US12515GAG29 / CD 2017-CD3 Mortgage Trust | 1.01 | 4.99 | 0.0958 | 0.0021 | |||||

| Sotheby's Artfi Master Trust / ABS-O (US83589CAE84) | 1.01 | -0.88 | 0.0957 | -0.0035 | |||||

| WIN Waste Innovations Holdings, Inc., Incremental Term Loan / LON (US38723BAL53) | 1.01 | 0.0954 | 0.0954 | ||||||

| US69688FAG54 / Palmer Square CLO 2021-3 Ltd | 1.00 | -0.20 | 0.0953 | -0.0028 | |||||

| US23284BAE48 / CyrusOne Data Centers Issuer I | 1.00 | -0.59 | 0.0952 | -0.0032 | |||||

| US62475WAG06 / MTN Commercial Mortgage Trust 2022-LPFL | 1.00 | -0.20 | 0.0948 | -0.0028 | |||||

| 46090K109 / Intrawest Resorts Holdings, Inc. | 1.00 | -0.30 | 0.0947 | -0.0029 | |||||

| US63875FAN69 / Natixis Commercial Mortgage Securities Trust | 1.00 | 0.60 | 0.0947 | -0.0020 | |||||

| Phoenix Guarantor Inc, Term Loan B / LON (US71913BAK89) | 0.99 | 0.20 | 0.0944 | -0.0024 | |||||

| US35833TAB17 / Freddie Mac Multifamily ML Certificates | 0.99 | -3.31 | 0.0943 | -0.0059 | |||||

| US74969CAN74 / RLGH Trust 2021-TROT | 0.99 | 0.20 | 0.0942 | -0.0024 | |||||

| US12593JBJ43 / Commercial Mortgage Trust, Series 2015-CR24, Class B | 0.99 | 0.61 | 0.0939 | -0.0020 | |||||

| XS2264968665 / Ivory Coast Government International Bond | 0.99 | -1.79 | 0.0936 | -0.0042 | |||||

| US64132NAC02 / Network i2i Ltd | 0.99 | 0.41 | 0.0936 | -0.0022 | |||||

| Concord Music Royalties LLC / ABS-O (US20633KAE82) | 0.99 | -2.09 | 0.0935 | -0.0045 | |||||

| USY6972HLP91 / Philippine Government International Bond | 0.98 | -3.35 | 0.0930 | -0.0059 | |||||

| CMCS34 / Comcast Corporation - Depositary Receipt (Common Stock) | 0.97 | -19.84 | 0.0924 | -0.0260 | |||||

| K1RC34 / The Kroger Co. - Depositary Receipt (Common Stock) | 0.97 | 0.0924 | 0.0924 | ||||||

| US41135UAB17 / Hanwha Life Insurance Co Ltd | 0.97 | -0.41 | 0.0919 | -0.0029 | |||||

| US78449RAL96 / SLG Office Trust, Series 2021-OVA, Class E | 0.97 | -0.21 | 0.0916 | -0.0027 | |||||

| Kingston Airport Revenue Finance Ltd / DBT (US49647QAA67) | 0.97 | -1.23 | 0.0916 | -0.0037 | |||||

| US67190AAE64 / Oak Street Investment Grade Net Lease Fund, Series 2021-1A, Class B1 | 0.96 | 1.05 | 0.0915 | -0.0015 | |||||

| IL0066204707 / Bank Hapoalim BM | 0.96 | 0.10 | 0.0908 | -0.0023 | |||||

| O1KE34 / ONEOK, Inc. - Depositary Receipt (Common Stock) | 0.95 | 0.0904 | 0.0904 | ||||||

| US29646AAC09 / Eskom Holdings SOC Ltd | 0.95 | 0.74 | 0.0902 | -0.0018 | |||||

| US08162QBA67 / Benchmark Mortgage Trust | 0.95 | 0.74 | 0.0900 | -0.0018 | |||||

| US00258BAA26 / Aaset 2021-2 Trust | 0.94 | -2.49 | 0.0891 | -0.0047 | |||||

| US06675QAC78 / Banque Ouest Africaine de Developpement | 0.94 | -0.43 | 0.0888 | -0.0028 | |||||

| US36251PAL85 / GS Mortgage Securities Trust 2016-GS3 | 0.93 | 1.63 | 0.0887 | -0.0009 | |||||

| US91087BAK61 / Mexico Government International Bond | 0.93 | -0.11 | 0.0883 | -0.0025 | |||||

| K1RC34 / The Kroger Co. - Depositary Receipt (Common Stock) | 0.92 | -52.44 | 0.0877 | -0.1017 | |||||

| US03512TAE10 / AngloGold Ashanti Holdings PLC | 0.92 | 0.76 | 0.0877 | -0.0016 | |||||

| US26442UAR59 / Duke Energy Progress LLC | 0.92 | -50.03 | 0.0873 | -0.0920 | |||||

| US23345LAC37 / DOLP Trust | 0.92 | -3.47 | 0.0870 | -0.0056 | |||||

| US716973AG71 / Pfizer Investment Enterprises Pte Ltd | 0.92 | -52.61 | 0.0870 | -0.1015 | |||||

| Boost Newco Borrower, LLC, Term Loan B / LON (US92943EAG17) | 0.91 | 0.11 | 0.0864 | -0.0022 | |||||

| US67091TAD72 / OCP SA | 0.90 | -0.11 | 0.0858 | -0.0024 | |||||

| US25755TAN00 / Domino's Pizza Master Issuer LLC | 0.90 | 0.22 | 0.0856 | -0.0021 | |||||

| US465968AM74 / JPMCC Commercial Mortgage Securities Trust 2017-JP7 | 0.86 | 5.65 | 0.0816 | 0.0022 | |||||

| US12591YAG08 / COMM 2014-UBS3 Mortgage Trust | 0.86 | -9.57 | 0.0816 | -0.0112 | |||||

| US01538TAA34 / Alfa Desarrollo SpA | 0.86 | -6.02 | 0.0816 | -0.0075 | |||||

| US88322YAK73 / Thaioil Treasury Center Co Ltd | 0.86 | -1.27 | 0.0815 | -0.0033 | |||||

| US08162NAK28 / Benchmark Mortgage Trust | 0.86 | 0.47 | 0.0815 | -0.0018 | |||||

| US36264KAV26 / GS Mortgage Securities Trust 2020-GSA2 | 0.86 | 0.94 | 0.0813 | -0.0014 | |||||

| Alterna Funding III LLC / ABS-O (US02157JAC99) | 0.84 | 0.00 | 0.0801 | -0.0022 | |||||

| Surgery Center Holdings, Inc., Term Loan B / LON (US86880NBB82) | 0.84 | -0.12 | 0.0801 | -0.0023 | |||||

| US17291HAL87 / Citigroup Commercial Mortgage Trust | 0.84 | -0.24 | 0.0798 | -0.0024 | |||||

| Banco de Credito e Inversiones SA / DBT (US05890MAC73) | 0.84 | -1.76 | 0.0794 | -0.0036 | |||||

| CD&R Smokey Buyer Inc / DBT (US12515KAA60) | 0.83 | -57.76 | 0.0788 | -0.1128 | |||||

| Alterna Funding III LLC / ABS-O (US02157JAA34) | 0.82 | -0.12 | 0.0780 | -0.0022 | |||||

| US08576PAH47 / Berry Global Inc | 0.82 | 108.38 | 0.0779 | 0.0395 | |||||

| US05377REK68 / Avis Budget Rental Car Funding AESOP LLC | 0.82 | 0.49 | 0.0778 | -0.0017 | |||||

| US42225UAF12 / Healthcare Trust of America Holdings LP | 0.81 | 0.0771 | 0.0771 | ||||||

| US221597BT31 / Costa Rica Government International Bond | 0.80 | -1.59 | 0.0762 | -0.0034 | |||||

| US12630DBB91 / COMM 2014-CR14 MORTGAGE TRUST COMM 2014-CR14 B | 0.80 | -0.25 | 0.0762 | -0.0022 | |||||

| US29245JAM45 / Empresa Nacional del Petroleo | 0.78 | 0.13 | 0.0744 | -0.0020 | |||||

| IL0011736738 / Energean Israel Finance Ltd | 0.78 | -0.76 | 0.0744 | -0.0026 | |||||

| US97064GAA13 / WILLIS ENGINE SECURITIZATION TRUST | 0.78 | -1.27 | 0.0737 | -0.0030 | |||||

| TRGP / Targa Resources Corp. | 0.78 | 0.0737 | 0.0737 | ||||||

| US126407AD72 / CSMC_21-NQM1 | 0.77 | 2.52 | 0.0735 | -0.0001 | |||||

| US91324PEW86 / UnitedHealth Group Inc | 0.77 | 8.87 | 0.0734 | -0.0255 | |||||

| US55916AAA25 / Magic Mergeco Inc | 0.77 | -9.24 | 0.0728 | -0.0095 | |||||

| US95003KBJ07 / Wells Fargo Mortgage Backed Securities Trust | 0.77 | -2.05 | 0.0727 | -0.0036 | |||||

| US95058XAK46 / Wendy's Funding LLC | 0.76 | -0.13 | 0.0724 | -0.0020 | |||||

| FI4000223532 / Kojamo Oyj | 0.76 | 1.20 | 0.0723 | -0.0012 | |||||

| US74727PBB67 / Qatar Government International Bond | 0.76 | -4.31 | 0.0717 | -0.0053 | |||||

| US617726AG97 / Morocco Government International Bond | 0.74 | -2.49 | 0.0706 | -0.0038 | |||||

| Albion Financing 1 SARL / Aggreko Holdings Inc / DBT (US01330AAA43) | 0.74 | 0.0703 | 0.0703 | ||||||

| US85573LAB71 / START Ireland | 0.73 | -3.80 | 0.0697 | -0.0047 | |||||

| Florida Power & Light Co / DBT (US341081GY79) | 0.71 | 0.0677 | 0.0677 | ||||||

| US12659BAA26 / CT Trust | 0.71 | 0.42 | 0.0677 | -0.0016 | |||||

| US44040HAA05 / Horizon Aircraft Finance II Ltd | 0.71 | -25.32 | 0.0676 | -0.0253 | |||||

| CVS / CVS Health Corporation | 0.71 | -3.93 | 0.0672 | -0.0046 | |||||

| A1TM34 / Atmos Energy Corporation - Depositary Receipt (Common Stock) | 0.71 | -31.92 | 0.0670 | -0.0341 | |||||

| US29246BAF58 / Empresas Publicas de Medellin ESP | 0.70 | 0.29 | 0.0662 | -0.0017 | |||||

| US06000BAA08 / Bangkok Bank PCL/Hong Kong | 0.70 | 0.14 | 0.0661 | -0.0018 | |||||

| US80007RAS40 / Sands China Ltd | 0.69 | -0.57 | 0.0658 | -0.0021 | |||||

| Jazz Financing Lux S.a.r.l., First Lien Term Loan B / LON (XAG5080AAJ16) | 0.69 | -0.58 | 0.0651 | -0.0021 | |||||

| US60937LAE56 / Mongolia Government International Bond | 0.69 | -1.01 | 0.0651 | -0.0024 | |||||

| US12529WAQ96 / CF Mortgage Trust | 0.68 | 0.74 | 0.0647 | -0.0013 | |||||

| US20753DAF50 / CORP CMO | 0.66 | -1.34 | 0.0630 | -0.0027 | |||||

| US64134KAA88 / Neuberger Berman Loan Advisers Clo 40 Ltd | 0.66 | -0.60 | 0.0630 | -0.0021 | |||||

| US279158AQ26 / Ecopetrol SA | 0.65 | -7.32 | 0.0614 | -0.0066 | |||||

| XS0496608984 / Ivory Coast Government International Bond | 0.62 | -1.75 | 0.0588 | -0.0027 | |||||

| US233046AK74 / DB Master Finance LLC | 0.62 | -0.32 | 0.0585 | -0.0018 | |||||

| A1JG34 / Arthur J. Gallagher & Co. - Depositary Receipt (Common Stock) | 0.60 | 0.0572 | 0.0572 | ||||||

| US12530MAD74 / SORT 20-1 B2 144A 2.6% 07-15-60/27 | 0.60 | 0.67 | 0.0570 | -0.0012 | |||||

| D1TE34 / DTE Energy Company - Depositary Receipt (Common Stock) | 0.60 | 0.0568 | 0.0568 | ||||||

| US12510HAM25 / Capital Automotive REIT | 0.60 | 0.00 | 0.0567 | -0.0015 | |||||

| US00489TAJ51 / ACRE Commercial Mortgage 2021-FL4 Ltd | 0.57 | -1.38 | 0.0544 | -0.0022 | |||||

| US98920MAA09 / ZAXBY_21-1A | 0.57 | 16.73 | 0.0543 | 0.0065 | |||||

| US06650AAK34 / BANK 2017-BNK8 | 0.57 | 1.25 | 0.0540 | -0.0008 | |||||

| US870674AA66 / Sweihan PV Power Co PJSC | 0.57 | 1.07 | 0.0538 | -0.0008 | |||||

| Petronas Capital Ltd / DBT (US716743AV14) | 0.57 | 0.0537 | 0.0537 | ||||||

| US279158AN94 / Ecopetrol SA | 0.57 | -1.74 | 0.0536 | -0.0025 | |||||

| US418097AL52 / Jordan Government International Bond | 0.56 | 0.90 | 0.0534 | -0.0010 | |||||

| US44040JAA60 / Horizon Aircraft Finance III Ltd., Series 2019-2, Class A | 0.56 | -6.54 | 0.0529 | -0.0052 | |||||

| QXO Inc, Term Loan B / LON (US07368RAJ05) | 0.55 | 0.0524 | 0.0524 | ||||||

| US17322VAE65 / Citigroup Commercial Mortgage Trust, Series 2014-GC23, Class D | 0.55 | -0.18 | 0.0521 | -0.0015 | |||||

| LD Celulose International GmbH / DBT (US50206BAA08) | 0.54 | -0.55 | 0.0513 | -0.0018 | |||||

| US92854VAB18 / Vivint Colar Financing V LLC | 0.52 | -13.29 | 0.0496 | -0.0092 | |||||

| US03072SNR21 / Ameriquest Mortgage Securities, Inc. Asset-Backed Securities, Series 2004-R1, Class A2 | 0.52 | 0.19 | 0.0494 | -0.0013 | |||||

| US58407HAA77 / Medco Maple Tree Pte Ltd | 0.52 | -1.71 | 0.0491 | -0.0023 | |||||

| Banco del Estado de Chile / DBT (US05957AAC36) | 0.52 | -0.96 | 0.0491 | -0.0019 | |||||

| US12593PBB76 / COMM 2015-CCRE25 Mortgage Trust | 0.52 | 0.39 | 0.0490 | -0.0011 | |||||

| US418097AJ07 / Jordan Government International Bond | 0.52 | -3.37 | 0.0490 | -0.0031 | |||||

| R2RX34 / Regal Rexnord Corporation - Depositary Receipt (Common Stock) | 0.51 | 0.0487 | 0.0487 | ||||||

| US55903VBC63 / Warnermedia Holdings Inc | 0.51 | 0.0483 | 0.0483 | ||||||

| US177510AK05 / Citrus Re 2022-1 Class A | 0.50 | -0.99 | 0.0474 | -0.0018 | |||||

| US78449RAC97 / SLG Office Trust 2021-OVA | 0.50 | -3.86 | 0.0473 | -0.0032 | |||||

| Republic of Kenya Government International Bond / DBT (US491798AM68) | 0.50 | -1.39 | 0.0473 | -0.0020 | |||||

| US55352NAN75 / MSCG Trust 2015-ALDR | 0.50 | 8.99 | 0.0472 | 0.0027 | |||||

| USP1400MAB48 / Banco Mercantil del Norte SA/Grand Cayman | 0.50 | -0.20 | 0.0471 | -0.0015 | |||||

| US58406RAA68 / Medco Laurel Tree Pte. Ltd. | 0.49 | -2.57 | 0.0467 | -0.0025 | |||||

| US842400HX47 / SOUTHERN CALIFORNIA EDISON COMPANY | 0.49 | -8.91 | 0.0467 | -0.0059 | |||||

| US90363PAA49 / UEP Penonome II SA | 0.49 | -3.37 | 0.0463 | -0.0029 | |||||

| IGT Holding IV AB, Term Loan B5 / LON (XAW5000CAC18) | 0.48 | 0.0457 | 0.0457 | ||||||

| US12514MBG96 / CD 2016-CD1 Mortgage Trust | 0.47 | -5.02 | 0.0450 | -0.0036 | |||||

| US12593JBK16 / COMM Mortgage Trust | 0.47 | 1.30 | 0.0444 | -0.0007 | |||||

| US72819QAM42 / PLAZE INC | 0.47 | 1.09 | 0.0441 | -0.0008 | |||||

| US059895AV49 / Bangkok Bank PCL | 0.44 | -0.90 | 0.0417 | -0.0015 | |||||

| US81720TAD72 / Senegal Government International Bond | 0.44 | -6.82 | 0.0415 | -0.0042 | |||||

| US77586RAS94 / Romanian Government International Bond | 0.43 | -5.45 | 0.0413 | -0.0035 | |||||

| US94767KAN19 / WEBER-STEPHEN PRODUCTS TERM B 1LN 10/30/2027 | 0.43 | -0.47 | 0.0406 | -0.0013 | |||||

| US00652MAH51 / Adani Ports & Special Economic Zone Ltd | 0.42 | 3.70 | 0.0399 | 0.0004 | |||||

| US71654QDD16 / Petroleos Mexicanos | 0.41 | -2.84 | 0.0390 | -0.0023 | |||||

| US05674RAD61 / Bahrain Government International Bond | 0.41 | -4.47 | 0.0386 | -0.0029 | |||||

| US12547JAE38 / CIFC Funding 2020-II Ltd | 0.39 | -0.52 | 0.0366 | -0.0012 | |||||

| US68377WAC55 / Oportun Issuance Trust 2021-C | 0.38 | -20.00 | 0.0357 | -0.0101 | |||||

| US279158AP43 / Ecopetrol SA | 0.37 | -2.62 | 0.0353 | -0.0020 | |||||

| US08162YAM49 / Benchmark 2019-B14 Mortgage Trust | 0.37 | -39.90 | 0.0347 | -0.0247 | |||||

| US00831TAB70 / AFRICAN EXPORT-IMPORT BANK/THE 144A 2.634000% 05/17/2026 | 0.36 | 0.83 | 0.0346 | -0.0007 | |||||

| US94989HBF64 / Wells Fargo Commercial Mortgage Trust | 0.36 | -77.44 | 0.0343 | -0.1217 | |||||

| US14687HAE36 / Carvana Auto Receivables Trust 2021-N4 | 0.36 | -12.25 | 0.0340 | -0.0058 | |||||

| C2AC34 / CACI International Inc - Depositary Receipt (Common Stock) | 0.36 | 0.0339 | 0.0339 | ||||||

| MPT Operating Partnership LP / MPT Finance Corp / DBT (US55342UAQ76) | 0.35 | -0.28 | 0.0336 | -0.0010 | |||||

| US36251SAJ78 / GS MORTGAGE SECURITIES TRUST GSMS 2018 TWR B 144A | 0.34 | -37.32 | 0.0324 | -0.0207 | |||||

| US40053FAC23 / Grupo Aval Ltd | 0.34 | -0.30 | 0.0318 | -0.0009 | |||||

| US452764AD53 / Imperial Fund Mortgage Trust | 0.33 | -4.89 | 0.0315 | -0.0025 | |||||

| US45254TDY73 / Impac Secured Assets CMN Owner Trust | 0.32 | -2.75 | 0.0302 | -0.0017 | |||||

| Sitios Latinoamerica SAB de CV / DBT (US82983PAA12) | 0.30 | 0.33 | 0.0289 | -0.0007 | |||||

| XS2214238102 / Ecuador Government International Bond | 0.29 | 17.60 | 0.0279 | 0.0035 | |||||

| US452764AC70 / Imperial Fund Mortgage Trust 2021-NQM1 | 0.28 | -1.39 | 0.0270 | -0.0012 | |||||

| US55400DAC56 / MVW Owner Trust | 0.27 | -8.11 | 0.0258 | -0.0031 | |||||

| US04285AAC99 / CORP CMO | 0.27 | -5.90 | 0.0258 | -0.0024 | |||||

| US483548AF00 / Kaman Corp Bond | 0.26 | 0.00 | 0.0244 | -0.0007 | |||||

| US11042WAA45 / IAGLN 8 3/8 11/15/28 | 0.23 | -5.79 | 0.0217 | -0.0020 | |||||

| US458140CJ73 / Intel Corp | 0.22 | -4.27 | 0.0213 | -0.0016 | |||||

| US452760AC58 / Imperial Fund Mortgage Trust 2020-NQM1 | 0.22 | -4.41 | 0.0206 | -0.0016 | |||||

| P2OD34 / Insulet Corporation - Depositary Receipt (Common Stock) | 0.22 | 0.0205 | 0.0205 | ||||||

| US68377WAD39 / Oportun Issuance Trust 2021-C | 0.21 | -19.62 | 0.0203 | -0.0056 | |||||

| US55317BAC19 / MFT Trust 2020-ABC | 0.21 | -5.33 | 0.0202 | -0.0018 | |||||

| US36251SAN80 / GS MORTGAGE SECURITIES CORP TRUST 2018-TWR SER 2018-TWR CL D V/R REGD 144A P/P 3.36538000 | 0.21 | -44.06 | 0.0201 | -0.0168 | |||||

| US43284HAC34 / Hilton Grand Vacations Trust 2019-A | 0.20 | -9.63 | 0.0187 | -0.0026 | |||||

| US50184BAC28 / Ladder Capital Commercial Mortgage Trust, Series 2013-GCP, Class A2 | 0.18 | 0.56 | 0.0170 | -0.0003 | |||||

| US716564AA72 / Petroleos del Peru SA | 0.15 | -3.90 | 0.0141 | -0.0010 | |||||

| Ghana Government International Bond / DBT (US374422AM52) | 0.14 | 2.88 | 0.0136 | 0.0000 | |||||

| US466275AA25 / JPALT_07-S1 | 0.13 | -4.29 | 0.0128 | -0.0009 | |||||

| Sauer Brands Inc, Delayed Draw Term Loan / LON (US80536AAC62) | 0.12 | 0.0115 | 0.0115 | ||||||

| US55292RAA95 / MAPS 2021-1 Trust | 0.12 | -3.25 | 0.0113 | -0.0007 | |||||

| US55389TAC53 / MVW 2021-1W LLC 1.94% 01/22/2041 144A | 0.10 | -10.09 | 0.0094 | -0.0013 | |||||

| US36257LAD91 / GS MORTGAGE-BACKED SECURITIES CORP TRUST 201 SER 2019-PJ2 CL A4 V/R REGD 144A P/P 4.00000000 | 0.09 | -1.10 | 0.0086 | -0.0004 | |||||

| US25273CAC47 / Diamond Resorts Owner Trust 2021-1 | 0.08 | -9.20 | 0.0076 | -0.0010 | |||||

| US25273CAD20 / Diamond Resorts Owner Trust 2021-1 | 0.08 | -9.20 | 0.0076 | -0.0010 | |||||

| City Brewing Company, LLC, FLFO Roll Up Term Loan / LON (US10756PAD15) | 0.08 | -18.95 | 0.0073 | -0.0020 | |||||

| US33850RBA95 / Flagstar Mortgage Trust | 0.07 | -1.41 | 0.0067 | -0.0003 | |||||

| 92943HAB5 / WR Grace Holdings LLC | 0.07 | 0.00 | 0.0064 | -0.0002 | |||||

| US71654QCC42 / Petroleos Mexicanos Bond | 0.07 | -2.90 | 0.0064 | -0.0003 | |||||

| ECOPET / Ecopetrol SA | 0.07 | -6.94 | 0.0064 | -0.0006 | |||||

| US64829EAK01 / New Residential Mortgage Loan Trust 2015-2 | 0.07 | -7.14 | 0.0062 | -0.0006 | |||||

| US91835CAC73 / Vine | 0.06 | -37.23 | 0.0057 | -0.0035 | |||||

| US82652QAC50 / Sierra Timeshare 2021-1 Receivables Funding LLC | 0.06 | -10.77 | 0.0056 | -0.0008 | |||||

| US56564RAA86 / MAPS 2018-1 Ltd | 0.06 | -5.17 | 0.0053 | -0.0005 | |||||

| US24736CBS26 / Delta Air Lines, Inc. 2020 1st Lien Term Loan B | 0.05 | -8.47 | 0.0051 | -0.0007 | |||||

| US12529WAN65 / CF 2020-P1 Mortgage Trust | 0.05 | 0.00 | 0.0045 | -0.0001 | |||||

| Ukraine Government International Bond / DBT (US903724CF76) | 0.04 | -27.08 | 0.0034 | -0.0013 | |||||

| Ukraine Government International Bond / DBT (US903724BZ40) | 0.03 | -15.38 | 0.0032 | -0.0006 | |||||

| City Brewing Company, LLC, First Out New Money Term Loan / LON (US10756PAB58) | 0.03 | -19.44 | 0.0028 | -0.0008 | |||||

| US939336T290 / Washington Mutual MSC Mortgage Pass-Through Certificates Series 2004-RA3 Trust | 0.03 | -3.45 | 0.0027 | -0.0002 | |||||

| US3136AGEJ71 / Fannie Mae REMICS | 0.02 | 0.00 | 0.0015 | -0.0001 | |||||

| City Brewing Company, LLC, PIK Super Priority Term Loan / LON (US10756PAF62) | 0.01 | 0.00 | 0.0014 | -0.0001 | |||||

| US31413HVV76 / Fannie Mae Pool | 0.01 | 0.00 | 0.0010 | -0.0000 | |||||

| US81747WBN65 / Sequoia Mortgage Trust 2018-7 | 0.01 | 0.00 | 0.0009 | -0.0000 | |||||

| Ukraine Government International Bond / DBT (US903724CG59) | 0.01 | -30.00 | 0.0007 | -0.0003 | |||||

| US42815KAA07 / HESTIA RE LTD UNSECURED 144A 04/25 VAR | 0.01 | -98.93 | 0.0005 | -0.0450 | |||||

| US81746YAU82 / SEQUOIA MORTGAGE TRUST 2019-2 SER 2019-2 CL A19 V/R REGD 144A P/P 4.00000000 | 0.01 | 0.00 | 0.0005 | -0.0000 | |||||

| US36257LAA52 / GS Mortgage-Backed Securities Corp Trust 2019-PJ2 | 0.00 | 0.00 | 0.0004 | -0.0000 | |||||

| US31411EDA29 / Fannie Mae Pool | 0.00 | 0.0001 | -0.0000 |