Mga Batayang Estadistika

| Nilai Portofolio | $ 76,321,646 |

| Posisi Saat Ini | 301 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

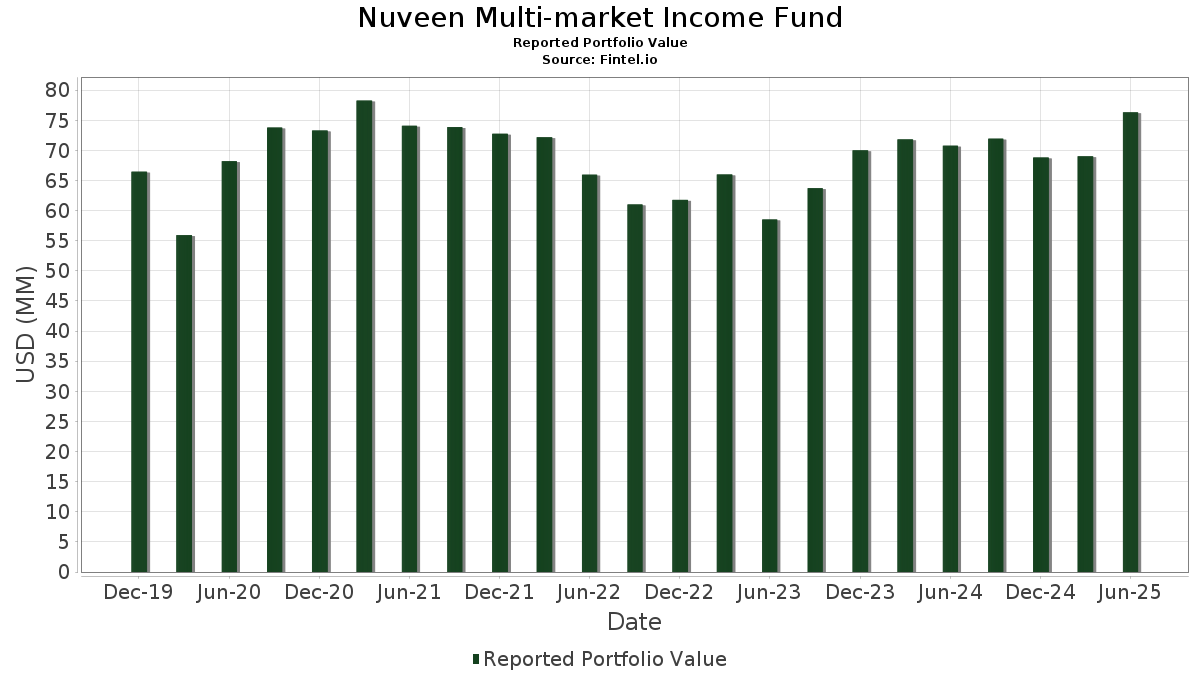

Nuveen Multi-market Income Fund telah mengungkapkan total kepemilikan 301 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 76,321,646 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Nuveen Multi-market Income Fund adalah Fannie Mae Pool (US:US31418ECR99) , Dreyfus Institutional Preferred Government Plus Money Market Fund (US:US85748R0096) , Fannie Mae Connecticut Avenue Securities (US:US20755AAC62) , Freddie Mac STACR REMIC Trust 2023-HQA1 (US:US35564KX872) , and FNMA, 30 Year (US:US31418D4Y57) . Posisi baru Nuveen Multi-market Income Fund meliputi: Fannie Mae Pool (US:US31418ECR99) , Dreyfus Institutional Preferred Government Plus Money Market Fund (US:US85748R0096) , Fannie Mae Connecticut Avenue Securities (US:US20755AAC62) , Freddie Mac STACR REMIC Trust 2023-HQA1 (US:US35564KX872) , and FNMA, 30 Year (US:US31418D4Y57) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 5.60 | 8.9845 | 8.9845 | ||

| 4.53 | 7.2639 | 7.2639 | ||

| 4.36 | 6.9963 | 6.9963 | ||

| 1.77 | 2.8483 | 1.9180 | ||

| 1.06 | 1.6960 | 1.6960 | ||

| 1.48 | 2.3748 | 1.2152 | ||

| 0.50 | 0.8042 | 0.8042 | ||

| 0.50 | 0.8033 | 0.8033 | ||

| 0.49 | 0.7899 | 0.7899 | ||

| 0.43 | 0.6894 | 0.6894 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.24 | 0.3873 | -0.1660 | ||

| 0.21 | 0.3304 | -0.1479 | ||

| 0.36 | 0.5787 | -0.1308 | ||

| 0.09 | 0.1511 | -0.1211 | ||

| 0.21 | 0.3370 | -0.1194 | ||

| 0.13 | 0.2120 | -0.1194 | ||

| 2.23 | 3.5862 | -0.1100 | ||

| 1.47 | 2.3532 | -0.0809 | ||

| 0.15 | 0.2459 | -0.0760 | ||

| 1.28 | 2.0572 | -0.0719 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-28 untuk periode pelaporan 2025-06-30. Investor ini belum mengungkapkan sekuritas yang diperhitungkan dalam bentuk saham, sehingga kolom terkait saham dalam tabel di bawah ini dihilangkan. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|

| US 10yr Ultra Fut Sep25 / DIR (N/A) | 5.60 | 8.9845 | 8.9845 | |||

| US ULTRA BOND CBT Sep25 / DIR (N/A) | 4.53 | 7.2639 | 7.2639 | |||

| US 5YR NOTE (CBT) Sep25 / DIR (N/A) | 4.36 | 6.9963 | 6.9963 | |||

| US31418ECR99 / Fannie Mae Pool | 2.23 | -2.19 | 3.5862 | -0.1100 | ||

| US85748R0096 / Dreyfus Institutional Preferred Government Plus Money Market Fund | 1.77 | 208.70 | 2.8483 | 1.9180 | ||

| US20755AAC62 / Fannie Mae Connecticut Avenue Securities | 1.57 | -0.51 | 2.5130 | -0.0341 | ||

| US35564KX872 / Freddie Mac STACR REMIC Trust 2023-HQA1 | 1.48 | 106.56 | 2.3748 | 1.2152 | ||

| US31418D4Y57 / FNMA, 30 Year | 1.47 | -2.53 | 2.3532 | -0.0809 | ||

| US20754EAB11 / Connecticut Avenue Securities Trust, Series 2023-R06, Class 1M2 | 1.46 | 0.55 | 2.3383 | -0.0073 | ||

| US26208LAD01 / DRIVEN BRANDS FUNDING LLC | 1.34 | -0.07 | 2.1568 | -0.0202 | ||

| US3133KNQT36 / Freddie Mac Pool | 1.28 | -2.58 | 2.0572 | -0.0719 | ||

| US31418EW227 / Fannie Mae Pool | 1.24 | -1.82 | 1.9898 | -0.0528 | ||

| US31418EU999 / Fannie Mae Pool | 1.17 | -2.65 | 1.8849 | -0.0674 | ||

| US08160JAD90 / Benchmark 2019-B9 Mortgage Trust | 1.11 | 0.91 | 1.7856 | 0.0023 | ||

| US233046AF89 / DB Master Finance LLC | 1.10 | 1.01 | 1.7669 | 0.0023 | ||

| US20754MCB19 / Connecticut Avenue Securities Trust 2022-R07 | 1.07 | 0.09 | 1.7121 | -0.0110 | ||

| US20754QAB41 / Connecticut Avenue Securities Trust 2023-R04 | 1.06 | 1.6960 | 1.6960 | |||

| Subway Funding LLC / ABS-O (US864300AA61) | 1.01 | 0.70 | 1.6236 | -0.0017 | ||

| US974153AB40 / Wingstop Funding LLC | 0.93 | 0.43 | 1.4980 | -0.0058 | ||

| US31418EU817 / Fannie Mae Pool | 0.86 | -2.15 | 1.3868 | -0.0431 | ||

| US31418EW300 / Fannie Mae Pool | 0.85 | -2.75 | 1.3648 | -0.0491 | ||

| US12530MAD74 / SORT 20-1 B2 144A 2.6% 07-15-60/27 | 0.81 | 1.00 | 1.2959 | 0.0031 | ||

| US63875FAJ57 / Natixis Commercial Mortgage Securities Trust | 0.79 | 0.90 | 1.2630 | -0.0001 | ||

| US3128MJSS02 / Freddie Mac Gold Pool | 0.76 | -2.06 | 1.2182 | -0.0361 | ||

| US20754EAF25 / Connecticut Avenue Securities Trust, Series 2023-R06, Class 1B1 | 0.75 | 0.27 | 1.2055 | -0.0075 | ||

| US12592XBJ46 / COMM 2015-CCRE22 Mortgage Trust | 0.70 | 1.89 | 1.1252 | 0.0115 | ||

| US11120VAJ26 / Brixmor Operating Partnership LP | 0.63 | 1.29 | 1.0119 | 0.0045 | ||

| US46646RAQ65 / JPMDB_16-C4 | 0.60 | 2.57 | 0.9610 | 0.0177 | ||

| US87342RAH75 / TACO BELL FUNDING LLC BELL 2021-1A A2II | 0.59 | 1.38 | 0.9462 | 0.0052 | ||

| US87342RAC88 / Taco Bell Funding LLC | 0.59 | 0.00 | 0.9402 | -0.0065 | ||

| Bank of America Corp / DBT (US06051GMQ90) | 0.58 | 1.92 | 0.9376 | 0.0091 | ||

| US097023DB86 / Boeing Co/The | 0.58 | 1.04 | 0.9338 | 0.0030 | ||

| US3140J9VU23 / Federal National Mortgage Association (FNMA) | 0.55 | -2.98 | 0.8904 | -0.0343 | ||

| US46616VAB62 / JGWPT XXV LLC | 0.54 | -2.35 | 0.8674 | -0.0273 | ||

| US20755CAF59 / CORP CMO | 0.53 | -0.19 | 0.8464 | -0.0082 | ||

| US31335AEK07 / Freddie Mac Gold Pool | 0.52 | -2.64 | 0.8298 | -0.0307 | ||

| US006346AW02 / Adams Outdoor Advertising LP | 0.51 | -0.39 | 0.8231 | -0.0092 | ||

| US95058XAK46 / Wendy's Funding LLC | 0.51 | 0.99 | 0.8206 | 0.0010 | ||

| US14686MAF05 / CARVANA AUTO REC. 11/10/2028 5.54% | 0.51 | 0.40 | 0.8163 | -0.0028 | ||

| US35910EAA29 / Frontier Issuer LLC | 0.51 | -0.39 | 0.8150 | -0.0088 | ||

| US20755DAB29 / Fannie Mae Connecticut Avenue Securities | 0.51 | 0.00 | 0.8126 | -0.0062 | ||

| US12593QBJ85 / COMM 2015-CCRE26 Mortgage Trust | 0.51 | 0.80 | 0.8126 | -0.0001 | ||

| Legends Outlets Kansas City KS Mortgage Secured Pass-Through Trust / ABS-MBS (US524947AA60) | 0.50 | -0.99 | 0.8055 | -0.0149 | ||

| US00867FAA66 / Ahead DB Holdings LLC | 0.50 | 2.87 | 0.8048 | 0.0153 | ||

| ARDN 2025-ARCP Mortgage Trust / ABS-MBS (US039961AA52) | 0.50 | 0.8042 | 0.8042 | |||

| US36251SAA69 / GS MORTGAGE SECURITIES CORP TRUST 2018-TWR SER 2018-TWR CL A V/R REGD 144A P/P 2.66538000 | 0.50 | 0.20 | 0.8040 | -0.0062 | ||

| US64135GAE89 / Neuberger Berman CLO Ltd | 0.50 | 0.00 | 0.8038 | -0.0055 | ||

| AGL CLO 19 Ltd / ABS-O (US001210AU73) | 0.50 | 0.8033 | 0.8033 | |||

| US001210AC75 / AGL CLO 19 Ltd | 0.50 | 0.00 | 0.8024 | -0.0069 | ||

| US31418EJ505 / Federal National Mortgage Association (FNMA) | 0.50 | -2.35 | 0.8001 | -0.0263 | ||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0.49 | 0.7899 | 0.7899 | |||

| US12510HAH30 / CARS-DB4 LP | 0.48 | 0.21 | 0.7750 | -0.0046 | ||

| US361841AP42 / GLP Capital LP / GLP Financing II Inc | 0.48 | 1.69 | 0.7710 | 0.0064 | ||

| US00489TAJ51 / ACRE Commercial Mortgage 2021-FL4 Ltd | 0.48 | -1.24 | 0.7675 | -0.0158 | ||

| US3132WD5B61 / Freddie Mac Gold Pool | 0.47 | -1.90 | 0.7465 | -0.0205 | ||

| US95001MAL46 / Wells Fargo Commercial Mortgage Trust | 0.46 | 0.88 | 0.7408 | -0.0000 | ||

| US31418EHK91 / Fannie Mae Pool | 0.46 | -2.35 | 0.7359 | -0.0237 | ||

| US411707AH55 / Hardee's Funding LLC | 0.45 | -0.22 | 0.7287 | -0.0086 | ||

| US44421MAG50 / Hudson Yards | 0.45 | 1.81 | 0.7238 | 0.0066 | ||

| US61766LBX64 / Morgan Stanley Bank of America Merrill Lynch Trust 2016-C28 | 0.45 | 0.90 | 0.7234 | 0.0008 | ||

| US12626GAT04 / COMM MORTGAGE TRUST COMM 2013 LC13 D 144A | 0.45 | 4.90 | 0.7221 | 0.0275 | ||

| US35564KWA32 / Freddie Mac STACR REMIC Trust, Series 2022-DNA3, Class B1 | 0.45 | 0.45 | 0.7211 | -0.0036 | ||

| US817743AE78 / SERVPRO Master Issuer LLC | 0.45 | 0.90 | 0.7182 | 0.0008 | ||

| US12593PBA93 / COMM 2015-CCRE25 Mortgage Trust | 0.44 | 0.46 | 0.7068 | -0.0032 | ||

| US95058XAG34 / Wendy's Funding LLC | 0.44 | 0.00 | 0.7004 | -0.0058 | ||

| US95002YAA10 / Wells Fargo & Co | 0.43 | 0.6894 | 0.6894 | |||

| US20753YCK64 / Connecticut Avenue Securities Trust, Series 2022-R04, Class 1M2 | 0.41 | 0.00 | 0.6617 | -0.0062 | ||

| US31418CU779 / FANNIE MAE 3.50% 03/01/2048 FNMA | 0.41 | -2.17 | 0.6504 | -0.0197 | ||

| OHA Credit Funding 19 Ltd / ABS-O (US67100SAE63) | 0.40 | 0.00 | 0.6440 | -0.0051 | ||

| Neuberger Berman CLO Ltd / ABS-O (US64135TAE01) | 0.40 | 0.25 | 0.6438 | -0.0044 | ||

| US26244QAQ64 / Dryden 49 Senior Loan Fund | 0.40 | 0.00 | 0.6428 | -0.0050 | ||

| US12547LAQ14 / CIFC Funding 2020-II Ltd | 0.40 | 0.00 | 0.6427 | -0.0050 | ||

| US46648KAC09 / JPMDB Commercial Mortgage Securities Trust 2017-C7 | 0.40 | -0.75 | 0.6372 | -0.0113 | ||

| US17323VBE48 / Citigroup Commercial Mortgage Trust 2015-GC29 | 0.39 | -0.51 | 0.6212 | -0.0094 | ||

| US08161CAJ09 / BENCHMARK 2018-B2 Mortgage Trust | 0.39 | 1.31 | 0.6201 | 0.0037 | ||

| Capital Automotive REIT / ABS-O (US12510HAV24) | 0.38 | -0.78 | 0.6119 | -0.0107 | ||

| US17325DAL73 / Citigroup Commercial Mortgage Trust 2016-P5 | 0.38 | 9.22 | 0.6083 | 0.0466 | ||

| US05610DAC65 / BX Trust | 0.38 | 0.53 | 0.6078 | -0.0013 | ||

| US46645UAC18 / JP Morgan Chase Commercial Mortgage Securities Trust 2016-JP4 | 0.38 | 3.58 | 0.6038 | 0.0165 | ||

| US95058XAE85 / Wendy's Funding LLC, Series 2018-1A, Class A2II | 0.37 | 0.54 | 0.6008 | -0.0018 | ||

| US563136AJ94 / Manhattan West | 0.37 | 1.09 | 0.5952 | 0.0026 | ||

| US31418EES54 / Fannie Mae Pool | 0.37 | -2.89 | 0.5927 | -0.0229 | ||

| US86828LAC63 / Superior Plus LP / Superior General Partner Inc | 0.36 | -17.81 | 0.5787 | -0.1308 | ||

| Ziply Fiber Issuer LLC / ABS-O (US98979QAA13) | 0.36 | -0.28 | 0.5767 | -0.0063 | ||

| US83546DAG34 / Sonic Capital LLC | 0.36 | 0.28 | 0.5754 | -0.0031 | ||

| US46651CAJ71 / JP Morgan Chase Commercial Mortgage Securities Cor | 0.36 | 0.28 | 0.5728 | -0.0023 | ||

| US05971KAG40 / Banco Santander SA | 0.36 | 2.59 | 0.5716 | 0.0093 | ||

| US64829EAK01 / New Residential Mortgage Loan Trust 2015-2 | 0.34 | -6.35 | 0.5454 | -0.0406 | ||

| US35564KB324 / Freddie Mac Structured Agency Credit Risk Debt Notes | 0.34 | 0.00 | 0.5424 | -0.0040 | ||

| US31418EPD66 / Fannie Mae Pool | 0.33 | -2.64 | 0.5335 | -0.0196 | ||

| US55916AAB08 / Magic Mergeco Inc | 0.33 | 23.40 | 0.5255 | 0.0964 | ||

| US62475WAC91 / MTN Commercial Mortgage Trust | 0.33 | 0.31 | 0.5216 | -0.0032 | ||

| ECPG / Encore Capital Group, Inc. | 0.32 | 3.88 | 0.5163 | 0.0161 | ||

| US3133KPGK84 / Freddie Mac Pool | 0.32 | -3.05 | 0.5107 | -0.0209 | ||

| US3132WDYQ12 / Freddie Mac Gold Pool | 0.32 | -2.16 | 0.5102 | -0.0154 | ||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0.32 | 0.5081 | 0.5081 | |||

| Bank of America Corp / DBT (US06055HAH66) | 0.31 | 0.4986 | 0.4986 | |||

| US92851QAA76 / Vitality Re XIV Ltd | 0.31 | -0.32 | 0.4928 | -0.0058 | ||

| Prologis Targeted US Logistics Fund LP / DBT (US74350LAB09) | 0.31 | 0.99 | 0.4915 | -0.0000 | ||

| US927804GK44 / Virginia Electric and Power Co | 0.30 | 2.02 | 0.4863 | 0.0054 | ||

| US89832QAD16 / Truist Financial Corp | 0.30 | 0.67 | 0.4821 | -0.0013 | ||

| US064058AH32 / BANK NEW YORK MELLON CORP 4.7%/VAR PERP | 0.30 | 0.34 | 0.4801 | -0.0023 | ||

| US025816CH00 / American Express Co | 0.29 | 1.04 | 0.4702 | 0.0014 | ||

| US489399AM73 / Kennedy-Wilson Inc | 0.29 | 2.46 | 0.4700 | 0.0073 | ||

| US46620DAB01 / JG Wentworth XXXVII LLC | 0.29 | -3.33 | 0.4664 | -0.0200 | ||

| US36290PAS65 / GSMPS Mortgage Loan Trust 2003-3 | 0.29 | -7.47 | 0.4586 | -0.0410 | ||

| US55261FAN42 / M&T Bank Corp | 0.28 | 1.79 | 0.4571 | 0.0045 | ||

| US36242DT786 / GSMPS Mortgage Loan Trust 2005-RP2 | 0.28 | -1.40 | 0.4518 | -0.0103 | ||

| US87342RAG92 / Taco Bell Funding LLC | 0.28 | 0.36 | 0.4508 | -0.0007 | ||

| US09261HAC16 / Blackstone Private Credit Fund | 0.27 | 1.50 | 0.4357 | 0.0026 | ||

| N1WG34 / NatWest Group plc - Depositary Receipt (Common Stock) | 0.27 | 2.67 | 0.4327 | 0.0081 | ||

| US233046AQ45 / DB Master Finance LLC | 0.27 | 0.75 | 0.4301 | -0.0008 | ||

| US172967PE54 / Citigroup, Inc., 7.625%, due 11/15/2028 | 0.26 | 1.15 | 0.4222 | 0.0014 | ||

| US78396YAA10 / Sesac Finance LLC | 0.26 | 0.38 | 0.4216 | -0.0021 | ||

| AerCap Ireland Capital DAC / AerCap Global Aviation Trust / DBT (US00774MBK09) | 0.26 | 1.57 | 0.4169 | 0.0029 | ||

| Antero Midstream Partners LP / Antero Midstream Finance Corp / DBT (US03690AAK25) | 0.26 | 1.57 | 0.4143 | 0.0031 | ||

| ICNQ 2024-MF Mortgage Trust / ABS-MBS (US450953AE40) | 0.26 | 1.18 | 0.4125 | 0.0007 | ||

| US05674RAG92 / Bahrain Government International Bond | 0.26 | -0.39 | 0.4114 | -0.0053 | ||

| MetroNet Infrastructure Issuer LLC / ABS-O (US59170JAG31) | 0.26 | 0.00 | 0.4099 | -0.0038 | ||

| Alliant Holdings Intermediate LLC / Alliant Holdings Co-Issuer / DBT (US01883LAG86) | 0.25 | 3.67 | 0.4086 | 0.0116 | ||

| US46115HAU14 / Intesa Sanpaolo SpA | 0.25 | 0.40 | 0.4019 | -0.0021 | ||

| US12674CAA18 / CA Magnum Holdings | 0.25 | 1.22 | 0.3982 | 0.0013 | ||

| US91831UAD90 / VNDO Trust | 0.25 | 1.23 | 0.3951 | 0.0004 | ||

| US31418EDE77 / Fannie Mae Pool | 0.24 | -2.41 | 0.3903 | -0.0129 | ||

| US043436AW48 / Asbury Automotive Group Inc | 0.24 | -29.53 | 0.3873 | -0.1660 | ||

| US900123DA57 / Turkey Government International Bond | 0.24 | 2.56 | 0.3861 | 0.0068 | ||

| US91823AAY73 / VB-S1 Issuer LLC - VBTEL | 0.24 | -1.65 | 0.3834 | -0.0084 | ||

| US362341LN77 / GSMPS Mortgage Loan Trust 2005-RP3 | 0.24 | -6.72 | 0.3800 | -0.0299 | ||

| US05971KAQ22 / Banco Santander SA | 0.23 | 1.75 | 0.3743 | 0.0026 | ||

| US29977LAA98 / EverArc Escrow Sarl | 0.23 | 3.11 | 0.3729 | 0.0088 | ||

| US46616YAC84 / JGWPT XXVI LLC | 0.23 | -2.16 | 0.3649 | -0.0104 | ||

| US72703PAD50 / Planet Fitness Master Issuer LLC | 0.23 | 0.89 | 0.3628 | -0.0011 | ||

| US20451RAB87 / Compass Group Diversified Holdings LLC | 0.22 | -4.68 | 0.3601 | -0.0215 | ||

| FCFS / FirstCash Holdings, Inc. | 0.22 | 2.30 | 0.3570 | 0.0048 | ||

| US05946KAM36 / Banco Bilbao Vizcaya Argentaria SA | 0.22 | 1.38 | 0.3542 | 0.0029 | ||

| US3128MJTY60 / Freddie Mac Gold Pool | 0.22 | -2.68 | 0.3506 | -0.0132 | ||

| US902613BF40 / UBS Group AG | 0.22 | 0.46 | 0.3503 | -0.0011 | ||

| US46115HBZ91 / Intesa Sanpaolo SpA | 0.22 | 1.40 | 0.3485 | 0.0021 | ||

| US3128MMRT23 / Freddie Mac Gold Pool | 0.22 | -9.28 | 0.3452 | -0.0388 | ||

| US05565AS207 / BNP Paribas SA | 0.21 | 0.47 | 0.3439 | -0.0020 | ||

| Zegona Finance PLC / DBT (US98927UAA51) | 0.21 | 0.95 | 0.3426 | -0.0001 | ||

| US36242DXL27 / GSMPS Mortgage Loan Trust 2005-RP1 | 0.21 | -1.40 | 0.3408 | -0.0074 | ||

| US207932AB01 / Connecticut Avenue Securities Trust 2023-R01 | 0.21 | 0.48 | 0.3389 | -0.0021 | ||

| US53944YAV56 / Lloyds Banking Group PLC | 0.21 | 1.45 | 0.3385 | 0.0027 | ||

| US17328FBA21 / CGCMT 2019 GC41 C | 0.21 | 3.45 | 0.3376 | 0.0086 | ||

| US46652BBJ70 / JP Morgan Chase Commercial Mortgage Securities Trust 2020-NNN | 0.21 | -25.53 | 0.3370 | -0.1194 | ||

| US576434LU63 / MASTR Alternative Loan Trust 2004-1 | 0.21 | -1.42 | 0.3368 | -0.0065 | ||

| Ardonagh Finco Ltd / DBT (US039853AA46) | 0.21 | 2.96 | 0.3355 | 0.0059 | ||

| Clarios Global LP / Clarios US Finance Co / DBT (US18060TAD72) | 0.21 | 0.3337 | 0.3337 | |||

| US431318BC74 / Hilcorp Energy I LP / Hilcorp Finance Co. | 0.21 | 1.47 | 0.3330 | 0.0014 | ||

| CNM / Core & Main, Inc. | 0.21 | 0.00 | 0.3325 | -0.0031 | ||

| US46649XAL10 / JPMCC_18-AON | 0.21 | -5.07 | 0.3312 | -0.0201 | ||

| XYZ / Block, Inc. - Depositary Receipt (Common Stock) | 0.21 | 0.3311 | 0.3311 | |||

| Albertsons Cos Inc / Safeway Inc / New Albertsons LP / Albertsons LLC / DBT (US01309QAB41) | 0.21 | 312.00 | 0.3308 | 0.2491 | ||

| ContourGlobal Power Holdings SA / DBT (US21220LAB99) | 0.21 | 3.00 | 0.3307 | 0.0057 | ||

| Flutter Treasury DAC / DBT (US344045AA72) | 0.21 | 1.48 | 0.3306 | 0.0009 | ||

| US70137WAL28 / Parkland Corp | 0.21 | -30.51 | 0.3304 | -0.1479 | ||

| Quikrete Holdings Inc / DBT (US74843PAA84) | 0.21 | 105.00 | 0.3300 | 0.1672 | ||

| Iliad Holding SASU / DBT (US449691AG96) | 0.20 | 2.00 | 0.3288 | 0.0048 | ||

| US49461MAB63 / Kinetik Holdings LP | 0.20 | 0.3282 | 0.3282 | |||

| Albion Financing 1 SARL / Aggreko Holdings Inc / DBT (US01330AAA43) | 0.20 | 0.3275 | 0.3275 | |||

| US12654YAL39 / CPTS 2019 CPT E 144A | 0.20 | 0.99 | 0.3275 | 0.0001 | ||

| DBSG 2024-ALTA Mortgage Trust / ABS-MBS (US239918AC92) | 0.20 | 0.50 | 0.3270 | -0.0010 | ||

| US87422VAK44 / Talen Energy Supply, LLC | 0.20 | 1.00 | 0.3267 | 0.0007 | ||

| US345397C437 / Ford Motor Credit Co LLC | 0.20 | -0.50 | 0.3240 | -0.0031 | ||

| Jane Street Group / JSG Finance Inc / DBT (US47077WAD02) | 0.20 | 0.3240 | 0.3240 | |||

| US539439AU36 / Lloyds Banking Group PLC | 0.20 | 0.00 | 0.3218 | -0.0029 | ||

| US74166MAE66 / PRIME SECSRVC BRW / FINANC | 0.20 | 0.00 | 0.3214 | -0.0024 | ||

| TransDigm Inc / DBT (US893647BY22) | 0.20 | 0.3212 | 0.3212 | |||

| US864486AK16 / Suburban Propane Partners Limited Partnership/Suburban Energy Finance Corp. | 0.20 | 0.51 | 0.3208 | -0.0010 | ||

| US552704AF51 / MEG Energy Corp | 0.20 | 1.53 | 0.3206 | 0.0024 | ||

| US126307BM89 / CSC Holdings LLC | 0.20 | 3.11 | 0.3197 | 0.0069 | ||

| US64828AAJ25 / New Residential Mortgage Loan Trust 2014-1 | 0.20 | -4.33 | 0.3194 | -0.0179 | ||

| Motion Finco Sarl / DBT (US61980LAB53) | 0.20 | -6.22 | 0.3161 | -0.0221 | ||

| Prime Healthcare Services Inc / DBT (US74165HAC25) | 0.19 | 5.03 | 0.3026 | 0.0126 | ||

| US097023DC69 / Boeing Co/The | 0.19 | 1.62 | 0.3024 | 0.0024 | ||

| US95000LBF94 / Wells Fargo Commercial Mortgage Trust 2016-C33 | 0.19 | 0.00 | 0.3005 | -0.0025 | ||

| Brightline East LLC / DBT (US093536AA89) | 0.18 | -15.91 | 0.2969 | -0.0594 | ||

| OLN / Olin Corporation | 0.18 | 121.95 | 0.2922 | 0.1586 | ||

| US85573LAB71 / START Ireland | 0.18 | -3.72 | 0.2917 | -0.0140 | ||

| W2EX34 / WEX Inc. - Depositary Receipt (Common Stock) | 0.18 | 129.11 | 0.2914 | 0.1634 | ||

| XAG4770MAL81 / INEOS Quattro Holdings UK Ltd 2023 USD 1st Lien Term Loan B | 0.18 | -3.23 | 0.2893 | -0.0121 | ||

| US91845AAA34 / VZ Secured Financing BV | 0.18 | 2.31 | 0.2855 | 0.0044 | ||

| US29670VAA70 / Essential Properties LP | 0.18 | 2.31 | 0.2854 | 0.0048 | ||

| ZF North America Capital Inc / DBT (US98877DAF24) | 0.18 | 1.14 | 0.2851 | 0.0007 | ||

| Caesars Entertainment Inc / DBT (US12769GAD25) | 0.18 | 4.76 | 0.2833 | 0.0113 | ||

| US68622TAB70 / Organon Finance 1 LLC | 0.17 | -0.57 | 0.2785 | -0.0036 | ||

| Panther Escrow Issuer LLC / DBT (US69867RAA59) | 0.17 | 1.79 | 0.2750 | 0.0030 | ||

| US00PAFSQ891 / Air Transport Services Group, Inc. | 0.17 | 177.05 | 0.2722 | 0.1732 | ||

| S1YM34 / Gen Digital Inc. - Depositary Receipt (Common Stock) | 0.17 | 1,107.14 | 0.2719 | 0.2477 | ||

| Walker & Dunlop Inc / DBT (US93148PAA03) | 0.17 | 164.06 | 0.2717 | 0.1668 | ||

| US12649AAQ22 / CSMC 2014-USA OA LLC | 0.16 | 15.60 | 0.2628 | 0.0334 | ||

| US3140JAPZ53 / Fannie Mae Pool | 0.16 | -1.22 | 0.2601 | -0.0067 | ||

| US98920MAA09 / ZAXBY_21-1A | 0.16 | 1.27 | 0.2569 | 0.0000 | ||

| Alliant Holdings Intermediate, LLC, Term Loan B6 / LON (US01881UAM71) | 0.16 | 0.63 | 0.2555 | -0.0005 | ||

| US35564KSJ96 / STACR_22-DNA2 | 0.16 | 0.64 | 0.2523 | -0.0015 | ||

| Rocket Software Inc / DBT (US77314EAB48) | 0.15 | 0.00 | 0.2481 | -0.0021 | ||

| CHRD / Chord Energy Corporation | 0.15 | -22.73 | 0.2459 | -0.0760 | ||

| US31418ES506 / Fannie Mae Pool | 0.15 | -2.55 | 0.2456 | -0.0095 | ||

| SCI / Service Corporation International | 0.15 | 2.72 | 0.2432 | 0.0047 | ||

| US362341LP26 / GSMPS Mortgage Loan Trust 2005-RP3 | 0.15 | -3.25 | 0.2401 | -0.0093 | ||

| US12543DBN93 / CHS/Community Health Systems Inc | 0.15 | 8.03 | 0.2381 | 0.0150 | ||

| US345370DA55 / Ford Motor Co | 0.15 | 2.08 | 0.2368 | 0.0034 | ||

| US77340RAT41 / Rockies Express Pipeline LLC | 0.15 | 0.2334 | 0.2334 | |||

| US97360AAA51 / Windsor Holdings III LLC | 0.14 | 3.60 | 0.2321 | 0.0068 | ||

| US70932MAB37 / PENNYMAC FIN SVCS INC REGD 144A P/P 4.25000000 | 0.14 | 0.2314 | 0.2314 | |||

| US382550BJ95 / Goodyear Tire & Rubber Co. (The) | 0.14 | 6.67 | 0.2312 | 0.0123 | ||

| US25755TAH32 / Domino's Pizza Master Issuer LLC | 0.14 | 0.00 | 0.2306 | -0.0008 | ||

| USA Compression Partners LP / USA Compression Finance Corp / DBT (US91740PAG37) | 0.14 | 0.70 | 0.2303 | -0.0001 | ||

| Wynn Resorts Finance LLC / Wynn Resorts Capital Corp / DBT (US983133AD10) | 0.14 | 2.94 | 0.2261 | 0.0055 | ||

| US71880K1016 / Phinia Inc | 0.14 | 3.79 | 0.2200 | 0.0058 | ||

| IQVIA Inc / DBT (US46266TAG31) | 0.13 | 0.2141 | 0.2141 | |||

| US389375AL09 / Gray Television Inc | 0.13 | -35.29 | 0.2120 | -0.1194 | ||

| US82967NBJ63 / Sirius XM Radio Inc | 0.13 | 3.20 | 0.2081 | 0.0043 | ||

| Queen MergerCo Inc / DBT (US74825NAA54) | 0.13 | 0.2066 | 0.2066 | |||

| US55342UAM62 / MPT OPER PARTNERSHIP LP/CORP 3.5% 03/15/2031 | 0.12 | 6.03 | 0.1985 | 0.0098 | ||

| US50201DAD57 / LCPR Senior Secured Financing DAC | 0.12 | -19.86 | 0.1890 | -0.0481 | ||

| US78449RAJ41 / SLG Office Trust 2021-OVA | 0.12 | 1.77 | 0.1857 | 0.0016 | ||

| US92332YAA91 / Venture Global LNG, Inc. | 0.11 | 0.89 | 0.1824 | 0.0006 | ||

| Windstream Escrow LLC / Windstream Escrow Finance Corp / DBT (US97381AAA07) | 0.11 | 2.83 | 0.1765 | 0.0035 | ||

| US12636FBP71 / COMM 2015-LC23 Mortgage Trust | 0.10 | 0.00 | 0.1667 | -0.0001 | ||

| US897051AC29 / Tronox Inc | 0.10 | 0.98 | 0.1662 | 0.0001 | ||

| Acrisure LLC / Acrisure Finance Inc / DBT (US00489LAL71) | 0.10 | 0.1658 | 0.1658 | |||

| S2TW34 / Starwood Property Trust, Inc. - Depositary Receipt (Common Stock) | 0.10 | 3.00 | 0.1657 | 0.0039 | ||

| 83001AAA0 / Six Flags Entertainment Corp Bond | 0.10 | 3.00 | 0.1655 | 0.0024 | ||

| US501797AW48 / L Brands Inc | 0.10 | 1.98 | 0.1654 | 0.0013 | ||

| US595481AA05 / Mid-State Capital Corp 2005-1 Trust | 0.10 | -19.69 | 0.1652 | -0.0415 | ||

| WESCO Distribution Inc / DBT (US95081QAQ73) | 0.10 | 0.1651 | 0.1651 | |||

| CD&R Smokey Buyer Inc / DBT (US12515KAA60) | 0.10 | -11.40 | 0.1635 | -0.0211 | ||

| US237266AJ06 / Darling Ingredients Inc | 0.10 | 0.1626 | 0.1626 | |||

| US23918KAS78 / DaVita Inc | 0.10 | 3.26 | 0.1537 | 0.0048 | ||

| US31392GWE15 / Fannie Mae REMIC Trust 2003-W1 | 0.10 | -18.80 | 0.1528 | -0.0380 | ||

| US683715AD87 / Open Text Corp | 0.09 | -44.05 | 0.1511 | -0.1211 | ||

| DVAI34 / DaVita Inc. - Depositary Receipt (Common Stock) | 0.09 | 0.1491 | 0.1491 | |||

| US315289AC26 / Ferrellgas Escrow LLC / FG Operating Finance Escrow Corp | 0.09 | 2.22 | 0.1485 | 0.0020 | ||

| US17888HAA14 / Civitas Resources Inc | 0.09 | 0.00 | 0.1479 | -0.0024 | ||

| US46627MER43 / JP Morgan Alternative Loan Trust 2006-S1 | 0.09 | -9.09 | 0.1455 | -0.0147 | ||

| HRI / Herc Holdings Inc. | 0.09 | 0.1424 | 0.1424 | |||

| US118230AJ01 / Buckeye Partners Lp 4.875% Senior Notes 02/01/21 | 0.08 | 2.47 | 0.1333 | 0.0022 | ||

| US513075BW03 / Lamar Media Corp | 0.08 | 0.1306 | 0.1306 | |||

| US55265K2U21 / MASTR Asset Securitization Trust 2003-11 | 0.08 | 0.00 | 0.1262 | -0.0015 | ||

| US45254TDY73 / Impac Secured Assets CMN Owner Trust | 0.08 | -2.53 | 0.1250 | -0.0031 | ||

| Efesto Bidco S.p.A Efesto US LLC / DBT (US28201XAB10) | 0.08 | 2.74 | 0.1219 | 0.0035 | ||

| Freedom Mortgage Holdings LLC / DBT (US35641AAC27) | 0.08 | 2.74 | 0.1216 | 0.0031 | ||

| US50190EAA29 / MAGLLC 4 7/8 05/01/29 | 0.07 | 2.86 | 0.1170 | 0.0032 | ||

| Primo Water Holdings Inc / Triton Water Holdings Inc / DBT (US74168RAB96) | 0.07 | 1.41 | 0.1167 | 0.0006 | ||

| US46284VAN10 / Iron Mountain, Inc. | 0.07 | 4.41 | 0.1147 | 0.0034 | ||

| US489399AL90 / KENNEDY-WILSON INC 4.75% 03/01/2029 | 0.07 | 2.94 | 0.1128 | 0.0017 | ||

| US576434RL01 / MASTR Alternative Loan Trust 2004-5 | 0.07 | -1.43 | 0.1118 | -0.0025 | ||

| US914906AV42 / UNIVISION COMMUNICATIONS INC 4.5% 05/01/2029 144A | 0.07 | 3.03 | 0.1094 | 0.0022 | ||

| HRI / Herc Holdings Inc. | 0.07 | 1.54 | 0.1070 | 0.0015 | ||

| US812127AB45 / Sealed Air Corp/Sealed Air Corp US | 0.06 | 1.61 | 0.1013 | 0.0009 | ||

| US16115QAF72 / Chart Industries Inc | 0.06 | 0.00 | 0.1008 | 0.0001 | ||

| US315289AA69 / Ferrellgas Escrow LLC / FG Operating Finance Escrow Corp | 0.06 | 0.00 | 0.0954 | -0.0007 | ||

| US88576XAB29 / 321 Henderson Receivables VI LLC | 0.06 | -9.52 | 0.0922 | -0.0112 | ||

| Rocket Cos Inc / DBT (US77311WAB72) | 0.06 | 0.0903 | 0.0903 | |||

| Rocket Cos Inc / DBT (US77311WAA99) | 0.06 | 0.0899 | 0.0899 | |||

| US36200MTY92 / Ginnie Mae I Pool | 0.05 | -3.57 | 0.0870 | -0.0040 | ||

| Genesis Energy LP / Genesis Energy Finance Corp / DBT (US37185LAQ59) | 0.05 | 2.00 | 0.0834 | 0.0020 | ||

| DVAI34 / DaVita Inc. - Depositary Receipt (Common Stock) | 0.05 | 2.00 | 0.0831 | 0.0018 | ||

| WESCO Distribution Inc / DBT (US95081QAS30) | 0.05 | 2.00 | 0.0829 | 0.0016 | ||

| Ascent Resources Utica Holdings LLC / ARU Finance Corp / DBT (US04364VAX10) | 0.05 | 2.04 | 0.0817 | 0.0011 | ||

| US25461LAA08 / DIRECTV Holdings LLC/DIRECTV Financing Co., Inc. | 0.05 | 2.08 | 0.0800 | 0.0016 | ||

| Azorra Finance Ltd / DBT (US05480AAB17) | 0.05 | 0.0737 | 0.0737 | |||

| US59549WAB90 / Mid-State Trust XI | 0.04 | -14.58 | 0.0669 | -0.0114 | ||

| Morgan Stanley / DIR (N/A) | 0.04 | 0.0645 | 0.0645 | |||

| US55916AAA25 / Magic Mergeco Inc | 0.04 | 14.71 | 0.0641 | 0.0086 | ||

| US92339LAA08 / VERDE PURCHASER LLC 10.5% 11/30/2030 144A | 0.04 | 0.00 | 0.0608 | 0.0008 | ||

| US31392CMS07 / Fannie Mae REMIC Trust 2002-W1 | 0.04 | -5.26 | 0.0591 | -0.0024 | ||

| MPT Operating Partnership LP / MPT Finance Corp / DBT (US55342UAQ76) | 0.04 | 2.86 | 0.0588 | 0.0011 | ||

| Acrisure LLC / Acrisure Finance Inc / DBT (US004961AA64) | 0.04 | 0.0570 | 0.0570 | |||

| US36291LT703 / Ginnie Mae I Pool | 0.03 | 0.00 | 0.0551 | -0.0015 | ||

| US36228FEC68 / GSMPS Mortgage Loan Trust 2001-2 | 0.03 | 0.00 | 0.0533 | -0.0011 | ||

| Gates Corp/DE / DBT (US367398AA27) | 0.03 | 3.33 | 0.0500 | 0.0006 | ||

| Jane Street Group / JSG Finance Inc / DBT (US47077WAE84) | 0.03 | 0.0495 | 0.0495 | |||

| US20268KAD28 / Commonbond Student Loan Trust 2017-B-GS | 0.03 | 3.45 | 0.0488 | 0.0004 | ||

| US17888HAB96 / Civitas Resources Inc | 0.03 | -46.43 | 0.0487 | -0.0427 | ||

| F2IC34 / Fair Isaac Corporation - Depositary Receipt (Common Stock) | 0.03 | 0.0486 | 0.0486 | |||

| Ryan Specialty LLC / DBT (US78351GAA31) | 0.03 | 3.45 | 0.0485 | 0.0006 | ||

| US22942KAV26 / CSMC Mortgage-Backed Trust 2006-7 | 0.03 | 0.00 | 0.0484 | -0.0013 | ||

| CNX Resources Corp / DBT (US12653CAL28) | 0.03 | 0.00 | 0.0415 | 0.0004 | ||

| JH North America Holdings Inc / DBT (US46593WAA36) | 0.03 | 0.0405 | 0.0405 | |||

| US12543DBL38 / CHS/CMNTY HEALTH SYSTEMS INC 6.125% 04/01/2030 144A | 0.02 | 23.53 | 0.0344 | 0.0064 | ||

| Stonex Escrow Issuer LLC / DBT (US86189AAA79) | 0.02 | 0.0324 | 0.0324 | |||

| US31416BK727 / Fannie Mae Pool | 0.02 | -5.26 | 0.0299 | -0.0011 | ||

| US31404ECF16 / Fannie Mae Pool | 0.02 | 0.00 | 0.0280 | -0.0009 | ||

| US61748HVK49 / Morgan Stanley Mortgage Loan Trust 2006-2 | 0.02 | -15.00 | 0.0277 | -0.0059 | ||

| US79549AYQ65 / Citigroup Global Markets Mortgage Securities VII Inc | 0.02 | -6.25 | 0.0256 | -0.0012 | ||

| US31409YUJ45 / Fannie Mae Pool | 0.01 | 0.00 | 0.0166 | -0.0003 | ||

| C2AC34 / CACI International Inc - Depositary Receipt (Common Stock) | 0.01 | 0.0166 | 0.0166 | |||

| US31407EHX40 / Fannie Mae Pool | 0.01 | 0.00 | 0.0155 | -0.0005 | ||

| US07325DAF15 / Bayview Financial Mortgage Pass-Through Trust 2006-C | 0.01 | 0.00 | 0.0117 | -0.0010 | ||

| US31409TQL51 / Fannie Mae Pool | 0.01 | 0.00 | 0.0107 | -0.0002 | ||

| US939336T290 / Washington Mutual MSC Mortgage Pass-Through Certificates Series 2004-RA3 Trust | 0.01 | 0.00 | 0.0083 | -0.0005 | ||

| US31401JNR58 / Fannie Mae Pool | 0.00 | -20.00 | 0.0068 | -0.0016 | ||

| US31292GXD32 / Freddie Mac Gold Pool | 0.00 | 0.00 | 0.0056 | -0.0006 | ||

| US02666BAG14 / American Homes 4 Rent 2015-SFR2 Trust | 0.00 | 0.0000 | -0.0000 | |||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | -3.29 | -3.32 | -5.2825 | 0.2260 | ||

| RBC USA Holdco Corp / RA (956CQD002) | -5.01 | 0.00 | -8.0425 | 0.0658 | ||

| TD Securities (USA), LLC / RA (935IKF006) | -7.44 | 0.00 | -11.9460 | 0.0978 | ||

| 913ZLW006 / Reverse Repo BNP Paribas | -9.96 | 0.00 | -15.9850 | 0.1308 |