Mga Batayang Estadistika

| Nilai Portofolio | $ 186,008,587 |

| Posisi Saat Ini | 100 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

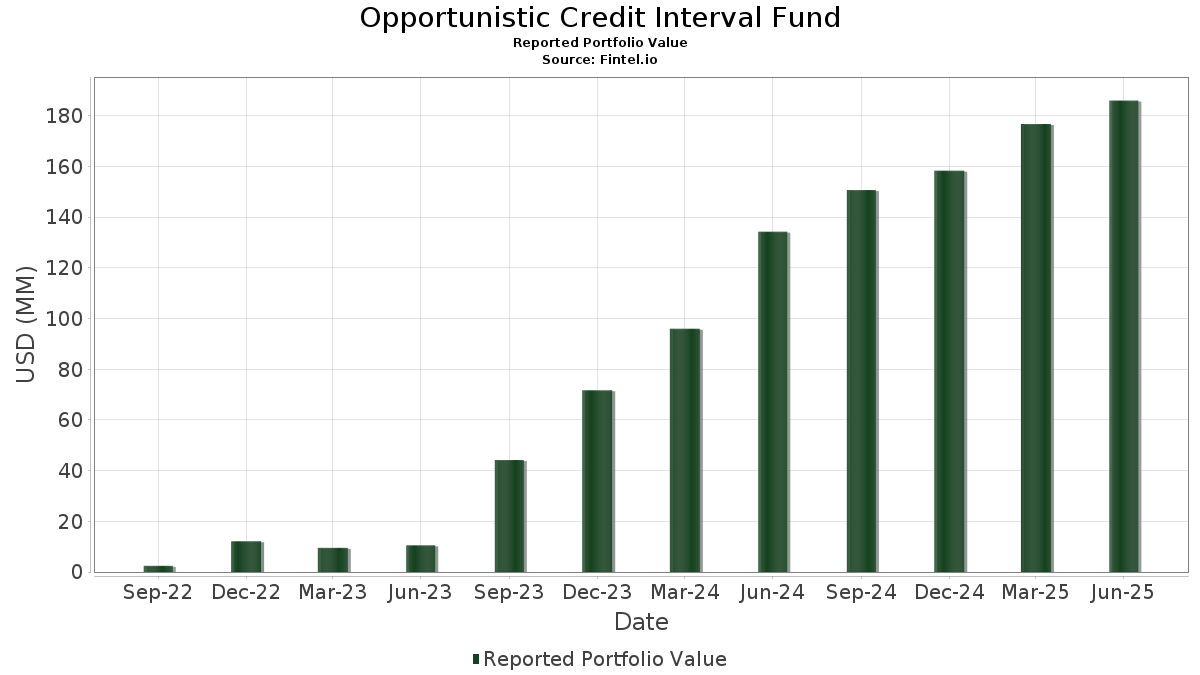

Opportunistic Credit Interval Fund telah mengungkapkan total kepemilikan 100 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 186,008,587 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Opportunistic Credit Interval Fund adalah US BANK MMDA (US:8AMMF0JA0) , Florida Food Products, LLC, First Lien Term Loan (US:US34068GAD43) , HS Purchaser LLC (US:US42351EAB20) , Neptune Bidco US Inc 2022 USD Term Loan A (US:US64069JAF93) , and Tank Holding Corp. 2022 Term Loan (US:US87583FAN87) . Posisi baru Opportunistic Credit Interval Fund meliputi: Florida Food Products, LLC, First Lien Term Loan (US:US34068GAD43) , HS Purchaser LLC (US:US42351EAB20) , Neptune Bidco US Inc 2022 USD Term Loan A (US:US64069JAF93) , Tank Holding Corp. 2022 Term Loan (US:US87583FAN87) , and Mount Logan Funding 2018-1 LP (US:US62188AAC53) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 5.66 | 6.46 | 4.1397 | 4.1397 | |

| 6.29 | 4.0325 | 4.0325 | ||

| 5.65 | 3.6215 | 3.6215 | ||

| 7.89 | 5.39 | 3.4550 | 3.4550 | |

| 5.13 | 3.2855 | 3.2855 | ||

| 5.10 | 3.2654 | 3.2654 | ||

| 5.00 | 3.2052 | 3.2052 | ||

| 4.99 | 3.1978 | 3.1978 | ||

| 4.96 | 3.1796 | 3.1796 | ||

| 4.64 | 2.9733 | 2.9733 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 2.75 | 1.7649 | -0.4619 | ||

| 6.36 | 4.0760 | -0.1619 | ||

| 4.91 | 3.1465 | -0.0512 | ||

| -0.06 | -0.0379 | -0.0379 | ||

| 1.74 | 1.1126 | -0.0296 | ||

| 0.85 | 0.5473 | -0.0266 | ||

| 0.27 | 0.1703 | -0.0166 | ||

| -0.01 | -0.0077 | -0.0077 | ||

| -0.00 | -0.0016 | -0.0016 | ||

| -0.00 | -0.0007 | -0.0007 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-29 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| EBSC Holdings LLC / EP (N/A) | 5.66 | 6.46 | 4.1397 | 4.1397 | |||||

| EJF CRT 2024-R1 LLC / ABS-MBS (US282930AA49) | 6.36 | -2.81 | 4.0760 | -0.1619 | |||||

| Cor Leonis Limited, Revolver / LON (N/A) | 6.29 | 4.0325 | 4.0325 | ||||||

| RHF VI Funding LLC, Revolver / LON (N/A) | 5.65 | 3.6215 | 3.6215 | ||||||

| Great Lakes Funding II LLC, Series A / EC (N/A) | 7.89 | 5.39 | 3.4550 | 3.4550 | |||||

| BetaNXT, Inc., First Lien Term Loan / LON (N/A) | 5.13 | 3.2855 | 3.2855 | ||||||

| SPB C-2024, LLC, First Lien Term Loan / LON (N/A) | 5.10 | 3.2654 | 3.2654 | ||||||

| VTX Intermediate Holdings, Inc., Second Lien Term Loan / LON (N/A) | 5.00 | 3.2052 | 3.2052 | ||||||

| RHF VIII Holdings LLC, Revolver / LON (N/A) | 4.99 | 3.1978 | 3.1978 | ||||||

| Expert Experience Credit Motors, LLC, Revolver / LON (N/A) | 4.96 | 3.1796 | 3.1796 | ||||||

| Resolute Investment Managers Inc, First Lien Term Loan / LON (04635WAL8) | 4.91 | -0.57 | 3.1465 | -0.0512 | |||||

| Marvel APS, Delayed Draw Term Loan / LON (N/A) | 4.64 | 2.9733 | 2.9733 | ||||||

| Synamedia Americas Holdings, Inc., First Lien Term Loan / LON (N/A) | 4.62 | 2.9589 | 2.9589 | ||||||

| Epilog Partners SPV III, LLC / EP (N/A) | 3.54 | 4.43 | 2.8368 | 2.8368 | |||||

| Epilog Partners SPV III, LLC / EP (N/A) | 3.54 | 4.43 | 2.8368 | 2.8368 | |||||

| Russell Investments US Institutional Holdco, Inc., First Lien Term Loan / LON (N/A) | 4.37 | 2.8003 | 2.8003 | ||||||

| Treville Capital Solutions Fund A LP / EC (N/A) | 3.50 | 4.09 | 2.6238 | 2.6238 | |||||

| 8AMMF0JA0 / US BANK MMDA | 4.07 | 51.49 | 4.07 | 51.47 | 2.6063 | 0.8678 | |||

| Fulcrum US Holdings, Inc., Revolver / LON (N/A) | 4.00 | 2.5629 | 2.5629 | ||||||

| Astro Acquisition, LLC, First Lien Term Loan / LON (N/A) | 3.95 | 2.5309 | 2.5309 | ||||||

| Highmount DP SPV, LLC, Class A, Preferred / EP (N/A) | 3.57 | 3.57 | 2.2883 | 2.2883 | |||||

| IDC Infusion Services, Second Amendment First Lien Term Loan / LON (N/A) | 3.45 | 2.2088 | 2.2088 | ||||||

| DCert Buyer, Inc., First Amendment Term Loan Refinancing, Second Lien Term Loan / LON (N/A) | 3.10 | 1.9892 | 1.9892 | ||||||

| VTX Intermediate Holdings, Inc., First Lien Term Loan / LON (N/A) | 3.04 | 1.9508 | 1.9508 | ||||||

| EJF CRT 2025-1 LLC / ABS-MBS (US282922AB97) | 3.00 | 1.9222 | 1.9222 | ||||||

| Princeton Medspa Partners, LLC / EP (N/A) | 3.96 | 2.83 | 1.8102 | 1.8102 | |||||

| PMA Parent Holdings LLC, First Lien Term Loan / LON (N/A) | 2.76 | 1.7687 | 1.7687 | ||||||

| US34068GAD43 / Florida Food Products, LLC, First Lien Term Loan | 2.75 | -19.92 | 1.7649 | -0.4619 | |||||

| Neptune Bidco US Inc., First Lien Term Loan / LON (N/A) | 2.48 | 1.5881 | 1.5881 | ||||||

| USN Opco, LLC, First Lien Term Loan / LON (N/A) | 2.47 | 1.5799 | 1.5799 | ||||||

| TA/WEG HOLDINGS, LLC, 2024 Delayed Draw Term Loan / LON (N/A) | 2.44 | 1.5629 | 1.5629 | ||||||

| Broadway Strategic Return Fund LP, Delayed Draw Term Loan / LON (N/A) | 2.42 | 1.5530 | 1.5530 | ||||||

| Middle West Spirits, LLC, Preferred / EP (N/A) | 2.45 | 2.41 | 1.5450 | 1.5450 | |||||

| US42351EAB20 / HS Purchaser LLC | 2.35 | 3.79 | 1.5079 | 0.0398 | |||||

| US64069JAF93 / Neptune Bidco US Inc 2022 USD Term Loan A | 2.33 | 9.18 | 1.4946 | 0.1116 | |||||

| Kofax, Inc., First Lien Term Loan / LON (N/A) | 2.32 | 1.4884 | 1.4884 | ||||||

| Ivanti Software, Inc., First Lien Term Loan / LON (N/A) | 2.08 | 1.3352 | 1.3352 | ||||||

| AIS Holdco, LLC, First Lien Term Loan / LON (N/A) | 2.07 | 1.3231 | 1.3231 | ||||||

| White Oak Equipment Finance 1, LLC / (N/A) | 2.05 | 1.3163 | 1.3163 | ||||||

| Radiology Partners, Inc, First Lien Term Loan / LON (N/A) | 2.02 | 1.2927 | 1.2927 | ||||||

| Jackson Ranch LLC, First Lien Term Loan / LON (N/A) | 2.02 | 1.2922 | 1.2922 | ||||||

| TRMEF Basis II LLC / EC (N/A) | 2.00 | 2.00 | 1.2814 | 1.2814 | |||||

| Franklin BSP Capital Corp / EC (N/A) | 0.14 | 1.97 | 1.2608 | 1.2608 | |||||

| PMP OPCO, LLC, First Lien Term Loan / LON (N/A) | 1.84 | 1.1800 | 1.1800 | ||||||

| Neptune Bidco US Inc., Second Lien Term Loan / LON (N/A) | 1.76 | 1.1284 | 1.1284 | ||||||

| US87583FAN87 / Tank Holding Corp. 2022 Term Loan | 1.74 | -1.59 | 1.1126 | -0.0296 | |||||

| Morae Global Corporation, Term Loan B / LON (N/A) | 1.67 | 1.0681 | 1.0681 | ||||||

| Tactical Air Support, Inc., First Lien Term Loan / LON (N/A) | 1.64 | 1.0504 | 1.0504 | ||||||

| CCMG Buyer, LLC, First Lien Term Loan / LON (N/A) | 1.57 | 1.0043 | 1.0043 | ||||||

| Dentive LLC, Delayed Draw Term Loan / LON (N/A) | 1.56 | 0.9977 | 0.9977 | ||||||

| Meridian Venture Partners II LP, First Lien Term Loan / LON (N/A) | 1.44 | 0.9196 | 0.9196 | ||||||

| Material Handling Systems, Inc., First Lien Term Loan / LON (N/A) | 1.24 | 0.7928 | 0.7928 | ||||||

| Morae Global Corporation, First Lien Term Loan / LON (N/A) | 1.24 | 0.7919 | 0.7919 | ||||||

| Lion FIV Debtco Limited, Revolver / LON (N/A) | 1.22 | 0.7811 | 0.7811 | ||||||

| PocketWatch, Inc., First Lien Term Loan / LON (N/A) | 1.21 | 0.7746 | 0.7746 | ||||||

| Riskonnect Parent LLC, First Lien Term Loan / LON (N/A) | 1.20 | 0.7693 | 0.7693 | ||||||

| Next Flight Ventures, First Lien Term Loan / LON (N/A) | 1.19 | 0.7605 | 0.7605 | ||||||

| Riddell Inc., First Lien Term Loan / LON (76566PAB6) | 0.85 | -3.61 | 0.5473 | -0.0266 | |||||

| Enverus Holdings, Inc., Initial First Lien Term Loan / LON (N/A) | 0.80 | 0.5123 | 0.5123 | ||||||

| HDC / HW Intermediate Holdings, LLC, First Lien Term Loan A / LON (N/A) | 0.80 | 0.5121 | 0.5121 | ||||||

| Global Integrated Flooring Systems Inc., First Lien Term Loan / LON (N/A) | 0.67 | 0.4273 | 0.4273 | ||||||

| PEAK Technology Partners, Inc., First Lien Term Loan / LON (N/A) | 0.61 | 0.3878 | 0.3878 | ||||||

| Royal Palm Equity Partners I L.P., Initial First Lien Term Loan / LON (N/A) | 0.60 | 0.3858 | 0.3858 | ||||||

| PhyNet Dermatology LLC, First Lien Term Loan / LON (N/A) | 0.47 | 0.3040 | 0.3040 | ||||||

| South Florida ENT Associates, First Lien Term Loan / LON (N/A) | 0.39 | 0.2472 | 0.2472 | ||||||

| Middle West Spirits, LLC, First Lien Term Loan / LON (N/A) | 0.38 | 0.2411 | 0.2411 | ||||||

| IDC Infusion Services, Inc., First Lien Term Loan / LON (N/A) | 0.36 | 0.2319 | 0.2319 | ||||||

| Taoglas Group Holdings Limited, First Lien Term Loan / LON (N/A) | 0.30 | 0.1939 | 0.1939 | ||||||

| Tactical Air Support, Inc., Delayed Draw Term Loan / LON (N/A) | 0.27 | 0.1751 | 0.1751 | ||||||

| US62188AAC53 / Mount Logan Funding 2018-1 LP | 0.27 | -7.99 | 0.1703 | -0.0166 | |||||

| Next Flight Ventures, Delayed Draw Term Loan / LON (N/A) | 0.25 | 0.1620 | 0.1620 | ||||||

| Dentive LLC, First Lien Term Loan / LON (N/A) | 0.23 | 0.1473 | 0.1473 | ||||||

| Ivanti Security Holdings LLC, NewCo First Lien Term Loan / LON (N/A) | 0.19 | 0.1192 | 0.1192 | ||||||

| AQ Phoenix Parent, L.P. / EC (N/A) | 0.05 | 0.16 | 0.1055 | 0.1055 | |||||

| South Florida ENT Associates, Delayed Draw Term Loan / LON (N/A) | 0.14 | 0.0868 | 0.0868 | ||||||

| IDC Infusion Services, Inc., Delayed Draw Term Loan / LON (N/A) | 0.12 | 0.0751 | 0.0751 | ||||||

| Dentive LLC, Delayed Draw Term Loan / LON (N/A) | 0.11 | 0.0732 | 0.0732 | ||||||

| Morae Global Corporation, Revolver / LON (N/A) | 0.10 | 0.0626 | 0.0626 | ||||||

| Morae Global Holdings Inc, Warrant 2 / (N/A) | 0.00 | 0.08 | 0.0543 | 0.0543 | |||||

| Morae Global Corporation, Warrants / (N/A) | 0.08 | 0.0507 | 0.0507 | ||||||

| Taoglas Group Holdings Limited, Revolver / LON (N/A) | 0.08 | 0.0484 | 0.0484 | ||||||

| Royal Palm Equity Partners I L.P., First Lien Term Loan / LON (N/A) | 0.07 | 0.0478 | 0.0478 | ||||||

| IFRG Investor III, L.P. / EC (N/A) | 1.28 | 0.07 | 0.0475 | 0.0475 | |||||

| Royal Palm Equity Partners I L.P., Delayed Draw Term Loan / LON (N/A) | 0.06 | 0.0387 | 0.0387 | ||||||

| VTX Holdings, LLC / EC (N/A) | 2.49 | 0.06 | 0.0379 | 0.0379 | |||||

| Morae Global Corporation, Delayed Draw Term Loan / LON (N/A) | 0.05 | 0.0308 | 0.0308 | ||||||

| Royal Palm Equity Partners II L.P., First Lien Term Loan / LON (N/A) | 0.04 | 0.0286 | 0.0286 | ||||||

| Middle West Spirits, LLC, Common Stock / EC (N/A) | 0.00 | 0.04 | 0.0242 | 0.0242 | |||||

| HDC/HW INTERMEDIATE HOLDINGS, LLC, Delayed Draw Term Loan / LON (N/A) | 0.03 | 0.0214 | 0.0214 | ||||||

| NFV Co-Pilot, Inc. / EC (N/A) | 0.00 | 0.03 | 0.0204 | 0.0204 | |||||

| Riskonnect Parent LLC, Delayed Draw Term Loan / LON (N/A) | 0.01 | 0.0080 | 0.0080 | ||||||

| Global Integrated Flooring Systems Inc., Revolver / LON (N/A) | 0.01 | 0.0043 | 0.0043 | ||||||

| Next Flight Ventures / EC (N/A) | 0.00 | 0.01 | 0.0041 | 0.0041 | |||||

| Enverus Holdings, Inc., Revolver / LON (N/A) | 0.00 | 0.0032 | 0.0032 | ||||||

| HDC / HW Intermediate Holdings, LLC, First Lien Term Loan B / LON (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| CCMG Buyer, LLC, Revolver / LON (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| TA/WEG HOLDINGS, LLC, Revolver / LON (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| Middle West Spirits, LLC, Revolver / LON (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| PhyNet Dermatology LLC, Delayed Draw Term Loan / LON (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| HDC / HW Intermediate Holdings, LLC / EC (N/A) | 0.02 | 0.00 | 0.0000 | 0.0000 | |||||

| Princeton Medspa Partners, LLC / DE (N/A) | 0.00 | 0.00 | 0.0000 | 0.0000 | |||||

| Princeton Medspa Partners, LLC / DE (N/A) | 0.00 | 0.00 | 0.0000 | 0.0000 | |||||

| US87583FAM05 / Tank Holding Corp., Revolver Loan | -0.00 | -0.0002 | -0.0001 | ||||||

| Riddell Inc., Delayed Draw Term Loan / LON (76566PAC4) | -0.00 | -0.0002 | -0.0002 | ||||||

| AIS Holdco, LLC, Revolver / LON (N/A) | -0.00 | -0.0007 | -0.0007 | ||||||

| PMA Parent Holdings LLC, Revolver / LON (N/A) | -0.00 | -0.0016 | -0.0016 | ||||||

| PMP OPCO, LLC, Revolver / LON (N/A) | -0.01 | -0.0077 | -0.0077 | ||||||

| PMP OPCO, LLC, Delayed Draw Term Loan / LON (N/A) | -0.06 | -0.0379 | -0.0379 |