Mga Batayang Estadistika

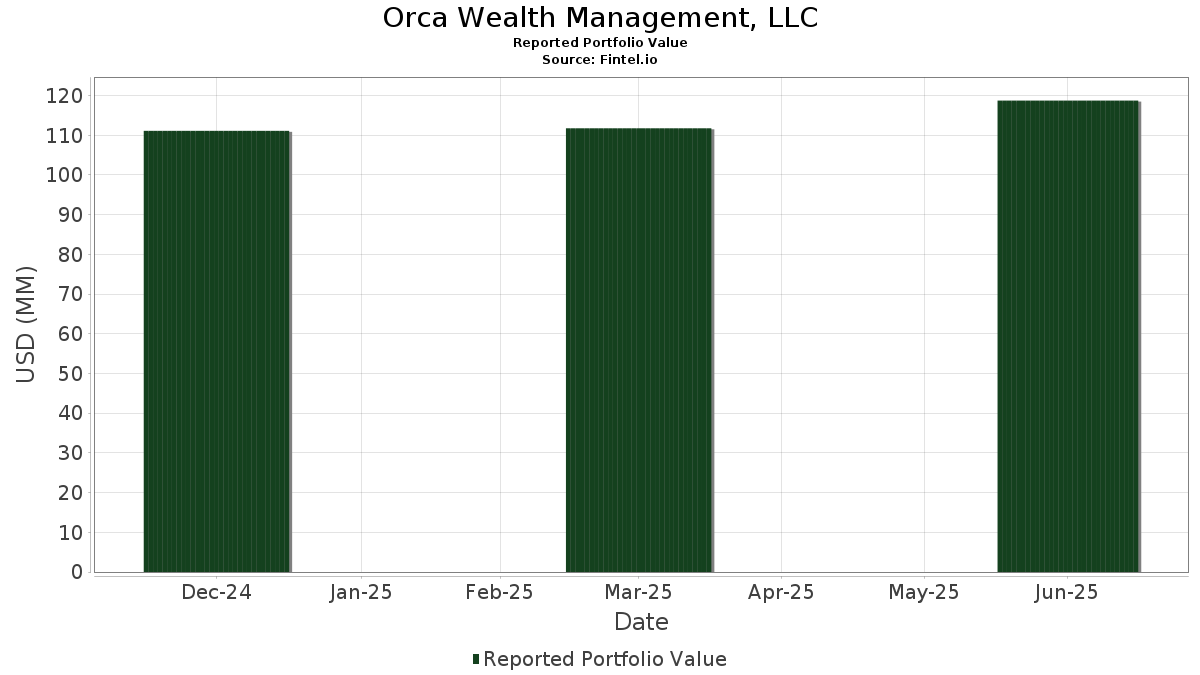

| Nilai Portofolio | $ 118,741,488 |

| Posisi Saat Ini | 64 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

Orca Wealth Management, LLC telah mengungkapkan total kepemilikan 64 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 118,741,488 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Orca Wealth Management, LLC adalah Apple Inc. (US:AAPL) , Old Republic International Corporation (US:ORI) , Cisco Systems, Inc. (US:CSCO) , QUALCOMM Incorporated (US:QCOM) , and Philip Morris International Inc. (US:PM) . Posisi baru Orca Wealth Management, LLC meliputi: British American Tobacco p.l.c. - Depositary Receipt (Common Stock) (US:BTI) , EOG Resources, Inc. (US:EOG) , Danaher Corporation (US:DHR) , Meta Platforms, Inc. (BG:FB2A) , and .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.06 | 2.66 | 2.2435 | 2.2435 | |

| 0.01 | 1.32 | 1.1130 | 1.1130 | |

| 0.02 | 4.63 | 3.1398 | 0.5832 | |

| 0.01 | 1.60 | 1.0859 | 0.4262 | |

| 0.00 | 0.49 | 0.4123 | 0.4123 | |

| 0.01 | 2.08 | 1.4140 | 0.1493 | |

| 0.00 | 0.21 | 0.1392 | 0.1392 | |

| 0.00 | 1.04 | 0.7030 | 0.0038 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.06 | 11.87 | 8.0583 | -3.7301 | |

| 0.15 | 5.93 | 4.0271 | -1.3728 | |

| 0.07 | 4.86 | 3.3025 | -1.3098 | |

| 0.03 | 3.37 | 2.2873 | -1.0133 | |

| 0.03 | 5.20 | 3.5312 | -0.9992 | |

| 0.01 | 3.38 | 2.2968 | -0.8744 | |

| 0.07 | 1.75 | 1.1897 | -0.8078 | |

| 0.03 | 3.11 | 2.1136 | -0.7843 | |

| 0.01 | 2.03 | 1.3775 | -0.7544 | |

| 0.01 | 1.90 | 1.2883 | -0.6761 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-22 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AAPL / Apple Inc. | 0.06 | -2.45 | 11.87 | -9.90 | 8.0583 | -3.7301 | |||

| ORI / Old Republic International Corporation | 0.15 | 0.29 | 5.93 | -1.71 | 4.0271 | -1.3728 | |||

| CSCO / Cisco Systems, Inc. | 0.08 | 0.37 | 5.53 | 12.86 | 3.7535 | -0.6308 | |||

| QCOM / QUALCOMM Incorporated | 0.03 | -0.91 | 5.20 | 2.73 | 3.5312 | -0.9992 | |||

| PM / Philip Morris International Inc. | 0.03 | 0.53 | 5.02 | 15.36 | 3.4060 | -0.4860 | |||

| AZN / AstraZeneca PLC - Depositary Receipt (Common Stock) | 0.07 | -0.74 | 4.86 | -5.63 | 3.3025 | -1.3098 | |||

| RTX / RTX Corporation | 0.03 | -0.05 | 4.83 | 10.18 | 3.2755 | -0.6430 | |||

| AVGO / Broadcom Inc. | 0.02 | -1.68 | 4.63 | 61.88 | 3.1398 | 0.5832 | |||

| JPM / JPMorgan Chase & Co. | 0.01 | -1.67 | 4.10 | 16.21 | 2.7842 | -0.3736 | |||

| CB / Chubb Limited | 0.01 | -0.49 | 3.38 | -4.54 | 2.2968 | -0.8744 | |||

| XOM / Exxon Mobil Corporation | 0.03 | 0.77 | 3.37 | -8.65 | 2.2873 | -1.0133 | |||

| PRU / Prudential Financial, Inc. | 0.03 | -0.07 | 3.11 | -3.86 | 2.1136 | -0.7843 | |||

| BTI / British American Tobacco p.l.c. - Depositary Receipt (Common Stock) | 0.06 | 2.66 | 2.2435 | 2.2435 | |||||

| BX / Blackstone Inc. | 0.02 | -2.76 | 2.52 | 4.04 | 1.7130 | -0.4570 | |||

| EXE / Expand Energy Corporation | 0.02 | 0.07 | 2.22 | 5.12 | 1.5065 | -0.3824 | |||

| CGDV / Capital Group Dividend Value ETF | 0.05 | 1.12 | 2.13 | 12.05 | 1.4465 | -0.2552 | |||

| CSX / CSX Corporation | 0.06 | 0.28 | 2.09 | 11.22 | 1.4204 | -0.2635 | |||

| NVDD / Direxion Shares ETF Trust - Direxion Daily NVDA Bear 1X Shares | 0.01 | 1.10 | 2.08 | 47.35 | 1.4140 | 0.1493 | |||

| UBS / UBS Group AG | 0.06 | 1.89 | 2.07 | 12.47 | 1.4031 | -0.2407 | |||

| CVX / Chevron Corporation | 0.01 | -0.50 | 2.03 | -14.82 | 1.3775 | -0.7544 | |||

| ABBV / AbbVie Inc. | 0.01 | -2.42 | 1.90 | -13.58 | 1.2883 | -0.6761 | |||

| GOOG / Alphabet Inc. | 0.01 | 0.30 | 1.84 | 13.90 | 1.2460 | -0.1960 | |||

| DOW / Dow Inc. | 0.07 | 3.52 | 1.75 | -21.51 | 1.1897 | -0.8078 | |||

| HON / Honeywell International Inc. | 0.01 | 0.12 | 1.73 | 10.11 | 1.1753 | -0.2314 | |||

| BAC / Bank of America Corporation | 0.04 | 1.20 | 1.67 | 14.76 | 1.1351 | -0.1687 | |||

| MU / Micron Technology, Inc. | 0.01 | 52.96 | 1.60 | 116.96 | 1.0859 | 0.4262 | |||

| GOOGL / Alphabet Inc. | 0.01 | 1.16 | 1.59 | 15.35 | 1.0815 | -0.1550 | |||

| CMI / Cummins Inc. | 0.00 | 0.61 | 1.51 | 5.16 | 1.0247 | -0.2601 | |||

| DUK / Duke Energy Corporation | 0.01 | 0.64 | 1.50 | -2.66 | 1.0174 | -0.3598 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | -0.69 | 1.48 | -9.45 | 1.0018 | -0.4559 | |||

| FITB / Fifth Third Bancorp | 0.04 | 1.07 | 1.47 | 6.07 | 0.9960 | -0.2420 | |||

| TTE / TotalEnergies SE - Depositary Receipt (Common Stock) | 0.02 | -1.07 | 1.38 | -6.12 | 0.9378 | -0.3788 | |||

| VZ / Verizon Communications Inc. | 0.03 | 0.99 | 1.34 | -3.66 | 0.9121 | -0.3359 | |||

| EOG / EOG Resources, Inc. | 0.01 | 1.32 | 1.1130 | 1.1130 | |||||

| BG / Bunge Global SA | 0.02 | 0.29 | 1.28 | 5.35 | 0.8700 | -0.2185 | |||

| CAT / Caterpillar Inc. | 0.00 | 0.21 | 1.28 | 18.06 | 0.8656 | -0.1016 | |||

| LMT / Lockheed Martin Corporation | 0.00 | 0.15 | 1.22 | 3.84 | 0.8259 | -0.2227 | |||

| MSFT / Microsoft Corporation | 0.00 | 0.00 | 1.04 | 32.52 | 0.7030 | 0.0038 | |||

| GD / General Dynamics Corporation | 0.00 | 0.18 | 0.99 | 7.17 | 0.6706 | -0.1541 | |||

| HD / The Home Depot, Inc. | 0.00 | -1.83 | 0.98 | -1.80 | 0.6656 | -0.2281 | |||

| T / AT&T Inc. | 0.03 | 0.94 | 0.94 | 3.29 | 0.6392 | -0.1765 | |||

| BNS / The Bank of Nova Scotia | 0.02 | 0.31 | 0.93 | 16.92 | 0.6337 | -0.0809 | |||

| ED / Consolidated Edison, Inc. | 0.01 | 0.83 | 0.77 | -8.54 | 0.5239 | -0.2309 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | 0.00 | 0.73 | -8.77 | 0.4947 | -0.2197 | |||

| MRK / Merck & Co., Inc. | 0.01 | -0.79 | 0.62 | -12.57 | 0.4209 | -0.2131 | |||

| SAN / Banco Santander, S.A. - Depositary Receipt (Common Stock) | 0.06 | 1.77 | 0.54 | 26.12 | 0.3644 | -0.0166 | |||

| DIS / The Walt Disney Company | 0.00 | -2.66 | 0.52 | 22.25 | 0.3549 | -0.0275 | |||

| DD / DuPont de Nemours, Inc. | 0.01 | -2.18 | 0.50 | -10.16 | 0.3423 | -0.1599 | |||

| DHR / Danaher Corporation | 0.00 | 0.49 | 0.4123 | 0.4123 | |||||

| SO / The Southern Company | 0.00 | 0.16 | 0.41 | 0.24 | 0.2797 | -0.0889 | |||

| ABT / Abbott Laboratories | 0.00 | -2.03 | 0.36 | 0.57 | 0.2410 | -0.0752 | |||

| CGXU / Capital Group International Focus Equity ETF | 0.01 | 3.70 | 0.34 | 15.02 | 0.2290 | -0.0336 | |||

| AMAT / Applied Materials, Inc. | 0.00 | -0.50 | 0.33 | 25.97 | 0.2206 | -0.0110 | |||

| JNJ / Johnson & Johnson | 0.00 | 0.70 | 0.29 | -7.44 | 0.1946 | -0.0820 | |||

| AXP / American Express Company | 0.00 | -25.70 | 0.29 | -12.04 | 0.1941 | -0.0961 | |||

| IBM / International Business Machines Corporation | 0.00 | 0.53 | 0.28 | 19.40 | 0.1882 | -0.0198 | |||

| MO / Altria Group, Inc. | 0.00 | 1.67 | 0.26 | -0.75 | 0.1790 | -0.0585 | |||

| FDX / FedEx Corporation | 0.00 | 0.62 | 0.26 | -6.16 | 0.1765 | -0.0712 | |||

| CGCB / Capital Group Fixed Income ETF Trust - Capital Group Core Bond ETF | 0.01 | 0.85 | 0.26 | 1.19 | 0.1738 | -0.0532 | |||

| VWO / Vanguard International Equity Index Funds - Vanguard FTSE Emerging Markets ETF | 0.01 | 0.29 | 0.26 | 9.44 | 0.1737 | -0.0352 | |||

| KLAC / KLA Corporation | 0.00 | -15.87 | 0.25 | 11.06 | 0.1708 | -0.0322 | |||

| GE / General Electric Company | 0.00 | -8.94 | 0.24 | 16.83 | 0.1655 | -0.0208 | |||

| FB2A / Meta Platforms, Inc. | 0.00 | 0.21 | 0.1392 | 0.1392 | |||||

| NUV / Nuveen Municipal Value Fund, Inc. | 0.02 | 0.95 | 0.18 | 0.00 | 0.1195 | -0.0380 | |||

| KHC / The Kraft Heinz Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PSX / Phillips 66 | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SBCF / Seacoast Banking Corporation of Florida | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| AMZN / Amazon.com, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |