Mga Batayang Estadistika

| Nilai Portofolio | $ 173,434,159 |

| Posisi Saat Ini | 373 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

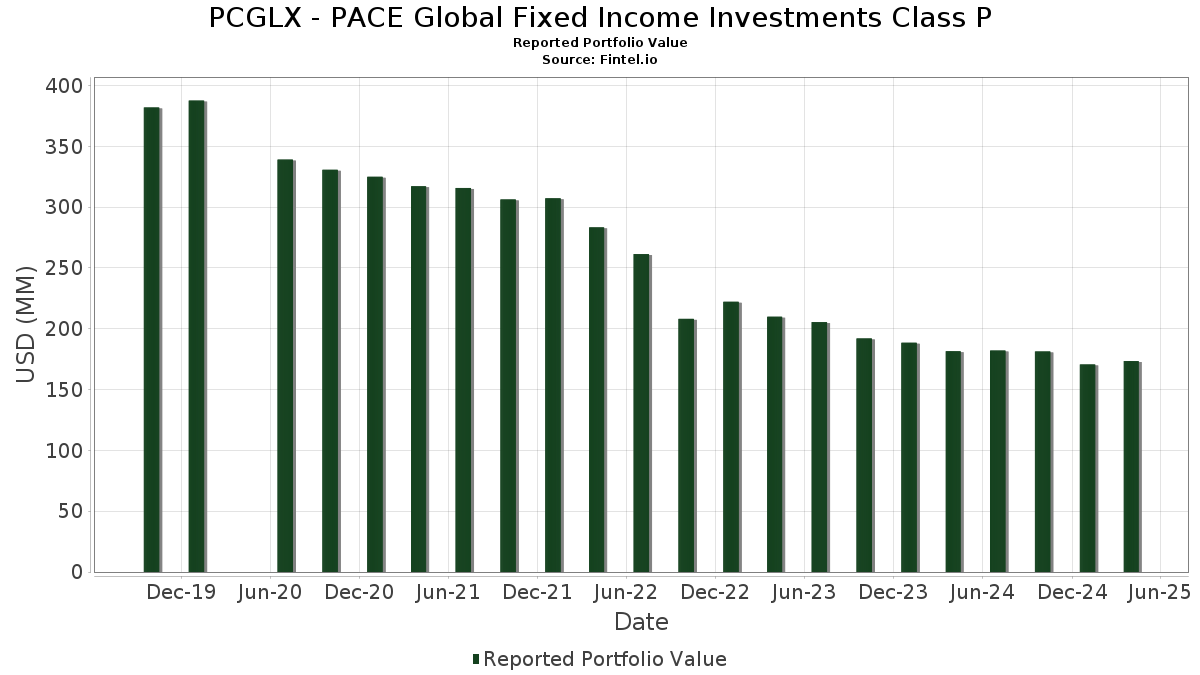

PCGLX - PACE Global Fixed Income Investments Class P telah mengungkapkan total kepemilikan 373 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 173,434,159 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama PCGLX - PACE Global Fixed Income Investments Class P adalah State Street Institutional Investment Trust - State Street Institutional US Govt Money Market Fnd Premier Cls (US:GVMXX) , Toronto-Dominion Bank (CA:XS2461741212) , State Street Navigator Securities Lending Government Money Market Portfolio (US:US8575093013) , French Republic Government Bond OAT (FR:FR0010070060) , and Fannie Mae Pool (US:US3140XB4P20) . Posisi baru PCGLX - PACE Global Fixed Income Investments Class P meliputi: Toronto-Dominion Bank (CA:XS2461741212) , French Republic Government Bond OAT (FR:FR0010070060) , Fannie Mae Pool (US:US3140XB4P20) , UK TSY GILT (GB:GB00BPCJD997) , and United States Treasury Note/Bond (US:US91282CGQ87) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 10.12 | 10.12 | 5.8431 | 4.5267 | |

| 7.39 | 4.2638 | 4.2638 | ||

| 5.01 | 2.8942 | 2.8942 | ||

| 3.02 | 1.7457 | 1.7457 | ||

| 2.63 | 1.5204 | 1.5204 | ||

| 2.52 | 1.4551 | 1.4551 | ||

| 2.45 | 1.4156 | 1.4156 | ||

| 1.92 | 1.1105 | 1.1105 | ||

| 3.53 | 2.0354 | 1.0367 | ||

| 1.71 | 0.9882 | 0.9882 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 3.15 | 3.15 | 1.8192 | -2.2290 | |

| 0.72 | 0.4169 | -1.6800 | ||

| 0.78 | 0.4522 | -1.3584 | ||

| 1.39 | 0.8053 | -1.0249 | ||

| 0.26 | 0.1517 | -0.9050 | ||

| 0.58 | 0.3372 | -0.6123 | ||

| 2.38 | 1.3763 | -0.3711 | ||

| 1.19 | 0.6883 | -0.1714 | ||

| 0.07 | 0.0408 | -0.1603 | ||

| 1.15 | 0.6641 | -0.1589 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-06-27 untuk periode pelaporan 2025-04-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| GVMXX / State Street Institutional Investment Trust - State Street Institutional US Govt Money Market Fnd Premier Cls | 10.12 | 353.57 | 10.12 | 353.65 | 5.8431 | 4.5267 | |||

| China Government Bonds / DBT (CND10008MC01) | 7.39 | 4.2638 | 4.2638 | ||||||

| U.S. Treasury Notes / DBT (US91282CME83) | 5.15 | 0.84 | 2.9708 | -0.0395 | |||||

| U.S. Treasury Inflation-Indexed Notes / DBT (US91282CLV18) | 5.01 | 2.8942 | 2.8942 | ||||||

| China Government Bonds / DBT (CND100089K10) | 3.53 | 108.21 | 2.0354 | 1.0367 | |||||

| XS2461741212 / Toronto-Dominion Bank | 3.26 | 10.50 | 1.8839 | 0.1414 | |||||

| US8575093013 / State Street Navigator Securities Lending Government Money Market Portfolio | 3.15 | -54.08 | 3.15 | -54.08 | 1.8192 | -2.2290 | |||

| FR0010070060 / French Republic Government Bond OAT | 3.12 | -18.84 | 1.7987 | 0.6917 | |||||

| U.S. Treasury Notes / DBT (US91282CMV09) | 3.02 | 1.7457 | 1.7457 | ||||||

| U.S. Treasury Notes / DBT (US91282CMG32) | 2.87 | 2.72 | 1.6541 | 0.0084 | |||||

| US3140XB4P20 / Fannie Mae Pool | 2.78 | 0.43 | 1.6038 | -0.0282 | |||||

| GB00BPCJD997 / UK TSY GILT | 2.72 | 5.72 | 1.5678 | 0.0530 | |||||

| US91282CGQ87 / United States Treasury Note/Bond | 2.63 | 1.5204 | 1.5204 | ||||||

| U.S. Treasury Notes / DBT (US91282CMS79) | 2.52 | 1.4551 | 1.4551 | ||||||

| CA68333ZAY30 / ONTARIO PROVINCE CDA 3.65% 06/02/2033 | 2.52 | 5.54 | 1.4520 | 0.0462 | |||||

| DE0001174068 / CHINA UNIVERSAL EX INC | 2.45 | 1.4156 | 1.4156 | ||||||

| CA74814ZFS70 / Province of Quebec Canada | 2.45 | 5.47 | 1.4128 | 0.0437 | |||||

| ES0000012L78 / SPAIN GOVT EUR 144A LIFE/REG S 3.55% 10-31-33 | 2.44 | 9.34 | 1.4067 | 0.0922 | |||||

| 114090 / Grand Korea Leisure Co., Ltd. | 2.41 | 4.60 | 1.3908 | 0.0318 | |||||

| XS2463967286 / WESTPAC BANKING | 2.38 | -19.51 | 1.3763 | -0.3711 | |||||

| AMI / Aurelia Metals Limited | 2.38 | 10.74 | 1.3748 | 0.1063 | |||||

| U.S. Treasury Notes / DBT (US91282CMU26) | 1.92 | 1.1105 | 1.1105 | ||||||

| CZ0001006894 / CZECH REPUBLIC BONDS 04/34 4.9 | 1.90 | 123.85 | 1.0948 | 0.5948 | |||||

| U.S. Treasury Notes / DBT (US91282CMM00) | 1.71 | 0.9882 | 0.9882 | ||||||

| US3140QMMS03 / Federal National Mortgage Association, Inc. | 1.56 | 0.78 | 0.9010 | -0.0122 | |||||

| 5831 / Shizuoka Financial Group,Inc. | 1.55 | 0.39 | 0.8976 | -0.0161 | |||||

| 5831 / Shizuoka Financial Group,Inc. | 1.53 | 0.8848 | 0.8848 | ||||||

| U.S. Treasury Notes / DBT (US91282CMT52) | 1.42 | 0.8207 | 0.8207 | ||||||

| JP1201831P14 / JAPAN GOVERNMENT OF 1.4% 12/20/2042 | 1.41 | 4.14 | 0.8137 | 0.0154 | |||||

| Italy Buoni Poliennali Del Tesoro / DBT (IT0005607970) | 1.39 | -55.06 | 0.8053 | -1.0249 | |||||

| GB00BFX0ZL78 / United Kingdom Gilt | 1.38 | 9.54 | 0.7956 | 0.0533 | |||||

| IDG000011701 / Indonesia Treasury Bond | 1.31 | -1.06 | 0.7561 | -0.0246 | |||||

| US3140XJHA48 / UMBS, 30 Year | 1.30 | 0.46 | 0.7488 | -0.0127 | |||||

| US3136BKYQ97 / Fannie Mae REMICS | 1.28 | -0.31 | 0.7362 | -0.0186 | |||||

| XS2597905905 / WESTPAC SEC NZ/LONDON /EUR/ REGD REG S EMTN 3.75000000 | 1.22 | 9.99 | 0.7057 | 0.0502 | |||||

| Hungary Government Bonds / DBT (HU0000406624) | 1.22 | 89.01 | 0.7054 | 0.3241 | |||||

| JP1201861PA6 / JAPAN (20 YEAR ISSUE) /JPY/ REGD SER 186 1.50000000 | 1.19 | -18.19 | 0.6883 | -0.1714 | |||||

| US3132DWH303 / Freddie Mac Pool | 1.15 | -17.56 | 0.6641 | -0.1589 | |||||

| U.S. Treasury Bonds / DBT (US912810UJ50) | 1.14 | 0.6568 | 0.6568 | ||||||

| GB00BMV7TC88 / United Kingdom Gilt | 1.13 | 8.13 | 0.6525 | 0.0668 | |||||

| US3140FXJH68 / FNMA, Other | 1.05 | -0.66 | 0.6078 | -0.0174 | |||||

| HK0000200722 / China Government Bond | 1.00 | 2.35 | 0.5792 | 0.0006 | |||||

| S56431109 / Northam Platinum Holdings Ltd | 0.96 | 0.52 | 0.5538 | -0.0091 | |||||

| US085209AF11 / Bermuda Government International Bond | 0.90 | 1.57 | 0.5216 | -0.0029 | |||||

| US05571AAR68 / BPCE SA | 0.88 | 1.15 | 0.5061 | -0.0048 | |||||

| Q / Quetzal Copper Corp. | 0.86 | 3.35 | 0.4988 | 0.0056 | |||||

| EU000A3K4DY4 / European Union | 0.86 | 3.61 | 0.4977 | 0.0067 | |||||

| US71643VAB18 / Petroleos Mexicanos | 0.86 | 82.13 | 0.4944 | 0.2310 | |||||

| XS2076099865 / Netflix Inc | 0.85 | 9.54 | 0.4910 | 0.0327 | |||||

| US853254CW88 / STANDARD CHARTERED PLC REGD 144A P/P 6.75000000 | 0.85 | 0.12 | 0.4882 | -0.0099 | |||||

| TD.PFA / The Toronto-Dominion Bank - Preferred Security | 0.83 | 9.74 | 0.4816 | 0.0330 | |||||

| XS2434512997 / Silverstone Master Issuer PLC | 0.80 | 7.42 | 0.4599 | 0.0223 | |||||

| ES0000012L52 / Spain Government Bond | 0.79 | 9.54 | 0.4577 | 0.0307 | |||||

| XS2586123965 / Ford Motor Credit Co. LLC | 0.79 | 8.50 | 0.4572 | 0.0268 | |||||

| XS2430951744 / Bank of Montreal | 0.78 | -74.49 | 0.4522 | -1.3584 | |||||

| XS2364199757 / Romanian Government International Bond | 0.77 | 9.57 | 0.4431 | 0.0302 | |||||

| XS2063540038 / Banque Ouest Africaine de Developpement | 0.77 | 0.53 | 0.4416 | -0.0077 | |||||

| US05401AAB70 / Avolon Holdings Funding Ltd | 0.75 | 0.40 | 0.4337 | -0.0079 | |||||

| US3132DWG982 / FNCL UMBS 5.5 SD8324 05-01-53 | 0.72 | -79.68 | 0.4169 | -1.6800 | |||||

| US05401AAB70 / Avolon Holdings Funding Ltd | 0.69 | 0.59 | 0.3968 | -0.0066 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.69 | -0.58 | 0.3962 | -0.0111 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 0.67 | 1.51 | 0.3875 | -0.0026 | |||||

| CA44889ZCM64 / Hydro-Quebec | 0.66 | 4.61 | 0.3804 | 0.0091 | |||||

| Bank of America Corp. / DBT (US06051GML04) | 0.66 | 1.70 | 0.3793 | -0.0024 | |||||

| XS0471436088 / Heathrow Funding Ltd | 0.65 | 6.86 | 0.3778 | 0.0165 | |||||

| USP3579ECH82 / Dominican Republic International Bond | 0.65 | 0.00 | 0.3737 | -0.0083 | |||||

| US3140XHXF94 / Fannie Mae Pool | 0.62 | -0.32 | 0.3603 | -0.0094 | |||||

| US3140QNS296 / FNCL UMBS 3.0 CB3236 03-01-52 | 0.60 | -0.33 | 0.3492 | -0.0084 | |||||

| TRT061124T11 / Turkey Government Bond | 0.60 | -3.22 | 0.3470 | -0.0196 | |||||

| XS2528858033 / NatWest Group plc | 0.59 | 9.28 | 0.3404 | 0.0224 | |||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 0.59 | 1.20 | 0.3398 | -0.0033 | |||||

| US3132DWES89 / FR SD8245 | 0.58 | -63.70 | 0.3372 | -0.6123 | |||||

| Credit Acceptance Auto Loan Trust / ABS-O (US22537GAA85) | 0.58 | 0.00 | 0.3342 | -0.0070 | |||||

| US31418EBS81 / FNMA UMBS, 30 Year | 0.57 | 0.17 | 0.3312 | -0.0067 | |||||

| US456837AR44 / ING Groep NV | 0.57 | -1.21 | 0.3294 | -0.0113 | |||||

| XS2464405229 / AIB Group PLC | 0.56 | 9.16 | 0.3236 | 0.0207 | |||||

| XS1675862012 / Bahrain Government International Bond | 0.55 | -0.54 | 0.3182 | -0.0089 | |||||

| US29250NBN49 / Enbridge Inc | 0.53 | -1.67 | 0.3068 | -0.0120 | |||||

| XS0383001053 / Heathrow Funding Ltd | 0.49 | 6.93 | 0.2856 | 0.0130 | |||||

| CABK / CaixaBank, S.A. | 0.49 | 7.25 | 0.2822 | 0.0132 | |||||

| XS2649712689 / CaixaBank SA | 0.48 | 9.30 | 0.2786 | 0.0183 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0.48 | 1.49 | 0.2762 | -0.0018 | |||||

| Glencore Funding LLC / DBT (US378272BU12) | 0.46 | 0.00 | 0.2661 | -0.0060 | |||||

| US23636AAZ49 / Danske Bank A/S | 0.45 | 0.67 | 0.2624 | -0.0037 | |||||

| CBOM / Credit Bank of Moscow (public joint-stock company) | 0.45 | 1.35 | 0.2604 | -0.0022 | |||||

| US172967ME81 / Citigroup Inc | 0.45 | 1.59 | 0.2584 | -0.0016 | |||||

| XS2101558307 / UniCredit SpA | 0.45 | 9.29 | 0.2584 | 0.0170 | |||||

| RRE 24 Loan Management DAC / ABS-CBDO (XS3004565886) | 0.45 | 0.2583 | 0.2583 | ||||||

| Avoca CLO XXXII DAC / ABS-CBDO (XS3011738492) | 0.44 | 0.2562 | 0.2562 | ||||||

| ARES European CLO XXI DAC / ABS-CBDO (XS2988590506) | 0.44 | 0.2553 | 0.2553 | ||||||

| GM Financial Automobile Leasing Trust / ABS-O (US36269FAD87) | 0.44 | -0.23 | 0.2539 | -0.0059 | |||||

| US29425AAG85 / CITIGROUP COMMERCIAL MORTGAGE TRUST 2015-GC33 SER 2015-GC33 CL B V/R REGD 4.72112200 | 0.44 | 0.69 | 0.2533 | -0.0037 | |||||

| US05565AM341 / BNP Paribas SA | 0.44 | -0.68 | 0.2522 | -0.0071 | |||||

| US05971KAP49 / BANCO SANTANDER SA 9.625%/VAR PERP | 0.44 | -1.14 | 0.2515 | -0.0085 | |||||

| US46115HBZ91 / Intesa Sanpaolo SpA | 0.43 | 1.88 | 0.2510 | -0.0004 | |||||

| US16411QAG64 / Cheniere Energy Partners LP | 0.43 | 0.70 | 0.2481 | -0.0035 | |||||

| CABK / CaixaBank, S.A. | 0.43 | 1.43 | 0.2470 | -0.0016 | |||||

| GB00BLH38158 / United Kingdom Gilt | 0.41 | 5.88 | 0.2390 | 0.0082 | |||||

| US90276XAZ87 / UBS COMMERCIAL MORTGAGE TRUST 2018-C11 SER 2018-C11 CL B V/R REGD 4.71290000 | 0.41 | 1.73 | 0.2380 | -0.0010 | |||||

| US29273VAP58 / Energy Transfer LP | 0.41 | 0.74 | 0.2378 | -0.0034 | |||||

| DE000A3E5MH6 / Vonovia SE | 0.41 | 11.23 | 0.2349 | 0.0191 | |||||

| XS0563638401 / Eversholt Funding PLC | 0.40 | 6.90 | 0.2332 | 0.0106 | |||||

| Merchants Fleet Funding LLC / ABS-O (US588926AF24) | 0.40 | -3.40 | 0.2300 | -0.0134 | |||||

| Dominican Republic International Bonds / DBT (US25714PFB94) | 0.39 | 0.2254 | 0.2254 | ||||||

| US836205BA15 / Republic of South Africa Government International Bond | 0.38 | 0.80 | 0.2173 | -0.0030 | |||||

| US05583JAN28 / BPCE SA | 0.37 | -0.27 | 0.2153 | -0.0048 | |||||

| US22535WAJ62 / Credit Agricole SA | 0.37 | 1.09 | 0.2151 | -0.0025 | |||||

| US465685AS47 / ITC Holdings Corp | 0.37 | 1.09 | 0.2137 | -0.0025 | |||||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 0.37 | -1.34 | 0.2129 | -0.0074 | |||||

| US780097BQ34 / Natwest Group PLC | 0.37 | -0.54 | 0.2123 | -0.0057 | |||||

| Hyundai Capital America / DBT (US44891ADK07) | 0.36 | 0.28 | 0.2080 | -0.0040 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 0.36 | 1.42 | 0.2064 | -0.0015 | |||||

| US10554TAD72 / Braskem Netherlands Finance BV | 0.36 | -3.27 | 0.2055 | -0.0110 | |||||

| 30064K105 / Exacttarget, Inc. | 0.35 | -3.03 | 0.2035 | -0.0111 | |||||

| XS2289133758 / UniCredit SpA | 0.35 | 9.15 | 0.2000 | 0.0127 | |||||

| XS2473346299 / Nationwide Building Society | 0.34 | 9.80 | 0.1943 | 0.0133 | |||||

| MUTHOOTFIN / Muthoot Finance Limited | 0.34 | -2.61 | 0.1941 | -0.0099 | |||||

| Toyota Lease Owner Trust / ABS-O (US89238GAD34) | 0.33 | -0.30 | 0.1922 | -0.0045 | |||||

| US12508GAZ90 / CCUBS Commercial Mortgage Trust 2017-C1 | 0.33 | 1.85 | 0.1916 | -0.0004 | |||||

| US853254CG39 / Standard Chartered plc | 0.33 | 0.92 | 0.1909 | -0.0021 | |||||

| Ravensdale Park CLO DAC / ABS-CBDO (XS3006390622) | 0.32 | 0.1858 | 0.1858 | ||||||

| US404280CN71 / HSBC Holdings PLC | 0.32 | -1.54 | 0.1842 | -0.0071 | |||||

| US00287YCB39 / AbbVie Inc | 0.32 | -0.63 | 0.1826 | -0.0056 | |||||

| US071813CS61 / Baxter International Inc | 0.32 | 1.61 | 0.1825 | -0.0012 | |||||

| US617726AK00 / Morocco Government International Bond | 0.32 | 1.29 | 0.1822 | -0.0013 | |||||

| Hungary Government International Bonds / DBT (US445545AU03) | 0.30 | -0.33 | 0.1753 | -0.0046 | |||||

| US03073EAT29 / AmerisourceBergen Corp | 0.30 | 2.38 | 0.1741 | 0.0002 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 0.30 | 1.01 | 0.1732 | -0.0022 | |||||

| US12636MAL28 / CSAIL 2016-C6 Commercial Mortgage Trust | 0.30 | -0.33 | 0.1732 | -0.0038 | |||||

| SOLV / Solventum Corporation | 0.30 | 1.37 | 0.1709 | -0.0015 | |||||

| BNP / BNP Paribas SA | 0.29 | 1.74 | 0.1693 | -0.0012 | |||||

| US476556DD44 / Jersey Central Power & Light Co | 0.28 | 1.07 | 0.1644 | -0.0015 | |||||

| US89117F8Z56 / Toronto-Dominion Bank/The | 0.28 | -1.05 | 0.1641 | -0.0054 | |||||

| INWI / Inwido AB (publ) | 0.28 | -2.46 | 0.1609 | -0.0077 | |||||

| US05571AAS42 / BPCE SA | 0.27 | 1.12 | 0.1569 | -0.0013 | |||||

| US36253PAJ12 / GS Mortgage Securities Trust, Series 2017-GS6, Class C | 0.27 | 5.47 | 0.1564 | 0.0053 | |||||

| US06051GKD06 / Bank of America Corp | 0.27 | 2.27 | 0.1560 | -0.0000 | |||||

| ENB.PRN / Enbridge Inc. - Preferred Security | 0.27 | 1.53 | 0.1537 | -0.0010 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 0.27 | -1.85 | 0.1530 | -0.0065 | |||||

| 4755 / Rakuten Group, Inc. | 0.27 | -2.21 | 0.1530 | -0.0069 | |||||

| PCG.PRD / Pacific Gas and Electric Company - Preferred Stock | 0.26 | 0.76 | 0.1527 | -0.0024 | |||||

| JP1300741N49 / Japan Government Thirty Year Bond | 0.26 | -85.37 | 0.1517 | -0.9050 | |||||

| US29336TAD28 / EnLink Midstream LLC | 0.26 | 0.39 | 0.1494 | -0.0026 | |||||

| XS2113658202 / Nationwide Building Society | 0.26 | 5.76 | 0.1488 | 0.0053 | |||||

| LYG / Lloyds Banking Group plc - Depositary Receipt (Common Stock) | 0.26 | -2.65 | 0.1487 | -0.0074 | |||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.26 | 1.59 | 0.1482 | -0.0006 | |||||

| US61747YFG52 / Morgan Stanley | 0.25 | 0.80 | 0.1458 | -0.0016 | |||||

| US12803RAC88 / CaixaBank SA | 0.25 | 2.04 | 0.1443 | -0.0004 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0.25 | 1.22 | 0.1442 | -0.0010 | |||||

| ACA / Crédit Agricole S.A. | 0.25 | 0.81 | 0.1442 | -0.0017 | |||||

| BE0002961424 / KBC Group NV | 0.25 | 7.42 | 0.1426 | 0.0073 | |||||

| M1TB34 / M&T Bank Corporation - Depositary Receipt (Common Stock) | 0.25 | 0.82 | 0.1417 | -0.0021 | |||||

| CR8C5U / Commerzbank AG - Equity Warrant | 0.24 | 5.63 | 0.1409 | 0.0041 | |||||

| US539439AY57 / LLOYDS BANKING GROUP PLC 5.985000% 08/07/2027 | 0.24 | 0.00 | 0.1407 | -0.0029 | |||||

| US19828TAB26 / Columbia Pipelines Operating Co LLC | 0.24 | 0.42 | 0.1372 | -0.0021 | |||||

| DANSKE / Danske Bank A/S | 0.24 | 1.28 | 0.1370 | -0.0014 | |||||

| A5G / AIB Group plc | 0.24 | 5.86 | 0.1357 | 0.0045 | |||||

| Future / DIR (000000000) | 0.23 | 0.1355 | 0.1355 | ||||||

| HCA, Inc. / DBT (US404121AK12) | 0.23 | 1.30 | 0.1346 | -0.0012 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 0.23 | -0.43 | 0.1326 | -0.0035 | |||||

| KBC / KBC Group NV | 0.23 | 1.80 | 0.1310 | -0.0002 | |||||

| US161175CD44 / Charter Communications Operating LLC / Charter Communications Operating Capital | 0.23 | 2.26 | 0.1309 | 0.0002 | |||||

| XS2455401328 / SEGRO CAPITAL SARL 1.25% 03/23/2026 REGS | 0.22 | 9.85 | 0.1292 | 0.0089 | |||||

| Tesla Auto Lease Trust / ABS-O (US88166VAD82) | 0.22 | -0.45 | 0.1269 | -0.0031 | |||||

| XS2319954710 / Standard Chartered plc | 0.22 | 9.00 | 0.1263 | 0.0080 | |||||

| XS2288825263 / Banque Ouest Africaine de Developpement | 0.22 | 8.50 | 0.1255 | 0.0075 | |||||

| XS2052968596 / WPC Eurobond BV | 0.22 | 10.20 | 0.1250 | 0.0091 | |||||

| US05946KAM36 / Banco Bilbao Vizcaya Argentaria SA | 0.22 | -1.38 | 0.1243 | -0.0043 | |||||

| US694308KJ55 / Pacific Gas and Electric Co. | 0.21 | 0.94 | 0.1236 | -0.0017 | |||||

| Turkiye Varlik Fonu Yonetimi AS / DBT (XS2764457235) | 0.21 | -1.83 | 0.1236 | -0.0051 | |||||

| FR0013534336 / Electricite de France SA | 0.21 | 8.76 | 0.1219 | 0.0070 | |||||

| US28504DAD57 / Electricite de France SA | 0.21 | -1.41 | 0.1217 | -0.0042 | |||||

| Banque Ouest Africaine de Developpement / DBT (US06675QAE35) | 0.21 | 0.1217 | 0.1217 | ||||||

| US279158AT64 / Ecopetrol SA | 0.21 | 0.1204 | 0.1204 | ||||||

| US097023CJ22 / BOEING CO SR UNSECURED 05/34 3.6 | 0.21 | 1.97 | 0.1195 | -0.0006 | |||||

| USV4819LAA09 / India Green Power Holdings | 0.21 | 0.1188 | 0.1188 | ||||||

| US92840VAG77 / Vistra Operations Co LLC | 0.21 | 0.99 | 0.1186 | -0.0015 | |||||

| Mersin Uluslararasi Liman Isletmeciligi AS / DBT (XS2696793012) | 0.21 | 0.1185 | 0.1185 | ||||||

| BNP / BNP Paribas SA | 0.20 | 0.99 | 0.1182 | -0.0009 | |||||

| XS2343822503 / VOLKSWAGEN LEAS | 0.20 | 9.19 | 0.1172 | 0.0077 | |||||

| US853254CM07 / Standard Chartered PLC | 0.20 | -2.42 | 0.1169 | -0.0052 | |||||

| CBOM / Credit Bank of Moscow (public joint-stock company) | 0.20 | 1.00 | 0.1167 | -0.0016 | |||||

| STAB / Standard Chartered PLC - Preferred Security | 0.20 | 1.52 | 0.1156 | -0.0008 | |||||

| US33767BAD10 / FirstEnergy Transmission LLC | 0.20 | 2.05 | 0.1149 | -0.0006 | |||||

| CBOM / Credit Bank of Moscow (public joint-stock company) | 0.20 | 0.00 | 0.1141 | -0.0021 | |||||

| Africa Finance Corp. / DBT (XS2913968363) | 0.20 | 0.1140 | 0.1140 | ||||||

| US251526CU14 / DEUTSCHE BANK AG SR NON PREF 6.819% 11-20-29/28 | 0.20 | 1.03 | 0.1135 | -0.0015 | |||||

| US58547DAB55 / Melco Resorts Finance Ltd | 0.20 | -1.01 | 0.1132 | -0.0037 | |||||

| N1IS34 / NiSource Inc. - Depositary Receipt (Common Stock) | 0.19 | -0.52 | 0.1111 | -0.0032 | |||||

| US281020AS67 / Edison International | 0.19 | 2.13 | 0.1109 | -0.0004 | |||||

| US161175BZ64 / Charter Communications Operating LLC / Charter Communications Operating Capital | 0.19 | -1.58 | 0.1085 | -0.0039 | |||||

| US8426EPAD09 / Southern Co Gas Capital Corp | 0.19 | 2.75 | 0.1080 | 0.0005 | |||||

| USV4605MAA63 / INDIA CLEAN ENERGY HOLDINGS 4.5% 04/18/2027 REGS | 0.19 | 0.1079 | 0.1079 | ||||||

| USP01703AC49 / Alpek SAB de CV | 0.19 | 0.1076 | 0.1076 | ||||||

| US172967MY46 / Citigroup Inc | 0.18 | 2.23 | 0.1059 | 0.0002 | |||||

| US30161MAG87 / Exelon Generation Co Llc Senior Notes 6.25% 10/01/39 | 0.18 | 0.00 | 0.1050 | -0.0019 | |||||

| ES0382042002 / Fondo de Titulizacion de Activos Santander Hipotecario 2 | 0.18 | -5.24 | 0.1049 | -0.0082 | |||||

| EBGEF / Enbridge Inc. - Preferred Stock | 0.18 | -1.63 | 0.1049 | -0.0042 | |||||

| US29278GAY44 / Enel Finance International NV | 0.18 | -1.63 | 0.1047 | -0.0039 | |||||

| US00774MBC82 / AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 0.18 | 0.56 | 0.1040 | -0.0017 | |||||

| USN15516AB83 / Braskem Netherlands Finance BV | 0.18 | 0.1035 | 0.1035 | ||||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0.18 | 1.16 | 0.1013 | -0.0012 | |||||

| US20030NDU28 / Comcast Corp | 0.17 | 0.58 | 0.1005 | -0.0021 | |||||

| USE4181LAA91 / EnfraGen Energia Sur SA / EnfraGen Spain SA / Prime Energia SpA | 0.17 | 0.0989 | 0.0989 | ||||||

| US670855AA38 / OBX Trust | 0.17 | -3.39 | 0.0988 | -0.0060 | |||||

| US05401AAB70 / Avolon Holdings Funding Ltd | 0.17 | 0.00 | 0.0962 | -0.0020 | |||||

| US281020AX52 / Edison International | 0.17 | 0.61 | 0.0962 | -0.0017 | |||||

| CA11070TAG37 / Province of British Columbia Canada | 0.17 | 1.23 | 0.0958 | -0.0005 | |||||

| US03846JAB61 / Egypt Government International Bond | 0.16 | -52.65 | 0.0931 | -0.1079 | |||||

| US573874AJ32 / Marvell Technology Inc | 0.16 | 1.91 | 0.0928 | -0.0002 | |||||

| US11135FBK66 / BROADCOM INC 3.419% 04/15/2033 144A | 0.16 | 1.91 | 0.0927 | -0.0002 | |||||

| US803014AB57 / Santos Finance Ltd | 0.16 | 0.00 | 0.0925 | -0.0024 | |||||

| US05401AAS06 / Avolon Holdings Funding Ltd | 0.16 | 0.00 | 0.0920 | -0.0021 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 0.16 | 1.94 | 0.0913 | -0.0006 | |||||

| US797440CD44 / San Diego Gas & Electric Co. | 0.16 | -0.64 | 0.0904 | -0.0027 | |||||

| PNCS34 / The PNC Financial Services Group, Inc. - Depositary Receipt (Common Stock) | 0.15 | 1.32 | 0.0887 | -0.0006 | |||||

| RWE Finance U.S. LLC / DBT (US749983AA01) | 0.15 | 1.33 | 0.0881 | -0.0004 | |||||

| Mars, Inc. / DBT (US571676BA26) | 0.15 | 0.0869 | 0.0869 | ||||||

| Future / DIR (000000000) | 0.14 | 0.0831 | 0.0831 | ||||||

| US694308KH99 / Pacific Gas and Electric Co | 0.14 | -2.72 | 0.0831 | -0.0041 | |||||

| Mars, Inc. / DBT (US571676BC81) | 0.14 | 0.0825 | 0.0825 | ||||||

| Duke Energy Progress LLC / DBT (US26442UAU88) | 0.14 | 0.0823 | 0.0823 | ||||||

| US45032QS347 / ITC Holdings Corporation | 0.14 | 0.00 | 0.0816 | -0.0016 | |||||

| US12527GAD51 / CF Industries Inc | 0.14 | -3.57 | 0.0783 | -0.0047 | |||||

| XS0596919299 / Gatwick Funding Ltd | 0.13 | 7.20 | 0.0778 | 0.0036 | |||||

| JBS USA Holding Lux SARL/JBS USA Food Co./JBS Lux Co. SARL / DBT (US47214BAD01) | 0.13 | 0.75 | 0.0778 | -0.0008 | |||||

| Vistra Operations Co. LLC / DBT (US92840VAU61) | 0.13 | 148.15 | 0.0776 | 0.0455 | |||||

| US00774MAX39 / AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 0.13 | 0.76 | 0.0765 | -0.0011 | |||||

| US031162DU18 / Amgen Inc | 0.13 | -31.25 | 0.0763 | -0.0375 | |||||

| Berry Global, Inc. / DBT (US08576PAQ46) | 0.13 | 0.0756 | 0.0756 | ||||||

| P1DT34 / Prudential Financial, Inc. - Depositary Receipt (Common Stock) | 0.12 | -0.80 | 0.0718 | -0.0025 | |||||

| XS2644969698 / Realty Income Corp | 0.12 | 8.77 | 0.0717 | 0.0041 | |||||

| US05526DBF15 / BAT Capital Corp | 0.12 | -1.60 | 0.0713 | -0.0026 | |||||

| US404119CB31 / HCA Inc | 0.12 | -1.61 | 0.0709 | -0.0026 | |||||

| DE000A30VQB2 / VONOVIA SE 5% 11/23/2030 REGS | 0.12 | 8.93 | 0.0709 | 0.0046 | |||||

| US20826FBG00 / ConocoPhillips Co | 0.12 | -2.42 | 0.0701 | -0.0030 | |||||

| XS2576550086 / ENEL SPA 6.375%/VAR PERP REGS | 0.12 | -63.77 | 0.0700 | -0.1272 | |||||

| ALO / Alstom SA | 0.12 | 6.42 | 0.0671 | 0.0028 | |||||

| IVW / Meta Platforms, Inc. - Depositary Receipt (Common Stock) | 0.12 | -0.86 | 0.0667 | -0.0020 | |||||

| XS2416413339 / COOPERATIEVE RAB | 0.11 | 10.10 | 0.0632 | 0.0045 | |||||

| US404119CA57 / HCA Inc | 0.11 | 2.83 | 0.0631 | 0.0001 | |||||

| XS2279559889 / GEMGARTO GMG 2021 1A A 144A | 0.11 | -15.50 | 0.0631 | -0.0131 | |||||

| FR0013455540 / BPCE SA | 0.11 | 10.10 | 0.0629 | 0.0044 | |||||

| US95000U3F88 / Wells Fargo & Co. | 0.11 | 0.94 | 0.0620 | -0.0007 | |||||

| XS0229567440 / General Electric Co | 0.10 | 8.42 | 0.0598 | 0.0032 | |||||

| US8426EPAG30 / Southern Co. Gas Capital Corp. | 0.10 | 0.98 | 0.0595 | -0.0009 | |||||

| K1EY34 / KeyCorp - Depositary Receipt (Common Stock) | 0.10 | -33.33 | 0.0568 | -0.0302 | |||||

| / Emera Inc. | 0.10 | 0.00 | 0.0549 | -0.0016 | |||||

| US378272BP27 / Glencore Funding LLC | 0.09 | 1.10 | 0.0535 | -0.0006 | |||||

| TotalEnergies Capital SA / DBT (US89157XAE13) | 0.09 | 0.00 | 0.0532 | -0.0014 | |||||

| C1OG34 / Coterra Energy Inc. - Depositary Receipt (Common Stock) | 0.09 | -4.26 | 0.0525 | -0.0032 | |||||

| E1TR34 / Entergy Corporation - Depositary Receipt (Common Stock) | 0.09 | -1.16 | 0.0493 | -0.0018 | |||||

| US404119CL13 / HCA Inc | 0.08 | -1.20 | 0.0475 | -0.0015 | |||||

| AXP / American Express Company - Depositary Receipt (Common Stock) | 0.08 | 0.0474 | 0.0474 | ||||||

| 30064K105 / Exacttarget, Inc. | 0.08 | 0.00 | 0.0458 | -0.0011 | |||||

| SCE.PRK / SCE Trust V - Preferred Security | 0.07 | 111.43 | 0.0432 | 0.0220 | |||||

| US29379VBR33 / Enterprise Products Operating LLC | 0.07 | -1.39 | 0.0412 | -0.0013 | |||||

| ORCL / Oracle Corporation - Depositary Receipt (Common Stock) | 0.07 | 0.0409 | 0.0409 | ||||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 0.07 | -79.47 | 0.0408 | -0.1603 | |||||

| US00287YCA55 / ABBVIE INC 4.05% 11/21/2039 | 0.07 | 1.45 | 0.0405 | -0.0005 | |||||

| US03073EAR62 / AMERISOURCEBERGEN CORPORATION | 0.07 | 2.94 | 0.0404 | 0.0001 | |||||

| US19828TAA43 / CORP. NOTE | 0.07 | 0.00 | 0.0392 | -0.0003 | |||||

| USB / U.S. Bancorp - Depositary Receipt (Common Stock) | 0.07 | 1.54 | 0.0382 | -0.0005 | |||||

| Future / DIR (000000000) | 0.07 | 0.0382 | 0.0382 | ||||||

| Vistra Operations Co. LLC / DBT (US92840VAS16) | 0.07 | 0.00 | 0.0379 | -0.0009 | |||||

| PCG.PRX / PG&E Corporation - Preferred Security | 0.06 | 0.00 | 0.0364 | -0.0008 | |||||

| US609935AA97 / Monongahela Power Co. | 0.06 | 0.00 | 0.0356 | -0.0005 | |||||

| Future / DIR (000000000) | 0.06 | 0.0352 | 0.0352 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0.06 | 0.0341 | 0.0341 | ||||||

| ORCL / Oracle Corporation - Depositary Receipt (Common Stock) | 0.06 | 0.0337 | 0.0337 | ||||||

| US67448TBE47 / OBX 2020-EXP1 TRUST | 0.06 | -1.72 | 0.0333 | -0.0015 | |||||

| US02377CAA27 / American Airlines Pass Through Trust, Series 2017-2, Class A | 0.05 | -3.57 | 0.0316 | -0.0019 | |||||

| US674599CF00 / Occidental Petroleum Corp | 0.05 | -20.31 | 0.0299 | -0.0081 | |||||

| U.S. Treasury Bonds / DBT (US912810UE63) | 0.05 | 2.13 | 0.0279 | -0.0002 | |||||

| GB00H240B223 / LME Nickel Base Metal | 0.05 | 0.0273 | 0.0273 | ||||||

| US03464RAA14 / Angel Oak Mortgage Trust 2020-1 | 0.05 | -9.80 | 0.0268 | -0.0037 | |||||

| US023771S255 / American Airlines 2016-3 Class A Pass Through Trust | 0.04 | -2.22 | 0.0258 | -0.0013 | |||||

| EAI / Entergy Arkansas, LLC - Corporate Bond/Note | 0.04 | 0.00 | 0.0255 | -0.0007 | |||||

| US465685AQ80 / ITC Holdings Corp | 0.04 | 2.50 | 0.0239 | 0.0001 | |||||

| US02361DAZ33 / Ameren Illinois Co | 0.04 | -2.44 | 0.0236 | -0.0006 | |||||

| Purchased MXN / Sold USD / DFE (000000000) | 0.04 | 0.0234 | 0.0234 | ||||||

| US92536PAA21 / Verus Securitization Trust 2020-1 | 0.04 | -7.14 | 0.0227 | -0.0026 | |||||

| Future / DIR (000000000) | 0.04 | 0.0219 | 0.0219 | ||||||

| SCE.PRK / SCE Trust V - Preferred Security | 0.04 | 0.00 | 0.0205 | -0.0003 | |||||

| Mars, Inc. / DBT (US571676BB09) | 0.03 | 0.0195 | 0.0195 | ||||||

| T1TW34 / Take-Two Interactive Software, Inc. - Depositary Receipt (Common Stock) | 0.03 | -20.00 | 0.0188 | -0.0049 | |||||

| US29365TAH77 / Entergy Texas Inc. | 0.03 | 0.00 | 0.0164 | -0.0006 | |||||

| GB00H240B223 / LME Nickel Base Metal | 0.02 | 0.0134 | 0.0134 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0.02 | 0.0130 | 0.0130 | ||||||

| EMP / Entergy Mississippi, LLC - Corporate Bond/Note | 0.02 | 0.0124 | 0.0124 | ||||||

| US26442CBL72 / Duke Energy Carolinas LLC | 0.02 | 0.0121 | 0.0121 | ||||||

| SCE.PRK / SCE Trust V - Preferred Security | 0.02 | -52.38 | 0.0117 | -0.0134 | |||||

| Future / DIR (000000000) | 0.02 | 0.0114 | 0.0114 | ||||||

| Future / DIR (000000000) | 0.02 | 0.0097 | 0.0097 | ||||||

| UBERD / Uber Technologies, Inc. - Depositary Receipt (Common Stock) | 0.02 | -93.59 | 0.0089 | -0.1294 | |||||

| XS2068932222 / HSBC BANK PLC WARRANT | 0.02 | 0.0089 | 0.0089 | ||||||

| Purchased AUD / Sold CAD / DFE (000000000) | 0.01 | 0.0074 | 0.0074 | ||||||

| Future / DIR (000000000) | 0.01 | 0.0071 | 0.0071 | ||||||

| US85573AAA34 / Starwood Mortgage Residential Trust 2020-1 | 0.01 | 0.00 | 0.0070 | -0.0004 | |||||

| Purchased JPY / Sold USD / DFE (000000000) | 0.01 | 0.0063 | 0.0063 | ||||||

| BNP / BNP Paribas SA | 0.01 | 0.0061 | 0.0061 | ||||||

| Purchased SGD / Sold USD / DFE (000000000) | 0.01 | 0.0057 | 0.0057 | ||||||

| Purchased CAD / Sold JPY / DFE (000000000) | 0.01 | 0.0052 | 0.0052 | ||||||

| Future / DIR (000000000) | 0.01 | 0.0051 | 0.0051 | ||||||

| US404119BZ18 / HCA Inc | 0.01 | 0.00 | 0.0050 | -0.0002 | |||||

| T1TW34 / Take-Two Interactive Software, Inc. - Depositary Receipt (Common Stock) | 0.01 | 0.0048 | 0.0048 | ||||||

| XS2068932222 / HSBC BANK PLC WARRANT | 0.01 | 0.0044 | 0.0044 | ||||||

| GB00H240B223 / LME Nickel Base Metal | 0.01 | 0.0041 | 0.0041 | ||||||

| Purchased ZAR / Sold USD / DFE (000000000) | 0.01 | 0.0040 | 0.0040 | ||||||

| Purchased AUD / Sold EUR / DFE (000000000) | 0.01 | 0.0040 | 0.0040 | ||||||

| Duke Energy Progress LLC / DBT (US26442UAV61) | 0.01 | 0.0039 | 0.0039 | ||||||

| HCA, Inc. / DBT (US404121AL94) | 0.01 | 0.00 | 0.0033 | -0.0001 | |||||

| GB00H240B223 / LME Nickel Base Metal | 0.01 | 0.0031 | 0.0031 | ||||||

| Purchased JPY / Sold USD / DFE (000000000) | 0.01 | 0.0030 | 0.0030 | ||||||

| Purchased JPY / Sold USD / DFE (000000000) | 0.00 | 0.0027 | 0.0027 | ||||||

| XS2068932222 / HSBC BANK PLC WARRANT | 0.00 | 0.0027 | 0.0027 | ||||||

| BNP / BNP Paribas SA | 0.00 | 0.0024 | 0.0024 | ||||||

| XS2068932222 / HSBC BANK PLC WARRANT | 0.00 | 0.0021 | 0.0021 | ||||||

| Future / DIR (000000000) | 0.00 | 0.0020 | 0.0020 | ||||||

| Purchased CHF / Sold EUR / DFE (000000000) | 0.00 | 0.0017 | 0.0017 | ||||||

| Purchased JPY / Sold EUR / DFE (000000000) | 0.00 | 0.0016 | 0.0016 | ||||||

| XS2068932222 / HSBC BANK PLC WARRANT | 0.00 | 0.0012 | 0.0012 | ||||||

| Purchased AUD / Sold NZD / DFE (000000000) | 0.00 | 0.0011 | 0.0011 | ||||||

| Purchased AUD / Sold GBP / DFE (000000000) | 0.00 | 0.0010 | 0.0010 | ||||||

| Purchased USD / Sold NZD / DFE (000000000) | 0.00 | 0.0008 | 0.0008 | ||||||

| BNP / BNP Paribas SA | 0.00 | 0.0008 | 0.0008 | ||||||

| XS2068932222 / HSBC BANK PLC WARRANT | 0.00 | 0.0004 | 0.0004 | ||||||

| BNP / BNP Paribas SA | 0.00 | 0.0003 | 0.0003 | ||||||

| Purchased USD / Sold CZK / DFE (000000000) | 0.00 | 0.0002 | 0.0002 | ||||||

| Purchased USD / Sold NZD / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | ||||||

| Purchased USD / Sold JPY / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | ||||||

| XS2068932222 / HSBC BANK PLC WARRANT | 0.00 | 0.0001 | 0.0001 | ||||||

| Purchased SEK / Sold USD / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | ||||||

| BNP / BNP Paribas SA | 0.00 | 0.0001 | 0.0001 | ||||||

| XS2068932222 / HSBC BANK PLC WARRANT | -0.00 | -0.0000 | -0.0000 | ||||||

| Purchased EUR / Sold JPY / DFE (000000000) | -0.00 | -0.0002 | -0.0002 | ||||||

| Purchased USD / Sold CNY / DFE (000000000) | -0.00 | -0.0004 | -0.0004 | ||||||

| Purchased SEK / Sold CHF / DFE (000000000) | -0.00 | -0.0004 | -0.0004 | ||||||

| Purchased RON / Sold USD / DFE (000000000) | -0.00 | -0.0005 | -0.0005 | ||||||

| Purchased EUR / Sold USD / DFE (000000000) | -0.00 | -0.0008 | -0.0008 | ||||||

| BNP / BNP Paribas SA | -0.00 | -0.0011 | -0.0011 | ||||||

| Future / DIR (000000000) | -0.00 | -0.0012 | -0.0012 | ||||||

| GB00H240B223 / LME Nickel Base Metal | -0.00 | -0.0014 | -0.0014 | ||||||

| Purchased USD / Sold CAD / DFE (000000000) | -0.00 | -0.0014 | -0.0014 | ||||||

| Purchased THB / Sold USD / DFE (000000000) | -0.00 | -0.0017 | -0.0017 | ||||||

| Purchased EUR / Sold AUD / DFE (000000000) | -0.00 | -0.0017 | -0.0017 | ||||||

| Purchased USD / Sold GBP / DFE (000000000) | -0.00 | -0.0020 | -0.0020 | ||||||

| GB00H240B223 / LME Nickel Base Metal | -0.00 | -0.0028 | -0.0028 | ||||||

| GB00H240B223 / LME Nickel Base Metal | -0.00 | -0.0028 | -0.0028 | ||||||

| GB00H240B223 / LME Nickel Base Metal | -0.01 | -0.0031 | -0.0031 | ||||||

| Purchased CHF / Sold EUR / DFE (000000000) | -0.01 | -0.0034 | -0.0034 | ||||||

| Purchased PLN / Sold USD / DFE (000000000) | -0.01 | -0.0040 | -0.0040 | ||||||

| Purchased CHF / Sold GBP / DFE (000000000) | -0.01 | -0.0042 | -0.0042 | ||||||

| Purchased CAD / Sold JPY / DFE (000000000) | -0.01 | -0.0044 | -0.0044 | ||||||

| GB00H240B223 / LME Nickel Base Metal | -0.01 | -0.0048 | -0.0048 | ||||||

| Purchased USD / Sold MXN / DFE (000000000) | -0.01 | -0.0055 | -0.0055 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0.01 | -0.0059 | -0.0059 | ||||||

| Purchased USD / Sold AUD / DFE (000000000) | -0.01 | -0.0064 | -0.0064 | ||||||

| Purchased CHF / Sold USD / DFE (000000000) | -0.01 | -0.0065 | -0.0065 | ||||||

| Purchased JPY / Sold SGD / DFE (000000000) | -0.01 | -0.0069 | -0.0069 | ||||||

| Purchased USD / Sold SGD / DFE (000000000) | -0.02 | -0.0087 | -0.0087 | ||||||

| Purchased USD / Sold HUF / DFE (000000000) | -0.02 | -0.0088 | -0.0088 | ||||||

| Purchased CAD / Sold AUD / DFE (000000000) | -0.02 | -0.0094 | -0.0094 | ||||||

| Purchased USD / Sold AUD / DFE (000000000) | -0.02 | -0.0104 | -0.0104 | ||||||

| GB00H240B223 / LME Nickel Base Metal | -0.02 | -0.0136 | -0.0136 | ||||||

| Purchased EUR / Sold USD / DFE (000000000) | -0.02 | -0.0139 | -0.0139 | ||||||

| Future / DIR (000000000) | -0.03 | -0.0148 | -0.0148 | ||||||

| GB00H240B223 / LME Nickel Base Metal | -0.04 | -0.0225 | -0.0225 | ||||||

| Future / DIR (000000000) | -0.04 | -0.0238 | -0.0238 | ||||||

| GB00H240B223 / LME Nickel Base Metal | -0.04 | -0.0240 | -0.0240 | ||||||

| Future / DIR (000000000) | -0.05 | -0.0269 | -0.0269 | ||||||

| Future / DIR (000000000) | -0.06 | -0.0326 | -0.0326 | ||||||

| Future / DIR (000000000) | -0.08 | -0.0440 | -0.0440 |